Top Line Expansion Driven by Solid Growth in

Both Segments

Second Quarter Operating Cash Flow of $116

Million Drove $71 million in Debt Reduction

Expanding Patient Direct Segment with Agreement

to Acquire Rotech Healthcare Holdings

Owens & Minor, Inc. (NYSE: OMI) today reported financial

results for the second quarter ended June 30, 2024.

Key Highlights:

- Consolidated revenue of $2.7 billion in the second quarter,

representing year-over-year growth of 4%

- Net loss of $(32) million or $(0.42) per share in the second

quarter

- Adjusted EBITDA of $127 million in the second quarter,

representing year-over-year growth of 12%

- Doubled second quarter year over year Adjusted earnings per

share from $0.18 to $0.36

“Our second-quarter performance is consistent with our

expectations, as we are in the early stages of implementing our

long-term strategy discussed at Investor Day in December 2023. Our

previous investments in our Products & Healthcare Services

segment yielded positive results and generated top-line growth in

our Medical Distribution division. Our Patient Direct segment

performed in line with our expectations, and we expect the segment

to benefit from seasonality and recent organic investments during

the back half of the year,” said Edward A. Pesicka, President &

Chief Executive Officer of Owens & Minor.

Financial

Summary (1)

YTD

YTD

($ in millions, except per share data)

2Q24

2Q23

2024

2023

Revenue

$

2,671

$

2,563

$

5,284

$

5,086

Operating income, GAAP

$

20.3

$

10.8

$

30.0

$

20.6

Adj. Operating Income, Non-GAAP

$

76.3

$

62.0

$

133.6

$

109.7

Net loss, GAAP

$

(31.9

)

$

(28.2

)

$

(53.8

)

$

(52.7

)

Adj. Net Income, Non-GAAP

$

28.2

$

14.2

$

43.0

$

17.8

Adj. EBITDA, Non-GAAP

$

126.8

$

112.8

$

243.1

$

221.5

Net loss per common share, GAAP

$

(0.42

)

$

(0.37

)

$

(0.70

)

$

(0.70

)

Adj. Net Income per share, Non-GAAP

$

0.36

$

0.18

$

0.55

$

0.23

(1) Reconciliations of the differences between the non-GAAP

financial measures presented in this release and their most

directly comparable GAAP financial measures are included in the

tables below.

Results and Business

Highlights

- Consolidated revenue of $2.7 billion in the second quarter of

2024, an increase of 4% compared to the second quarter of 2023

- Patient Direct revenue of $660 million, up 4% compared to the

second quarter of 2023 driven by continued strong growth in

diabetes and sleep supplies

- Products & Healthcare Services revenue of $2.0 billion, up

4% compared to the second quarter of 2023 driven by strong same

store sales and new wins in our Medical Distribution division

- Second quarter 2024 operating income of $20.3 million and

Adjusted Operating Income of $76.3 million

- Operating income grew by 87% and Adjusted Operating Income grew

by 23% compared to the prior year

- Net loss of $(32) million and Adjusted Net Income of $28

million in the second quarter of 2024

- Adjusted EBITDA of $127 million in the second quarter,

representing year-over-year growth of 12%

- Operating cash flow for the second quarter of 2024 was $116

million

- Increased by $169 million as compared to the first quarter of

2024

- Enabled $71 million debt reduction during the second

quarter

Tax Matter

In the second quarter of 2024, the Company recorded a one-time

income tax charge of $17 million (or $0.22 per share) related to a

recent decision associated with Notices of Proposed Adjustments

received in 2020 and 2021. This was communicated to the Company in

late June 2024. Due to the nature of this charge, this item is

included in our GAAP to Non-GAAP reconciliations. The matter at

hand, as discussed in previously filed SEC documents, is related to

past transfer pricing methodology, which is no longer employed.

There is an expected related cash payment to be made in the second

half of the year in the range of $30-$35 million. The Company

believes the matter will be concluded without further impact to its

financial results.

