false

0000873860

0000873860

2023-11-07

2023-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 7, 2023

OCWEN

FINANCIAL CORPORATION

(Exact

name of registrant as specified in its charter)

| Florida |

|

1-13219 |

|

65-0039856 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

1661

Worthington Road, Suite 100

West

Palm Beach, Florida 33409

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (561) 682-8000

Not

applicable.

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.01 Par Value |

|

OCN |

|

New

York Stock Exchange (NYSE) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On

November 7, 2023, Ocwen Financial Corporation issued a press release announcing results for the third quarter ended September 30, 2023

and providing a business update. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The

information in this Item 2.02 and the information in the related exhibit attached hereto shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned, hereunto duly authorized.

| |

OCWEN

FINANCIAL CORPORATION |

| |

(Registrant) |

| |

|

|

| Date:

November 7, 2023 |

By: |

/s/

Sean B. O’Neil |

| |

|

Sean

B. O’Neil |

| |

|

Chief

Financial Officer |

Exhibit

99.1

|

Ocwen Financial Corporation® |

| |

|

OCWEN

FINANCIAL ANNOUNCES THIRD QUARTER 2023 RESULTS

| ● | Net

income of $8 million and earnings per share of $1.10; annualized return on equity of 8% |

| | | |

| ● | Adjusted

pre-tax income of $10 million, driven by servicing segment; achieved 9% annualized adjusted

pre-tax return on equity |

| | | |

| ● | Total

servicing UPB of $296 billion and total subservicing UPB of $167 billion, up 2% and 6%, respectively,

compared to Q2’23 |

| | | |

| ● | Repurchased

$14 million in PHH senior secured notes below par |

West

Palm Beach, FL – (November 7, 2023) – Ocwen Financial Corporation (NYSE: OCN) (“Ocwen” or the “Company”),

a leading non-bank mortgage servicer and originator, today announced its third quarter 2023 results and provided a business update.

The

Company reported GAAP net income of $8 million for the third quarter with an adjusted pre-tax income of $10 million (see “Note

Regarding Non-GAAP Financial Measures” below).

Glen

A. Messina, Chair, President and CEO of Ocwen, said, “I am very pleased with our performance this quarter. The strength of our

balanced business has enabled us to operate profitably in the current industry environment and perform in line with our return on equity

guidance. Our low-cost, diversified servicing platform continues to drive strong earnings results, and we delivered positive earnings

in originations despite industry headwinds. Additionally, we are pleased to announce that we have agreed with Oaktree to extend the investment

period for our MSR Asset Vehicle, and we have renewed our subservicing relationship with Rithm. We thank Oaktree and Rithm for their

ongoing trust in us and look forward to continuing our partnerships with them.”

Messina

continued, “We believe our performance in 2023 thus far demonstrates the resilience of our balanced business and that we are one

of the strongest mortgage operators in the industry. We will continue to focus on sustaining financial performance, increasing return

on equity, and capitalizing on market-cycle opportunities to deliver shareholder value.”

Additional

Third Quarter 2023 Operating and Business Highlights

| ● | Added

$15 billion from subservicing additions and MSR capital partner sales in Q3’23, an

increase of nearly $5 billion from Q2’23 |

| | | |

| ● | Portfolio

with MSR capital partners at $89 billion, up 12% compared to Q2’23 |

| | | |

| | ● | On November 1, 2023, Ocwen and Oaktree agreed to extend the investment

period for capital contributions to MAV through May 2, 2025 |

| | | |

| ● | On

November 1, 2023, Ocwen and Rithm renewed their subservicing agreements through December

31, 2024 |

| | | |

| ● | Maintained

mix of higher-margin products while increasing volume of these products to $3 billion of

owned MSR originations compared to $2 billion in Q2’23 |

| | | |

| | ● | Continued

to control enterprise costs with an annualized cost reduction of $137 million compared to

Q2’22 ($147 million, excluding Expense Notables) |

| | | |

| ● | Book

value per share of $58 as of September 30, 2023, up 3% compared to June 30, 2023 |

Webcast

and Conference Call

Ocwen

will hold a conference call on Tuesday, November 7, 2023, at 8:30 a.m. (ET) to review the Company’s third quarter 2023 operating

results and to provide a business update. A live audio webcast and slide presentation for the call will be available by visiting the

Shareholder Relations page at www.ocwen.com. Participants can access the conference call by dialing (888) 886-7786 or (416) 764-8658

approximately 10 minutes prior to the call. A replay of the conference call will be available via the website approximately two hours

after the conclusion of the call and will remain available for approximately 15 days.

