UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE TO

(RULE 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR

13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

NIO Inc.

(Name of Subject Company (Issuer))

NIO Inc.

(Name of Filing Person (Issuer))

0.50% Convertible Senior Notes due 2027

(Title of Class of Securities)

62914VAF3

(CUSIP Number of Class of Securities)

Yu Qu

Chief Financial Officer

Building 19, No. 1355, Caobao Road

Minhang District, Shanghai 201804

People’s Republic of China

Telephone: +86 21-6908 2018

with copy to:

|

Yuting Wu, Esq.

Skadden, Arps, Slate, Meagher & Flom

LLP

46/F, Tower II, Jing An Kerry Centre

1539 Nanjing West Road

Shanghai 200040, China

+86 (21) 6193-8200 |

(Name, address and telephone number of person authorized to receive

notices and communications on behalf of the filing person)

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| ¨ |

third-party tender offer subject to Rule 14d-1. |

| x |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting

the results of the tender offer: ¨

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

INTRODUCTORY STATEMENT

As required by, pursuant to the terms of and subject

to the conditions set forth in the Indenture dated as of January 15, 2021 (the “Indenture”), by and between NIO Inc.

(the “Company”) and The Deutsche Bank Trust Company Americas, as trustee (the “Trustee”), for the Company’s

0.50% Convertible Senior Notes due 2027 (the “Notes”), this Tender Offer Statement on Schedule TO (“Schedule TO”)

is filed by the Company with respect to the right of each holder (the “Holder”) of the Notes to require the Company to repurchase

the Notes, as set forth in the Company’s Notice to the Holders dated December 26, 2024 (the “Repurchase Right Notice”)

and the related notice materials filed as exhibits to this Schedule TO (which Repurchase Right Notice and related notice materials, as

amended or supplemented from time to time, collectively constitute the “Repurchase Right”).

This Schedule TO is intended to satisfy the disclosure

requirements of Rule 13e-4(c)(2) under the Securities Exchange Act of 1934 (the “Exchange Act”).

ITEMS 1 through 9.

The Company is the issuer of the Notes and is obligated

to purchase all of the Notes if properly tendered by the Holders under the terms and subject to the conditions set forth in the Repurchase

Right. The Notes are convertible into the Company’s American depositary shares (“ADSs”), each representing one Class A

ordinary share, par value US$0.00025 per share, of the Company, subject to the terms, conditions and adjustments specified in the Indenture

and the Notes. The Company maintains its principal executive offices at Building 19, No. 1355, Caobao Road, Minhang District, Shanghai,

201804, People’s Republic of China, and the telephone number at this address is +86 21-6908 2018. The Company’s registered

office in the Cayman Islands is located at the offices of Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104,

Cayman Islands.

From November 25, 2024 to December 19,

2024, the Company entered into and completed separate, privately negotiated transactions with a limited number of holders of the

Notes resulting in the exchange of US$127.1 million principal amount of the Notes (or approximately 25.1% of the Notes outstanding immediately

before these transactions) into ADSs. In these exchange transactions, we delivered to the participating holders 27.7 million ADSs. The

exchange prices ranged from 207.04 to 227.59 ADSs per US$1,000 principal amount of the Notes. We did not receive any cash proceeds from

the issuance of the ADSs upon exchange. As of December 25, 2024, US$378.5 million principal amount of the Notes remained outstanding.

The above exchange transactions were made in reliance on the exemption from registration provided under Section 4(a)(2) of the

Securities Act of 1933.

Concurrently, CHJ Limited, a wholly-owned subsidiary

of the Company, surrendered 27.7 million Class A ordinary shares held by it to the Company for cancellation at no consideration.

As a result, the total number of issued and outstanding shares of the Company remains unchanged.

As permitted by General Instruction F to Schedule

TO, all of the information set forth in the Repurchase Right is incorporated by reference into this Schedule TO.

| ITEM 10. | FINANCIAL STATEMENTS. |

| (a) | Pursuant to Instruction 2 to Item 10 of Schedule TO, the Company’s financial condition is not material to a Holder’s decision

whether to put the Notes to the Company because (i) the consideration being paid to Holders surrendering Notes consists solely of

cash, (ii) the Repurchase Right is not subject to any financing conditions, (iii) the Company is a public reporting company

under the Exchange Act that files reports electronically on EDGAR, and (iv) the Repurchase Right applies to all outstanding Notes.

The financial condition and results of operations of the Company, its subsidiaries and consolidated affiliate entities are reported electronically

on EDGAR on a consolidated basis. |

| ITEM 11. | ADDITIONAL INFORMATION. |

(a) Not

applicable.

(c) Not

applicable.

(a) Exhibits.

(b) Filing Fee Exhibit.

| ITEM 13. | INFORMATION REQUIRED BY SCHEDULE 13E-3. |

Not applicable.

* Filed

herewith.

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

| (a)(1)* |

|

Repurchase Right Notice to Holders of 0.50% Convertible Senior Notes due 2027 issued by the Company, dated as of December 26, 2024. |

| (a)(5)(A)* |

|

Press Release issued by the Company, dated as of December 26, 2024. |

| (d) |

|

Indenture, dated as of January 15, 2021, between the Company and The Deutsche Bank Trust Company Americas, as trustee (incorporated by reference to Exhibit 4.41 to the Company’s annual report on Form 20-F (File No. 001-38638), filed with the Securities and Exchange Commission on April 6, 2021). |

| 107* |

|

Filing Fee Table |

* Filed

herewith.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

NIO Inc. |

| |

|

|

| |

By: |

/s/ Bin Li |

| |

|

Name: |

Bin Li |

| |

|

Title: |

Chairman of the Board of Directors and Chief Executive Officer |

Dated: December 26, 2024

Exhibit (a)(1)

NOTICE OF REPURCHASE OF NOTES

AT OPTION OF HOLDERS

TO HOLDERS OF

0.50% CONVERTIBLE SENIOR NOTES DUE 2027

ISSUED BY

NIO INC.

CUSIP NO. 62914VAF31

Reference is made to that certain Indenture, dated

as of January 15, 2021 (the “Indenture”), by and between NIO Inc. (the “Company”) and The Deutsche Bank

Trust Company Americas, as trustee and paying agent (the “Trustee” and the “Paying Agent”), for the Company’s

0.50% Convertible Senior Notes due 2027 (the “Notes”). Capitalized terms used but not defined herein shall have the meaning

ascribed to such terms in the Indenture.

Notice is hereby given pursuant to Section 15.01

of the Indenture that, at the option of each holder of the Notes (each, a “Holder” and collectively, the “Holders”),

the Company will repurchase such Holder’s Notes or any portion of the principal thereof that is equal to US$1,000 or an integral

multiple thereof at a purchase price (the “Repurchase Price”) equal to 100% of the principal amount of the Notes to be repurchased, plus any

accrued and unpaid interest, if any, to, but excluding, February 1, 2025, which is the date specified for repurchase in the Indenture

(the “Repurchase Date”), subject to the terms and conditions of the Indenture, the Notes, and this Repurchase Right Notice

and related notice materials, as amended and supplemented from time to time (the “Repurchase Right”). To exercise its Repurchase

Right, a Holder must deliver a Repurchase Notice (as further described in this Repurchase Right Notice) at any time between 9:00 a.m.,

New York City time, on Monday, December 30, 2024 and 5:00 p.m., New York City time, on Thursday, January 30, 2025 (the “Expiration

Date”).

To exercise your Repurchase Right and receive

the Repurchase Price, you must deliver the Notes through the transmittal procedures of the Depository Trust Company (“DTC”)

prior to 5:00 p.m., New York City time, on the Expiration Date. Notes delivered through the transmittal procedures of DTC for purchase

may be withdrawn at any time prior to 5:00 p.m., New York City time, on Thursday, January 30, 2025, by complying with the withdrawal

procedures of DTC. The surrender by a Holder of any Notes to DTC via the transmittal procedures of DTC’s Automated Tender Offer

Program will constitute delivery of a Repurchase Notice that satisfies such Holder’s notice requirements for its exercise of its

Repurchase Right.

