false

0000314203

0000314203

2024-02-29

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

February 29, 2024 |

McEWEN MINING INC.

(Exact name of registrant as specified in

its charter)

| Colorado |

|

001-33190 |

|

84-0796160 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

150 King Street West, Suite 2800

Toronto,

Ontario, Canada

|

M5H 1J9 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number including area code: |

(866) 441-0690 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

MUX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On February 29, 2024,

McEwen Mining Inc. (the “Company”) issued a press release summarizing its fourth quarter and year-end 2023 financial and operating

results together with certain operation updates, and announcing the quarter-end conference call and webcast to discuss those results.

A copy of that press release is furnished with this report as Exhibit 99.1.

The information furnished

under this Item 2.02, including the referenced exhibit, shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except

as shall be expressly set forth by reference to such filing.

| Item 9.01 | Financial

Statements and Exhibits. |

| (d) | Exhibits. The following exhibits are furnished or filed

with this report, as applicable: |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline

XBRL document (contained in Exhibit 101) |

Cautionary Statement

With the exception of historical

matters, the matters discussed in the press release include forward-looking statements within the meaning of applicable securities laws

that involve risks and uncertainties that could cause actual results to differ materially from projections or estimates contained therein.

Such forward-looking statements include, among others, statements regarding future production and cost estimates, exploration, development,

construction and production activities. Factors that could cause actual results to differ materially from projections or estimates include,

among others, future drilling results, metal prices, economic and market conditions, operating costs, receipt of permits, and receipt

of working capital, as well as other factors described in the Company’s Annual Report on Form 10-K for the year ended December 31,

2022, and other filings with the United States Securities and Exchange Commission. Most of these factors are beyond the Company’s

ability to predict or control. The Company disclaims any obligation to update any forward-looking statement made in the press release,

whether as a result of new information, future events, or otherwise. Readers are cautioned not to put undue reliance on forward-looking

statements.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

McEWEN MINING INC. |

| |

|

| Date: March 1, 2024 |

By: |

/s/ Carmen Diges |

| |

|

Carmen Diges, General Counsel |

Exhibit 99.1

McEWEN MINING: 2023 YEAR END AND Q4 RESULTS

2023 Net income $1.15/share vs. 2022 net loss

$1.71/share

TORONTO, February 29th,

2024 - McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today reported its fourth quarter (“Q4”) and full year 2023 financial

and operational results. Net income for the year was $54.7 million or $1.15 per share versus a 2022 net loss of $81.1 million or $1.71

per share! Gold production at the Fox Complex and Gold Bar mine came in just above the low end of guidance and San José just

below guidance. However, cash costs(1) and AISC(1) per ounce remain 12-18% higher than guided and need

more attention.

Growth Plans for 2024

“Our biggest single asset

with the greatest near-term potential to increase our share value is our 48% owned subsidiary McEwen Copper. Its 2nd and 3rd

largest shareholders are global giants, Rio Tinto and Stellantis, the world’s 2nd largest mining company and the

world’s 4th largest automaker, owning 14.5% and 19.4% of McEwen Copper, respectively. McEwen Copper is driving hard,

with 22 drills operating on site, to complete the necessary work to deliver a bankable Feasibility Study in Q1 2025.

Compared to conventional copper

mines, Los Azules is designed with a much lighter impact on the environment, initially emitting one third (1/3) of the CO2-e

emissions and progressing to net-zero carbon by 2038, utilizing one quarter (1/4) the water, powered by 100% renewable electricity, and

producing sustainable copper cathode.

At our Canadian and Mexican

mines we are advancing two important development projects. At the Fox Complex, the construction of the underground ramp access to

the Stock orebodies will start in Q1. The Stock West deposit will become the primary source of production following the completion of

mining at the Froome deposit in 2026. At the Fenix project, construction is expected to start in H2. Both of these projects are designed

to extend the mine lives by over 9 years,” said Rob McEwen, Chairman and Chief Owner.

Individual Mine Performance and

Growth (see Table 1 and 2)

Fox Complex, Timmins, Canada

Fox performed well in 2023, achieving

its annual production guidance. Mill throughput achieved a record average of 1,300 tonnes per day in Q4, the highest since our acquisition

in 2017. As a result, mill throughput in Q4 was 36% higher than in Q4 2022. This is an important achievement by our team in Canada, as

we aim to continue to increase mining productivity and mill throughput capacity during 2024 in preparation for production from our Stock

West project. While we work to develop our ramp access to Stock West in 2024, with completion expected by the end of 2025, we also intend

to conduct exploration activities at Stock East and Stock Main. We see operational improvements and cost savings at Stock as compared

to Froome due to the close proximity of the Stock Mill (expected savings of $7 per tonne), softer material enabling higher mill throughput,

and deposits which are not encumbered by a meaningful royalty or a stream (Froome’s 2023 stream cost estimated at $108 per ounce

produced). Exploration activities are also underway with our Grey Fox project where we see significant long-term growth potential. In

2023, cash costs(1) of $1,157 per GEO sold were higher than our annual guidance of $1,020 per GEO sold due to moving

to contractor crushing in early 2023, however AISC(1) of $1,351 per GEO sold came in below guidance of $1,465 per GEO

sold, as a result of reduced sustaining capital expenditure requirements enabled by the productivity improvements achieved by contractor

crushing.

Gold Bar, Nevada, USA

Despite weather conditions in early

2023 that led to flooding and a slowdown of production at Gold Bar, our team ramped up gold production significantly through Q4,

as planned, and achieved its annual production guidance. Cash costs(1) of $1,565 per GEO sold and AISC(1) of

$1,891 per GEO sold were 12% and 13% higher than annual guidance of $1,400 and $1,680 per GEO sold, respectively, but improved compared

to 2022 as a result of mine contractor and crushing crew productivity, as well as the expansion of our heap leach pad, which was completed

on time and on budget. Our Q4 unit costs were significantly below annual guidance at cash costs(1) of $1,253 and AISC(1) of

$1,467, and we expect similar trends during H1 2024.

