Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 01 2024 - 4:10PM

Edgar (US Regulatory)

U.S. SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

For the Month

of August, 2024

Nexa Resources S.A.

(Exact Name as

Specified in its Charter)

N/A

(Translation

of Registrant’s Name)

37A, Avenue

J.F. Kennedy

L-1855, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: August

1, 2024

| Nexa

Resources S.A. |

| By:/s/

José Carlos del Valle |

| Name: José Carlos del Valle |

Title: Senior Vice President of Finance and Group Chief Financial Officer

|

EXHIBIT

INDEX

Cover

note to CEO and CFO Certifications Nexa Resources S.A. (“NEXA”) relies on an exemption under Part 4 of National Instrument

71-102 Continuous Disclosure and Other Exemptions Relating to Foreign Issuers, from securities legislation requirements relating to preparation,

approval, filing and delivery of interim MD&A. As a result, reference in the attached certifications to “interim MD&A”

in paragraph 1 and paragraph 6 thereof is to the Earnings Release of NEXA August 1, 2024. FORM 52-109F2 CERTIFICATION OF INTERIM FILINGS

FULL CERTIFICATE I, Ignacio Rosado, President and Chief Executive Officer of Nexa Resources S.A., certify the following: 1. Review: I

have reviewed the interim financial report and interim MD&A (together, the “interim filings”) of Nexa Resources S.A.

(the “issuer”) for the interim period ended June 30, 2024. 2. No misrepresentations: Based on my knowledge, having exercised

reasonable diligence, the interim filings do not contain any untrue statement of a material fact or omit to state a material fact required

to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect

to the period covered by the interim filings. 3. Fair presentation: Based on my knowledge, having exercised reasonable diligence, the

interim financial report together with the other financial information included in the interim filings fairly present in all material

respects the financial condition, financial performance and cash flows of the issuer, as of the date of and for the periods presented

in the interim filings. 4. Responsibility: The issuer’s other certifying officer(s) and I are responsible for establishing and

maintaining disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as those terms are defined

in National Instrument 52-109 Certification of Disclosure in Issuers’ Annual and Interim Filings, for the issuer. 5. Design: Subject

to the limitations, if any, described in paragraphs 5.2 and 5.3, the issuer’s other certifying officer(s) and I have, as at the

end of the period covered by the interim filings (a) designed DC&P, or caused it to be designed under our supervision, to provide

reasonable assurance that (i) material information relating to the issuer is made known to us by others, particularly during the period

in which the interim filings are being prepared; and (ii) information required to be disclosed by the issuer in its annual filings, interim

filings or other reports filed or submitted by it under securities legislation is recorded, processed, summarized and reported within

the time periods specified in securities legislation; and (b) designed ICFR, or caused it to be designed under our supervision, to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes

in accordance with the issuer’s GAAP. 5.1 Control framework: The control framework the issuer’s other certifying officer(s)

and I used to design the issuer’s ICFR is the Committee of Sponsoring Organization of the Tradeway Commission (COSO 2013). 5.2

ICFR: N/A 5.3 Limitation on scope of design: N/A 6. Reporting changes in ICFR: The issuer has disclosed in its interim MD&A any change

in the issuer’s ICFR that occurred during the period beginning on April 1, 2024 and ended on June 30, 2024 that has materially

affected, or is reasonably likely to materially affect, the issuer’s ICFR. Date: August 1, 2024 _______________________ Ignacio

Rosado President and Chief Executive Officer

Cover

note to CEO and CFO Certifications Nexa Resources S.A. (“NEXA”) relies on an exemption under Part 4 of National Instrument

71-102 Continuous Disclosure and Other Exemptions Relating to Foreign Issuers, from securities legislation requirements relating to preparation,

approval, filing and delivery of interim MD&A. As a result, reference in the attached certifications to “interim MD&A”

in paragraph 1 and paragraph 6 thereof is to the Earnings Release of NEXA dated August 1, 2024. FORM 52-109F2 CERTIFICATION OF INTERIM

FILINGS FULL CERTIFICATE I, José Carlos del Valle, Senior Vice President of Finance and Group Chief Financial Officer of Nexa

Resources S.A. certify the following: 1. Review: I have reviewed the interim financial report and interim MD&A (together, the “interim

filings”) of Nexa Resources S.A. (the “issuer”) for the interim period ended June 30, 2024. 2. No misrepresentations:

Based on my knowledge, having exercised reasonable diligence, the interim filings do not contain any untrue statement of a material fact

or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances

under which it was made, with respect to the period covered by the interim filings. 3. Fair presentation: Based on my knowledge, having

exercised reasonable diligence, the interim financial report together with the other financial information included in the interim filings

fairly present in all material respects the financial condition, financial performance and cash flows of the issuer, as of the date of

and for the periods presented in the interim filings. 4. Responsibility: The issuer’s other certifying officer(s) and I are responsible

for establishing and maintaining disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR),

as those terms are defined in National Instrument 52-109 Certification of Disclosure in Issuers’ Annual and Interim Filings, for

the issuer. 5. Design: Subject to the limitations, if any, described in paragraphs 5.2 and 5.3, the issuer’s other certifying officer(s)

and I have, as at the end of the period covered by the interim filings (a) designed DC&P, or caused it to be designed under our supervision,

to provide reasonable assurance that (i) material information relating to the issuer is made known to us by others, particularly during

the period in which the interim filings are being prepared; and (ii) information required to be disclosed by the issuer in its annual

filings, interim filings or other reports filed or submitted by it under securities legislation is recorded, processed, summarized and

reported within the time periods specified in securities legislation; and (b) designed ICFR, or caused it to be designed under our supervision,

to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external

purposes in accordance with the issuer’s GAAP. 5.1 Control framework: The control framework the issuer’s other certifying

officer(s) and I used to design the issuer’s ICFR is the Committee of Sponsoring Organization of the Tradeway Commission (COSO

2013). 5.2 ICFR: N/A 5.3 Limitation on scope of design: N/A 6. Reporting changes in ICFR: The issuer has disclosed in its interim MD&A

any change in the issuer’s ICFR that occurred during the period beginning on April 1, 2024 and ended on June 30, 2024 that has

materially affected, or is reasonably likely to materially affect, the issuer’s ICFR. Date: August 1, 2024 _______________________

José Carlos del Valle Senior Vice President of Finance and Group Chief Financial Officer

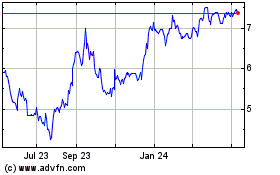

Nexa Resources (NYSE:NEXA)

Historical Stock Chart

From Nov 2024 to Dec 2024

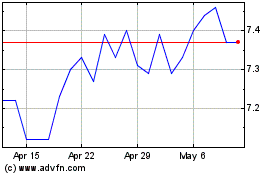

Nexa Resources (NYSE:NEXA)

Historical Stock Chart

From Dec 2023 to Dec 2024