SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2024

Commission File Number: 001-13382

KINROSS GOLD CORPORATION

(Translation of registrant's name into English)

17th Floor, 25 York Street

Toronto, Ontario M5J 2V5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form

20-F o Form 40-F ý

EXPLANATORY NOTE

This Current Report on Form 6-K, dated November 5, 2024, is being furnished

for the sole purpose of providing a copy of the Consolidated Financial Statements and Management’s Discussion and Analysis for the

period ended September 30, 2024.

This current report is specifically incorporated by reference into

Kinross Gold Corporation’s Registration Statements on Form S-8 (Registration Nos. 333-180822, 333-180823, 333-180824 filed on April

19, 2012, Registration No. 333-217099 filed on April 3, 2017 and Registration No. 333-262966 filed on February 24, 2022).

EXHIBITS

SIGNATURES

Pursuant to the requirements of Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

|

| |

KINROSS GOLD CORPORATION |

|

| |

|

|

| |

By: |

/s/ Kar Ng |

|

| |

Name:

Title: |

Kar Ng

Vice-President, Finance |

|

| |

|

|

|

|

|

Date: |

November 5, 2024 |

|

| |

|

|

|

|

Exhibit 99.1

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and nine months ended

September 30, 2024

This

management's discussion and analysis ("MD&A"), prepared as of November 5, 2024, relates to the financial condition

and results of operations of Kinross Gold Corporation together with its wholly owned subsidiaries, as at September 30, 2024 and

for the three and nine months then ended, and is intended to supplement and complement Kinross

Gold Corporation’s unaudited interim condensed consolidated financial statements for the three and nine months ended September 30,

2024 and the notes thereto (the “interim financial statements”). Readers are cautioned that the MD&A contains forward-looking

statements about expected future events and financial and operating performance of the Company, and that actual events may vary from

management's expectations. Readers are encouraged to read the Cautionary Statement on Forward Looking Information included with this

MD&A and to consult Kinross Gold Corporation's annual audited consolidated financial statements for 2023 and corresponding notes

to the financial statements which are available on the Company's web site at www.kinross.com and

on www.sedarplus.ca. The interim financial statements and MD&A

are presented in U.S. dollars. The interim financial statements have been prepared in accordance with International Accounting Standard

(“IAS”) 34 “Interim Financial Reporting” as issued by the International Accounting Standards Board (“IASB”).

This discussion addresses matters we consider important for an understanding of our financial condition and results of operations as

at and for the three and nine months ended September 30, 2024, as well as our outlook.

This MD&A contains forward-looking

statements and should be read in conjunction with the risk factors described in "Risk Analysis" and in the “Cautionary

Statement on Forward-Looking Information” on pages 33 – 34 of this MD&A. In certain instances, references are made

to relevant notes in the interim financial statements for additional information.

Where

we say "we", "us", "our", the "Company" or "Kinross", we mean Kinross Gold Corporation

or Kinross Gold Corporation and/or one or more or all of its subsidiaries, as it may apply. Where we refer to the "industry",

we mean the gold mining industry.

| 1. | DESCRIPTION OF THE BUSINESS |

Kinross

is engaged in gold mining and related activities, including exploration and acquisition of gold-bearing properties, the extraction and

processing of gold-containing ore, and reclamation of gold mining properties. Kinross’ gold production and exploration activities

are carried out principally in Canada, the United States, Brazil, Chile, Mauritania and Finland. Gold is produced in the form of doré,

which is shipped to refineries for final processing. Kinross also produces and sells a quantity of silver.

The

profitability and operating cash flow of Kinross are affected by various factors, including the amount of gold and silver produced, the

market prices of gold and silver, operating costs, interest rates, regulatory and environmental compliance, the level of exploration

activity and capital expenditures, general and administrative costs, and other discretionary costs and activities. Kinross is also exposed

to fluctuations in currency exchange rates, political risks, and varying levels of taxation that can impact profitability and cash flow.

Kinross seeks to manage the risks associated with its business operations; however, many of the factors affecting these risks are beyond

the Company’s control.

Commodity

prices continue to be volatile as economies around the world continue to experience economic challenges along with political changes

and uncertainties. Volatility in the price of gold and silver impacts the Company's revenue, while volatility in the price of input costs,

such as oil, and foreign exchange rates, particularly the Brazilian real, Chilean peso, Mauritanian ouguiya and Canadian dollar, may

have an impact on the Company's operating costs and capital expenditures.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and nine months ended

September 30, 2024

Consolidated

Financial and Operating Highlights

| |

|

Three

months ended September 30, |

|

|

Nine

months ended September 30, |

|

| (in

millions, except ounces, per share amounts and per ounce amounts) |

|

2024 |

|

|

2023 |

|

|

Change |

|

|

%

Change(g) |

|

|

2024 |

|

|

2023 |

|

|

Change |

|

|

%

Change(g) |

|

| Operating Highlights(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total gold equivalent ounces(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Produced |

|

|

593,699 |

|

|

|

585,449 |

|

|

|

8,250 |

|

|

|

1 |

% |

|

|

1,656,436 |

|

|

|

1,606,507 |

|

|

|

49,929 |

|

|

|

3 |

% |

| Sold |

|

|

578,323 |

|

|

|

571,248 |

|

|

|

7,075 |

|

|

|

1 |

% |

|

|

1,621,483 |

|

|

|

1,614,547 |

|

|

|

6,936 |

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Attributable gold equivalent

ounces(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Produced |

|

|

564,106 |

|

|

|

585,449 |

|

|

|

(21,343 |

) |

|

|

(4 |

)% |

|

|

1,626,843 |

|

|

|

1,606,507 |

|

|

|

20,336 |

|

|

|

1 |

% |

| Sold |

|

|

550,548 |

|

|

|

571,248 |

|

|

|

(20,700 |

) |

|

|

(4 |

)% |

|

|

1,593,708 |

|

|

|

1,614,547 |

|

|

|

(20,839 |

) |

|

|

(1 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Highlights(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Metal sales |

|

$ |

1,432.0 |

|

|

$ |

1,102.4 |

|

|

$ |

329.6 |

|

|

|

30 |

% |

|

$ |

3,733.0 |

|

|

$ |

3,124.0 |

|

|

$ |

609.0 |

|

|

|

19 |

% |

| Production cost of sales |

|

$ |

564.3 |

|

|

$ |

520.6 |

|

|

$ |

43.7 |

|

|

|

8 |

% |

|

$ |

1,613.3 |

|

|

$ |

1,502.4 |

|

|

$ |

110.9 |

|

|

|

7 |

% |

| Depreciation, depletion and amortization |

|

$ |

296.2 |

|

|

$ |

263.9 |

|

|

$ |

32.3 |

|

|

|

12 |

% |

|

$ |

862.7 |

|

|

$ |

715.1 |

|

|

$ |

147.6 |

|

|

|

21 |

% |

| Reversal of impairment charge |

|

$ |

(74.1 |

) |

|

$ |

- |

|

|

$ |

(74.1 |

) |

|

|

nm |

|

|

$ |

(74.1 |

) |

|

$ |

- |

|

|

$ |

(74.1 |

) |

|

|

nm |

|

| Operating earnings |

|

$ |

547.7 |

|

|

$ |

226.2 |

|

|

$ |

321.5 |

|

|

|

142 |

% |

|

$ |

1,039.2 |

|

|

$ |

607.9 |

|

|

$ |

431.3 |

|

|

|

71 |

% |

| Net earnings attributable to

common shareholders |

|

$ |

355.3 |

|

|

$ |

109.7 |

|

|

$ |

245.6 |

|

|

|

nm |

|

|

$ |

673.2 |

|

|

$ |

350.9 |

|

|

$ |

322.3 |

|

|

|

92 |

% |

| Basic earnings per share attributable

to common shareholders |

|

$ |

0.29 |

|

|

$ |

0.09 |

|

|

$ |

0.20 |

|

|

|

nm |

|

|

$ |

0.55 |

|

|

$ |

0.29 |

|

|

$ |

0.26 |

|

|

|

90 |

% |

| Diluted earnings per share attributable

to common shareholders |

|

$ |

0.29 |

|

|

$ |

0.09 |

|

|

$ |

0.20 |

|

|

|

nm |

|

|

$ |

0.55 |

|

|

$ |

0.28 |

|

|

$ |

0.27 |

|

|

|

96 |

% |

| Adjusted net earnings attributable

to common shareholders(c) |

|

$ |

298.7 |

|

|

$ |

144.6 |

|

|

$ |

154.1 |

|

|

|

107 |

% |

|

$ |

598.3 |

|

|

$ |

399.8 |

|

|

$ |

198.5 |

|

|

|

50 |

% |

| Adjusted net earnings per share(c) |

|

$ |

0.24 |

|

|

$ |

0.12 |

|

|

$ |

0.12 |

|

|

|

100 |

% |

|

$ |

0.49 |

|

|

$ |

0.33 |

|

|

$ |

0.16 |

|

|

|

48 |

% |

| Net cash flow provided from operating

activities |

|

$ |

733.5 |

|

|

$ |

406.8 |

|

|

$ |

326.7 |

|

|

|

80 |

% |

|

$ |

1,711.9 |

|

|

$ |

1,194.4 |

|

|

$ |

517.5 |

|

|

|

43 |

% |

| Attributable adjusted operating

cash flow(c) |

|

$ |

625.0 |

|

|

$ |

472.1 |

|

|

$ |

152.9 |

|

|

|

32 |

% |

|

$ |

1,529.0 |

|

|

$ |

1,267.1 |

|

|

$ |

261.9 |

|

|

|

21 |

% |

| Capital expenditures(d) |

|

$ |

278.7 |

|

|

$ |

283.9 |

|

|

$ |

(5.2 |

) |

|

|

(2 |

)% |

|

$ |

794.8 |

|

|

$ |

787.0 |

|

|

$ |

7.8 |

|

|

|

1 |

% |

| Attributable capital expenditures(c) |

|

$ |

275.5 |

|

|

$ |

272.4 |

|

|

$ |

3.1 |

|

|

|

1 |

% |

|

$ |

772.1 |

|

|

$ |

757.3 |

|

|

$ |

14.8 |

|

|

|

2 |

% |

| Attributable free cash flow(c) |

|

$ |

414.6 |

|

|

$ |

137.7 |

|

|

$ |

276.9 |

|

|

|

nm |

|

|

$ |

905.8 |

|

|

$ |

443.0 |

|

|

$ |

462.8 |

|

|

|

104 |

% |

| Average realized gold price per

ounce(e) |

|

$ |

2,477 |

|

|

$ |

1,929 |

|

|

$ |

548 |

|

|

|

28 |

% |

|

$ |

2,304 |

|

|

$ |

1,935 |

|

|

$ |

369 |

|

|

|

19 |

% |

| Production cost of sales per

equivalent ounce(b) sold(f) |

|

$ |

976 |

|

|

$ |

911 |

|

|

$ |

65 |

|

|

|

7 |

% |

|

$ |

995 |

|

|

$ |

931 |

|

|

$ |

64 |

|

|

|

7 |

% |

| Attributable production cost

of sales per equivalent ounce(b) sold(c) |

|

$ |

980 |

|

|

$ |

911 |

|

|

$ |

69 |

|

|

|

8 |

% |

|

$ |

997 |

|

|

$ |

931 |

|

|

$ |

66 |

|

|

|

7 |

% |

| Attributable production cost

of sales per ounce sold on a by-product basis(c) |

|

$ |

956 |

|

|

$ |

860 |

|

|

$ |

96 |

|

|

|

11 |

% |

|

$ |

962 |

|

|

$ |

876 |

|

|

$ |

86 |

|

|

|

10 |

% |

| Attributable all-in sustaining

cost per ounce sold on a by-product basis(c) |

|

$ |

1,332 |

|

|

$ |

1,264 |

|

|

$ |

68 |

|

|

|

5 |

% |

|

$ |

1,324 |

|

|

$ |

1,269 |

|

|

$ |

55 |

|

|

|

4 |

% |

| Attributable all-in sustaining

cost per equivalent ounce(b) sold(c) |

|

$ |

1,350 |

|

|

$ |

1,296 |

|

|

$ |

54 |

|

|

|

4 |

% |

|

$ |

1,349 |

|

|

$ |

1,303 |

|

|

$ |

46 |

|

|

|

4 |

% |

| Attributable all-in cost per

ounce sold on a by-product basis(c) |

|

$ |

1,677 |

|

|

$ |

1,561 |

|

|

$ |

116 |

|

|

|

7 |

% |

|

$ |

1,682 |

|

|

$ |

1,590 |

|

|

$ |

92 |

|

|

|

6 |

% |

| Attributable all-in cost per

equivalent ounce(b) sold(c) |

|

$ |

1,689 |

|

|

$ |

1,579 |

|

|

$ |

110 |

|

|

|

7 |

% |

|

$ |

1,697 |

|

|

$ |

1,608 |

|

|

$ |

89 |

|

|

|

6 |

% |

| (a) | All

measures and ratios include 100% of the results from Manh Choh, except measures and ratios

denoted as “attributable.” “Attributable” includes Kinross’

70% share of Manh Choh production, sales, cash flow, capital expenditures and costs, as applicable. |

| (b) | “Gold

equivalent ounces” include silver ounces produced and sold converted to a gold

equivalent based on a ratio of the average spot market prices for the commodities for each

period. The ratio for the third quarter and first nine months of 2024 was 84.06:1 and 84.34:1,

respectively (third quarter and first nine months of 2023 – 81.82:1 and 82.50:1, respectively). |

| (c) | The

definition and reconciliation of these non-GAAP financial measures and ratios is included

in Section 11. Non-GAAP financial measures and ratios have no standardized meaning under

International Financial Reporting Standards (“IFRS”) and therefore, may not be

comparable to similar measures presented by other issuers. |

| (d) | “Capital

expenditures” is as reported as “Additions to property, plant and equipment”

on the interim condensed consolidated statements of cash

flows. |

| (e) | “Average

realized gold price per ounce” is defined as gold metal sales divided by total gold

ounces sold. |

| (f) | “Production

cost of sales per equivalent ounce sold” is defined as production cost of sales divided

by total gold equivalent ounces sold. |

| (g) | “nm”

means not meaningful. |

Consolidated

Financial Performance

This

Consolidated Financial Performance section references adjusted net earnings attributable to common shareholders, adjusted net earnings

per share, attributable adjusted operating cash flow, attributable free cash flow, attributable all-in sustaining cost per equivalent

ounce sold and per ounce sold on a by-product basis, and attributable all-in cost per equivalent ounce sold and per ounce sold on a by-product

basis, all of which are non-GAAP financial measures or ratios. The definitions and reconciliations of these non-GAAP financial measures

and ratios are included in Section 11 of this MD&A.

Third

quarter 2024 vs. Third quarter 2023

Kinross’

production increased by 1% compared to the third quarter of 2023, primarily due to the commencement

of production from Manh Choh, offset by lower production at Paracatu, Round Mountain and La Coipa. At Paracatu, mining was in a lower-grade

area of the pit in accordance with planned mine sequencing. At Round Mountain, fewer ounces were recovered from the heap leach pads.

At La Coipa, production was lower as a result of lower silver grades and a decrease in throughput due to increased maintenance activity

at the mill.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and nine months ended

September 30, 2024

Metal

sales increased by 30% to $1,432.0 million compared to the third quarter of 2023, due to a 28% increase

in the average realized gold price to $2,477 per ounce, from $1,929 per

ounce in the same period in 2023. Total gold equivalent ounces sold in the third quarter of 2024 were comparable to the same period in

2023.

Production

cost of sales increased by 8% in the third quarter of 2024 compared to 2023, due to higher royalties as

a result of higher metal prices realized, and the production and sales mix, including higher production at Fort Knox largely related

to the start of Manh Choh. These increases were partially offset by a decrease in production cost of sales at Round Mountain due to the

decrease in production.

Production

cost of sales per equivalent ounce sold increased by 7% in the third quarter of 2024 compared to the same period in 2023, primarily due

to planned mine sequencing, with higher gold equivalent ounces sold at Fort Knox and Bald Mountain, offset by fewer gold equivalent ounces

sold at Paracatu and La Coipa.

In

the third quarter of 2024, depreciation, depletion and amortization increased by 12% compared to the same period in 2023, primarily due

to a higher depreciable asset base at Tasiast and Bald Mountain.

In

the third quarter of 2024, the Company recorded an after-tax impairment reversal of $71.5 million,

related entirely to property, plant and equipment at Round Mountain, as a result of an increase in the Company’s estimates of future

gold prices. The reversal was limited to the carrying value that would have been determined, net of any applicable depreciation, had

no impairment charge been recognized previously, and represents the full reversal of the impairment charge previously recorded in 2022.

The tax impact of the impairment reversal at Round Mountain was an income tax expense of $2.6 million.

Operating

earnings increased to $547.7 million in the third quarter of 2024 from $226.2 million in the same

period in 2023 primarily as a result of the increase in metal sales.

In

the third quarter of 2024, the Company recorded an income tax expense of $134.2 million, compared

to $102.4 million in the third quarter of 2023. Income tax expense included $7.7 million of deferred tax expense, compared to $36.9 million

in the third quarter of 2023, resulting from the net foreign currency translation of tax deductions related to the Company’s operations

in Brazil and Mauritania. The remaining change in income tax expense is due to differences in the level of income in the Company’s

operating jurisdictions. Kinross' combined federal and provincial statutory tax rate for the third quarters of both 2024 and 2023 was

26.5%.

Net

earnings attributable to common shareholders in the third quarter of 2024 were $355.3 million, or $0.29

per share, compared to $109.7 million, or $0.09 per share, in the same period in 2023. The change was primarily a result of the increase

in operating earnings, partially offset by the increase in income tax expense, as described above.

Adjusted

net earnings attributable to common shareholders in the third quarter of 2024 were $298.7 million, or $0.24 per share, compared to $144.6

million, or $0.12 per share, for the same period in 2023. The increase was primarily due to an increase in margins as metal sales increased

by $329.6 million, or 30%, partially offset by the 8% increase in production cost of sales, as described above.

Net

cash flow provided from operating activities increased to $733.5 million in the third quarter of 2024 from $406.8 million in the third

quarter of 2023, primarily due to the increase in margins, as described above, and favourable working capital movements.

In the

third quarter of 2024, attributable adjusted operating cash flow increased to $625.0 million compared to $472.1 million in the same period

of 2023, primarily due to the increase in margins.

Capital

expenditures decreased marginally to $278.7 million from $283.9 million in the third quarter of 2023, primarily due

to the focus on Manh Choh construction and completion of heap leach pad expansions at Bald Mountain in 2023, partially offset by Phase

S capital development at Round Mountain which began in early 2024.

Attributable

free cash flow increased to $414.6 million from $137.7 million in the third quarter of 2023, primarily due to the increase in net cash

flow provided from operating activities, as discussed above.

In the

third quarter of 2024, attributable all-in sustaining cost per equivalent ounce sold and per ounce sold on a by-product basis increased

by 4% and 5%, respectively, compared to the same period in 2023, primarily as a result of the increase in production cost of sales, as

discussed above, partially offset by a decrease in sustaining capital expenditures.

In the

third quarter of 2024, attributable all-in cost per equivalent ounce sold and per ounce sold on a by-product basis increased by 7% compared

to the same period in 2023, primarily as a result of the increase in production cost of sales.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and nine months ended

September 30, 2024

First

nine months of 2024 vs. First nine months of 2023

Kinross’

production increased by 3% compared to the first nine months of 2023, primarily due to higher production

from Fort Knox with the commencement of production from higher-grade Manh Choh ore, higher throughput at Tasiast, and higher grades at

Bald Mountain, partially offset by lower grades at Paracatu, in accordance with planned mine sequencing.

Metal

sales increased by 19% to $3,733.0 million compared to the first nine months of 2023, due to a 19%

increase in the average realized gold price to $2,304 per ounce, from $1,935

per ounce in the same period in 2023. Total gold equivalent ounces sold in the first nine months of 2024 were comparable to the

same period in 2023.

Production

cost of sales increased by 7% in the first nine months of 2024 compared to 2023, due to the production and sales mix, including higher

production at Fort Knox largely related to the start of Manh Choh, a lower proportion of mining activities related to capital development

and higher mill maintenance costs at La Coipa, and higher input costs at Paracatu. These increases were partially offset by a decrease

in production cost of sales at Round Mountain due to a higher proportion of costs allocated to capital development, related to the start

of Phase S development in early 2024.

Production

cost of sales per equivalent ounce sold increased by 7% compared to the first nine months of 2023, primarily due to higher royalties

as a result of higher metal prices realized, and planned mine sequencing, with higher gold equivalent

ounces sold at Fort Knox, offset by fewer gold equivalent ounces sold at Paracatu.

In

the first nine months of 2024, depreciation, depletion and amortization increased by 21% compared to the same period in 2023, primarily

due to a higher depreciable asset base at Tasiast, a decrease in mineral reserves for Phase W at

Round Mountain at the end of 2023, and the increase in gold equivalent ounces sold at Fort Knox.

In

the first nine months of 2024, the Company recorded an after-tax impairment reversal of $71.5 million,

related entirely to property, plant and equipment at Round Mountain, as a result of an increase in the Company’s estimates of future

gold prices. The reversal was limited to the carrying value that would have been determined, net of any applicable depreciation, had

no impairment charge been recognized previously, and represents the full reversal of the impairment charge previously recorded in 2022.

The tax impact of the impairment reversal at Round Mountain was an income tax expense of $2.6 million.

Operating

earnings increased by 71% to $1,039.2 million in the first nine months of 2024 from $607.9 million

in the same period in 2023. The increase was primarily due to the increase in metal sales and the impairment reversal at Round Mountain,

partially offset by the increase in production cost of sales and depreciation, depletion and amortization, as described above.

In

the first nine months of 2024, the Company recorded an income tax expense of $281.1 million, compared

to $204.2 million in the first nine months of 2023. Income tax expense included $32.0 million of deferred tax expense, compared to $5.2

million in the first nine months of 2023, resulting from the net foreign currency translation of tax deductions related to the Company’s

operations in Brazil and Mauritania. The income tax expense in the first nine months of 2024 is net of a $37.8 million deferred tax recovery

as a result of changes in income tax-related uncertain tax positions. The remaining change in income tax expense is due to differences

in the level of income in the Company’s operating jurisdictions. Kinross' combined federal and provincial statutory tax rate for

the first nine months of both 2024 and 2023 was 26.5%.

Net

earnings attributable to common shareholders in the first nine months of 2024 were $673.2 million,

or $0.55 per share, compared to $350.9 million, or $0.29 per share, in the same period in 2023. The change was primarily a result of

the increase in operating earnings, partially offset by the increase in income tax expense, as described above.

Adjusted

net earnings attributable to common shareholders in the first nine months of 2024 were $598.3 million, or $0.49 per share, compared to

$399.8 million, or $0.33 per share, for the same period in 2023. The increase was primarily due to an increase in margins as metal sales

increased by $609.0 million, or 19%, partially offset by the 7% increase in production cost of sales.

Net

cash flow provided from operating activities increased to $1,711.9 million in the first nine months of 2024 from $1,194.4 million in

the first nine months of 2023, primarily due to the increase in margins and favourable working capital movements.

In the

first nine months of 2024, attributable adjusted operating cash flow increased to $1,529.0 million compared to $1,267.1 million in the

same period of 2023, primarily due to the increase in margins.

Capital

expenditures increased marginally to $794.8 million from $787.0 million in the first nine months of 2023 due to the start of Phase S

capital development at Round Mountain, increased spending at Great Bear and increased capital development at Tasiast for

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and nine months ended

September 30, 2024

West Branch 5.

These increases were partially offset by the completion of the heap leach pad expansions at Bald Mountain and the focus

on Manh Choh construction in 2023, as well as a decrease in capital development at La Coipa and Bald Mountain.

Attributable

free cash flow increased to $905.8 million from $443.0 million in the first nine months of 2023, primarily due to the increase in net

cash flow provided from operating activities, as described above.

In the

first nine months of 2024, attributable all-in sustaining cost per equivalent ounce sold and per ounce sold on a by-product basis increased

by 4% compared to the same period in 2023, primarily as a result of the increase in production cost of sales, as discussed above, partially

offset by a decrease in sustaining capital expenditures.

In the

first nine months of 2024, attributable all-in cost per equivalent ounce sold and per ounce sold on a by-product basis increased by 6%

compared to the same period in 2023, primarily as a result of the increase in production cost of sales, as discussed above.

| 2. | IMPACT OF KEY ECONOMIC TRENDS |

Kinross’

2023 annual MD&A contains a discussion of key economic trends that affect the Company and its financial statements. Please refer

to the MD&A for the year ended December 31, 2023, which is available on the Company's website www.kinross.com and

on www.sedarplus.ca or is available upon request from the Company. Included in this MD&A is an update reflecting significant

changes since the preparation of the 2023 annual MD&A.

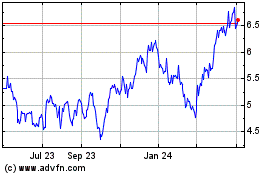

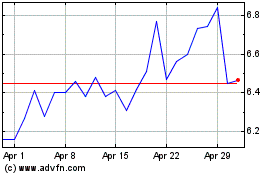

Price

of Gold

The

price of gold is the single largest factor in determining profitability and cash flow from operations, therefore, the financial performance

of the Company has been, and is expected to continue to be, closely linked to the price of gold. During the third quarter of 2024, the

average price of gold was $2,474 per ounce, with gold trading between $2,329 and

$2,664 per ounce based on the LBMA Gold Price PM benchmark. This compares

to an average of $1,928 per ounce during the third quarter of 2023, with gold trading between $1,871 per ounce and $1,976 per ounce.

During the third quarter of 2024, Kinross realized an average price of $2,477 per

ounce, compared to $1,929 per ounce for the same period in 2023. Major influences on the gold price during the third quarter of 2024

included market expectations of further interest rate cuts, continued growing geopolitical tensions as well as political uncertainty

in the United States.

For

the first nine months of 2024, the price of gold averaged $2,296 per

ounce compared to $1,930 per ounce in the same period of 2023 based on the LBMA Gold Price PM benchmark. Kinross realized an average

price of $2,304 per ounce in the first nine months of 2024 compared to

$1,935 per ounce in the first nine months of 2023.

Cost

Sensitivity

The

Company’s profitability is subject to industry-wide cost pressures on development and operating costs with respect to labour, energy,

capital expenditures and consumables in general. Since mining is generally an energy intensive activity, especially in open pit mining,

energy prices have a significant impact on operations.

The

cost of fuel as a percentage of operating costs varies amongst the Company’s mines, and overall, fuel prices in the third quarter

of 2024 were weaker compared to the third quarter of 2023. Kinross manages its exposure to fuel costs by entering into various hedge

positions from time to time – refer to Section 6 – Liquidity and Capital Resources for details.

Currency

Fluctuations

At the

Company’s non-U.S. mining operations and exploration activities, which are primarily located in Brazil, Chile, Mauritania, and

Canada, a portion of operating costs and capital expenditures are denominated in their respective local currencies. Generally, as the

U.S. dollar strengthens, these currencies weaken, and as the U.S. dollar weakens, these foreign currencies strengthen. During the three

and nine months ended September 30, 2024, the U.S. dollar, on average, was stronger relative to the Canadian dollar, Brazilian real,

Chilean peso and Mauritanian ouguiya, compared to the same periods in 2023. As at September 30, 2024, the U.S. dollar was stronger

compared to the December 31, 2023 spot exchange rates of the Canadian dollar, Brazilian real, Chilean peso and Mauritanian ouguiya.

In order to manage this risk, the Company uses currency hedges for certain foreign currency exposures – refer to Section 6

– Liquidity and Capital Resources for details.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and nine months ended

September 30, 2024

The

following section of this MD&A represents forward-looking information and users are cautioned that actual results may vary. We

refer to the risks and assumptions contained in the Cautionary Statement on Forward-Looking Information on pages 33 – 34 of

this MD&A..

This Outlook section references

attributable production cost of sales per equivalent ounce, attributable all-in sustaining cost per equivalent ounce sold and attributable

capital expenditures, which are non-GAAP ratios and financial measures, as applicable, with no standardized meaning under IFRS and therefore,

may not be comparable to similar measures presented by other issuers. The definitions of these non-GAAP ratios and financial measures

and comparable reconciliation is included in Section 11 of this MD&A.

Kinross is on track to meet its 2024

guidance of 2.1 million (+/- 5%) attributable1 gold equivalent ounces produced at an attributable1 production

cost of sales per equivalent ounce sold2 of $1,020 (+/- 5%) and an attributable1 all-in sustaining cost per equivalent

ounce sold2 of $1,360 (+/- 5%). The Company is also on track to meet its 2024 attributable1 capital expenditures2

guidance of $1,050 million (+/- 5%).

Kinross’

annual attributable1 production is expected to remain stable in 2025 and 2026 at 2.0 million (+/- 5%) gold equivalent ounces

per year.

| 4. | PROJECT

UPDATES AND NEW DEVELOPMENTS |

Great Bear

Kinross continues to make excellent

progress at the Great Bear project. Kinross released the Preliminary Economic Assessment (“PEA”) for Great Bear on September

10, 2024. The PEA provided visibility into the potential production scale, construction capital, all-in sustaining cost and margins for

both the open pit and the underground. The PEA represents a point in time estimate and is only a window into the long-term potential of

the asset given the indications of continued mineralization at depth.

The PEA supports the Company’s

acquisition thesis of a top-tier, high-margin operation in a stable jurisdiction with strong infrastructure. Based on mineral resources

drilled to date, the PEA outlines a high-grade combined open pit and underground mine with an initial planned mine life of approximately

12 years and production cost of sales of $594 per ounce. The project is expected to produce over 500,000 ounces per year at an all-in

sustaining cost of approximately $800 per ounce during the first eight years through a conventional, modest capital 10,000 tonne per day

mill3.

Kinross also released an updated mineral

resource estimate for the project, increasing the inferred resource estimate by 568 thousand ounces to 3.9 million ounces, which is in

addition to the measured and indicated resource estimate of 2.7 million ounces.

For the Advanced Exploration (“AEX”)

program, permitting, detailed engineering, execution planning, and procurement continue to advance. Kinross has submitted its final Closure

Plan to the Ontario Ministry of Mines and approval is expected shortly. This is an important permit milestone that is required for all

AEX construction activities. The Closure Plan will allow for the immediate commencement of early works construction on the site including

laydown areas, temporary offices, and earthworks.

The Company is focused on progressing

the AEX program to begin drilling underground to continue unlocking the full potential of the asset, with construction of the underground

decline planned to commence in 2025.

For the Main Project, Kinross expects

to advance engineering definition and execution planning following the selection of design partners later this year.

Following

the receipt of the Tailored Impact Statement Guidelines earlier this year, the Company continues to work with the Impact Assessment Agency of Canada

on its Impact Statement, which is planned to be submitted later in 2025.

1 Attributable guidance

includes Kinross’ 70% share of Manh Choh production, costs and capital expenditures. Attributable guidance figures are non-GAAP

financial ratios and measures. Refer to footnote 2.

2 These figures are

non-GAAP financial ratios and measures, as applicable, and are defined, and actual results for the three and nine months ended September

30, 2024 are reconciled, in Section 11 of this MD&A. Non-GAAP financial ratios and measures have no standardized meaning under IFRS

and therefore, may not be comparable to similar measures presented by other issuers.

3 The PEA is preliminary

in nature and is based, in part, on inferred mineral resources. Inferred mineral resources are considered too geologically speculative

to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty

that the economic forecasts on which the PEA is based will be realized.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and nine months ended

September 30, 2024

Kinross will also be working closely

with the Ontario authorities on obtaining provincial permits, similar to the AEX permits, for the Main Project.

In 2025, Kinross intends to conduct

regional exploration with the goal of identifying new open pit and underground deposits.

Round Mountain

Infill drilling on the lower zone of

the primary Phase X exploration target commenced in the third quarter of 2024, as planned, alongside continued opportunity drilling outside

the primary Phase X exploration target. The drilling in the third quarter of 2024 has demonstrated strong grades and widths from within

the primary Phase X target. Drilling outside of the primary exploration target also continues to indicate strong grades and widths.

These results continue to support the

Company’s hypothesis of potential for higher-margin mining from a bulk underground operation.

At Round Mountain Phase S mining remains

on track. Construction of the heap leach pad expansion is complete, on schedule and under budget, with solution application permits received.

Curlew Basin exploration

At Curlew, drilling progressed in the

third quarter of 2024 with three drill rigs active underground testing the Stealth and EVP Zones. Drilling this year expanded mineralization

in zones with favourable grade and width to support higher-margin production.

Chile

Kinross is progressing baseline studies

at Lobo-Marte and continues to engage and build relationships with communities and government stakeholders.

Lobo-Marte continues to be a potential

large, low-cost mine upon the conclusion of mining at La Coipa where Kinross remains focused on potential opportunities to extend mine

life.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and nine months ended

September 30, 2024

| 5. | CONSOLIDATED RESULTS OF OPERATIONS |

Operating

Highlights

| |

|

Three

months ended September 30, |

|

|

Nine

months ended September 30, |

|

| (in

millions, except ounces and per ounce amounts) |

|

2024 |

|

|

2023 |

|

|

Change |

|

|

%

Change(d) |

|

|

2024 |

|

|

2023 |

|

|

Change |

|

|

%

Change(d) |

|

| Operating Statistics(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total gold equivalent ounces(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Produced |

|

|

593,699 |

|

|

|

585,449 |

|

|

|

8,250 |

|

|

|

1 |

% |

|

|

1,656,436 |

|

|

|

1,606,507 |

|

|

|

49,929 |

|

|

|

3 |

% |

| Sold |

|

|

578,323 |

|

|

|

571,248 |

|

|

|

7,075 |

|

|

|

1 |

% |

|

|

1,621,483 |

|

|

|

1,614,547 |

|

|

|

6,936 |

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Attributable gold equivalent ounces(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Produced |