San José, Santa Cruz,

Argentina(4)

San José had a difficult start

to 2023 as seen in our Q1 results. The team at San José was quick to respond by implementing operational changes that resulted

in consistent quarterly improvements to production and unit costs. This was achieved through mining and processing more tonnes containing

higher average gold and silver grades compared to Q1. As a result, San José achieved annual production of 65,800 GEOs(2) in

2023, slightly under the production guidance range of 66,000 to 74,000 GEOs(2). Annual cash costs(1) of $1,413

per GEO sold and AISC(1) of $1,840 per GEO sold remained 12% and 18% higher than guidance of $1,250 and $1,550 per GEO

sold, respectively, as a result of lower than expected metal grades. By Q4, cash costs(1) of $1,228 per GEO sold and

AISC(1) of $1,573 per GEO sold were achieved, which was in line with annual guidance. With the investment in improving

the mine plan in mid-2023 and recent exploration results indicating better than expected grades on portions of 2024 production targets,

we expect operations to continue to improve. Early 2024 production and financial results have exceeded expectations to date.

Table 1: Comparative production

and cost per oz results for Q4 and full year 2023 and 2022, and 2023 guidance:

| | |

Q4 | | |

Full year | | |

Full Year

2023 | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

Guidance

Range | |

| Consolidated Production | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gold (oz) | |

| 28,970 | | |

| 42,400 | | |

| 102,680 | | |

| 128,650 | | |

| 123,000-139,000 | |

| Silver (oz) | |

| 702,000 | | |

| 635,650 | | |

| 2,598,230 | | |

| 2,166,850 | | |

| 2,300,000-2,600,000 | |

| GEOs(2) | |

| 37,280 | | |

| 49,850 | | |

| 133,300 | | |

| 154,600 | | |

| 150,000-170,000 | |

| Gold Bar Mine, Nevada | |

| | | |

| | | |

| | | |

| | | |

| | |

| GEOs(2) | |

| 7,940 | | |

| 19,800 | | |

| 26,620 | | |

| 43,700 | | |

| 42,000-48,000 | |

| Cash

Costs/GEO(1) | |

| 1,083 | | |

| 1,345 | | |

| 1,622 | | |

| 1,565 | | |

$ | 1,400 | |

| AISC/GEO(1) | |

| 1,395 | | |

| 1,506 | | |

| 1,989 | | |

| 1,891 | | |

$ | 1,680 | |

| Fox Complex, Canada | |

| | | |

| | | |

| | | |

| | | |

| | |

| GEOs(2) | |

| 9,870 | | |

| 10,200 | | |

| 36,650 | | |

| 44,450 | | |

| 42,000-48,000 | |

| Cash

Costs/GEO(1) | |

| 1,137 | | |

| 1,253 | | |

| 1,020 | | |

| 1,157 | | |

$ | 1,000 | |

| AISC/GEO(1) | |

| 1,606 | | |

| 1,467 | | |

| 1,465 | | |

| 1,351 | | |

$ | 1,320 | |

| San

José Mine, Argentina (49%)(4) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gold production (oz) | |

| 11,170 | | |

| 11,700 | | |

| 38,610 | | |

| 39,700 | | |

| 39,000-43,000 | |

| Silver production (oz) | |

| 700,850 | | |

| 635,650 | | |

| 2,593,300 | | |

| 2,166,850 | | |

| 2,300,000-2,600,000 | |

| GEOs(2) | |

| 19,420 | | |

| 19,150 | | |

| 69,130 | | |

| 65,650 | | |

| 66,000-74,000 | |

| Cash

Costs/GEO(1) | |

$ | 1,321 | | |

$ | 1,228 | | |

$ | 1,306 | | |

$ | 1,413 | | |

$ | 1,250 | |

| AISC/GEO(1) | |

$ | 1,701 | | |

$ | 1,573 | | |

$ | 1,714 | | |

$ | 1,840 | | |

$ | 1,550 | |

Table 2: 2024 Production & Costs per

GEO Guidance

| | |

| 2024 Guidance | |

| 100% Owned Mines (Gold Bar and Fox) | |

| | |

| GEOs(2) | |

| 80,000-85,000 | |

| Cash Costs/GEO(1) | |

| $1,350-1,450 | |

| AISC/GEO(1) | |

| $1,550-1,650 | |

| Gold Bar Mine, Nevada | |

| | |

| GEOs(2) | |

| 40,000-43,000 | |

| Cash Costs/GEO(1) | |

| $1,450-1,550 | |

| AISC/GEO(1) | |

| $1,650-1,750 | |

| Fox Complex, Canada | |

| | |

| GEOs(2) | |

| 40,000-42,000 | |

| Cash Costs/GEO(1) | |

| $1,225-1,325 | |

| AISC/GEO(1) | |

| $1,450-1,550 | |

| San José Mine, Argentina (49%) | |

| | |

| GEOs(2) | |

| 50,000-60,000 | |

| Cash Costs/GEO(1) | |

| $1,300-1,500 | |

| AISC/GEO(1) | |

| $1,500-1,700 | |

Advances in Q4 2023

| · | McEwen

Copper: Financings with Stellantis and Nuton (Rio Tinto) were closed in Q4, raising ARS $42

billion and $10.0 million, respectively, at a value of $26.00 per share,

implying a market value of $800 million for McEwen Copper. Concurrently with

these transactions, McEwen Mining sold 232,000 common shares of McEwen Copper in return for

