Matador Resources Company (NYSE: MTDR) (“Matador” or the

“Company”) today reported financial and record operating results

for the third quarter of 2024, increased full-year 2024 guidance

and expects to produce over 200,000 barrels of oil and natural gas

equivalent (“BOE”) per day in 2025. A short slide presentation

summarizing the highlights of Matador’s third quarter 2024 earnings

release is also included on the Company’s website at

www.matadorresources.com on the Events and Presentations page under

the Investor Relations tab.

Management Commentary

Joseph Wm. Foran, Matador’s Founder, Chairman and CEO,

commented, “Matador’s third quarter of 2024 was one of the best

quarters in Matador’s history with record production and the

closing of our largest acquisition to date. Before highlighting

these record results, I wanted to take a moment and point to one of

the factors that evidences the confidence Matador’s management

team, staff and Board of Directors have in the Company’s continuing

positive outlook over the years. Recently, The Wall Street Journal

published a front-page article noting that insider purchases of

company stock have significantly decreased in 2024 (see Slide

A). For the public record, I wish to state clearly that Matador

is not one of these companies. In fact, Matador’s executive

officers and directors have purchased approximately $1,400,000 of

Matador stock over just the last twelve months, and since the

beginning of 2021, Matador’s executive officers have made 27

separate open market purchases totaling 50,000 shares of Matador

stock for approximately $2,000,000. During that time, Matador is

not only the only company among its peers where management has

purchased more shares than management has sold but also Matador’s

executive officers have yet to sell a single share (see Slide

B). This confidence in Matador’s future extends throughout the

Company, as over 95% of Matador’s employees participate in its

Employee Stock Purchase Plan.

“Our confidence in Matador’s future is bolstered by the long

track record of success achieved by both Matador I and Matador II.

Over the last 40 years, Matador I and II have consistently grown

shareholder value regardless of structure, industry cycles or

volatility in commodity prices. Starting from scratch in 2003 with

just $6 million in beginning equity capital, Matador II has grown

to a market cap of approximately $6.5 billion. Matador now owns

nearly 200,000 net acres in the Delaware Basin, which is believed

by many to be the best basin in the United States. The Delaware

Basin is also where we have 10 to 15 years of inventory with an

average rate of return in excess of over 50% and rank among the top

producers there in both size and profitability (see Slide

C). During 2025, Matador expects to produce a record average

amount of at least 200,000 BOE per day. Furthermore, Matador

presently has over 600 million BOE in proved oil and natural gas

reserves—again a record amount and a gain of nearly 150 million BOE

over this same time period a year ago (see Slide D). Matador

can also count on a midstream business that we estimate to be worth

more than $1.5 billion net to Matador (see Slide I).

Financially, Matador maintains a strong balance sheet with over

$1.25 billion in liquidity as of September 30, 2024.

“All of these accomplishments are connected to the teamwork,

planning and execution by Matador’s Board, management, staff,

vendors, leaseholders, banks and other friends. We try to come into

work with a focus on how each of us can get better each day and how

we can help the team and the Company get better each day. This

focus has resulted in the organizational excellence that allows me

to say that our team thinks that there is still plenty of work to

do but Matador’s future has truly never been brighter.

Integration of the Ameredev

Acquisition

“One of the significant accomplishments during the third quarter

of 2024 was the closing of the Ameredev acquisition (see Slide

E). The positive benefits of this contiguous block of 33,500

net acres are already exceeding our expectations. Production from

the Ameredev assets averaged 31,500 BOE per day following the

closing of the acquisition on September 18, 2024. In fact,

production from the first seven wells turned to sales since the

effective date of the acquisition have exceeded our expectations by

over 10% and averaged 1,975 BOE per day (76% oil) during 24-hour

initial production tests.

“Similar to the acquisition of our Advance properties in 2023,

integration of the Ameredev assets is off to a great start. We

moved a drilling rig to the Ameredev acreage the weekend following

closing and this quarter we expect to implement operational

efficiencies such as ‘simul-frac’ and ‘trimul-frac’ completion

operations, dual fuel technologies and other operational

efficiencies on the Ameredev properties, which we expect to result

in synergies of approximately $160 million within the next five

years. Our production team is now operating the six existing

Ameredev facilities and is working hard to improve the lease

operating expenses elsewhere on the Ameredev assets. We expect that

these efforts could result in additional operational synergies of

over $1 million per month.

“The Ameredev acquisition included an approximate 19% equity

interest in the parent company of Piñon Midstream. Piñon recently

announced that it expects to sell to an affiliate of Enterprise

Products Partners L.P. in the fourth quarter of 2024, subject to

customary regulatory approvals. We currently expect to receive

between $110 million and $120 million from the sale of this 19%

interest. We expect to use these proceeds to repay borrowings under

our revolving credit facility and help reduce our leverage ratio

from the current level of 1.3 times to less than one times.

“The smooth integration of the Ameredev properties is the result

of the hard work, the experience and extra efforts of many office

and field personnel at Matador, Ameredev and EnCap. We are very

grateful for the professionalism of the Ameredev and EnCap teams

both before and after closing the acquisition. We thank them for

their part in making this acquisition a true win-win for all the

parties involved.

Record Production While Increasing

Efficiencies and Decreasing Costs

“During the third quarter of 2024, Matador achieved record

production on its existing properties while continuing to implement

new ways to gain additional operational efficiencies and reduce

well costs (see Slide F). Matador achieved record average

total production of 171,480 BOE per day during the third quarter of

2024, which was 5% better than our guidance. Matador’s record

average oil production of 100,315 barrels of oil per day during the

third quarter of 2024 was 3% better than our guidance.

“Notably, in the third quarter of 2023, Matador produced an

average of 135,000 BOE per day. In comparison, for the fourth

quarter of 2024, a year later, Matador’s guidance is 198,000 BOE

per day. Matador achieved a 32% increase in net cash provided by

operating activities of $610.4 million in the third quarter of

2024, as compared to net cash provided by operating activities of

$461.0 million in the third quarter of 2023. The record oil and

natural gas production during the third quarter of 2024 led to a

significant jump in Adjusted Free Cash Flow to $196.1 million for

the third quarter of 2024, which was an increase of 36% as compared

to the Adjusted Free Cash Flow of $144.6 million for the third

quarter of 2023. Matador is using this Adjusted Free Cash Flow

primarily to repay outstanding borrowings under our revolving

credit facility as well as for payment of our dividend and our

brick-by-brick acquisitions.

“Operational efficiencies, good wells and strong vendor

relationships continue to drive average well costs lower. We

currently estimate that full-year 2024 drilling and completion

costs will be improved to between $925 and $935 per completed

lateral foot, which is an 8% reduction from our original guidance

of $1,010 per completed lateral foot estimated at the first of the

year for calendar year 2024.

“Much of the efficiency savings achieved by Matador during 2024

were driven by embracing certain operational innovations occurring

in the Delaware Basin such as U-Turn wells, remote hydraulic

fracturing operations and the optimization of simul-frac and

trimul-frac completion operations. For an example of our

improvement in this regard, we expect to turn-in-line five new

U-Turn wells during the fourth quarter of 2024. In doing so, we

have successfully reduced drill cycle times on these five U-Turn

wells by 30% as compared to the U-Turn wells we turned to sales in

2023. Remote simul-frac was utilized on four of the five 2024

U-Turn wells providing additional cost savings in the completing of

these wells. The team estimated $3 million in cost savings per

U-Turn well when compared to the alternative of drilling eight

one-mile lateral length wells of equal aggregate length. The

primary driver of these savings is the elimination of four vertical

wellbores. Drilling four U-Turn wells only requires four vertical

wellbores to drill and complete eight miles of lateral length as

compared to drilling eight one-mile single-direction lateral length

wells that require eight vertical wellbores to complete eight miles

of lateral length (see Slide G).