|

|

564,106 |

|

|

|

585,449 |

|

|

|

(21,343 |

) |

|

|

(4 |

)% |

|

|

1,626,843 |

|

|

|

1,606,507 |

|

|

|

20,336 |

|

|

|

1 |

% |

| Sold |

|

|

550,548 |

|

|

|

571,248 |

|

|

|

(20,700 |

) |

|

|

(4 |

)% |

|

|

1,593,708 |

|

|

|

1,614,547 |

|

|

|

(20,839 |

) |

|

|

(1 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gold ounces - sold |

|

|

569,506 |

|

|

|

544,199 |

|

|

|

25,307 |

|

|

|

5 |

% |

|

|

1,578,232 |

|

|

|

1,531,816 |

|

|

|

46,416 |

|

|

|

3 |

% |

| Silver ounces - sold (000's) |

|

|

741 |

|

|

|

2,213 |

|

|

|

(1,472 |

) |

|

|

(67 |

)% |

|

|

3,676 |

|

|

|

6,828 |

|

|

|

(3,152 |

) |

|

|

(46 |

)% |

| Average realized gold price per ounce(c) |

|

$ |

2,477 |

|

|

$ |

1,929 |

|

|

$ |

548 |

|

|

|

28 |

% |

|

$ |

2,304 |

|

|

$ |

1,935 |

|

|

$ |

369 |

|

|

|

19 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial data(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Metal sales |

|

$ |

1,432.0 |

|

|

$ |

1,102.4 |

|

|

$ |

329.6 |

|

|

|

30 |

% |

|

$ |

3,733.0 |

|

|

$ |

3,124.0 |

|

|

$ |

609.0 |

|

|

|

19 |

% |

| Production cost of sales |

|

$ |

564.3 |

|

|

$ |

520.6 |

|

|

$ |

43.7 |

|

|

|

8 |

% |

|

$ |

1,613.3 |

|

|

$ |

1,502.4 |

|

|

$ |

110.9 |

|

|

|

7 |

% |

| Depreciation, depletion and amortization |

|

$ |

296.2 |

|

|

$ |

263.9 |

|

|

$ |

32.3 |

|

|

|

12 |

% |

|

$ |

862.7 |

|

|

$ |

715.1 |

|

|

$ |

147.6 |

|

|

|

21 |

% |

| Reversal of impairment charge |

|

$ |

(74.1 |

) |

|

$ |

- |

|

|

$ |

(74.1 |

) |

|

|

nm |

|

|

$ |

(74.1 |

) |

|

$ |

- |

|

|

$ |

(74.1 |

) |

|

|

nm |

|

| Operating earnings |

|

$ |

547.7 |

|

|

$ |

226.2 |

|

|

$ |

321.5 |

|

|

|

142 |

% |

|

$ |

1,039.2 |

|

|

$ |

607.9 |

|

|

$ |

431.3 |

|

|

|

71 |

% |

| Net earnings attributable to common shareholders |

|

$ |

355.3 |

|

|

$ |

109.7 |

|

|

$ |

245.6 |

|

|

|

nm |

|

|

$ |

673.2 |

|

|

$ |

350.9 |

|

|

$ |

322.3 |

|

|

|

92 |

% |

| (a) | All

measures and ratios include 100% of the results from Manh Choh, except measures denoted as

“attributable.” “Attributable” includes Kinross’ 70% share

of Manh Choh production and sales, as appropriate. |

| (b) | “Gold

equivalent ounces” include silver ounces produced and sold converted to a gold

equivalent based on a ratio of the average spot market prices for the commodities for each

period. The ratio for the third quarter and first nine months of 2024 was 84.06:1 and 84.34:1,

respectively (third quarter and first nine months of 2023 – 81.82:1 and 82.50:1, respectively). |

| (c) | “Average

realized gold price per ounce” is defined as gold metal

sales divided by total gold ounces sold. |

| (d) | “nm”

means not meaningful. |

Operating

Earnings (Loss) by Segment

| |

|

Three

months ended September 30, |

|

|

Nine

months ended September 30, |

|

| (in

millions) |

|

2024 |

|

|

2023 |

|

|

Change |

|

|

%

Change(c) |

|

|

2024 |

|

|

2023 |

|

|

Change |

|

|

%

Change(c) |

|

| Operating segments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tasiast |

|

$ |

180.7 |

|

|

$ |

123.6 |

|

|

$ |

57.1 |

|

|

|

46 |

% |

|

$ |

473.4 |

|

|

$ |

345.2 |

|

|

$ |

128.2 |

|

|

|

37 |

% |

| Paracatu |

|

|

156.5 |

|

|

|

125.0 |

|

|

|

31.5 |

|

|

|

25 |

% |

|

|

352.4 |

|

|

|

335.3 |

|

|

|

17.1 |

|

|

|

5 |

% |

| La Coipa |

|

|

34.4 |

|

|

|

44.6 |

|

|

|

(10.2 |

) |

|

|

(23 |

)% |

|

|

120.1 |

|

|

|

115.4 |

|

|

|

4.7 |

|

|

|

4 |

% |

| Fort Knox(a) |

|

|

171.3 |

|

|

|

25.0 |

|

|

|

146.3 |

|

|

|

nm |

|

|

|

222.4 |

|

|

|

82.1 |

|

|

|

140.3 |

|

|

|

171 |

% |

| Round Mountain |

|

|

63.0 |

|

|

|

(27.6 |

) |

|

|

90.6 |

|

|

|

nm |

|

|

|

21.7 |

|

|

|

(72.0 |

) |

|

|

93.7 |

|

|

|

nm |

|

| Bald Mountain |

|

|

10.1 |

|

|

|

1.4 |

|

|

|

8.7 |

|

|

|

nm |

|

|

|

39.5 |

|

|

|

0.9 |

|

|

|

38.6 |

|

|

|

nm |

|

| Non-operating segments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Great Bear |

|

|

(11.2 |

) |

|

|

(12.6 |

) |

|

|

1.4 |

|

|

|

nm |

|

|

|

(37.1 |

) |

|

|

(38.0 |

) |

|

|

0.9 |

|

|

|

nm |

|

| Corporate and other(b) |

|

|

(57.1 |

) |

|

|

(53.2 |

) |

|

|

(3.9 |

) |

|

|

nm |

|

|

|

(153.2 |

) |

|

|

(161.0 |

) |

|

|

7.8 |

|

|

|

nm |

|

| Total |

|

$ |

547.7 |

|

|

$ |

226.2 |

|

|

$ |

321.5 |

|

|

|

142 |

% |

|

$ |

1,039.2 |

|

|

$ |

607.9 |

|

|

$ |

431.3 |

|

|

|

71 |

% |

| (a) | The

Fort Knox segment includes Manh Choh, which was aggregated with Fort Knox during the nine

months ended September 30, 2024. Results for all periods include 100% for Manh Choh.