$6.0 million. After the closing of these transactions, Stellantis and Nuton own 19.4%

and 14.5%, respectively, of McEwen Copper, while the Company’s ownership decreased

to 47.7%. |

| · | Safety

at all of our operations was excellent with no lost-time incidents. |

| · | Gold

Bar: During Q4, we achieved new daily, monthly, and quarterly production records as a result

of the improvements in mining productivity, the addition of crushing crews and the completion

of the heap leach pad expansion. |

| · | Fox

Complex: We achieved the highest average daily mill throughput on record since acquisition

in 2017, reaching 1,300 tonnes per day during Q4, and are currently reviewing improvements

in 2024 to mining productivity and processing flowsheets to continue to increase throughput

levels. |

| · | In

December, the Company completed a private placement offering of 1,903,000 flow-through common

shares for gross proceeds of $16.1 million (CAD $22.0 million) to be used exclusively

to support exploration and development work at the Fox Complex, which includes the development

of the Stock ramp. |

| · | We

continue to invest heavily in exploration and the results have been most encouraging, particularly

at Los Azules, where the resource base increased by 27%, and at the Fox Complex, where

the results allow us to see the potential for significant increase in mine life at Stock

and Grey Fox. |

Financial Results

McEwen Mining ceased being the

majority owner of McEwen Copper after the October 2023 financing (moving from 51.9% to 47.7% ownership), therefore for the fourth

quarter and moving forward the Company’s financial statements no longer consolidates McEwen Copper on a 100% basis, and instead

accounts for McEwen Copper as an equity investment. As a result of the deconsolidation of McEwen Copper, we recognized a gain of

$224 million and an investment value of $384 million based on the value per share achieved in our October financing.

Notice to reader:

Under US GAAP, McEwen Mining consolidates 100% of the accounts of its fully owned and majority owned subsidiaries in its reported financial

results. Entities over which we exert significant influence but do not control (such as Minera Santa Cruz S.A. (“MSC”), the

operator of the San José mine, and McEwen Copper, the owner of the Los Azules copper project) are presented as equity investments

on our balance sheet.

Net income for full year 2023 was

$54.7 million, or $1.15 per share, compared to net loss of $81.1 million, or $1.71 per share for full year 2022. Our net

income for full year 2023 improved primarily as a result of the $224.0 million accounting gain recognized on the deconsolidation

of McEwen Copper. Net income for Q4 was $137.9 million, or $2.88 per share, compared with a net loss of $37.4 million,

or $0.79 per share for Q4 2022.

Liquidity and Capital Resources

We reported consolidated cash and

cash equivalents of $23.0 million and consolidated working capital of $22.7 million as at December 31, 2023,

compared to the respective numbers at December 31, 2022, of $39.8 million and negative $2.5 million. The reported consolidated cash

balance at December 31, 2023 does not include cash balances held by McEwen Copper given the deconsolidation recognized in Q4 2023;

while our cash and cash equivalents balance of $39.8 million included $38.1 million attributable to McEwen Copper.

During 2023, we decreased our total

debt by $25 million or 38% to $40 million and entered into the Third Amended and Restated Credit Agreement effective May 23,

2023.

The Company also holds a portfolio

of royalties including a 1.25% net smelter royalty at both our Los Azules and Elder Creek properties, together with other royalties

on properties in Nevada, Yukon, Canada and in Santa Cruz, Argentina.

Exploration

Exploration results from the Stock

deposits at the Fox Complex were published in a separate press release on February 28th. Highlights include a

31% increase in gold resources compared to 2022. Drilling in the Stock East deposit area returned high grade intersections up to 121.5

grams per tonne (3.91 oz/t) in an orientation that suggests that earlier drilling may have missed other possible high-grade occurrences.

Gold Bar exploration activities

are currently focused on discovering near mine resources. Additional drilling targets have been identified at our Pick and Cabin pits

to expand upon results from our 2023 drilling.

McEwen Copper

New metallurgical and exploration

results from Los Azules were published in news releases dated February 22nd and 26th. Metallurgical

highlights include a 76% expected average copper recovery (3.2% higher compared to the 2023 NI 43-101 Preliminary Economic Assessment

(“PEA”)) during the 27-year life of mine and 8.3% lower acid consumption, resulting in a potential increase in the project

after-tax NPV(8%) of $262 million(3). Exploration highlights included 446 m of 0.76% including 76 m of 0.92% (hole

AZ23228MET). Our 2023-2024 drilling season began in October 2023; during Q4 we completed

over 74,000 feet (22,627 meters) of drilling out of a full season target of 203,000 feet (62,000 meters). A full complement of 22 drill

rigs is operating on site to reach this target.

Confirmatory metallurgical testing

and a large drilling campaign to upgrade resources, as well as geotechnical, hydrological, and geohydrological works are well underway

to support the delivery of the feasibility study by early 2025.

We own a 47.7% interest in McEwen

Copper Inc., which holds a 100% interest in the Los Azules copper project in San Juan, Argentina, and the Elder Creek exploration project

in Nevada, USA. The last financings completed by McEwen Copper with Stellantis and Nuton (Rio Tinto) gave the Company a market value

of $800 million. This translates to $384 million for McEwen Mining shareholders’ 47.7% ownership.

Management Conference Call

Management will discuss our Q4 financial

results and project developments and follow with a question-and-answer session. Questions can be asked directly by participants over

the phone during the webcast.

Friday

Mar 1, 2024

at 10:00 AM EST |

Toll

Free (US & Canada): |

(888)

210-3454 |

| Toll Free Dial-In Other Countries: |

https://events.q4irportal.com/custom/access/2324/ |

| Toll Dial In: |

(646)

960-0130 |

| Conference ID Number: |

3232920 |

| Event

Registration Link: |

https://events.q4inc.com/attendee/876515509 |

An archived

replay of the webcast will be available approximately 2 hours following the conclusion of the live event. Access the replay on the Company’s

media page at https://www.mcewenmining.com/media.