2024 Financial Outlook

The Company’s recently reaffirmed financial guidance; summarized

below:

- Revenue for 2024 to be in a range of $10.5 billion to $10.9

billion

- Adjusted EBITDA for 2024 to be in a range of $550 million to

$590 million

- Adjusted EPS for 2024 to be in a range of $1.40 to $1.70

The Company’s outlook for 2024 contains assumptions, including

current expectations regarding the impact of general economic

conditions, including inflation, and the continuation of pressure

on pricing and demand in our Products & Healthcare Services

segment. Key assumptions supporting the Company’s 2024 financial

guidance include:

- Gross margin rate of 21.0% to 21.5%

- Interest expense of $141 to $146 million

- Adjusted effective tax rate of 27.5% to 28.5%

- Diluted weighted average shares of ~78.5 million

- Capital expenditures of $220 to $240 million

- Stable commodity prices

- FX rates as of 12/31/2023

Although the Company does provide guidance for adjusted EBITDA

and adjusted EPS (which are non-GAAP financial measures), it is not

able to forecast the most directly comparable measures calculated

and presented in accordance with GAAP without unreasonable effort.

Certain elements of the composition of the GAAP amounts are not

predictable, making it impracticable for the Company to forecast.

Such elements include, but are not limited to, restructuring and

acquisition charges, which could have a significant and

unpredictable impact on our GAAP results. As a result, no GAAP

guidance or reconciliation of the Company’s adjusted EBITDA

guidance or adjusted EPS guidance is provided. The outlook is based

on certain assumptions that are subject to the risk factors

discussed in the Company’s filings with the SEC.

Investor Conference Call for Second

Quarter 2024 Financial Results

Owens & Minor executives will host a conference call for

investors and analysts on Friday, August 2, 2024, at 8:30 a.m. EDT.

Participants may access the call via the toll-free dial-in number

at 1-888-300-2035, or the toll dial-in number at 1-646-517-7437.

The conference ID access code is 1058917.

All interested stakeholders are encouraged to access the

simultaneous live webcast by visiting the investor relations page

of the Owens & Minor website available at

investors.owens-minor.com/events-and-presentations/. A replay of

the webcast can be accessed following the presentation at the link

provided above.

Safe Harbor

This release is intended to be disclosure through methods

reasonably designed to provide broad, non-exclusionary distribution

to the public in compliance with the SEC's Fair Disclosure

Regulation. This release contains certain ''forward-looking''

statements made pursuant to the Safe Harbor provisions of the

Private Securities Litigation Reform Act of 1995. These statements

include, but are not limited to, the statements in this release

regarding our future prospects and performance, including our

expectations with respect to our 2024 financial performance, our

Operating Model Realignment Program and other cost-saving

initiatives, future indebtedness and growth, industry trends, as

well as statements related to our expectations regarding the

performance of our business, including the results of our Operating

Model Realignment Program and our ability to address macro and

market conditions. Forward-looking statements involve known and

unknown risks and uncertainties that may cause our actual results

in future periods to differ materially from those projected or

contemplated in the forward-looking statements. Investors should

refer to Owens & Minor’s Annual Report on Form 10-K for the

year ended December 31, 2023, filed with the SEC on February 20,

2024, including the sections captioned “Cautionary Note Regarding

Forward-Looking Statements” and “Item 1A. Risk Factors,” and

subsequent quarterly reports on Form 10-Q and current reports on

Form 8-K filed with or furnished to the SEC, for a discussion of

certain known risk factors that could cause the Company’s actual

results to differ materially from its current estimates. These

filings are available at www.owens-minor.com. Given these risks and

uncertainties, Owens & Minor can give no assurance that any

forward-looking statements will, in fact, transpire and, therefore,

cautions investors not to place undue reliance on them. Owens &

Minor specifically disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future developments or otherwise.

About Owens & Minor

Owens & Minor, Inc. (NYSE: OMI) is a Fortune 500 global

healthcare solutions company providing essential products and

services that support care from the hospital to the home. For over

100 years, Owens & Minor and its affiliated brands, Apria®,

Byram® and HALYARD*, have helped to make each day better for the

patients, providers, and communities we serve. Powered by more than

20,000 teammates worldwide, Owens & Minor delivers comfort and

confidence behind the scenes so healthcare stays at the forefront.

Owens & Minor exists because every day, everywhere, Life Takes

Care™. For more information about Owens & Minor and our

affiliated brands, visit owens-minor.com or follow us on LinkedIn

and Instagram.

*Registered Trademark or Trademark of O&M Halyard or its

affiliates.

Owens & Minor, Inc.

