0001759631FALSE00017596312023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2023

HYLIION HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38823 | | 83-2538002 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

1202 BMC Drive, Suite 100 Cedar Park,TX | | 78613 |

| (Address of principal executive offices) | | (Zip Code) |

(833) 495-4466

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | HYLN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2023, Hyliion Holdings Corp. (the “Company”) issued a press release announcing certain financial and other results for the quarter ended September 30, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | HYLIION HOLDINGS CORP. |

| | | | |

| | | By: | /s/ Thomas Healy |

| Date: | November 8, 2023 | | Thomas Healy |

| | | | Chief Executive Officer |

Hyliion Holdings Corp.

Ryann Malone

press@hyliion.com

(833) 495-4466

Kellen Ferris

ir@hyliion.com

(737) 292-8649

HYLIION HOLDINGS REPORTS THIRD-QUARTER 2023 FINANCIAL RESULTS

Company Announces Plans to Focus on KARNO and Wind Down Powertrain Operations, Preserving Technology for Potential Future Use or Sale

AUSTIN, Texas, November 8, 2023 – Hyliion Holdings Corp. (NYSE: HYLN) (“Hyliion”), a developer of KARNO generator and electric powertrain technologies, today reported its third-quarter 2023 financial results and announced that it will concentrate its future efforts on the KARNO generator while winding down its powertrain operations. The Company will preserve its powertrain technology for potential application in the future.

This strategic shift will help maintain the company’s robust cash position and align its KARNO generator business for future success. The Company projects to finish 2023 with approximately $285 million of available capital and estimates cash burn of approximately $40 million in 2024.

Powertrain Business Transition and Technology Preservation

With the recent receipt of CARB certification and launch of extended fleet trials, Hyliion has completed all steps on its well-publicized path to commercialization of the Hypertruck ERX powertrain. Despite these accomplishments, the Company previously announced that its Board of Directors had engaged expert advisors to explore a range of strategic alternatives for its powertrain business. The reasons for undertaking this strategic review included lower-than-expected industry adoption of electrified commercial vehicle solutions, increases in component costs, evolving regulatory requirements, and uncertainty about the ability to raise additional needed capital for ongoing investment in the business.

The Company considered a range of options and concluded that discontinuing the powertrain business and focusing on the commercialization of the KARNO generator is in the best interest of Hyliion and its shareholders. Hyliion intends to retain the powertrain technology enabling the Company to explore future use, including a resumption of powertrain commercialization or a sale of the technology and tangible assets from the powertrain division.

“The decision around our powertrain business was very difficult, but we believe it is a necessary step to safeguard our financial stability, especially given the current economic climate,” said Hyliion’s Founder and CEO, Thomas Healy. “Our focus on KARNO aligns with the growing demand for electricity. With commercial deliveries planned for the upcoming year, the KARNO generator offers a more capital-efficient path to market,” added Healy.

KARNO Generator Update

Hyliion remains committed to the ongoing commercialization of the KARNO generator as the Company undergoes a strategic shift to concentrate on this business segment. The Company continues to be encouraged by the substantial progress achieved in development and growing interest from potential customers to leverage the KARNO generator for diverse power generating applications.

KARNO Development Highlights:

•Delivered power successfully to the grid, marking a significant achievement in ongoing development and validation

•Executed customer showcases to grow demand for future deliveries

•Performed simulations and in-lab testing that indicate power, efficiency, and emissions objectives for the production unit design will be achieved

•Demonstrated potential for future mobility applications with Hypertruck KARNO vehicle

•Moved into a new R&D and low-volume production facility near Cincinnati, OH

Hyliion anticipates its first revenue-generating deployments of the KARNO generator to occur in late 2024 and is in discussions with inaugural customers. With the strategic shift to focus on the KARNO generator, Hyliion is positioned to achieve commercialization with capital on hand.

Hyliion is planning to host a technology fireside chat later in the quarter to highlight the unique capabilities of the KARNO generator, business opportunities for near- and long-term deployments, and key development milestones.

Financial Highlights and Guidance

Third quarter operating expenses totaled $33.3 million, compared to $62.9 million in the prior-year quarter, which included one-time expenses of $28.8 million associated with the purchase of KARNO generator technology. Year-to-date expenses totaled $103.7 million, compared to $120.8 million in the prior year period. Hyliion ended the quarter with $324 million in cash, short-term and long-term investments.