The Trustee has informed the Company that,

as of the date of this Repurchase Right Notice, all custodians and beneficial holders of the Notes hold the Notes through DTC accounts

and that there are no certificated Notes in non-global form.

| 1 | This CUSIP number

has been included solely for the convenience of the holders of Notes. Neither the Company

nor the Trustee shall be responsible for the selection or use of the CUSIP number, nor is

any representation made as to its correctness with respect to the Notes or as indicated in

this Put Right Notice. |

The Paying Agent is

Deutsche Bank Trust Company Americas2

and for purposes of this Put Right Notice, the address is:

| By

Regular, Registered or Certified Mail or Overnight Courier: |

For

Information or Confirmation by Telephone: |

| |

|

| DB

Services Americas, Inc. |

+1

(800) 735-7777 |

| 5022

Gate Parkway Suite 200 |

|

| MS

JCK01-218 |

For

Information or Confirmation by Email: |

| Jacksonville,

FL 32256 |

|

| U.S.A. |

db.reorg@db.com |

Additional copies of this Repurchase Right Notice

may be obtained from the Paying Agent at its addresses set forth above.

| |

Very truly yours, |

| |

|

| |

NIO Inc. |

| |

|

| |

By: |

/s/

Bin Li |

| |

|

Name: Bin Li |

| |

|

Title: Chairman of the Board

of Directors and Chief Executive Officer |

Dated: December 26, 2024

| 2 | Deutsche Bank Trust

Company Americas is also the Conversion Agent with respect to the Notes. The address and

contact information of the Conversion Agent is the same as the Paying Agent. |

TABLE OF CONTENTS

| SUMMARY TERM

SHEET |

1 |

| IMPORTANT INFORMATION

CONCERNING THE REPURCHASE RIGHT |

7 |

| 1. |

Information Concerning the

Company |

7 |

| 2. |

Information Concerning the

Notes |

7 |

| |

2.1 Interest |

7 |

| |

2.2 The

Company’s Obligation to Purchase the Notes |

7 |

| |

2.3

Repurchase Price |

8 |

| |

2.4 Source

of Funds |

8 |

| |

2.5 Conversion

Rights of the Notes |

8 |

| |

2.6

Market for the Notes and the Company’s ADSs |

9 |

| |

2.7 Redemption |

9 |

| |

2.8 Ranking |

10 |

| 3. |

Procedures to Be Followed

by Holders Electing to Exercise the Repurchase Right |

10 |

| |

3.1 Method

of Delivery |

10 |

| |

3.2 Agreement

to Be Bound by the Terms of the Repurchase Right |

10 |

| |

3.3 Exercise

of Repurchase Right; Delivery of Notes. |

12 |

| 4. |

Right of Withdrawal |

13 |

| 5. |

Payment for Surrendered

Notes |

14 |

| 6. |

Notes Acquired |

14 |

| 7. |

Plans or Proposals of the

Company |

14 |

| 8. |

Interests of Directors,

Executive Officers and Affiliates of the Company in the Notes |

15 |

| 9. |

Agreements Involving the

Company’s Securities |

15 |

| 10. |

U.S. Federal Income Tax

Considerations. |

15 |

| 11. |

Additional Information |

17 |

| 12. |

No Solicitation |

18 |

| 13. |

Definitions |

18 |

| 14. |

Conflicts |

18 |

No person has been authorized to give any information or to make

any representation other than those contained in this Repurchase Right Notice and, if given or made, such information or representation

must not be relied upon as having been authorized. You should not assume that the information contained in this Repurchase Right Notice

is accurate as of any date other than the date on the front of this Repurchase Right Notice. This Repurchase Right Notice does not constitute

an offer to buy or the solicitation of an offer to sell securities in any circumstances or jurisdiction in which such offer or solicitation

is unlawful. The delivery of this Repurchase Right Notice shall not under any circumstances create any implication that the information

contained in this Repurchase Right Notice is current as of any time subsequent to the date of such information. None of the Company,

its board of directors, or its executive management is making any representation or recommendation to any Holder as to whether or not

to exercise the Repurchase Right. You should consult your own financial and tax advisors and must make your own decision as to whether

to exercise the Repurchase Right and, if so, the principal amount of Notes for which the Repurchase Right should be exercised.

SUMMARY TERM SHEET

The following are answers to some of the questions that you may have

about the Repurchase Right. To understand the Repurchase Right fully and for a more complete description of the terms of the Repurchase

Right, we urge you to carefully read the remainder of this Repurchase Right Notice because the information in this summary is not complete.

We have included page references to direct you to a more complete description of the topics in this summary.

Who is offering to purchase my Notes?

NIO Inc., a Cayman Islands company (the “Company”), is

obligated to purchase those 0.50% Convertible Senior Notes due 2027 with respect to which you validly exercise your Repurchase Right.

(Pages 7-8)

Why is the Company offering to purchase my Notes?

The right of each Holder of the Notes to sell and the obligation of

the Company to purchase such Holder’s Notes pursuant to the Repurchase Right at the time described in this Repurchase Right Notice

is a term of the Notes and has been a right of the Holders from the time the Notes were issued on January 15, 2021. We are required

to repurchase the Notes of any Holder that exercises its Repurchase Right pursuant to the terms of the Notes and the Indenture. (Pages 7-8)

Which of the Notes is the Company obligated to purchase?

We

are obligated to purchase all of the Notes surrendered (and not withdrawn) by any Holder through the facilities of, and in accordance

with the procedures of, the Depository Trust Company (“DTC”) prior to 5:00 p.m., New York City time, on Thursday, January 30,

2025. As of December 25, 2024 US$378,525,000.00 in aggregate principal amount of the Notes was outstanding. The Notes were

issued under the Indenture, dated as of January 15, 2021 (the “Indenture”), by and between the Company and The Deutsche

Bank Trust Company Americas, as trustee and paying agent (the “Trustee” and the “Paying Agent”). The surrender

by a Holder of any Notes to DTC via the transmittal procedures of DTC’s Automated Tender Offer Program will constitute delivery

of a Repurchase Notice that satisfies such Holder’s notice requirements for its exercise of its Repurchase Right. (Pages 7-8)

How much will the Company pay and what is the form of payment?

Pursuant

to the terms of the Indenture and the Notes, we will pay, in cash, a repurchase price equal to 100% of the principal amount of the Notes,

plus any accrued and unpaid interest, if any, to, but excluding, February 1, 2025 (the “Repurchase Price”), with

respect to any and all Notes validly surrendered for repurchase and not withdrawn; provided that such accrued and unpaid interest (if

any) will not be paid to the Holder submitting the Notes for repurchase on February 1, 2025 but will be paid to the Holder of record

as of 5:00 p.m., New York City time, on Wednesday, January 15, 2025. (Page 8)

How much accrued and unpaid interest will the Company pay as part

of the Repurchase Price?

None. Pursuant to the terms of the Indenture and the Notes, the next

interest payment date for the Notes is Saturday, February 1, 2025. As February 1, 2025 is a Saturday, pursuant to the terms

of the Indenture and the Notes, on Monday, February 3, 2025, the Company will pay accrued and unpaid interest, if any, on all of

the Notes through January 31, 2025 to all Holders who were Holders of record as of 5:00 p.m., New York City time, on Wednesday,

January 15, 2025, regardless of whether the Repurchase Right is exercised with respect to such Notes, with the same force and effect

as if paid on February 1, 2025 and no interest shall accrue in respect of the delay. As a result, on February 1, 2025, which

is the date specified in the Indenture for repurchase (the “Repurchase Date”), there will be no accrued and unpaid interest

on the Notes. (Page 8)

Can the Company redeem the Notes?

