Orchid Island Capital, Inc. (NYSE:ORC) ("Orchid” or the

"Company"), a real estate investment trust ("REIT"), today

announced results of operations for the three and twelve month

periods ended December 31, 2023.

Fourth Quarter 2023 Results

- Net income of $27.1 million, or $0.52 per common share, which

consists of:

- Net interest expense of $(2.8) million, or $(0.05) per common

share

- Total expenses of $4.1 million, or $0.08 per common share

- Net realized and unrealized gains of $34.0 million, or $0.65

per common share, on RMBS and derivative instruments, including net

interest income on interest rate swaps

- Fourth quarter and full year total dividends declared and paid

of $0.36 and $1.80 per common share, respectively

- Book value per common share of $9.10 at December 31, 2023

- Total return of 6.05%, comprised of $0.36 dividends per common

share and an $0.18 increase in book value per common share, divided

by beginning book value per common share

Other Financial Highlights

- Orchid maintained a strong liquidity position of $200.4 million

in cash and cash equivalents and unpledged securities (net of

unsettled purchased securities, or 43% of stockholder’s equity as

of December 31, 2023

- Borrowing capacity in excess of December 31, 2023 outstanding

repurchase agreement balances of $3,705.7 million, spread across 21

active lenders

- Company to discuss results on Friday, February 2, 2024, at

10:00 AM ET

- Supplemental materials to be discussed on the call can be

downloaded from the investor relations section of the Company’s

website at https://ir.orchidislandcapital.com

Management Commentary

Commenting on the fourth quarter results, Robert E. Cauley,

Chairman and Chief Executive Officer, said, “The last quarter of

2023 may prove to be a very pivotal period. At the conclusion of

the third quarter of 2023 several factors were driving interest

rates rapidly higher and the market fully expected rates to remain

higher for an extended period. Rapidly expanding federal deficits

were a key driver and the Federal Reserve’s (the "Fed") own

outlook, expressed via their quarterly “dot plots,” reflected rates

remaining high through 2024. The outlook began to change in early

November. The impetus was twofold. Economic data, particularly

inflation data, appeared to moderate. The Fed reacted to this

development in their public comments. Even the Chairman at the

press conference at the conclusion of their December meeting

strongly hinted that if inflation continued to moderate, they were

done raising rates and they would likely cut rates – perhaps

relatively soon.

“The markets reacted strongly to these developments. Risk assets

of all types performed very well over the balance of the fourth

quarter. Several sectors of the fixed income markets with negative

year to date returns as of November 1, 2023 ended the quarter and

year with positive returns. Interest rates ended the quarter

significantly lower than the levels at September 30, 2023, even

after rising significantly during October. The yield on the 2-year

U.S. Treasury declined by nearly 80 basis points during the fourth

quarter, and the 10-year U.S. Treasury declined by approximately 70

basis points. Equity markets performed even better, with the

S&P 500 finishing the quarter with a positive 11.7% return and

the year with a positive 26.3% return. Agency MBS had a relatively

strong quarter, outperforming most other sectors of the fixed

income markets except for municipals and emerging market high

yield. For the year Agency MBS returns were not as strong on a

relative basis, but still positive at +5.05%.

“Orchid’s book value increased over the quarter, from $8.92 at

the end of the third quarter to $9.10 at December 31, 2023. During

the turbulent weeks at the beginning of the quarter as rates moved

higher and mortgage performance was quite poor, we reduced leverage

and decreased the size of the portfolio by approximately 15.7% with

the sales focused solely in longer duration discount securities.

When the market reversed and interest rates decreased, we kept our

hedge coverage constant as it appeared the market might be getting

too optimistic on the magnitude and timing of rate cuts in 2024. As

we entered 2024 this proved to be a prudent step as the market has

since reversed again and market pricing of Fed rates cuts in 2024

has both declined and been pushed further into the future.

Mortgages have not performed very well, having widened to

comparable duration rates or swaps slightly.

“As we enter 2024 the steps taken in 2023 should serve us well.

We have reduced our exposure to lower coupon securities and

increased the weighted average coupon of the portfolio from 3.47%

at December 31, 2022 to 4.33% at December 31, 2023. Our hedge

strategy has protected our funding costs from increasing too high

as the Fed raised overnight funding costs towards 5.5%. In fact,

our economic interest spread, which reflects the effect of our

hedges, increased from 1.33% at September 30, 2023 to 2.35% at year

end. Going forward, the severe book value pressure for the bulk of

the last two years appears to have abated and with our earnings

having stabilized, we believe there is room for our earnings to

increase should Fed rate cuts lower our funding costs.”