“Building upon the successful trimul-frac pilot test in the

second quarter of 2024, Matador successfully completed two

additional trimul-frac completions in the third quarter of 2024,

including its first remote trimul-frac completion. Remote hydraulic

fracturing operations continue to increase simul-frac and

trimul-frac opportunities, which has resulted in simul-frac and

trimul-frac completions on 90 wells that otherwise would have been

completed using traditional zipper-frac completion operations.

Simul-frac operations result in savings of approximately $250,000

per well while trimul-frac operations result in savings of

approximately $350,000 per well.

“These operational efficiencies include savings generated from

the 300-plus drilling records set by our MaxCom Center assisting

the operating group. When the collective savings generated by these

efficiencies are added up, such efficiencies have resulted in total

estimated operational savings of $135 million since 2022 (see

Slide G). As a result, Matador’s tradition of drilling

better wells for less money has enabled Matador to have the highest

revenue per BOE and profit per BOE among our peers (see Slide

H).

Midstream Assets Continue to Provide

Value

“Our record results during the third quarter of 2024 were made

possible by the close coordination between our upstream and

midstream teams. Matador’s midstream business creates value by

providing flow assurance for our production in addition to the

economic benefits of owning a profitable and growing midstream

business (see Slide I). San Mateo, our midstream joint

venture, owns and operates the Black River Processing Plant, which

has a designed inlet capacity of 460 million cubic feet of natural

gas per day. Pronto, our wholly-owned midstream subsidiary, owns

and operates the Marlan Processing Plant, which has a designed

inlet capacity of 60 million cubic feet of natural gas per day. The

Black River Processing Plant and the Marlan Processing Plant had a

combined uptime of over 99% during the third quarter of 2024. This

high percentage of uptime provides reliability and flow assurance

to both Matador and third-party participants (see Slide

J).

“San Mateo also achieved record water handling volumes of

513,000 barrels per day during the third quarter of 2024 due in

part to increased volumes from our third-party participants. These

record processing and water volumes led to a 66% increase in record

San Mateo net income of $49.8 million during the third quarter of

2024 as compared to the third quarter of 2023, and a 45% increase

in record Adjusted EBITDA of $68.5 million during the third quarter

of 2024 as compared to the third quarter of 2023 (see Slide

J). Pronto’s 200 million cubic feet per day expansion of the

Marlan Processing Plant remains on track to be operational during

the first half of 2025. This new processing plant will provide

additional flow assurance and economic benefits for Matador, its

shareholders and its third-party participants.

Strong Balance Sheet

“Matador completed the Ameredev acquisition and achieved record

results during the third quarter of 2024 while continuing to

maintain a strong balance sheet. As part of the financing of the

Ameredev acquisition, we amended our credit facility to increase

the elected commitment under the revolving credit facility to $2.25

billion and provide for a term loan of $250 million. Shortly after

the Ameredev acquisition closed on September 18, 2024, Matador

opportunistically issued $750 million of 6.25% senior notes to

repay the term loan and a portion of the borrowings under the

revolving credit facility (see Slide K). We believe the

issuance of these notes was extremely successful as it was more

than three times oversubscribed and was essentially debt neutral

for Matador as it did not materially add to Matador’s debt but

instead merely extended the term. At September 30, 2024, Matador

had $955 million outstanding under its revolving credit facility

with a leverage ratio of 1.3 times. Matador expects to return to a

leverage ratio of 1.0 times or less by the middle of 2025 at

current oil and natural gas prices, expected operating results and

the anticipated proceeds to us from the sale of Piñon

Midstream.

Dividend Increase

“Last week, in light of our progress on various fronts and our

outlook going forward, our Board of Directors increased our fixed

quarterly dividend by 25% to $0.25 per quarter, or $1.00 per share

on an annual basis, from the prior dividend of $0.20 per quarter

(see Slide L). This was the fifth dividend increase in four

years and is further evidence of the confidence of the Board and

our senior staff in Matador’s future. Since 2021, Matador has

doubled the value of its assets and returned $230 million in

dividends to its shareholders.

Looking Ahead to 2025 Operational

Flexibility

“Matador expects continued records and consistently improving

operational execution in 2025. We anticipate that average total

production will exceed 200,000 BOE per day (60% oil) during 2025

with our current nine rig program (see Slide M).

Importantly, we have positioned Matador to be able to modify our

drilling program without material costs to Matador if oil prices

were to substantially decrease or to increase activity if other

appealing opportunities should arise. Please also see our growing

and improving environmental work in our 2023 Sustainability Report,

which is available on request. Nevertheless, we have hedged

approximately 30% to 40% of our oil production through June 2025 to

protect our balance sheet and ensure that we can continue to return

value to our shareholders. Historically, Matador has often made its

greatest operational progress during difficult times, and we

believe we are well positioned to make such progress again if that

situation occurs.

Closing Thoughts

“Matador’s Board, management and staff remain optimistic about

the future of the oil and natural gas business as well as Matador’s

opportunities for continued success. The quality of our acreage in

the Delaware Basin, our differentiated midstream business, our

experienced and proven staff, our consistent execution over 40

years and our financial stability all make Matador an inviting

investment (see Slide N). We have come a long way from

starting Matador I in 1983 with $270,000 in beginning equity

capital and from starting Matador II in 2003 with beginning equity

capital of only $6 million. According to The Dallas Morning News’

most recent list of the 50 largest public companies in Dallas,

Matador has grown to be the largest exploration and production

public company in Dallas and the 17th most profitable public

company across all industries in the Dallas-Fort Worth area in 2023

(see Slide O). Today, we have assets valued at over $11

billion and fully expect to continue in the coming years our

history of profitable growth at a measured pace (see Slide

P). Matador looks forward to finishing the year on a strong

note and to delivering another year of continued strong

organizational performance and results.”

Third Quarter 2024 Matador Operational and Financial

Highlights (for comparisons to prior periods, please see the

remainder of this press release)

- Average production of 171,480 BOE per day (100,315 barrels of

oil per day)

- Net cash provided by operating activities of $610.4

million

- Adjusted free cash flow of $196.1 million

- Net income of $248.3 million, or $1.99 per diluted common

share

- Adjusted net income of $236.0 million, or adjusted earnings of

$1.89 per diluted common share

- Adjusted EBITDA of $574.5 million

- San Mateo net income of $49.8 million

- San Mateo Adjusted EBITDA of $68.5 million

- Drilling, completing and equipping (“D/C/E”) capital

expenditures of $329.9 million

- Midstream capital expenditures of $48.9 million

All references to Matador’s net income, adjusted net income,

Adjusted EBITDA and adjusted free cash flow reported throughout

this earnings release are those values attributable to Matador

Resources Company shareholders after giving effect to any net

income, adjusted net income, Adjusted EBITDA or adjusted free cash

flow, respectively, attributable to third-party non-controlling

interests, including in San Mateo Midstream, LLC (“San Mateo”).

Matador owns 51% of San Mateo. For a definition of adjusted net

income, adjusted earnings per diluted common share, Adjusted EBITDA

and adjusted free cash flow and reconciliations of such non-GAAP

financial metrics to their comparable GAAP metrics, please see

“Supplemental Non-GAAP Financial Measures” below.

