UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-38430

Meta Data Limited

Flat H 3/F, Haribest Industrial Building, 45-47

Au Pui Wan Street

Sha Tin New Territories

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Meta Data Limited |

| |

|

| |

By : |

/s/ Xiaoming Li |

| |

Name: |

Xiaoming Li |

| |

Title : |

Chairman of the Board of Directors and

Chief Executive Officer |

Date: November 14, 2023

Exhibit 99.1

META DATA LIMITED

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 7, 2023

Notice is hereby given that

Meta Data Limited, a Cayman Islands exempted company (the “Company”), will hold its extraordinary general meeting of

shareholders at 10:00 p.m., local time, on December 7, 2023 (the “Extraordinary Meeting”) at the Company’s headquarters

located at Flat H 3/F, Haribest Industrial Building, 45-47 Au Pui Wan Street, Sha Tin New Territories, Hong Kong, to consider and, if

thought fit, to pass, the following resolutions:

| 1. | As an ordinary resolution, that Xiaoming Li be re-elected as

director of the Company. |

| 2. | As an ordinary resolution, that Yanyi Tang be re-elected as

director of the Company. |

| 3. | As an ordinary resolution, that Shengcong Ma be re-elected as

director of the Company. |

| 4. | As an ordinary resolution, that Mengchu Zhou be re-elected as

director of the Company. |

| 5. | As an ordinary resolution, that Robert Angell be re-elected

as director of the Company. |

| 6. | As an ordinary resolution, that Abbie Li be re-elected as director

of the Company. |

| 7. | As an ordinary resolution, to approve the change of the Company’s

authorized share capital, from US$100,000 divided into 200,000,000 shares of a par value of US$0.0005 each, comprising of (i) 140,000,000

Class A Ordinary Shares of a par value of US$0.0005 each, (ii) 20,000,000 Class B Ordinary Shares of a par value of US$0.0005 each, and

(iii) 40,000,000 shares of a par value of US$0.0005 each to be designated by the board of directors, by (i) redesignation of 40,000,000

shares of a par value of US$0.0005 each to be designated by the board of directors as 40,000,000 Class A Ordinary Shares of a par value

of US$0.0005 each, and (ii) the creation of an additional (i) 19,620,000,000 Class A Ordinary Shares of a par value of US$0.0005 each,

and (ii) 180,000,000 Class B Ordinary Shares of a par value of US$0.0005 each, such that the authorized share capital shall be US$10,000,000

divided into 20,000,000,000 shares of a par value of US$0.0005 each, comprising of (i) 19,800,000,000 Class A Ordinary Shares of a par

value of US$0.0005 each, and (ii) 200,000,000 Class B Ordinary Shares of a par value of US$0.0005 each (the “Change in Share

Capital”). |

Only holders of Class A Ordinary

Shares or Class B Ordinary Shares (collectively, “Ordinary Shares”) registered in the register of members at the close

of business on November 13, 2023, New York time (the “Record Date”), can vote at the Extraordinary Meeting or at any

adjournment that may take place. If you are a holder of American Depositary Shares, please see the discussion in the attached

proxy statement under the heading “Voting by Holders of American Depositary Shares.”

We cordially invite all holders

of Ordinary Shares to attend the Extraordinary Meeting in person. However, holders of Ordinary Shares entitled to attend and vote are

entitled to appoint a proxy to attend and vote instead of such holders. A proxy need not be a shareholder of the Company. Holders

of Class B Ordinary Shares may not appoint another holder of Class B Ordinary Shares as its proxy. If you are a holder of Ordinary

Shares and whether or not you expect to attend the Extraordinary Meeting in person, please mark, date, sign and return the enclosed form

of proxy as promptly as possible to ensure your representation and the presence of a quorum at the Extraordinary Meeting. If

you send in your form of proxy and then decide to attend the Extraordinary Meeting to vote your Ordinary Shares in person, you may still

do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement. The enclosed form of proxy is to be

delivered to the attention of Mr. Xiaoming Li, Flat H 3/F, Haribest Industrial Building, 45-47 Au Pui Wan Street, Sha Tin New Territories,

Hong Kong, and must arrive no later than the time for holding the Extraordinary Meeting or any adjournment thereof.

Shareholders may obtain a

copy of the proxy materials, including the Company’s annual report on Form 20-F, from the Company’s website at http://www.aiumeta.com/en/Investors.html

or by submitting a request to ir@aiumeta.com.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Xiaoming Li |

| |

Xiaoming Li |

| |

Chairman and Chief Executive Officer |

| |

Date: November 13, 2023 |

META DATA LIMITED

PROXY STATEMENT

GENERAL

The board of directors of

Meta Data Limited, a Cayman Islands exempted company (the “Company”), is soliciting proxies for the extraordinary general

meeting of shareholders to be held on December 7, 2023 at 10:00 p.m., local time, or at any adjournment or postponement thereof (the “Extraordinary

Meeting”). The Extraordinary Meeting will be held at our headquarters located at Flat H 3/F, Haribest Industrial

Building, 45-47 Au Pui Wan Street, Sha Tin New Territories, Hong Kong.

RECORD DATE, SHARE OWNERSHIP AND QUORUM

Record holders of Class A

Ordinary Shares or Class B Ordinary Shares (collectively, “Ordinary Shares”) as of the close of business on November

13, 2023, New York time, are entitled to vote at the Extraordinary Meeting. As of November 13, 2023, 153,948,323 of our Class

A Ordinary Shares, par value US$0.0005 per share, and 0 of our Class B Ordinary Shares, par value US$0.0005 per share, were issued and

outstanding. As of November 13, 2023, approximately 6,058,538 of our Class A Ordinary Shares were represented by American Depositary Shares

(“ADSs”). One or more holders of Ordinary Shares which represent, in aggregate, not less than one-third

(1/3) of the votes attaching to all issued and outstanding Ordinary Shares and entitled to vote, present in person or by proxy or, if

a corporation or other non-natural person, by its duly authorized representative, shall be a quorum for all purposes.

PROPOSALS TO BE VOTED ON

| 1. | As an ordinary resolution, that Xiaoming Li be re-elected as

director of the Company. |

| 2. | As an ordinary resolution, that Yanyi Tang be re-elected as

director of the Company. |

| 3. | As an ordinary resolution, that Shengcong Ma be re-elected as

director of the Company. |

| 4. | As an ordinary resolution, that Mengchu Zhou be re-elected as

director of the Company. |

| 5. | As an ordinary resolution, that Robert Angell be re-elected

as director of the Company. |

| 6. | As an ordinary resolution, that Abbie Li be re-elected as director

of the Company. |

| 7. | As an ordinary resolution, to approve the change of the Company’s

authorized share capital, from US$100,000 divided into 200,000,000 shares of a par value of US$0.0005 each, comprising of (i) 140,000,000

Class A Ordinary Shares of a par value of US$0.0005 each, (ii) 20,000,000 Class B Ordinary Shares of a par value of US$0.0005 each, and

(iii) 40,000,000 shares of a par value of US$0.0005 each to be designated by the board of directors, by (i) redesignation of 40,000,000

shares of a par value of US$0.0005 each to be designated by the board of directors as 40,000,000 Class A Ordinary Shares of a par value

of US$0.0005 each, and (ii) the creation of an additional (i) 19,620,000,000 Class A Ordinary Shares of a par value of US$0.0005 each,

and (ii) 180,000,000 Class B Ordinary Shares of a par value of US$0.0005 each, such that the authorized share capital shall be US$10,000,000

divided into 20,000,000,000 shares of a par value of US$0.0005 each, comprising of (i) 19,800,000,000 Class A Ordinary Shares of a par

value of US$0.0005 each, and (ii) 200,000,000 Class B Ordinary Shares of a par value of US$0.0005 each (the “Change in Share

Capital”). |

| 8. | To

transact any such other business that may properly come before the meeting. |

The Board of Directors recommends a vote “FOR”

each proposal from Proposals No. 1-8.

VOTING AND SOLICITATION

Except as required by applicable

law and subject to the terms and conditions of the Articles, the holders of Class A Ordinary Shares and Class B Ordinary Shares shall

vote together as one class on all matters submitted to a vote at the Extraordinary Meeting. Each Class A Ordinary Share shall be entitled

to one (1) vote on all matters subject to the vote at the Extraordinary Meeting, and each Class B Ordinary Share shall be entitled to

twenty (20) votes on all matters subject to the vote at the Extraordinary Meeting.

At the Extraordinary Meeting,

every holder of Ordinary Shares present in person or by proxy may vote the fully paid Ordinary Shares held by such holder of Ordinary

Shares. A resolution put to the vote of a meeting shall be decided on a show of hands. In computing the majority, regard shall

be had to the number of votes to which each holder of Ordinary Shares is entitled.

The costs of soliciting proxies

will be borne by us. Proxies may be solicited by certain of our directors, officers and regular employees, without additional compensation,

in person or by telephone or electronic mail. Copies of solicitation materials will be furnished to banks, brokers, fiduciaries

and custodians holding in their names our Ordinary Shares or ADSs beneficially owned by others to forward to those beneficial owners.

VOTING BY HOLDERS OF ORDINARY SHARES

Holders of Ordinary Shares

whose shares are registered in their own names may vote by attending the Extraordinary Meeting in person, via the Internet or by completing,

dating, signing and returning the enclosed form of proxy to the attention of Mr. Xiaoming Li, Flat H 3/F, Haribest Industrial Building,

45-47 Au Pui Wan Street, Sha Tin New Territories, Hong Kong, and must arrive no later than the time for holding the Extraordinary Meeting

or any adjournment thereof.

When proxies are properly

completed, dated, signed and returned by holders of Ordinary Shares, the Ordinary Shares they represent, unless the proxies are revoked,

will be voted at the Extraordinary Meeting in accordance with the instructions of the shareholder. If no specific instructions

are given by such holders, the Ordinary Shares will be voted “FOR” each proposal and in the proxy holder’s discretion

as to other matters that may properly come before the Extraordinary Meeting. Abstentions and broker non-votes will be counted as

present for purposes of determining whether a quorum is present.

Please refer to this proxy

statement for information related to the proposals.

VOTING BY HOLDERS OF AMERICAN DEPOSITARY

SHARES

Deutsche Bank Trust Company

Americas, as depositary of the ADSs, has advised us that it intends to mail to all record owners of ADSs this proxy statement, the accompanying

notice of Extraordinary Meeting and a voting instruction card for record owners of ADSs. Upon the written request of an owner

of record of ADSs by such owner’s delivery of a properly completed, dated and signed voting instruction card to Deutsche Bank Trust

Company Americas prior to 10:00 AM, New York City time on November 30, 2023, Deutsche Bank Trust Company Americas will endeavor, in so

far as practicable, to vote or cause to be voted the amount of Class A Ordinary Shares or other deposited securities represented by such

ADSs, evidenced by American Depositary Receipts related to those ADSs, in accordance with the instructions set forth in such request.

Deutsche Bank Trust Company Americas has advised us that it will not vote or attempt to exercise the right to vote other than in accordance

with those instructions. As the holder of record for all the Class A Ordinary Shares represented by all of our ADSs, only Deutsche

Bank Trust Company Americas may vote those Class A Ordinary Shares at the Extraordinary Meeting.

If the enclosed voting instruction

card is signed but the voting instructions fail to specify the manner in which to vote, Deutsche Bank Trust Company Americas shall deem

such holder of record to have instructed it to give a discretionary proxy to a person designated by the Company.

REVOCABILITY OF PROXIES

Any proxy given pursuant to

this solicitation may be revoked by the person giving it at any time before its use by delivering a written notice of revocation or a

duly executed proxy bearing a later date or, if you hold Ordinary Shares, by attending the meeting and voting in person. A written notice

of revocation must be delivered to the attention of Meta Data Limited, if you hold our Ordinary Shares, or to Deutsche Bank Trust Company

Americas if you hold ADSs representing our Class A Ordinary Shares.

ANNUAL REPORT TO SHAREHOLDERS

The Company makes available

its annual report to shareholders through the Company’s website. The 2022 annual report for the year ended August 31, 2022 (the

“2022 Annual Report”) has been filed with the U.S. Securities and Exchange Commission. The Company adopted this practice

to avoid the considerable expense associated with mailing physical copies of such report to record holders and beneficial owners of the

Company’s ADSs. You may obtain a copy of our 2022 Annual Report by visiting the “Annual Reports” heading under the “Financials”

section of the Company’s website at http://www.aiumeta.com/en/Investors.html. If you want to receive a paper or email copy of the

Company’s 2022 Annual Report, you must request one. There is no charge to you for requesting a copy. Please make your request for

a copy to the Investor Relations department of the Company, at ir@aiumeta.com.

PROPOSALS 1 THROUGH 6

RE-ELECTION OF DIRECTORS

The Election of Directors

The nominees listed below

(the “Director Nominees”) have been nominated by the Nominating and Corporate Governance Committee and approved by

our Board to stand for re-election as directors of the Company. Unless such authority is withheld, proxies will be voted for the re-election

of the persons named below, each of whom has been designated as a nominee. If, for any reason not presently known, any person is not available

to serve as a director, another person who may be nominated will be voted for in the discretion of the proxies. Each of the Director Nominees

have entered into an amendment and restatement of their director offer letter (“A&R Director Offer Letter”), pursuant

to which the term of their directorship shall be changed from an annual re-election at the Company’s annual general meeting of shareholders,

to the earlier of (i) the resignation or termination of the director pursuant to the terms of the director offer letter; or (ii) the next

general meeting of shareholders of the Company upon which the directors of the Board stand for re-election. The form of the A&R Director

Offer Letter is attached hereto as Annex A.

Unless you indicate otherwise,

shares represented by executed proxies in the form enclosed will be voted for the election of each nominee unless any such nominee shall

be unavailable, in which case such shares will be voted for a substitute nominee designated by the Board.

Director Nominees

The Director Nominees

recommended by the Board are as follows:

| Name |

|

Age |

|

Position with the Company |

| Xiaoming Li |

|

41 |

|

Executive Chairman and Chief Executive Officer |

| Shengcong Ma |

|

49 |

|

Executive Director and Chief Operating Officer |

| Yanyi Tang |

|

39 |

|

Independent Director |

| Dr. Mengchu Zhou |

|

60 |

|

Independent Director |

| Dr. Robert Angell |

|

62 |

|

Independent Director |

| Abbie Li |

|

28 |

|

Director |

Information Regarding the Company’s Directors

and Nominees

Mr. Xiaoming Li

has served as the CEO of Henan Shenglong Culture Communication Co., Ltd. since December 2019. From December 2016 to May 2019, he served

as the chief technical officer of Shenzhen Aladdin Technology Development Co., Ltd. Mr. Li served as a professor at Henan Agricultural

University’s enterprise, Henan Big Feed Technology Co., Ltd., where he taught in the teaching and research department, as well as

actively researching the development and direction of contemporary education and new educational technology systems. Mr. Li graduated

from Henan University of Economics and Law, China, with a bachelor’s degree in software engineering with a concentration in IT and

education.

Mr. Shengcong Ma served

as the vice president of Aier Medical Investment Group CO., Ltd. from March 2017 to March 2021. From October 2016 to March 2021, he served

as the general manager of Aier Health Insurance Co., Ltd. Mr. Ma was a member of the Technology Committee of Anbang Insurance Group and

also the general manager of its Community Finance Business Department from October 2014 to March 2017. From October 2010 to October 2014,

Mr. Ma served as the deputy general manager of theShandong Banking Insurance Division of Centennial Life Corporation. Mr. Ma received

his bachelor’s degree in Industrial and Foreign Trade from the Beijing Technology and Business University, a MBA from The Open University

of Hong Kong, and an Executive MBA from Peking University National Development Research Institute.

Ms. Yanyi Tang has

served as Project Manager at Shanghai Jiaan Certified Public Accountants since December 2010. From January 2007 to November 2010, she

served as Assistant Manager at KPMG Huazhen Accounting Firm. Ms. Tang received her bachelor’s degree in Economics and Business from

Shanghai University, China and University of Technology, Sydney, respectively. Ms. Tang is a certified public accountant in China (CICPA)

and also a certified public accountant in the United States (AICPA) in the State of Texas.

Dr. Mengchu Zhou has

been the Distinguished Professor of electrical and computer engineering in the Helen and John C. Hartmann Dept. of Electrical and Computer

Engineering at New Jersey Institute of Technology (NJIT) since 2013. He is a Fellow of the Institute of Electrical and Electronics Engineers

(IEEE), a Fellow of the International Federation of Automatic Control (IFAC), a Fellow of the American Association for the Advancement

of Science (AAAS) and a Fellow of the Chinese Association of Automation (CAA). Zhou is the Founding Editor-in-Chief of the IEEE/Wiley

Book Series on Systems Science and Engineering and the Editor-in-Chief of the IEEE/CAA Journal of Automatica Sinica. In 2015, he received

the Norbert Wiener Award for “fundamental contributions to the area of Petri net theory and applications to discrete event systems,”

from the IEEE Systems, Man, and Cybernetics Society which also awarded him the Franklin V. Taylor Memorial Award for Best Paper award

in 2010. Dr, Zhou earned his Ph.D. in Computer & Systems Engineering, Rensselaer Polytechnic Institute in 1990. He completed his M.

S. in Automatic Control, Beijing Institute of Technology in, 1986 following the completion of his B. S. in Control Engineering, Nanjing

University of Science & Technology in 1983.

Dr. Robert Angell is

an expert in healthcare AI, predictive analytics, temporal medicine, and data science. Since May 2019, he has been the principal and founder

of Applied Data Sciences, LLC, a data science company, and CoMorbus, a public health provider. Dr. Angell was a data scientist at the

division of cardiovascular genetics in University of Utah, where he provided support to all data science activities from 2014 to 2018.

Dr. Angell was an adjunct faculty at Salt Lake Community College from 2009 to 2014, where he taught computer science related courses.

Dr. Angell received her Ph.D. degree in biomedical informatics and Bachelor’s degree in industrial engineering from University of

Utah.

Ms. Abbie Li is

the co-founder of X DAO since January 2023. From January 2021 to December 2021, Ms. Li served as an associate of Investment Banking Division

at CICC. From January 2020 to December 2020, Ms. Li served as a partner of Coldharbour Capital. From October 2020 to August 2021, Ms.

Li served as the managing director of Faith-Group Co. Ltd. From September 2019 to October 2020, Ms. Li served as an associate of Investment

Banking Division at JP Morgan. Ms. Li obtained her bachelor’s degree in Mathematics from New York University in 2018.

Vote Required and Board Recommendation

If a quorum is present, the

affirmative vote of a simple majority of the votes of the holders of Ordinary Shares present in person or represented by proxy and entitled

to vote at the Extraordinary Meeting will be required to elect all of the Director Nominees.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

PROPOSALS 1 THROUGH 6, THE RE-ELECTION TO THE BOARD OF DIRECTORS OF ALL OF THE NOMINEES AS DESCRIBED IN THESE PROPOSALS 1 THROUGH 6

PROPOSAL 7

TO APPROVE THE CHANGE IN THE COMPANY’S

AUTHORIZED SHARE CAPITAL

General

The Board of Directors believes

that it is in the best interest of the Company and the shareholders, and is hereby soliciting shareholder approval, to increase the Company’s

authorized share capital from US$100,000 divided into 200,000,000 shares of a par value of US$0.0005 each, comprising of (i) 140,000,000

Class A Ordinary Shares of a par value of US$0.0005 each, (ii) 20,000,000 Class B Ordinary Shares of a par value of US$0.0005 each, and

(iii) 40,000,000 shares of a par value of US$0.0005 each to be designated by the board of directors, by (i) redesignation of 40,000,000

shares of a par value of US$0.0005 each to be designated by the board of directors as 40,000,000 Class A Ordinary Shares of a par value

of US$0.0005 each, and (ii) the creation of an additional (i) 19,620,000,000 Class A Ordinary Shares of a par value of US$0.0005 each,

and (ii) 180,000,000 Class B Ordinary Shares of a par value of US$0.0005 each, such that the authorized share capital shall be US$10,000,000

divided into 20,000,000,000 shares of a par value of US$0.0005 each, comprising of (i) 19,800,000,000 Class A Ordinary Shares of a par

value of US$0.0005 each, and (ii) 200,000,000 Class B Ordinary Shares of a par value of US$0.0005 each (the “Change in Share

Capital”).

The Change in Share Capital

must be passed by an ordinary resolution which requires the affirmative vote of a simple majority of the votes cast at the Extraordinary

Meeting by the shareholders present in person or represented by proxy and entitled to vote on such proposals, either in person, by proxy

or by authorized representative. If our shareholders approve this proposal, our Board of Directors will have the authority to implement

the Change in Share Capital by instructing the registered office to file the notice to amend the Memorandum and Articles of Association

with the Cayman Islands Registrar of Companies at any time after the approval of the Change in Share Capital. The resolutions be put to

the shareholders to consider and to vote upon at the Extraordinary Meeting in relation to amending the authorized share capital of the

Company are:

| 1. | “IT

IS HEREBY RESOLVED, as an ordinary resolution, that: |

| (A) | the

Company’s authorized share capital will increase from US$100,000 divided into 200,000,000 shares of a par value of US$0.0005 each,

comprising of (i) 140,000,000 Class A Ordinary Shares of a par value of US$0.0005 each, (ii) 20,000,000 Class B Ordinary Shares of a

par value of US$0.0005 each, and (iii) 40,000,000 shares of a par value of US$0.0005 each to be designated by the board of directors,

by (i) redesignation of 40,000,000 shares of a par value of US$0.0005 each to be designated by the board of directors as 40,000,000 Class

A Ordinary Shares of a par value of US$0.0005 each, and (ii) the creation of an additional (i) 19,620,000,000 Class A Ordinary Shares

of a par value of US$0.0005 each, and (ii) 180,000,000 Class B Ordinary Shares of a par value of US$0.0005 each, such that the authorized

share capital shall be US$10,000,000 divided into 20,000,000,000 shares of a par value of US$0.0005 each, comprising of (i) 19,800,000,000

Class A Ordinary Shares of a par value of US$0.0005 each, and (ii) 200,000,000 Class B Ordinary Shares of a par value of US$0.0005 each. |

Vote Required and Board Recommendation

If a quorum is present, the

affirmative vote of a simple majority of the votes casted by the holders of Ordinary Shares present in person or represented by proxy

and entitled to vote at the Extraordinary Meeting will be required to approve the Change in Share Capital.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

PROPOSAL 7, TO APPROVE THE SHARE CONSOLIDATION OF THE COMPANY’S ORDINARY SHARES AS DESCRIBED IN THIS PROPOSAL 7

OTHER MATTERS

We know of no other matters

to be submitted to the Extraordinary Meeting. If any other matters properly come before the Extraordinary Meeting, it is the

intention of the persons named in the enclosed form of proxy to vote the shares they represent as the Board of Directors may recommend.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Xiaoming Li |

| |

Xiaoming Li |

| |

Chairman and Chief Executive Officer |

| |

Date: November 13, 2023 |

7

Exhibit 99.2

META DATA LIMITED

(incorporated

in the Cayman Islands with limited liability)

FORM OF PROXY FOR THE EXTRAORDINARY GENERAL MEETING

to be held on December 7, 2023

(or any adjourned or postponed meeting thereof)

I/we, the undersigned acknowledges receipt

of the Notice of Extraordinary General Meeting of Shareholders and Proxy Statement and, being the registered holder of _________

Class A Ordinary Shares1, par value US$0.0005 per share, and _________ Class B

Ordinary Shares2, par value US$0.0005 per share (together with Class A Ordinary

Shares, “Ordinary Shares”), of Meta Data Limited (the “Company”), hereby appoint Mr. Xiaoming

Li, the Chief Executive Officer of the Company or (Name) of (Address) as my/our proxy to attend and

act for me/us at the Extraordinary General Meeting3 (or at any adjournment or

postponement thereof) of the Company to be held at 10:00 p.m., local time, on December 7, 2023 at Flat H 3/F, Haribest Industrial

Building, 45-47 Au Pui Wan Street, Sha Tin New Territories, Hong Kong (the “Meeting”).

| 1 | Please insert the number of Class A Ordinary Shares registered

in your name(s) to which this proxy relates. If no number is inserted, this form of proxy will be deemed to relate to all the shares

in the Company registered in your name(s) |

| 2 | Please insert the number of Class B Ordinary Shares registered

in your name(s) to which this proxy relates. If no number is inserted, this form of proxy will be deemed to relate to all the shares

in the Company registered in your name(s). |

| 3 | If any proxy other than the Board Secretary of the Company is

preferred, strike out the words “Ms. Vivian Liu, the Board Secretary of the Company or” and insert the name and address of

the proxy desired in the space provided. A proxy need not be a shareholder. Holders of Class B Ordinary Shares may not appoint another

holder of Class B Ordinary Shares as its proxy. If you are the holder of two or more Ordinary Shares, you may appoint more than one proxy

to represent you and vote on your behalf at the Extraordinary General Meeting. Any alteration made to this form of proxy must be initialed

by the person(s) who sign(s) it. |

My/our proxy is instructed to vote on the resolutions

in respect of the matters specified in the Notice of the Extraordinary General Meeting as indicated below:

| |

For |

|

Against |

|

Abstain |

| |

|

|

|

|

|

|

Proposal 1: As an ordinary resolution, that Xiaoming

Li be re-elected as director of the Company.

|

☐ |

|

☐ |

|

☐ |

|

Proposal 2: As an ordinary resolution, that Yanyi

Tang be re-elected as director of the Company.

|

☐ |

|

☐ |

|

☐ |

|

Proposal 3: As an ordinary resolution, that Shengcong

Ma be re-elected as director of the Company.

|

☐ |

|

☐ |

|

☐ |

|

Proposal 4: As an ordinary resolution, that Mengchu

Zhou be re-elected as director of the Company.

|

☐ |

|

☐ |

|

☐ |

|

Proposal 5: As an ordinary resolution, that Robert

Angell be re-elected as director of the Company.

|

☐ |

|

☐ |

|

☐ |

|

Proposal 6: As an ordinary resolution, that Abbie

Li be re-elected as director of the Company.

|

☐ |

|

☐ |

|

☐ |

| Proposal 7: As an ordinary resolution, to approve the change of the Company’s authorized share capital, from US$100,000 divided into 200,000,000 shares of a par value of US$0.0005 each, comprising of (i) 140,000,000 Class A Ordinary Shares of a par value of US$0.0005 each, (ii) 20,000,000 Class B Ordinary Shares of a par value of US$0.0005 each, and (iii) 40,000,000 shares of a par value of US$0.0005 each to be designated by the board of directors, by (i) redesignation of 40,000,000 shares of a par value of US$0.0005 each to be designated by the board of directors as 40,000,000 Class A Ordinary Shares of a par value of US$0.0005 each, and (ii) the creation of an additional (i) 19,620,000,000 Class A Ordinary Shares of a par value of US$0.0005 each, and (ii) 180,000,000 Class B Ordinary Shares of a par value of US$0.0005 each, such that the authorized share capital shall be US$10,000,000 divided into 20,000,000,000 shares of a par value of US$0.0005 each, comprising of (i) 19,800,000,000 Class A Ordinary Shares of a par value of US$0.0005 each, and (ii) 200,000,000 Class B Ordinary Shares of a par value of US$0.0005 each (the “Change in Share Capital”). |

☐ |

|

☐ |

|

☐ |

|

Dated _________, 2023

|

| Signature(s) _________________________ |

|

| Name of Signatory ___________________ |

|

| Name of Shareholder _________________ |

|

Notes:

| 1. | Only the holders of record of the Class A Ordinary Shares or Class B Ordinary Shares of the Company at

the close of business on November 13, 2023, New York time, should use this form of proxy. |

| 2. | Please indicate your voting preference by ticking, or inserting in the number of shares to be voted for

or against or to abstain, the boxes above in respect of each resolution. If NO instruction is given, your proxy will vote or abstain from

voting at his/her discretion. If any other matter properly comes before the Extraordinary General Meeting, or any adjournment or postponement

thereof, which may properly be acted upon, unless otherwise indicated, your proxy will vote or abstain from voting at his/her discretion. |

| 3. | Any alteration made to this form of proxy must be initialed by the person(s) who sign(s) it. |

| 4. | This form of proxy must be signed by you or your attorney duly authorized in writing or, in the case of

a corporation, must be either under seal or executed under the hand of an officer or attorney duly authorized to sign the same. In the

case of joint holders, all holders must sign. |

| 5. | This form of proxy and any authority under which it is executed (or a notarized and/or duly certified

copy of such authority) must be returned to the attention of Mr. Xiaoming Li, Flat H 3/F, Haribest Industrial Building, 45-47 Au Pui Wan

Street, Sha Tin New Territories, Hong Kong no later than the time for holding the Extraordinary General Meeting or any adjournment thereof. |

| 6. | Completion and return of the form of proxy will not prevent you from attending and voting in person at

the Extraordinary General Meeting. |

3

Exhibit

99.3

November

15, 2023

Meta

Data Limited

Please

be advised of the following Final Depositary’s Notice of Extraordinary General Meeting of Shareholders:

Depositary Receipt Information

| CUSIP: |

68276W400 (DTC

Eligible) ADS ISIN: US68276W4006 |

| |

|

| Country of Incorporation: |

Cayman Islands |

| |

|

| Meeting Details: |

Extraordinary General Meeting at 10:00 p.m., local time at Flat H 3/F, Haribest Industrial Building, 45-47 Au Pui Wan Street, Sha Tin New Territories, Hong Kong |

| |

|

| ADS Record Date: |

November 13, 2023 |

| |

|

| Voting Deadline: |

November 30, 2023 at 10:00 AM EST |

| |

|

| Meeting Date: |

December 07, 2023 |

| |

|

| Meeting Agenda: |

The Company’s Notice of Meeting, including the Agenda, is available at the Company’s website: http://www.aiumeta.com/en/Investors.html |

| |

|

| Ratio (ORD:ADS): |

2 : 1 |

Holders

of American Depositary Shares (“ADSs”) representing ordinary shares (the “Deposited Securities”) of Meta Data Limited

(the “Company”) are hereby notified of the Company’s Extraordinary General Meeting of shareholders. A copy of the Notice of

Meeting from the Company, which includes the agenda, is available at http://www.aiumeta.com/en/Investors.html.

Shareholders

may obtain a copy of the Company’s annual report on Form 20-F, from the Company’s website at http://www.aiumeta.com/en/Investors.html

or by submitting a request to ir@aiumeta.com.

Holders

of ADSs as of the close of business on the ADS Record Date stated above will be entitled, subject to any applicable law, the provisions

of the deposit agreement entered into between the Company, Deutsche Bank Trust Company Americas (the “Depositary”) and the

Holders of ADSs (the “Deposit Agreement”), the Company’s memorandum and articles of association and the provisions of or governing

the Deposited Securities, to instruct the Depositary as to the exercise of the voting rights, if any, pertaining to the Deposited Securities

represented by such Holder’s ADSs.