Subject to the provisions of the Indenture, the Company may, at its

option, (i) on not less than 30 Scheduled Trading Days’ nor more than 40 Scheduled Trading Days’ prior notice, redeem

all but not part of the Notes (except in respect of certain Holders that elect otherwise as described in the Indenture) in connection

with a change in tax law; and (ii) on or after February 6, 2025 and on or prior to the 20th Scheduled Trading Day

immediately prior to the Maturity Date, redeem for cash all or part of the Notes, at its option, if the Last Reported Sale Price of the

ADSs has been at least 130% of the Conversion Price then in effect on (A) each of at least 20 Trading Days ending on, and including,

the Trading Day immediately prior to the date the Company provides notice of redemption, and (B) the Trading Day immediately preceding

the date the Company sends such notice, each at a redemption price equal to 100% of the principal amount plus accrued and unpaid

interest, if any, to, but not including, the redemption date as described in the Indenture. Upon receiving such notice of redemption,

each Holder will have the right to elect to not have its Notes redeemed, subject to the provisions of the Indenture. (Pages 9-10)

What are my rights to convert my Notes?

Subject

to and upon compliance with the provisions of the Indenture, a Holder will have the right, at such Holder’s option, to convert

all or any portion (if the portion to be converted is US$1,000 principal amount or an integral multiple thereof) of such Note on

or after August 1, 2026 and prior to 5:00 p.m., New York City time, on Thursday, January 28, 2027 at an initial conversion

rate of 10.7458 ADSs (subject to certain adjustments, the “Conversion Rate”) per US$1,000 principal amount of Notes (the

“Conversion Obligation”). If a Holder has already delivered a Fundamental Change Repurchase Notice or a Repurchase Notice

with respect to a Note, such Holder may not surrender that Note for conversion until the Holder has withdrawn the applicable repurchase

notice in accordance with the Indenture. The conversion of your Notes is subject to the provisions regarding conversion contained in

the Indenture and the Notes.

Generally, if you exercise the conversion right and the price per

ADS is less than the Conversion Price during the relevant observation period, the value of the consideration that you receive in exchange

for your Notes will be less than the aggregate principal amount of the Notes. The Conversion Price at any given time is computed by dividing

US$1,000 by the applicable Conversion Rate at such time. (Pages 8-9)

How will the Company fund the purchase of the Notes?

The Company plans to use its cash balance as of the Repurchase Date

to fund the repurchase of the Notes. The Company does not currently have alternative financing plans or arrangements as it has sufficient

cash on hand to pay the total amount of consideration required to repurchase all of the Notes. (Page 8)

How can I determine the market value of the Notes?

There is no established reporting system or market for trading in

the Notes. To the extent that the Notes are traded, prices of the Notes may fluctuate widely depending on trading volume, the balance

between buy and sell orders, prevailing interest rates, the Company’s operating results, the market price and implied volatility

of the Company’s ADSs, and the market for similar securities. To the extent available, Holders are urged to obtain current market

quotations for the Notes prior to making any decision with respect to the Repurchase Right. The value of the Notes upon exercise of the

conversion right will be based on the applicable conversion rate for the Notes, as summarized above, under the caption “What are

my rights to convert my Notes?” (Page 9)

What does the board of directors of the Company think of the Repurchase

Right?

The board of directors of the Company has not made any recommendation

as to whether you should exercise the Repurchase Right. You must make your own decision whether to exercise the Repurchase Right and,

if so, the principal amount of Notes for which the Repurchase Right should be exercised. (Page 8)

When does the Repurchase Right expire?

Your right to exercise the Repurchase Right expires at 5:00 p.m.,

New York City time, on Thursday, January 30, 2025 (the “Expiration Date”). We may extend the period Holders have to

exercise the Put Right, but we do not currently expect to do so unless we are required to by law. If we extend the offer period, we will

publicly disclose the new expiration date by filing an amendment to the Schedule TO and/or by issuing a press release. (Pages 7-8)

What are the conditions to the purchase by the Company of the Notes?

Our purchase of Notes for which the Repurchase Right is validly exercised

is not subject to any condition other than such purchase being lawful, the relevant Notes being surrendered, and the procedural requirements

described in this Repurchase Right Notice being satisfied. (Pages 7-8)

How do I exercise the Repurchase Right?

The Trustee has informed the Company that, as of

the date of this Repurchase Right Notice, all custodians and beneficial holders of the Notes hold the Notes through DTC accounts and

that there are no certificated Notes in non-global form. Accordingly, you may exercise the Repurchase Right with respect to

your Notes held through DTC, prior to 5:00 p.m., New York City time, on the Expiration Date, in the following manner

| · | If

your Notes are held through a broker, dealer, commercial bank, trust company, or other nominee,

you must contact such nominee if you desire to exercise the Repurchase Right and instruct

such nominee to exercise the Repurchase Right by surrendering the Notes on your behalf through

the transmittal procedures of DTC’s Automated Tender Offer Program (“ATOP”)

before 5:00 p.m., New York City time, on the Expiration Date; or |

| · | If

you are a DTC participant and hold your Notes through DTC directly, you must surrender your

Notes electronically through ATOP before 5:00 p.m., New York City time, on the Expiration

Date, subject to the terms and procedures of ATOP, if you desire to exercise the Repurchase

Right. |

While we do not expect any Notes to be issued to a Holder other than

DTC or its nominee in physical certificates after the date hereof, in the event that physical certificates evidencing the Notes are issued

to such a Holder, any such Holder who desires to tender Notes pursuant to the Repurchase Right and holds physical certificates evidencing

such Notes must complete and sign a Repurchase Notice in the form attached hereto as Annex A (a “Repurchase Notice”)

in accordance with the instructions set forth therein, have the signature thereon guaranteed and timely deliver such manually signed

Repurchase Notice, together with the certificates evidencing the Notes being tendered and all necessary endorsements, to the Paying Agent.

By surrendering your Notes through the transmittal procedures of DTC

or to the Paying Agent, as applicable, you agree to be bound by the terms of the Repurchase Right set forth in this Repurchase Right

Notice. (Pages 10-13)

HOLDERS THAT HOLD NOTES THROUGH DTC ACCOUNTS MAY ONLY EXERCISE

THE REPURCHASE RIGHT BY COMPLYING WITH THE TRANSMITTAL PROCEDURES OF DTC AND SHOULD NOT SUBMIT A PHYSICAL REPURCHASE NOTICE.

If I exercise the Repurchase Right, when will I receive payment

for my Notes?

We will forward the appropriate amount of cash required to pay the

Repurchase Price for your Notes to the Paying Agent, prior to 10:00 a.m., New York City time, on Saturday, February 1, 2025, which

is the Repurchase Date, and the Paying Agent will promptly distribute the consideration to DTC, the sole Holder of record of the Notes.

DTC will thereafter distribute the cash to its participants in accordance with its procedures. To the extent that you are not a DTC participant,

your broker, dealer, commercial bank, trust company, or other nominee, as the case may be, will distribute the cash to you. (Page 14)

Until what time may I withdraw my previous exercise of the Repurchase

Right?

You may withdraw your exercise of the Repurchase Right with respect

to any Notes at any time until 5:00 p.m., New York City time, on Thursday, January 30, 2025. (Page 13)

How do I withdraw my previous exercise of the Repurchase Right?

To withdraw your previous exercise of the Repurchase Right with respect

to any Notes, you must comply with the withdrawal procedures of DTC prior to 5:00 p.m., New York City time, on Thursday, January 30,

2025. While the Trustee has informed us that there are currently no certificated Notes in non-global form, in the event that

after the date hereof physical certificates evidencing the Notes are issued to a Holder other than DTC or its nominee, any such Holder

who desires to withdraw any Notes evidenced by physical certificates with respect to which a Repurchase Notice was previously delivered

must, instead of complying with DTC withdrawal procedures, complete and sign a notice of withdrawal specifying (i) the principal

amount of the Notes with respect to which such notice of withdrawal is being submitted, which portion must be US$1,000 aggregate principal

amount or an integral multiple thereof, (ii) the certificate numbers of the Notes in respect of which such notice of withdrawal

is being submitted, and (iii) the principal amount, if any, of such Note which remains subject to the Repurchase Notice, which portion

must be US$1,000 aggregate principal amount or an integral multiple thereof, and deliver such manually signed notice of withdrawal to

the Paying Agent prior to 5:00 p.m., New York City time, on Thursday, January 30, 2025. (Page 13)

HOLDERS THAT HOLD NOTES THROUGH DTC ACCOUNTS MAY ONLY WITHDRAW

THEIR PREVIOUS EXERCISE OF THE REPURCHASE RIGHT WITH RESPECT TO SUCH NOTES BY COMPLYING WITH THE TRANSMITTAL PROCEDURES OF DTC AND SHOULD

NOT SUBMIT A PHYSICAL NOTICE OF WITHDRAWAL.