About

Ocwen Financial Corporation

Ocwen

Financial Corporation (NYSE: OCN) is a leading non-bank mortgage servicer and originator providing solutions through its primary brands,

PHH Mortgage and Liberty Reverse Mortgage. PHH Mortgage is one of the largest servicers in the country, focused on delivering a variety

of servicing and lending programs. Liberty is one of the nation’s largest reverse mortgage lenders dedicated to education and providing

loans that help customers meet their personal and financial needs. We are headquartered in West Palm Beach, Florida, with offices and

operations in the United States, the U.S. Virgin Islands, India and the Philippines, and have been serving our customers since 1988.

For additional information, please visit our website (www.ocwen.com).

Forward

Looking Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by a reference to a future

period or by the use of forward-looking terminology. Forward-looking statements are typically identified by words such as “expect”,

“believe”, “foresee”, “anticipate”, “intend”, “estimate”, “goal”,

“strategy”, “plan” “target” and “project” or conditional verbs such as “will”,

“may”, “should”, “could” or “would” or the negative of these terms, although not all

forward-looking statements contain these words, and includes statements in this press release regarding our growth opportunities. Forward-looking

statements by their nature address matters that are, to different degrees, uncertain. Readers should bear these factors in mind when

considering such statements and should not place undue reliance on such statements.

Forward-looking

statements involve a number of assumptions, risks and uncertainties that could cause actual results to differ materially. In the past,

actual results have differed from those suggested by forward looking statements and this may happen again. Important factors that could

cause actual results to differ materially from those suggested by the forward-looking statements include, but are not limited to, the

potential for ongoing disruption in the financial markets and in commercial activity generally as a result of geopolitical events, changes

in monetary and fiscal policy, and other sources of instability; the impacts of inflation, employment disruption, and other financial

difficulties facing our borrowers; the impact of recent failures and re-organization of banking institutions and continued uncertainty

in the banking industry; our ability to timely reduce operating costs, or generate offsetting revenue, in proportion to the industry-wide

decrease in originations activity; the impact of cost-reduction initiatives on our business and operations; the extent to which MAV,

other transactions and our enterprise sales initiatives will generate additional subservicing volume, and result in increased profitability;

MAV’s continued ownership of its MSR portfolio after May 2024, and any impact on our subservicing income as a result of the sale

of MAV’s MSRs; the future of our long-term relationship with Rithm Capital Corp. (Rithm); the timing and amount of presently anticipated

forward and reverse loan boarding; our ability to close acquisitions of MSRs and other transactions, including the ability to obtain

regulatory approvals; our ability to grow our reverse servicing business; our ability to retain clients and employees of acquired businesses,

and the extent to which acquisitions and our other strategic initiatives will contribute to achieving our growth objectives; the adequacy

of our financial resources, including our sources of liquidity and ability to sell, fund and recover servicing advances, forward and

reverse whole loans, future draws on existing reverse loans, and HECM and forward loan buyouts and put backs, as well as repay, renew

and extend borrowings, borrow additional amounts as and when required, meet our MSR or other asset investment objectives and comply with

our debt agreements, including the financial and other covenants contained in them; increased servicing costs based on increased borrower

delinquency levels or other factors; uncertainty related to past, present or future claims, litigation, cease and desist orders and investigations

regarding our servicing, foreclosure, modification, origination and other practices brought by government agencies and private parties,

including state regulators, the Consumer Financial Protection Bureau (CFPB), State Attorneys General, the Securities and Exchange Commission

