Improved gross margins and adjusted EBITDA

driven by strong performance of Signature Systems

Ongoing demand headwinds within certain end

markets expected for the remainder of 2024

Continued focus on cost reduction; additional

$15 million of annualized run rate cost savings targeted by

2025

Full-year guidance revised to $0.92 - $1.02 for

adjusted earnings per share

Myers Industries Inc. (NYSE: MYE), a leading manufacturer of a

wide range of polymer and metal products and distributor for tire,

wheel, and under vehicle service industry, today announced results

for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial

Highlights

- Net sales of $205.1 million compared with $197.8 million in the

prior-year period

- Net Income (loss) of $(10.9) million, compared to $12.7 million

in the prior-year period inclusive of a non-cash goodwill

impairment charge of $22.0 million

- Adjusted EBITDA of $30.7 million, compared to $25.6 million in

the prior-year period

- GAAP gross margin of 31.8%, up 30 basis points versus the

prior-year period

- Adjusted gross margin of 32.4%, up 70 basis points versus the

prior-year period

- GAAP net income (loss) per diluted share of $(0.29) compared

with $0.34 in the prior-year period

- Adjusted earnings per diluted share of $0.25 compared with

$0.38 in the prior-year period

- Cash flow provided by operations of $17.3 million and free cash

flow of $10.1 million

- Additional debt paydown of $13 million

Dave Basque, Myers Industries Interim President and CEO,

commented “This quarter’s results were driven by continued strong

performance from our Signature Systems acquisition, growth in our

military end market, the initial benefits of our cost cutting

initiatives and reduced variable compensation. These benefits

mitigated some broader macro-economic challenges in the RV and

Marine and new headwinds in the Food and Beverage end markets.

“During the quarter, we diligently focused on our cost

containment actions which we now estimate will lead to an

additional $15 million in annualized cost savings. These cost

savings are incremental to our original target of $7 million to $9

million and are expected to be driven by labor savings,

manufacturing efficiencies, continued footprint optimization and

other savings initiatives. We will continue to implement cost

actions to help mitigate the impact of revenue headwinds in key end

markets.

“We have taken additional action to address the underperformance

of our Distribution business, starting with naming Jeff Baker as

President, Distribution. Since assuming this role on September 30,

Jeff and his team have systematically identified plans to close

sales coverage gaps and win back customers, add digital sales

channels, improve the customer experience and implement further

efficiency improvements.

“We are updating our outlook and expect full year adjusted

earnings per share to be in the range of $0.92 to $1.02. We

continue to have confidence in the growth and earnings potential of

our four power brands as demand recovers in affected end markets,

and we remain focused on improving operations in the near-term to

navigate choppy macro-economic conditions.”

Third Quarter 2024 Financial

Summary

Quarter Ended September

30,

(Dollars in thousands, except per share

data)

2024

2023

% Inc (Dec)

Net sales

$

205,067

$

197,798

3.7

%

Gross profit

$

65,130

$

62,379

4.4

%

Gross margin

31.8

%

31.5

%

Operating income (loss)

$

(4,764

)

$

18,703

(125.5

)%

Net income (loss)

$

(10,878

)

$

12,747

(185.3

)%

Net income (loss) per diluted share

$

(0.29

)

$

0.34

(185.3

)%

Adjusted operating income

$

20,539

$

20,039

2.5

%

Adjusted net income

$

9,212

$

13,875

(33.6

)%

Adjusted earnings per diluted share

$

0.25

$

0.38

(34.2

)%

Adjusted EBITDA

$

30,735

$

25,648

19.8

%

Net sales were $205.1 million, an increase of $7.3 million, or

3.7%, compared with $197.8 million for the third quarter of 2023.

The increase in net sales was driven by contributions from the

recent acquisition of Signature Systems, partially offset by lower

volumes and pricing in both the Material Handling and Distribution

segments.