Consolidated Statements of Operations

(unaudited)

(dollars in thousands, except per share

data)

Three Months Ended June

30,

2024

2023

Net revenue

$

2,671,006

$

2,563,226

Cost of goods sold

2,126,853

2,043,794

Gross profit

544,153

519,432

Distribution, selling and administrative

expenses

469,313

455,030

Acquisition-related charges and intangible

amortization

19,985

22,203

Exit and realignment charges, net

29,293

28,963

Other operating expense, net

5,263

2,397

Operating income

20,299

10,839

Interest expense, net

35,899

40,728

Other expense, net

1,205

1,072

Loss before income taxes

(16,805

)

(30,961

)

Income tax provision (benefit)

15,108

(2,720

)

Net loss

$

(31,913

)

$

(28,241

)

Net loss per common share:

Basic

$

(0.42

)

$

(0.37

)

Diluted

$

(0.42

)

$

(0.37

)

Owens & Minor, Inc.

Consolidated Statements of Operations

(unaudited)

(i) (dollars in thousands, except per

share data)

Six Months Ended June

30,

2024

2023

Net revenue

$

5,283,686

$

5,086,075

Cost of goods sold

4,204,003

4,069,336

Gross profit

1,079,683

1,016,739

Distribution, selling and administrative

expenses

946,926

903,752

Acquisition-related charges and intangible

amortization

40,298

44,392

Exit and realignment charges, net

56,649

44,637

Other operating expense, net

5,815

3,312

Operating income

29,995

20,646

Interest expense, net

71,554

82,926

Other expense, net

2,358

2,458

Loss before income taxes

(43,917

)

(64,738

)

Income tax benefit (provision)

9,882

(12,079

)

Net loss

$

(53,799

)

$

(52,659

)

Net loss per common share:

Basic

$

(0.70

)

$

(0.70

)

Diluted

$

(0.70

)

$

(0.70

)

Owens & Minor, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

(dollars in thousands)

June 30,

December 31,

2024

2023

Assets

Current assets

Cash and cash equivalents

$

243,671

$

243,037

Accounts receivable, net

662,444

598,257

Merchandise inventories

1,231,413

1,110,606

Other current assets

189,542

150,890

Total current assets

2,327,070

2,102,790

Property and equipment, net

493,075

543,972

Operating lease assets

368,471

296,533

Goodwill

1,634,723

1,638,846

Intangible assets, net

326,173

361,835

Other assets, net

154,492

149,346

Total assets

$

5,304,004

$

5,093,322

Liabilities and equity

Current liabilities

Accounts payable

$

1,381,871

$

1,171,882

Accrued payroll and related

liabilities

108,103

116,398

Current portion of long-term debt

210,913

206,904

Other current liabilities

430,298

396,701

Total current liabilities

2,131,185

1,891,885

Long-term debt, excluding current

portion

1,871,800

1,890,598

Operating lease liabilities, excluding

current portion

297,728

222,429

Deferred income taxes, net

28,900

41,652

Other liabilities

113,689

122,592

Total liabilities

4,443,302

4,169,156

Total equity

860,702

924,166

Total liabilities and equity

$

5,304,004

$

5,093,322

Owens & Minor, Inc.

Consolidated Statements of Cash Flows

(unaudited)

(dollars in thousands)

Three Months Ended June

30,

2024

2023

Operating activities:

Net loss

$

(31,913

)

$

(28,241

)

Adjustments to reconcile net loss to cash

provided by operating activities:

Depreciation and amortization

63,879

72,062

Share-based compensation expense

6,735

5,212

Provision (benefit) for losses on accounts

receivable

143

(379

)

Loss on extinguishment of debt

—

279

Deferred income tax benefit

(5,370

)

(6,167

)

Changes in operating lease right-of-use

assets and lease liabilities

2,627

(2,852

)

Gain on sale and dispositions of property

and equipment

(12,257

)

(10,294

)

Changes in operating assets and

liabilities:

Accounts receivable

6,702

84,963

Merchandise inventories

(87,665

)

119,819

Accounts payable

150,445

29,077

Net change in other assets and

liabilities

20,100

46,471

Other, net

2,723

3,162

Cash provided by operating

activities

116,149

313,112

Investing activities:

Additions to property and equipment

(44,382

)

(46,600

)

Additions to computer software

(1,418

)

(2,889

)

Proceeds from sale of property and

equipment

17,488

18,423

Other, net

(6,858

)

(418

)

Cash used for investing

activities

(35,170

)

(31,484

)

Financing activities:

Borrowings under amended Receivables

Financing Agreement

462,300

116,100

Repayments under amended Receivables

Financing Agreement

(528,000

)

