Current Report Filing (8-k)

February 24 2022 - 4:13PM

Edgar (US Regulatory)

0001818383FALSE00018183832022-02-242022-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 24, 2022

_____________________________

MediaAlpha, Inc.

(Exact Name of Registrant as Specified in Its Charter)

_____________________________

| | | | | | | | |

| Delaware | 001-39671 | 85-1854133 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

700 South Flower Street, Suite 640 Los Angeles, California | 90017 |

| (Address of Principal Executive Offices) | (Zip Code) |

(213) 316-6256

(Registrant’s telephone number, including area code)

(Not Applicable)

(Former name or former address, if changed since last report)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.01 par value | | MAX | | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company o If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

ITEM 2.02 – Results of Operations and Financial Condition.

On February 24, 2022, MediaAlpha, Inc. (“MediaAlpha” or the “Company”) issued a press release and an accompanying shareholder letter announcing its financial results as of and for the fourth quarter and full year ended December 31, 2021. In addition, this press release also announced that, on February 24, 2022, MediaAlpha signed an agreement to acquire substantially all of the assets of Customer Helper Team, LLC (“CHT”), a leading provider of Medicare inquiries with deep expertise in social media marketing. Copies of the press release and shareholder letter are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Form 8-K and are incorporated by reference herein.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

MediaAlpha refers to non-GAAP financial information in the press release and shareholder letter. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in each document.

ITEM 7.01 – Regulation FD Disclosure

On February 24, 2022, MediaAlpha held a conference call to discuss the Company's fourth quarter and full year 2021 results and its financial outlook for the first quarter of 2022. During this call, the Company’s management noted that (a) the purchase price for the acquisition of CHT will be approximately $50 million in cash at closing plus up to an additional $20 million of contingent cash consideration based on CHT’s achievement of revenue and profitability targets over the next two years, (b) MediaAlpha expects the transaction to have a minimal impact on the Company’s revenue and Adjusted EBITDA for the first quarter of 2022, and expects CHT to contribute in excess of $25 million of revenue and $5 million of Adjusted EBITDA to the Company’s results in the full year of 2022, and (c) MediaAlpha expects the transaction to close by March 11, 2022 (subject to the satisfaction of customary closing conditions).

MediaAlpha is not providing a reconciliation of CHT’s expected Adjusted EBITDA contribution to CHT’s net income contribution because the Company is unable to predict with reasonable certainty the reconciling items that may affect CHT’s net income without unreasonable effort. These reconciling items are uncertain, depend on various factors and could significantly impact, either individually or in the aggregate, the GAAP measures for the applicable period.

ITEM 9.01 – Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit No. | Description |

99.1 | |

99.2 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MediaAlpha, Inc. |

| | |

| Date: February 24, 2022 | By: | /s/ Jeffrey Coyne |

| | Name: | Jeffrey Coyne |

| | Title: | General Counsel & Secretary |

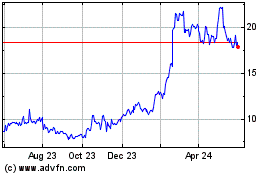

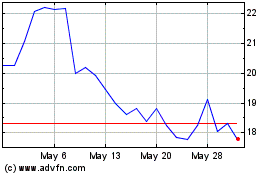

MediaAlpha (NYSE:MAX)

Historical Stock Chart

From Jun 2024 to Jul 2024

MediaAlpha (NYSE:MAX)

Historical Stock Chart

From Jul 2023 to Jul 2024