NOG Announces the Exercise of Option to Purchase Additional Uinta Basin Assets

August 07 2024 - 6:00AM

Business Wire

HIGHLIGHTS

- NOG and SM Energy Company (“SM”) exercised option to jointly

acquire additional Uinta Basin assets adjacent to the XCL

Resources, LLC asset acquisition, which were previously owned by

Altamont Energy LLC (the “Altamont Assets”)

- NOG to acquire a 20% undivided stake in the Altamont Assets

(the “Acquired Assets”) for an unadjusted purchase price of $17.5

million in cash (all data below is net to NOG)

- Expands Uinta footprint by ~6,500 net acres, located primarily

in Duchesne and Uintah Counties, UT

- Transaction to close simultaneously with the close of the XCL

asset acquisition

- NOG’s total Uinta net acreage to increase to ~15,800 with ~116

net underwritten undeveloped locations and additional exploration

upside potential

- Altamont purchase to be funded by cash flow from operations,

cash on hand and borrowings under NOG’s Senior Secured Revolving

Credit Facility

Northern Oil and Gas, Inc. (NYSE: NOG) (the “Company” or “NOG”)

today announced that it has exercised its option to acquire a 20%

undivided stake in the Altamont Assets in partnership with SM for a

purchase price, net to NOG, of $17.5 million in cash, subject to

customary closing adjustments.

The Acquired Assets are located primarily in Uintah and Duchesne

Counties, Utah and include approximately 6,500 net acres. NOG’s

initial estimates are for approximately 18 net undeveloped

locations on the properties and ~250 Boe per day of expected

production. Altamont was previously under contract with XCL

Resources and was offered to NOG and SM under a right of first

refusal in connection with the XCL asset acquisition.

Upon closing and transition of services, the operator of

substantially all of the assets will be SM, with NOG participating

in development pursuant to cooperation and joint development

agreements entered into in connection with the XCL asset

acquisition.

NOG expects to close the transaction simultaneously with the

closing of the XCL asset acquisition in early Q4 2024. The

obligations of the parties to complete the transactions

contemplated by the acquisition agreement are subject to the

satisfaction or waiver of customary closing conditions.

MANAGEMENT COMMENTS

“We are excited to execute the option to purchase

additional Uinta assets under our Area of Mutual Interest agreement

with SM. The Altamont Assets increase our Uinta footprint

substantially and are a testament to the benefits of the joint

venture structures we have pursued in recent years,” commented Nick

O’Grady, NOG’s Chief Executive Officer. “This transaction grows our

estimated Uinta inventory by nearly 20% and given the 70% increase

in acreage, provides significant future exploration potential for a

minimal cash outlay.”

ADVISORS

RBC Capital Markets served as financial advisor to NOG for the

XCL and Altamont acquisitions.

Kirkland & Ellis LLP is serving as legal counsel to NOG.

ABOUT NOG

NOG is a real asset company with a primary strategy of acquiring

and investing in non-operated minority working and mineral

interests in the premier hydrocarbon producing basins within the

contiguous United States. More information about NOG can be found

at www.noginc.com.

SAFE HARBOR

This press release contains forward-looking statements regarding

future events and future results that are subject to the safe

harbors created under the Securities Act of 1933 (the “Securities

Act”) and the Securities Exchange Act of 1934 (the “Exchange Act”).

All statements other than statements of historical facts included

in this release regarding NOG’s financial position, common stock

dividends, business strategy, plans and objectives of management

for future operations, industry conditions, capital expenditures,

production, cash flow, hedging and other matters are

forward-looking statements. When used in this release,

forward-looking statements are generally accompanied by terms or

phrases such as “estimate,” “guidance,” “project,” “predict,”

“believe,” “expect,” “continue,” “anticipate,” “target,” “could,”

“plan,” “intend,” “seek,” “goal,” “will,” “should,” “may” or other

words and similar expressions that convey the uncertainty of future

events or outcomes. Items contemplating or making assumptions about

actual or potential future sales, production, drilling locations,

capital expenditures, market size, collaborations, and trends or

operating results also constitute such forward-looking

statements.

Forward-looking statements involve inherent risks and

uncertainties, and important factors (many of which are beyond

NOG’s control) that could cause actual results to differ materially

from those set forth in the forward-looking statements, including

the following: changes in crude oil and natural gas prices; the

pace of drilling and completions activity on NOG's properties and

properties pending acquisition; infrastructure constraints and

related factors affecting NOG’s properties; cost inflation or

supply chain disruptions; ongoing legal disputes over and potential

shutdown of the Dakota Access Pipeline; NOG’s ability to acquire

additional development opportunities, potential or pending

acquisition transactions (including the transactions described

herein), the projected capital efficiency savings and other

operating efficiencies and synergies resulting from NOG’s

acquisition transactions, integration and benefits of property

acquisitions, or the effects of such acquisitions on NOG’s cash

position and levels of indebtedness; changes in NOG's reserves

estimates or the value thereof; disruption to NOG’s business due to

acquisitions and other significant transactions; general economic

or industry conditions, nationally and/or in the communities in

which NOG conducts business; changes in the interest rate

environment, legislation or regulatory requirements, conditions of

the securities markets; increasing attention to environmental,

social and governance matters; NOG's ability to consummate any

pending acquisition transactions (including the transactions

described herein); other risks and uncertainties related to the

closing of pending acquisition transactions (including the

transactions described herein); NOG's ability to raise or access

capital; cyber incidents; changes in accounting principles,

policies or guidelines; events beyond NOG’s control, including a

global or domestic health crisis, acts of terrorism, political or

economic instability or armed conflict in oil and gas producing

regions or elsewhere; and other economic, competitive,

governmental, regulatory and technical factors affecting NOG's

operations, products and prices.

NOG has based these forward-looking statements on its current

expectations and assumptions about future events. While management

considers these expectations and assumptions to be reasonable, they

are inherently subject to significant business, economic,

competitive, regulatory, and other risks, contingencies and

uncertainties, most of which are difficult to predict and many of

which are beyond NOG's control. Accordingly, results actually

achieved may differ materially from expected results described in

these statements. Forward-looking statements speak only as of the

date they are made. NOG does not undertake, and specifically

disclaims, any duty to update or revise any forward-looking

statements to reflect events or circumstances after the date of

such statements, except as may be required by applicable law or

regulation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807540111/en/

Evelyn Leon Infurna Vice President of Investor Relations (952)

476-9800 ir@northernoil.com

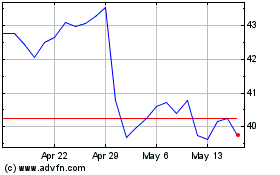

Northern Oil and Gas (NYSE:NOG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Northern Oil and Gas (NYSE:NOG)

Historical Stock Chart

From Dec 2023 to Dec 2024