(116,100

)

Repayments of term loans

(7,750

)

(51,801

)

Other, net

(4,790

)

(3,830

)

Cash used for financing

activities

(78,240

)

(55,631

)

Effect of exchange rate changes on

cash, cash equivalents and restricted cash

(64

)

(88

)

Net increase in cash, cash equivalents

and restricted cash

2,675

225,909

Cash, cash equivalents and restricted

cash at beginning of period

270,794

83,194

Cash, cash equivalents and restricted

cash at end of period(1)

$

273,469

$

309,103

Supplemental disclosure of cash flow

information:

Income taxes paid (received), net

$

2,875

$

(12,911

)

Interest paid

$

52,608

$

46,089

Noncash investing activity:

Unpaid purchases of property and equipment

and computer software at end of period

$

76,373

$

65,808

(1) Restricted cash as of June 30, 2024 and March 31, 2024 was

$29.8 million and $25.9 million and includes amounts held in an

escrow account as required by the Centers for Medicare &

Medicaid Services (CMS) in conjunction with the Bundled Payments

for Care Improvement (BPCI) initiatives related to wind-down costs

of Fusion5, as well as restricted cash deposits received under the

Master Receivables Purchase Agreement to be remitted to a

third-party financial institution.

Owens & Minor, Inc.

Consolidated Statements of Cash Flows

(unaudited)

(dollars in thousands)

Six Months Ended June

30,

2024

2023

Operating activities:

Net loss

$

(53,799

)

$

(52,659

)

Adjustments to reconcile net loss to cash

provided by operating activities:

Depreciation and amortization

137,974

142,988

Share-based compensation expense

13,601

11,675

Provision (benefit) for losses on accounts

receivable

324

(900

)

Loss on extinguishment of debt

—

843

Deferred income tax benefit

(9,029

)

(6,758

)

Changes in operating lease right-of-use

assets and lease liabilities

3,766

(3,077

)

Gain on sale and dispositions of property

and equipment

(27,876

)

(18,563

)

Changes in operating assets and

liabilities:

Accounts receivable

(68,442

)

90,203

Merchandise inventories

(123,077

)

165,651

Accounts payable

203,371

52,159

Net change in other assets and

liabilities

(19,517

)

82,954

Other, net

5,891

6,994

Cash provided by operating

activities

63,187

471,510

Investing activities:

Additions to property and equipment

(90,379

)

(92,750

)

Additions to computer software

(4,829

)

(8,229

)

Proceeds from sale of property and

equipment

67,026

35,729

Other, net

(8,858

)

(418

)

Cash used for investing

activities

(37,040

)

(65,668

)

Financing activities:

Borrowings under amended Receivables

Financing Agreement

667,300

348,200

Repayments under amended Receivables

Financing Agreement

(667,300

)

(444,200

)

Repayments of term loans

(12,375

)

(78,301

)

Other, net

(12,545

)

(8,819

)

Cash used for financing

activities

(24,920

)

(183,120

)

Effect of exchange rate changes on

cash, cash equivalents and restricted cash

(682

)

196

Net increase in cash, cash equivalents

and restricted cash

545

222,918

Cash, cash equivalents and restricted

cash at beginning of period

272,924

86,185

Cash, cash equivalents and restricted

cash at end of period(1)

$

273,469

$

309,103

Supplemental disclosure of cash flow

information:

Income taxes paid (received), net

$

5,240

$

(10,506

)

Interest paid

$

70,819

$

78,625

Noncash investing activity:

Unpaid purchases of property and equipment

and computer software at end of period

$

76,373

$

65,808

(1) Restricted cash as of June 30, 2024 and December 31, 2023

was $29.8 million and $29.9 million and includes amounts held in an

escrow account as required by the Centers for Medicare &

Medicaid Services (CMS) in conjunction with the Bundled Payments

for Care Improvement (BPCI) initiatives related to wind-down costs

of Fusion5, as well as restricted cash deposits received under the

Master Receivables Purchase Agreement to be remitted to a

third-party financial institution.

Owens & Minor, Inc.