(SEC), the Department of Justice or the Department of Housing and Urban Development (HUD); scrutiny of our compliance with COVID-19-related

rules and regulations, including requirements instituted by state governments, the Federal National Mortgage Association (Fannie Mae),

and Federal Home Loan Mortgage Corporation (Freddie Mac) (together, the GSEs), the Government National Mortgage Association (Ginnie Mae)

and regulators; the reactions of key counterparties, including lenders, the GSEs and Ginnie Mae, to our regulatory engagements and litigation

matters; increased regulatory scrutiny and media attention; any adverse developments in existing legal proceedings or the initiation

of new legal proceedings; our ability to effectively manage our regulatory and contractual compliance obligations; our ability to interpret

correctly and comply with liquidity, net worth and other financial and other requirements of regulators, the GSEs and Ginnie Mae, as

well as those set forth in our debt and other agreements, including our ability to identify and implement a cost-effective response to

Ginnie Mae’s risk-based capital requirements that take effect in late 2024; our ability to comply with our servicing agreements,

including our ability to comply with the requirements of the GSEs and Ginnie Mae and maintain our seller/servicer and other statuses

with them; our ability to fund future draws on existing loans in our reverse mortgage portfolio; our servicer and credit ratings as well

as other actions from various rating agencies, including any future downgrades; as well as other risks and uncertainties detailed in

our reports and filings with the SEC, including our annual report on Form 10-K for the year ended December 31, 2022. Anyone wishing to

understand Ocwen’s business should review our SEC filings. Our forward-looking statements speak only as of the date they are made

and, we disclaim any obligation to update or revise forward-looking statements whether as a result of new information, future events

or otherwise.

Note

Regarding Non-GAAP Financial Measures

This

press release contains references to adjusted pre-tax income (loss), a non-GAAP financial measure.

We

believe this non-GAAP financial measure provides a useful supplement to discussions and analysis of our financial condition, because

it is a measure that management uses to assess the financial performance of our operations and allocate resources. In addition, management

believes that this presentation may assist investors with understanding and evaluating our initiatives to drive improved financial performance.

Management believes, specifically, that the removal of fair value changes of our net MSR exposure due to changes in market interest rates

and assumptions provides a useful, supplemental financial measure as it enables an assessment of our ability to generate earnings regardless

of market conditions and the trends in our underlying businesses by removing the impact of fair value changes due to market interest

rates and assumptions, which can vary significantly between periods. However, this measure should not be analyzed in isolation or as

a substitute to analysis of our GAAP pre-tax income (loss) nor a substitute for cash flows from operations. There are certain limitations

to the analytical usefulness of the adjustments we make to GAAP pre-tax income (loss) and, accordingly, we use these adjustments only

for purposes of supplemental analysis. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Ocwen’s

reported results under accounting principles generally accepted in the United States. Other companies may use non-GAAP financial measures

with the same or similar titles that are calculated differently to our non-GAAP financial measures. As a result, comparability may be

limited. Readers are cautioned not to place undue reliance on analysis of the adjustments we make to GAAP pre-tax income (loss).

Notables

Beginning

with the three months ended March 31, 2023, for purposes of calculating Income Statement Notables and Adjusted Pre-Tax Income, we changed

the methodology used to calculate MSR Valuation Adjustments due to rates and assumption changes to use a runoff calculation that reflects

the actual runoff of the fair value of the MSR instead of the realization of expected cash flows (the prior methodology). We made this

change because reporting on the actual runoff of the MSR fair value provides an additional supplemental piece of information for investors

to assess this fair value runoff in addition to realization of expected cash flows (which are still provided in the financial statements),

and this supplemental piece of information mirrors the way that management assesses the performance of our Servicing segment and the

owned MSR portfolio.

In

the table below, we adjust GAAP pre-tax income (loss) for the following factors: MSR valuation adjustments, expense notables, and other

income statement notables. MSR valuation adjustments are comprised of changes to Forward MSR and Reverse mortgage valuations due to rates

and assumption changes. Expense notables include significant legal and regulatory settlement expenses, expense recoveries, severance

and retention costs, LTIP stock price changes, consolidation of office facilities and other expenses (such as costs associated with strategic

transactions). Other income statement notables include non-routine transactions that are not categorized in the above.