Notes:

| 1. | Cash gross profit, cash costs per ounce,

all-in sustaining costs (AISC) per ounce, adjusted net income or loss and adjusted net income

or loss per share are non-GAAP financial performance measures with no standardized definition

under U.S. GAAP. For definition and reconciliation of the non-GAAP measures see "Non-GAAP

Financial Measures" section in this press release and the unaudited Consolidated Balance

Sheets and Consolidated Statements of Operations and Comprehensive Income below. |

| 2. | 'Gold Equivalent Ounces' are calculated

based on a gold to silver price ratio of 85:1 for Q4 2023, 83:1 for 2023, 85:1 for Q4 2022

and 84:1 for 2022. 2023 and 2024 production guidance is calculated based on 85:1 gold to

silver price ratio. |

| 3. | This disclosure should not be taken to

modify or update the conclusions of the PEA. |

| 4. | Please refer to the “Reliability

of Information Regarding San José” section in this press release. |

MCEWEN MINING INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME (LOSS)

FOR THE YEARS ENDED DECEMBER 31,

(unaudited, in thousands of U.S. dollars, except

per share amounts)

| | |

2023 | | |

2022 | | |

2021 | |

| Revenue from gold and silver sales | |

$ | 166,231 | | |

$ | 110,417 | | |

$ | 136,541 | |

| Production costs applicable to sales | |

| (119,230 | ) | |

| (91,260 | ) | |

| (119,223 | ) |

| Depreciation and depletion | |

| (29,221 | ) | |

| (19,701 | ) | |

| (23,798 | ) |

| Gross profit (loss) | |

| 17,780 | | |

| (544 | ) | |

| (6,480 | ) |

| | |

| | | |

| | | |

| | |

| OTHER OPERATING EXPENSES: | |

| | | |

| | | |

| | |

| Advanced projects - Los Azules | |

| (80,038 | ) | |

| (61,148 | ) | |

| (5,019 | ) |

| Advanced projects - Other | |

| (6,292 | ) | |

| (5,580 | ) | |

| (7,420 | ) |

| Exploration | |

| (20,167 | ) | |

| (14,973 | ) | |

| (22,604 | ) |

| General and administrative | |

| (15,449 | ) | |

| (11,890 | ) | |

| (11,435 | ) |

| Loss from investment in McEwen Copper Inc. | |

| (60,084 | ) | |

| — | | |

| — | |

| Loss (income) from investment in Minera Santa Cruz S.A.(4) | |

| (281 | ) | |

| 2,776 | | |

| (7,533 | ) |

| Depreciation | |

| (1,086 | ) | |

| (733 | ) | |

| (339 | ) |

| Reclamation and remediation | |

| (2,693 | ) | |

| (3,345 | ) | |

| (3,450 | ) |

| | |

| (186,090 | ) | |

| (94,893 | ) | |

| (57,800 | ) |

| Operating loss | |

| (168,310 | ) | |

| (95,437 | ) | |

| (64,280 | ) |

| | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE): | |

| | | |

| | | |

| | |

| Interest and other finance income (expenses), net | |

| 36,918 | | |

| (7,789 | ) | |

| (6,200 | ) |

| Other (expense) income | |

| (29,925 | ) | |

| 22,938 | | |

| 6,281 | |

| Gain on deconsolidation of McEwen Copper Inc. | |

| 224,048 | | |

| — | | |

| — | |

| Total other income | |

| 231,041 | | |

| 15,149 | | |

| 81 | |

| Income (loss) before income and mining taxes | |

| 62,731 | | |

| (80,288 | ) | |

| (64,199 | ) |

| Income and mining tax recovery (expense) | |

| (31,873 | ) | |

| (5,806 | ) | |

| 7,315 | |

| Net income (loss) after income and mining taxes | |

| 62,731 | | |

| (86,094 | ) | |

| (56,884 | ) |

| Net loss attributable to non-controlling interests | |

| 23,872 | | |

| 5,019 | | |

| 172 | |

| Net income (loss) and comprehensive income (loss) attributable

to McEwen shareholders | |

$ | 54,730 | | |

$ | (81,075 | ) | |

$ | (56,712 | ) |

| | |

| | | |

| | | |

| | |

| Net income (loss) per share: | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | 1.15 | | |

$ | (1.71 | ) | |

$ | (1.25 | ) |

| Weighted average common shares outstanding (thousands): | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 47,544 | | |

| 47,427 | | |

| 45,490 | |

MCEWEN MINING INC.

CONSOLIDATED BALANCE SHEETS AS AT DECEMBER

31,

(unaudited, in thousands of U.S. dollars and

shares)

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 23,020 | | |

$ | 39,782 | |

| Investments | |

| 1,743 | | |

| 1,295 | |

| Receivables, prepaids and other current assets | |

| 5,578 | | |

| 8,840 | |

| Due from McEwen Copper Inc. | |

| 2,376 | | |

| — | |

| Inventories, current portion | |

| 19,944 | | |

| 31,735 | |

| Total current assets | |

| 52,661 | | |

| 81,652 | |

| Mineral property interests and plant and equipment, net | |

| 170,000 | | |

| 346,281 | |

| Investment in McEwen Copper Inc. | |

| 323,884 | | |

| — | |

| Investment in Minera Santa Cruz S.A.(4) | |

| 92,875 | | |

| 93,451 | |

| Inventories | |

| 10,100 | | |

| 2,432 | |

| Restricted cash | |

| 4,490 | | |

| 3,797 | |

| Other assets | |

| 674 | | |

| 1,106 | |

| TOTAL ASSETS | |

$ | 654,684 | | |

$ | 528,719 | |

| | |

| | | |

| | |

| LIABILITIES & SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 22,656 | | |