Do I need to do anything if I do not wish to exercise the Repurchase

Right?

No. If you do not exercise the Repurchase Right before the expiration

of the Repurchase Right, we will not purchase your Notes on the Repurchase Date and such Notes will remain outstanding subject to their

existing terms. (Page 10)

If I choose to exercise the Repurchase Right, do I have to exercise

the Repurchase Right with respect to all of my Notes?

No. You may exercise the Repurchase Right with respect to all

of your Notes or any portion of your Notes. If you wish to exercise the Repurchase Right with respect to a portion of your Notes, you

must exercise the Repurchase Right with respect to Notes for a principal amount of US$1,000 or an integral multiple thereof. (Page 8)

If I do not exercise the Repurchase Right, will I continue to be

able to exercise my conversion rights?

Yes. If you do not exercise the Repurchase Right, your conversion

rights will not be affected. You will continue to have the conversion rights subject to the terms, conditions and adjustments specified

in the Indenture and the Notes, as summarized above, under the caption “What are my rights to convert my Notes?” (Pages 8-9)

If I exercise the Repurchase Right, will my receipt of cash for

Notes with respect to which I exercised the Repurchase Right be a taxable transaction for U.S. federal income tax purposes?

Yes. The receipt of cash for Notes pursuant to an

exercise of the Repurchase Right will be a taxable transaction for U.S. federal income tax purposes. You should consult with your tax

advisor regarding the actual tax consequences to you. (Pages 15-17)

Who is the Paying Agent?

The Deutsche Bank Trust Company Americas, the Trustee under the Indenture,

is serving as Paying Agent in connection with the Repurchase Right. Its address and telephone number are set forth on the front cover

page of this Repurchase Right Notice.

Whom can I talk to if I have questions about the Repurchase Right?

Questions and requests for assistance in connection with the exercise

of the Repurchase Right may be directed to the Paying Agent at the address and telephone and facsimile numbers set forth on the cover

page of this Repurchase Right Notice.

IMPORTANT INFORMATION CONCERNING THE REPURCHASE

RIGHT

Information

Concerning the Company. NIO Inc. is a pioneer and a leading company in the global smart electric vehicle market. Founded in

November 2014, NIO aspires to shape a sustainable and brighter future with the mission of “Blue Sky Coming”. NIO envisions

itself as a user enterprise where innovative technology meets experience excellence. NIO designs, develops, manufactures and sells smart

electric vehicles, driving innovations in next-generation core technologies. NIO distinguishes itself through continuous technological

breakthroughs and innovations, exceptional products and services, and a community for shared growth. NIO provides premium smart electric

vehicles under the NIO brand, family-oriented smart electric vehicles through the ONVO brand, and small smart high-end electric cars

with the FIREFLY brand.

The

Company was incorporated in the Cayman Islands in November 2014 and its ADSs began trading on the New York Stock Exchange since

September 2018. The Company’s ADSs are currently traded under the ticker symbol “NIO.” The Company’s principal

executive offices are located at Building 19, No. 1355, Caobao Road, Minhang District, Shanghai, 201804, People’s Republic

of China, and its telephone number is +86 21-6908 2018. The Company’s registered office in the Cayman Islands is located at the

offices of Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

Information

Concerning the Notes. The Notes were issued under the Indenture. The Notes mature on February 1, 2027.

Interest. The

Notes bear interest at the rate of 0.50% per year from January 15, 2021, or from the most recent date to which interest has been

paid or duly provided. Interest is payable semi-annually in arrears on February 1 and August 1 of each year, commencing on

August 1, 2021, to Holders of record at the close of business on the preceding January 15 and July 15, respectively. The

amount of interest payable will be computed on the basis of a 360-day year consisting of twelve 30-day months. Unless the Company fails

to make the payment of the Repurchase Price for Notes for which a Repurchase Notice has been submitted and not properly withdrawn, such

Notes will no longer be outstanding and interest, if any, on the Notes will cease to accrue on and after the Repurchase Date.

The

Company’s Obligation to Purchase the Notes. Pursuant to the terms of the Indenture and the Notes, on February 1,

2025, which is the Repurchase Date, the Company is obligated to purchase all Notes for which the Repurchase Right has been timely exercised

and not withdrawn by the Holders. This Repurchase Right will expire at 5:00 p.m., New York City time, on Thursday, January 30, 2025,

the Expiration Date. The terms and conditions of the Indenture and Notes require Holders that choose to exercise the Repurchase Right

to do so by 5:00 p.m., New York City time, on the Expiration Date. We may extend the period Holders have to exercise the Put Right, but

we do not currently expect to do so unless required to by law. If we extend the offer period, we will publicly disclose the new expiration

date by filing an amendment to the Schedule TO and/or by issuing a press release. Regardless of whether we extend this period, the Indenture

does not provide us with the right to delay the Repurchase Date. The purchase by the Company of Notes for which the Repurchase Right

is validly exercised is not subject to any condition other than such purchase being lawful, the relevant Notes being surrendered, and

the procedural requirements described in this Repurchase Right Notice being satisfied. You may only exercise the Repurchase Right with

respect to Notes in principal amounts equal to US$1,000 or integral multiples thereof.

Repurchase

Price. The Repurchase Price to be paid by the Company with respect to any and all Notes validly surrendered for

repurchase and not withdrawn on the Repurchase Date is equal to 100% of the principal amount of the Notes, plus any

accrued and unpaid interest, if any, to, but excluding, February 1, 2025; provided that such accrued and unpaid

interest (if any) will not be paid to the Holder submitting the Notes for repurchase on February 1, 2025 but will be paid to the

Holder of record as of 5:00 p.m., New York City time, on Wednesday, January 15, 2025, whether or not such Holders exercise their

Repurchase Right. Pursuant to the terms of the Indenture and the Notes, the next interest payment date for the Notes is February 1,

2025. As February 1, 2025 is a Saturday, pursuant to the terms of the Indenture and the Notes, on Monday, February 3, 2025,

which is the next succeeding business day, the Company will pay accrued and unpaid interest on all of the Notes through January 31,

2025, to all Holders of record as of 5:00 p.m., New York City time, on Wednesday, January 15, 2025, regardless of whether the Repurchase

Right is exercised with respect to such Notes, with the same force and effect as if paid on February 1, 2025 and no interest shall

accrue in respect of the delay. As a result, on February 1, 2024, which is the date specified in the Indenture for repurchase, there

will be no accrued and unpaid interest on the Notes. The Repurchase Price will be paid in cash with respect to any and all Notes validly

surrendered for repurchase and not withdrawn prior to 5:00 p.m., New York City time, on the Expiration Date.

The

Repurchase Price, which will be paid in cash, is based solely on the requirements of the Indenture and the Notes and bears no

relationship to the market price of the Notes or the ADSs. Thus, the Repurchase Price may be significantly greater or less than the market

price of the Notes on the Repurchase Date. Holders are urged to obtain the best available information as to potential current market

prices of the Notes, to the extent available, and the ADSs before making a decision whether to exercise the Repurchase Right.

None

of the Company, its board of directors or its executive management is making any recommendation to Holders as to whether to exercise

the Repurchase Right or refrain from exercising the Repurchase Right. Each Holder must make such Holder’s own decision whether

to exercise the Repurchase Right with respect to such Holder’s Notes and, if so, the principal amount of Notes for which the Repurchase

Right should be exercised.

Source

of Funds. If the Repurchase Right is exercised for any Notes, the Company plans to use its cash balance as of

the Repurchase Date to pay the Repurchase Price for the Notes. The Company does not currently have alternative financing plans or arrangements

as it has sufficient cash on hand to pay the total amount of consideration required to repurchase all of the Notes.

