false

0000065433

0000065433

2024-11-30

2024-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): November 30, 2024

The Mexico Fund, Inc.

(Exact name of registrant as specified in its charter)

| Maryland |

811-02409 |

13-3069854 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

6700 Alexander Bell Drive, Suite 200

Columbia, Maryland 21046

(Address of principal executive offices) (Zip Code)

Registrant’s telephone

number, including area code:

(614) 469-3265

(none)

(Former name or former address, if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

☐ Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock |

MXF |

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

Pursuant to Regulation

FD Rules 100-103, The Mexico Fund, Inc. (the “Fund”) furnishes the Monthly Summary Report of the Fund’s Investment Adviser.

Item 9.01 Financial

Statements and Exhibits

(d) Exhibits

The following

exhibit is filed as part of this report:

(i) November 2024 Monthly Summary Report

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

|

|

The

Mexico Fund, Inc. |

|

| |

|

|

|

|

| Date: |

December 6,

2024 |

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

By: |

/s/ Tofi Dayan |

|

| |

|

|

|

Tofi

Dayan |

|

| |

|

|

|

Treasurer |

|

The Mexico Fund, Inc. 8-K

Exhibit 99(i)

Description

The

Mexico Fund, Inc. (the “Fund”) is a non-diversified closed-end management investment company with the investment objective

of long-term capital appreciation through investments in securities, primarily equity, listed on the Mexican Stock Exchanges. The Fund

provides a vehicle to investors who wish to invest in Mexican companies through a managed non-diversified portfolio as part of their

overall investment program. The Fund’s shares are listed and traded on the New York Stock Exchange (“NYSE”) under the

symbol “MXF.”

Managed

Distribution Plan (“MDP”)

The

Board of Directors of the Fund has authorized quarterly distributions of $0.22 per share under the MDP. With each distribution, the Fund

will issue a notice to stockholders and an accompanying press release, which will provide detailed information regarding the amount and

composition of the distribution and other information required by the Fund’s MDP exemptive order. The Fund’s Board of Directors

may amend or terminate the MDP at any time without prior notice to stockholders. You should not draw any conclusions about the Fund’s

investment performance from the amount of distributions or from the terms of the Fund’s MDP.

Highlights

| Total

Net Assets (million)1 |

$251.15 |

Daily

Average Number of Shares Traded2 |

83,181 |

| NAV

per share1 |

$17.00 |

Outstanding

Shares3 |

14,771,862 |

| Closing

price2 |

$13.55 |

Expense

Ratio (4/30/2024) |

1.34% |

| Discount |

20.29% |

Portfolio

Turnover (4/30/2024) |

6.33% |

| Performance1 |

Cumulative |

Annualized |

| 1

Month |

YTD |

1

Year |

3

Years |

5

Years |

10

Years |

15

Years |

| MXF

Market Price |

-3.28% |

-25.07% |

-18.02% |

3.96% |

5.13% |

-0.63% |

3.89% |

| MXF

NAV |

-3.47% |

-24.61% |

-17.91% |

5.12% |

5.99% |

0.60% |

3.81% |

| MSCI

Mexico Index |

-3.62% |

-25.23% |

-18.27% |

5.16% |

5.37% |

-0.28% |

2.38% |

These

figures represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal

value will fluctuate so that an investor’s shares, at the time of sale, may be worth more or less than their original cost. Current

performance may be lower or higher than the performance quoted above.

1

Source: Impulsora del Fondo México, S.C. Performance figures take into account reinvestments of distributions.

2

Source: NYSE. Shares traded figure represents average volume traded on U.S. consolidated markets during the month.

3

During November 2024, the Fund repurchased no shares.

| Top

Ten Holdings (66.17% of Net Assets) |

| 1

Grupo Financiero Banorte |

11.64% |

6

Cemex |

4.57% |

| 2

Fomento Económico Mexicano |

10.83% |

7

Gruma |

4.04% |

| 3

Grupo México |

10.76% |

8

Grupo Aeroportuario del Pacífico |

3.67% |

| 4

Wal-Mart de México |

8.43% |

9

Alfa |

3.48% |

| 5

América Móvil |

5.35% |

10

Grupo Aeroportuario del Centro Norte |

3.40% |

Holdings

are subject to change and are provided for informational purposes only and should not be deemed as a recommendation to buy or sell the

securities shown.