Full-Year 2024 Guidance Update

Effective October 22, 2024, Matador increased its full-year 2024

guidance range for total oil and natural gas equivalent production,

oil production and natural gas production as set forth in the table

below. This increased production guidance includes expected

production from Matador’s acquisition of a subsidiary of Ameredev

II Parent, LLC (“Ameredev”).

In addition, Matador’s operations team continues to reduce

drilling and completion times, which has allowed Matador to advance

completion operations for 11 wells on its Firethorn and Pimento

acreage that was acquired in the Ameredev acquisition into the

fourth quarter of 2024, as opposed to completing most of these

wells in the first quarter of 2025. Accelerating these completions

should allow Matador to make more capital-efficient use of its

stimulation crews that will enable Matador to turn to sales these

additional wells in January 2025, which is two to three months

earlier than previously expected. In addition, Matador optimized

its drill schedule during 2024 and now expects to turn to sales

101.9 net operated wells for full-year 2024 as compared to its

prior expectation of 97.9 net operated wells turned to sales during

full-year 2024. As a result of accelerating the completion of the

11 additional wells and the 4.0 additional net operated wells

expected to be turned to sales in 2024, Matador increased its

full-year 2024 capital expenditure guidance range by $50 million as

set forth in the table below.

Production

Prior Full-Year 2024

Guidance Range

New Full-Year 2024

Guidance Range

Difference(1)

Total, BOE per day

158,500 to 163,500

167,500 to 172,500

+6%

Oil, Bbl per day

93,500 to 96,500

98,500 to 101,500

+5%

Natural Gas, MMcf per day

390.0 to 402.0

414.0 to 426.0

+6%

D/C/E CapEx(2)

$1.10 to $1.30 billion

$1.15 to $1.35 billion

+4%

Midstream CapEx(3)

$200 to $250 million

$200 to $250 million

No Change

Total CapEx

$1.30 to $1.55 billion

$1.35 to $1.60 billion

+4%

(1)

The midpoint of guidance provided on

October 22, 2024 as compared to the midpoint of guidance provided

on July 23, 2024.

(2)

Capital expenditures associated with

drilling, completing and equipping wells.

(3)

Includes Matador’s share of estimated

capital expenditures for San Mateo and other wholly-owned midstream

projects, including projects competed by Pronto. Excludes the

acquisition cost of Ameredev’s midstream assets.

Operational and Financial Update

Third Quarter 2024

Record Oil, Natural Gas and Total Oil and

Natural Gas Equivalent Production

As summarized in the table below, Matador’s total oil and

natural gas production averaged 171,480 BOE per day in the third

quarter of 2024, which was a 7% sequential production increase from

an average of 160,305 BOE per day in the second quarter of 2024 and

a 27% year-over-year increase from an average of 135,096 BOE per

day in the third quarter of 2023. The increase in total average

production is due to better-than-expected initial production from

new wells drilled by Matador during the third quarter of 2024 in

addition to continued strong performance of our existing wells,

especially the 21 gross (19 net) Dagger Lake South wells that were

acquired as part of the Advance acquisition in 2023 and turned to

sales in the second quarter of 2024. These factors resulted in

Matador’s total oil and natural gas production during the third

quarter of 2024 exceeding Matador’s guidance expectations by

5%.

Production

Q3 2024 Average

Daily Volume

Q3 2024

Guidance Range(1)

Difference(2)

Sequential(3)

YoY(4)

Total, BOE per day

171,480

163,000 to 165,000

+5% Better than Guidance

+7%

+27%

Oil, Bbl per day

100,315

96,500 to 97,500

+3% Better than Guidance

+5%

+29%

Natural Gas, MMcf per day

427.0

399.0 to 405.0

+6% Better than Guidance

+10%

+24%

(1)

Production range previously projected, as

provided on July 23, 2024.

(2)

As compared to midpoint of guidance

provided on July 23, 2024.

(3)

Represents sequential percentage change

from the second quarter of 2024.

(4)

Represents year-over-year percentage

change from the third quarter of 2023.

Third Quarter 2024 Realized Commodity

Prices

The following table summarizes Matador’s realized commodity

prices during the third quarter of 2024, as compared to the second

quarter of 2024 and the third quarter of 2023.

Sequential (Q3 2024 vs. Q2

2024)

YoY (Q3 2024 vs. Q3 2023)

Realized Commodity Prices

Q3 2024

Q2 2024

Sequential

Change(1)

Q3 2024

Q3 2023

YoY

Change(2)

Oil Prices, per Bbl

$75.67

$81.20

-7%

$75.67

$82.49

-8%

Natural Gas Prices, per Mcf

$1.83

$2.00

-9%

$1.83

$3.56

-49%

(1)

Third quarter 2024 as compared to second

quarter 2024.

(2)

Third quarter 2024 as compared to third

quarter 2023.

Third Quarter 2024

Expenses

Matador’s lease operating expenses (“LOE”) increased 1%

sequentially from $5.42 per BOE in the second quarter of 2024 to

$5.50 per BOE in the third quarter of 2024. This increase is due in

part to increased repair and maintenance costs in the third quarter

of 2024 and costs related to operating the Ameredev properties

after closing the transaction on September 18, 2024, partially

offset by increased production. Due to the historically higher LOE

per BOE on the Ameredev properties, Matador expects the fourth

quarter 2024 LOE to be between $5.75 to $6.25 per BOE. As a result,

Matador narrowed its expected range for full-year 2024 LOE to $5.55

to $5.75 per BOE from its previously expected and announced range

of $5.25 to $5.75 per BOE. Matador anticipates reducing the

historically higher LOE per BOE on the Ameredev properties in the

fourth quarter of 2024 and into 2025.

Matador’s general and administrative (“G&A”) expenses

decreased 5% sequentially from $1.91 per BOE in the second quarter

of 2024 to $1.82 per BOE in the third quarter of 2024, which was a

record low for Matador. This decrease is due in part to increased

production volumes and a decrease in the value of certain employee

stock awards that are settled in cash, which are measured at each

quarterly reporting period. The value of these cash-settled stock

awards decreased due to the 17% decrease in Matador’s share price

from $59.60 at the end of the second quarter of 2024 to $49.42 at

the end of the third quarter of 2024. As of October 22, 2024,

Matador expects full-year 2024 G&A expenses to be between $1.80

and $2.00 per BOE, below its previous expected and announced range

of $2.00 to $2.50 per BOE.

Matador’s depletion, depreciation and amortization expense

decreased 1% sequentially from $15.49 per BOE in the second quarter

of 2024 to $15.39 per BOE in the third quarter of 2024. This

decrease was primarily due to cost savings in Matador’s D/C/E

capital expenditures discussed below, which were offset by the

impacts of the purchase price of Ameredev. Due to the favorable

impact of the Ameredev purchase price, Matador expects depletion,

depreciation and amortization expense in the fourth quarter of 2024

to be between $15.75 and $16.25 per BOE, which is less than our

prior expectations for these expenses in the fourth quarter of

2024. As a result, Matador is lowering its full-year 2024 guidance

range from $15.75 to $16.75 per BOE to $15.50 to $15.90 per

BOE.

Third Quarter 2024 Capital

Expenditures

Matador’s D/C/E capital expenditures of $329.9 million for the

third quarter of 2024 were approximately $20 million lower than

expected due to cost savings that were the result of the

operational efficiencies and teamwork noted above. Midstream

capital expenditures of $48.9 million for the third quarter of 2024

were below Matador’s expectations of $55 million in total midstream

capital expenditures for the quarter, as approximately $6 million

in capital expenditures was deferred due to the timing of Pronto’s

midstream projects.