Gross profit increased $2.8 million, or 4.4%, to $65.1 million,

driven by performance at Signature Systems and favorable product

mix, partially offset by lower pricing and volume, as well as

higher material and other cost inflation. Gross margin improved 30

basis points to 31.8% compared with 31.5% for the third quarter of

2023. On an adjusted basis, gross margin increased 70 basis points

to 32.4% from 31.7%. Selling, general and administrative expenses

were $47.7 million, an increase of $4.0 million, primarily due to

the addition of Signature and partially offset by lower incentive

compensation expense. SG&A as a percent of sales was 23.3% vs

22.1% in the prior year in part due to the executive severance

recorded in the quarter. The company also recorded a $22.0 million

non-cash goodwill impairment charge related to goodwill from prior

rotational molding acquisitions. Net income per diluted share was

($0.29), compared with $0.34 for the third quarter of 2023.

Adjusted earnings per diluted share were $0.25, compared with $0.38

for the third quarter of 2023.

Third Quarter 2024 Segment

Results

(Dollar amounts in the segment tables below are reported in

millions)

Material Handling

Net Sales

Op Income

Op Income

Margin

Adj EBITDA

Adj

EBITDA

Margin

Q3 2024 Results

$150.7

$0.9

0.6%

$33.5

22.2%

Q3 2023 Results

$132.5

$20.0

15.1%

$25.1

19.0%

$ Increase (decrease) vs prior year

$18.2

($19.1)

$8.3

% Increase (decrease) vs prior year

13.8%

(95.6)%

-1,450bps

33.0%

+320bps

Items in this table may not recalculate

due to rounding

Net sales for the Material Handling segment were $150.7 million,

an increase of $18.2 million, or 13.8%, compared with $132.5

million for the third quarter of 2023. Sales from the addition of

Signature Systems were partly offset by sales declines, primarily

in Seed boxes and within Food and Beverage end markets.

Operating income was $0.9 million compared with $20.0 million in

the third quarter of 2023 primarily due to the non-cash goodwill

impairment and the lower sales volume and pricing in the legacy

business, partially offset by the Signature acquisition. Material

Handling’s operating income margin of 0.6%, or 15.2% excluding the

non-cash goodwill impairment, compared to 15.1% in the third

quarter of 2023. Adjusted EBITDA increased 33.0% to $33.5 million,

compared with $25.1 million in the third quarter of 2023. SG&A

expenses increased year-over-year, primarily due to incremental

SG&A from Signature, partly offset by lower incentive

compensation. Adjusted EBITDA margin improved by 320 basis points,

primarily attributed to the Signature acquisition, partially offset

by higher material costs and lower sales volume and pricing in the

legacy business. A $22.0 million non-cash goodwill impairment

charge is included in the third quarter 2024 GAAP results of the

Material Handling segment.

Distribution

Net Sales

Op Income

Op Income

Margin

Adj EBITDA

Adj

EBITDA

Margin

Q3 2024 Results

$54.4

$2.1

3.9%

$3.2

5.8%

Q3 2023 Results

$65.3

$5.0

7.6%

$6.6

10.1%

$ Increase (decrease) vs prior year

($11.0)

($2.9)

($3.4)

% Increase (decrease) vs prior year

(16.8)%

(57.3)%

-370bps

(51.8)%

-430bps

Items in this table may not recalculate

due to rounding

Net sales for the Distribution segment were $54.4 million, a

decrease of $11.0 million, or 16.8%, compared with $65.3 million

for the third quarter of 2023. The decrease was primarily driven by

lower volume and pricing, partially offset by improved SG&A

costs.

Operating income decreased $2.9 million to $2.1 million,

compared with $5.0 million for the third quarter of 2023. Adjusted

EBITDA decreased to $3.2 million, compared with $6.6 million in the

third quarter of 2023. The decrease in operating income and

adjusted EBITDA was primarily due to lower volume and pricing, as

well as higher material costs. SG&A expenses decreased

year-over-year, primarily due to lower payroll costs. The

Distribution segment's operating income margin was 3.9% compared

with 7.6% for the third quarter of 2023. The Distribution segment’s

adjusted EBITDA margin was 5.8%, compared with 10.1% for the third

quarter of 2023.