Conversion

Rights of the Notes. Subject to and upon compliance with the provisions of the Indenture, a Holder will have the

right, at such Holder’s option, to convert all or any portion (if the portion to be converted is US$1,000 principal amount or an

integral multiple thereof) of such Note on or after August 1, 2026 and prior to 5:00 p.m., New York City time, on Thursday, January 28,

2027 at an initial conversion rate of 10.7458 ADSs (subject to certain adjustments) per US$1,000 principal amount of Notes. If a Holder

has already delivered a Fundamental Change Repurchase Notice or a Repurchase Notice with respect to a Note, such Holder may not surrender

that Note for conversion until the Holder has withdrawn the applicable repurchase notice in accordance with the Indenture. The conversion

of your Notes is subject to the provisions regarding conversion contained in the Indenture and the Notes.

Generally,

if you exercise the conversion right and the price per ADS is less than the Conversion Price during the relevant observation period,

the value of the consideration that you receive in exchange for your Notes will be less than the aggregate principal amount of

the Notes. The Conversion Price at any given time is computed by dividing US$1,000 by the applicable Conversion Rate at such time.

Market

for the Notes and the Company’s ADSs. There is no established reporting system or market for trading in

the Notes. To the extent that the Notes are traded, prices of the Notes may fluctuate widely depending on trading volume, the balance

between buy and sell orders, prevailing interest rates, the Company’s operating results, the market price and implied volatility

of the Company’s ADSs, and the market for similar securities. As of December 25, 2024, US$378,525,000.00 in aggregate principal

amount of the Notes was outstanding.

The

Company’s ADSs into which the Notes are convertible are listed on the New York Stock Exchange under the ticker symbol “NIO.”

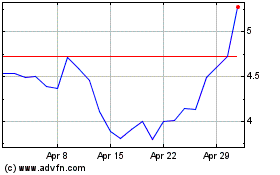

The following table sets forth, for the fiscal quarters indicated, the high and low sales prices of the ADSs as reported on the

New York Stock Exchange.

| Quarter Ended | |

High | | |

Low | |

| | |

| | |

| |

| | |

(US$) | |

| Fourth Quarter 2022 | |

| 16.73 | | |

| 9.25 | |

| First Quarter 2023 | |

| 12.71 | | |

| 8.25 | |

| Second Quarter 2023 | |

| 9.83 | | |

| 7.41 | |

| Third Quarter 2023 | |

| 15.46 | | |

| 8.35 | |

| Fourth Quarter 2023 | |

| 9.43 | | |

| 7.15 | |

| First Quarter 2024 | |

| 8.94 | | |

| 4.45 | |

| Second Quarter 2024 | |

| 6.05 | | |

| 3.61 | |

| Third Quarter 2024 | |

| 7.71 | | |

| 3.63 | |

| Fourth Quarter 2024 (through December 24, 2024) | |

| 7.38 | | |

| 4.28 | |

On

December 24, 2024, the closing price of the ADSs on the New York Stock Exchange was US$4.62 per ADS. As of December 24, 2024,

there were approximately 1,202,581,225 ADSs outstanding. We urge you to obtain current market information for the Notes, to the extent

available, and the ADSs before making any decision to exercise the Repurchase Right.

Redemption. Subject

to the provisions of the Indenture, the Company may, at its option, (i) on not less than 30 Scheduled Trading Days’ nor more

than 40 Scheduled Trading Days’ prior notice, redeem all but not part of the Notes (except in respect of certain Holders that elect

otherwise as described in the Indenture) in connection with a change in tax law; and (ii) on or after February 6, 2025 and

on or prior to the 20th Scheduled Trading Day immediately prior to the Maturity Date, redeem for cash all or part of the Notes,

at its option, if the Last Reported Sale Price of the ADSs has been at least 130% of the Conversion Price then in effect on (A) each

of at least 20 Trading Days ending on, and including, the Trading Day immediately prior to the date the Company provides notice of redemption,

and (B) the Trading Day immediately preceding the date the Company sends such notice, each at a redemption price equal to 100% of

the principal amount plus accrued and unpaid interest, if any, to, but not including, the redemption date as described in the

Indenture. Upon receiving such notice of redemption, each Holder will have the right to elect to not have its Notes redeemed, subject

to the provisions of the Indenture.

Ranking. The

Notes are senior unsecured obligations of the Company, ranking senior in right of payment to any of the Company’s indebtedness

that is expressly subordinated in right of payment to the notes, and equal in right of payment to any of the Company’s unsecured

indebtedness that is not so subordinated. The Notes are effectively junior in right of payment to any of the Company’s secured

indebtedness to the extent of the value of the assets securing such indebtedness, and effectively junior to all indebtedness and other

liabilities (including trade payables) of the Company’s subsidiaries and consolidated affiliated entities.

Procedures

to Be Followed by Holders Electing to Exercise the Repurchase Right. Holders will not be entitled to receive the

Repurchase Price for their Notes unless they elect to exercise the Repurchase Right by delivering their Repurchase Notice on or before

5:00 p.m., New York City time, on Thursday, January 30, 2025 and have not withdrawn the Repurchase Notice prior to 5:00 p.m., New

York City time, on Thursday, January 30, 2025. Holders may exercise the Repurchase Right with respect to some or all of their Notes.

Any Repurchase Notice must specify a principal amount of Notes to be purchased by the Company of US$1,000 or an integral multiple thereof.

If Holders do not elect to exercise the Repurchase Right, their Notes will remain outstanding subject to the existing terms of the Indenture

and the Notes.

Method

of Delivery. The Trustee has informed the Company that, as of the date of this Repurchase Right Notice, all custodians

and beneficial holders of the Notes hold the Notes through DTC accounts and that there are no certificated Notes in non-global form.

Accordingly, unless physical certificates are issued following the date hereof, all Notes surrendered for repurchase hereunder must be

delivered through DTC’s ATOP system. Valid delivery of Notes via ATOP will constitute delivery of a Repurchase Notice that satisfies

such Holder’s notice requirements for its exercise of its Repurchase Right. Delivery of Notes and all other required documents,

including delivery and acceptance through ATOP, is at the election and risk of the person surrendering such Notes.

HOLDERS THAT HOLD NOTES THROUGH DTC ACCOUNTS MAY ONLY EXERCISE

THE REPURCHASE RIGHT BY COMPLYING WITH THE TRANSMITTAL PROCEDURES OF DTC AND SHOULD NOT SUBMIT A PHYSICAL REPURCHASE NOTICE.

Agreement

to Be Bound by the Terms of the Repurchase Right. By exercising the Repurchase Right with respect to any portion

of your Notes, you acknowledge and agree as follows:

| · | such

Notes shall be purchased as of the Repurchase Date pursuant to the terms and conditions set

forth in this Repurchase Right Notice; |

| · | you

agree to all of the terms of this Repurchase Right Notice; |

| · | you

have received this Repurchase Right Notice and acknowledge that this Repurchase Right Notice

provides the notice required pursuant to the Indenture; |

| · | upon

the terms and subject to the conditions set forth in this Repurchase Right Notice, the Indenture,

and the Notes, and effective upon the acceptance for payment thereof, you (i) irrevocably

sell, assign, and transfer to the Company all right, title, and interest in and to all the

Notes surrendered, (ii) release and discharge the Company and its directors, officers,

employees, and affiliates from any and all claims you may now have, or may have in the future,

arising out of, or related to, the Notes, including, without limitation, any claims that

you are entitled to receive additional principal or interest payments with respect to the

Notes or to participate in any redemption or defeasance of the Notes, and (iii) irrevocably

constitute and appoint the Paying Agent as your true and lawful agent and attorney-in-fact

with respect to any such surrendered Notes, with full power of substitution and resubstitution

(such power of attorney being deemed to be an irrevocable power coupled with an interest)

to (a) deliver certificates representing such Notes, or transfer ownership of such Notes

on the account books maintained by DTC, together, in any such case, with all accompanying

evidences of transfer and authenticity, to the Company, (b) present such Notes for transfer

on the relevant security register, and (c) receive all benefits or otherwise exercise

all rights of beneficial ownership of such Notes (except that the Paying Agent will have

no rights to, or control over, funds from the Company, except as agent for the Company for

the Repurchase Price of any surrendered Notes that are purchased by the Company), all in

accordance with the terms set forth in this Repurchase Right Notice; |

| · | you

represent and warrant that you (i) own the Notes surrendered and are entitled to surrender

such Notes and (ii) have full power and authority to surrender, sell, assign, and transfer

the Notes surrendered hereby and that when such Notes are accepted for purchase and payment

by the Company, the Company will acquire good title thereto, free and clear of all liens,

restrictions, charges, and encumbrances and not subject to any adverse claim or right; |

| · | you

agree, upon request from the Company, to execute and deliver any additional transfer documents

deemed by the Paying Agent or the Company to be necessary or desirable to complete the sale,

assignment, and transfer of the Notes surrendered; |

| · | you

understand that all Notes properly surrendered for purchase prior to 5:00 p.m., New York