Details of Fourth Quarter 2023 Results of Operations

The Company reported net income of $27.1 million for the three

month period ended December 31, 2023, compared with net income of

$34.9 million for the three month period ended December 31, 2022.

The Company decreased its Agency RMBS portfolio during the fourth

quarter of 2023, from $4.5 billion at September 30, 2023 to $3.9

billion at December 31, 2023. Interest income on the portfolio in

the fourth quarter was down approximately $0.6 million from the

third quarter of 2023. The yield on our average Agency RMBS

increased from 4.51% in the third quarter of 2023 to 4.71% for the

fourth quarter of 2023, repurchase agreement borrowing costs

decreased from 5.44% for the third quarter of 2023 to 5.15% for the

fourth quarter of 2023, and our net interest spread increased from

(0.93)% in the third quarter of 2023 to (0.44)% in the fourth

quarter of 2023.

Book value increased by $0.18 per share in the fourth quarter of

2023. The increase in book value reflects our net income of $0.52

per share and the dividend distribution of $0.36 per share. The

Company recorded net realized and unrealized gains of $0.65 per

share on Agency RMBS assets and derivative instruments, including

net interest income on interest rate swaps.

Details of Full Year 2023 Results of Operations

The Company reported a net loss of $39.2 million for the year

ended December 31, 2023, compared with a net loss of $258.5 million

for the year ended December 31, 2022. Interest income on the

portfolio in the year ended December 31, 2023 was approximately

$177.6 million and the yield on our average Agency RMBS was 4.28%.

Repurchase agreement interest expense was $201.9 million during

2023 with an average cost of 5.07%.

Prepayments

For the quarter ended December 31, 2023, Orchid received $88.8

million in scheduled and unscheduled principal repayments and

prepayments, which equated to a 3-month constant prepayment rate

(“CPR”) of approximately 5.5%. Prepayment rates on the two RMBS

sub-portfolios were as follows (in CPR):

Structured

PT RMBS

RMBS

Total

Three Months Ended

Portfolio (%)

Portfolio (%)

Portfolio (%)

December 31, 2023

5.4

7.9

5.5

September 30, 2023

6.1

5.7

6.0

June 30, 2023

5.6

7.0

5.6

March 31, 2023

3.9

5.7

4.0

December 31, 2022

4.9

6.0

5.0

September 30, 2022

6.1

10.4

6.5

June 30, 2022

8.3

13.7

9.4

March 31, 2022

8.1

19.5

10.7

Portfolio

The following tables summarize certain characteristics of

Orchid’s PT RMBS (as defined below) and structured RMBS as of

December 31, 2023 and December 31, 2022:

($ in thousands)

Weighted

Percentage

Average

of

Weighted

Maturity

Fair

Entire

Average

in

Longest

Asset Category

Value

Portfolio

Coupon

Months

Maturity

December 31, 2023

Fixed Rate RMBS

$

3,877,082

99.6

%

4.33

%

334

1-Nov-53

Interest-Only Securities

16,572

0.4

%

4.01

%

223

25-Jul-48

Inverse Interest-Only Securities

358

0.0

%

0.00

%

274

15-Jun-42

Total Mortgage Assets

$

3,894,012

100.0

%

4.30

%

331

1-Nov-53

December 31, 2022

Fixed Rate RMBS

$

3,519,906

99.4

%

3.47

%

339

1-Nov-52

Interest-Only Securities

19,669

0.6

%

4.01

%

234

25-Jul-48

Inverse Interest-Only Securities

427

0.0

%

0.00

%

286

15-Jun-42

Total Mortgage Assets

$

3,540,002

100.0

%

3.46

%

336

1-Nov-52

($ in thousands)

December 31, 2023

December 31, 2022

Percentage of

Percentage of

Agency

Fair Value

Entire Portfolio

Fair Value

Entire Portfolio

Fannie Mae

$

2,714,192

69.7

%

$

2,320,960

65.6

%

Freddie Mac

1,179,820

30.3

%

1,219,042

34.4

%

Total Portfolio

$

3,894,012

100.0

%

$

3,540,002

100.0

%

December 31, 2023

December 31, 2022

Weighted Average Pass-through Purchase

Price

$

104.10

$

106.41

Weighted Average Structured Purchase

Price

$

18.74

$

18.74

Weighted Average Pass-through Current

Price

$

95.70

$

91.46

Weighted Average Structured Current

Price

$

13.51

$

14.05

Effective Duration (1)