Balance Sheet & Cash

Flow

As of September 30, 2024, the Company’s cash on hand totaled

$29.7 million. Total debt as of September 30, 2024, was $396.2

million. Under the terms of the Company’s loan agreement, its net

leverage ratio was 2.7x and it had $239.4 million of availability

under its revolving credit facility as of September 30, 2024. For

the third quarter of 2024, cash flow provided by operations was

$17.3 million and free cash flow was $10.1 million, compared with

cash flow provided by operations of $22.1 million and free cash

flow of $18.1 million for the third quarter of 2023. The decrease

in free cash flow was driven primarily by the timing of

disbursements. Capital expenditures for the third quarter of 2024

were $7.2 million compared with $4.1 million for the third quarter

of 2023.

2024 Outlook

Based on current exchange rates, market outlook and business

forecast, the Company is providing the following outlook for fiscal

2024:

- Net sales growth of 0% to 5% compared to prior guidance of 5%

to 10%

- Net income per diluted share in the range of $0.11 to $0.21

compared to prior guidance of $0.76 to $0.91

- Adjusted earnings per diluted share in the range of $0.92 to

$1.02 compared to prior guidance of $1.05 to $1.20

- Capital expenditures in the range of $28 million to $32 million

compared to prior guidance of $30 million to $35 million

- Effective tax rate to approximate 26%

Myers will continue to monitor market conditions and provide

updates throughout the year.

Conference Call Details

The Company will host an earnings conference call and webcast

for investors and analysts on Monday, November 4, 2024, at 4:30

p.m. ET. The call is anticipated to last less than one hour and may

be accessed using the following online participation registration

link:

https://www.netroadshow.com/events/login?show=2acccce1&confId=72128.

Upon registering, each participant will be provided with call

details and a registrant ID. Reminders will also be sent to

registered participants via email. Alternatively, the conference

call will be available via a live webcast. To access the live

webcast or a replay, visit the Company's website

www.myersindustries.com and click on the Investor Relations tab. An

archived replay of the call will also be available on the site

shortly after the event. To listen to the telephone replay, callers

should dial: (U.S. Local) 1-929-458-6194 or (U.S. Toll-Free)

1-866-813-9403 and use access code 818386.

Use of Non-GAAP Financial

Measures

The Company uses certain non-GAAP measures in this release.

Adjusted gross profit, adjusted gross margin, adjusted operating

income (loss), adjusted operating income margin, adjusted earnings

before interest, taxes, depreciation and amortization (EBITDA),

adjusted EBITDA margin, adjusted net income, adjusted earnings per

diluted share (adjusted EPS), and free cash flow are non-GAAP

financial measures and are intended to serve as a supplement to

results provided in accordance with accounting principles generally

accepted in the United States. Myers Industries believes that such

information provides an additional measurement and consistent

historical comparison of the Company’s performance. A

reconciliation of the non-GAAP financial measures to the most

directly comparable GAAP measures is available in this news

release.

About Myers Industries

Myers Industries Inc., based in Akron, Ohio, is a manufacturer

of sustainable plastic and metal products for industrial,

agricultural, automotive, commercial, and consumer markets. The

Company is also the largest distributor of tools, equipment and

supplies for the tire, wheel, and under-vehicle service industry in

the United States. Visit www.myersindustries.com to learn more.

Caution on Forward-Looking

Statements

Statements in this release include “forward-looking statements”

within the meaning of the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995, including

information regarding the Company’s financial outlook, future

plans, objectives, business prospects and anticipated financial

performance. Forward-looking statements can be identified by words

such as “will,” “believe,” “anticipate,” “expect,” “estimate,”

“intend,” “plan,” or variations of these words, or similar

expressions. These forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based only on the Company’s current beliefs, expectations

and assumptions regarding the future of our business, future plans

and strategies, projections, anticipated events and trends, the

economy and other future conditions. Because forward-looking

statements relate to the future, these statements inherently

involve a wide range of inherent uncertainties, risks and changes

in circumstances that are difficult to predict and many of which

are outside of our control. The Company’s actual actions, results,

and financial condition may differ materially from what is

expressed or implied by the forward-looking statements.

