MSCI Inc. (NYSE: MSCI), a leading provider of critical decision

support tools and services for the global investment community,

announced today the results of the MSCI 2024 Global Market

Accessibility Review. The detailed report, covering market

accessibility assessments for 85 markets now including Niger, has

been made available on www.msci.com/market-classification.

Key takeaways:

- There were more improvements than deteriorations in market

accessibility ratings. A significant portion of those improvements

is attributed to developments in Market Infrastructure,

particularly in Frontier Markets.

- MSCI continues to monitor the evolution of shorter settlement

processes across global equity markets.

The MSCI Global Market Accessibility Review aims to assess and

track the evolution of accessibility in individual markets, and to

inform market authorities about areas that global institutional

investors perceive as not meeting international standards and would

welcome improvements.

Consistent with prior years, the MSCI 2024 Global Market

Accessibility Review provides a detailed assessment of market

accessibility for each equity market included in the MSCI Indexes

and evaluates the following five market accessibility criteria:

- Openness to foreign ownership

- Ease of capital inflows / outflows

- Efficiency of the operational framework

- Availability of investment instruments

- Stability of the institutional framework

These five criteria are reflective of the areas international

institutional investors generally place strong emphasis on when

evaluating investment accessibility of a market, including equal

treatment of investors, free flow of capital, cost of investment,

unrestrictive use of stock market data, and market specific risk.

MSCI uses 18 distinct accessibility measures to assess these five

criteria, described in detail in the MSCI 2024 Global Market

Accessibility Review report.

Market accessibility, along with economic development and size

and liquidity, determine classification of markets into Developed,

Emerging, Frontier and Standalone Markets. The classification of

markets is a key input in the process of index construction as it

determines the composition of the investment opportunity sets to be

represented. The results of the MSCI 2024 Annual Market

Classification Review will be announced on June 20, 2024. More

information on the MSCI Market Classification Framework is

available at www.msci.com/market-classification.

-Ends-

About MSCI

MSCI is a leading provider of critical decision support tools

and services for the global investment community. With over 50

years of expertise in research, data and technology, we power

better investment decisions by enabling clients to understand and

analyze key drivers of risk and return and confidently build more

effective portfolios. We create industry-leading research-enhanced

solutions that clients use to gain insight into and improve

transparency across the investment process. To learn more, please

visit www.msci.com.

This document and all of the information contained in it,

including without limitation all text, data, graphs, charts

(collectively, the “Information”) is the property of MSCI Inc. or

its subsidiaries (collectively, “MSCI”), or MSCI’s licensors,

direct or indirect suppliers or any third party involved in making

or compiling any Information (collectively, with MSCI, the

“Information Providers”) and is provided for informational purposes

only. The Information may not be modified, reverse-engineered,

reproduced or redisseminated in whole or in part without prior

written permission from MSCI. All rights in the Information are

reserved by MSCI and/or its Information Providers.

The Information may not be used to create derivative works or to

verify or correct other data or information. For example (but

without limitation), the Information may not be used to create

indexes, databases, risk models, analytics, software, or in

connection with the issuing, offering, sponsoring, managing or

marketing of any securities, portfolios, financial products or

other investment vehicles utilizing or based on, linked to,

tracking or otherwise derived from the Information or any other

MSCI data, information, products or services.

The user of the Information assumes the entire risk of any use

it may make or permit to be made of the Information. NONE OF THE

INFORMATION PROVIDERS MAKES ANY EXPRESS OR IMPLIED WARRANTIES OR

REPRESENTATIONS WITH RESPECT TO THE INFORMATION (OR THE RESULTS TO

BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT

PERMITTED BY APPLICABLE LAW, EACH INFORMATION PROVIDER EXPRESSLY

DISCLAIMS ALL IMPLIED WARRANTIES (INCLUDING, WITHOUT LIMITATION,

ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS,

NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND FITNESS FOR A

PARTICULAR PURPOSE) WITH RESPECT TO ANY OF THE INFORMATION.

Without limiting any of the foregoing and to the maximum extent

permitted by applicable law, in no event shall any Information

Provider have any liability regarding any of the Information for

any direct, indirect, special, punitive, consequential (including

lost profits) or any other damages even if notified of the

possibility of such damages. The foregoing shall not exclude or

limit any liability that may not by applicable law be excluded or

limited, including without limitation (as applicable), any

liability for death or personal injury to the extent that such

injury results from the negligence or willful default of itself,

its servants, agents or sub-contractors.

Information containing any historical information, data or

analysis should not be taken as an indication or guarantee of any

future performance, analysis, forecast or prediction. Past

performance does not guarantee future results.

The Information should not be relied on and is not a substitute

for the skill, judgment and experience of the user, its management,

employees, advisors and/or clients when making investment and other

business decisions. All Information is impersonal and not tailored

to the needs of any person, entity or group of persons.

None of the Information constitutes an offer to sell (or a

solicitation of an offer to buy), any security, financial product

or other investment vehicle or any trading strategy.

It is not possible to invest directly in an index. Exposure to

an asset class or trading strategy or other category represented by

an index is only available through third party investable

instruments (if any) based on that index. MSCI does not issue,

sponsor, endorse, market, offer, review or otherwise express any

opinion regarding any fund, ETF, derivative or other security,

investment, financial product or trading strategy that is based on,

linked to or seeks to provide an investment return related to the

performance of any MSCI index (collectively, “Index Linked

Investments”). MSCI makes no assurance that any Index Linked

Investments will accurately track index performance or provide

positive investment returns. MSCI Inc. is not an investment adviser

or fiduciary and MSCI makes no representation regarding the

advisability of investing in any Index Linked Investments.

