Orchid Island Capital, Inc. (NYSE:ORC) ("Orchid” or the

"Company"), a real estate investment trust ("REIT"), today

announced results of operations for the three month period ended

September 30, 2023.

Third Quarter 2023 Results

- Net loss of $80.1 million, or $1.68 per common share, which

consists of:

- Net interest expense of $8.6 million, or $0.18 per common

share

- Total expenses of $4.6 million, or $0.10 per common share

- Net realized and unrealized losses of $66.9 million, or $1.40

per common share, on RMBS and derivative instruments, including net

interest income on interest rate swaps

- Third quarter dividends declared and paid of $0.48 per common

share

- Book value per common share of $8.92 at September 30, 2023

- Total return of (15.77)%, comprised of $0.48 dividend per

common share and $2.24 decrease in book value per common share,

divided by beginning book value per common share

Other Financial Highlights

- Borrowing capacity in excess of September 30, 2023 outstanding

repurchase agreement balances of $4,427.0 million, spread across 20

active lenders

- Company to discuss results on Friday, October 27, 2023, at

10:00 AM ET

- Supplemental materials to be discussed on the call can be

downloaded from the investor relations section of the Company’s

website at https://ir.orchidislandcapital.com

Management Commentary

Commenting on the third quarter results, Robert E. Cauley,

Chairman and Chief Executive Officer, said, “As the third quarter

unfolded interest rates were trading in a fairly well-defined

range, volatility was trending lower and we were comfortable with

our leverage and positioning. Orchid has maintained a lower coupon

bias throughout the tightening cycle that began in 2022 as we

believe these securities still offer superior total return

potential over new origination, higher coupon securities. We

continue to hold these securities for the same reasons although we

used the proceeds from capital raising activity via our ATM program

and paydowns to add higher coupon, low pay-up specified pools and

hedged these positions predominantly with swaps. We added higher

coupons to mitigate the lower carry of our legacy assets to allow

us to continue to hold them and retain their higher return

potential in the event of a normalization of rates and U.S.

Treasury curve shape.

“The rates market shifted dramatically during the quarter. The

credit rating of the U.S. was downgraded by Fitch, and Moody's has

indicated it may do the same. Deficits in the U.S. were revised

meaningfully higher in July as the Congressional Budget Office

raised its estimate for the deficit this year to near $2 trillion.

As the anticipated supply of U.S. Treasury debt has shifted up

dramatically, the market appears to be demanding a term-premium to

hold this debt. At the conclusion of the Federal Reserve's (the

"Fed") September FOMC meeting, the Fed released its “dot” plot, a

summary of FOMC members' anticipated level of the Federal Funds

rate for the next several years. The dot plot released reflected a

Federal Funds rate 50 basis points higher at the end of 2024 than

the last dot plot issued at the conclusion of the FOMC meeting in

June. The increase reflected expectations for a minimal reduction

in the Federal Funds rate prior to the end of 2024. The Fed cited

the persistently strong economy as the reason for keeping monetary

policy restrictive for so long. Economic data released during the

third quarter implies the U.S. economy is very resilient in the

face of higher interest rates and growth for the quarter was 4.9%.

All of these factors caused rates to increase dramatically, and

they continue to do so into the fourth quarter. We have yet to see

the rates market stabilize. All of these interest rate and economic

forces coupled with the multiple sources of uncertainty created by

the emerging war in the middle east, a House of Representatives

without a speaker, and a presidential election on the horizon,

among other factors, have created a perfect storm for financial

markets and the mortgage market in particular. In the case of the

latter, the elevated levels of volatility resulting from all of the

above coupled with few buyers of the asset class have led to

meaningful underperformance for the sector since early August and

since mid-September in particular. The fact investors can earn more

than 5% holding cash or U.S. Treasury bills has kept buyers of

Agency RMBS on the sidelines and left the Agency RMBS sector, as

well as many other risky asset classes, to perform very poorly.

“In response to the significant increase in interest rates and

volatility, with the corresponding weakness in Agency RMBS assets

continuing since the end of the third quarter, we have reduced our

leverage and increased hedges. Since September 30, 2023, we have

reduced our holding of 30-year fixed rate 3.0% coupons by

approximately 40%, added to shorts in the same coupon and

eliminated our 15-year TBA long position. Finally, we eliminated

our short TBA positions in higher coupons. In the face of such

challenging market conditions our goal is to weather the current

storm by preserving our liquidity and maintaining suitable levels

of leverage while attempting to maximize our potential upside when

the market stabilizes. Going forward, there remains considerable

uncertainty as to what lies beyond the current Fed tightening

cycle. Will the Fed succeed in slowing demand and bring inflation

back towards its 2.0% target, ultimately leading to reduced

short-term rates and a steeper rates curve that is positively

sloped? Or are we entering a new “new normal”, with rates

appreciably higher than those that prevailed before the pandemic,

with funding costs still at very elevated levels, rates generally

much higher and maybe even inflation settling in above the Fed’s

target? We anticipate the former outcome will materialize soon

enough and are positioned accordingly. However, we are also

prepared to make additional adjustments if the latter comes to

pass.”

Details of Third Quarter 2023 Results of Operations

The Company reported net loss of $80.1 million for the three

month period ended September 30, 2023, compared with a net loss of

$84.5 million for the three month period ended September 30, 2022.

The Company increased its Agency RMBS portfolio over the course of

the third quarter of 2023, from $4.4 billion at June 30, 2023 to

$4.5 billion at September 30, 2023. Interest income on the

portfolio in the third quarter was up approximately $10.2 million

from the second quarter of 2023. The yield on our average Agency

RMBS increased from 3.81% in the second quarter of 2023 to 4.51%

for the third quarter of 2023, repurchase agreement borrowing costs

increased from 4.88% for the second quarter of 2023 to 5.44% for

the third quarter of 2023, and our net interest spread improved

from (1.07)% in the second quarter of 2023 to (0.93)% in the third

quarter of 2023.

Book value decreased by $2.24 per share in the third quarter of

2023. The decrease in book value reflects our net loss of $1.68 per

share and the dividend distribution of $0.48 per share. The Company

recorded net realized and unrealized losses of $1.40 per share on

Agency RMBS assets and derivative instruments, including net

interest income on interest rate swaps.

Prepayments

For the quarter ended September 30, 2023, Orchid received $99.5

million in scheduled and unscheduled principal repayments and

prepayments, which equated to a 3-month constant prepayment rate

(“CPR”) of approximately 6.0%. Prepayment rates on the two RMBS

sub-portfolios were as follows (in CPR):

Structured

PT RMBS

RMBS

Total

Three Months Ended

Portfolio (%)

Portfolio (%)

Portfolio (%)

September 30, 2023

6.1

5.7

6.0

June 30, 2023

5.6

7.0

5.6

March 31, 2023

3.9

5.7

4.0

December 31, 2022

4.9

6.0

5.0

September 30, 2022

6.1

10.4

6.5

June 30, 2022

8.3

13.7

9.4

March 31, 2022

8.1

19.5

10.7

Portfolio

The following tables summarize certain characteristics of

Orchid’s PT RMBS (as defined below) and structured RMBS as of

September 30, 2023 and December 31, 2022:

($ in thousands)

Weighted

Percentage

Average

of

Weighted

Maturity

Fair

Entire

Average

in

Longest

Asset Category

Value

Portfolio

Coupon

Months

Maturity

September 30, 2023

Fixed Rate RMBS

$

4,502,115

99.6

%

4.03

%

335

1-Sep-53

Interest-Only Securities

17,833

0.4

%

4.01

%

225

25-Jul-48

Inverse Interest-Only Securities

277

0.0

%

0.00

%

277

15-Jun-42

Total Mortgage Assets

$

4,520,225

100.0

%

4.01

%

333

1-Sep-53

December 31, 2022

Fixed Rate RMBS

$

3,519,906

99.4

%

3.47

%

339

1-Nov-52

Interest-Only Securities

19,669

0.6

%

4.01

%

234

25-Jul-48

Inverse Interest-Only Securities

427

0.0

%

0.00

%

286

15-Jun-42

Total Mortgage Assets

$

3,540,002

100.0

%

3.46

%

336

1-Nov-52

($ in thousands)

September 30, 2023

December 31, 2022

Percentage of

Percentage of

Agency

Fair Value

Entire Portfolio

Fair Value

Entire Portfolio

Fannie Mae

$

2,989,840

66.1

%

$

2,320,960

65.6

%

Freddie Mac

1,530,385

33.9

%

1,219,042

34.4

%

Total Portfolio

$

4,520,225

100.0

%

$

3,540,002

100.0

%

September 30, 2023

December 31, 2022

Weighted Average Pass-through Purchase

Price

$

104.87

$

106.41

Weighted Average Structured Purchase

Price

$

18.74

$

18.74

Weighted Average Pass-through Current

Price

$

89.08

$

91.46

Weighted Average Structured Current

Price

$

13.92

$

14.05

Effective Duration (1)

5.460

5.580

(1)

Effective duration is the approximate

percentage change in price for a 100 bps change in rates. An

effective duration of 5.460 indicates that an interest rate

increase of 1.0% would be expected to cause a 5.460% decrease in

the value of the RMBS in the Company’s investment portfolio at

September 30, 2023. An effective duration of 5.580 indicates that

an interest rate increase of 1.0% would be expected to cause a

5.580% decrease in the value of the RMBS in the Company’s

investment portfolio at December 31, 2022. These figures include

the structured securities in the portfolio, but do not include the

effect of the Company’s funding cost hedges. Effective duration

quotes for individual investments are obtained from The Yield Book,

Inc.

Financing, Leverage and Liquidity

As of September 30, 2023, the Company had outstanding repurchase

obligations of approximately $4,427.0 million with a net weighted

average borrowing rate of 5.49%. These agreements were

collateralized by RMBS and U.S. Treasury securities with a fair

value, including accrued interest, of approximately $4,537.1

million and cash pledged to counterparties of approximately $113.4

million. The Company’s adjusted leverage ratio, defined as the

balance of repurchase agreement liabilities divided by

stockholders' equity, at September 30, 2023 was 9.5 to 1. At

September 30, 2023, the Company’s liquidity was approximately

$163.7 million consisting of cash and cash equivalents and

unpledged RMBS (not including unsettled securities purchases). To

enhance our liquidity even further, we may pledge more of our

structured RMBS as part of a repurchase agreement funding, but

retain the cash in lieu of acquiring additional assets. In this way

we can, at a modest cost, retain higher levels of cash on hand and

decrease the likelihood we will have to sell assets in a distressed

market in order to raise cash. Below is a list of our outstanding

borrowings under repurchase obligations at September 30, 2023.

($ in thousands)

Weighted

Weighted

Total

Average

Average

Outstanding

% of

Borrowing

Amount

Maturity

Counterparty

Balances

Total

Rate

at Risk(1)

in Days

Cantor Fitzgerald & Co.

$

354,817

8.1

%

5.48

%

$

18,500

28

Wells Fargo Bank, N.A.

353,817

8.0

%

5.47

%

18,931

26

Mirae Asset Securities (USA) Inc.

337,442

7.6

%

5.51

%

14,082

42

ASL Capital Markets Inc.

321,162

7.3

%

5.49

%

17,557

39

J.P. Morgan Securities LLC

320,537

7.2

%

5.47

%

17,940

16

Mitsubishi UFJ Securities (USA), Inc.

312,097

7.0

%

5.51

%

17,114

50

Citigroup Global Markets, Inc.

294,638

6.7

%

5.45

%

15,239

10

RBC Capital Markets, LLC

293,169

6.6

%

5.52

%

9,273

46

Daiwa Capital Markets America, Inc.

232,596

5.3

%

5.49

%

9,377

17

ED&F Man Capital Markets Inc.

222,216

5.0

%

5.44

%

9,639

9

ING Financial Markets LLC

212,132

4.8

%

5.48

%

8,861

33

ABN AMRO Bank N.V.

211,135

4.8

%

5.52

%

5,925

45

Merrill Lynch, Pierce, Fenner & Smith

Inc.

196,295

4.4

%

5.54

%

6,821

46

Banco Santander, N.A.

182,495

4.1

%

5.49

%

7,833

35

Goldman Sachs & Co. LLC

173,371

3.9

%

5.47

%

9,118

18

StoneX Financial Inc.

167,366

3.8

%

5.54

%

8,783

63

South Street Securities, LLC

111,871

2.5

%

5.51

%

5,807

57

BMO Capital Markets Corp.

110,904

2.5

%

5.47

%

5,803

12

Lucid Prime Fund, LLC

10,575

0.2

%

5.50

%

568

19

Lucid Cash Fund USG, LLC

8,312

0.2

%

5.50

%

462

19

Total / Weighted Average

$

4,426,947

100.0

%

5.49

%

$

207,633

32

(1)

Equal to the sum of the fair value of

securities sold, accrued interest receivable and cash posted as

collateral (if any), minus the sum of repurchase agreement

liabilities, accrued interest payable and the fair value of

securities posted by the counterparties (if any).