$ | 42,521 | |

| Flow-through share premium | |

| 1,661 | | |

| 4,056 | |

| Reclamation and remediation liabilities, current portion | |

| 3,105 | | |

| 12,576 | |

| Tax liabilities | |

| 1,603 | | |

| 7,663 | |

| Lease liabilities, current portion | |

| 978 | | |

| 1,215 | |

| Long-term debt, current portion | |

| — | | |

| 10,000 | |

| Contract liability | |

| — | | |

| 6,155 | |

| Total current liabilities | |

| 30,003 | | |

| 84,186 | |

| Long-term debt | |

| 40,000 | | |

| 53,979 | |

| Reclamation and remediation liabilities | |

| 39,916 | | |

| 29,270 | |

| Deferred tax liabilities | |

| 38,586 | | |

| — | |

| Lease liabilities | |

| 488 | | |

| 1,191 | |

| Other liabilities | |

| 3,840 | | |

| 3,819 | |

| Total liabilities | |

$ | 152,833 | | |

$ | 172,445 | |

| | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | |

| Common shares | |

$ | 1,768,456 | | |

$ | 1,644,144 | |

| Non-controlling interests | |

| — | | |

| 33,465 | |

| Accumulated deficit | |

| (1,266,605 | ) | |

| (1,321,335 | ) |

| Total shareholders’ equity | |

| 501,851 | | |

| 356,274 | |

| TOTAL LIABILITIES & SHAREHOLDERS’ EQUITY | |

$ | 654,684 | | |

$ | 528,719 | |

MCEWEN MINING INC.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’

EQUITY

FOR THE YEARS ENDED DECEMBER 31,

(unaudited, in thousands of U.S. dollars and

shares)

| | |

Common Shares | | |

| | |

| | |

| |

| | |

and Additional | | |

| | |

Non- | | |

| |

| | |

Paid-in Capital | | |

Accumulated | | |

controlling | | |

| |

| | |

Shares | | |

Amount | | |

Deficit | | |

Interests | | |

Total | |

| Balance, December 31, 2020 | |

| 41,659 | | |

$ | 1,548,876 | | |

$ | (1,183,548 | ) | |

$ | — | | |

$ | 365,328 | |

| Stock-based compensation | |

| — | | |

| 837 | | |

| — | | |

| — | | |

| 837 | |

| Sale of flow-through shares | |

| 1,260 | | |

| 10,785 | | |

| — | | |

| — | | |

| 10,785 | |

| Sale of shares for cash | |

| 3,000 | | |

| 29,875 | | |

| — | | |

| — | | |

| 29,875 | |

| Issuance of equity by subsidiary | |

| — | | |

| 25,051 | | |

| — | | |

| 14,949 | | |

| 40,000 | |

| Net loss and comprehensive loss | |

| — | | |

| — | | |

| (56,712 | ) | |

| (172 | ) | |

| (56,884 | ) |

| Balance, December 31, 2021 | |

| 45,919 | | |

$ | 1,615,424 | | |

$ | (1,240,260 | ) | |

$ | 14,777 | | |

$ | 389,941 | |

| Stock-based compensation | |

| — | | |

| 340 | | |

| — | | |

| — | | |

| 340 | |

| Sale of flow-through shares | |

| 1,450 | | |

| 10,320 | | |

| — | | |

| — | | |

| 10,320 | |

| Shares issued for debt refinancing | |

| 59 | | |

| 500 | | |

| — | | |

| — | | |

| 500 | |

| Issuance of equity by subsidiary | |

| — | | |

| 17,643 | | |

| — | | |

| 23,707 | | |

| 41,350 | |

| Share repurchase | |

| — | | |

| (87 | ) | |

| — | | |

| — | | |

| (87 | ) |

| Exercise of warrants | |

| — | | |

| 4 | | |

| — | | |

| — | | |

| 4 | |

| Net loss and comprehensive loss | |

| — | | |

| — | | |

| (81,075 | ) | |

| (5,019 | ) | |

| (86,094 | ) |

| Balance, December 31, 2022 | |

| 47,428 | | |

$ | 1,644,144 | | |

$ | (1,321,335 | ) | |

$ | 33,465 | | |

$ | 356,274 | |

| Stock-based compensation | |

| 66 | | |

| 605 | | |

| — | | |

| — | | |

| 605 | |

| Restricted shares issued | |

| 43 | | |

| 366 | | |

| — | | |

| — | | |

| 366 | |

| Proceeds from McEwen Copper financing | |

| — | | |

| 109,913 | | |

| — | | |

| 75,477 | | |

| 185,390 | |

| Sale of flow-through shares | |

| 1,903 | | |

| 13,428 | | |

| — | | |

| — | | |

| 13,428 | |

| Net income (loss) and comprehensive income (loss) | |

| — | | |

| — | | |

| 54,730 | | |

| (23,872 | ) | |

| 30,858 | |

| McEwen Copper Inc. deconsolidation | |

| — | | |

| — | | |

| — | | |

| (85,070 | ) | |

| (85,070 | ) |

| Balance, December 31, 2023 | |

| 49,440 | | |

$ | 1,768,456 | | |

$ | (1,266,605 | ) | |

$ | — | | |

$ | 501,851 | |

MCEWEN MINING INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31,

(unaudited, in thousands of U.S. dollars)

| | |

Year ended December 31, | |

| | |

2023 | | |

2022 | | |

2021 | |

| Cash flows from operating activities: | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 30,858 | | |