City time, on Thursday, January 30, 2025 for which a Repurchase Notice has been delivered

and not withdrawn prior to 5:00 p.m., New York City time, on Thursday, January 30, 2025,

will be purchased at the Repurchase Price, in cash, pursuant to the terms and conditions

of the Indenture, the Notes, this Repurchase Right Notice, and related notice materials,

as amended and supplemented from time to time; |

| · | surrendered

Notes may be withdrawn by complying with the withdrawal procedures of DTC at any time prior

to 5:00 p.m., New York City time, on Thursday, January 30, 2025; and |

| · | all

authority conferred or agreed to be conferred pursuant to your exercise of the Repurchase

Right hereby shall survive your death or incapacity and every obligation of yours shall be

binding upon your heirs, personal representatives, executors, administrators, successors,

assigns, trustees in bankruptcy, and other legal representatives. |

Exercise of Repurchase Right; Delivery of

Notes.

Notes

Held Through a Custodian. If you wish to exercise the Repurchase Right with respect to any of your Notes and your Notes

are held by a broker, dealer, commercial bank, trust company, or other nominee, you must contact such nominee and instruct such nominee

to surrender the Notes for purchase on your behalf through the transmittal procedures of DTC as set forth below in “Notes Held

by a DTC Participant” on or prior to the deadline set by such nominee to permit such nominee to surrender the Notes by 5:00 p.m.,

New York City time, on the Expiration Date.

Notes

Held by a DTC Participant. If you are a DTC participant who wishes to exercise the Repurchase Right with respect to any

of your Notes, you must electronically transmit your acceptance through DTC’s ATOP system, subject to the terms and procedures

of that system, on or prior to 5:00 p.m., New York City time, on the Expiration Date.

In exercising the Repurchase Right through ATOP, the electronic instructions

sent to DTC by you or by a broker, dealer, commercial bank, trust company, or other nominee on your behalf, and transmitted by DTC to

the Paying Agent, will acknowledge, on behalf of you and DTC, your receipt of and agreement to be bound by the terms of the Repurchase

Right, including those set forth above under 3.2 — “Agreement to Be Bound by the Terms of the Repurchase Right.”

Notes

Held in Certificated Non-Global Form. While we do not expect any Notes to be issued to a Holder other than

DTC or its nominee in physical certificates after the date hereof, in the event that physical certificates evidencing the Notes are issued

to such a Holder, then, in order to exercise the Repurchase Right with respect to such Notes, any such Holder of the Notes must complete

and sign a Repurchase Notice in the form attached hereto as Annex A in accordance with the instructions set forth therein,

have the signature thereon guaranteed and deliver such manually signed Repurchase Notice to the Paying Agent prior to 5:00 p.m., New

York City time, on the Expiration Date. For such a Holder to receive payment of the Repurchase Price for such Notes with respect to the

Repurchase Right was exercised, the Holder must deliver such Notes to the Paying Agent prior to, on or after the Repurchase Date together

with all necessary endorsements.

All signatures on a Repurchase Notice and endorsing the Notes must

be guaranteed by a recognized participant in the Securities Transfer Agents Medallion Program, the NYSE Medallion Signature Program,

or the Stock Exchange Medallion Program (each, an “Eligible Institution” ); provided, however, that

signatures need not be guaranteed if such Notes are tendered for the account of an Eligible Institution. If a Repurchase Notice or any

Note is signed by a trustee, executor, administrator, guardian, attorney-in-fact, agent, officer of a corporation, or other

person acting in a fiduciary or representative capacity, such person must so indicate when signing, and proper evidence satisfactory

to the Company of the authority of such person so to act must be submitted.

You bear the risk of untimely surrender of your Notes. You must allow

sufficient time for completion of the necessary DTC or Paying Agent procedures, as applicable, before 5:00 p.m., New York City time,

on the Expiration Date.

Right

of Withdrawal. You may withdraw your previous exercise of the Repurchase Right with respect to any Notes at any time

prior to 5:00 p.m., New York City time, on Thursday, January 30, 2025.

Except

as described below with respect to Notes, if any, for which physical certificates are issued to a Holder other than DTC or its nominee,

in order to withdraw your previous exercise of the Repurchase Right, you must comply with the withdrawal procedures of DTC prior to 5:00

p.m., New York City time, on Thursday, January 30, 2025. This means you must deliver, or cause to be delivered, a valid withdrawal

request through the ATOP system before 5:00 p.m., New York City time, on Thursday, January 30, 2025.

If

after the date hereof physical certificates evidencing the Notes are issued to a Holder other than DTC or its nominee, any such Holder

who desires to withdraw any previously surrendered Notes evidenced by physical certificates must, instead of complying with the DTC withdrawal

procedures, complete and sign a notice of withdrawal specifying (i) the principal amount of the Notes with respect to which such

notice of withdrawal is being submitted, which portion must be US$1,000 aggregate principal amount or an integral multiple thereof, (ii) the

certificate numbers of the Notes in respect of which such notice of withdrawal is being submitted, and (iii) the principal amount,

if any, of such Note which remains subject to the Repurchase Notice, which portion must be US$1,000 aggregate principal amount or an

integral multiple thereof, and deliver such manually signed notice of withdrawal to the Paying Agent prior to 5:00 p.m., New York City

time, on Thursday, January 30, 2025.

In

addition, pursuant to Rule 13e-4(f)(2)(ii) promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”

), Holders are advised that if they timely surrender Notes for purchase under the Repurchase Right, they are also permitted to withdraw

such Notes on Thursday, January 30, 2025 (New York City time) in the event that we have not yet accepted the Notes for payment

as of that time. Pursuant to the Indenture, we are required to forward the appropriate amount of cash required to pay the Repurchase

Price for your Notes to the Paying Agent, prior to 10:00 a.m., New York City time, on Saturday, February 1, 2025, which is the Repurchase

Date.

You may exercise the Repurchase Right with respect to Notes for which

your election to exercise your Repurchase Right had been previously withdrawn, by following the procedures described in Section 3 above.

We will determine all questions as to the validity, form and eligibility, including time of receipt, of notices of withdrawal.

You

bear the risk of untimely withdrawal of your Notes. You must allow sufficient time for completion of the necessary DTC or Paying Agent

procedures by withdrawing before 5:00 p.m., New York City time, on Thursday, January 30, 2025.

Payment

for Surrendered Notes. We will forward to the Paying Agent, prior to 10:00 a.m., New York City time, on the Repurchase

Date, the appropriate amount of cash required to pay the Repurchase Price for your Notes, and the Paying Agent will promptly distribute

the consideration to DTC, the sole Holder of record of the Notes. DTC will thereafter distribute the cash to its participants in accordance

with its procedures. To the extent that you are not a DTC participant, your broker, dealer, commercial bank, trust company, or other

nominee, as the case may be, will distribute the cash to you.

The total amount of consideration required by us to repurchase all

of the Notes is US$378,525,000.00 (assuming all of the Notes are validly surrendered for repurchase and accepted for payment).

Notes

Acquired. Any Notes repurchased by us pursuant to the Repurchase Right will be cancelled by the Trustee, pursuant to

the terms of the Indenture.