Comparative results are presented in accordance with the current year’s presentation. |

| (b) | “Corporate

and other” includes operating costs which are not directly related to individual mining

properties such as overhead expenses, insurance recoveries, gains and losses on disposal

of assets and investments, and other costs relating to corporate, shutdown, and other non-operating

assets (including Kettle River-Buckhorn, Lobo-Marte, and Maricunga). |

| (c) | “nm”

means not meaningful. |

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and nine months ended

September 30, 2024

Mining

Operations

Tasiast

(100% ownership and operator) – Mauritania

| |

|

Three

months ended September 30, |

|

|

Nine

months ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

Change |

|

|

%

Change(a) |

|

|

2024 |

|

|

2023 |

|

|

Change |

|

|

%

Change |

|

| Operating Statistics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tonnes ore mined

(000's) |

|

|

1,748 |

|

|

|

3,486 |

|

|

|

(1,738 |

) |

|

|

(50 |

)% |

|

|

5,777 |

|

|

|

6,864 |

|

|

|

(1,087 |

) |

|

|

(16 |

)% |

| Tonnes processed (000's) |

|

|

2,203 |

|

|

|

1,796 |

|

|

|

407 |

|

|

|

23 |

% |

|

|

6,437 |

|

|

|

4,667 |

|

|

|

1,770 |

|

|

|

38 |

% |

| Grade (grams/tonne) |

|

|

2.46 |

|

|

|

3.10 |

|

|

|

(0.64 |

) |

|

|

(21 |

)% |

|

|

2.54 |

|

|

|

3.25 |

|

|

|

(0.71 |

) |

|

|

(22 |

)% |

| Recovery |

|

|

91.2 |

% |

|

|

92.3 |

% |

|

|

(1.1 |

)% |

|

|

(1 |

)% |

|

|

91.4 |

% |

|

|

92.1 |

% |

|

|

(0.7 |

)% |

|

|

(1 |

)% |

| Gold equivalent ounces: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Produced |

|

|

162,155 |

|

|

|

171,140 |

|

|

|

(8,985 |

) |

|

|

(5 |

)% |

|

|

482,983 |

|

|

|

460,029 |

|

|

|

22,954 |

|

|

|

5 |

% |

| Sold |

|

|

158,521 |

|

|

|

162,823 |

|

|

|

(4,302 |

) |

|

|

(3 |

)% |

|

|

465,573 |

|

|

|

443,866 |

|

|

|

21,707 |

|

|

|

5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Data (in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Metal sales |

|

$ |

393.2 |

|

|

$ |

313.9 |

|

|

$ |

79.3 |

|

|

|

25 |

% |

|

$ |

1,072.2 |

|

|

$ |

861.3 |

|

|

$ |

210.9 |

|

|

|

24 |

% |

| Production cost of sales |

|

|

109.0 |

|

|

|

108.5 |

|

|

|

0.5 |

|

|

|

0 |

% |

|

|

311.0 |

|

|

|

296.4 |

|

|

|

14.6 |

|

|

|

5 |

% |

| Depreciation,

depletion and amortization |

|

|

94.3 |

|

|

|

69.0 |

|

|

|

25.3 |

|

|

|

37 |

% |

|

|

256.2 |

|

|

|

173.8 |

|

|

|

82.4 |

|

|

|

47 |

% |

| |

|

|

189.9 |

|

|

|

136.4 |

|

|

|

53.5 |

|

|

|

39 |

% |

|

|

505.0 |

|

|

|

391.1 |

|

|

|

113.9 |

|

|

|

29 |

% |

| Other operating expense |

|

|

6.5 |

|

|

|

12.2 |

|

|

|

(5.7 |

) |

|

|

(47 |

)% |

|

|

25.5 |

|

|

|

43.6 |

|

|

|

(18.1 |

) |

|

|

(42 |

)% |

| Exploration and business development |

|

|

2.7 |

|

|

|

0.6 |

|

|

|

2.1 |

|

|

|

nm |

|

|

|

6.1 |

|

|

|

2.3 |

|

|

|

3.8 |

|

|

|

165 |

% |

| Segment operating earnings |

|

$ |

180.7 |

|

|

$ |

123.6 |

|

|

$ |

57.1 |

|

|

|

46 |

% |

|

$ |

473.4 |

|

|

$ |

345.2 |

|

|

$ |

128.2 |

|

|

|

37 |

% |

| (a) | “nm”

means not meaningful. |

Third

quarter 2024 vs. Third quarter 2023

In the

third quarter of 2024, mining at Tasiast decreased at West Branch 4 and capital development increased at West Branch 5, resulting in

a decrease in tonnes of ore mined of 50% compared to the third quarter of 2023. Mill grades decreased by 21% in the third quarter of

2024 compared to the same period in 2023 as a result of mine sequencing. Mill throughput increased by 23% in the third quarter of 2024

compared to the same period in 2023 as Tasiast continued to achieve higher throughput levels as a result of the completion of the 24k

project in the second half of 2023. Gold equivalent ounces produced and sold decreased by 5% and 3%, respectively, in the third quarter

of 2024 compared to the same period in 2023, due to the decrease in mill grades, partially offset by the increase in mill throughput.

In the

third quarter of 2024, metal sales increased by 25% compared to the third quarter of 2023, due to the increase in average metal prices

realized, partially offset by the decrease in gold equivalent ounces sold. Production cost of sales was consistent with the same period

in 2023, as a higher proportion of costs allocated to capital development and the decrease in gold equivalent ounces sold were partially

offset by higher royalties due to the increase in average metal prices. Depreciation, depletion and amortization increased by 37% in

the third quarter of 2024, primarily due to an increase in the depreciable asset base.

First

nine months of 2024 vs. First nine months of 2023

In the

first nine months of 2024, mining at Tasiast decreased at West Branch 4 and capital development increased at West Branch 5, resulting

in a decrease in tonnes of ore mined of 16% compared to the first nine months of 2023. Mill grades decreased by 22% in the first nine

months of 2024 compared to the same period in 2023 as a result of mine sequencing. Mill throughput increased by 38% in the first nine

months of 2024 compared to the same period in 2023 as Tasiast continued to achieve higher throughput levels as a result of the completion

of the 24k project in the second half of 2023. In addition, the prior period was impacted by a planned 15-day plant shutdown in February 2023.

Elevated mill throughput levels, partially offset by lower grades, drove overall increases in gold equivalent ounces produced and sold

of 5% in the first nine months of 2024 compared to the same period in 2023.

In

the first nine months of 2024, metal sales increased by 24% compared to the first nine months of 2023, due to the increases in average

metal prices realized and gold equivalent ounces sold. Production cost of sales increased by 5% in the first nine months of 2024, compared

to the same period in 2023, primarily due to the increase in gold equivalent ounces sold and higher

royalties due to the increase in average metal prices, partially offset by a higher proportion of costs allocated to capital development.

