Full Year 2023 Highlights:

- 10% revenue growth (8% organic) driven by higher volume,

pricing actions, favorable foreign currency impacts and

acquisitions

- 16.1% operating margin, up 40 basis points; 16.9% adjusted

operating margin, up 100 basis points

- Operating cash flow of $538 million, up $260 million; free cash

flow of $430 million, up $257 million

- Initiates 2024 EPS guidance up 13% at the midpoint (adjusted

EPS up 9% at the midpoint)

February 8, 2024-- ITT Inc. (NYSE: ITT) today reported financial

results for the fourth quarter and full year ended December 31,

2023. For the fourth quarter, the company reported a year-over-year

revenue increase of 7%, up 4% on an organic basis, primarily driven

by higher Friction original equipment (OE) volumes in Motion

Technologies (MT) and pricing actions in Connect & Control

Technologies (CCT) and Industrial Process (IP). Fourth quarter

results included a 2% favorable foreign currency impact, while the

Micro-Mode acquisition contributed 1% to total revenue growth.

Fourth quarter operating income of $119 million decreased 21%

compared to prior year, and operating margin of 14.3% decreased 520

basis points versus prior year primarily due to a one-time loss of

$15 million on the sale of the Matrix Composites (Matrix) business

in CCT, a prior year non-recurring gain of $16 million on the sale

of IP facilities, higher restructuring and corporate charges and

cost inflation. On an adjusted basis, operating income of $141

million increased 4% primarily due to higher volumes, pricing

actions and productivity. The increase was partially offset by

higher corporate expenses, including strategic growth investments,

incentive compensation and M&A costs.

Earnings per share for the fourth quarter of $1.12 decreased 19%

versus prior year primarily due to the impact of non-recurring

items, lower operating income and higher tax rate, partially offset

by lower interest expense. On an adjusted basis, earnings per share

of $1.34 increased 4% compared to prior year due to higher

operating income including favorable foreign currency impact.

Operating cash flow for the fourth quarter of $170 million

increased 5% versus prior year driven by higher operating income

and strong accounts receivable collections. Free cash flow for the

fourth quarter of $131 million was flat versus prior year. For the

full year 2023, ITT generated operating cash flow of $538 million,

an increase of $260 million versus 2022, and free cash flow of $430

million, an increase of $257 million versus 2022. Both increases

were due to higher net income and improved inventory velocity and

receivables collections.

Change in Presentation of Operating Income and Operating

Margin

ITT is transitioning to a new measure for operating income and

operating margin in its press release and related earnings

presentation. This is not due to any error, correction or

misstatement by ITT. Beginning with the fourth quarter of 2023, the

company will no longer disclose total segment operating income or

margin, or total adjusted segment operating income or margin and

instead will focus on operating income and margin and adjusted

operating income and margin on a consolidated basis. This will

reflect our previous segment operating income measures minus

corporate expense (previously presented below the segment operating

income line in ITT’s earnings materials). The difference between

adjusted segment operating margin and adjusted operating margin for

the fourth quarter and full year 2023 is 180 and 170 basis points,

respectively.

Table 1. Fourth Quarter Performance

Q4 2023 Q4 2022 Change Revenue $

829.1

$

774.6

7.0

%

Organic Growth

4.5

%

Operating Income(1) $

118.8

$

150.9

(21.3)

%

Operating Margin(1)

14.3

%

19.5

%

(520)

bps Adjusted Operating Income(1) $

140.9

$

136.0

3.6

%

Adjusted Operating Margin(1)

17.0

%

17.6

%

(60)

bps Earnings Per Share $

1.12

$

1.39

(19.4)

%

Adjusted Earnings Per Share $

1.34

$

1.29

3.9

%

Operating Cash Flow $

170.4

$

162.5

4.9

%

Free Cash Flow $

131.3

$

132.3

(0.8)

%

Note: all results unaudited; dollars in millions except per

share amounts

(1) Reflects transition from segment

operating income and adjusted segment operating income (and

accompanying margin) to operating income and adjusted operating

income (and accompanying margin), as described above.

Management Commentary

“In 2023, ITT continued to drive growth and differentiation

through performance and innovation. We drove high single-digit

orders growth whilst also winning the largest single contract ever

in our flow business. We outperformed the global automotive market

by roughly six hundred basis points in Friction OE to reach more

than 29% market share globally. And we invested over $100 million

towards future growth, including for capacity expansion and new

technologies. With our pricing actions and relentless productivity

focus, we grew operating margins 100 basis points, with 330 basis

points of improvement in Industrial Process. On capital deployment,

we expanded our flow and connectors portfolio through two strategic

acquisitions, divested two non-core product lines, and repurchased

nearly $70 million of ITT shares. We positioned ITT for another

strong performance in 2024,” said Luca Savi, ITT’s Chief Executive

Officer and President.

