Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 17 2024 - 8:02AM

Edgar (US Regulatory)

No.1-7628

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF JULY 2024

COMMISSION FILE NUMBER: 1-07628

HONDA GIKEN KOGYO KABUSHIKI KAISHA

(Name of registrant)

HONDA

MOTOR CO., LTD.

(Translation of registrant’s name into English)

1-1, Minami-Aoyama 2-chome,

Minato-ku, Tokyo 107-8556, Japan

(Address of principal

executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Contents

Exhibit 1:

Notice

Concerning Determination of Selling Price, etc.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this

report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| HONDA GIKEN KOGYO KABUSHIKI KAISHA |

| ( HONDA MOTOR CO., LTD. ) |

|

| /s/ Sumihiro Takahashi |

| Sumihiro Takahashi |

| General Manager |

| Finance Division |

| Honda Motor Co., Ltd. |

Date: July 17, 2024

[Translation]

July 17, 2024

|

|

|

| To: |

|

Shareholders of Honda Motor Co., Ltd. |

| From: |

|

Honda Motor Co., Ltd. |

|

|

1-1, Minami-Aoyama 2-chome, |

|

|

Minato-ku, Tokyo, 107-8556 |

|

|

Toshihiro Mibe |

|

|

Director, President and Representative Executive Officer |

Notice Concerning Determination of Selling Price, etc.

Honda Motor Co., Ltd. (the “Company”) hereby announces that it has determined the selling price, etc. concerning the secondary offering of its

common stock by an approval at the meeting of the Executive Council held on July 4, 2024, as described below.

Particulars

| 1. |

Secondary Offering of Shares by way of Purchase and Subscription by the Underwriters |

|

|

|

|

|

|

|

| (1) |

|

Selling price |

|

|

Per share: 1,664.5 yen |

|

|

|

|

| (2) |

|

Total amount of the selling price |

|

|

432,569,760,650 yen |

|

|

|

|

| (3) |

|

Underwriters’ purchase price |

|

|

Per share: 1,613.02 yen |

|

|

|

|

| (4) |

|

Total amount of the underwriters’ purchase price |

|

|

419,191,153,694 yen |

|

|

|

|

| (5) |

|

Share delivery date |

|

|

Wednesday, July 24, 2024 |

|

|

|

| Note: |

|

The underwriters shall purchase the shares at the underwriters’ purchase price and offer them at the selling price. |

|

| 2. |

Secondary Offering by way of Over-allotment |

|

|

|

|

|

|

|

| (1) |

|

Number of shares to be offered |

|

|

38,981,900 shares |

|

|

|

|

| (2) |

|

Selling price |

|

|

Per share: 1,664.5 yen |

|

|

|

|

| (3) |

|

Total amount of the selling price |

|

|

64,885,372,550 yen |

|

|

|

|

| (4) |

|

Share delivery date |

|

|

Wednesday, July 24, 2024 |

|

|

|

Note: This press release was not created for the purpose of offering for sale or soliciting offers for purchase for the shares of our common stock. In

addition, this press release does not constitute an offer to sell or a solicitation of an offer to purchase any securities in the United Statesor elsewhere. The shares of our common stock referred to above have not been, and will not be, registered

under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration thereunder or an applicable exemption from registration requirements. The shares of our common stock referred to

above will not be publicly offered or sold in the United States. |

- 1 -

References

|

|

|

|

|

|

|

|

|

| 1. |

|

Calculation of Selling Price |

|

|

|

|

|

|

|

|

|

|

(1) |

|

Calculation reference date and price |

|

|

Wednesday, July 17, 2024 1,716.0 yen |

|

|

|

|

|

|

|

(2) |

|

Discount rate |

|

|

3.00 % |

|

|

|

| 2. |

|

The Number of Shares to be Offered by way of Purchase and Subscription by the Underwriters: |

|

|

|

|

|

|

259,879,700 shares |

|

|

|

|

|

|

|

|

Of the above shares offered, 47,772,300 shares will be sold to investors in overseas markets such as Europe and Asia (excluding the United States and Canada). |

|

|

|

| 3. |

|

Syndicate Cover Transaction Period |

|

|

|

|

|

From Saturday, July 20, 2024 through Friday, August 16, 2024 |

|

End

|

|

Note: This press release was not created for the purpose of offering for sale or soliciting offers for purchase for the shares of our common stock. In

addition, this press release does not constitute an offer to sell or a solicitation of an offer to purchase any securities in the United Statesor elsewhere. The shares of our common stock referred to above have not been, and will not be, registered

under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration thereunder or an applicable exemption from registration requirements. The shares of our common stock referred to

above will not be publicly offered or sold in the United States. |

- 2 -

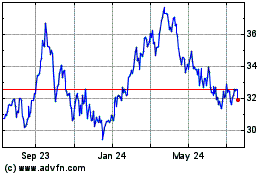

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Dec 2024 to Jan 2025

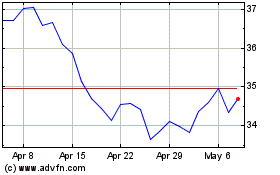

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jan 2024 to Jan 2025