Specific factors that could cause such a difference on our

business, financial position, results of operations and/or

liquidity include, without limitation, raw material availability,

increases in raw material costs, or other production costs; risks

associated with our strategic growth initiatives or the failure to

achieve the anticipated benefits of such initiatives; unanticipated

downturn in business relationships with customers or their

purchases; competitive pressures on sales and pricing; changes in

the markets for the Company’s business segments; changes in trends

and demands in the markets in which the Company competes;

operational problems at our manufacturing facilities or unexpected

failures at those facilities; future economic and financial

conditions in the United States and around the world; inability of

the Company to meet future capital requirements; claims, litigation

and regulatory actions against the Company; changes in laws and

regulations affecting the Company; unforeseen events, including

natural disasters, unusual or severe weather events and patterns,

public health crises, geopolitical crises, and other catastrophic

events; and other risks and uncertainties detailed from time to

time in the Company’s filings with the SEC, including without

limitation, the risk factors disclosed in Item 1A, “Risk Factors,”

in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023. Given these factors, as well as other variables

that may affect our operating results, readers should not rely on

forward-looking statements, assume that past financial performance

will be a reliable indicator of future performance, nor use

historical trends to anticipate results or trends in future

periods. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date

thereof. The Company expressly disclaims any obligation or

intention to provide updates to the forward-looking statements and

the estimates and assumptions associated with them.

M-INV

MYERS INDUSTRIES, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

(Dollars in thousands, except

share and per share data)

Quarter Ended

Nine Months Ended

September 30,

2024

September 30,

2023

September 30,

2024

September 30,

2023

Net sales

$

205,067

$

197,798

$

632,405

$

621,990

Cost of sales

139,937

135,419

427,489

420,136

Gross profit

65,130

62,379

204,916

201,854

Selling, general and administrative

expenses

47,686

43,698

152,804

148,130

(Gain) loss on disposal of fixed

assets

192

(22

)

253

(78

)

Impairment charges

22,016

—

22,016

—

Operating income (loss)

(4,764

)

18,703

29,843

53,802

Interest expense, net

8,091

1,539

23,176

4,975

Income (loss) before income

taxes

(12,855

)

17,164

6,667

48,827

Income tax expense (benefit)

(1,977

)

4,417

3,763

12,499

Net income (loss)

$

(10,878

)

$

12,747

$

2,904

$

36,328

Net income (loss) per common

share:

Basic

$

(0.29

)

$

0.35

$

0.08

$

0.99

Diluted

$

(0.29

)

$

0.34

$

0.08

$

0.98

Weighted average common shares

outstanding:

Basic

37,220,456

36,811,296

37,102,761

36,712,662

Diluted

37,220,456

36,979,880

37,250,512

36,972,384

MYERS INDUSTRIES, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION (UNAUDITED)

(Dollars in thousands)

September 30, 2024

December 31, 2023

Assets

Current Assets

Cash

$

29,710

$

30,290

Trade accounts receivable, net

122,723

113,907

Other accounts receivable, net

8,495

14,726

Inventories, net

105,103

90,844

Other current assets

9,215

6,854

Total Current Assets

275,246

256,621

Property, plant, & equipment, net

134,641

107,933

Right of use asset - operating leases

30,550

27,989

Goodwill and intangible assets, net

450,967

140,521

Deferred income taxes

210

209

Other assets

13,385

8,358

Total Assets

$

904,999

$

541,631

Liabilities & Shareholders'