Beginning

with Q2’23, Expense Notables and Income Statement Notables, previously presented in separate tables, are presented in a single

table for ease of reading; there were no changes to the categories or calculation of Notables presented.

| (Dollars in millions) | |

Q3’23 | | |

Q2’23 | | |

Q3’22 | |

| I | |

Reported Net Income (Loss) | |

| 8 | | |

| 15 | | |

| 37 | |

| | |

Income Tax Benefit (Expense) | |

| (1 | ) | |

| (1 | ) | |

| 4 | |

| II | |

Reported Pre-Tax Income (Loss) | |

| 10 | | |

| 16 | | |

| 33 | |

| | |

Forward MSR Valuation Adjustments due to rates and assumption changes, net(a)(b)(c) | |

| 13 | | |

| (23 | ) | |

| 63 | |

| | |

Reverse Mortgage Fair Value Change due to rates and assumption changes (b)(d) | |

| (12 | ) | |

| (10 | ) | |

| (10 | ) |

| III | |

Total MSR Valuation Adjustments due to rates and assumption changes, net | |

| 0 | | |

| (33 | ) | |

| 54 | |

| | |

Significant legal and regulatory settlement expenses | |

| (3 | ) | |

| 28 | | |

| (3 | ) |

| | |

Expense recoveries | |

| - | | |

| - | | |

| (0 | ) |

| | |

Severance and retention (e) | |

| (0 | ) | |

| (1 | ) | |

| (8 | ) |

| | |

LTIP stock price changes (f) | |

| 2 | | |

| (1 | ) | |

| 2 | |

| | |

Office facilities consolidation | |

| 0 | | |

| 0 | | |

| (3 | ) |

| | |

Other expense notables (g) | |

| 1 | | |

| 0 | | |

| 1 | |

| A | |

Total Expense Notables | |

| (1 | ) | |

| 28 | | |

| (11 | ) |

| B | |

Other Income Statement Notables (h) | |

| 0 | | |

| (1 | ) | |

| (2 | ) |

| IV | |

Total Other Notables [A + B] | |

| (0 | ) | |

| 27 | | |

| (13 | ) |

| V | |

Total Notables (i) [III + IV] | |

| (0 | ) | |

| (6 | ) | |

| 40 | |

| VI | |

Adjusted Pre-tax Income (Loss) [II – V] | |

| 10 | | |

| 23 | | |

| (7 | ) |

| (a) | MSR

Valuation Adjustments that are due to changes in market interest rates, valuation inputs

or other assumptions, net of overall fair value gains / (losses) on MSR hedge, including

FV changes of Pledged MSR liabilities associated with MSR transferred to MAV, RITM

and others and ESS financing liabilities that are due to changes in market interest

rates, valuation inputs or other assumptions, a component of MSR valuation adjustment, net.

The adjustment does not include revaluation gains on MSR purchases of $3.6M for

Q3’22. Effective in the fourth quarter of 2022, in our consolidated statements

of operations we now present all fair value gains and losses of Other financing liabilities,

at fair value in MSR valuation adjustments, net (previously reported in Pledged MSR liability

expense); other financing liabilities, at fair value include the financing liabilities recognized

upon transfers of MSRs that do not meet the requirements for sale accounting treatment (also

referred as Pledged MSR liability) and the ESS financing liabilities for which we

elected the fair value option - refer to Note 1 to the consolidated financial statements

in Ocwen’s Q3’23 Form 10-Q; the presentation of past periods has been conformed

to the current presentation |

| | | |

| (b) | The

changes in fair value due to market interest rates were measured by isolating the impact

of market interest rate changes on the valuation model output as provided by our third-party

valuation expert |

| | | |

| (c) | Beginning

with the three months ended March 31, 2023, for purposes of calculating Income Statement

Notables and Adjusted Pre-Tax Income, we changed the methodology used to calculate MSR Valuation

Adjustments due to rates and assumption changes; the presentation of past periods has been

conformed to the current presentation; if we had used the methodology employed prior to Q1’23,

Forward MSR Valuation Adjustments due to rates and assumption changes, net for Q3’22,

Q2’23 and Q3’23 would have been $64M, $(14)M and $16M and Adjusted Pre-tax Income