Plans

or Proposals of the Company. Except as publicly disclosed on or prior to the date of this Repurchase Right Notice, neither

the Company nor its directors and executive officers currently has any plans, proposals, or negotiations that would be material to a

Holder’s decision to exercise the Repurchase Right, which relate to or which would result in:

| · | any

extraordinary transaction, such as a merger, reorganization, or liquidation, involving the

Company or any of its subsidiaries; |

| · | any

purchase, sale, or transfer of a material amount of assets of the Company or any of its subsidiaries; |

| · | any

material change in the present dividend rate or policy, or in the indebtedness or capitalization

of the Company or any of its subsidiaries; |

| · | any

change in the present board of directors or management of the Company or any of its subsidiaries,

including, but not limited to, any plans or proposals to change the number or the term of

directors or to fill any existing vacancies on the board or to change any material term of

the employment contract of any executive officer; |

| · | any

other material change in the corporate structure or business of the Company or any of its

subsidiaries; |

| · | any

class of equity securities of the Company or any of its subsidiaries being delisted from

a national securities exchange or ceasing to be authorized to be quoted in an automated quotation

system operated by a national securities association; |

| · | any

class of equity securities of the Company or any of its subsidiaries becoming eligible for

termination of registration under Section 12(g)(4) of the Exchange Act; |

| · | the

suspension of the Company’s obligation to file reports under Section 15(d) of

the Exchange Act; |

| · | the

acquisition by any person of additional securities of the Company, or the disposition of

securities of the Company; or |

| · | any

changes in the Company’s charter, bylaws, or other governing instruments or other actions

that could impede the acquisition of control of the Company. |

Interests

of Directors, Executive Officers and Affiliates of the Company in the Notes. Based on a reasonable inquiry by the Company:

| · | none

of the executive officers or directors of the Company or any associate of such executive

officers or directors owns any Notes; and |

| · | during

the 60 days preceding the date of this Repurchase Right Notice, none of the executive officers

or directors of the Company has engaged in any transactions in the Notes. |

The Company will not purchase any Notes from its affiliates or the

executive officers or directors of the Company. Neither the Company nor any of its associates or majority-owned subsidiaries owns any

Notes. During the 60 days preceding the date of this Repurchase Right Notice, neither the Company nor any of its subsidiaries has engaged

in any transactions in the Notes.

Agreements

Involving the Company’s Securities. The Company has entered into the following agreement relating to the

Notes:

There are no agreements between the Company and any other person with

respect to any other securities issued by the Company that are material to the Repurchase Right or the Notes. The Company is not aware

of any agreements between any directors or executive officers of the Company and any other person with respect to any other securities

issued by the Company that are material to the Repurchase Right or the Notes.

U.S. Federal Income Tax Considerations.

The following discussion is a summary of U.S. federal income tax considerations

generally applicable to the exercise of the Repurchase Right by U.S. Holders (defined below) of our Notes. This summary is based upon

the Internal Revenue Code of 1986, as amended (the “Code”), the regulations promulgated by the U.S. Treasury Department,

current administrative interpretations and practices of the Internal Revenue Service (the “IRS”) and judicial decisions,

all as currently in effect and all of which are subject to differing interpretations or to change, possibly with retroactive effect.

No assurance can be given that the IRS would not assert, or that a court would not sustain a position contrary to any of the tax considerations

described below. This summary is for general information only and does not discuss all aspects of U.S. federal income taxation that may

be relevant to particular holders in light of their individual circumstances, including holders subject to special tax rules (for

example, banks and other financial institutions, insurance companies, broker-dealers in securities or currencies, traders in securities

that elect mark-to-market treatment, partnerships and other pass-through entities and holders of interests therein, pension plans, regulated

investment companies, real estate investment trusts, cooperatives, foreign entities treated as domestic corporations for U.S. federal

income tax purposes, and tax-exempt organizations (including private foundations)), holders that hold their Notes as part of a straddle,

hedge, conversion, constructive sale, or other integrated transaction for U.S. federal income tax purposes, holders who acquire their

Notes as compensation, U.S. expatriates and certain former citizens or long-term residents of the United States, U.S. Holders whose “functional

currency” is not the U.S. dollar, persons liable for any minimum tax, and persons that actually or constructively own 10% or more

of our equity (by vote or value), all of whom may be subject to tax rules that differ significantly from those summarized below.

This summary is limited to U.S. Holders who hold the Notes as “capital assets” within the meaning of Section 1221 of

the Code (generally, property held for investment). In addition, this summary of U.S. federal income tax considerations does not discuss

any state, local, or non-U.S. tax considerations, any non-income tax (such as gift or estate tax) considerations, any minimum tax or

the Medicare net investment income tax. Each U.S. Holder is urged to consult its tax advisor regarding the U.S. federal, state, local,

and non-U.S. income and other tax considerations relating to the exercise of the Repurchase Right of our Notes.

For purposes of this discussion, a “U.S. Holder” is a

beneficial owner of our Notes that is, for U.S. federal income tax purposes:

| · | an

individual who is a citizen or resident of the United States; |

| · | a

corporation (including an entity treated as a corporation for U.S. federal income tax purposes)

created or organized in or under the laws of the United States, any state thereof or the

District of Columbia; |

| · | an

estate the income of which is includible in gross income for U.S. federal income tax purposes

regardless of its source; or |

| · | a

trust (i) the administration of which is subject to the primary supervision of a U.S.

court and which has one or more U.S. persons who have the authority to control all substantial

decisions of the trust or (ii) that has in effect a valid election under applicable

Treasury regulations to be treated as a U.S. person. |

If a partnership (including an entity or arrangement treated as a

partnership for U.S. federal income tax purposes) holds our Notes, the U.S. federal income tax treatment of a partner in such partnership

will generally depend upon the status of the partner and the activities of the partnership. If you are a partner of a partnership holding

our Notes, you are urged to consult your tax advisor regarding the tax consequences of the exercise of the Repurchase Right.

Sale of Notes Pursuant to the Repurchase Right

Upon exercise of the Repurchase Right, subject to the discussion of

market discount below, a U.S. Holder generally will recognize gain or loss equal to the difference between (i) the amount of cash

proceeds received on the exercise (other than any amount attributable to accrued but unpaid interest, which will be taxable as ordinary

interest income, to the extent not previously included in income), and (ii) such U.S. Holder’s adjusted tax basis in the Note.

A U.S. Holder’s adjusted tax basis in a Note generally will equal its cost, increased by any accrued market discount if the U.S.

Holder has elected to include such market discount as it accrued (as described below), and reduced (but not to below zero) by amortizable

bond premium (generally, the excess, if any, of the tax basis of the Note to a U.S. Holder immediately after its acquisition over the

principal amount of the Note payable at maturity) allowed as an offset against interest income with respect to the Note. Except to the

extent it is subject to the market discount rules discussed below, any gain or loss recognized will be capital gain or loss and

will be long-term capital gain or loss if, on the date of the sale, the Note has been held for more than one year. Non-corporate U.S.

Holders will generally be eligible for beneficial rates on long-term capital gains. The deductibility of capital losses is subject to

limitations. The gain or loss will generally be treated as U.S. source gain or loss.

Market Discount

An exception to the capital gain treatment described above may apply

to a U.S. Holder that purchased the Notes at a “market discount.” In general, the Notes have “market discount”

if their stated redemption price at maturity (as defined for purposes of the market discount rules) exceeds their tax basis in the hands

of a U.S. Holder immediately after their acquisition, unless a statutorily defined de minimis exception applies. Gain recognized by a

U.S. Holder with respect to the Notes acquired with market discount generally will be subject to tax as ordinary income to the extent

of the market discount accrued during the period the Notes were held by such U.S. Holder, unless the U.S. Holder previously elected to

include market discount in income as it accrued for U.S. federal income tax purposes. Market discount is accrued on a ratable basis,

unless the U.S. Holder elected to accrue market discount using a constant-yield method. Gain in excess of accrued market discount will

be subject to the capital gains rules described above. Each U.S. Holder should consult its tax advisor regarding the portion of

any gain, if any, that could be taxable as ordinary income under the market discount rules.

Additional

Information. The Company is subject to the reporting and other informational requirements of the Exchange Act

and, in accordance therewith, files reports and other information with the SEC. Such reports and other information can be inspected and

copied at the Public Reference Section of the SEC located at Station Place, 100 F Street, N.E., Washington, DC 20549. Copies of

such material can be obtained from the Public Reference Section of the SEC at prescribed rates. Such material may also be accessed

electronically by means of the SEC’s home page on the Internet at http://www.sec.gov.