Hedging

In connection with its interest rate risk management strategy,

the Company economically hedges a portion of the cost of its

repurchase agreement funding against a rise in interest rates by

entering into derivative financial instrument contracts. The

Company has not elected hedging treatment under U.S. generally

accepted accounting principles (“GAAP”) in order to align the

accounting treatment of its derivative instruments with the

treatment of its portfolio assets under the fair value option

election. As such, all gains or losses on these instruments are

reflected in earnings for all periods presented. At September 30,

2023, such instruments were comprised of U.S. Treasury note

(“T-Note”) futures contracts, interest rate swap agreements,

interest rate swaption agreements, interest rate caps, interest

rate floors and contracts to sell to-be-announced ("TBA")

securities.

The table below presents information related to the Company’s

T-Note futures contracts at September 30, 2023.

($ in thousands)

September 30, 2023

Average

Weighted

Weighted

Contract

Average

Average

Notional

Entry

Effective

Open

Expiration Year

Amount

Rate

Rate

Equity(1)

Treasury Note Futures Contracts (Short

Positions)(2)

December 2023 5-year T-Note futures (Dec

2023 - Feb 2028 Hedge Period)

$

471,500

4.33

%

4.78

%

$

5,414

December 2023 10-year T-Note futures (Dec

2023 - Aug 2030 Hedge Period)

$

395,000

4.24

%

4.97

%

$

9,069

(1)

Open equity represents the cumulative

gains (losses) recorded on open futures positions from

inception.

(2)

5-Year T-Note futures contracts were

valued at a price of $105.4. The contract values of the short

positions were $496.8 million. 10-Year T-Note futures contracts

were valued at a price of $108.1. The contract values of the short

positions were $426.8 million.

The table below presents information related to the Company’s

interest rate swap positions at September 30, 2023.

($ in thousands)

Average

Fixed

Average

Average

Notional

Pay

Receive

Maturity

Amount

Rate

Rate

(Years)

Expiration > 1 to ≤ 5 years

$

500,000

0.84

%

5.31

%

3.0

Expiration > 5 years

$

2,126,500

2.84

%

5.31

%

7.4

$

2,626,500

2.46

%

5.31

%

6.6

The following table presents information related to our interest

rate swaption positions as of September 30, 2023.

($ in thousands)

Option

Underlying Swap

Weighted

Weighted

Average

Average

Average

Average

Fair

Months to

Notional

Fixed

Adjustable

Term

Expiration

Cost

Value

Expiration

Amount

Rate

Rate

(Years)

Payer Swaptions (long

positions)

≤ 1 year

$

1,619

$

1,418

8.0

$

800,000

5.40

%

SOFR

1.0

$

1,619

$

1,418

8.0

$

800,000

5.40

%

1.0

The following table presents information related to our interest

cap positions as of September 30, 2023.

($ in thousands)

Strike

Estimated

Notional

Swap

Curve

Fair

Expiration

Amount

Cost

Rate

Spread

Value

February 8, 2024

$

200,000

$

1,450

0.09

%

2Y10Y

$

704

The table below presents information related to the Company’s

interest rate floor positions at September 30, 2023.

($ in thousands)

Strike

Notional

Swap

Fair

Amount

Cost

Rate

Terms

Value

September 30, 2023

Long Position

$

1,000,000

$

2,500

0.13

%

2Y_2s30s

$

3,981

Short Position

$

(1,000,000

)

$

(1,358

)

(0.37

)%

2Y_2s30s

$

(2,500

)

The following table summarizes our contracts to sell TBA

securities as of September 30, 2023.

($ in thousands)

Notional

Net

Amount

Cost

Market

Carrying

Long (Short)(1)

Basis(2)

Value(3)

Value(4)

September 30, 2023

15-Year TBA securities:

5.00%

$

100,000

$

97,617

$

97,386

$

(231

)

30-Year TBA securities:

3.00%

(350,000

)

(297,154

)

(290,116

)

7,038

6.00%

(100,000

)

(99,872

)

(98,766

)

1,106

6.50%

(152,500

)

(154,382

)

(153,310

)

1,072

$

(502,500

)

$

(453,791

)

$

(444,806

)

$

8,985

(1)

Notional amount represents the par value

(or principal balance) of the underlying Agency RMBS.