4.400

5.580

(1)

Effective duration of 4.400 indicates that

an interest rate increase of 1.0% would be expected to cause a

4.400% decrease in the value of the RMBS in the Company’s

investment portfolio at December 31, 2023. An effective duration of

5.580 indicates that an interest rate increase of 1.0% would be

expected to cause a 5.580% decrease in the value of the RMBS in the

Company’s investment portfolio at December 31, 2022. These figures

include the structured securities in the portfolio, but do not

include the effect of the Company’s funding cost hedges. Effective

duration quotes for individual investments are obtained from The

Yield Book, Inc.

Financing, Leverage and Liquidity

As of December 31, 2023, the Company had outstanding repurchase

obligations of approximately $3,705.6 million with a net weighted

average borrowing rate of 5.55%. These agreements were

collateralized by RMBS with a fair value, including accrued

interest, of approximately $3,900.5 million. The Company’s adjusted

leverage ratio, defined as the balance of repurchase agreement

liabilities divided by stockholders' equity, at December 31, 2023

was 7.9 to 1. At December 31, 2023, the Company’s liquidity was

approximately $200.4 million consisting of cash and cash

equivalents and unpledged securities (not including unsettled

securities purchases). To enhance our liquidity even further, we

may pledge more of our structured RMBS as part of a repurchase

agreement funding, but retain the cash in lieu of acquiring

additional assets. In this way we can, at a modest cost, retain

higher levels of cash on hand and decrease the likelihood we will

have to sell assets in a distressed market in order to raise cash.

Below is a list of our outstanding borrowings under repurchase

obligations at December 31, 2023.

($ in thousands)

Weighted

Weighted

Total

Average

Average

Outstanding

% of

Borrowing

Amount

Maturity

Counterparty

Balances

Total

Rate

at Risk(1)

in Days

RBC Capital Markets, LLC

300,275

8.1

%

5.53

%

$

9,705

16

Citigroup Global Markets Inc

298,549

8.1

%

5.55

%

15,832

26

Mitsubishi UFJ Securities (USA), Inc.

284,167

7.7

%

5.57

%

15,761

22

J.P. Morgan Securities LLC

266,958

7.2

%

5.54

%

14,264

18

Cantor Fitzgerald & Co

257,999

7.0

%

5.54

%

12,990

44

ASL Capital Markets Inc.

244,611

6.6

%

5.53

%

13,391

17

Wells Fargo Bank, N.A.

218,540

5.9

%

5.56

%

11,522

26

Mirae Asset Securities (USA) Inc.

200,200

5.4

%

5.53

%

8,721

52

Merrill Lynch, Pierce, Fenner &

Smith

193,715

5.2

%

5.56

%

13,036

16

Daiwa Securities America Inc.

179,787

4.9

%

5.54

%

6,862

24

ABN AMRO Bank N.V.

177,114

4.8

%

5.55

%

10,102

20

Bank of Montreal

169,041

4.6

%

5.55

%

9,112

16

StoneX Financial Inc.

168,852

4.6

%

5.55

%

9,023

16

Goldman, Sachs & Co

160,410

4.3

%

5.56

%

8,533

18

Banco Santander SA

154,412

4.2

%

5.53

%

7,670

71

ING Financial Markets LLC

128,758

3.5

%

5.55

%

5,498

16

Marex Capital Markets Inc.

115,143

3.1

%

5.52

%

4,385

10

DV Securities, LLC Repo

88,423

2.4

%

5.55

%

5,105

48

South Street Securities, LLC

80,295

2.2

%

5.57

%

4,131

59

Lucid Cash Fund USG LLC

9,840

0.3

%

5.55

%

768

18

Lucid Prime Fund, LLC

8,560

0.2

%

5.54

%

474

18

Total / Weighted Average

$

3,705,649

100.0

%

5.55

%

$

186,885

26

(1)

Equal to the sum of the fair value of

securities sold, accrued interest receivable and cash posted as

collateral (if any), minus the sum of repurchase agreement

liabilities, accrued interest payable and the fair value of

securities posted by the counterparties (if any).

