0001492691false00014926912021-12-062021-12-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________________________________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2024

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

Knight-Swift Transportation Holdings Inc.

(Exact name of registrant as specified in its charter)

___________________________________________________________________________________________________________________________________

| | | | | | | | | | | | | | | | | |

| Delaware | | 001-35007 | | 20-5589597 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

2002 West Wahalla Lane

Phoenix, Arizona 85027

(Address of principal executive offices and zip code)

(602) 269-2000

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

| | | | | | | | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock $0.01 Par Value | | KNX | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| ITEM 7.01 | REGULATION FD DISCLOSURE |

On July 30, 2024, Knight-Swift Transportation Holdings Inc. issued a press release announcing the acquisition by one of its wholly owned subsidiaries of the operating assets and assumption of certain liabilities of the non-union regional less-than-truckload ("LTL") division of Dependable Highway Express, Inc. based in Los Angeles, California. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item 7.01.

| | | | | |

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description |

| | |

Exhibit 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

The information contained in Items 7.01 and 9.01 of this Current Report, including the exhibits hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The information contained in this Current Report and the exhibits hereto may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. Such statements are made based on the current beliefs and expectations of Knight-Swift's management and are subject to significant risks and uncertainties. Actual results or events may differ from those anticipated by the forward-looking statements. Please refer to the paragraphs at the end of the attached press release, as well as various disclosures by Knight-Swift in its press releases, stockholder reports, and filings with the Securities and Exchange Commission for information concerning risks, uncertainties, and other factors that may affect future results.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | Knight-Swift Transportation Holdings Inc. |

| | | | (Registrant) |

| | | | | |

| Date: | July 30, 2024 | | /s/ Andrew Hess |

| | | | Andrew Hess |

| | | | Chief Financial Officer |

KNIGHT-SWIFT TRANSPORTATION ACQUIRES REGIONAL LTL CARRIER DEPENDABLE HIGHWAY EXPRESS

PHOENIX, ARIZONA – July 30, 2024 – Effective July 30, 2024, Knight-Swift Transportation Holdings Inc. (NYSE: KNX) ("Knight-Swift" or the “Company”) acquired the operating assets and assumed certain liabilities of the non-union regional less-than-truckload (“LTL”) division ("DHE") of Dependable Highway Express, Inc. ("Dependable"), based in Los Angeles, California. The acquisition is expected to be immediately accretive to Knight-Swift’s earnings per share.

Knight-Swift CEO, Adam Miller, commented, “We are excited to take the next step toward building a nationwide LTL business, and especially to grow our network to include the key Southwest markets of California, Arizona, and Nevada. This transaction increases our LTL terminal and door counts by approximately 10% and brings our network’s coverage of the US population to approximately 70%. The strategic value of acquiring a strong Southwest competitor like DHE is meaningful given the impact to our coverage area significantly expands the customers we can serve as well as the difficulty of building or acquiring LTL facilities in many of these locations. DHE will connect with our existing AAA Cooper and MME businesses to provide seamless coast-to-coast service to our customers.

“I want to welcome the DHE employees to the Knight-Swift family and look forward to working together to deliver creative solutions and excellent service to even more customers. Coupling the proud DHE brand with our resources, network, and scale should represent expanded opportunities for employees and enhanced offerings for customers. We are grateful for the efforts of many at Knight-Swift, AAA Cooper, and DHE who have worked to bring this transaction to fruition and who will continue to work together to ensure a smooth transition for all employees and customers.”

Dependable CEO Ronald Massman added, "The entire Massman family is immensely proud of the legacy built by the DHE LTL team and thankful for their efforts over our many years in business. While we never intended to sell the division, we have watched with admiration as Knight-Swift set about building a leading national LTL business. When the Company approached us about a transaction, we immediately saw the strategic merit of the Dependable LTL division joining the platform. Additionally, we felt the entire Knight-Swift organization epitomized our core values of Integrity, Service and Diversity in every way. We could not have asked for a better steward of the business and look forward to watching the combined LTL business grow from here."

Financial terms were not disclosed. The Company estimates that DHE generated approximately $122 million in total operating revenue over the past twelve months with an operating margin of approximately 10%. The DHE associates and assets will operate as a separate brand under the AAA Cooper corporate group. Joe Finney served as Chief Operating Officer of DHE prior to the transaction and will continue leading DHE as its President after the transaction. Scudder Law served as legal advisor to Knight-Swift. Houlihan Lokey served as financial advisor to Dependable, and Proskauer served as legal advisor to Dependable.

About Dependable Supply Chain Services

Prior to the transaction, Dependable's LTL division operated within the broader integrated services offering of Dependable Supply Chain Services, an affiliated group of asset-based third-party logistics providers founded over 70 years ago by the Massman family. The LTL division serves its customers through a network of facilities located across California, Arizona, and Nevada, and has developed a strong reputation for integrity, reliability and diversity. Dependable will continue to operate its full truckload, warehousing and distribution, harbor drayage and third-party logistics businesses under its existing Dependable Supply Chain Services branding.

About Knight-Swift

Knight-Swift Transportation Holdings Inc. is one of North America's largest and most diversified freight transportation companies, providing multiple truckload transportation, less-than-truckload, logistics, and business services to the shipping and transportation sectors. Knight-Swift uses a nationwide network of business units and terminals in the United States and Mexico to serve customers throughout North America. In addition to operating the country's largest tractor fleet, Knight-Swift also contracts with third-party equipment providers to provide a broad range of services to its customers while creating quality driving jobs for driving associates and successful business opportunities for independent contractors.

Contacts

Adam Miller, CEO, Andrew Hess, CFO, or Brad Stewart, Treasurer and SVP

(602) 606-6349

Forward Looking Statements

This communication contains “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 that provides a safe harbor for forward-looking statements, including statements relating to the completion of the transaction, all statements that do not relate solely to historical or current facts, and expectations, intentions or strategies regarding the future. These forward-looking statements are generally denoted by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “aim,” “target,” “plan,” “continue,” “estimate,” “project,” “may,” “will,” “should,” “could,” “would,” “predict,” “potential,” “ongoing,” “goal,” “can,” “seek,” “designed,” “likely,” “foresee,” “forecast,” “project,” “hope,” “strategy,” “objective,” “mission,” “continue,” “outlook,” “potential,” “feel,” and similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Statements in this announcement that are forward looking may include, but are not limited to, statements regarding the benefits of the transaction with DHE, including statements regarding expected impacts on Knight-Swift’s LTL network and relationships with customers and employees, expected synergies and revenue opportunities, anticipated future operating performance and results of Knight-Swift, including statements regarding anticipated earnings. By their nature, all forward-looking statements are not guarantees of future performance or results and are subject to risks and uncertainties that are difficult to predict and/or quantify. Such risks and uncertainties include, but are not limited to: the risk that there may be unexpected costs, charges or expenses resulting from the transaction; risks related to the ability of Knight-Swift to successfully integrate the businesses and achieve the expected synergies and operating efficiencies within the expected timeframes or at all and the possibility that such integration may be more difficult, time consuming or costly than expected; risks that the transaction disrupts Knight-Swift’s current plans and operations; risks related to disruption of each company’s management’s time and attention from ongoing business operations due to the integration;

continued and sufficient availability of capital; the risk that the transaction could have an adverse effect on the ability of Knight-Swift to retain and hire key personnel, to retain customers and to maintain relationships with its business partners, suppliers and customers and on its respective operating results and businesses generally; the risk associated with assumed liabilities including related litigation, and of future litigation related to the transaction, including the effects of any outcomes related thereto; risks related to changes in accounting standards or tax rates, laws or regulations; risks related to unpredictable and severe or catastrophic events, including but not limited to acts of terrorism, war or hostilities (including effects of the conflict in Ukraine), cyber-attacks, or the impact of any pandemic, epidemic or outbreak of an infectious disease in the United States or worldwide on Knight-Swift’s business, financial condition and results of operations, as well as the response thereto by the Company; and other business effects, including the effects of industry, market, economic (including the effect of inflation), political or regulatory conditions. Also, Knight-Swift’s actual results may differ materially from those contemplated by the forward-looking statements for a number of additional reasons as described in Knight-Swift’s SEC filings, including those set forth in the Risk Factors section and under any “Forward-Looking Statements” or similar heading in Knight-Swift’s most recently filed Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024, and Current Reports on Form 8-K.

You are cautioned not to place undue reliance on Knight-Swift’s forward-looking statements. Knight-Swift’s forward-looking statements are and will be based upon management’s then-current views and assumptions regarding Knight-Swift’s transaction with DHE, future events and operating performance, and are applicable only as of the dates of such statements. Knight-Swift does not assume any duty to update or revise forward-looking statements, whether as a result of new information, future events, uncertainties or otherwise.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

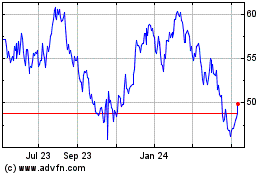

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From Oct 2024 to Nov 2024

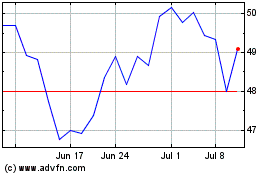

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From Nov 2023 to Nov 2024