Current Report Filing (8-k)

November 21 2022 - 5:08PM

Edgar (US Regulatory)

LENNAR CORP /NEW/ false 0000920760 0000920760 2022-11-17 2022-11-17 0000920760 us-gaap:CommonStockMember 2022-11-17 2022-11-17 0000920760 us-gaap:CommonClassBMember 2022-11-17 2022-11-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

November 17, 2022

Date of Report (Date of earliest event reported)

LENNAR CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-11749 |

|

95-4337490 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

5505 Blue Lagoon Drive, Miami, Florida 33126

(Address of principal executive offices) (Zip Code)

(305) 559-4000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, par value $.10 |

|

LEN |

|

New York Stock Exchange |

| Class B Common Stock, par value $.10 |

|

LEN.B |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Throughout 2022, we received feedback from extensive outreach to our shareholders to obtain their suggestions for changes to our executive compensation programs. We also consulted with an independent compensation advisor to obtain additional input. Based on this feedback, on November 17, 2022, the Compensation Committee (the “Committee”) of the Board of Directors of Lennar Corporation (the “Company”) approved the significant changes noted below to the fiscal 2022 executive compensation programs for each of Stuart Miller, the Company’s Executive Chairman, Rick Beckwitt, the Company’s Co-Chief Executive Officer and Co-President, and Jonathan Jaffe, the Company’s Co-Chief Executive Officer and Co-President.

SUMMARY

The Company expects to deliver record earnings in fiscal 2022. Notwithstanding these results, the Committee has established new 2022 compensation programs for Messrs. Miller, Beckwitt, and Jaffe as follows:

| |

• |

|

Total compensation for each of the executive officers for fiscal 2022 is expected to be reduced approximately 11-12% from total compensation earned for fiscal 2021. |

| |

• |

|

Short-term cash incentives will be a lower percentage of total compensation. Additionally, such incentives will be subject to a maximum annual payout cap set as a dollar amount. |

| |

• |

|

Long-term equity incentives will be a higher percentage of total compensation. Long-term equity incentives include both time-based shares and performance shares. The mix between time-based shares and performance shares will be weighted more heavily towards performance shares. The time-based shares vest over three years and the performance shares are based on three years of performance. |

| |

• |

|

The performance shares target will be increased, requiring even greater performance relative to our peer group. |

|

|

|

| WHAT WE HEARD FROM OUR SHAREHOLDERS |

|

CHANGES FOR FISCAL 2022 |

| • Evaluate total executive compensation relative to peers. |

|

• Total compensation for our two Co-CEOs for fiscal 2022 will be reduced approximately 12% from total compensation for fiscal 2021. • Target total compensation for each CEO is approximately $30 million • Total Executive Chairman compensation for fiscal 2022 will be reduced approximately 11% from total compensation for fiscal 2021. • Target total compensation is approximately $34 million |

|

|

| • Short-term cash incentives should be a lower percentage of total compensation, and long-term equity incentives should be a higher percentage of total compensation. Suggested incentive pay mix: 30% cash / 70% equity. |

|

• The incentive pay mix will be targeted at approximately 20% cash / 80% equity. • The increased equity percentage will provide even greater alignment with shareholders. |

|

|

| • Short-term cash incentive bonuses should be subject to a maximum annual payout cap set as a dollar amount. |

|

• Short-term cash incentive bonus for each Co-CEO will be capped at $6 million. • Short-term cash incentive bonus for our Executive Chairman will be capped at $7 million. |

|

|

| • Long-term equity incentives should be more heavily weighted towards performance shares versus time-based shares. Suggested weighting: 40% time-based shares / 60% performance shares. |

|

• The total value of long-term equity incentives will be weighted with a target of approximately 35% in value of time-based shares and 65% in value of performance shares to be accomplished by issuing additional performance shares. • The increase in the performance share allocation will provide even greater alignment with shareholders. |

|

|

| • Performance shares target award payouts should only be provided in connection with outperformance versus peers, which provides a stronger link between executive pay and Company performance. Target should be greater than 50th percentile. Suggested target: 55th percentile. |

|

• Performance shares target award payouts will be increased to the 60th percentile. • The increase in the performance target goals (for gross profit percentage, return on tangible capital, and total shareholder returns) to the 60th percentile relative to those in our peer group will further strengthen the alignment between executive pay and Company performance. |

Earlier in the year, the Committee authorized the establishment of a bonus pool to be funded by reductions in executive cash bonuses that would provide additional compensation to Associates at the lower end of the Company’s compensation levels. Based on the significant changes in cash bonus compensation described above that we are implementing in response to shareholder and independent compensation advisor feedback, combined with the recognition of challenging market conditions throughout fiscal 2022, the Company decided against establishing the bonus pool. Rather, the Company adjusted compensation upward throughout the year for certain Associates at the lower end of the Company’s compensation levels to reward and ensure the retention of the Company’s valued Associates. These adjustments provided more immediate benefits to the Associates in a highly inflationary period.

The Amended and Restated 2022 Award Agreements under the Company’s 2016 Incentive Compensation Plan, as amended and restated (“Incentive Plan”), and the Form of the Amended and Restated 2022 Award Agreement under the Company’s 2016 Equity Incentive Plan, as amended and restated (“Equity Plan”), are attached as exhibits to this filing and are incorporated by reference herein. In addition, the Form of the 2022 Award Agreement under the Equity Plan under which Mr. Miller, Mr. Beckwitt and Mr. Jaffe were granted target awards of 89,064, 77,470, and 77,470 shares of Class A common stock, respectively, that are subject to performance-based vesting conditions, is attached as an exhibit to this filing and is incorporated by reference herein.

Forward-Looking Statements. Some of the statements in this Form 8-K are “forward-looking statements,” as that term is defined in the Private Securities Litigation Reform Act of 1995, including statements regarding the Company’s earnings in fiscal 2022. These forward-looking statements are subject to risks, uncertainties and assumptions. Accordingly, these forward-looking statements should be evaluated with consideration given to the many risks and uncertainties that could cause actual results and events to differ materially from those in the forward-looking statements. They include the risks detailed in the Company’s filings with the Securities and Exchange Commission, including the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2021. We do not undertake any obligation to update forward-looking statements, whether as a result of new information, future events or otherwise.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: November 21, 2022 |

|

|

|

|

|

Lennar Corporation |

|

|

|

|

|

|

|

|

By: |

|

/s/ Diane Bessette |

|

|

|

|

Name: |

|

Diane Bessette |

|

|

|

|

Title: |

|

Vice President, Chief Financial Officer and Treasurer |

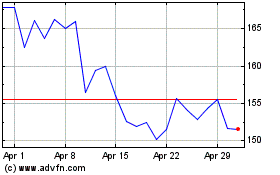

Lennar (NYSE:LEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lennar (NYSE:LEN)

Historical Stock Chart

From Jul 2023 to Jul 2024