Ford Motor Company and Honda Motor Co., Ltd. Sales Improve Along With the Economy

April 03 2012 - 8:20AM

Marketwired

Strong sales in March are a positive sign of recovery in the U.S.

auto sector. On average, 34 analysts surveyed by Thomson Reuters

expect March sales to hit an annualized pace of 14.75 million

vehicles. That would be up from 13.3 million a year ago but down

from 15.1 million in February. Five Star Equities examines the

outlook for companies in the Oil and Gas Industry and provides

equity research on Ford Motor Company (NYSE: F) and Honda Motor

Co., Ltd. (NYSE: HMC)

Access to the full company reports can be found at:

www.fivestarequities.com/F www.fivestarequities.com/HMC

"The current level of gas prices will further accelerate the

release of pent-up demand as consumers lean towards significantly

more fuel efficient new vehicles while used prices are still

strong," Morgan Stanley analyst Adam Jonas said. Current trends

make Morgan Stanley's projection of 14 million vehicle sales in the

United States this year look "very conservative," Jonas said in a

research note.

Consumers who held off purchases during the economic downturn --

which led to the worst U.S. auto sales since World War II adjusted

for population -- are returning to the market, said Edmunds.com

analyst Jessica Caldwell. "Vehicle trade-in rates have achieved

sustained highs in recent months, which suggests that consumers

have decided that they've held on to their cars for too long,"

Caldwell said. "And with the average credit score for new car

buyers at its lowest level since the first half of 2008, the market

is clearly becoming a friendlier place for all buyers."

Five Star Equities releases regular market updates on the Oil

and Gas Industry so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.fivestarequities.com and

get exclusive access to our numerous stock reports and industry

newsletters.

Ford Motor Company announced that Board of Directors of the

Company declared a second quarter dividend $0.05 per share on the

company's Class B and common stock. This is the same level of

dividend paid in the first quarter of 2012. The second quarter

dividend is payable on June 1, 2012, to shareholders of record on

May 2, 2012.

Honda Motor Co., Japan's third-largest car maker, officially

resumed production on Saturday at its plant in Ayutthaya in

Thailand, which was forced to close for almost six months after

severe flooding last October. Pitak Pruittisarikorn, executive

vice-president for Honda Automobile (Thailand), told a news

conference the plant should produce 150,000 vehicles in the

remaining nine months of 2012 and the target was for output of

240,000 per year.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.fivestarequities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

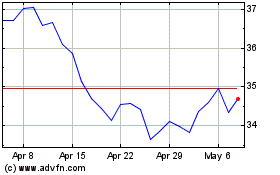

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Sep 2024 to Oct 2024

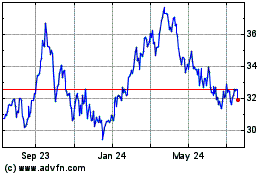

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Oct 2023 to Oct 2024