$ | (86,094 | ) | |

$ | (56,884 | ) |

| Adjustments to reconcile net loss from operating activities: | |

| | | |

| | | |

| | |

| Loss from investment in McEwen Copper Inc. | |

| 60,084 | | |

| — | | |

| — | |

| Loss (income) from investment in Minera Santa Cruz S.A.(4) | |

| 281 | | |

| (2,776 | ) | |

| 7,533 | |

| Gain on sale of mineral property interests | |

| — | | |

| — | | |

| (2,271 | ) |

| Depreciation, amortization and depletion | |

| 30,307 | | |

| 19,532 | | |

| 25,338 | |

| Unrealized (gain) loss on investments | |

| (20,542 | ) | |

| 511 | | |

| (28 | ) |

| Foreign exchange loss on investments | |

| 9,858 | | |

| — | | |

| — | |

| Foreign exchange loss | |

| 48,977 | | |

| 2,029 | | |

| 160 | |

| Reclamation accretion and adjustments to estimate | |

| 2,693 | | |

| 7,168 | | |

| 3,677 | |

| Income and mining tax recovery | |

| 35,033 | | |

| (1,856 | ) | |

| (7,315 | ) |

| Stock-based compensation | |

| 971 | | |

| 340 | | |

| 837 | |

| Gain on deconsolidation of McEwen Copper Inc. | |

| (224,048 | ) | |

| — | | |

| — | |

| Change in non-cash working capital items: | |

| | | |

| | | |

| | |

| Change in other assets related to operations | |

| 7,113 | | |

| (12,873 | ) | |

| 7,887 | |

| Change in liabilities related to operations | |

| (24,298 | ) | |

| 17,439 | | |

| 1,003 | |

| Cash used in operating activities | |

$ | (42,713 | ) | |

$ | (56,580 | ) | |

$ | (20,063 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | |

| Additions to mineral property interests and plant and equipment | |

$ | (23,021 | ) | |

$ | (24,187 | ) | |

$ | (34,888 | ) |

| Proceeds from disposal of property and equipment | |

| — | | |

| — | | |

| 492 | |

| Investment in marketable equity securities | |

| (34,157 | ) | |

| — | | |

| — | |

| Dividends received from Minera Santa Cruz S.A. | |

| 295 | | |

| 286 | | |

| 9,832 | |

| Cash outflow on McEwen Copper Inc. deconsolidation | |

| (45,708 | ) | |

| — | | |

| — | |

| Cash used in investing activities | |

$ | (101,591 | ) | |

$ | (23,901 | ) | |

$ | (24,564 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | |

| Proceeds from McEwen Copper Inc. financing | |

| 185,390 | | |

| 41,263 | | |

| 29,875 | |

| Proceeds from sale of investment in McEwen Copper Inc. | |

| 6,032 | | |

| — | | |

| — | |

| Issuance of flow-through common shares, net of issuance costs | |

| 13,428 | | |

| 14,376 | | |

| 11,966 | |

| Proceeds from promissory note | |

| — | | |

| 15,000 | | |

| 40,000 | |

| Principal repayment on long-term debt | |

| (25,000 | ) | |

| — | | |

| — | |

| Subscription proceeds received in advance | |

| — | | |

| (2,850 | ) | |

| 2,550 | |

| Proceeds from exercise of warrants | |

| — | | |

| 4 | | |

| — | |

| Payment of finance lease obligations | |

| (1,637 | ) | |

| (2,338 | ) | |

| (3,408 | ) |

| Cash provided by financing activities | |

$ | 178,213 | | |

$ | 65,455 | | |

$ | 80,983 | |

| Effect of exchange rate change on cash and cash equivalents | |

| (48,977 | ) | |

| (2,029 | ) | |

| (160 | ) |

| (Decrease) increase in cash, cash equivalents and restricted cash | |

| (16,068 | ) | |

| (17,055 | ) | |

| 36,196 | |

| Cash, cash equivalents and restricted cash, beginning of year | |

| 43,579 | | |

| 60,634 | | |

| 24,438 | |

| Cash, cash equivalents and restricted cash, end of year | |

$ | 27,511 | | |

$ | 43,579 | | |

$ | 60,634 | |

NON-GAAP FINANCIAL PERFORMANCE MEASURES

We have included in this report certain non-GAAP

performance measures as detailed below. In the gold mining industry, these are common performance measures but do not have any standardized

meaning and are considered non-GAAP measures. We use these measures to evaluate our business on an ongoing basis and believe that, in

addition to conventional measures prepared in accordance with GAAP, certain investors use such non-GAAP measures to evaluate our performance

and ability to generate cash flow. We also report these measures to provide investors and analysts with useful information about our

underlying costs of operations and clarity over our ability to finance operations. Accordingly, they are intended to provide additional

information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

There are limitations associated with the use of such non-GAAP measures. We compensate for these limitations by relying primarily on

our US GAAP results and using the non-GAAP measures supplementally.

The non-GAAP measures are presented for our wholly

owned mines and our interest in the San José mine. The amounts in the reconciliation tables labeled “49% basis” were

derived by applying to each financial statement line item the ownership percentage interest used to arrive at our share of net income

or loss during the period when applying the equity method of accounting. We do not control the interest in or operations of MSC and the

presentations of assets and liabilities and revenues and expenses of MSC do not represent our legal claim to such items. The amount of

cash we receive is based upon specific provisions of the Option and Joint Venture Agreement (“OJVA”) and varies depending

on factors including the profitability of the operations.

The presentation of these measures, including

the minority interest in the San José, has limitations as an analytical tool. Some of these limitations include:

| · | The

amounts shown on the individual line items were derived by applying our overall economic

ownership interest percentage determined when applying the equity method of accounting and

do not represent our legal claim to the assets and liabilities, or the revenues and expenses;

and |

| · | Other

companies in our industry may calculate their cash cost per ounce and all-in sustaining costs

differently than we do, limiting the usefulness as a comparative measure. |

Cash Costs and All-In Sustaining Costs

The terms cash costs, cash cost per ounce, all-in

sustaining costs (“AISC”), and all-in sustaining cost per ounce used in this report are non-GAAP financial measures. We report

these measures to provide additional information regarding operational efficiencies on an individual mine basis, and believe these measures

provide investors and analysts with useful information about our underlying costs of operations.

Cash costs consist of mining, processing, on-site

general and administrative expenses, community and permitting costs related to current operations, royalty costs, refining and treatment

charges (for both doré and concentrate products), sales costs, export taxes and operational stripping costs, but exclude depreciation

and amortization (non-cash items). The sum of these costs is divided by the corresponding gold equivalent ounces sold to determine

a per ounce amount.