(Loss) for Q3’22, Q2’23 and Q3’23 would have been $(8)M, $13M and $7M;

see Note regarding Non-GAAP Financial Measures for more information |

| (d) | FV

changes of loans HFI and HMBS related borrowings due to market interest rates and assumptions,

a component of gain on reverse loans held for investment and HMBS-related borrowings, net |

| | | |

| (e) | Severance

and retention due to organizational rightsizing or reorganization |

| | | |

| (f) | Long-term

incentive program (LTIP) compensation expense changes attributable to stock price changes

during the period |

| | | |

| (g) | Includes

costs associated with strategic transactions including but not limited to transaction costs

related to the reverse subservicing acquisition from MAM(RMS), rebranding, MAV upsize |

| | | |

| (h) | Contains

non-routine transactions including but not limited to gain on debt extinguishment,

early asset retirement, and fair value assumption changes on other investments recorded in

other income/expense |

| | | |

| (i) | Certain

previously presented notable categories with nil numbers for each quarter shown have been

omitted; prior periods have been adjusted to conform with current period information |

Condensed

Consolidated Balance Sheet

| Assets ($ in millions) | |

Sep 30, 2023 | | |

Jun 30, 2023 | | |

Sep 30, 2022 | |

| Cash and cash equivalents | |

$ | 194.0 | | |

$ | 213.4 | | |

$ | 226.6 | |

| Restricted cash | |

| 71.8 | | |

| 119.1 | | |

| 45.3 | |

| Mortgage servicing rights (MSRs), at fair value | |

| 2,859.8 | | |

| 2,675.7 | | |

| 2,714.2 | |

| Advances, net | |

| 564.6 | | |

| 602.7 | | |

| 642.5 | |

| Loans held for sale | |

| 948.3 | | |

| 1,356.5 | | |

| 729.6 | |

| Loans held for investment, at fair value | |

| 7,783.5 | | |

| 7,680.7 | | |

| 7,402.3 | |

| Receivables, net | |

| 164.7 | | |

| 188.6 | | |

| 170.8 | |

| Investment in equity method investee | |

| 39.5 | | |

| 34.6 | | |

| 38.7 | |

| Premises and equipment, net | |

| 16.1 | | |

| 16.9 | | |

| 18.8 | |

| Other assets | |

| 369.3 | | |

| 327.6 | | |

| 371.3 | |

Total

Assets | |

$ | 13,011.7 | | |

$ | 13,216.0 | | |

$ | 12,360.1 | |

| Liabilities & Stockholders’ Equity ($ in millions) | |

Sep 30, 2023 | | |

Jun 30, 2023 | | |

Sep 30, 2022 | |

Home Equity Conversion Mortgage-Backed Securities (HMBS) related borrowings, at fair value | |