Table 2. Fourth Quarter Segment Results

Revenue Operating Income Operating Margin

Q4 2023 ReportedIncrease /(Decrease)

OrganicGrowth Q4 2023 ReportedIncrease

/(Decrease) AdjustedIncrease /(Decrease) Q4 2023

ReportedIncrease /(Decrease) AdjustedIncrease

/(Decrease) Motion Technologies $

364.7

10.4

%

7.4

%

$

60.3

26.2

%

28.5

%

16.5%

200

bps

240

bps Industrial Process

289.7

3.2

%

2.1

%

57.2

(28.5)

%

(5.9)

%

19.7%

(880)

bps

(210)

bps Connect & Control Technologies

175.6

6.7

%

2.5

%

16.5

(47.8)

%

5.7

%

9.4%

(980)

bps

(20)

bps Note: all results unaudited; excludes intercompany

eliminations of $0.9 million; comparisons to Q4 2022; dollars in

millions.

Motion Technologies revenue increased 10%, driven by

higher sales volume in Friction OE, including 30% growth in China,

higher rail shipments and favorable foreign currency translation.

Operating income of $60 million increased 26% due to productivity

savings, higher sales volume, and lower material inflation,

partially offset by higher labor and overhead costs, unfavorable

product mix and higher strategic investments.

Industrial Process revenue increased 3%, primarily driven

by growth in aftermarket parts and service, pricing actions and

favorable foreign currency impacts. Operating income of $57 million

decreased 29% driven by a non-recurring gain of $16 million in the

prior year on facilities sales and higher restructuring and labor

costs, partially offset by pricing actions and productivity

savings.

Connect & Control Technologies revenue increased 7%,

primarily driven by growth in aerospace and industrial components,

pricing actions, the Micro-Mode acquisition and favorable foreign

currency impacts. Operating income of $17 million decreased 48%

driven by a one-time loss of $15 million on the sale of Matrix and

higher raw material, labor and overhead costs. The decrease was

partially offset by pricing actions and productivity savings. On an

adjusted basis, operating income of $33 million increased 6% due to

pricing actions.

Table 3. 2023 Full Year Results

FY 2023 FY 2022 Change Revenue $

3,283.0

$

2,987.7

9.9

%

Organic Growth

8.1

%

Operating Income(1) $

528.2

$

468.0

12.9

%

Operating Margin(1)

16.1

%

15.7

%

40

bps Adjusted Operating Income(1) $

554.6

$

473.8

17.1

%

Adjusted Operating Margin(1)

16.9

%

15.9

%

100

bps Earnings Per Share $

4.97

$

4.40

13.0

%

Adjusted Earnings Per Share $

5.21

$

4.44

17.3

%

Operating Cash Flow $

538.0

$

277.7

93.7

%

Free Cash Flow $

430.4

$

173.8

147.6

%

Note: all results unaudited; dollars in millions except per

share amounts (1) Reflects transition from segment operating income

and adjusted segment operating income (and accompanying margin) to

operating income and adjusted operating income (and accompanying

margin), as described above.

Quarterly Dividend Increase

The company announced today an increase in its quarterly

dividend of 10% to $0.319 per share on the company’s outstanding

common stock. ITT’s Board of Directors approved the cash dividend

for the first quarter of 2024, which will be payable on April 1,

2024 to shareholders of record as of the close of business on March

8, 2024. The 10% increase in the quarterly dividend announced today

follows increases of 20% and 10% in 2022 and 2023, respectively.

Including the 10% increase in 2024, the company’s dividend has

grown at a 16% compounded annual growth rate since 2019.

2024 Guidance

We expect revenue growth of 9% to 12%, up 3% to 6% on an organic

basis; operating margin of 16.7% to 17.3%, and adjusted operating

margin of 16.9% to 17.5%, flat to up 60 bps; EPS of $5.37 to $5.82,

and adjusted EPS of $5.45 to $5.90, representing growth of 9% at

the midpoint; and free cash flow of $435 million to $475 million,

representing free cash flow margin of 12% to 13% for full year

2024.

It is not possible, without unreasonable efforts, to estimate

the impacts of foreign currency fluctuations, acquisitions and

certain other special items that may occur in 2024 as these items

are inherently uncertain and difficult to predict. As a result, we

are unable to quantify certain amounts that would be included in a

reconciliation of organic revenue growth and adjusted operating

margin to the most directly comparable GAAP financial measures

without unreasonable efforts and we have not provided

reconciliations for these forward-looking non-GAAP financial

measures.