(2)

Cost basis represents the forward price to

be paid (received) for the underlying Agency RMBS.

(3)

Market value represents the current market

value of the TBA securities (or of the underlying Agency RMBS) as

of period-end.

(4)

Net carrying value represents the

difference between the market value and the cost basis of the TBA

securities as of period-end and is reported in derivative assets

(liabilities) at fair value in our balance sheets.

Dividends

In addition to other requirements that must be satisfied to

qualify as a REIT, we must pay annual dividends to our stockholders

of at least 90% of our REIT taxable income, determined without

regard to the deduction for dividends paid and excluding any net

capital gains. We intend to pay regular monthly dividends to our

stockholders and have declared the following dividends since our

February 2013 IPO.

(in thousands, except per share data)

Year

Per Share Amount

Total

2013

$

6.975

$

4,662

2014

10.800

22,643

2015

9.600

38,748

2016

8.400

41,388

2017

8.400

70,717

2018

5.350

55,814

2019

4.800

54,421

2020

3.950

53,570

2021

3.900

97,601

2022

2.475

87,906

2023 - YTD(1)

1.560

68,604

Totals

$

66.210

$

596,074

(1)

On October 11, 2023, the Company declared

a dividend of $0.12 per share to be paid on November 28, 2023. The

effect of this dividend is included in the table above but is not

reflected in the Company’s financial statements as of September 30,

2023.

Book Value Per Share

The Company's book value per share at September 30, 2023 was

$8.92. The Company computes book value per share by dividing total

stockholders' equity by the total number of shares outstanding of

the Company's common stock. At September 30, 2023, the Company's

stockholders' equity was $466.8 million with 52,332,306 shares of

common stock outstanding.

Capital Allocation and Return on Invested Capital

The Company allocates capital to two RMBS sub-portfolios, the

pass-through RMBS portfolio, consisting of mortgage pass-through

certificates issued by Fannie Mae, Freddie Mac or Ginnie Mae (the

“GSEs”) and collateralized mortgage obligations (“CMOs”) issued by

the GSEs (“PT RMBS”), and the structured RMBS portfolio, consisting

of interest-only (“IO”) and inverse interest-only (“IIO”)

securities. As of September 30, 2023, approximately 95.1% of the

Company’s investable capital (which consists of equity in pledged

PT RMBS, available cash and unencumbered assets) was deployed in

the PT RMBS portfolio. At June 30, 2023, the allocation to the PT

RMBS portfolio was approximately 95.8%.

The table below details the changes to the respective

sub-portfolios during the quarter.

(in thousands)

Portfolio Activity for the

Quarter

Structured Security

Portfolio

Pass-Through

Interest-Only

Inverse Interest

Portfolio

Securities

Only Securities

Sub-total

Total

Market value - June 30, 2023

$

4,356,203

$

17,448

$

321

$

17,769

$

4,373,972

Securities purchased

455,003

-

-

-

455,003

Securities sold

-

-

-

-

-

Losses on sales

-

-

-

-

-

Return of investment

n/a

(581

)

-

(581

)

(581

)

Pay-downs

(98,932

)

n/a

n/a

n/a

(98,932

)

Discount accretion due to pay-downs

7,252

n/a

n/a

n/a

7,252

Mark to market losses (gains)

(217,411

)

966

(44

)

922

(216,489

)

Market value - September 30,

2023

$

4,502,115

$

17,833

$

277

$

18,110

$

4,520,225

The tables below present the allocation of capital between the

respective portfolios at September 30, 2023 and June 30, 2023, and

the return on invested capital for each sub-portfolio for the three

month period ended September 30, 2023.

($ in thousands)

Capital Allocation

Structured Security

Portfolio

Pass-Through

Interest-Only

Inverse Interest

Portfolio

Securities

Only Securities

Sub-total

Total

September 30, 2023

Market value

$

4,502,115

$

17,833

$

277

$

18,110

$

4,520,225

Cash

278,217

-

-

-

278,217

Borrowings(1)

(4,426,947

)

-

-

-

(4,426,947

)

Total

$

353,385

$

17,833

$

277

$

18,110

$

371,495

% of Total

95.1

%

4.8

%

0.1

%

4.9

%

100.0

%

June 30, 2023

Market value

$

4,356,203

$

17,448

$

321

$

17,769

$

4,373,972

Cash

249,337

-

-

-

249,337

Borrowings(2)

(4,201,717

)

-

-

-

(4,201,717

)

Total

$

403,823

$

17,448

$

321

$

17,769

$

421,592

% of Total

95.8

%

4.1

%

0.1

%

4.2

%

100.0

%

(1)

At September 30, 2023, there were

outstanding repurchase agreement balances of $14.7 million secured

by IO securities and $0.5 million secured by IIO securities. We

entered into these arrangements to generate additional cash

available to meet margin calls on PT RMBS; therefore, we have not

considered these balances to be allocated to the structured

securities strategy.

