- Enhances ability to deliver innovative, customized, and highly

technical micro-precision solutions that are increasingly essential

to customer product performance

- Increases opportunities in semiconductor wafer fab equipment,

energy transition, medical technologies, space & defense, and

water purification industries

- Complements successful integration of the Muon Group, Iridian

Spectral Technologies, and STC Material Solutions, providing unique

process-based capabilities working with specialized materials

- Drives near- and long-term value creation through

implementation of 8020 and the IDEX Operating Model

IDEX Corporation (NYSE: IEX) (“IDEX”) today announced it has

entered into a definitive agreement to acquire Mott Corporation and

its subsidiaries (“Mott”) for cash consideration of $1 billion (the

“transaction”), subject to customary adjustments. When adjusted for

the present value of expected tax benefits of approximately $100

million, the net transaction value is approximately $900 million.

This represents approximately 19x Mott’s forecasted full year 2024

EBITDA and a mid-teens multiple based on forecasted 2025 EBITDA.

The transaction is expected to be accretive to adjusted earnings

per share in fiscal year 2026.

Mott is a leader in the design and manufacturing of sintered

porous material structures and flow control solutions, with deep

applied material science knowledge and process control

capabilities. For more than 60 years, Mott has solved highly

complex engineering challenges by co-innovating with the world’s

largest technical brands and OEMs in dynamic markets including

semiconductor, energy, water, and space.

“Mott’s business fits the IDEX sweet spot of highly engineered,

configurable mission-critical components focused on scalable select

applications. The addition of Mott represents an important step in

our evolution, as we continue building our differentiated

capabilities in applied materials technologies. Mott brings

advanced technical and application expertise that will expand our

capabilities in high-value end markets and open new organic growth

opportunities. Our focus on driving profitable growth through the

enterprise-wide application of 80/20 is expected to yield material

benefits,” said Eric D. Ashleman, Chief Executive Officer and

President of IDEX. “The addition of Mott supports our strategy to

deliver long-term, compounding value to our customers, employees,

and shareholders, which includes targeted inorganic growth funded

by strong cash flow generation. With shared cultural values,

including a deep passion for solving customer challenges through

technical capabilities and innovative solutions, our great teams

combine to offer meaningful go-to-market opportunities. We look

forward to welcoming the over 500 Mott employees to IDEX.”

Transaction Expected to Deliver

Significant Strategic and Financial Benefits

Expands applied material science technologies portfolio:

Brings scale to IDEX’s growing suite of focused, high-value

businesses – including IDEX Optical Technologies, the Muon Group,

and recently acquired Iridian Spectral Technologies and STC

Material Solutions – that address customer demand for novel

solutions and expertise across advanced materials, microscale

features, precision components, and proprietary production

processes.

Extends similar value proposition into new customer

relationships: Like IDEX, Mott develops and delivers essential

products and solutions that represent a modest cost relative to the

scale of the overall systems and processes that they support.

Mott’s strong tradition of innovating closely with OEM customers

brings additive, long-term customer relationships, enabling

efficient integration into the IDEX family.

Extends capabilities to address unique customer needs:

Adds advanced customization and system-design capabilities,

deepening IDEX’s position as an innovation partner. This allows

IDEX to further address customer needs for extremely precise

solutions in fluidic applications from the product to system-level,

including the opportunity to offer tailored, cross-functional

products. For example, we expect Mott, IDEX Health & Science,

Muon, and our Material Processing Technologies businesses to find

additive commercial and technology solutions for medical device,

healthcare and biotech customers. Within transitioning energy

markets, Mott and IDEX’s pneumatics businesses could bring

operational and applications expertise to meet customer needs for

more efficiency and lower carbon emissions.

Enhances positioning across high-value end markets:

Bolsters ability to grow presence in select, technology-enabled

applications with substantial growth potential, including across

semiconductor wafer fab equipment, the energy transition, medical

technologies, space & defense, and water purification.

