Nutrien to Highlight Strategic Priorities and 2026 Targets at Investor Day

June 12 2024 - 8:30AM

Business Wire

Nutrien Ltd. (TSX and NYSE: NTR) today is hosting an Investor

Day at the New York Stock Exchange beginning at 10:00 a.m. EDT. At

the event, management will detail plans to fortify its leadership

position across the ag value chain and position the Company to

deliver long-term growth.

“Nutrien operates the most extensive crop inputs and services

ecosystem with low-cost upstream production assets, global supply

chain capabilities, and the leading downstream retail channel to

the farmer. Our differentiated business model is centred on our

ability to efficiently produce and distribute the products and

services needed in key agriculture markets around the world,”

commented Ken Seitz, Nutrien’s President and CEO.

“Today, we look forward to providing an update on the evolution

of our strategy and establish new performance targets that we

believe provide a clear pathway to deliver long-term value for our

shareholders. Our simplified and focused plan prioritizes

initiatives that enhance our ability to serve growers in our core

markets, maintain the low-cost position and reliability of our

assets, and improve the quality of our earnings and free cash

flow,” added Mr. Seitz.

Strategic Priorities and Performance Targets

Simplifying portfolio and focusing on core assets and markets

to enhance earnings quality and free cash flow.

- Prioritizing investments to enhance our North American

fertilizer production assets and proprietary products capabilities,

strengthen our global distribution network and grow in our core

downstream Retail markets.

- Reviewing strategic options for our 50 percent ownership stake

in Profertil and announcing we are no longer pursuing our Geismar

clean ammonia project.

Driving operational improvements and network optimization

opportunities to increase asset efficiency.

- Focused on maintaining a low-cost position and enhancing the

reliability of our upstream production assets. Supporting these

objectives through the deployment of automation and other

operational excellence initiatives in potash and the implementation

of reliability and energy efficiency programs in nitrogen.

- Optimizing downstream Retail network through modernization and

consolidation initiatives in North America and a targeted margin

improvement plan in Brazil.

Utilizing competitive advantages to deliver scalable

growth.

- Targeting potash and nitrogen sales volume growth of

approximately 2.0 to 3.0 million tonnes by 2026, compared to 2023

levels.

- Targeting Retail adjusted EBITDA of $1.9 to $2.1 billion in

2026, including a goal of $1.4 billion in gross margin from our

proprietary products portfolio.

Maintaining disciplined approach to cost and capital

management.

- Intend to reduce controllable costs across our operations and

corporate functions by approximately $200 million by 2026 and

maintain annual average capital expenditures of $2.2 to $2.3

billion through 2026.

- Expect to generate strong cash flow through the cycle,

providing the opportunity to pursue high conviction capital

deployment opportunities, including meaningful returns to

shareholders.

Nutrien will provide more detail on its strategic priorities,

2026 performance targets and capital allocation plans at its

Investor Day this morning.

The event will begin at 10:00 a.m. EDT and conclude at

approximately 12:30 p.m. EDT. To view the live webcast and access

the presentation materials, visit the investor relations page of

Nutrien’s website at

https://www.nutrien.com/investors/events/nutrien-2024-investor-day.

A replay of the webcast will be available following the event.

Forward-Looking Statements

Certain statements in this news release constitute

"forward-looking information" or "forward-looking statements"

(collectively, "forward-looking statements") under applicable

securities laws including Nutrien’s strategic priorities and

performance targets; our expectations for quality of earnings and

free cash flow; our intention to increase asset efficiency

including our expectations for potash automation, nitrogen

reliability and efficiency programs as well as optimizing our

Retail network and margin improvement plans in Brazil; our targets

for potash and nitrogen sales volumes and our target for Retail

adjusted EBITDA by the end of 2026 as well as our goal of $1.4

billion in proprietary products gross margin by the end of 2026;

our targets to reduce controllable costs by 2026 and to maintain

annual average capital expenditures through 2026; and our

expectations for cash flow through the cycle and capital deployment

opportunities. Forward looking statements in this news release are

based on certain key expectations and assumptions made by Nutrien,

many of which are outside of our control including but not limited

to: that future business, regulatory and industry conditions and

global economic conditions will be within the parameters expected

by us, including with respect to margins, demand, supply, energy

and commodity prices, and availability and cost of labor and

technology. Although Nutrien believes that the expectations and

assumptions on which such forward looking statements are based are

reasonable, undue reliance should not be placed on the

forward-looking statements because Nutrien can give no assurance

that they will prove to be correct. Forward looking statements are

subject to various risks and uncertainties which could cause actual

results and experience to differ materially from the anticipated

results or expectations expressed in this news release including,

but not limited to: general global economic, market, industry, and

business conditions including supply, demand, energy and commodity

prices; regulatory and stock exchange requirements; access and

availability of technology; and performance of third parties. For

additional information on the assumptions made, and the risks and

uncertainties that could cause actual results to differ from the

anticipated results, refer to our reports filed with the Canadian

securities regulatory authorities and the United States Securities

and Exchange Commission.

The forward-looking statements in this news release are made as

of the date hereof and Nutrien disclaims any intention or

obligation to update or revise any forward-looking statements in

this news release, except as may be required under applicable

laws.

About Nutrien

Nutrien is a leading provider of crop inputs and services,

helping to safely and sustainably feed a growing world. We operate

a world-class network of production, distribution and ag retail

facilities that positions us to efficiently serve the needs of

growers. We focus on creating long-term value by prioritizing

investments that strengthen the advantages of our integrated

business and by maintaining access to the resources and the

relationships with stakeholders needed to achieve our goals.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240611005416/en/

Investor Relations Jeff Holzman Vice President, Investor

Relations (306) 933-8545

Media Relations Megan Fielding Vice President, Brand

& Culture Communications (403) 797-3015

Contact us at: www.nutrien.com

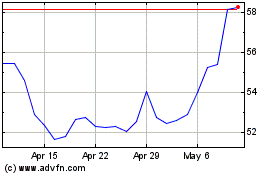

Nutrien (NYSE:NTR)

Historical Stock Chart

From Oct 2024 to Nov 2024

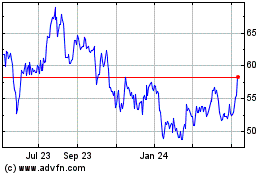

Nutrien (NYSE:NTR)

Historical Stock Chart

From Nov 2023 to Nov 2024