Forward guidance for 2023 includes full-year operating expenses of approximately $140 million, including expenses associated with winding down powertrain operations. Hyliion expects no additional revenue from powertrain sales in 2023. Year-end cash and investments are expected to total approximately $285 million with cash burn in 2024 projected at approximately $40 million, excluding potential revenues or monetization of powertrain assets or technology.

About Hyliion

Hyliion is committed to creating innovative solutions that enable clean, flexible and affordable electricity production. The Company’s primary focus is to provide distributed power generators that can operate on various fuel sources to future-proof against an ever-changing energy economy. Headquartered in Austin, Texas, and with research and development in Cincinnati, OH, Hyliion is addressing the commercial space first with a locally-deployable generator that can offer prime power, peak shaving, and renewables matching. Beyond stationary power, Hyliion will address mobile applications such as vehicles and marine. The KARNO generator is a fuel-

agnostic solution, enabled by additive manufacturing, that leverages a linear heat generator architecture. The Company aims to offer innovative, yet practical solutions that contribute positively to the environment in the energy economy. For further information, please visit www.hyliion.com.

Forward Looking Statements

The information in this press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, regarding Hyliion and its future financial and operational performance, as well as its strategy, future operations, estimated financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward looking statements. When used in this press release, including any oral statements made in connection therewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Hyliion expressly disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements herein, to reflect events or circumstances after the date of this press release. Hyliion cautions you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Hyliion. These risks include, but are not limited to, our status as an early stage the Company with a history of losses, and our expectation of incurring significant expenses and continuing losses for the foreseeable future; our ability to develop to develop key commercial relationships with suppliers and customers; our ability to retain the services of Thomas Healy, our Chief Executive Officer; the expected performance of the KARNO generator and system; the execution of the strategic shift from our powertrain business to our KARNO business, and the other risks and uncertainties described under the heading “Risk Factors” in our SEC filings including in our Annual Report (See item 1A. Risk Factors) on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2023 for the year ended December 31, 2022 and Form 10-Q filed with the SEC on November 8, 2023 for the quarterly period ended September 30, 2023. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Should one or more of the risks or uncertainties described in this press release occur, or should underlying assumptions prove incorrect, actual results and plans could different materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Hyliion’s operations and projections can be found in its filings with the SEC. Hyliion’s SEC Filings are available publicly on the SEC’s website at www.sec.gov, and readers are urged to carefully review and consider the various disclosures made in such filings.

HYLIION HOLDINGS CORP.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollar amounts in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | | | | | | | |

| Product sales and other | $ | 96 | | | $ | 499 | | | $ | 672 | | | $ | 1,011 | |

| Total revenues | 96 | | | 499 | | | 672 | | | 1,011 | |

| Cost of revenues | | | | | | | |

| Product sales and other | 677 | | | 2,916 | | | 1,675 | | | 7,160 | |

| Total cost of revenues | 677 | | | 2,916 | | | 1,675 | | | 7,160 | |

| Gross loss | (581) | | | (2,417) | | | (1,003) | | | (6,149) | |

| Operating expenses | | | | | | | |

| Research and development | 25,115 | | | 52,678 | | | 73,472 | | | 88,543 | |

| Selling, general and administrative | 8,186 | | | 10,264 | | | 30,265 | | | 32,255 | |

| Total operating expenses | 33,301 | | | 62,942 | | | 103,737 | | | 120,798 | |

| Loss from operations | (33,882) | | | (65,359) | | | (104,740) | | | (126,947) | |

| | | | | | | |

| Interest income | 3,534 | | | 1,926 | | | 10,345 | | | 3,066 | |

| Gain (loss) on disposal of assets | — | | | 46 | | | 1 | | | (89) | |

| Other income, net | 26 | | | — | | | 14 | | | — | |

| Net loss | $ | (30,322) | | | $ | (63,387) | | | $ | (94,380) | | | $ | (123,970) | |

| | | | | | | |

| Net loss per share, basic and diluted | $ | (0.17) | | | $ | (0.36) | | | $ | (0.52) | | | $ | (0.71) | |

| | | | | | | |

| Weighted-average shares outstanding, basic and diluted | 181,641,060 | | | 174,345,022 | | | 180,914,250 | | | 173,945,156 | |