The Company has filed with the SEC a Tender Offer Statement on Schedule

TO, pursuant to Section 13(e) of the Exchange Act and Rule 13e-4 promulgated thereunder, furnishing certain information

with respect to the Repurchase Right. The Tender Offer Statement on Schedule TO, together with any exhibits and any amendments thereto,

may be examined and copies may be obtained at the same places and in the same manner as set forth above.

The documents listed below (as such documents may be amended from

time to time) contain important information about the Company and its financial condition, and we incorporate by reference such documents

herein:

| · | The

annual report on Form 20-F of the Company for the year ended December 31, 2023,

as filed on April 9, 2024; |

| · | All

other reports filed pursuant to Sections 13, 14 or 15(d) of the Exchange Act and Rule 13a-16

or 15d-16 under the Exchange Act since the end of the fiscal year covered by the Form 20-F

mentioned above; and |

| · | All

documents filed with the SEC by the Company pursuant to Sections 13, 14 and 15(d) of

the Exchange Act and Rule 13a-16 or 15d-16 under the Exchange Act subsequent to the

date of this Repurchase Right Notice and prior to 5:00 p.m., New York City time, on the Expiration

Date. |

All documents we file with the SEC shall be deemed to be incorporated

by reference in this Repurchase Right Notice and to be a part hereof from the date of the filing or furnishing of such documents. Any

statement contained in a document incorporated, or deemed to be incorporated, by reference herein or contained in this Repurchase Right

Notice shall be deemed to be modified or superseded for purposes of this Repurchase Right Notice to the extent any statement contained

herein or in any subsequently filed or furnished document which also is, or is deemed to be, incorporated by reference herein modifies

or supersedes such statement. Any such statement so modified or superseded shall not be deemed to constitute a part hereof except as

so modified or superseded.

Notwithstanding the foregoing, the Schedule TO to which this Repurchase

Right Notice relates does not permit forward “incorporation by reference.” Accordingly, if a material change occurs in the

information set forth in this Repurchase Right Notice, we will amend the Schedule TO accordingly.

No

Solicitation. The Company has not employed any person to make solicitations or recommendations in connection with

the Repurchase Right.

Definitions. All

capitalized terms used but not specifically defined in this Repurchase Right Notice shall have the meanings given to such terms in the

Indenture and the Notes.

Conflicts. In

the event of any conflict between this Repurchase Right Notice on the one hand and the terms of the Indenture or the Notes or any applicable

laws on the other hand, the terms of the Indenture or the Notes or applicable laws, as the case may be, will control..

None of the Company, its board of directors, or its executive management

is making any recommendation to any Holder as to whether to exercise the Repurchase Right or refrain from exercising the Repurchase Right

pursuant to this Repurchase Right Notice. Each Holder must make such Holder’s own decision whether to exercise the Repurchase Right

and, if so, the principal amount of Notes for which the Repurchase Right should be exercised.

NIO INC.

Annex A

FORM OF REPURCHASE NOTICE

To: NIO

INC.

THE DEUTSCHE BANK TRUST COMPANY AMERICAS, as Trustee

The undersigned registered owner of this Note

hereby acknowledges receipt of a notice from NIO Inc. (the “Company”) regarding the right of Holders to elect to require

the Company to repurchase the entire principal amount of this Note, or the portion thereof (that is US$1,000 principal amount or an integral

multiple thereof) below designated, in accordance with the applicable provisions of the Indenture referred to in this Note, at the Repurchase

Price to the registered Holder hereof.

In the case of certificated Notes, the certificate

numbers of the Notes to be purchased are as set forth below:

Certificate Number(s):

Dated:

| |

Signature(s) |

| |

|

| |

|

| |

Social Security or Other Taxpayer

Identification Number |

| |

|

| |

Principal amount to be repaid (if less than all):

US$ ,000 |

| |

|

| |

NOTICE: The

above signature(s) of the Holder(s) hereof must correspond with the name as written upon the face of the Note in every

particular without alteration or enlargement or any change whatever. |

Exhibit (a)(5)(A)

NIO Inc. Announces Repurchase Right Notification

for

0.50% Convertible Senior Notes due 2027

SHANGHAI,

China, December 26, 2024 (GLOBE NEWSWIRE) — NIO Inc. (NYSE: NIO; HKEX: 9866; SGX: NIO) (“NIO” or the

“Company”), a pioneer and a leading company in the global smart electric vehicle market, today announced that it is notifying

holders of its 0.50% Convertible Senior Notes due 2027 (CUSIP No. 62914VAF3) (the “Notes”) that pursuant to the Indenture

dated as of January 15, 2021 (the “Indenture”) relating to the Notes by and between the Company and The Deutsche Bank

Trust Company Americas, as trustee, each holder has the right, at the option of such holder, to require the Company to repurchase all

of such holder’s Notes or any portion thereof that is an integral multiple of US$1,000 principal amount for cash on February 1,

2025 (the “Repurchase Right”). The Repurchase Right expires at 5:00 p.m., New York City time, on Thursday, January 30,

2025.

As required by rules of the United States Securities and Exchange

Commission (the “SEC”), the Company will file a Tender Offer Statement on Schedule TO. In addition, documents specifying the

terms, conditions and procedures for exercising the Repurchase Right will be available through the Depository Trust Company and the paying

agent, which is The Deutsche Bank Trust Company Americas. None of the Company, its board of directors or its employees has made or is

making any representation or recommendation to any holder as to whether to exercise or refrain from exercising the Repurchase Right.

The Repurchase Right entitles each holder of the Notes to require the

Company to repurchase all of such holder's Notes or any portion thereof that is an integral multiple of US$1,000 principal amount. The

repurchase price for such Notes will be equal to 100% of the principal amount of the Notes to be repurchased, plus any

accrued and unpaid additional interest, if any, to, but excluding, February 1, 2025, which is the date specified for repurchase in

the Indenture (the “Repurchase Date”), subject to the terms and conditions of the Indenture and the Notes. The Repurchase

Date is an interest payment date under the terms of the Indenture and the Notes. As February 1, 2025 is a Saturday, pursuant to the

Indenture and the Notes, on Monday, February 3, 2025, which is the next succeeding business day, the Company will pay accrued and

unpaid interest on all of the Notes through January 31, 2025 to all holders who were holders of record as of close of business on

Wednesday, January 15, 2025. As of December 25, 2024, there was US$378,525,000.00 in aggregate principal

amount of the Notes outstanding. If all outstanding Notes are surrendered for repurchase through exercise of the Repurchase Right, the

aggregate cash purchase price will be US$378,525,000.00.

The opportunity for holders of the Notes to exercise the Repurchase

Right commences at 9:00 a.m., New York City time on Monday, December 30, 2024, and will terminate at 5:00 p.m., New York City time, on

Thursday, January 30, 2025. In order to exercise the Repurchase Right, a holder must follow the transmittal procedures set forth

in the Company’s Repurchase Right Notice to holders (the “Repurchase Right Notice”), which is available through the

Depository Trust Company and The Deutsche Bank Trust Company Americas. Holders may withdraw any previously tendered Notes pursuant to

the terms of the Repurchase Right at any time prior to 5:00 p.m., New York City time, on Thursday, January 30, 2025, or as otherwise

provided by applicable law.

This press release is for information only and is not an offer to purchase,

a solicitation of an offer to purchase, or a solicitation of an offer to sell the Notes or any other securities of the Company. The offer

to purchase the Notes will be only pursuant to, and the Notes may be tendered only in accordance with, the Company’s Repurchase

Right Notice dated December 26, 2024 and related documents.

Holders of the Notes should refer to the Indenture for a complete description

of repurchase procedures and direct any questions concerning the mechanics of repurchase to the Trustee by contacting The Deutsche Bank

Trust Company Americas. Holders of Notes may request the Company’s Repurchase Right Notice from the paying agent, The Deutsche Bank

Trust Company Americas, c/o DB Services Americas Inc., at 5022 Gate Parkway Suite 200, MS JCK01-218, Jacksonville, FL 32256 (email: