Nu Holdings Ltd. (NYSE: NU) (“Nu” or the “Company”), one of the

world's largest digital financial services platforms, released its

Third Quarter financial results today. Financial results are

expressed in U.S. dollars and are presented in accordance with

International Financial Reporting Standards (IFRS). The full

earnings release has been made available on the Company’s Investor

Relations website at www.investors.nu, as well as the details of

the Earnings Conference Call Nu will hold today at 5:00 pm Eastern

time/7:00 pm Brasilia time.

"Our third quarter 2024 underscores the strength of our business

model, demonstrating top-line growth and sustained profitability.

We reached $2.9 billion in revenue, driven by both customer

acquisition – now reaching 110 million globally – and enhanced

customer engagement through cross-selling and up-selling

initiatives, alongside appealing product launches. This growth was

accompanied by a virtually stable cost-to-serve and a record ROE of

30%, resulting in a more than doubling of net income to $553

million for the quarter (YoY FXN). Our expansion into Mexico and

Colombia continues to generate impressive results, with nearly 9

million customers in Mexico and over 2 million in Colombia. As we

make progress in our execution, we are preparing ourselves to

consolidate Nu as the world's leading digital services platform,

going beyond financial services," said David Vélez, founder and CEO

of Nubank.

Q3’24 Results Snapshot

Below are the Q3’24 performance highlights of Nu Holdings

Ltd.:

Operating Highlights:

- Customer growth: Nu added 5.2 million customers in

Q3’24, reaching a total of 109.7 million customers globally by

September 30, 2024, reflecting a 23% YoY increase. This growth

further strengthens Nu's position as one of the fastest-growing

digital services platforms worldwide, and one of the largest

financial institutions in Latin America by number of customers. In

Brazil, Nu has already become the institution with the largest

number of active customers in credit operations.

- Engagement and activity rates: Monthly Average Revenue

per Active Customer (ARPAC) stands at $11.0 in Q3’24, with more

mature cohorts already at $25. On an FX neutral basis1 it grew 2%

sequentially and 25% year-over-year, up from US$10.0 from one year

ago. The monthly activity rate2 had another sequential increase to

84%, up from 83% one year ago. This represents the twelfth

consecutive increase in activity rate, underscoring our ability to

consistently provide a compelling value proposition to our

customers.

- Low-cost operating platform: Monthly Average Cost to

Serve Per Active Customer remained below the one dollar level at

$0.7 per customer (or $0.8 when adjusted by one-offs occurred in

Q3'24), demonstrating the strong operating leverage of the business

model. The company’s efficiency ratio improved 60 basis points

quarter-over-quarter, reaching 31.4% and more than 300 basis points

better than a year ago, and despite the one-off expenses of US$48

million associated with the repositioning of Nucoins.

- Asset Quality: Our leading indicator, the 15-90 NPL

ratio, declined once again during the third quarter, dropping 10

basis points from last quarter to 4.4%. 90+ NPLs increased by 20

basis points to 7.2%, also in line with expectations. The 20 basis

points increase this quarter reflects the increase in the NPL 15-90

accumulated over prior periods, since this indicator behaves as a

stock rather than flow metric.

Financial Highlights:

- Net & Adjusted Income: At a Holding level, Nu

continued to drive increasing profitability and posted a Net Income

for Q3’24 of $553.4 million and an annualized ROE of 30%. Adjusted

Net Income3 for Q3’24 reached $592.2 million with an annualized

adjusted ROE of 33%. Nu is achieving these strong levels of

profitability and efficiency, despite maintaining a considerable

excess cash of $2.4 billion sitting at the holding level and

continuing to make substantial investments in future products and

geographic expansion, as the company sees tremendous potential to

continue building the largest consumer platform in Latin

America.

- Revenue: Nu’s revenues were up 56% year-over-year on FX

neutral basis, setting a new record at $2.9 billion. This showcases

the company’s unique ability to consistently expand its active

customer base while compounding revenue growth and

profitability.

- Gross Profit: Nu’s gross profit stands at $1.348

billion, marking a 67% year-over-year growth, with a gross margin

of 46% from 43% in Q3’23.

- Liquidity: On September 30, 2024, Nu had an

interest-earning portfolio (IEP) of $11.2 billion which rose 81%

YoY FXN. The ramp up of the lending portfolio, which expanded 97%

year-over-year and 19% quarter-over-quarter on an FX neutral basis,

to US$5.7 billion, and credit card receivables, which increased 33%

year-over-year and 4% quarter-over-quarter, on an FX neutral basis,

to US$15.2 billion, were the main drivers of growth. Total deposits

increased to US$28.3 billion, up 60% year-over-year on FX neutral

terms, supported by robust expansion across all three

geographies.

- Net interest income: increased 63% year-on-year. On a

sequential basis, NII expanded 4% quarter-over-quarter on FX

neutral terms, to US$1.7 billion. The net interest margin (NIM)

compressed 140 base points sequentially to 18.4% this quarter.

Risk-Adjusted NIM compressed 90bp QoQ to 10.1%, a slower pace

compared to NIM as cost of risk improved 50bp sequentially. Yet,

Risk-Adjusted NIM expanded 110bp YoY, underscoring once again the

result of our focus on optimizing the lifetime value of our

customer relationship cohorts. The NIM compression in the quarter

was mainly driven by the combination of three factors. First,

yields on the credit card portfolio declined reflecting lower risk

in products and customer mix; Second, lending yields declined due

to the increasing mix of secured loans in the portfolio; and Third,

funding costs were pressured by the deposit ramp-up in Mexico and

Colombia, in line with our depo rates strategy in new geos.

Business highlights:

- Performance and Growth in Brazil: In Brazil, the

customer base reached 98.8 million by September 30, 2024, with an

average of 1.1 million new customers monthly, and recently the

company celebrated the milestone of surpassing 100 million

customers in the country.

- International Expansion: In Mexico, Nu’s growth remained

strong, with a net add of 1.2 million new customers in the quarter,

reaching a total of 8.9 million customers at quarter-end. The

expansion validates the strategy of increasing deposit yields in

the country. In Colombia, Nu surpassed 2 million customers,

sustaining the positive momentum from the launch of the Cuenta

product.

Footnotes 1 FX neutral measures were calculated to

present what such measures in preceding periods/years would have

been had exchange rates remained stable from these preceding

periods/years until the date of the Company’s more recent financial

information. 2 Activity rate is defined as monthly active customers

divided by the total number of customers as of a specific date. 3

Adjusted Net Income is a non-IFRS measure calculated using Net

Income adjusted for expenses related to Nu's share-based

compensation as well as the hedge accounting and tax effects

related to these items, among others. For more information, please

see “Non-IFRS Financial Measures and Reconciliations – Adjusted Net

Income Reconciliation".

CONFERENCE EARNINGS CALL

DETAILS

Nu will hold a Conference Earnings Call

today at 5:00pm Eastern time/7:00pm Brasília time with simultaneous

translation in Portuguese and English.

To pre-register for this call, please

click here.

A replay of the webcast will be made

available after the call on the Investor Relations page: click

here.

Note on forward-looking statements and non-IFRS financial

measures

This release speaks at the date hereof and the Company is under

no obligation to update or keep current the information contained

in this presentation. Any information expressed herein is subject

to change without notice. Any market or other third-party data

included in this presentation has been obtained by the Company from

third-party sources. While the Company has compiled and extracted

the market data, it can provide no assurances of the accuracy and

completeness of such information and takes no responsibility for

such data.

This release contains forward-looking statements. All statements

other than statements of historical fact contained in this

presentation may be forward-looking statements and include, but are

not limited to, statements regarding the Company’s intent, belief

or current expectations. These forward-looking statements are

subject to risks and uncertainties, and may include, among others,

financial forecasts and estimates based on assumptions or

statements regarding plans, objectives and expectations. Although

the Company believes that these estimates and forward-looking

statements are based upon reasonable assumptions, they are subject

to several risks and uncertainties and are made in light of

information currently available, and actual results may differ

materially from those expressed or implied in the forward-looking

statements due to various factors, including those risks and

uncertainties included under the captions “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in the prospectus dated December 8, 2021

filed with the Securities and Exchange Commission pursuant to Rule

424(b) under the Securities Act of 1933, as amended, and in the

Annual Report on Form 20-F for the year ended December 31, 2023,

which was filed with the Securities and Exchange Commission on

April 19, 2024. The Company, its advisers and each of their

respective directors, officers and employees disclaim any

obligation to update the Company’s view of such risks and

uncertainties or to publicly announce the result of any revision to

the forward-looking statements made herein, except where it would

be required to do so under applicable law. The forward-looking

statements can be identified, in certain cases, through the use of

words such as “believe,” “may,” “might,” “can,” “could,” “is

designed to,” “will,” “aim,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “forecast”, “plan”, “predict”, “potential”,

“aspiration,” “should,” “purpose,” “belief,” and similar, or

variations of, or the negative of such words and expressions.

The financial information in this document includes forecasts,

projections and other predictive statements that represent the

Company’s assumptions and expectations in light of currently

available information. These forecasts, projections and other

predictive statements are based on the Company’s expectations and

are subject to variables and uncertainties. The Company’s actual

performance results may differ. Consequently, no guarantee is

presented or implied as to the accuracy of specific forecasts,

projections or predictive statements contained herein, and undue

reliance should not be placed on the forward-looking statements in

this presentation, which are inherently uncertain.

In addition to IFRS financials, this presentation includes

certain summarized, non-audited or non-IFRS financial information.

These summarized, non-audited or non-IFRS financial measures are in

addition to, and not a substitute for or superior to, measures of

financial performance prepared in accordance with IFRS. References

in this presentation to “R$” refer to the Brazilian Real, the

official currency of Brazil.

About Nu

Nu is one of the world’s largest digital financial services

platforms, serving 110 million customers across Brazil, Mexico, and

Colombia. The company has been leading an industry transformation

by leveraging data and proprietary technology to develop innovative

products and services. Guided by its mission to fight complexity

and empower people, Nu caters to customers’ complete financial

journey, promoting financial access and advancement with

responsible lending and transparency. The company is powered by an

efficient and scalable business model that combines low cost to

serve with growing returns. Nu’s impact has been recognized in

multiple awards, including Time 100 Companies, Fast Company’s Most

Innovative Companies, and Forbes World’s Best Banks

For more information, please visit

https://international.nubank.com.br/about/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241113354057/en/

Investors Relations J�rg Friedemann

investors@nubank.com.br Media Relations Leila Suwwan

press@nubank.com.br

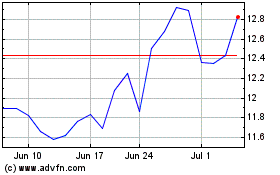

Nu (NYSE:NU)

Historical Stock Chart

From Nov 2024 to Dec 2024

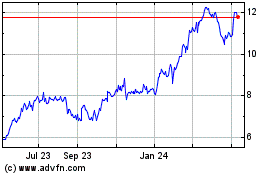

Nu (NYSE:NU)

Historical Stock Chart

From Dec 2023 to Dec 2024