Q3 2024 Capital Expenditures

($ millions)

Actual

Guidance(1)

Difference vs. Guidance(2)

D/C/E

$329.9

$350.0

-6%

Midstream(3)

$48.9

$55.0

-11%

(1)

Midpoint of guidance as provided on July

23, 2024.

(2)

As compared to the midpoint of guidance

provided on July 23, 2024.

(3)

Excludes the acquisition cost of

Ameredev’s midstream assets.

Midstream Update

San Mateo’s operations in the third quarter of 2024 were

highlighted by better-than-expected operating and financial

results. These strong results primarily reflect

better-than-expected volumes delivered by Matador and third-party

customers into the San Mateo system. San Mateo’s net income of

$49.8 million and Adjusted EBITDA of $68.5 million were each

quarterly records.

The table below sets forth San Mateo’s throughput volumes, as

compared to the second quarter of 2024 and the third quarter of

2023.

Sequential (Q3 2024 vs. Q2

2024)

YoY (Q3 2024 vs. Q3 2023)

San Mateo Throughput Volumes

Q3 2024

Q2 2024

Change(1)

Q3 2024

Q3 2023

Change(2)

Natural gas gathering, MMcf per day

431

393

+10%

431

350

+23%

Natural gas processing, MMcf per day

460

355

+30%

460

385

+19%

Oil gathering and transportation, Bbl per

day

52,300

46,300

+13%

52,300

40,200

+30%

Produced water handling, Bbl per day

513,200

429,800

+19%

513,200

354,000

+45%

(1)

Third quarter 2024 as compared to second

quarter 2024.

(2)

Third quarter 2024 as compared to third

quarter 2023.

Fourth Quarter 2024 Estimates

Fourth Quarter 2024

Estimated Oil, Natural Gas and Total Oil

Equivalent Production Growth

As noted in the table below, Matador anticipates its average

daily oil equivalent production of 171,480 BOE per day in the third

quarter of 2024 to grow by 15% to a midpoint of approximately

198,000 BOE per day in the fourth quarter of 2024. This production

growth is a result of the production associated with the Ameredev

acquisition as well as continued strong results from Matador’s

existing assets.

Q3 and Q4 2024 Production

Comparison

Period

Average Daily

Total Production,

BOE per day

Average Daily

Oil Production,

Bbl per day

Average Daily

Natural Gas Production,

MMcf per day

% Oil

Q3 2024

171,480

100,315

427.0

59%

Q4 2024E

197,000 to 199,000

118,500 to 119,500

472.0 to 476.0

60%

Fourth Quarter 2024 Estimated Wells

Turned to Sales

At October 22, 2024, Matador expects to turn to sales 33 gross

(26.9 net) operated horizontal wells in the Delaware Basin during

the fourth quarter of 2024, consisting of 24 gross (21.0 net) wells

in the Antelope Ridge asset area and nine gross (5.9 net) wells in

the Rustler Breaks asset area.

Fourth Quarter 2024 Estimated Capital

Expenditures

Matador is currently operating nine drilling rigs in the

Delaware Basin and expects to operate nine drilling rigs for the

remainder of 2024. Matador elected to accelerate the completion of

11 additional wells on the newly acquired Ameredev properties and

expects 4.0 additional net operated wells to be turned to sales in

2024 on other properties. Due to this accelerated timing

difference, Matador increased its full-year 2024 capital

expenditure guidance range by $50 million. At October 22, 2024,

Matador expects D/C/E capital expenditures for the fourth quarter

of 2024 will be approximately $205 to $305 million, which is still

a 23% decrease as compared to $329.9 million for the third quarter

of 2024. Matador estimates its proportionate share of midstream

capital expenditures (over 90% allocated to Pronto) to be

approximately $42 to $62 million in the fourth quarter of 2024,

which is a 6% increase as compared to $48.9 million in the third

quarter of 2024 due to the construction schedule of Pronto’s new

processing plant, which is on time and on budget.

Improved Estimate and Outlook for 2024

Cash Taxes

Matador recognized a current tax benefit of $21.1 million during

the third quarter of 2024 and is lowering its expected cash tax

payments from 5% to 10% of pre-tax book net income to 1% to 5% of

pre-tax book net income for the year ending December 31, 2024. This

improvement is due to the additional tax deductions related to the

preliminary estimate of the allocation of value acquired as part of

the Ameredev acquisition. In addition, the Company anticipates that

it will not be subject to the Corporate Alternative Minimum Tax in

2025 based upon estimated qualifying taxable income for 2024.

Conference Call Information

The Company will host a live conference call on Wednesday,

October 23, 2024, at 10:00 a.m. Central Time to review its third

quarter 2024 operational and financial results. To access the live

conference call by phone, you can use the following link

https://register.vevent.com/register/BI7913e6f5b9e94b8b9b83dc122a0d4273

and you will be provided with dial in details. To avoid delays, it

is recommended that participants dial into the conference call 15

minutes ahead of the scheduled start time.

The live conference call will also be available through the

Company’s website at www.matadorresources.com on the Events and

Presentations page under the Investor Relations tab. The replay for

the event will be available on the Company’s website at

www.matadorresources.com on the Events and Presentations page under

the Investor Relations tab for one year.

About Matador Resources Company

Matador is an independent energy company engaged in the

exploration, development, production and acquisition of oil and

natural gas resources in the United States, with an emphasis on oil

and natural gas shale and other unconventional plays. Its current

operations are focused primarily on the oil and liquids-rich

portion of the Wolfcamp and Bone Spring plays in the Delaware Basin

in Southeast New Mexico and West Texas. Matador also operates in

the Eagle Ford shale play in South Texas and the Haynesville shale

and Cotton Valley plays in Northwest Louisiana. Additionally,

Matador conducts midstream operations in support of its

exploration, development and production operations and provides

natural gas processing, oil transportation services, natural gas,

oil and produced water gathering services and produced water

disposal services to third parties.

For more information, visit Matador Resources Company at

www.matadorresources.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. “Forward-looking statements” are statements related to

future, not past, events. Forward-looking statements are based on

current expectations and include any statement that does not

directly relate to a current or historical fact. In this context,

forward-looking statements often address expected future business

and financial performance, and often contain words such as “could,”

“believe,” “would,” “anticipate,” “intend,” “estimate,” “expect,”

“may,” “should,” “continue,” “plan,” “predict,” “potential,”

“project,” “hypothetical,” “forecasted” and similar expressions

that are intended to identify forward-looking statements, although

not all forward-looking statements contain such identifying words.