In

order for a voting instruction to be valid, Holders must complete, sign and return the enclosed voting instruction form so that it is

received by the voting deadline stated above. Voting instructions may be given only in respect of a number of ADSs representing an integral

number of Deposited Securities. Upon the timely receipt of voting instructions of a Holder on the ADS Record Date in the manner specified

by the Depositary, the Depositary shall endeavor, insofar as practicable and permitted under applicable law, the provisions of the Deposit

Agreement, the Company’s memorandum and articles of association and the provisions of or governing the Deposited Securities, to vote

or cause the custodian to vote the Deposited Securities (in person or by proxy) represented by ADSs evidenced by such receipt in accordance

with such voting instructions.

Holders

are advised that in the event that (i) the Depositary timely receives voting instructions from a Holder which fail to specify the manner

in which the Depositary is to vote the Deposited Securities represented by such Holder’s ADSs or (ii) no timely instructions are received

by the Depositary from a Holder with respect to any of the Deposited Securities represented by the ADSs held by such Holder on the ADS

Record Date, the Depositary shall deem such Holder to have instructed the Depositary to give a discretionary proxy to a person designated

by the Company with respect to such Deposited Securities and the Depositary shall give a discretionary proxy to a person designated by

the Company to vote such Deposited Securities, provided, however, that no such instruction shall be deemed to have been given and no

such discretionary proxy shall be given with respect to any matter as to which the Company informs the Depositary (and the Company agrees

to provide such information as promptly as practicable in writing, if applicable) that (x) the Company does not wish to give such proxy,

(y) the Company is aware or should reasonably be aware that substantial opposition exists from Holders against the outcome for which

the person designated by the Company would otherwise vote or (z) the outcome for which the person designated by the Company would otherwise

vote would materially and adversely affect the rights of holders of Deposited Securities, provided, further, that the Company will have

no liability to any Holder or Beneficial Owner (as defined below) resulting from such notification.

Additionally,

Holders are advised that in the event that voting on any resolution or matter is conducted on a show of hands basis in accordance with

the Company’s memorandum and articles of association, the Depositary will refrain from voting and the voting instructions (or the deemed

voting instructions, as set out above) received by the Depositary from Holders shall lapse. The Depositary will have no obligation to

demand voting on a poll basis with respect to any resolution and shall have no liability to any Holder or Beneficial Owners for not having

demanded voting on a poll basis.

Please

note that persons beneficially holding ADSs through a bank, broker or other nominee that wish to provide voting instructions with respect

to the securities represented by such ADSs must follow the voting instruction requirements of, and adhere to the deadlines set by, such

bank, broker or other nominee. Such requirements and deadlines will differ from those set forth herein for registered holders of ADSs.

Holders

and persons and/or entities having a beneficial interest in any ADS (“Beneficial Owners”) are advised that (a) the Depositary

has not reviewed the Company’s website or any of the items thereon, and is not liable for the contents thereof, (b) neither the Depositary

nor any of its affiliates controls, is responsible for, endorses, adopts, or guarantees the accuracy or completeness of any information

contained in any document prepared by the Company or on the Company’s website and neither the Depositary nor any of its affiliates are

or shall be liable or responsible for any information contained therein or thereon, (c) there can be no assurance that Holders or Beneficial

Owners generally or any Holder or Beneficial Owner in particular will receive this notice with sufficient time to enable the Holder to

return voting instructions to the Depositary in a timely manner, and (d) the Depositary and its agents shall not be liable for any failure

to carry out any instructions to vote any of the Deposited Securities, or for the manner in which any vote is cast or the effect of any

vote.

For

further information, please contact:

Depositary

Receipts

Phone: (800) 821-8780

shemaildb@equiniti.com

Exhibit 99.4

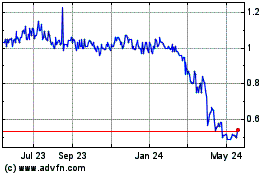

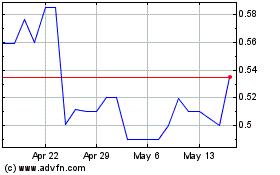

Meta Data (NYSE:AIU)

Historical Stock Chart

From Feb 2025 to Mar 2025

Meta Data (NYSE:AIU)

Historical Stock Chart

From Mar 2024 to Mar 2025