(2)

At June 30, 2023, there were outstanding

repurchase agreement balances of $14.8 million secured by IO

securities and $0.3 million secured by IIO securities. We entered

into these arrangements to generate additional cash available to

meet margin calls on PT RMBS; therefore, we have not considered

these balances to be allocated to the structured securities

strategy.

The return on invested capital in the PT RMBS and structured

RMBS portfolios was approximately (19.0)% and 7.7%, respectively,

for the third quarter of 2023. The combined portfolio generated a

return on invested capital of approximately (17.9)%.

($ in thousands)

Returns for the Quarter Ended

September 30, 2023

Structured Security

Portfolio

Pass-Through

Interest-Only

Inverse Interest

Portfolio

Securities

Only Securities

Sub-total

Total

Income (net of borrowing cost)

$

(9,045

)

$

447

$

-

$

447

$

(8,598

)

Realized and unrealized losses (gains)

(209,854

)

966

(44

)

922

(208,932

)

Derivative gains

142,042

n/a

n/a

n/a

142,042

Total Return

$

(76,857

)

$

1,413

$

(44

)

$

1,369

$

(75,488

)

Beginning Capital Allocation

$

403,823

$

17,448

$

321

$

17,769

$

421,592

Return on Invested Capital for the

Quarter(1)

(19.0

)%

8.1

%

(13.7

)%

7.7

%

(17.9

)%

Average Capital Allocation(2)

$

378,604

$

17,641

$

299

$

17,940

$

396,544

Return on Average Invested Capital for the

Quarter(3)

(20.3

)%

8.0

%

(14.7

)%

7.6

%

(19.0

)%

(1)

Calculated by dividing the Total Return by

the Beginning Capital Allocation, expressed as a percentage.

(2)

Calculated using two data points, the

Beginning and Ending Capital Allocation balances.

(3)

Calculated by dividing the Total Return by

the Average Capital Allocation, expressed as a percentage.

Stock Offerings

On October 29, 2021, we entered into an equity distribution

agreement (the “October 2021 Equity Distribution Agreement”) with

four sales agents pursuant to which we could offer and sell, from

time to time, up to an aggregate amount of $250,000,000 of shares

of our common stock in transactions that were deemed to be “at the

market” offerings and privately negotiated transactions. We issued

a total of 9,742,188 shares under the October 2021 Equity

Distribution Agreement for aggregate gross proceeds of

approximately $151.8 million, and net proceeds of approximately

$149.3 million, after commissions and fees, prior to its

termination in March 2023.

On March 7, 2023, we entered into an equity distribution

agreement (the “March 2023 Equity Distribution Agreement”) with

three sales agents pursuant to which we may offer and sell, from

time to time, up to an aggregate amount of $250,000,000 of shares

of our common stock in transactions that are deemed to be “at the

market” offerings and privately negotiated transactions. Through

September 30, 2023, we issued a total of 13,190,039 shares under

the March 2023 Equity Distribution Agreement for aggregate gross

proceeds of approximately $129.8 million, and net proceeds of

approximately $127.8 million, after commissions and fees.