Summary Segment Information

(unaudited)

(dollars in thousands)

Three Months Ended June

30,

2024

2023

% of

% of

consolidated

consolidated

Amount

net revenue

Amount

net revenue

Net revenue:

Products & Healthcare Services

$

2,010,605

75.28

%

$

1,930,723

75.32

%

Patient Direct

660,401

24.72

%

632,503

24.68

%

Consolidated net revenue

$

2,671,006

100.00

%

$

2,563,226

100.00

%

% of segment

% of segment

Operating income:

net revenue

net revenue

Products & Healthcare Services

$

11,468

0.57

%

$

2,940

0.15

%

Patient Direct

64,787

9.81

%

59,065

9.34

%

Acquisition-related charges and intangible

amortization

(19,985

)

(22,203

)

Exit and realignment charges, net

(29,293

)

(28,963

)

Litigation and related charges (1)

(6,678

)

—

Consolidated operating income

$

20,299

$

10,839

Depreciation and amortization:

Products & Healthcare Services

$

19,084

$

18,772

Patient Direct

44,795

53,290

Consolidated depreciation and

amortization

$

63,879

$

72,062

Capital expenditures:

Products & Healthcare Services

$

3,117

$

6,602

Patient Direct

42,683

42,887

Consolidated capital expenditures

$

45,800

$

49,489

(1) Litigation and related charges are reported within Other

operating expense, net in our Statements of Operations. Refer to

footnote 3 in the GAAP/Non-GAAP Reconciliations below.

Owens & Minor, Inc.

Summary Segment Information

(unaudited)

(dollars in thousands)

Six Months Ended June

30,

2024

2023

% of

% of

consolidated

consolidated

Amount

net revenue

Amount

net revenue

Net revenue:

Products & Healthcare Services

$

3,985,442

75.43

%

$

3,846,212

75.62

%

Patient Direct

1,298,244

24.57

%

1,239,863

24.38

%

Consolidated net revenue

$

5,283,686

100.00

%

$

5,086,075

100.00

%

% of segment

% of segment

Operating income:

net revenue

net revenue

Products & Healthcare Services

$

22,954

0.58

%

$

4,761

0.12

%

Patient Direct

110,666

8.52

%

104,914

8.46

%

Acquisition-related charges and intangible

amortization

(40,298

)

(44,392

)

Exit and realignment charges, net

(56,649

)

(44,637

)

Litigation and related charges (1)

(6,678

)

—

Consolidated operating income

$

29,995

$

20,646

Depreciation and amortization:

Products & Healthcare Services

$

42,450

$

37,338

Patient Direct

95,524

105,650

Consolidated depreciation and

amortization

$

137,974

$

142,988

Capital expenditures:

Products & Healthcare Services

$

11,367

$

12,934

Patient Direct

83,841

88,045

Consolidated capital expenditures

$

95,208

$

100,979

(1) Litigation and related charges are reported within Other

operating expense, net in our Statements of Operations. Refer to

footnote 3 in the GAAP/Non-GAAP Reconciliations below.

Owens & Minor, Inc.

Net Loss Per Common Share

(unaudited)

(dollars in thousands, except per share

data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net loss

$

(31,913

)

$

(28,241

)

$

(53,799

)

$

(52,659

)

Weighted average shares outstanding -

basic

76,727

75,801

76,526

75,559

Dilutive shares

—

—

—

—

Weighted average shares outstanding -

diluted

76,727

75,801

76,526

75,559

Net loss per common share:

Basic

$

(0.42

)

$

(0.37

)

$

(0.70

)

$

(0.70

)

Diluted

$

(0.42

)

$

(0.37

)

$

(0.70

)

$

(0.70

)

Share-based awards of approximately 1.6 million shares for the

three and six months ended June 30, 2024 and approximately 1.8

million and 1.7 million shares for the three and six months ended

June 30, 2023 were excluded from the calculation of net loss per

diluted common share as the effect would be anti-dilutive.

Owens & Minor, Inc.

GAAP/Non-GAAP Reconciliations

(unaudited)

(dollars in thousands, except per share

data)

The following table provides a

reconciliation of reported operating income, net loss and net loss

per share to non-GAAP measures used by management.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Operating income, as reported (GAAP)

$

20,299

$

10,839

$

29,995

$

20,646

Acquisition-related charges and intangible

amortization (1)

19,985

22,203

40,298

44,392

Exit and realignment charges, net (2)

29,293

28,963

56,649

44,637

Litigation and related charges (3)

6,678

—

6,678

—

Operating income, adjusted (non-GAAP)

(Adjusted Operating Income)

$

76,255

$

62,005

$

133,620

$

109,675

Operating income as a percent of net

revenue (GAAP)