Hedging

In connection with its interest rate risk management strategy,

the Company economically hedges a portion of the cost of its

repurchase agreement funding against a rise in interest rates by

entering into derivative financial instrument contracts. The

Company has not elected hedging treatment under U.S. generally

accepted accounting principles (“GAAP”) in order to align the

accounting treatment of its derivative instruments with the

treatment of its portfolio assets under the fair value option

election. As such, all gains or losses on these instruments are

reflected in earnings for all periods presented. At December 31,

2023, such instruments were comprised of U.S. Treasury note

(“T-Note”) and Secured Overnight Financing Rate ("SOFR") futures

contracts, interest rate swap agreements, interest rate swaption

agreements, and contracts to sell to-be-announced ("TBA")

securities.

The table below presents information related to the Company’s

T-Note and SOFR futures contracts at December 31, 2023.

($ in thousands)

December 31, 2023

Average

Weighted

Weighted

Contract

Average

Average

Notional

Entry

Effective

Open

Expiration Year

Amount

Rate

Rate

Equity(1)

U.S. Treasury Note Futures Contracts

(Short Positions)(2)

March 2024 5-year T-Note futures (Mar 2024

- Mar 2029 Hedge Period)

$

421,500

4.36

%

4.04

%

$

(9,936

)

March 2024 10-year Ultra futures (Mar 2024

- Mar 2034 Hedge Period)

320,000

4.38

%

4.39

%

$

(11,393

)

SOFR Futures Contracts (Short

Positions)

June 2024 3-Month SOFR futures (Mar 2024 -

Jun 2024 Hedge Period)

$

25,000

5.08

%

4.99

%

$

(24

)

September 2024 3-Month SOFR futures (Jun

2024 - Sep 2024 Hedge Period)

25,000

4.67

%

4.52

%

$

(39

)

December 2024 3-Month SOFR futures (Sep

2024 - Dec 2024 Hedge Period)

25,000

4.27

%

4.10

%

$

(44

)

March 2025 3-Month SOFR futures (Dec 2024

- Mar 2025 Hedge Period)

25,000

3.90

%

3.73

%

$

(43

)

June 2025 3-Month SOFR futures (Mar 2025 -

Jun 2025 Hedge Period)

25,000

3.58

%

3.42

%

$

(41

)

September 2025 3-Month SOFR futures (Jun

2025 - Sep 2025 Hedge Period)

25,000

3.37

%

3.21

%

$

(39

)

December 2025 3-Month SOFR futures (Sep

2025 - Dec 2025 Hedge Period)

25,000

3.25

%

3.10

%

$

(37

)

March 2026 3-Month SOFR futures (Dec 2025

- Mar 2026 Hedge Period)

25,000

3.21

%

3.07

%

$

(35

)

(1)

Open equity represents the cumulative

gains (losses) recorded on open futures positions from

inception.

(2)

5-Year T-Note futures contracts were

valued at a price of $108.77 at December 31, 2023. The contract

values of the short positions were $458.5 million at December 31,

2023. 10-Year Ultra futures contracts were valued at a price of

$112.89 at December 31, 2023. The contract value of the short

positions was $361.3 million at December 31, 2023.

The table below presents information related to the Company’s

interest rate swap positions at December 31, 2023.

($ in thousands)

Average

Fixed

Average

Average

Notional

Pay

Receive

Maturity

Amount

Rate

Rate

(Years)

Expiration > 1 to ≤ 5 years

$

500,000

0.84

%

5.64

%

2.7

Expiration > 5 years

1,826,500

2.62

%

5.40

%

6.8

$

2,326,500

2.24

%

5.45

%

5.9

The following table presents information related to our interest

rate swaption positions as of December 31, 2023.

($ in thousands)

Option

Underlying Swap

Weighted

Average

Weighted

Average

Average

Adjustable

Average

Fair

Months to

Notional

Fixed

Rate

Term

Expiration

Cost

Value

Expiration

Amount

Rate

(LIBOR)

(Years)

Payer Swaptions (long

positions)

≤ 1 year

$

1,619

$

72

5.0

$

800,000

5.40

%

SOFR

1.0

The following table summarizes our contracts to sell TBA

securities as of December 31, 2023.