Equity

Current Liabilities

Accounts payable

$

79,279

$

79,050

Accrued expenses

47,392

53,523

Operating lease liability - short-term

6,422

5,943

Finance lease liability - short-term

615

593

Long-term debt - current portion

19,624

25,998

Total Current Liabilities

153,332

165,107

Long-term debt

367,854

31,989

Operating lease liability - long-term

23,738

22,352

Finance lease liability - long-term

8,151

8,615

Other liabilities

19,079

12,108

Deferred income taxes

57,206

8,660

Total Shareholders' Equity

275,639

292,800

Total Liabilities & Shareholders'

Equity

$

904,999

$

541,631

MYERS INDUSTRIES, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED)

(Dollars in thousands)

Quarter Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Cash Flows From Operating

Activities

Net income (loss)

$

(10,878

)

$

12,747

$

2,904

$

36,328

Adjustments to reconcile net income (loss)

to net cash provided by (used for) operating activities

Depreciation and amortization

10,196

5,609

28,760

16,904

Amortization of deferred financing

costs

543

78

1,318

234

Amortization of acquisition-related

inventory step-up

—

—

4,457

—

Non-cash stock-based compensation

expense

190

686

737

5,078

(Gain) loss on disposal of fixed

assets

192

(22

)

253

(78

)

Impairment charges

22,016

—

22,016

—

Other

386

(19

)

550

2,473

Cash flows provided by (used for) working

capital

Accounts receivable - trade and other,

net

7,434

(1,332

)

15,646

13,764

Inventories

574

1,825

(1,385

)

(2,905

)

Prepaid expenses and other current

assets

2,975

1,775

(1,668

)

(2,053

)

Accounts payable and accrued expenses

(16,301

)

787

(21,644

)

1,027

Net cash provided by (used for) operating

activities

17,327

22,134

51,944

70,772

Cash Flows From Investing

Activities

Capital expenditures

(7,178

)

(4,076

)

(17,302

)

(19,292

)

Acquisition of business, net of cash

acquired

—

—

(348,312

)

(160

)

Proceeds from sale of property, plant, and

equipment

28

—

112

142

Net cash provided by (used for) investing

activities

(7,150

)

(4,076

)

(365,502

)

(19,310

)

Cash Flows From Financing

Activities

Net borrowings (repayments) from revolving

credit facility

(8,000

)

(19,000

)

(15,000

)

(34,000

)

Proceeds from Term Loan A

—

—

400,000

—

Repayments of Term Loan A

(5,000

)

—

(10,000

)

—

Repayments of senior unsecured notes

—

—

(38,000

)

—

Payments on finance lease

(150

)

(145

)

(442

)

(403

)

Cash dividends paid

(5,025

)

(4,970

)

(15,392

)

(15,266

)

Proceeds from issuance of common stock

295

379

3,053

1,948

Shares withheld for employee taxes on

equity awards

(53

)

(22

)

(2,027

)

(2,055

)

Deferred financing fees

—

—

(9,172

)

—

Net cash provided by (used for) financing

activities

(17,933

)

(23,758

)

313,020

(49,776

)

Foreign exchange rate effect on cash

121

(224

)

(42

)

(57

)

Net increase (decrease) in cash

(7,635

)

(5,924

)

(580

)

1,629

Beginning Cash

37,345

30,692

30,290

23,139

Ending Cash

$

29,710

$

24,768

$

29,710

$

24,768

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

GROSS PROFIT, OPERATING INCOME

AND EBITDA (UNAUDITED)

(Dollars in thousands)

Quarter Ended September 30,

2024

Material

Handling

Distribution

Segment

Total

Corporate &

Other

Total

Net sales

$

150,718

$

54,384

$

205,102

$

(35

)

$

205,067

Net income (loss)

(10,878

)

Net income margin

-5.3

%

Gross profit

65,130

Add: Restructuring expenses and other

adjustments

1,211

Adjusted gross profit

66,341

Gross margin as adjusted

32.4

%

Operating income (loss)

886

2,131

3,017

(7,781

)

(4,764

)

Operating income margin

0.6

%

3.9

%

1.5

%

n/a

-2.3

%

Add: Executive severance costs

—

—

—

1,405

1,405

Add: Restructuring expenses and other

adjustments

1,396

220

1,616

417

2,033

Add: Acquisition and integration costs

—

—

—

349

349

Add: Impairment charges

22,016

—

22,016

—

22,016

Less: Environmental reserves, net(2)