Stock Repurchase Program

On July 29, 2015, the Company’s Board of Directors authorized

the repurchase of up to 400,000 shares of our common stock. The

timing, manner, price and amount of any repurchases is determined

by the Company in its discretion and is subject to economic and

market conditions, stock price, applicable legal requirements and

other factors. The authorization does not obligate the Company to

acquire any particular amount of common stock and the program may

be suspended or discontinued at the Company’s discretion without

prior notice. On February 8, 2018, the Board of Directors approved

an increase in the stock repurchase program for up to an additional

904,564 shares of the Company’s common stock. Coupled with the

156,751 shares remaining from the original 400,000 share

authorization, the increased authorization brought the total

authorization to 1,061,316 shares, representing 10% of the

Company’s then outstanding share count. On December 9, 2021, the

Board of Directors approved an increase in the number of shares of

the Company’s common stock available in the stock repurchase

program for up to an additional 3,372,399 shares, bringing the

remaining authorization under the stock repurchase program to

3,539,861 shares, representing approximately 10% of the Company’s

then outstanding shares of common stock. On October 12, 2022, the

Board of Directors approved an increase in the number of shares of

the Company’s common stock available in the stock repurchase

program for up to an additional 4,300,000 shares, bringing the

remaining authorization under the stock repurchase program to

6,183,601 shares, representing approximately 18% of the Company’s

then outstanding shares of common stock. This stock repurchase

program has no termination date.

From the inception of the stock repurchase program through

September 30, 2023, the Company repurchased a total of 4,048,613

shares at an aggregate cost of approximately $68.8 million,

including commissions and fees, for a weighted average price of

$16.99 per share. During the nine months ended September 30, 2023,

the Company repurchased a total of 373,041 shares at an aggregate

cost of approximately $4.0 million, including commissions and fees,

for a weighted average price of $10.62 per share.

Earnings Conference Call Details

An earnings conference call and live audio webcast will be

hosted Friday, October 27, 2023, at 10:00 AM ET. The conference

call may be accessed by dialing toll free (888) 510-2356. The

conference passcode is 8493186. The supplemental materials may be

downloaded from the investor relations section of the Company’s

website at https://ir.orchidislandcapital.com. A live audio webcast

of the conference call can be accessed via the investor relations

section of the Company’s website at

https://ir.orchidislandcapital.com, and an audio archive of the

webcast will be available until November 27, 2023.

About Orchid Island Capital, Inc.

Orchid Island Capital, Inc. is a specialty finance company that

invests on a leveraged basis in Agency RMBS. Our investment

strategy focuses on, and our portfolio consists of, two categories

of Agency RMBS: (i) traditional pass-through Agency RMBS, such as

mortgage pass-through certificates, and CMOs issued by the GSEs,

and (ii) structured Agency RMBS, such as IOs, IIOs and principal

only securities, among other types of structured Agency RMBS.

Orchid is managed by Bimini Advisors, LLC, a registered investment

adviser with the Securities and Exchange Commission.

Forward Looking Statements

Statements herein relating to matters that are not historical

facts, including, but not limited to statements regarding interest

rates, inflation, liquidity, pledging of our structured RMBS,

funding levels and spreads, prepayment speeds, portfolio

positioning and repositioning, hedging levels, leverage ratio,

dividends, growth, return opportunities, the supply and demand for

Agency RMBS and the performance of the Agency RMBS sector

generally, the effect of actual or expected actions of the U.S.

government, including the Fed, market expectations, capital

raising, future opportunities and prospects of the Company, the

stock repurchase program, geopolitical uncertainty and general

economic conditions, are forward-looking statements as defined in

the Private Securities Litigation Reform Act of 1995. The reader is

cautioned that such forward-looking statements are based on

information available at the time and on management's good faith

belief with respect to future events, and are subject to risks and

uncertainties that could cause actual performance or results to

differ materially from those expressed in such forward-looking

statements. Important factors that could cause such differences are

described in Orchid Island Capital, Inc.'s filings with the

Securities and Exchange Commission, including its most recent

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

Orchid Island Capital, Inc. assumes no obligation to update

forward-looking statements to reflect subsequent results, changes

in assumptions or changes in other factors affecting

forward-looking statements.

Summarized Financial Statements

The following is a summarized presentation of the unaudited

balance sheets as of September 30, 2023, and December 31, 2022, and

the unaudited quarterly statements of operations for the nine and

three months ended September 30, 2023 and 2022. Amounts presented

are subject to change.

ORCHID ISLAND CAPITAL,

INC.