HYLIION HOLDINGS CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollar amounts in thousands, except share data)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| (Unaudited) | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 28,600 | | | $ | 119,468 | |

| Accounts receivable | 140 | | | 1,136 | |

| Inventory | 139 | | | 74 | |

| Prepaid expenses and other current assets | 11,509 | | | 9,795 | |

| Short-term investments | 153,625 | | | 193,740 | |

| Total current assets | 194,013 | | | 324,213 | |

| | | |

| Property and equipment, net | 11,076 | | | 5,606 | |

| Operating lease right-of-use assets | 7,494 | | | 6,470 | |

| Intangible assets, net | 200 | | | 200 | |

| Other assets | 2,038 | | | 1,686 | |

| Long-term investments | 141,324 | | | 108,568 | |

| Total assets | $ | 356,145 | | | $ | 446,743 | |

| | | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 3,507 | | | $ | 2,800 | |

| Current portion of operating lease liabilities | 807 | | | 347 | |

| Accrued expenses and other current liabilities | 8,867 | | | 11,535 | |

| Total current liabilities | 13,181 | | | 14,682 | |

| | | |

| Operating lease liabilities, net of current portion | 7,354 | | | 6,972 | |

| Other liabilities | 1,248 | | | 1,515 | |

| Total liabilities | 21,783 | | | 23,169 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Stockholders’ equity | | | |

Common stock, $0.0001 par value; 250,000,000 shares authorized; 182,716,445 and 179,826,309 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 18 | | | 18 | |

| Additional paid-in capital | 402,978 | | | 397,810 | |

| (Accumulated deficit) retained earnings | (68,634) | | | 25,746 | |

| Total stockholders’ equity | 334,362 | | | 423,574 | |

| Total liabilities and stockholders’ equity | $ | 356,145 | | | $ | 446,743 | |

HYLIION HOLDINGS CORP.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollar amounts in thousands)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net loss | $ | (94,380) | | | $ | (123,970) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 1,796 | | | 823 | |

| Amortization and accretion of investments, net | (1,821) | | | 1,300 | |

| Noncash lease expense | 1,072 | | | 922 | |

| Inventory write-down | 992 | | | 5,634 | |

| (Gain) loss on disposal of assets | (1) | | | 89 | |

| Share-based compensation | 5,170 | | | 5,268 | |

| Acquired in-process research and development | — | | | 28,752 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 996 | | | (824) | |

| Inventory | (1,057) | | | (5,660) | |

| Prepaid expenses and other assets | (1,200) | | | 3,097 | |

| Accounts payable | 555 | | | (5,201) | |

| Accrued expenses and other liabilities | (3,295) | | | 7,228 | |

| Operating lease liabilities | (1,254) | | | (900) | |

| Net cash used in operating activities | (92,427) | | | (83,442) | |

| | | |

| Cash flows from investing activities | | | |

| Purchase of property and equipment and other | (6,755) | | | (2,621) | |

| Proceeds from sale of property and equipment | 2 | | | 33 | |

| Purchase of in-process research and development | — | | | (14,428) | |

| Payments for security deposit, net | (45) | | | — | |

| Purchase of investments | (170,197) | | | (160,116) | |

| Proceeds from sale and maturity of investments | 178,556 | | | 156,382 | |

| Net cash provided by (used in) investing activities | 1,561 | | | (20,750) | |

| | | |

| Cash flows from financing activities | | | |

| | | |

| | | |

| Proceeds from exercise of common stock options | 230 | | | 65 | |

| Taxes paid related to net share settlement of equity awards | (232) | | | (157) | |

| | | |

| Net cash used in financing activities | (2) | | | (92) | |

| | | |

| Net decrease in cash and cash equivalents and restricted cash | (90,868) | | | (104,284) | |

| Cash and cash equivalents and restricted cash, beginning of period | 120,133 | | | 259,110 | |

| Cash and cash equivalents and restricted cash, end of period | $ | 29,265 | | | $ | 154,826 | |

Cover

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity Registrant Name |

HYLIION HOLDINGS CORP.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38823

|

| Entity Tax Identification Number |

83-2538002

|

| Entity Address, Address Line One |

1202 BMC Drive,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Cedar Park,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78613

|

| City Area Code |

833

|

| Local Phone Number |

495-4466

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

HYLN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001759631

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

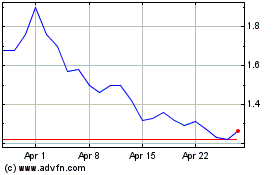

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Jul 2023 to Jul 2024