Such forward-looking statements include, but are not limited to,

statements about the anticipated benefits, opportunities and

results with respect to the Ameredev acquisition, guidance,

projected or forecasted financial and operating results, future

liquidity, the payment of dividends, results in certain basins,

objectives, project timing, expectations and intentions, regulatory

and governmental actions and other statements that are not

historical facts. Actual results and future events could differ

materially from those anticipated in such statements, and such

forward-looking statements may not prove to be accurate. These

forward-looking statements involve certain risks and uncertainties,

including, but not limited to, disruption from the Company’s

acquisitions, including the Ameredev acquisition, making it more

difficult to maintain business and operational relationships;

significant transaction costs associated with the Company’s

acquisitions, including the Ameredev acquisition; the risk of

litigation and/or regulatory actions related to the Company’s

acquisitions, including the Ameredev acquisition, as well as the

following risks related to financial and operational performance:

general economic conditions; the Company’s ability to execute its

business plan, including whether its drilling program is

successful; changes in oil, natural gas and natural gas liquids

prices and the demand for oil, natural gas and natural gas liquids;

its ability to replace reserves and efficiently develop current

reserves; the operating results of the Company’s midstream oil,

natural gas and water gathering and transportation systems,

pipelines and facilities, the acquiring of third-party business and

the drilling of any additional salt water disposal wells; costs of

operations; delays and other difficulties related to producing oil,

natural gas and natural gas liquids; delays and other difficulties

related to regulatory and governmental approvals and restrictions;

impact on the Company’s operations due to seismic events; its

ability to make acquisitions on economically acceptable terms; its

ability to integrate acquisitions, including the Ameredev

acquisition; availability of sufficient capital to execute its

business plan, including from future cash flows, available

borrowing capacity under its revolving credit facilities and

otherwise; the operating results of and the availability of any

potential distributions from our joint ventures; weather and

environmental conditions; and the other factors that could cause

actual results to differ materially from those anticipated or

implied in the forward-looking statements. For further discussions

of risks and uncertainties, you should refer to Matador’s filings

with the Securities and Exchange Commission (“SEC”), including the

“Risk Factors” section of Matador’s most recent Annual Report on

Form 10-K and any subsequent Quarterly Reports on Form 10-Q.

Matador undertakes no obligation to update these forward-looking

statements to reflect events or circumstances occurring after the

date of this press release, except as required by law, including

the securities laws of the United States and the rules and

regulations of the SEC. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. All forward-looking statements

are qualified in their entirety by this cautionary statement.

Selected Financial and Operating

Items

Sequential and year-over-year quarterly

comparisons of selected financial and operating items are shown in

the following table:

Three Months Ended

September 30,

2024

June 30,

2024

September 30,

2023

Net Production Volumes:(1)

Oil (MBbl)(2)

9,229

8,689

7,133

Natural gas (Bcf)(3)

39.3

35.4

31.8

Total oil equivalent (MBOE)(4)

15,776

14,588

12,429

Average Daily Production Volumes:(1)

Oil (Bbl/d)(5)

100,315

95,488

77,529

Natural gas (MMcf/d)(6)

427.0

388.9

345.4

Total oil equivalent (BOE/d)(7)

171,480

160,305

135,096

Average Sales Prices:

Oil, without realized derivatives (per

Bbl)

$

75.67

$

81.20

$

82.49

Oil, with realized derivatives (per

Bbl)

$

75.67

$

81.20

$

82.49

Natural gas, without realized derivatives

(per Mcf)(8)

$

1.83

$

2.00

$

3.56

Natural gas, with realized derivatives

(per Mcf)

$

1.94

$

2.11

$

3.34

Revenues (millions):

Oil and natural gas revenues

$

770.2

$

776.3

$

701.5

Third-party midstream services

revenues

$

38.3

$

32.7

$

29.9

Realized gain (loss) on derivatives

$

4.5

$

3.8

$

(7.0

)

Operating Expenses (per BOE):

Production taxes, transportation and

processing

$

4.61

$

5.27

$

5.77

Lease operating

$

5.50

$

5.42

$

5.34

Plant and other midstream services

operating

$

2.77

$

2.55

$

2.48

Depletion, depreciation and

amortization

$

15.39

$

15.49

$

15.51

General and administrative(9)

$

1.82

$

1.91

$

2.55

Total(10)

$

30.09

$

30.64

$

31.65

Other (millions):

Net sales of purchased natural gas(11)

$

20.4

$

11.0

$

2.7

Net income (millions)(12)

$

248.3

$

228.8

$

263.7

Earnings per common share

(diluted)(12)

$

1.99

$

1.83

$

2.20

Adjusted net income (millions)(12)(13)

$

236.0

$

255.9

$

223.4

Adjusted earnings per common share

(diluted)(12)(14)

$

1.89

$

2.05

$

1.86

Adjusted EBITDA (millions)(12)(15)

$

574.5

$

578.1

$

508.3

Net cash provided by operating activities

(millions)(16)

$

610.4

$

592.9

$

461.0

Adjusted free cash flow

(millions)(12)(17)

$

196.1

$

167.0

$

144.6

San Mateo net income (millions)(18)

$

49.8

$

38.3

$

29.9

San Mateo Adjusted EBITDA

(millions)(15)(18)

$

68.5

$

58.0

$

47.1

San Mateo net cash provided by operating

activities (millions)(18)

$

50.5

$

48.1

$

36.5

San Mateo adjusted free cash flow

(millions)(16)(17)(18)

$

47.6

$

35.2

$

10.7

D/C/E capital expenditures (millions)

$

329.9

$

314.5

$

296.0

Midstream capital expenditures

(millions)(19)

$

48.9

$

45.3

$

41.7

(1)

Production volumes reported in two

streams: oil and natural gas, including both dry and liquids-rich

natural gas.

(2)

One thousand barrels of oil.

(3)

One billion cubic feet of natural gas.

(4)

One thousand barrels of oil equivalent,

estimated using a conversion ratio of one barrel of oil per six

thousand cubic feet of natural gas.

(5)

Barrels of oil per day.

(6)

Millions of cubic feet of natural gas per

day.

(7)

Barrels of oil equivalent per day,

estimated using a conversion ratio of one barrel of oil per six

thousand cubic feet of natural gas.

(8)

Per thousand cubic feet of natural

gas.

(9)

Includes approximately $0.27, $0.40 and

$0.37 per BOE of non-cash, stock-based compensation expense in the

third quarter of 2024, the second quarter of 2024 and the third

quarter of 2023, respectively.

(10)

Total does not include the impact of

purchased natural gas or immaterial accretion expenses.

(11)

Net sales of purchased natural gas reflect

those natural gas purchase transactions that the Company

periodically enters into with third parties whereby the Company

purchases natural gas and (i) subsequently sells the natural gas to

other purchasers or (ii) processes the natural gas at either the

San Mateo or Pronto cryogenic natural gas processing plants and

subsequently sells the residue natural gas and natural gas liquids

to other purchasers. Such amounts reflect revenues from sales of

purchased natural gas of $51.7 million, $46.3 million and $40.3

million less expenses of $31.2 million, $35.2 million and $37.6

million in the third quarter of 2024, the second quarter of 2024

and the third quarter of 2023, respectively.

(12)

Attributable to Matador Resources Company

shareholders.

(13)

Adjusted net income is a non-GAAP

financial measure. For a definition of adjusted net income and a

reconciliation of adjusted net income (non-GAAP) to net income

(GAAP), please see “Supplemental Non-GAAP Financial Measures.”

(14)

Adjusted earnings per diluted common share

is a non-GAAP financial measure. For a definition of adjusted

earnings per diluted common share and a reconciliation of adjusted

earnings per diluted common share (non-GAAP) to earnings per

diluted common share (GAAP), please see “Supplemental Non-GAAP

Financial Measures.”

(15)

Adjusted EBITDA is a non-GAAP financial

measure. For a definition of Adjusted EBITDA and a reconciliation

of Adjusted EBITDA (non-GAAP) to net income (GAAP) and net cash

provided by operating activities (GAAP), please see “Supplemental

Non-GAAP Financial Measures.”

(16)

As reported for each period on a

consolidated basis, including 100% of San Mateo’s net cash provided

by operating activities.

(17)

Adjusted free cash flow is a non-GAAP

financial measure. For a definition of adjusted free cash flow and

a reconciliation of adjusted free cash flow (non-GAAP) to net cash

provided by operating activities (GAAP), please see “Supplemental

Non-GAAP Financial Measures.”