Investor Conference Call Details

ITT’s management will host a conference call for investors on

Thursday, February 8, 2024 at 8:30 a.m. Eastern Time. The briefing

can be accessed live via webcast which is available on the

company’s website: https://investors.itt.com. A replay of the

webcast will be available two hours after the call until Thursday,

February 22, 2024 at midnight Eastern Time. Reconciliations of

non-GAAP financial performance metrics to their most comparable

U.S. GAAP financial performance metrics are defined and presented

below and should not be considered a substitute for, nor superior

to, the financial data prepared in accordance with U.S. GAAP.

Safe Harbor Statement

This release contains “forward-looking statements” intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. In addition, the

conference call (including the financial results presentation

material) may include, and officers and representatives of ITT may

from time to time make and discuss, projections, goals,

assumptions, and statements that may constitute “forward-looking

statements”. These forward-looking statements are not historical

facts, but rather represent only a belief regarding future events

based on current expectations, estimates, assumptions and

projections about our business, future financial results, the

industry in which we operate, and other legal, regulatory, and

economic developments. These forward-looking statements include,

but are not limited to, future strategic plans and other statements

that describe the company’s business strategy, outlook, objectives,

plans, intentions or goals, and any discussion of future events and

future operating or financial performance.

We use words such as “anticipate,” “estimate,” “expect,”

“project,” “intend,” “plan,” “believe,” “target,” “future,” “may,”

“will,” “could,” “should,” “potential,” “continue,” “guidance” and

other similar expressions to identify forward-looking statements.

Forward-looking statements are uncertain and, by their nature, many

are inherently unpredictable and outside of ITT’s control, and are

subject to known and unknown risks, uncertainties and other

important factors that could cause actual results to differ

materially from those expressed or implied in, or reasonably

inferred from, such forward-looking statements.

Where in any forward-looking statement we express an expectation

or belief as to future results or events, such expectation or

belief is based on current plans and expectations of our

management, expressed in good faith and believed to have a

reasonable basis. However, we cannot provide any assurance that the

expectation or belief will occur or that anticipated results will

be achieved or accomplished.

Among the factors that could cause our results to differ

materially from those indicated by forward-looking statements are

risks and uncertainties inherent in our business including, without

limitation:

- uncertain global economic and capital markets conditions, which

have been influenced by heightened geopolitical tensions,

inflation, changes in monetary policies, the threat of a possible

global economic recession, trade disputes between the U.S. and its

trading partners, political and social unrest, and the availability

and fluctuations in prices of energy and commodities, including

steel, oil, copper and tin;

- fluctuations in interest rates and the impact of such

fluctuations on customer behavior and on our cost of debt;

- fluctuations in foreign currency exchange rates and the impact

of such fluctuations on our revenues, customer demand for our

products and on our hedging arrangements;

- volatility in raw material prices and our suppliers’ ability to

meet quality and delivery requirements;

- risk of liabilities from recent mergers, acquisitions, or

venture investments, and past divestitures and spin-offs;

- our inability to hire or retain key personnel;

- failure to compete successfully and innovate in our

markets;

- failure to manage the distribution of products and services

effectively;

- failure to protect our intellectual property rights or

violations of the intellectual property rights of others;

- the extent to which there are quality problems with respect to

manufacturing processes or finished goods;

- the risk of cybersecurity breaches or failure of any

information systems used by the Company, including any flaws in the

implementation of any enterprise resource planning systems;

- loss of or decrease in sales from our most significant

customers;

- risks due to our operations and sales outside the U.S. and in

emerging markets, including the imposition of tariffs and trade

sanctions;

- fluctuations in demand or customers’ levels of capital

investment, maintenance expenditures, production, and market

cyclicality;

- the risk of material business interruptions, particularly at

our manufacturing facilities;

- risks related to government contracting, including changes in

levels of government spending and regulatory and contractual

requirements applicable to sales to the U.S. government;

- fluctuations in our effective tax rate, including as a result

of changing tax laws and other possible tax reform legislation in

the U.S. and other jurisdictions;

- changes in environmental laws or regulations, discovery of

previously unknown or more extensive contamination, or the failure

of a potentially responsible party to perform;

- failure to comply with the U.S. Foreign Corrupt Practices Act

(or other applicable anti-corruption legislation), export controls

and trade sanctions; and

- risk of product liability claims and litigation.