($ in thousands)

Notional

Net

Amount

Cost

Market

Carrying

Long (Short)(1)

Basis(2)

Value(3)

Value(4)

December 31, 2023

30-Year TBA securities:

3.00%

$

(70,700

)

$

(59,278

)

$

(62,647

)

$

(3,369

)

5.00%

(250,000

)

(242,725

)

(247,657

)

(4,932

)

5.50%

(325,000

)

(322,410

)

(326,803

)

(4,393

)

$

(645,700

)

$

(624,413

)

$

(637,107

)

$

(12,694

)

(1)

Notional amount represents the

par value (or principal balance) of the underlying Agency RMBS.

(2)

Cost basis represents the forward

price to be paid (received) for the underlying Agency RMBS.

(3)

Market value represents the

current market value of the TBA securities (or of the underlying

Agency RMBS) as of period-end.

(4)

Net carrying value represents the

difference between the market value and the cost basis of the TBA

securities as of period-end and is reported in derivative assets

(liabilities) at fair value in our balance sheets.

Dividends

In addition to other requirements that must be satisfied to

qualify as a REIT, we must pay annual dividends to our stockholders

of at least 90% of our REIT taxable income, determined without

regard to the deduction for dividends paid and excluding any net

capital gains. We intend to pay regular monthly dividends to our

stockholders and have declared the following dividends since our

February 2013 IPO.

(in thousands, except per share

amounts)

Year

Per Share Amount

Total

2013

$

6.975

$

4,662

2014

10.800

22,643

2015

9.600

38,748

2016

8.400

41,388

2017

8.400

70,717

2018

5.350

55,814

2019

4.800

54,421

2020

3.950

53,570

2021

3.900

97,601

2022

2.475

87,906

2023

1.800

81,127

2024 YTD(1)

0.120

6,181

Totals

$

66.570

$

614,778

(1)

On January 10, 2024, the Company declared

a dividend of $0.12 per share to be paid on February 27, 2024. The

effect of this dividend is included in the table above but is not

reflected in the Company’s financial statements as of December 31,

2023.

Book Value Per Share

The Company's book value per share at December 31, 2023 was

$9.10. The Company computes book value per share by dividing total

stockholders' equity by the total number of shares outstanding of

the Company's common stock. At December 31, 2023, the Company's

stockholders' equity was $469.9 million with 51,636,074 shares of

common stock outstanding.

Capital Allocation and Return on Invested Capital

The Company allocates capital to two RMBS sub-portfolios, the

pass-through RMBS portfolio, consisting of mortgage pass-through

certificates issued by Fannie Mae, Freddie Mac or Ginnie Mae (the

“GSEs”) and collateralized mortgage obligations (“CMOs”) issued by

the GSEs (“PT RMBS”), and the structured RMBS portfolio, consisting

of interest-only (“IO”) and inverse interest-only (“IIO”)

securities. As of September 30, 2023, approximately 95.1% of the

Company’s investable capital (which consists of equity in pledged

PT RMBS, available cash and unencumbered assets) was deployed in

the PT RMBS portfolio. At December 31, 2023, the allocation to the

PT RMBS portfolio increased to approximately 95.6%.

The table below details the changes to the respective

sub-portfolios during the quarter.

(in thousands)

Portfolio Activity for the

Quarter

Structured Security

Portfolio

Pass-Through

Interest-Only

Inverse Interest

Portfolio

Securities

Only Securities

Sub-total

Total

Market value - September 30,

2023

$

4,502,115

$

17,833

$

277

$

18,110

$

4,520,225

Securities purchased

77,243

-

-

-

77,243

Securities sold

(797,633

)

-

-

-

(797,633

)

Losses on sales

(22,642

)

-

-

-

(22,642

)

Return of investment

n/a

(593

)

-

(593

)

(593

)

Pay-downs

(88,223

)

n/a

-

n/a

(88,223

)

Discount accretion due to pay-downs

8,067

n/a

-

n/a

8,067

Mark to market gains (losses)

198,155

(668

)

81

(587

)

197,568

Market value - December 31,

2023

$

3,877,082

$

16,572

$

358

$

16,930

$

3,894,012

The tables below present the allocation of capital between the

respective portfolios at December 31, 2023 and September 30, 2023,

and the return on invested capital for each sub-portfolio for the

three month period ended December 31, 2023.