Index returns do not represent the results of actual trading of

investible assets/securities. MSCI maintains and calculates

indexes, but does not manage actual assets. The calculation of

indexes and index returns may deviate from the stated methodology.

Index returns do not reflect payment of any sales charges or fees

an investor may pay to purchase the securities underlying the index

or Index Linked Investments. The imposition of these fees and

charges would cause the performance of an Index Linked Investment

to be different than the MSCI index performance.

The Information may contain back tested data. Back-tested

performance is not actual performance, but is hypothetical. There

are frequently material differences between back tested performance

results and actual results subsequently achieved by any investment

strategy.

Constituents of MSCI equity indexes are listed companies, which

are included in or excluded from the indexes according to the

application of the relevant index methodologies. Accordingly,

constituents in MSCI equity indexes may include MSCI Inc., clients

of MSCI or suppliers to MSCI. Inclusion of a security within an

MSCI index is not a recommendation by MSCI to buy, sell, or hold

such security, nor is it considered to be investment advice.

Data and information produced by various affiliates of MSCI

Inc., including MSCI ESG Research LLC and Barra LLC, may be used in

calculating certain MSCI indexes. More information can be found in

the relevant index methodologies on www.msci.com.

MSCI receives compensation in connection with licensing its

indexes to third parties. MSCI Inc.’s revenue includes fees based

on assets in Index Linked Investments. Information can be found in

MSCI Inc.’s company filings on the Investor Relations section of

msci.com.

MSCI ESG Research LLC is a Registered Investment Adviser under

the Investment Advisers Act of 1940 and a subsidiary of MSCI Inc.

Neither MSCI nor any of its products or services recommends,

endorses, approves or otherwise expresses any opinion regarding any

issuer, securities, financial products or instruments or trading

strategies and MSCI’s products or services are not a recommendation

to make (or refrain from making) any kind of investment decision

and may not be relied on as such, provided that applicable products

or services from MSCI ESG Research may constitute investment

advice. MSCI ESG Research materials, including materials utilized

in any MSCI ESG Indexes or other products, have not been submitted

to, nor received approval from, the United States Securities and

Exchange Commission or any other regulatory body. MSCI ESG and

climate ratings, research and data are produced by MSCI ESG

Research LLC, a subsidiary of MSCI Inc. MSCI ESG Indexes, Analytics

and Real Estate are products of MSCI Inc. that utilize information

from MSCI ESG Research LLC. MSCI Indexes are administered by MSCI

Limited (UK).

Please note that the issuers mentioned in MSCI ESG Research

materials sometimes have commercial relationships with MSCI ESG

Research and/or MSCI Inc. (collectively, “MSCI”) and that these

relationships create potential conflicts of interest. In some

cases, the issuers or their affiliates purchase research or other

products or services from one or more MSCI affiliates. In other

cases, MSCI ESG Research rates financial products such as mutual

funds or ETFs that are managed by MSCI’s clients or their

affiliates, or are based on MSCI Inc. Indexes. In addition,

constituents in MSCI Inc. equity indexes include companies that

subscribe to MSCI products or services. In some cases, MSCI clients

pay fees based in whole or part on the assets they manage. MSCI ESG

Research has taken a number of steps to mitigate potential

conflicts of interest and safeguard the integrity and independence

of its research and ratings. More information about these conflict

mitigation measures is available in our Form ADV, available at

https://adviserinfo.sec.gov/firm/summary/169222.

Any use of or access to products, services or information of

MSCI requires a license from MSCI. MSCI, Barra, RiskMetrics, IPD

and other MSCI brands and product names are the trademarks, service

marks, or registered trademarks of MSCI or its subsidiaries in the

United States and other jurisdictions. The Global Industry

Classification Standard (GICS) was developed by and is the

exclusive property of MSCI and S&P Global Market Intelligence.

“Global Industry Classification Standard (GICS)” is a service mark

of MSCI and S&P Global Market Intelligence.

MIFID2/MIFIR notice: MSCI ESG Research LLC does not distribute

or act as an intermediary for financial instruments or structured

deposits, nor does it deal on its own account, provide execution

services for others or manage client accounts. No MSCI ESG Research

product or service supports, promotes or is intended to support or

promote any such activity. MSCI ESG Research is an independent

provider of ESG data.

Privacy notice: For information about how MSCI collects and uses

personal data, please refer to our Privacy Notice at

https://www.msci.com/privacy-pledge.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240606717000/en/

Media Inquiries PR@msci.com Melanie Blanco +1 212

981 1049 Konstantinos Makrygiannis +44 (0) 7768 930056 Tina Tan

+852 2844 9320

MSCI Global Client Service EMEA Client Service + 44 20

7618.2222 Americas Client Service +1 888 588 4567 (toll-free) Asia

Pacific Client Service + 852 2844 9333

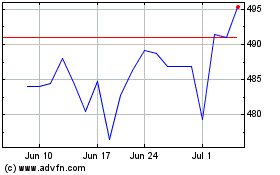

MSCI (NYSE:MSCI)

Historical Stock Chart

From Oct 2024 to Nov 2024

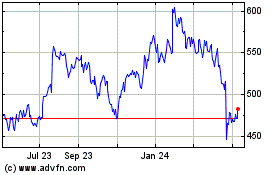

MSCI (NYSE:MSCI)

Historical Stock Chart

From Nov 2023 to Nov 2024