Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 05 2024 - 6:10AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number 1-14926

KT Corporation

(Translation of registrant’s name into English)

90, Buljeong-ro,

Bundang-gu,

Seongnam-si,

Gyeonggi-do,

Korea

(Address of

principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| Dated: November 5, 2024 |

| KT Corporation |

|

|

| By: |

|

/s/ Youngkyoon Yun |

| Name: Youngkyoon Yun |

| Title: Vice President |

|

|

| By: |

|

/s/ Sanghyun Cho |

| Name: Sanghyun Cho |

| Title: Director |

Corporate Value-Up Plan

|

|

|

This disclosure may include predictive information and is subject to change. Actual results may differ from the predictions.

This disclosure may include predictive information and is subject to change. Actual results may differ from the predictions. |

| |

|

| 1. Title |

|

KT Corporate Value-Up Plan |

| |

|

| 2. Details |

|

[FY2028 Target]

- FY2028 Consolidated ROE of 9%~10%

[Action Plan]

-Transform into AICT Company: Increase AI/IT revenue by 3 times compared to 2023

- Increase Profitability: Achieve consolidated operating profit margin of 9% by FY2028 through revamping

business structure based on profitability - Liquidate Non-Core

Assets: Increase resources for capital allocation through liquidating idle real estate assets and non-core investment portfolio

- Enhance Capital Efficiency: Buyback and cancel a total of KRW 1 trillion worth of treasury shares from FY2025

to FY2028 |

| |

|

| 3. Date of Determination |

|

November 5, 2024 |

| |

|

| 4. Other Important Information Relevant to Investment Decision |

|

- Please refer to the ‘KT Corporate Value-Up Plan’ uploaded on

the KT website (http://corp.kt.com) for detailed information. - The ‘Consolidated ROE’

mentioned in ‘2. Details’ above refers to ‘Return on Equity’, and is calculated by dividing the net income by equity (attributable to the owners of the controlling company)

- The ‘2. Details’ above and ‘KT Corporate Value-Up

Plan’ uploaded on the website are subject to change based on market conditions. - The ‘3. Date of

Determination’ above refers to the date of the Board resolution. |

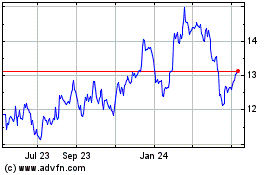

KT (NYSE:KT)

Historical Stock Chart

From Dec 2024 to Jan 2025

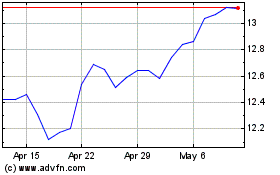

KT (NYSE:KT)

Historical Stock Chart

From Jan 2024 to Jan 2025