(18)

Represents 100% of San Mateo’s net income,

Adjusted EBITDA, net cash provided by operating activities or

adjusted free cash flow for each period reported.

(19)

Includes Matador’s share of estimated

capital expenditures for San Mateo and other wholly-owned midstream

projects, including projects completed by Pronto. Excludes the

acquisition cost of Ameredev’s midstream assets in 2024.

Matador Resources Company and

Subsidiaries

CONDENSED CONSOLIDATED BALANCE SHEETS -

UNAUDITED

(In thousands, except par value and share

data)

September 30,

2024

December 31,

2023

ASSETS

Current assets

Cash

$

23,277

$

52,662

Restricted cash

53,746

53,636

Accounts receivable

Oil and natural gas revenues

297,757

274,192

Joint interest billings

255,724

163,660

Other

52,656

35,102

Derivative instruments

25,697

2,112

Lease and well equipment inventory

34,119

41,808

Prepaid expenses and other current

assets

104,210

92,700

Total current assets

847,186

715,872

Property and equipment, at cost

Oil and natural gas properties, full-cost

method

Evaluated

12,035,981

9,633,757

Unproved and unevaluated

1,757,034

1,193,257

Midstream properties

1,617,007

1,318,015

Other property and equipment

45,676

40,375

Less accumulated depletion, depreciation

and amortization

(5,910,029

)

(5,228,963

)

Net property and equipment

9,545,669

6,956,441

Other assets

Equity method investment

115,000

—

Derivative instruments

2,336

558

Other long-term assets

113,100

54,125

Total other assets

230,436

54,683

Total assets

$

10,623,291

$

7,726,996

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities

Accounts payable

$

114,206

$

68,185

Accrued liabilities

474,238

365,848

Royalties payable

224,554

161,983

Amounts due to affiliates

28,321

28,688

Advances from joint interest owners

55,059

19,954

Other current liabilities

69,577

40,617

Total current liabilities

965,955

685,275

Long-term liabilities

Borrowings under Credit Agreement

955,000

500,000

Borrowings under San Mateo Credit

Facility

526,000

522,000

Senior unsecured notes payable

2,115,229

1,184,627

Asset retirement obligations

119,392

87,485

Deferred income taxes

784,475

581,439

Other long-term liabilities

61,030

38,482

Total long-term liabilities

4,561,126

2,914,033

Shareholders’ equity

Common stock - $0.01 par value,

160,000,000 shares authorized; 124,895,537 and 119,478,282 shares

issued; and 124,813,565 and 119,458,674 shares outstanding,

respectively

1,249

1,194

Additional paid-in capital

2,498,678

2,133,172

Retained earnings

2,373,732

1,776,541

Treasury stock, at cost, 81,972 and 19,608

shares, respectively

(3,029

)

(45

)

Total Matador Resources Company

shareholders’ equity

4,870,630

3,910,862

Non-controlling interest in

subsidiaries

225,580

216,826

Total shareholders’ equity

5,096,210

4,127,688

Total liabilities and shareholders’

equity

$

10,623,291

$

7,726,996

Matador Resources Company and

Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME - UNAUDITED

(In thousands, except per share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenues

Oil and natural gas revenues

$

770,155

$

701,527

$

2,249,974

$

1,792,353

Third-party midstream services

revenues

38,316

29,931

103,324

86,517

Sales of purchased natural gas

51,666

40,329

147,377

106,481

Realized gain (loss) on derivatives

4,528

(6,975

)

8,573

(6,454

)

Unrealized gain (loss) on derivatives

35,118

7,482

25,364

(8,244

)

Total revenues

899,783

772,294

2,534,612

1,970,653

Expenses

Production taxes, transportation and

processing

72,737

71,697

219,702

189,174

Lease operating

86,808

66,395

242,133

171,845

Plant and other midstream services

operating

43,695

30,808

120,576

92,510

Purchased natural gas

31,222

37,641

105,894

93,192

Depletion, depreciation and

amortization

242,821

192,794

681,066

496,633

Accretion of asset retirement

obligations

1,657

1,218

4,259

2,709

General and administrative

28,787

31,731

86,353

80,879

Total expenses

507,727

432,284

1,459,983

1,126,942

Operating income

392,056

340,010

1,074,629

843,711

Other income (expense)

Net loss on impairment

—

—

—

(202

)

Interest expense

(36,169

)

(35,408

)

(111,717

)

(85,813

)

Other income (expense)

2,111

(11,614

)

567

5,289

Total other expense

(34,058

)

(47,022

)

(111,150

)

(80,726

)

Income before income taxes

357,998

292,988

963,479

762,985

Income tax provision (benefit)

Current

(21,096

)

8,958

26,280

8,958

Deferred

106,417

5,631

203,805

119,609

Total income tax provision

85,321

14,589

230,085

128,567

Net income

272,677

278,399

733,394

634,418

Net income attributable to non-controlling

interest in subsidiaries

(24,386

)

(14,660

)

(62,605

)

(42,883

)

Net income attributable to Matador

Resources Company shareholders

$

248,291

$

263,739

$

670,789

$

591,535

Earnings per common share

Basic

$

1.99

$

2.21

$

5.45

$

4.97

Diluted

$

1.99

$

2.20

$

5.44

$

4.93

Weighted average common shares

outstanding

Basic

124,814

119,147

123,107

119,121

Diluted

124,983

120,081

123,358

120,045

Matador Resources Company and

Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS - UNAUDITED

(In thousands)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Operating activities

Net income

$

272,677

$

278,399

$

733,394

$

634,418

Adjustments to reconcile net income to net

cash provided by operating activities

Unrealized (gain) loss on derivatives

(35,118

)

(7,482

)

(25,364

)

8,244

Depletion, depreciation and

amortization

242,821

192,794

681,066

496,633

Accretion of asset retirement

obligations

1,657

1,218

4,259

2,709

Stock-based compensation expense

4,279

4,556

10,091

10,777

Deferred income tax provision

106,417

5,631

203,805

119,609

Amortization of debt issuance cost and

other debt-related costs

2,700

2,101

12,286

4,996

Other non-cash changes

(363

)

15,696

(1,027

)

14

Changes in operating assets and

liabilities

Accounts receivable

(20,818

)

(52,983

)

(75,904

)

3,424

Lease and well equipment inventory

(1,207

)

(2,986

)

(8,587

)

(10,223

)

Prepaid expenses and other current

assets

(398

)

(17,693

)

(78

)

(41,817

)

Other long-term assets

3,231

(803

)

3,075

1,269

Accounts payable, accrued liabilities and

other current liabilities

31,100

46,923

45,932

18,691

Royalties payable

19,071

12,570

52,882

22,655

Advances from joint interest owners

(1,380

)

(25,962

)

35,105

(30,941

)

Income taxes payable

(15,794

)

10,550

(1,948

)

8,873

Other long-term liabilities

1,562

(1,559

)

2,939

150

Net cash provided by operating

activities

610,437

460,970

1,671,926

1,249,481

Investing activities

Drilling, completion and equipping capital

expenditures

(293,716

)

(315,957

)

(905,431

)

(855,468

)

Acquisition of Advance

—

—

—

(1,608,427

)

Acquisition of Ameredev

(1,735,964

)

—

(1,831,214

)

—

Acquisition of oil and natural gas

properties

(65,717

)

(64,689

)

(321,827

)

(120,586

)

Midstream capital expenditures

(61,988

)

(42,738

)

(219,189

)

(75,609

)

Expenditures for other property and

equipment

(3,186

)

(486

)

(3,957

)

(2,964

)