0.76

%

0.42

%

0.57

%

0.41

%

Adjusted operating income as a percent of

net revenue (non-GAAP)

2.85

%

2.42

%

2.53

%

2.16

%

Net loss, as reported (GAAP)

$

(31,913

)

$

(28,241

)

$

(53,799

)

$

(52,659

)

Pre-tax adjustments:

Acquisition-related charges and intangible

amortization (1)

19,985

22,203

40,298

44,392

Exit and realignment charges, net (2)

29,293

28,963

56,649

44,637

Litigation and related charges (3)

6,678

—

6,678

—

Other (4)

430

843

861

1,972

Income tax benefit on pre-tax adjustments

(5)

(13,553

)

(9,551

)

(24,901

)

(20,530

)

One-time income tax charge (6)

17,233

—

17,233

—

Net income, adjusted (non-GAAP) (Adjusted

Net Income)

$

28,153

$

14,217

$

43,019

$

17,812

Net loss per common share, as reported

(GAAP)

$

(0.42

)

$

(0.37

)

$

(0.70

)

$

(0.70

)

After-tax adjustments:

Acquisition-related charges and intangible

amortization (1)

0.19

0.24

0.39

0.45

Exit and realignment charges, net (2)

0.29

0.30

0.55

0.46

Litigation and related charges (3)

0.08

—

0.08

—

Other (4)

—

0.01

0.01

0.02

One-time income tax charge (6)

0.22

—

0.22

—

Net income per common share, adjusted

(non-GAAP) (Adjusted EPS)

$

0.36

$

0.18

$

0.55

$

0.23

Owens & Minor, Inc.

GAAP/Non-GAAP Reconciliations

(unaudited), continued

(dollars in thousands)

The following tables provide

reconciliations of net loss and total debt to non-GAAP measures

used by management.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net loss, as reported (GAAP)

$

(31,913

)

$

(28,241

)

$

(53,799

)

$

(52,659

)

Income tax provision (benefit)

15,108

(2,720

)

9,882

(12,079

)

Interest expense, net

35,899

40,728

71,554

82,926

Acquisition-related charges and intangible

amortization (1)

19,985

22,203

40,298

44,392

Exit and realignment charges, net (2)

29,293

28,963

56,649

44,637

Other depreciation and amortization

(7)

46,146

50,737

94,160

100,726

Litigation and related charges (3)

6,678

—

6,678

—

Stock compensation (8)

6,312

4,796

12,488

11,146

LIFO (credits) and charges (9)

(1,124

)

(4,534

)

4,314

406

Other (4)

430

843

861

1,972

Adjusted EBITDA (non-GAAP)

$

126,814

$

112,775

$

243,085

$

221,467

June 30,

December 31,

2024

2023

Total debt, as reported (GAAP)

$

2,082,713

$

2,097,502

Cash and cash equivalents

(243,671

)

(243,037

)

Net debt (non-GAAP)

$

1,839,042

$

1,854,465

The following items have been excluded in our non-GAAP financial

measures:

(1) Acquisition-related charges and intangible amortization

includes $3.7 million of acquisition-related charges for the three

and six months ended June 30, 2024 consisting of costs related to

the pending Rotech transaction and $1.3 million and $2.5 million

for the three and six months ended June 30, 2023 consisting

primarily of costs related to the acquisition of Apria, Inc., as

well as amortization of intangible assets established during

acquisition method of accounting for business combinations.

Acquisition-related charges consist primarily of one-time costs

related to acquisitions, including transaction costs necessary to

consummate the acquisition, which consist of investment banking

advisory fees and legal fees and director and officer tail

insurance expense, as well as transition costs, such as severance

and retention bonuses, information technology (IT) integration

costs and professional fees. These amounts are highly dependent on

the size and frequency of acquisitions and are being excluded to

allow for a more consistent comparison with forecasted, current and

historical results.

(2) During the three and six months ended June 30, 2024 exit and

realignment charges, net were $29.3 million and $56.6 million.

These charges primarily related to our (1) Operating Model

Realignment Program of $22.9 million and $56.4 million,

professional fees, severance, and other costs to streamline

functions and processes, (2) costs related to IT strategic

initiatives such as converting certain divisions to common IT

systems of $5.4 million and $6.7 million and (3) other costs

associated with strategic initiatives of $1.0 million and $1.1

million for the three and six months ended June 30, 2024. Exit and

realignment charges, net also included a $7.4 million gain on the

sale of our corporate headquarters for the six months ended June

30, 2024. During the three and six months ended June 30, 2023 exit

and realignment charges, net were $29.0 million and $44.6 million.

