Statement of Changes in Beneficial Ownership (4)

December 13 2021 - 5:46PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Neri Antonio F |

2. Issuer Name and Ticker or Trading Symbol

Hewlett Packard Enterprise Co

[

HPE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

President and CEO |

|

(Last)

(First)

(Middle)

C/O HEWLETT PACKARD ENTERPRISE COMPANY, 11445 COMPAQ CENTER DRIVE WEST |

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/9/2021 |

|

(Street)

HOUSTON, TX 77070

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 12/9/2021 | | A | | 206123 (1) | A | $15.38 | 600163 | D | |

| Common Stock | 12/9/2021 | | F | | 93938 | D | $15.38 | 506225 | D | |

| Common Stock | 12/9/2021 | | A | | 146449 (2) | A | $15.38 | 652674 | D | |

| Common Stock | 12/9/2021 | | F | | 65363 | D | $15.38 | 587311 | D | |

| Common Stock | 12/10/2021 | | M | | 116106 | A | $15.21 | 703417 | D | |

| Common Stock | 12/10/2021 | | F | | 53495 | D | $15.21 | 649922 | D | |

| Common Stock | 12/10/2021 | | M | | 12720 | A | $15.21 | 662642 | D | |

| Common Stock | 12/10/2021 | | F | | 5861 | D | $15.21 | 656781 | D | |

| Common Stock | 12/10/2021 | | M | | 113110 | A | $15.21 | 769891 | D | |

| Common Stock | 12/10/2021 | | F | | 50140 | D | $15.21 | 719751 | D | |

| Common Stock | 12/10/2021 | | M | | 8931 | A | $15.21 | 728682 | D | |

| Common Stock | 12/10/2021 | | F | | 3959 | D | $15.21 | 724723 | D | |

| Common Stock | 12/10/2021 | | M | | 171892 | A | $15.21 | 896615 | D | |

| Common Stock | 12/10/2021 | | F | | 67640 | D | $15.21 | 828975 | D | |

| Common Stock | 12/10/2021 | | M | | 5842 | A | $15.21 | 834817 | D | |

| Common Stock | 12/10/2021 | | F | | 2299 | D | $15.21 | 832518 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Restricted Stock Units | (3) | 12/10/2021 | | M | | | 116106 (4) | (4) | (4) | Common Stock | 116106 | (4) | 0 | D | |

| Restricted Stock Units | (3) | 12/10/2021 | | M | | | 113110 (5) | (5) | (5) | Common Stock | 113110 | (5) | 122040 | D | |

| Restricted Stock Units | (3) | 12/10/2021 | | M | | | 171892 (6) | (6) | (6) | Common Stock | 171892 | (6) | 355467 | D | |

| Restricted Stock Units | (3) | 12/9/2021 | | A | | 422627 (7) | | (7) | (7) | Common Stock | 422627 | (7) | 422627 | D | |

| Explanation of Responses: |

| (1) | As previously reported, on 12/10/18 the reporting person was granted performance adjusted restricted stock units ("PARSUs") subject to Non-GAAP Net Income and relative total stockholder return conditions being met at the time of vesting. These PARSUs vest 50% after 2 and 3 years subject to performance and are issued in Issuer's common stock. |

| (2) | On 12/10/19 the reporting person was granted PARSUs subject to Non-GAAP Net Income and relative total stockholder return conditions being met at the time of vesting. These PARSUs vest 50% after 2 and 3 years subject to performance and are issued in Issuer's common stock. |

| (3) | Each restricted stock unit represents a contingent right to receive one share of Issuer's common stock. |

| (4) | As previously reported, on 12/10/18 the reporting person was granted 348,318 Restricted Stock Units ("RSUs"), 116,106 of which vested on each of 12/10/19 and 12/10/20, and 116,106 of which vested on 12/10/21. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. The number of derivative securities in column 5 also includes 12,720 vested RSU dividend equivalent rights and a de minimus adjustment of 0.4960 due to fractional rounding of the dividend. |

| (5) | As previously reported, on 12/10/19 the reporting person was granted 339,331 RSUs, 113,110 of which vested on 12/10/20, 113,110 of which vested on 12/10/21, and 113,111 of which will vest on 12/10/22. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. The number of derivative securities in column 5 also includes 8,931 vested RSU dividend equivalent rights and a de minimus adjustment of 0.5778 due to fractional rounding of the dividend. |

| (6) | As previously reported, on 12/10/20 the reporting person was granted 515,677 RSUs, 171,892 of which vested on 12/10/21, 171,892 of which will vest on 12/10/22, and 171,893 of which will vest on 12/10/23. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. The number of derivative securities in column 5 also includes 5,842 vested RSU dividend equivalent rights and a de minimus adjustment of 0.3094 due to fractional rounding of the dividend. |

| (7) | On 12/09/21 the reporting person was granted 422,627 RSUs, 140,875 of which will vest on 12/09/22, and 140,876 of which will vest on each of 12/09/23 and 12/09/24. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Neri Antonio F

C/O HEWLETT PACKARD ENTERPRISE COMPANY

11445 COMPAQ CENTER DRIVE WEST

HOUSTON, TX 77070 |

|

| President and CEO |

|

Signatures

|

| Derek Windham as Attorney-in-Fact for Antonio F. Neri | | 12/13/2021 |

| **Signature of Reporting Person | Date |

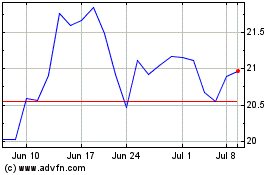

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Jun 2024 to Jul 2024

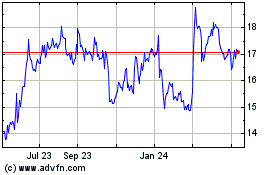

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Jul 2023 to Jul 2024