Adds to long-term growth and margin profile: Combines the

technical and commercial excellence of IDEX with leading-edge

innovation, technology, and R&D expertise of Mott, which is

anticipated to yield meaningful commercial growth synergies over

the next three years and drive EBITDA expansion through the proven

application of 80/20 as part of the IDEX Operating Model.

“We’re excited to join an industry leader with a strong record

of helping customers solve their toughest problems. Mott brings

applied material science, chemistry, and application expertise, an

additive and complementary customer base, and a growing pipeline of

opportunities. When combined with the scale of IDEX,

industry-leading positions, and deep technological know-how, this

will yield meaningful synergies and benefits. Our culture and

capabilities align with IDEX, and our employees will add tremendous

value to the company, just as they’ve driven Mott’s growth for

generations.” said Boris Levin, President and Chief Executive

Officer of Mott.

In 2024, Mott is expected to generate approximately $200 million

of revenue, with an EBITDA margin in the low 20s. Mott will join

IDEX’s Health & Science Technologies segment. The transaction

will be funded through a combination of cash on hand, borrowings

from IDEX’s current credit facility, and potential debt issuance,

and it is expected to close by the end of the third quarter of

2024, subject to regulatory approvals and customary closing

conditions.

Conference Call

Information

IDEX will host a conference call to discuss the transaction at

9:30 am Central Time (CDT) today. The conference call will be

webcast live from IDEX’s investor relations website at

https://investors.idexcorp.com. The conference call can also be

accessed live over the phone by dialing 1-877-709-8150 or +1

201-689-8354. The conference ID is 13747873. A replay will be

available approximately three hours after the call and can be

accessed by dialing 877-660-6853 or +1 201-612-7415 for

international callers. The replay will be available through August

23, 2024.

About IDEX

IDEX Corporation (NYSE: IEX) designs and builds engineered

products and mission-critical components that make everyday life

better. IDEX precision components help craft the microchip powering

your electronics, treat water so it is safe to drink, and protect

communities and the environment from sewer overflows. Our optics

enable communications across outer space, and our pumps move

challenging fluids that range from hot, to viscous, to caustic.

IDEX components assist healthcare professionals in saving lives as

part of many leading diagnostic machines, including DNA sequencers

that help doctors personalize treatment. And our fire and rescue

tools, including the industry-leading Hurst Jaws of Life®, are

trusted by rescue workers around the world. These are just some of

the thousands of products that help IDEX live its purpose – Trusted

Solutions, Improving Lives™. Founded in 1988 with three small,

entrepreneurial manufacturing companies, IDEX now includes more

than 50 diverse businesses around the world. With about 8,800

employees and manufacturing operations in more than 20 countries,

IDEX is a diversified, high-performing, global company with

approximately $3.3 billion in annual sales.

For further information on IDEX Corporation and its business

units, visit the company’s website at www.idexcorp.com

About Mott

Mott is a leading microfiltration business specializing in the

design, customization, and manufacturing of sintered porous metal

components and engineered solutions used in fluidic applications.

Mott combines design expertise for thousands of applications with

the power of cutting-edge technology to create highly engineered

products. Founded in 1959 in Farmington, CT, Mott is globally known

for its reliability and unmatched dependability, serving the

highest-cost of failure applications. With approximately 500

employees, Mott partners with world-class customers with demanding

technical specifications to design, engineer, produce, and employ

innovative products to solve their most challenging filtration and

flow control problems.

Use of Non-GAAP Financial

Information

IDEX prepares its public financial statements in conformity with

accounting principles generally accepted in the United States of

America (GAAP). IDEX supplements certain GAAP financial performance

metrics with non-GAAP financial performance metrics. Management

believes these non-GAAP financial performance metrics provide

investors with greater insight, transparency and a more

comprehensive understanding of the financial information used by

management in its financial and operational decision-making because

certain of these non-GAAP metrics exclude items not reflective of

ongoing operations. Non-GAAP financial performance metrics should

not be considered a substitute for, nor superior to, the financial

data prepared in accordance with GAAP. EBITDA is calculated as net

income plus interest expense plus provision for income taxes plus

depreciation and amortization. EBITDA margin is calculated as

EBITDA divided by net sales.

IDEX has not provided a reconciliation of Mott’s expected EBITDA

and EBITDA margin for fiscal year 2024 or 2025 because we are

unable to quantify certain amounts that would be required to be

included in Mott’s contribution to net income without unreasonable

efforts. In addition, IDEX believes such reconciliation would imply

a degree of precision that would be confusing or misleading to

investors.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended. Such forward-looking statements include

statements regarding the expected benefits of the acquisition of

Mott, the expected impact of the acquisition on IDEX’s product

offerings or proposed product offerings, IDEX’s combined existing

and new customers and access to high-value end markets, the

enhancement of IDEX’s business strategy, integration plans, the

expected growth opportunities, profitability and synergies

resulting from the acquisition, including the timing of such

expected synergies, the present value of expected tax benefits, the

anticipated long-term value to IDEX’s shareholders, the projected

revenue, EBITDA and EBITDA margin of Mott and the related impact

and timing for such impact on IDEX’s earnings, return on invested

capital, and the expected timing for the closing of the

transaction. These statements are subject to inherent uncertainties

and risks that could cause actual results to differ materially from

those anticipated at the date of this press release. The risks and

uncertainties include, but are not limited to, the following:

levels of industrial activity and economic conditions in the U.S.

and other countries around the world, including uncertainties in

the financial markets; pricing pressures, including inflation and

rising interest rates and other competitive factors and levels of

capital spending in certain industries; the impact of catastrophic

weather events, natural disasters and public health threats;

economic and political consequences resulting from terrorist

attacks and wars; risks relating to the satisfaction of the closing

conditions set forth in the definitive agreement; IDEX’s ability to

integrate Mott and to acquire, integrate and operate other acquired

businesses on a profitable basis; cybersecurity incidents; the

relationship of the U.S. dollar to other currencies and its impact

on pricing and cost competitiveness; political and economic

conditions in foreign countries in which IDEX operates;

developments with respect to trade policy and tariffs; interest

rates; capacity utilization and the effect this has on costs; labor

markets; supply chain conditions; market conditions and material

costs; risks related to environmental, social and corporate

governance issues, including those related to climate change and

sustainability; and developments with respect to contingencies,

such as litigation and environmental matters. Additional factors

that could cause actual results to differ materially from those

reflected in the forward-looking statements include, but are not

limited to, the risks discussed in the “Risk Factors” section

included in IDEX’s most recent annual report on Form 10-K and

IDEX’s subsequent quarterly reports filed with the Securities and

Exchange Commission (“SEC”) and the other risks discussed in IDEX’s

filings with the SEC. The forward-looking statements included here

are only made as of the date of this press release and management

undertakes no obligation to publicly update them to reflect

subsequent events or circumstances, except as may be required by

law. Investors are cautioned not to rely unduly on forward-looking

statements when evaluating the information presented here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240722904638/en/

Investor Contact: Wendy Palacios Vice President, FP&A

and Investor Relations (847) 457-3723 wpalacios@idexcorp.com

Media Contact: Mark Spencer Vice President, Global

Communications (847) 457-3793 mdspencer@idexcorp.com

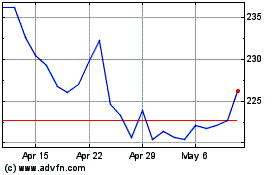

IDEX (NYSE:IEX)

Historical Stock Chart

From Oct 2024 to Nov 2024

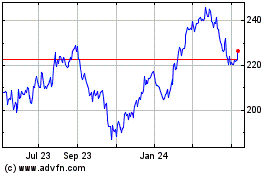

IDEX (NYSE:IEX)

Historical Stock Chart

From Nov 2023 to Nov 2024