Proceeds from sale of assets

—

279

900

730

Net cash used in investing activities

(2,160,571

)

(423,591

)

(3,280,718

)

(2,662,324

)

Financing activities

Repayments of borrowings under Credit

Agreement

(1,360,000

)

(432,000

)

(3,080,000

)

(2,622,000

)

Borrowings under Credit Agreement

2,220,000

402,000

3,535,000

3,152,000

Repayments of borrowings under San Mateo

Credit Facility

(57,000

)

(32,000

)

(193,000

)

(140,000

)

Borrowings under San Mateo Credit

Facility

71,000

47,000

197,000

150,000

Cost to amend credit facilities

(14,512

)

—

(25,936

)

(8,645

)

Proceeds from issuance of senior unsecured

notes

750,000

—

1,650,000

494,800

Cost to issue senior unsecured notes

(10,452

)

(248

)

(26,073

)

(8,503

)

Purchase of senior unsecured notes

—

—

(699,191

)

—

Proceeds from issuance of common stock

—

—

344,663

—

Cost to issue equity

—

—

(2,566

)

—

Dividends paid

(24,851

)

(17,780

)

(73,598

)

(53,465

)

Contributions related to formation of San

Mateo

12,250

9,000

22,500

23,700

Contributions from non-controlling

interest owners of less-than-wholly-owned subsidiaries

—

—

19,110

24,500

Distributions to non-controlling interest

owners of less-than-wholly-owned subsidiaries

(22,785

)

(16,660

)

(72,961

)

(61,103

)

Taxes paid related to net share settlement

of stock-based compensation

(79

)

(43

)

(14,519

)

(22,833

)

Other

(317

)

(312

)

(912

)

(764

)

Net cash provided by (used in) financing

activities

1,563,254

(41,043

)

1,579,517

927,687

Change in cash and restricted cash

13,120

(3,664

)

(29,275

)

(485,156

)

Cash and restricted cash at beginning of

period

63,903

65,838

106,298

547,330

Cash and restricted cash at end of

period

$

77,023

$

62,174

$

77,023

$

62,174

Supplemental Non-GAAP Financial Measures

Adjusted EBITDA

This press release includes the non-GAAP financial measure of

Adjusted EBITDA. Adjusted EBITDA is a supplemental non-GAAP

financial measure that is used by management and external users of

the Company’s consolidated financial statements, such as securities

analysts, investors, lenders and rating agencies. “GAAP” means

Generally Accepted Accounting Principles in the United States of

America. The Company believes Adjusted EBITDA helps it evaluate its

operating performance and compare its results of operations from

period to period without regard to its financing methods or capital

structure. The Company defines, on a consolidated basis and for San

Mateo, Adjusted EBITDA as earnings before interest expense, income

taxes, depletion, depreciation and amortization, accretion of asset

retirement obligations, property impairments, unrealized derivative

gains and losses, non-recurring transaction costs for certain

acquisitions, certain other non-cash items and non-cash stock-based

compensation expense and net gain or loss on asset sales and

impairment. Adjusted EBITDA is not a measure of net income or net

cash provided by operating activities as determined by GAAP. All

references to Matador’s Adjusted EBITDA are those values

attributable to Matador Resources Company shareholders after giving

effect to Adjusted EBITDA attributable to third-party

non-controlling interests, including in San Mateo.

Adjusted EBITDA should not be considered an alternative to, or

more meaningful than, net income or net cash provided by operating

activities as determined in accordance with GAAP or as an indicator

of the Company’s operating performance or liquidity. Certain items

excluded from Adjusted EBITDA are significant components of

understanding and assessing a company’s financial performance, such

as a company’s cost of capital and tax structure. Adjusted EBITDA

may not be comparable to similarly titled measures of another

company because all companies may not calculate Adjusted EBITDA in

the same manner. The following table presents the calculation of

Adjusted EBITDA and the reconciliation of Adjusted EBITDA to the

GAAP financial measures of net income and net cash provided by

operating activities, respectively, that are of a historical

nature. Where references are pro forma, forward-looking,

preliminary or prospective in nature, and not based on historical

fact, the table does not provide a reconciliation. The Company

could not provide such reconciliation without undue hardship

because such Adjusted EBITDA numbers are estimations,

approximations and/or ranges. In addition, it would be difficult

for the Company to present a detailed reconciliation on account of

many unknown variables for the reconciling items, including future

income taxes, full-cost ceiling impairments, unrealized gains or

losses on derivatives and gains or losses on asset sales and

impairment. For the same reasons, the Company is unable to address

the probable significance of the unavailable information, which

could be material to future results.

Adjusted EBITDA – Matador Resources

Company

Three Months Ended

September 30,

June 30,

September 30,

(In thousands)

2024

2024

2023

Unaudited Adjusted EBITDA

Reconciliation to Net Income:

Net income attributable to Matador

Resources Company shareholders

$

248,291

$

228,769

$

263,739

Net income attributable to non-controlling

interest in subsidiaries

24,386

18,758

14,660

Net income

272,677

247,527

278,399

Interest expense

36,169

35,986

35,408

Total income tax provision

85,321

77,986

14,589

Depletion, depreciation and

amortization

242,821

225,934

192,794

Accretion of asset retirement

obligations

1,657

1,329

1,218

Unrealized (gain) loss on derivatives

(35,118

)

11,829

(7,482

)

Non-cash stock-based compensation

expense

4,279

2,974

4,556

Expense related to contingent

consideration and other

243

2,933

11,895

Consolidated Adjusted EBITDA

608,049

606,498

531,377

Adjusted EBITDA attributable to

non-controlling interest in subsidiaries

(33,565

)

(28,425

)

(23,102

)

Adjusted EBITDA attributable to Matador

Resources Company shareholders

$

574,484

$

578,073

$

508,275

Three Months Ended

September 30,

June 30,

September 30,

(In thousands)

2024

2024

2023

Unaudited Adjusted EBITDA

Reconciliation to Net Cash Provided by Operating

Activities:

Net cash provided by operating

activities

$

610,437

$

592,927

$

460,970

Net change in operating assets and

liabilities

(15,367

)

(50,841

)

31,943

Interest expense, net of non-cash

portion

33,469

31,044

33,307

Current income tax (benefit) provision

(21,096

)

30,104

8,958

Other non-cash and non-recurring expense

(income)

606

3,264

(3,801

)

Adjusted EBITDA attributable to

non-controlling interest in subsidiaries

(33,565

)

(28,425

)

(23,102

)

Adjusted EBITDA attributable to Matador

Resources Company shareholders

$

574,484

$

578,073

$

508,275

Adjusted EBITDA – San Mateo

(100%)

Three Months Ended

September 30,

June 30,

September 30,

(In thousands)

2024

2024

2023

Unaudited Adjusted EBITDA

Reconciliation to Net Income:

Net income

$

49,768

$

38,285

$

29,917

Depletion, depreciation and

amortization

9,514

9,237

8,821

Interest expense

9,116

9,189

8,325

Accretion of asset retirement

obligations

101

99

84

Non-recurring expense

—

1,200

—

Adjusted EBITDA

$

68,499

$

58,010

$

47,147

Three Months Ended

September 30,

June 30,

September 30,

(In thousands)

2024

2024

2023

Unaudited Adjusted EBITDA

Reconciliation to Net Cash Provided by Operating

Activities:

Net cash provided by operating

activities

$

50,496

$

48,052

$

36,483

Net change in operating assets and

liabilities

9,164

(154

)

2,588

Interest expense, net of non-cash

portion

8,839

8,912

8,076

Non-recurring expense

—

1,200

—

Adjusted EBITDA

$

68,499

$

58,010

$

47,147

Adjusted Net Income and Adjusted Earnings

Per Diluted Common Share

This press release includes the non-GAAP financial measures of

adjusted net income and adjusted earnings per diluted common share.