The forward-looking statements included in this release speak

only as of the date hereof. We undertake no obligation (and

expressly disclaim any obligation) to update any forward-looking

statements, whether written or oral or as a result of new

information, future events or otherwise.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (IN

MILLIONS, EXCEPT PER SHARE AMOUNTS) Three Months Ended Full

Year

December 31,2023 December 31,2022

December

31,2023 December 31,2022 Revenue

$

829.1

$

774.6

$

3,283.0

$

2,987.7

Cost of revenue

543.1

526.3

2,175.7

2,065.4

Gross profit

286.0

248.3

1,107.3

922.3

General and administrative expenses

98.6

51.9

302.6

217.2

Sales and marketing expenses

42.8

38.6

174.0

156.9

Research and development expenses

25.5

22.8

102.6

96.5

Loss (gain) on sale of long-lived assets

0.3

(15.9)

(0.1)

(16.3)

Operating income

118.8

150.9

528.2

468.0

Interest expense (income), net

1.5

3.1

10.4

6.4

Other non-operating (income) expense, net

(0.2)

0.5

(1.7)

(0.2)

Income from continuing operations before income tax expense

117.5

147.3

519.5

461.8

Income tax expense

24.2

31.2

104.8

91.1

Income from continuing operations

93.3

116.1

414.7

370.7

Loss from discontinued operations, net of tax benefit of $0.3,

$0.1, $0.3 and $0.4, respectively

(0.9)

-

(0.9)

(1.3)

Net income

92.4

116.1

413.8

369.4

Less: Income attributable to noncontrolling interests

0.9

0.9

3.3

2.4

Net income attributable to ITT Inc.

$

91.5

$

115.2

$

410.5

$

367.0

Amounts attributable to ITT Inc.: Income from

continuing operations

$

92.4

$

115.2

$

411.4

$

368.3

Loss from discontinued operations, net of tax

(0.9)

-

(0.9)

(1.3)

Net income attributable to ITT Inc.

$

91.5

$

115.2

$

410.5

$

367.0

Earnings (loss) per share attributable to ITT Inc.:

Basic: Continuing operations

$

1.13

$

1.39

$

5.00

$

4.42

Discontinued operations

(0.02)

-

(0.01)

(0.02)

Net income

$

1.11

$

1.39

$

4.99

$

4.40

Diluted: Continuing operations

$

1.12

$

1.39

$

4.97

$

4.40

Discontinued operations

(0.01)

-

(0.01)

(0.02)

Net income

$

1.11

$

1.39

$

4.96

$

4.38

Weighted average common shares – basic

82.1

82.7

82.3

83.4

Weighted average common shares – diluted

82.6

83.1

82.7

83.7

CONSOLIDATED BALANCE SHEETS (UNAUDITED) (IN MILLIONS,

EXCEPT PER SHARE AMOUNTS) As of the Period Ended

December 31, 2023

December 31, 2022

Assets Current assets: Cash and cash equivalents

$

489.2

$

561.2

Receivables, net

675.2

628.8

Inventories

575.4

533.9

Other current assets

117.9

112.9

Total current assets

1,857.7

1,836.8

Non-current assets: Plant, property and equipment, net

561.0

526.8

Goodwill

1,016.3

964.8

Other intangible assets, net

116.6

112.8

Other non-current assets

381.0

339.1

Total non-current assets

2,074.9

1,943.5

Total assets

$

3,932.6

$

3,780.3

Liabilities and Shareholders’ Equity Current liabilities:

Short-term borrowings

$

187.7

$

451.0

Accounts payable

437.0

401.1

Accrued and other current liabilities

413.1

333.4

Total current liabilities

1,037.8

1,185.5

Non-current liabilities: Postretirement benefits

138.7

137.2

Other non-current liabilities

217.0

200.2

Total non-current liabilities

355.7

337.4

Total liabilities

1,393.5

1,522.9

Shareholders’ equity: Common stock: Authorized – 250.0 shares, $1

par value per share Issued and outstanding – 82.1 shares and 82.7

shares, respectively

82.1

82.7

Retained earnings

2,778.0

2,509.7

Accumulated other comprehensive loss: Postretirement benefit plans

(1.6)

3.6

Cumulative translation adjustments

(330.3)

(347.9)

Total accumulated other comprehensive loss

(331.9)

(344.3)

Total ITT Inc. shareholders’ equity

2,528.2

2,248.1

Noncontrolling interests

10.9

9.3

Total shareholders’ equity

2,539.1

2,257.4

Total liabilities and shareholders’ equity

$

3,932.6

$

3,780.3

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) (IN MILLIONS) For the Year Ended

December

31,2023 December 31,2022

Operating Activities Income

from continuing operations attributable to ITT Inc.

$

411.4

$

368.3

Adjustments to income from continuing operations: Depreciation and

amortization

109.2

107.4

Equity-based compensation

20.2

18.1

Deferred income tax (benefit) expense

(27.6)

2.9

Gain on sale of long-lived assets

(0.1)

(16.3)

Other non-cash charges, net

37.1

29.3

Changes in assets and liabilities: Change in receivables

(39.2)

(90.7)

Change in inventories

(34.4)

(99.5)

Change in contract assets

(0.3)

(7.4)

Change in contract liabilities

23.1

23.3

Change in accounts payable

26.3

39.4

Change in accrued expenses

47.6

(36.9)

Change in income taxes

5.4

(13.5)

Other, net

(40.7)

(46.7)

Net Cash – Operating Activities

538.0

277.7

Investing Activities Capital expenditures

(107.6)

(103.9)

Proceeds from sale of business

11.5

-

Proceeds from sale of long-lived assets

0.9

20.9

Acquisitions, net of cash acquired

(79.3)

(146.9)

Payments to acquire interest in unconsolidated subsidiaries

(2.5)

(25.6)

Other, net

(4.0)

0.4

Net Cash – Investing Activities

(181.0)

(255.1)

Financing Activities (Repayments of)/Proceeds from

commercial borrowings, net

(266.0)

259.7

Long-term debt, repayments

(2.2)

(2.1)

Share repurchases under repurchase plan

(60.0)

(245.3)

Payments for taxes related to net share settlement of stock

incentive plans

(7.2)

(8.8)

Dividends paid

(95.8)

(87.9)

Other, net

(1.1)

1.1

Net Cash – Financing Activities

(432.3)

(83.3)

Exchange rate effects on cash and cash equivalents

3.6

(25.8)

Net cash – operating activities of discontinued operations

(0.3)

0.1

Net change in cash and cash equivalents

(72.0)

(86.4)

Cash and cash equivalents – beginning of year (includes restricted

cash of $0.7 and $0.8, respectively)

561.9

648.3

Cash and Cash Equivalents – end of year (includes restricted cash

of $0.7 and $0.7, respectively)

$

489.9

$

561.9

Supplemental Disclosures of Cash Flow Information Interest

paid

$

15.7

$

10.8

Income taxes paid, net of refunds received

113.1

92.7

Unpaid capital expenditures

$

25.3

$

21.8

Key Performance Indicators and Non-GAAP Measures

Management reviews a variety of key performance indicators

including revenue, segment operating income and margins, earnings

per share, order growth, and backlog, some of which are calculated

on a non-GAAP basis. In addition, we consider certain measures to

be useful to management and investors when evaluating our operating

performance for the periods presented. These measures provide a

tool for evaluating our ongoing operations and management of assets

from period to period. This information can assist investors in

assessing our financial performance and measures our ability to

generate capital for deployment among competing strategic

alternatives and initiatives, including, but not limited to,

acquisitions, dividends, and share repurchases. Some of these

metrics, however, are not measures of financial performance under

accounting principles generally accepted in the United States of

America (GAAP) and should not be considered a substitute for

measures determined in accordance with GAAP. We consider the

following non-GAAP measures, which may not be comparable to

similarly titled measures reported by other companies, to be key

performance indicators for purposes of our reconciliation

tables.

Organic Revenues and Organic Orders are defined,

respectively, as revenue and orders, excluding the impacts of

foreign currency fluctuations and acquisitions. The

period-over-period change resulting from foreign currency

fluctuations is estimated using a fixed exchange rate for both the

current and prior periods. We believe that reporting organic

revenue and organic orders provides useful information to investors

by helping identify underlying trends in our business and

facilitating comparisons of our revenue performance with prior and

future periods and to our peers.

Adjusted Operating Income is defined as operating income

adjusted to exclude special items that include, but are not limited

to, restructuring, divestiture-related costs, certain asset

impairment charges, certain acquisition-related impacts, and

unusual or infrequent operating items. Special items represent

charges or credits that impact current results, which management

views as unrelated to the Company's ongoing operations and

performance. Adjusted Operating Margin is defined as

adjusted operating income divided by revenue. We believe these

financial measures are useful to investors and other users of our

financial statements in evaluating ongoing operating profitability,

as well as in evaluating operating performance in relation to our

competitors.

Adjusted Income from Continuing Operations is defined as

income from continuing operations attributable to ITT Inc. adjusted

to exclude special items that include, but are not limited to,

restructuring, divestiture-related costs, certain asset impairment

charges, certain acquisition-related impacts, income tax

settlements or adjustments, and unusual or infrequent items.

Special items represent charges or credits, on an after-tax basis,

that impact current results, which management views as unrelated to

the Company’s ongoing operations and performance. The after-tax

basis of each special item is determined using the jurisdictional

tax rate of where the expense or benefit occurred. Adjusted

income from continuing operations per diluted share (adjusted

EPS) is defined as adjusted income from continuing operations

divided by diluted weighted average common shares outstanding. We

believe that adjusted income from continuing operations and

adjusted EPS are useful to investors and other users of our

financial statements in evaluating ongoing operating profitability,

as well as in evaluating operating performance in relation to our

competitors.