$ | 7,613.6 | | |

$ | 7,486.4 | | |

$ | 7,208.4 | |

| Other financing liabilities, at fair value | |

| 1,380.3 | | |

| 1,274.0 | | |

| 989.7 | |

| Advance match funded liabilities | |

| 403.0 | | |

| 430.4 | | |

| 457.5 | |

| Mortgage loan financing facilities | |

| 1,034.7 | | |

| 1,515.0 | | |

| 819.6 | |

| MSR financing facilities, net | |

| 901.7 | | |

| 864.8 | | |

| 1,020.6 | |

| Senior notes, net | |

| 594.1 | | |

| 605.0 | | |

| 597.1 | |

| Other liabilities | |

| 639.2 | | |

| 606.6 | | |

| 721.1 | |

| Total Liabilities | |

$ | 12,566.6 | | |

$ | 12,782.2 | | |

$ | 11,814.0 | |

Total Stockholders’ Equity | |

$ | 445.1 | | |

$ | 433.8 | | |

$ | 546.1 | |

Total Liabilities and Stockholders’ Equity | |

$ | 13,011.7 | | |

$ | 13,216.0 | | |

$ | 12,360.1 | |

Condensed

Consolidated Statement of Operations

| ($ in millions) | |

Sep 30, 2023 | | |

Jun 30, 2023 | | |

Sep 30, 2022 | |

| Revenue | |

| | | |

| | | |

| | |

| Servicing and subservicing fees | |

$ | 237.8 | | |

$ | 237.6 | | |

$ | 215.6 | |

| Gain (loss) on reverse loans held for investment and HMBS-related borrowings,

net | |

| (0.4 | ) | |

| 0.7 | | |

| 6.9 | |

| Gain on loans held for sale, net | |

| 8.2 | | |

| 25.3 | | |

| 18.9 | |

| Other revenue, net | |

| 10.0 | | |

| 8.5 | | |

| 8.3 | |

| Total Revenue | |

| 255.5 | | |

| 272.0 | | |

| 249.7 | |

| MSR Valuation Adjustments, net | |

| (16.4 | ) | |

| (48.9 | ) | |

| 27.9 | |

| | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | |

| Compensation and benefits | |

| 55.7 | | |

| 57.7 | | |

| 71.3 | |

| Servicing and origination | |

| 15.5 | | |

| 17.6 | | |

| 19.0 | |

| Technology and communication | |

| 13.1 | | |

| 13.0 | | |

| 14.4 | |

| Professional services | |

| 13.5 | | |

| (16.9 | ) | |

| 17.2 | |

| Occupancy and equipment | |

| 7.7 | | |

| 7.7 | | |

| 12.4 | |

| Other expenses | |

| 4.6 | | |

| 5.1 | | |

| 7.1 | |

| Total Operating Expenses | |

| 110.0 | | |

| 84.3 | | |

| 141.4 | |

| | |

| | | |

| | | |

| | |

| Other Income (Expense) | |

| | | |

| | | |

| | |

| Interest income | |

| 25.9 | | |

| 20.3 | | |

| 13.7 | |

| Interest expense | |

| (74.3 | ) | |

| (68.3 | ) | |

| (50.4 | ) |

| Pledged MSR liability expense | |

| (76.5 | ) | |

| (73.0 | ) | |

| (65.6 | ) |

| Earnings of equity method investee | |

| 2.8 | | |

| 2.9 | | |

| 3.3 | |

| Gain on extinguishment of debt | |

| 1.2 | | |

| — | | |

| — | |

| Other, net | |

| 1.3 | | |

| (4.4 | ) | |

| (4.3 | ) |

| Total Other Income (Expense), net | |

| (119.7 | ) | |

| (122.5 | ) | |

| (103.2 | ) |

| | |

| | | |

| | | |

| | |

| Income (loss) before income taxes | |

| 9.5 | | |

| 16.3 | | |

| 33.0 | |

| Income tax expense (benefit) | |

| 1.0 | | |

| 0.9 | | |

| (4.0 | ) |

| Net Income (loss) | |

$ | 8.5 | | |

$ | 15.5 | | |

$ | 36.9 | |

| Basic EPS | |

$ | 1.10 | | |

$ | 2.02 | | |

$ | 4.33 | |

| Diluted EPS | |

$ | 1.05 | | |

$ | 1.95 | | |

$ | 4.17 | |

For

Further Information Contact:

Dico

Akseraylian, SVP, Corporate Communications

(856)

917-0066

mediarelations@ocwen.com

v3.23.3

Cover

|

Nov. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2023

|

| Entity File Number |

1-13219

|

| Entity Registrant Name |

OCWEN

FINANCIAL CORPORATION

|

| Entity Central Index Key |

0000873860

|

| Entity Tax Identification Number |

65-0039856

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

1661

Worthington Road

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

West

Palm Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33409

|

| City Area Code |

(561)

|

| Local Phone Number |

682-8000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.01 Par Value

|

| Trading Symbol |

OCN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

applicable.

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

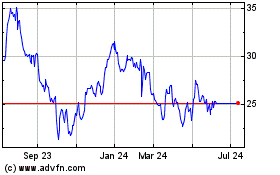

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Oct 2024 to Nov 2024

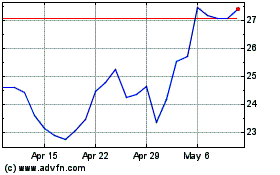

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Nov 2023 to Nov 2024