($ in thousands)

Capital Allocation

Structured Security

Portfolio

Pass-Through

Interest-Only

Inverse Interest

Portfolio

Securities

Only Securities

Sub-total

Total

December 31, 2023

Market value

$

3,877,082

$

16,572

$

358

$

16,930

$

3,894,012

Cash

200,289

-

-

-

200,289

Borrowings(1)

(3,705,649

)

-

-

-

(3,705,649

)

Total

$

371,722

$

16,572

$

358

$

16,930

$

388,652

% of Total

95.6

%

4.3

%

0.1

%

4.4

%

100.0

%

September 30, 2023

Market value

$

4,502,115

$

17,833

$

277

$

18,110

$

4,520,225

Cash

278,217

-

-

-

278,217

Borrowings(2)

(4,426,947

)

-

-

-

(4,426,947

)

Total

$

353,385

$

17,833

$

277

$

18,110

$

371,495

% of Total

95.1

%

4.8

%

0.1

%

4.9

%

100.0

%

(1)

At December 31, 2023, there were

outstanding repurchase agreement balances of $13.9 million secured

by IO securities and $0.2 million secured by IIO securities. We

entered into these arrangements to generate additional cash

available to meet margin calls on PT RMBS; therefore, we have not

considered these balances to be allocated to the structured

securities strategy.

(2)

At September 30, 2023, there were

outstanding repurchase agreement balances of $14.7 million secured

by IO securities and $0.5 million secured by IIO securities. We

entered into these arrangements to generate additional cash

available to meet margin calls on PT RMBS; therefore, we have not

considered these balances to be allocated to the structured

securities strategy.

The return on invested capital in the PT RMBS and structured

RMBS portfolios was approximately 8.7% and (1.1)%, respectively,

for the fourth quarter of 2023. The combined portfolio generated a

return on invested capital of approximately 8.2%.

($ in thousands)

Returns for the Quarter Ended

December 31, 2023

Structured Security

Portfolio

Pass-Through

Interest-Only

Inverse Interest

Portfolio

Securities

Only Securities

Sub-total

Total

Income (net of borrowing cost)

$

(3,191

)

$

403

$

-

$

403

$

(2,788

)

Realized and unrealized gains (losses)

183,580

(668

)

81

(587

)

182,993

Derivative losses

(149,016

)

n/a

n/a

n/a

(149,016

)

Total Return

$

31,373

$

(265

)

$

81

$

(184

)

$

31,189

Beginning Capital Allocation

$

353,385

$

17,833

$

277

$

18,110

$

371,495

Return on Invested Capital for the

Quarter(1)

8.9

%

(1.5

)%

29.2

%

(1.0

)%

8.4

%

Average Capital Allocation(2)

$

362,554

$

17,203

$

318

$

17,521

$

380,075

Return on Average Invested Capital for the

Quarter(3)

8.7

%

(1.5

)%

25.5

%

(1.1

)%

8.2

%

(1)

Calculated by dividing the Total Return by

the Beginning Capital Allocation, expressed as a percentage.

(2)

Calculated using two data points, the

Beginning and Ending Capital Allocation balances.

(3)

Calculated by dividing the Total Return by

the Average Capital Allocation, expressed as a percentage.

Stock Offerings

On March 7, 2023, we entered into an equity distribution

agreement (the “March 2023 Equity Distribution Agreement”) with

three sales agents pursuant to which we may offer and sell, from

time to time, up to an aggregate amount of $250,000,000 of shares

of our common stock in transactions that are deemed to be “at the

market” offerings and privately negotiated transactions. Through

December 31, 2023, we issued a total of 13,190,039 shares under the

March 2023 Equity Distribution Agreement for aggregate gross

proceeds of approximately $129.9 million, and net proceeds of

approximately $127.8 million, after commissions and fees.