Free Cash Flow is defined as net cash provided by

operating activities less capital expenditures. Free Cash Flow

Margin is defined as free cash flow divided by revenue. We

believe that free cash flow and free cash flow margin provides

useful information to investors as it provides insight into a

primary cash flow metric used by management to monitor and evaluate

cash flows generated by our operations.

ITT Inc. Non-GAAP Reconciliation Statements (In

millions; all amounts unaudited)

Reconciliation of Revenue to Organic Revenue

Fourth Quarter 2023 Full Year 2023 MT IP CCT Elim

Total MT IP CCT Elim Total

Revenue

$

364.7

$

289.7

$

175.6

$

(0.9

)

$

829.1

$

1,457.8

$

1,129.6

$

699.4

$

(3.8

)

$

3,283.0

Less: Acquisitions

-

-

5.6

-

5.6

-

15.0

15.5

-

30.5

Less: FX

10.0

3.0

1.3

-

14.3

17.0

4.7

1.4

-

23.1

CY Organic Revenue

354.7

286.7

168.7

(0.9

)

809.2

1,440.8

1,109.9

682.5

(3.8

)

3,229.4

Less: PY Revenue

330.4

280.7

164.6

(1.1

)

774.6

1,374.0

971.0

645.6

(2.9

)

2,987.7

Organic Revenue Growth - $

$

24.3

$

6.0

$

4.1

$

34.6

$

66.8

$

138.9

$

36.9

$

241.7

Organic Revenue Growth - %

7.4

%

2.1

%

2.5

%

4.5

%

4.9

%

14.3

%

5.7

%

8.1

%

Reported Revenue Growth - $

$

34.3

$

9.0

$

11.0

$

54.5

$

83.8

$

158.6

$

53.8

$

295.3

Reported Revenue Growth - %

10.4

%

3.2

%

6.7

%

7.0

%

6.1

%

16.3

%

8.3

%

9.9

%

Reconciliation of Orders to Organic

Orders Fourth Quarter 2023 Full Year 2023

MT IP CCT Elim Total MT IP CCT Elim Total

Orders

$

373.0

$

285.9

$

183.1

$

(0.9

)

$

841.1

$

1,487.5

$

1,227.0

$

738.3

$

(3.3

)

$

3,449.5

Less: Acquisitions

-

-

6.8

-

6.8

-

13.8

16.4

-

30.2

Less: FX

10.8

2.4

0.8

-

14.0

18.6

2.2

0.4

-

21.2

CY Organic Orders

362.2

283.5

175.5

(0.9

)

820.3

1,468.9

1,211.0

721.5

(3.3

)

3,398.1

Less: PY Orders

337.4

271.1

168.6

(0.9

)

776.2

1,376.6

1,101.9

701.3

(3.5

)

3,176.3

Organic Orders Growth - $

$

24.8

$

12.4

$

6.9

$

44.1

$

92.3

$

109.1

$

20.2

$

221.8

Organic Orders Growth - %

7.4

%

4.6

%

4.1

%

5.7

%

6.7

%

9.9

%

2.9

%

7.0

%

Reported Orders Growth - $

$

35.6

$

14.8

$

14.5

$

64.9

$

110.9

$

125.1

$

37.0

$

273.2

Reported Orders Growth - %

10.6

%

5.5

%

8.6

%

8.4

%

8.1

%

11.4

%

5.3

%

8.6

%

Note: Immaterial differences due to rounding.

ITT Inc. Non-GAAP Reconciliation Statements (In millions;

all amounts unaudited)

Reconciliations of Operating

Income/Margin to Adjusted Operating Income/Margin Fourth

Quarter 2023 Fourth Quarter 2022 MT IP CCT Corporate ITT

MT IP CCT Corporate ITT

Reported Operating Income

$

60.3

$

57.2

$

16.5

$

(15.2

)

$

118.8

$

47.8

$

80.0

$

31.6

$

(8.5

)

$

150.9

Loss on sale of business

-

-

15.3

-

15.3

-

-

-

-

-

Restructuring costs

2.5

3.7

0.9

-

7.1

0.5

(0.1

)

-

(0.1

)

0.3

Acquisition and divestiture related costs

-

-

0.8

-

0.8

-

0.2

-

-

0.2

(Gain) on sale of long-lived assets

-

-

-

-

-

-

(15.5

)

-

-

(15.5

)

Impacts related to Russia-Ukraine war

(0.6

)

(0.6

)

-

-

(1.2

)

(0.1

)

(0.2

)

-

-

(0.3

)

Other [a]