—

—

—

(500

)

(500

)

Adjusted operating income (loss)(1)

24,298

2,351

26,649

(6,110

)

20,539

Adjusted operating income margin

16.1

%

4.3

%

13.0

%

n/a

10.0

%

Add: Depreciation and amortization

9,158

823

9,981

215

10,196

Adjusted EBITDA

$

33,456

$

3,174

$

36,630

$

(5,895

)

$

30,735

Adjusted EBITDA margin

22.2

%

5.8

%

17.9

%

n/a

15.0

%

(1) Includes gross profit adjustments of

$1,211, impairment charges of $22,016 and SG&A adjustments of

$2,076

(2) Includes environmental charges of $200

net of probable insurance recoveries of $700

Quarter Ended September 30,

2023

Material

Handling

Distribution

Segment

Total

Corporate &

Other

Total

Net sales

$

132,484

$

65,335

$

197,819

$

(21

)

$

197,798

Net income (loss)

12,747

Net income margin

6.4

%

Gross profit

62,379

Add: Restructuring expenses and other

adjustments

307

Adjusted gross profit

62,686

Gross margin as adjusted

31.7

%

Operating income (loss)

19,978

4,993

24,971

(6,268

)

18,703

Operating income margin

15.1

%

7.6

%

12.6

%

n/a

9.5

%

Add: Restructuring expenses and other

adjustments

529

674

1,203

156

1,359

Add: Acquisition and integration costs

—

77

77

—

77

Less: Environmental reserves, net(2)

—

—

—

(100

)

(100

)

Adjusted operating income (loss)(1)

20,507

5,744

26,251

(6,212

)

20,039

Adjusted operating income margin

15.5

%

8.8

%

13.3

%

n/a

10.1

%

Add: Depreciation and amortization

4,641

842

5,483

126

5,609

Adjusted EBITDA

$

25,148

$

6,586

$

31,734

$

(6,086

)

$

25,648

Adjusted EBITDA margin

19.0

%

10.1

%

16.0

%

n/a

13.0

%

(1) Includes gross profit adjustments of

$307 and SG&A adjustments of $1,029

(2) Includes environmental charges of $300

net of probable insurance recoveries of $400

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

GROSS PROFIT, OPERATING INCOME

AND EBITDA (UNAUDITED)

(Dollars in thousands)

Nine Months Ended September

30, 2024

Material

Handling

Distribution

Segment

Total

Corporate &

Other

Total

Net sales

$

468,951

$

163,543

$

632,494

$

(89

)

$

632,405

Net income (loss)

2,904

Net income margin

0.5

%

Gross profit

204,916

Add: Restructuring expenses and other

adjustments

4,163

Add: Acquisition-related inventory

step-up

4,457

Adjusted gross profit

213,536

Gross margin as adjusted

33.8

%

Operating income (loss)

51,843

4,915

56,758

(26,915

)

29,843

Operating income margin

11.1

%

3.0

%

9.0

%

n/a

4.7

%

Add: Executive severance costs

—

—

—

1,405

1,405

Add: Restructuring expenses and other

adjustments

3,860

975

4,835

417

5,252

Add: Acquisition and integration costs

305

—

305

4,132

4,437

Add: Acquisition-related inventory

step-up

4,457

—

4,457

—

4,457

Add: Impairment charges

22,016

—

22,016

—

22,016

Less: Insurance recovery of legal fees

(702

)

—

(702

)

—

(702

)

Less: Environmental reserves, net(2)

—

—

—

(700

)

(700

)

Adjusted operating income (loss)(1)

81,779

5,890

87,669

(21,661

)

66,008

Adjusted operating income margin

17.4

%

3.6

%

13.9

%

n/a

10.4

%

Add: Depreciation and amortization

25,706

2,426

28,132

628

28,760

Adjusted EBITDA

$

107,485

$

8,316

$

115,801

$

(21,033

)

