Better-than-expected 4Q for Zynga - Analyst Blog

February 06 2013 - 4:10AM

Zacks

Zynga Inc. (ZNGA)

reported better-than-expected fourth-quarter 2012 results.

Accounting for stock-based compensation expenses, Zynga lost 1 cent

per share, narrower than the Zacks Consensus Estimate of a loss of

4 cents.

On a non-GAAP basis, the company

reported EPS of 1 cent, which was down from 5 cents earned in the

year-ago quarter.

Quarter

Details

Though total revenue for the

quarter remained flat on year-over-year basis at $311.2 million, it

comfortably beat the Zacks Consensus Estimate of $214 million.

However, on a sequential basis, revenues were down 2%.

Advertising revenues jumped 35%

year over year to $37.0 million, due to the addition of several new

advertisers. Companies such as Progressive Insurance and LG

Electronics were added by Zynga, while McDonald’s

(MCD), Honda (HMC), and NBC Universal renewed

their advertising deals with the social game maker.

Online game revenues were down 3%

year over year to $274 million. Bookings decreased 15% year over

year to $261.3 million in the reported quarter, primarily due to

lower web user pay from its games. However, bookings improved 2% on

a sequential basis, aided by the launch of FarmVille

2.

Daily Active Users (“DAU”) were up

3% year over year to 56 million but down 6% sequentially. Monthly

Active Users (“MAU”) spiked 24% year over year to 298 million.

However, on a sequential basis, MAU were down 4%.

During the quarter, Zynga launched

6 new games (4 web-based and 2 mobile games). Moreover, the company

entered into a partnership with bwin.party that will enable Zynga

to offer real money gaming in UK.

The company undertook several

cost-cutting initiatives, which included spending cuts in marketing

acquisition, data hosting, and outside services. Zynga also shut

several of its remote studios (Boston and Japan) and trimmed its

workforce. These resulted in a 65.7% annual decrease in costs to

$273.6 million.

Adjusted EBITDA was $45.0 million

in the quarter, down from $67.8 million reported in the year-ago

quarter. However, on a sequential basis, adjusted EBITDA was up

from $16.2 million.

Zynga reported non-GAAP profit of

$6.9 million in the quarter compared with net income of $37.2

million a year ago. However, including stock based compensation of

$14.9 million, net loss came in at $7.9 million.

At the end of fourth quarter, Zynga

had cash and cash equivalents (including marketable securities) of

$1.28 billion compared with $1.32 billion in the previous quarter.

Zynga generated cash flow from operating activities of $19.8

million versus $30.1 million in the previous quarter. Free cash

flow was $29.5 million.

Outlook

For the first quarter of 2013,

Zynga expects non-GAAP loss per share in the range of 5 cents to 4

cents per share. Stock-based expense is expected to be between $35

million and $45 million

The company expects to generate

revenues in between $255 million and $265 million. Bookings for the

first quarter are projected in the range of $200 million-$210

million.

Moreover, Zynga expects adjusted

EBITDA to be in the range of ($10) million to break even in the

first quarter. For fiscal 2013, Zynga expects adjusted EBITDA

margin to be between 0% and 10%.

Recommendation

We believe that Zynga is well

positioned to grow in the near term based on its innovative product

pipeline and its dominant position in the social and mobile gaming

sector. The company’s expansion in the advertising space is another

positive for the company. Zynga’s initiatives to expand in the real

money casino and poker games across different platforms should act

in its favor. However, we believe that competition from

International Game Technology (IGT) could be a

possible headwind.

Moreover, shareholder friendly

initiatives such as the buyback and cost reduction program will

drive the stock in the near term.

However, we also note that barriers

to entry are low in the social gaming market and this will attract

new entrants, thereby further increasing competition for Zynga over

the long term.

Currently, Zynga has a Zacks Rank

#2 (Buy).

HONDA MOTOR (HMC): Free Stock Analysis Report

INTL GAME TECH (IGT): Free Stock Analysis Report

MCDONALDS CORP (MCD): Free Stock Analysis Report

ZYNGA INC (ZNGA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

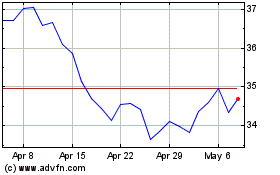

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

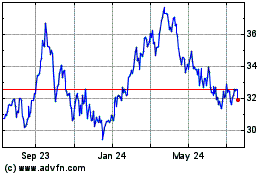

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jul 2023 to Jul 2024