Depreciation, depletion and amortization increased by 47% in the first nine months of 2024, primarily due to an increase in the depreciable

asset base and the increase in gold equivalent ounces sold.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and nine months ended

September 30, 2024

Paracatu

(100% ownership and operator) – Brazil

| |

|

Three

months ended September 30, |

|

|

Nine

months ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

Change |

|

|

%

Change |

|

|

2024 |

|

|

2023 |

|

|

Change |

|

|

%

Change |

|

| Operating Statistics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tonnes ore mined

(000's) |

|

|

13,127 |

|

|

|

14,725 |

|

|

|

(1,598 |

) |

|

|

(11 |

)% |

|

|

41,299 |

|

|

|

36,980 |

|

|

|

4,319 |

|

|

|

12 |

% |

| Tonnes processed (000's) |

|

|

14,551 |

|

|

|

14,669 |

|

|

|

(118 |

) |

|

|

(1 |

)% |

|

|

45,213 |

|

|

|

44,903 |

|

|

|

310 |

|

|

|

1 |

% |

| Grade (grams/tonne) |

|

|

0.38 |

|

|

|

0.41 |

|

|

|

(0.03 |

) |

|

|

(7 |

)% |

|

|

0.35 |

|

|

|

0.40 |

|

|

|

(0.05 |

) |

|

|

(13 |

)% |

| Recovery |

|

|

81.1 |

% |

|

|

79.0 |

% |

|

|

2.1 |

% |

|

|

3 |

% |

|

|

80.2 |

% |

|

|

79.2 |

% |

|

|

1.0 |

% |

|

|

1 |

% |

| Gold equivalent ounces: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Produced |

|

|

146,174 |

|

|

|

172,482 |

|

|

|

(26,308 |

) |

|

|

(15 |

)% |

|

|

404,675 |

|

|

|

460,059 |

|

|

|

(55,384 |

) |

|

|

(12 |

)% |

| Sold |

|

|

145,235 |

|

|

|

167,105 |

|

|

|

(21,870 |

) |

|

|

(13 |

)% |

|

|

403,519 |

|

|

|

459,338 |

|

|

|

(55,819 |

) |

|

|

(12 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Data (in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Metal sales |

|

$ |

358.0 |

|

|

$ |

321.7 |

|

|

$ |

36.3 |

|

|

|

11 |

% |

|

$ |

927.0 |

|

|

$ |

887.2 |

|

|

$ |

39.8 |

|

|

|

4 |

% |

| Production cost of sales |

|

|

146.1 |

|

|

|

141.2 |

|

|

|

4.9 |

|

|

|

3 |

% |

|

|

417.0 |

|

|

|

394.4 |

|

|

|

22.6 |

|

|

|

6 |

% |

| Depreciation,

depletion and amortization |

|

|

52.6 |

|

|

|

53.1 |

|

|

|

(0.5 |

) |

|

|

(1 |

)% |

|

|

145.0 |

|

|

|

143.3 |

|

|

|

1.7 |

|

|

|

1 |

% |

| |

|

|

159.3 |

|

|

|

127.4 |

|

|

|

31.9 |

|

|

|

25 |

% |

|

|

365.0 |

|

|

|

349.5 |

|

|

|

15.5 |

|

|

|

4 |

% |

| Other operating expense |

|

|

1.0 |

|

|

|

0.6 |

|

|

|

0.4 |

|

|

|

67 |

% |

|

|

7.2 |

|

|

|

10.4 |

|

|

|

(3.2 |

) |

|

|

(31 |

)% |

| Exploration and business development |

|

|

1.8 |

|

|

|

1.8 |

|

|

|

- |

|

|

|

0 |

% |

|

|

5.4 |

|

|

|

3.8 |

|

|

|

1.6 |

|

|

|

42 |

% |

| Segment operating earnings |

|

$ |

156.5 |

|

|

$ |

125.0 |

|

|

$ |

31.5 |

|

|

|

25 |

% |

|

$ |

352.4 |

|

|

$ |

335.3 |

|

|

$ |

17.1 |

|

|

|

5 |

% |

Third

quarter 2024 vs. Third quarter 2023

Planned

mine sequencing at Paracatu resulted in an 11% decrease in tonnes of ore mined as well as a 7% decrease in grade in the third quarter

of 2024 compared to the same period in 2023. Mill recoveries increased by 3% as a result of process improvements implemented in the gravity

flotation circuit. Gold equivalent ounces produced and sold decreased 15% and 13%, respectively, in the third quarter of 2024 compared

to the same period in 2023 due to the timing of ounces processed through the mill and lower grades.

Metal

sales increased by 11% compared to the third quarter of 2023, due to the increase in average metal prices realized, partially offset

by the decrease in gold equivalent ounces sold. Production cost of sales increased 3% compared to the same period in 2023, due to higher

milling, drilling contractor and blasting supply costs, partially offset by the decrease in gold equivalent ounces sold. Depreciation,

depletion and amortization decreased by 1% compared to the same period in 2023, primarily due to the decrease in gold equivalent ounces

sold, partially offset by an increase in the depreciable asset base and a decrease in mineral reserves at the end of 2023.

First

nine months of 2024 vs. First nine months of 2023

Planned

mine sequencing at Paracatu, which included mining lower-grade ore in shorter haul distance areas of the pit earlier in the year, resulted

in a 12% increase in tonnes of ore mined and a 13% decrease in grade in the first nine months of 2024 compared to the first nine months

of 2023. Lower grades drove decreases in gold equivalent ounces produced and sold of 12% in the first nine months of 2024 compared to

the same period in 2023.

Metal

sales increased by 4% compared to the first nine months of 2023, due to the increase in average metal prices realized, partially offset

by the decrease in gold equivalent ounces sold. Production cost of sales increased by 6% compared to the same period in 2023, due to

higher drilling contractor, blasting supply and labour costs, partially offset by lower gold equivalent ounces sold. Depreciation, depletion

and amortization increased by 1% compared to the same period in 2023, primarily due to an increase in the depreciable asset base and

a decrease in mineral reserves at the end of 2023, partially offset by the decrease in gold equivalent ounces sold.

Kinross Gold Corporation

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the three and nine months ended September 30, 2024 and 2023

La Coipa (100% ownership and operator) – Chile

| | |

Three

months ended September 30, | | |

Nine

months ended September 30, | |

| | |

2024 | | |

2023 | | |

Change | | |

%

Change | | |

2024 | | |

2023 | | |

Change | | |

%

Change | |

| Operating Statistics | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tonnes

ore mined (000's) | |

| 786 | | |

| 1,137 | | |

| (351 | ) | |

| (31 | )% | |

| 2,511 | | |

| 2,754 | | |

| (243 | ) | |

| (9 | )% |

| Tonnes processed (000's) | |

| 809 | | |

| 1,017 | | |

| (208 | ) | |

| (20 | )% | |

| 2,518 | | |

| 2,679 | | |

| (161 | ) | |

| (6 | )% |