$

94,768

Adjusted EBITDA margin

22.9

%

5.1

%

18.3

%

n/a

15.0

%

(1) Includes gross profit adjustments of

$8,620, impairment charges of $22,016 and SG&A adjustments of

$5,529

(2) Includes environmental charges of

$1,000 net of probable insurance recoveries of $1,700

Nine Months Ended September

30, 2023

Material

Handling

Distribution

Segment

Total

Corporate &

Other

Total

Net sales

$

428,341

$

193,693

$

622,034

$

(44

)

$

621,990

Net income (loss)

36,328

Net income margin

5.8

%

Gross profit

201,854

Add: Restructuring expenses and other

adjustments

589

Adjusted gross profit

202,443

Gross margin as adjusted

32.5

%

Operating income (loss)

70,157

10,628

80,785

(26,983

)

53,802

Operating income margin

16.4

%

5.5

%

13.0

%

n/a

8.6

%

Add: Restructuring expenses and other

adjustments

1,225

853

2,078

166

2,244

Add: Acquisition and integration costs

—

297

297

126

423

Add: Executive severance costs

—

410

410

289

699

Add: Environmental reserves, net(2)

—

—

—

2,200

2,200

Adjusted operating income (loss)(1)

71,382

12,188

83,570

(24,202

)

59,368

Adjusted operating income margin

16.7

%

6.3

%

13.4

%

n/a

9.5

%

Add: Depreciation and amortization

13,995

2,505

16,500

404

16,904

Adjusted EBITDA

$

85,377

$

14,693

$

100,070

$

(23,798

)

$

76,272

Adjusted EBITDA margin

19.9

%

7.6

%

16.1

%

n/a

12.3

%

(1) Includes gross profit adjustments of

$589 and SG&A adjustments of $4,977

(2) Includes environmental charges of

$3,800 net of probable insurance recoveries of $1,600

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

ADJUSTED OPERATING INCOME,

ADJUSTED EBITDA AND FREE CASH FLOW (UNAUDITED)

(Dollars in thousands)

Quarter Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Adjusted operating income (loss)

reconciliation:

Operating income (loss)

$

(4,764

)

$

18,703

$

29,843

$

53,802

Restructuring expenses and other

adjustments

2,033

1,359

5,252

2,244

Acquisition and integration costs

349

77

4,437

423

Acquisition-related inventory step-up

—

—

4,457

—

Impairment charges

22,016

—

22,016

—

Insurance recovery of legal fees

—

—

(702

)

—

Executive severance costs

1,405

—

1,405

699

Environmental reserves, net

(500

)

(100

)

(700

)

2,200

Adjusted operating income (loss)

$

20,539

$

20,039

$

66,008

$

59,368

Adjusted EBITDA reconciliation:

Net income (loss)

$

(10,878

)

$

12,747

$

2,904

$

36,328

Income tax expense (benefit)

(1,977

)

4,417

3,763

12,499

Interest expense, net

8,091

1,539

23,176

4,975

Operating income (loss)

(4,764

)

18,703

29,843

53,802

Depreciation and amortization

10,196

5,609

28,760

16,904

Restructuring expenses and other

adjustments

2,033

1,359

5,252

2,244

Acquisition and integration costs

349

77

4,437

423

Acquisition-related inventory step-up

—

—

4,457

—

Impairment charges

22,016

—

22,016

—

Insurance recovery of legal fees

—

—

(702

)

—

Executive severance costs

1,405

—

1,405

699

Environmental reserves, net

(500

)

(100

)

(700

)

2,200

Adjusted EBITDA

$

30,735

$

25,648

$

94,768

$

76,272

Free cash flow reconciliation:

Net cash provided by (used for) operating

activities

$

17,327

$

22,134

$

51,944

$

70,772

Capital expenditures

(7,178

)

(4,076

)

(17,302

)

(19,292

)