Stock Repurchase Program

On July 29, 2015, the Company’s Board of Directors authorized

the repurchase of up to 400,000 shares of our common stock. The

timing, manner, price and amount of any repurchases is determined

by the Company in its discretion and is subject to economic and

market conditions, stock price, applicable legal requirements and

other factors. The authorization does not obligate the Company to

acquire any particular amount of common stock and the program may

be suspended or discontinued at the Company’s discretion without

prior notice. On February 8, 2018, the Board of Directors approved

an increase in the stock repurchase program for up to an additional

904,564 shares of the Company’s common stock. Coupled with the

156,751 shares remaining from the original 400,000 share

authorization, the increased authorization brought the total

authorization to 1,061,315 shares, representing 10% of the

Company’s then outstanding share count. On December 9, 2021, the

Board of Directors approved an increase in the number of shares of

the Company’s common stock available in the stock repurchase

program for up to an additional 3,372,399 shares, bringing the

remaining authorization under the stock repurchase program to

3,539,861 shares, representing approximately 10% of the Company’s

then outstanding shares of common stock. On October 12, 2022, the

Board of Directors approved an increase in the number of shares of

the Company’s common stock available in the stock repurchase

program for up to an additional 4,300,000 shares, bringing the

remaining authorization under the stock repurchase program to

6,183,601 shares, representing approximately 18% of the Company’s

then outstanding shares of common stock. This stock repurchase

program has no termination date.

From the inception of the stock repurchase program through

December 31, 2023, the Company repurchased a total of 4,748,361

shares at an aggregate cost of approximately $74.2 million,

including commissions and fees, for a weighted average price of

$15.63 per share. During the year ended December 31, 2023, the

Company repurchased a total of 1,072,789 shares at an aggregate

cost of approximately $9.4 million, including commissions and fees,

for a weighted average price of $8.79 per share. Subsequent to

December 31, 2023, the Company repurchased a total of 332,773

shares at an aggregate cost of approximately $2.8 million,

including commissions and fees, for a weighted average price of

$8.35 per share.

Earnings Conference Call Details

An earnings conference call and live audio webcast will be

hosted Friday, February 2, 2024, at 10:00 AM ET. The conference

call may be accessed by dialing toll free (800) 715-9871. The

conference passcode is 8307491. The supplemental materials may be

downloaded from the investor relations section of the Company’s

website at https://ir.orchidislandcapital.com. A live audio webcast

of the conference call can be accessed via the investor relations

section of the Company’s website at

https://ir.orchidislandcapital.com, and an audio archive of the

webcast will be available until March 1, 2024.

About Orchid Island Capital, Inc.

Orchid Island Capital, Inc. is a specialty finance company that

invests on a leveraged basis in Agency RMBS. Our investment

strategy focuses on, and our portfolio consists of, two categories

of Agency RMBS: (i) traditional pass-through Agency RMBS, such as

mortgage pass-through certificates, and CMOs issued by the GSEs,

and (ii) structured Agency RMBS, such as IOs, IIOs and principal

only securities, among other types of structured Agency RMBS.

Orchid is managed by Bimini Advisors, LLC, a registered investment

adviser with the Securities and Exchange Commission.

Forward Looking Statements

Statements herein relating to matters that are not historical

facts, including, but not limited to statements regarding interest

rates, inflation, liquidity, pledging of our structured RMBS,

funding costs, prepayment speeds, portfolio positioning and

repositioning, hedging levels, book value, leverage ratio,

earnings, dividends the supply and demand for Agency RMBS and the

performance of the Agency RMBS sector generally, the effect of

actual or expected actions of the U.S. government, including the

Fed, market expectations, future opportunities and prospects of the

Company, the stock repurchase program and general economic

conditions, are forward-looking statements as defined in the

Private Securities Litigation Reform Act of 1995. The reader is

cautioned that such forward-looking statements are based on

information available at the time and on management's good faith

belief with respect to future events, and are subject to risks and

uncertainties that could cause actual performance or results to

differ materially from those expressed in such forward-looking

statements. Important factors that could cause such differences are

described in Orchid Island Capital, Inc.'s filings with the

Securities and Exchange Commission, including its most recent

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

Orchid Island Capital, Inc. assumes no obligation to update

forward-looking statements to reflect subsequent results, changes

in assumptions or changes in other factors affecting

forward-looking statements.

Summarized Financial Statements

The following is a summarized presentation of the unaudited

balance sheets as of December 31, 2023 and 2022 ,and the unaudited

quarterly statements of operations for the twelve and three months

ended December 31, 2023 and 2022. Amounts presented are subject to

change.

ORCHID ISLAND CAPITAL,

INC.