0.1

0.1

(0.1

)

-

0.1

0.3

(0.2

)

-

0.3

0.4

Adjusted Operating Income

$

62.3

$

60.4

$

33.4

$

(15.2

)

$

140.9

$

48.5

$

64.2

$

31.6

$

(8.3

)

$

136.0

Change in Operating Income

26.2

%

(28.5

%)

(47.8

%)

78.8

%

(21.3

%)

Change in Adjusted Operating Income

28.5

%

(5.9

%)

5.7

%

83.1

%

3.6

%

Reported Operating Margin

16.5

%

19.7

%

9.4

%

14.3

%

14.5

%

28.5

%

19.2

%

19.5

%

Impact of special item adjustments 60 bps 110 bps 960 bps 270 bps

20 bps -560 bps 0 bps -190 bps

Adjusted Operating Margin

17.1

%

20.8

%

19.0

%

17.0

%

14.7

%

22.9

%

19.2

%

17.6

%

Change in Operating Margin 200 bps -880 bps -980 bps -520 bps

Change in Adjusted Operating Margin 240 bps -210 bps -20 bps -60

bps

Full Year 2023 Full Year 2022 MT IP

CCT Corporate ITT MT IP CCT Corporate ITT

Reported Operating

Income

$

230.8

$

243.6

$

107.5

$

(53.7

)

$

528.2

$

208.5

$

187.6

$

115.8

$

(43.9

)

$

468.0

Loss on sale of business

-

-

15.3

-

15.3

-

-

-

-

-

Restructuring costs

4.0

4.6

1.3

-

9.9

2.7

1.3

-

(0.2

)

3.8

Impacts related to Russia-Ukraine war

1.3

1.2

-

-

2.5

3.1

4.8

-

-

7.9

Acquisition and divestiture related costs

-

-

2.4

-

2.4

-

3.2

-

0.5

3.7

(Gain) on sale of long-lived assets

-

-

-

-

-

-

(15.5

)

-

-

(15.5

)

Asset impairment charges

-

-

-

-

-

-

-

-

1.7

1.7

Other [a]

0.1

-

(0.1

)

(3.7

)

(3.7

)

1.3

1.2

-

1.7

4.2

Adjusted Operating Income

$

236.2

$

249.4

$

126.4

$

(57.4

)

$

554.6

$

215.6

$

182.6

$

115.8

$

(40.2

)

$

473.8

Change in Operating Income

10.7

%

29.9

%

(7.2

%)

22.3

%

12.9

%

Change in Adjusted Operating Income

9.6

%

36.6

%

9.2

%

42.8

%

17.1

%

Reported Operating Margin

15.8

%

21.6

%

15.4

%

16.1

%

15.2

%

19.3

%

17.9

%

15.7

%

Impact of special item adjustments 40 bps 50 bps 270 bps 80 bps 50

bps -50 bps 0 bps 20 bps

Adjusted Operating Margin

16.2

%

22.1

%

18.1

%

16.9

%

15.7

%

18.8

%

17.9

%

15.9

%

Change in Operating Margin 60 bps 230 bps -250 bps 40 bps Change in

Adjusted Operating Margin 50 bps 330 bps 20 bps 100 bps

Note: Immaterial differences due to rounding. [a] 2023

includes income from a recovery of costs associated with the 2020

lease termination of a legacy site. 2022 primarily includes

severance charges and accelerated amortization of an intangible

asset.

ITT Inc. Non-GAAP Reconciliation Statements

(In millions, except earns per share; all amounts unaudited)

Reconciliation of Reported vs. Adjusted Income from Continuing

Operating and Diluted EPS Income from Continuing Operations

Diluted Earnings per Share Q4 2023 Q4 2022 % Change FY 2023 FY 2022

% Change Q4 2023 Q4 2022 % Change FY 2023 FY 2022 % Change

Reported

$

92.4

$

115.2

(19.8

%)

$

411.4

$

368.3

11.7

%

$

1.12

$

1.39

(19.4

%)

$

4.97

$

4.40

13.0

%

Special Items Expense / (Income): Loss on sale of business

15.3

-

15.3

-

0.19

-

0.19

-

Restructuring costs

7.1

0.3

9.9

3.8

0.09

-

0.12

0.05

Impacts related to Russia-Ukraine war

(1.2

)

(0.3

)

2.5

7.9

(0.01

)

-

0.03

0.09

Acquisition and divestiture related costs

0.8

0.2

2.4

3.7

0.01

-

0.03

0.04

(Gain) on sale of long-lived assets

-

(15.5

)

-

(15.5

)

-

(0.19

)

-

(0.19

)

Asset impairment charges

-

-

-

1.7

-

-

-

0.02

Other [a] [b]