These charges primarily related to our (1) Operating Model

Realignment Program of $24.3 million and $39.3 million, including

professional fees, severance and other costs to streamline

functions and processes, (2) IT restructuring charges such as

converting to common IT systems of $3.4 million and $3.5 million

and, (3) other costs associated with strategic initiatives of $1.3

million and $1.8 million for the three and six months ended June

30, 2023. These costs are not normal recurring, cash operating

expenses necessary for the Company to operate its business on an

ongoing basis.

(3) Litigation and related charges includes settlement costs and

related charges of legal matters within our Apria division. These

costs do not occur in the ordinary course of our business, are

non-recurring/infrequent and are inherently unpredictable in timing

and amount.

(4) For the three and six months ended June 30, 2024 and 2023,

other includes interest costs and net actuarial losses related to

our frozen noncontributory, unfunded retirement plan for certain

retirees in the United States (U.S.). Additionally, for the three

and six months ended June 30, 2023 other includes loss on

extinguishment of debt of $0.3 million and $0.8 million associated

with the early retirement of indebtedness of $48.0 million and

$73.0 million.

(5) These charges have been tax effected by determining the

income tax rate depending on the amount of charges incurred in

different tax jurisdictions and the deductibility of those charges

for income tax purposes.

(6) One-time income tax charge relates to a recent decision

associated with the Notice of Proposed Adjustments received in 2020

and 2021. The matter at hand, as discussed in previously filed SEC

documents, is related to past transfer pricing methodology which is

no longer employed. We believe the matter will be concluded without

further impact to our financial results.

(7) Other depreciation and amortization relates to property and

equipment and capitalized computer software, excluding such amounts

captured within exit and realignment charges, net or

acquisition-related charges.

(8) Stock compensation includes share-based compensation expense

related to our share-based compensation plans, excluding such

amounts captured within exit and realignment charges, net or

acquisition-related charges.

(9) LIFO (credits) and charges includes non-cash adjustments to

merchandise inventories valued at the lower of cost or market, with

the approximate cost determined by the last-in, first-out (LIFO)

method for distribution inventories in the U.S. within our Products

& Healthcare Services segment.

Use of Non-GAAP

Measures

This earnings release contains financial measures that are not

calculated in accordance with U.S. generally accepted accounting

principles (GAAP). In general, the measures exclude items and

charges that (i) management does not believe reflect Owens &

Minor, Inc.’s (the Company) core business and relate more to

strategic, multi-year corporate activities; or (ii) relate to

activities or actions that may have occurred over multiple or in

prior periods without predictable trends. Management uses these

non-GAAP financial measures internally to evaluate the Company’s

performance, evaluate the balance sheet, engage in financial and

operational planning and determine incentive compensation.

Management provides these non-GAAP financial measures to

investors as supplemental metrics to assist readers in assessing

the effects of items and events on its financial and operating

results and in comparing the Company’s performance to that of its

competitors. However, the non-GAAP financial measures used by the

Company may be calculated differently from, and therefore may not

be comparable to, similarly titled measures used by other

companies.

The non-GAAP financial measures disclosed by the Company should

not be considered substitutes for, or superior to, financial

measures calculated in accordance with GAAP, and the financial

results calculated in accordance with GAAP and reconciliations to

those financial statements set forth above should be carefully

evaluated.

OMI-CORP

OMI-IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240802259992/en/

Investors Alpha IR Group

Jackie Marcus or Nick Teves OMI@alpha-ir.com

Jonathan Leon Senior Vice President, Corporate Treasurer &

Interim Chief Financial Officer

Investor.Relations@owens-minor.com

Media Stacy Law

media@owens-minor.com

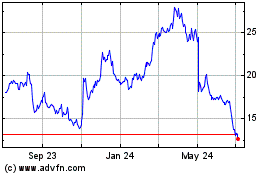

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Oct 2024 to Nov 2024

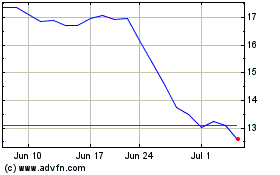

Owens and Minor (NYSE:OMI)

Historical Stock Chart

From Nov 2023 to Nov 2024