BALANCE SHEETS

($ in thousands, except per

share data)

(Unaudited - Amounts Subject

to Change)

December 31, 2023

December 31, 2022

ASSETS:

Mortgage-backed securities

$

3,894,012

$

3,540,002

U.S. Treasury securities

148,820

36,382

Cash, cash equivalents and restricted

cash

200,289

237,219

Accrued interest receivable

14,951

11,519

Derivative assets, at fair value

6,420

40,172

Other assets

455

442

Total Assets

$

4,264,947

$

3,865,736

LIABILITIES AND STOCKHOLDERS'

EQUITY

Repurchase agreements

$

3,705,649

$

3,378,445

Payable of investment securities

purchased

60,454

-

Dividends payable

6,222

5,908

Derivative liabilities, at fair value

12,694

7,161

Accrued interest payable

7,939

9209

Due to affiliates

1,013

1,131

Other liabilities

1,031

25,119

Total Liabilities

3,795,002

3,426,973

Total Stockholders' Equity

469,945

438,763

Total Liabilities and Stockholders'

Equity

$

4,264,947

$

3,865,736

Common shares outstanding

51,636,074

36,764,983

Book value per share

$

9.10

$

11.93

ORCHID ISLAND CAPITAL,

INC.

STATEMENTS OF COMPREHENSIVE

INCOME

($ in thousands, except per

share data)

(Unaudited - Amounts Subject

to Change)

Years Ended December

31,

Three Months Ended December

31,

2023

2022

2023

2022

Interest income

$

177,569

$

144,633

$

49,539

$

31,898

Interest expense

(201,918

)

(61,708

)

(52,325

)

(29,512

)

Net interest (expense) income

(24,349

)

82,925

(2,786

)

2,386

Gains (losses) on RMBS and derivative

contracts

3,654

(323,929

)

33,977

36,728

Net portfolio (loss) income

(20,695

)

(241,004

)

31,191

39,114

Expenses

18,531

17,449

4,064

4,188

Net (loss) income

$

(39,226

)

$

(258,453

)

$

27,127

$

34,926

Other comprehensive income

17

-

1

-

Comprehensive net

$

(39,209

)

$

(258,453

)

$

27,128

$

34,926

Basic and diluted net (loss) income per

share

$

(0.89

)

$

(6.90

)

$

0.52

$

0.95

Weighted Average Shares

Outstanding

44,649,039

37,464,671

52,396,001

36,786,056

Dividends Declared Per Common

Share:

$

1.800

$

2.475

$

0.360

$

0.480

Three Months Ended December

31,

Key Balance Sheet Metrics

2023

2022

Average RMBS(1)

$

4,207,118

$

3,370,608

Average repurchase agreements(1)

4,066,298

3,256,153

Average stockholders' equity(1)

468,393

419,570

Adjusted leverage ratio(2)

7.9:1

7.7:1

Economic leverage ratio(3)

6.7:1

6.3:1

Key Performance Metrics

Average yield on RMBS(4)

4.71

%

3.79

%

Average cost of funds(4)

5.15

%

3.63

%

Average economic cost of funds(5)

2.36

%

2.47

%

Average interest rate spread(6)

(0.44

)%

0.16

%

Average economic interest rate

spread(7)

2.35

%

1.32

%

(1)

Average RMBS, borrowings and stockholders’

equity balances are calculated using two data points, the beginning

and ending balances.

(2)

The adjusted leverage ratio is calculated

by dividing ending repurchase agreement liabilities by ending

stockholders’ equity.

(3)

The economic leverage ratio is calculated

by dividing ending total liabilities adjusted for net notional TBA

positions by ending stockholders' equity.

(4)

Portfolio yields and costs of funds are

calculated based on the average balances of the underlying

investment portfolio/borrowings balances and are annualized for the

quarterly periods presented.

(5)

Represents the interest cost of our

borrowings and the effect of derivative agreements attributed to

the period related to hedging activities, divided by average

borrowings.

(6)

Average interest rate spread is calculated

by subtracting average cost of funds from average yield on

RMBS.

(7)

Average economic interest rate spread is

calculated by subtracting average economic cost of funds from

average yield on RMBS.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240201758251/en/

Orchid Island Capital, Inc. Robert E. Cauley, 772-231-1400

Chairman and Chief Executive Officer

https://ir.orchidislandcapital.com

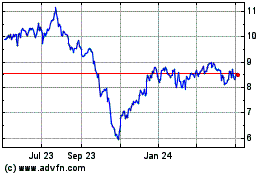

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

From Nov 2024 to Dec 2024

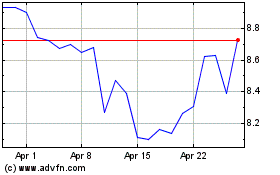

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

From Dec 2023 to Dec 2024