Fund

Manager´s Comments

Global

equity markets registered mixed returns in November 2024. The MSCI World Index increased 4.5%, while the MSCI Emerging Markets Index

decreased 3.7% during the month. Major central banks kept easing their monetary policies; both the Federal Reserve and the Bank of England

decreased their reference interest rates by 25 basis points, to a range of 4.50% - 4.75% and 4.75%, respectively.

In

the United States, Presidential elections were held on November 5th, 2024, resulting in Mr. Donald Trump, the Republican Party

candidate, being elected. On November 25th, 2024, Mr. Trump announced that he plans to impose a 25% tariff on all products

entering the U.S. from Canada and Mexico, and an additional 10% tariff on goods from China, starting January 20th, 2025, claiming

that illegal immigration and drug trafficking are creating border security concerns and encouraging Mexico and Canada to act against

these issues. The President of Mexico has expressed her willingness for dialogue and cooperation to work on these issues and reach an

agreement on tariffs. The DJIA and the S&P 500 increased 7.5% and 5.7%, respectively, while the yield on the 10-year Treasury note

decreased 12 basis points to 4.17% and the U.S. dollar appreciated 1.7% (measured by the DXY Index4) during November 2024.

In

Mexico, the MSCI Mexico Index decreased 3.6% and the Mexican peso depreciated 1.7% during the month to Ps. $20.38, whereas the Fund’s

NAV decreased 3.5%, outperforming its benchmark. Concerns on the tariffs mentioned above were behind the negative performance of Mexican

financial assets during the month. In local news, Mexico´s Central Bank (“Banxico”) also decreased its reference interest

rate by 25 basis points to 10.25%, while GDP for the third quarter of 2024 registered an annual growth of 1.6%. The Government presented

its 2025 budget where it emphasized its goal of fiscal consolidation, expecting a decrease in total public sector requirements (broadest

measure of the public deficit) from an expected 5.9% of GDP in 2024 to 3.9% of GDP in 2025. Moody´s revised its sovereign credit

outlook of Mexico to negative from stable, maintaining its ‘Baa2’ credit rating; however, Mexico maintains its investment

grade credit rating.

The

information presented in this report has been derived from the sources indicated. Neither The Mexico Fund, Inc. nor its Adviser, Impulsora

del Fondo México, S.C., has independently verified or confirmed the information presented herein.

Important

Risk Disclosure

All

performance shown is historical. Closed-end funds are traded on the secondary market through one of the stock exchanges. Shares of closed-end

funds may trade above (premium) or below (discount) the NAV of the fund’s portfolio. The NAV is the value of an entity’s

assets less the value of its liabilities. The Market Price is the current price at which an asset can be bought or sold. There is no

assurance that the Fund will achieve its investment objective.

An

investment in the Fund entails special risk considerations, including among others the risks of foreign investments, Mexican investments,

market illiquidity and volatility, market corrections, risks associated with the Mexican economy, political factors and security, currency

exchange rate fluctuations, NAV discount risk, foreign custody risk, dollar denominated investments risk and risks associated with the

concentration of the Mexican equity market. Investors should consider their investment goals, time horizons and risk tolerance before

investing in the Fund. An investment in the Fund is not appropriate for all investors, and the Fund is not intended to be a complete

investment program. Investors should carefully review and consider the Fund’s investment objective, risks, charges and expenses

before investing.

4

DXY Index computes the value of the U.S. dollar relative to a basket of foreign currencies.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

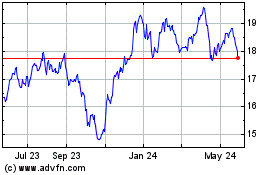

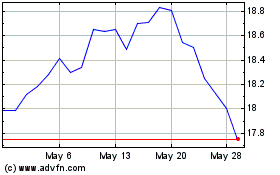

Mexico (NYSE:MXF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mexico (NYSE:MXF)

Historical Stock Chart

From Dec 2023 to Dec 2024