Free cash flow

$

10,149

$

18,058

$

34,642

$

51,480

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

ADJUSTED NET INCOME AND

ADJUSTED EARNINGS PER DILUTED SHARE (UNAUDITED)

(Dollars in thousands, except

per share data)

Quarter Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Adjusted net income (loss)

reconciliation:

Net income (loss)

$

(10,878

)

$

12,747

$

2,904

$

36,328

Income tax expense (benefit)

(1,977

)

4,417

3,763

12,499

Income (loss) before income taxes

(12,855

)

17,164

6,667

48,827

Restructuring expenses and other

adjustments

2,033

1,359

5,252

2,244

Acquisition and integration costs

349

77

4,437

423

Acquisition-related inventory step-up

—

—

4,457

—

Impairment charges

22,016

—

22,016

—

Insurance recovery of legal fees

—

—

(702

)

—

Executive severance costs

1,405

—

1,405

699

Environmental reserves, net

(500

)

(100

)

(700

)

2,200

Adjusted income (loss) before income

taxes

12,448

18,500

42,832

54,393

Income tax expense, as adjusted (1)

(3,236

)

(4,625

)

(11,136

)

(13,598

)

Adjusted net income (loss)

$

9,212

$

13,875

$

31,696

$

40,795

Adjusted earnings per diluted share

reconciliation:

Net income (loss) per common diluted

share

$

(0.29

)

$

0.34

$

0.08

$

0.98

Restructuring expenses and other

adjustments

0.05

0.04

0.14

0.06

Acquisition and integration costs

0.01

0.00

0.12

0.01

Acquisition-related inventory step-up

—

—

0.12

—

Impairment charges

0.59

—

0.59

—

Insurance recovery of legal fees

—

—

(0.02

)

—

Executive severance costs

0.04

—

0.04

0.02

Environmental reserves, net

(0.01

)

(0.00

)

(0.02

)

0.06

Adjusted effective income tax rate

impact

(0.14

)

(0.01

)

(0.20

)

(0.03

)

Adjusted earnings per diluted share(2)

$

0.25

$

0.38

$

0.85

$

1.10

Items in this table may not recalculate

due to rounding

(1) Income taxes are calculated using the

normalized effective tax rate for each year. The rate used in 2024

is 26% and in 2023 is 25%.

(2) Adjusted earnings per diluted share is

calculated using the weighted average common shares outstanding for

the respective period.

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

GUIDANCE FOR FULL YEAR

ADJUSTED EARNINGS PER DILUTED SHARE

(UNAUDITED)

Full Year 2024

Guidance

Low

High

GAAP diluted net income per common

share

$

0.11

$

0.21

Add: Net restructuring expenses and other

adjustments

0.21

0.21

Add: Acquisition and integration costs

(3)

0.25

0.25

Add: Impairment charges

0.59

0.59

Add: Executive severance

0.04

0.04

Less: Insurance recovery of legal fees

(0.02

)

(0.02

)

Less: Environmental reserves, net

(0.02

)

(0.02

)

Less: Adjusted effective income tax rate

impact (1)

(0.24

)

(0.24

)

Adjusted earnings per diluted share

(2)

$

0.92

$

1.02

(1) Income taxes are calculated using the

normalized effective tax rate for each year. The rate used in 2024

is 26%.

(2) Adjusted earnings per diluted share is

calculated using the weighted average common shares

outstanding.

(3) Includes acquisition-related inventory

step-up costs

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104971000/en/

Meghan Beringer, Senior Director Investor Relations,

252-536-5651

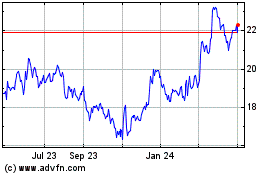

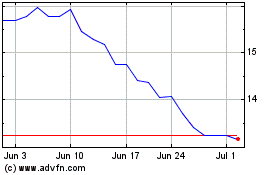

Myers Industries (NYSE:MYE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Myers Industries (NYSE:MYE)

Historical Stock Chart

From Dec 2023 to Dec 2024