All-in sustaining costs consist of cash costs

(as described above), plus accretion of retirement obligations and amortization of the asset retirement costs related to operating sites,

environmental rehabilitation costs for mines with no reserves, sustaining exploration and development costs, sustaining capital expenditures

and sustaining lease payments. Our all-in sustaining costs exclude the allocation of corporate general and administrative costs. The

following is additional information regarding our all-in sustaining costs:

| · | Sustaining

operating costs represent expenditures incurred at current operations that are considered

necessary to maintain current annual production at the mine site and include mine development

costs and ongoing replacement of mine equipment and other capital facilities. Sustaining

capital costs do not include costs of expanding the project that would result in improved

productivity of the existing asset, increased existing capacity or extended useful life. |

| McEwen Mining Inc. | Page 10 | |

| · | Sustaining

exploration and development costs include expenditures incurred to sustain current operations

and to replace reserves and/or resources extracted as part of the ongoing production. Exploration

activity performed near-mine (brownfield) or new exploration projects (greenfield) are classified

as non-sustaining. |

The sum of all-in sustaining costs is divided

by the corresponding gold equivalent ounces sold to determine a per ounce amount.

Costs excluded from cash costs and all-in sustaining

costs, in addition to depreciation and depletion, are income and mining tax expenses, all corporate financing charges, costs related

to business combinations, asset acquisitions and asset disposal, and any items that are deducted for the purpose of normalizing items.

The following tables reconcile these non-GAAP

measures to the most directly comparable GAAP measure, production costs applicable to sales. The El Gallo mine results are excluded from

this reconciliation for 2023, 2022 and 2021 as the economics of residual leaching operations are measured by incremental revenue exceeding

incremental costs. Residual leaching costs for the year ended December 31, 2023, were $nil million compared to $0.7 million in 2022

and $9.3 million in 2021. As a result, we have ceased using cash cost and all-in sustaining cost per gold equivalent ounce to evaluate

the El Gallo mine on an ongoing basis and have therefore ceased disclosure of such metric:

| | |

Three

months ended December 31, 2023 | | |

Year

ended December 31, 2023 | |

| | |

Gold

Bar | | |

Fox

Complex | | |

Total | | |

Gold

Bar | | |

Fox

Complex | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands, except

per ounce) | | |

(in thousands, except

per ounce) | |

| Production

costs applicable to sales - Cash costs (100% owned) | |

$ | 25,889 | | |

$ | 13,298 | | |

$ | 39,187 | | |

$ | 67,335 | | |

$ | 51,895 | | |

$ | 119,230 | |

| In-mine exploration | |

| 1,705 | | |

| — | | |

| 1,705 | | |

| 4,759 | | |

| — | | |

| 4,759 | |

| Capitalized underground mine development

(sustaining) | |

| — | | |

| 2,119 | | |

| 2,119 | | |

| — | | |

| 8,046 | | |

| 8,046 | |

| Capital expenditures on plant and equipment

(sustaining) | |

| 1,374 | | |

| — | | |

| 1,374 | | |

| 9,028 | | |

| — | | |

| 9,028 | |

| Sustaining leases | |

| 11 | | |

| 153 | | |

| 164 | | |

| 248 | | |

| 676 | | |

| 924 | |

| All-in sustaining

costs | |

$ | 28,979 | | |

$ | 15,570 | | |

$ | 44,549 | | |

$ | 81,370 | | |

$ | 60,617 | | |

$ | 141,987 | |

| Ounces sold, including stream (GEO) | |

| 19.2 | | |

| 10.6 | | |

| 29.9 | | |

| 43.0 | | |

| 44.9 | | |

| 87.9 | |

| Cash cost per

ounce sold ($/GEO) | |

$ | 1,345 | | |

$ | 1,253 | | |

$ | 1,313 | | |

$ | 1,565 | | |

$ | 1,157 | | |

$ | 1,356 | |

| AISC per ounce

sold ($/GEO) | |

$ | 1,506 | | |

$ | 1,467 | | |

$ | 1,492 | | |

$ | 1,891 | | |

$ | 1,351 | | |

$ | 1,615 | |

| | |

Three months ended December 31, 2022 | | |

Year ended December 31, 2022 | |

| | |

Gold Bar | | |

Fox Complex | | |

Total | | |

Gold Bar | | |

Fox Complex | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands, except per ounce) | | |

(in thousands, except per ounce) | |

| Production costs applicable to sales - Cash costs (100% owned) | |

$ | 8,666 | | |

$ | 10,742 | | |

$ | 19,408 | | |

$ | 43,500 | | |

$ | 36,845 | | |

$ | 80,345 | |

| Mine site reclamation, accretion and amortization | |

| 218 | | |

| — | | |

| 218 | | |

| 1,654 | | |

| — | | |

| 1,654 | |

| In-mine exploration | |

| 505 | | |

| — | | |

| 505 | | |

| 3,335 | | |

| — | | |

| 3,335 | |

| Capitalized underground mine development (sustaining) | |

| — | | |

| 4,317 | | |

| 4,317 | | |

| — | | |

| 15,448 | | |

| 15,448 | |

| Capital expenditures on plant and equipment (sustaining) | |

| 1,576 | | |

| — | | |

| 1,576 | | |

| 3,084 | | |

| — | | |

| 3,084 | |

| Sustaining leases | |

| 191 | | |

| 110 | | |

| 301 | | |

| 1,754 | | |

| 619 | | |

| 2,373 | |

| All-in sustaining costs | |

$ | 11,156 | | |

$ | 15,169 | | |

$ | 26,325 | | |

$ | 53,327 | | |

$ | 52,912 | | |

$ | 106,239 | |

| Ounces sold, including stream (GEO)(1) | |

| 8.0 | | |

| 9.4 | | |

| 17.4 | | |

| 26.8 | | |

| 36.1 | | |

| 62.9 | |

| Cash cost per ounce sold ($/GEO) | |

$ | 1,083 | | |

$ | 1,137 | | |

$ | 1,112 | | |

$ | 1,622 | | |

$ | 1,020 | | |

$ | 1,276 | |

| AISC per ounce sold ($/GEO) | |

$ | 1,395 | | |

$ | 1,606 | | |

$ | 1,509 | | |

$ | 1,989 | | |

$ | 1,465 | | |

$ | 1,688 | |

| McEwen Mining Inc. | Page 11 | |

| | |

Three

months ended December 31, | | |

Year

ended December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2021 | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands, except