0.1

0.4

(2.3

)

4.2

(0.01

)

0.01

(0.04

)

0.06

Tax impact of special items [c]

(5.4

)

4.5

(6.2

)

(0.3

)

(0.07

)

0.05

(0.07

)

-

Other tax special items [d] [e]

1.8

2.6

(2.0

)

(2.3

)

0.02

0.03

(0.02

)

(0.03

)

Adjusted

$

110.9

$

107.4

3.3

%

$

431.0

$

371.5

16.0

%

$

1.34

$

1.29

3.9

%

$

5.21

$

4.44

17.3

%

Note: Amounts may not calculate due to rounding Per share

amounts are based on diluted weighted average common shares

outstanding. [a] Q4 2022 primarily reflects severance costs.

[b] FY 2023 primarily includes income of $3.7 from a recovery of

costs associated with the 2020 lease termination of a legacy site,

partially offset by interest expense of $1.4 related to a tax audit

settlement in Italy. FY 2022 primarily includes severance costs.

[c] The tax impact of each adjustment is determined using the

jurisdictional tax rate of where the expense or benefit occurred.

[d] Q4 2023 tax-related special items include expense (benefits)

from the tax impact on distributions of $5.9, return to accrual

adjustments of $(1.8), a change in uncertain tax positions of

$(1.5) and other tax special items of $(0.8). Q4 2022 tax-related

special items include a tax on future distribution of foreign

earnings of $5.5, the tax impact on distributions of $2.0, return

to accrual adjustments of $(4.2), settlements of $(2.1), and other

tax special items of $1.4. [e] FY 2023 tax-related special items

include expense (benefits) from valuation allowance reversals of

$(16.0), settlements of $14.4 primarily related to a tax audit in

Italy, the tax impact on distributions of $7.5, an amendment of our

federal tax return of $(4.9), and other tax special items of

$(3.0). FY 2022 tax-related special items include a change in

deferred tax asset valuation allowance of $(1.2), a change in

uncertain tax positions of $(0.7), a tax on future distribution of

foreign earnings of $(0.3), and other tax special items of $(0.1).

ITT Inc. Non-GAAP Reconciliation Statements (In

millions, except earns per share; all amounts unaudited)

Reconciliation of GAAP vs Adjusted EPS Guidance -

Full Year 2024 2024 Full-Year Guidance Low High

EPS from Continuing Operations - GAAP

$

5.37

$

5.82

Estimated restructuring

0.05

0.05

Other special items

0.05

0.05

Tax on special Items

(0.02

)

(0.02

)

EPS from Continuing Operations - Adjusted

$

5.45

$

5.90

Note: The Company has provided forward-looking non-GAAP

financial measures for organic revenue growth and adjusted

operating margin. It is not possible, without unreasonable efforts,

to estimate the impacts of foreign currency fluctuations,

acquisitions and certain other special items that may occur in 2024

as these items are inherently uncertain and difficult to predict.

As a result, the Company is unable to quantify certain amounts that

would be included in a reconciliation of organic revenue growth and

adjusted operating margin to the most directly comparable GAAP

financial measures without unreasonable efforts and accordingly has

not provided reconciliations for these forward looking non-GAAP

financial measures.

Reconciliation of Cash from Operating Activities to Free Cash

Flow FY 2024 Guidance Q4 2023 Q4 2022 FY 2023 FY 2022 Low High

Net Cash - Operating Activities

$

170.4

$

162.5

$

538.0

$

277.7

$

580.0

$

620.0

Less: Capital expenditures

39.1

30.2

107.6

103.9

145.0

145.0

Free Cash Flow

$

131.3

$

132.3

$

430.4

$

173.8

$

435.0

$

475.0

Revenue

$

829.1

$

774.6

$

3,283.0

$

2,987.7

$

3,625.0

$

3,625.0

Free Cash Flow Margin

15.8

%

17.1

%

13.1

%

5.8

%

12

%

13

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240208091422/en/

Investor Contact Mark Macaluso +1 914-641-2064

mark.macaluso@itt.com

Media Contact Phil Terrigno +1 914-641-2143

phil.terrigno@itt.com

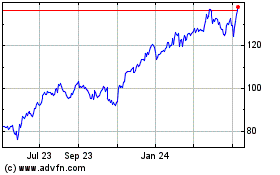

ITT (NYSE:ITT)

Historical Stock Chart

From Dec 2024 to Jan 2025

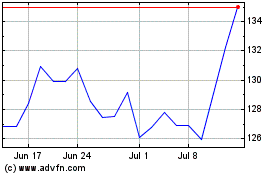

ITT (NYSE:ITT)

Historical Stock Chart

From Jan 2024 to Jan 2025