BALANCE SHEETS

($ in thousands, except per

share data)

(Unaudited - Amounts Subject

to Change)

September 30, 2023

December 31, 2022

ASSETS:

Mortgage-backed securities, at fair

value

$

4,520,225

$

3,540,002

U.S. Treasury securities, at fair

value

-

36,382

U.S. Treasury securities,

available-for-sale

98,326

-

Cash, cash equivalents and restricted

cash

278,217

237,219

Accrued interest receivable

17,316

11,519

Derivative assets, at fair value

20,605

40,172

Other assets

2,204

442

Total Assets

$

4,936,893

$

3,865,736

LIABILITIES AND STOCKHOLDERS'

EQUITY

Repurchase agreements

$

4,426,947

$

3,378,445

Dividends payable

8,398

5,908

Derivative liabilities, at fair value

2,731

7,161

Accrued interest payable

15,836

9,209

Due to affiliates

1,252

1,131

Other liabilities

14,888

25,119

Total Liabilities

4,470,052

3,426,973

Total Stockholders' Equity

466,841

438,763

Total Liabilities and Stockholders'

Equity

$

4,936,893

$

3,865,736

Common shares outstanding

52,332,306

36,764,983

Book value per share

$

8.92

$

11.93

ORCHID ISLAND CAPITAL,

INC.

STATEMENTS OF COMPREHENSIVE

INCOME

($ in thousands, except per

share data)

(Unaudited - Amounts Subject

to Change)

Nine Months Ended September

30,

Three Months Ended September

30,

2023

2022

2023

2022

Interest income

$

128,030

$

112,735

$

50,107

$

35,610

Interest expense

(149,593

)

(32,196

)

(58,705

)

(21,361

)

Net interest (expense) income

(21,563

)

80,539

(8,598

)

14,249

Losses on RMBS and derivative

contracts

(30,323

)

(360,657

)

(66,890

)

(94,433

)

Net portfolio loss

(51,886

)

(280,118

)

(75,488

)

(80,184

)

Expenses

14,467

13,261

4,644

4,329

Net loss

$

(66,353

)

$

(293,379

)

$

(80,132

)

$

(84,513

)

Other comprehensive income

16

-

16

-

Comprehensive net loss

$

(66,337

)

$

(293,379

)

$

(80,116

)

$

(84,513

)

Basic and diluted net loss per

share

$

(1.58

)

$

(8.31

)

$

(1.68

)

$

(2.40

)

Weighted Average Shares

Outstanding

42,103,532

35,336,702

47,773,409

35,205,888

Dividends Declared Per Common

Share:

$

1.440

$

1.995

$

0.480

$

0.545

Three Months Ended September

30,

Key Balance Sheet Metrics

2023

2022

Average RMBS(1)

$

4,447,098

$

3,571,037

Average repurchase agreements(1)

4,314,332

3,446,420

Average stockholders' equity(1)

478,463

453,369

Adjusted leverage ratio - as of period

end(2)

9.5:1

7.8:1

Economic leverage ratio - as of period

end(3)

8.5:1

7.3:1

Key Performance Metrics

Average yield on RMBS(4)

4.51

%

3.99

%

Average cost of funds(4)

5.44

%

2.48

%

Average economic cost of funds(5)

3.18

%

2.00

%

Average interest rate spread(6)

(0.93

)%

1.51

%

Average economic interest rate

spread(7)

1.33

%

1.99

%

(1)

Average RMBS, borrowings and stockholders’

equity balances are calculated using two data points, the beginning

and ending balances.

(2)

The adjusted leverage ratio is calculated

by dividing ending repurchase agreement liabilities by ending

stockholders’ equity.

(3)

The economic leverage ratio is calculated

by dividing ending total liabilities adjusted for net notional TBA

positions by ending stockholders' equity.

(4)

Portfolio yields and costs of funds are

calculated based on the average balances of the underlying

investment portfolio/borrowings balances and are annualized for the

quarterly periods presented.

(5)

Represents the interest cost of our

borrowings and the effect of derivative agreements attributed to

the period related to hedging activities, divided by average

borrowings.

(6)

Average interest rate spread is calculated

by subtracting average cost of funds from average yield on

RMBS.

(7)

Average economic interest rate spread is

calculated by subtracting average economic cost of funds from

average yield on RMBS.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231026165984/en/

Orchid Island Capital, Inc. Robert E. Cauley, 772-231-1400

Chairman and Chief Executive Officer

https://ir.orchidislandcapital.com

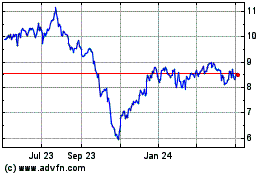

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

From Dec 2024 to Jan 2025

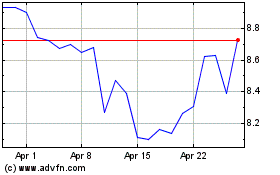

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

From Jan 2024 to Jan 2025