per ounce) | | |

| |

| San José mine cash costs (100% basis) (4) | |

| | |

| |

| Production

costs applicable to sales - Cash costs | |

$ | 48,680 | | |

$ | 51,963 | | |

$ | 180,115 | | |

$ | 182,195 | | |

$ | 196,032 | |

| Mine site reclamation, accretion and

amortization | |

| 93 | | |

| 111 | | |

| 535 | | |

| 400 | | |

| 451 | |

| Site exploration expenses | |

| 1,831 | | |

| 2,158 | | |

| 9,167 | | |

| 8,946 | | |

| 11,207 | |

| Capitalized underground mine development

(sustaining) | |

| 10,407 | | |

| 10,201 | | |

| 38,346 | | |

| 37,959 | | |

| 27,548 | |

| Less: Depreciation | |

| (768 | ) | |

| (499 | ) | |

| (2,930 | ) | |

| (1,990 | ) | |

| (1,971 | ) |

| Capital expenditures

(sustaining) | |

| 2,106 | | |

| 3,006 | | |

| 9,224 | | |

| 11,636 | | |

| 15,751 | |

| All-in sustaining

costs | |

$ | 62,349 | | |

$ | 66,940 | | |

$ | 234,457 | | |

$ | 239,146 | | |

$ | 249,018 | |

| Ounces sold (GEO) | |

| 39.6 | | |

| 39.3 | | |

| 127.5 | | |

| 139.5 | | |

| 155.3 | |

| Cash cost per

ounce sold ($/GEO) | |

$ | 1,228 | | |

$ | 1,321 | | |

$ | 1,413 | | |

$ | 1,306 | | |

| 1,262 | |

| AISC per ounce

sold ($/GEO) | |

$ | 1,573 | | |

$ | 1,701 | | |

$ | 1,840 | | |

$ | 1,714 | | |

| 1,603 | |

Technical Information

The technical content of this news release related

to financial results, mining and development projects has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen

Mining and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 "Standards

of Disclosure for Mineral Projects."

Reliability of Information Regarding San José

The Company accounts for its investment in Minera

Santa Cruz S.A., the owner of the San José Mine, using the equity method. The Company relies on the management of MSC to provide

accurate financial information prepared in accordance with GAAP. While the Company is not aware of any errors or possible misstatements

of the financial information provided by MSC, MSC is responsible for and has supplied to the Company all reported results from the San

José Mine, and such results are unaudited as of the date of this release. McEwen Mining’s joint venture partner, a subsidiary

of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy

or accuracy of this release.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking

statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s

(the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking

statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management,

are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no

assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially

from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the forward -looking statements and information include, but are not limited

to, effects of the COVID-19 pandemic, fluctuations in the market price of precious metals, mining industry risks, political, economic,

social and security risks associated with foreign operations, the ability of the Company to receive or receive in a timely manner permits

or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement

of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and

hazards, uncertainty as to calculation of mineral resources and reserves, foreign exchange volatility, foreign exchange controls, foreign

currency risk, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein,

which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information

as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on

Form 10-K for the fiscal year ended December 31, 2022, Quarterly Report on Form 10-Q for the three and six months ended

June 30, 2023, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional

information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company.

All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do

not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management

of McEwen Mining Inc.

| McEwen Mining Inc. | Page 12 | |

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 47.7% of McEwen Copper which owns the large, advanced

stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the

objective of increasing its share price and providing a yield. Rob McEwen, Chairman and Chief Owner, has a personal investment in the

group of US$220 million and takes an annual salary of US$1.

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

| |

|

|

|

|

|

|

| |

WEB SITE |

|

SOCIAL MEDIA |

|

|

|

| |

www.mcewenmining.com

|

|

McEwen

Mining |

Facebook: |

facebook.com/mcewenmining |

|

| |

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc- |

|

| |

CONTACT INFORMATION |

|

Twitter: |

twitter.com/mcewenmining |

|

| |

150

King Street West |

|

Instagram:

|

instagram.com/mcewenmining |

|

| |

Suite 2800,

PO Box 24 |

|

|

|

|

|

| |

Toronto,

ON, Canada |

|

McEwen

Copper |

Facebook: |

facebook.com/

mcewencopper |

|

| |

M5H

1J9 |

|

LinkedIn: |

linkedin.com/company/mcewencopper |

|

| |

|

|

Twitter: |

twitter.com/mcewencopper |

|

| |

Relationship

with Investors: |

|

Instagram:

|

instagram.com/mcewencopper |

|

| |

(866)-441-0690

- Toll free line |

|

|

|

|

|

| |

(647)-258-0395

|

|

Rob

McEwen |

Facebook: |

facebook.com/mcewenrob |

|

| |

Mihaela

Iancu ext. 320 |

|

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

| |

info@mcewenmining.com

|

|

Twitter:

|

twitter.com/robmcewenmux

|

|

| |

|

|

|

|

|

|

| McEwen Mining Inc. | Page 13 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

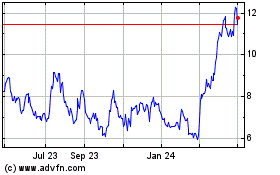

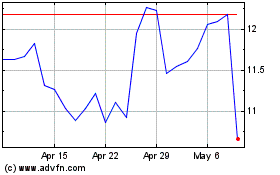

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Oct 2024 to Nov 2024

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Nov 2023 to Nov 2024