These non-GAAP items are measured as net income attributable to

Matador Resources Company shareholders, adjusted for dollar and per

share impact of certain items, including unrealized gains or losses

on derivatives, the impact of full cost-ceiling impairment charges,

if any, and non-recurring transaction costs for certain

acquisitions or other non-recurring income or expense items, along

with the related tax effect for all periods. This non-GAAP

financial information is provided as additional information for

investors and is not in accordance with, or an alternative to, GAAP

financial measures. Additionally, these non-GAAP financial measures

may be different than similar measures used by other companies. The

Company believes the presentation of adjusted net income and

adjusted earnings per diluted common share provides useful

information to investors, as it provides them an additional

relevant comparison of the Company’s performance across periods and

to the performance of the Company’s peers. In addition, these

non-GAAP financial measures reflect adjustments for items of income

and expense that are often excluded by securities analysts and

other users of the Company’s financial statements in evaluating the

Company’s performance. The table below reconciles adjusted net

income and adjusted earnings per diluted common share to their most

directly comparable GAAP measure of net income attributable to

Matador Resources Company shareholders.

Three Months Ended

September 30,

June 30,

September 30,

2024

2024

2023

(In thousands, except per share data)

Unaudited Adjusted Net Income and

Adjusted Earnings Per Share Reconciliation to Net

Income:

Net income attributable to Matador

Resources Company shareholders

$

248,291

$

228,769

$

263,739

Total income tax provision

85,321

77,986

14,589

Income attributable to Matador Resources

Company shareholders before taxes

333,612

306,755

278,328

Less non-recurring and unrealized charges

to income before taxes:

Unrealized (gain) loss on derivatives

(35,118

)

11,829

(7,482

)

Expense related to contingent

consideration and other

243

5,359

11,895

Adjusted income attributable to Matador

Resources Company shareholders before taxes

298,737

323,943

282,741

Income tax expense(1)

62,735

68,028

59,376

Adjusted net income attributable to

Matador Resources Company shareholders (non-GAAP)

$

236,002

$

255,915

$

223,365

Weighted average shares outstanding -

basic

124,814

124,786

119,147

Dilutive effect of options and restricted

stock units

169

110

934

Weighted average common shares outstanding

- diluted

124,983

124,896

120,081

Adjusted earnings per share attributable

to Matador Resources Company shareholders (non-GAAP)

Basic

$

1.89

$

2.05

$

1.87

Diluted

$

1.89

$

2.05

$

1.86

(1) Estimated using federal statutory tax

rate in effect for the period.

Adjusted Free Cash Flow

This press release includes the non-GAAP financial measure of

adjusted free cash flow. This non-GAAP item is measured, on a

consolidated basis for the Company and for San Mateo, as net cash

provided by operating activities, adjusted for changes in working

capital and cash performance incentives that are not included as

operating cash flows, less cash flows used for capital

expenditures, adjusted for changes in capital accruals. On a

consolidated basis, these numbers are also adjusted for the cash

flows related to non-controlling interest in subsidiaries that

represent cash flows not attributable to Matador shareholders.

Adjusted free cash flow should not be considered an alternative to,

or more meaningful than, net cash provided by operating activities

as determined in accordance with GAAP or an indicator of the

Company’s liquidity. Adjusted free cash flow is used by the

Company, securities analysts and investors as an indicator of the

Company’s ability to manage its operating cash flow, internally

fund its D/C/E capital expenditures, pay dividends and service or

incur additional debt, without regard to the timing of settlement

of either operating assets and liabilities or accounts payable

related to capital expenditures. Additionally, this non-GAAP

financial measure may be different than similar measures used by

other companies. The Company believes the presentation of adjusted

free cash flow provides useful information to investors, as it

provides them an additional relevant comparison of the Company’s

performance, sources and uses of capital associated with its

operations across periods and to the performance of the Company’s

peers. In addition, this non-GAAP financial measure reflects

adjustments for items of cash flows that are often excluded by

securities analysts and other users of the Company’s financial

statements in evaluating the Company’s cash spend.

The table below reconciles adjusted free cash flow to its most

directly comparable GAAP measure of net cash provided by operating

activities. All references to Matador’s adjusted free cash flow are

those values attributable to Matador shareholders after giving

effect to adjusted free cash flow attributable to third-party

non-controlling interests, including in San Mateo.

Adjusted Free Cash Flow - Matador

Resources Company

Three Months Ended

September 30,

June 30,

September 30,

(In thousands)

2024

2024

2023

Net cash provided by operating

activities

$

610,437

$

592,927

$

460,970

Net change in operating assets and

liabilities

(15,367

)

(50,841

)

31,943

San Mateo discretionary cash flow

attributable to non-controlling interest in subsidiaries(1)

(29,233

)

(23,470

)

(19,145

)

Performance incentives received from Five

Point

12,250

8,750

9,000

Total discretionary cash flow

578,087

527,366

482,768

Drilling, completion and equipping capital

expenditures

293,716

375,076

315,957

Midstream capital expenditures

61,988

52,115

42,738

Expenditures for other property and

equipment

3,186

545

486

Net change in capital accruals

28,940

(61,168

)

(7,104

)

San Mateo accrual-based capital

expenditures related to non-controlling interest in

subsidiaries(2)

(5,890

)

(6,220

)

(13,908

)

Total accrual-based capital

expenditures(3)

381,940

360,348

338,169

Adjusted free cash flow

$

196,147

$

167,018

$

144,599

(1)

Represents Five Point Energy LLC’s (“Five

Point”) 49% interest in San Mateo discretionary cash flow, as

computed below.

(2)

Represents Five Point’s 49% interest in

accrual-based San Mateo capital expenditures, as computed

below.

(3)

Represents drilling, completion and

equipping costs, Matador’s share of San Mateo capital expenditures

plus 100% of other midstream capital expenditures not associated

with San Mateo.

Adjusted Free Cash Flow - San Mateo

(100%)

Three Months Ended

September 30,

June 30,

September 30,

(In thousands)

2024

2024

2023

Net cash provided by San Mateo operating

activities

$

50,496

$

48,052

$

36,483

Net change in San Mateo operating assets

and liabilities

9,164

(154

)

2,588

Total San Mateo discretionary cash

flow

59,660

47,898

39,071

San Mateo capital expenditures

14,037

11,215

22,812

Net change in San Mateo capital

accruals

(2,017

)

1,479

5,571

San Mateo accrual-based capital

expenditures

12,020

12,694

28,383

San Mateo adjusted free cash flow

$

47,640

$

35,204

$

10,688

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022553401/en/

Mac Schmitz Senior Vice President - Investor Relations (972)

371-5225 investors@matadorresources.com

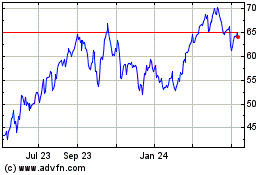

Matador Resources (NYSE:MTDR)

Historical Stock Chart

From Oct 2024 to Nov 2024

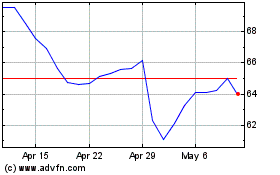

Matador Resources (NYSE:MTDR)

Historical Stock Chart

From Nov 2023 to Nov 2024