Amended Current Report Filing (8-k/a)

November 05 2021 - 9:12AM

Edgar (US Regulatory)

Form 8-K/A date of report 11-04-21

true

0000719413

0000719413

2021-11-04

2021-11-04

0000719413

hl:CommonStockParValue025PerShareCustomMember

2021-11-04

2021-11-04

0000719413

hl:SeriesBCumulativeConvertiblePreferredStockParValue025PerShareCustomMember

2021-11-04

2021-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K/A

(Amendment No. 1)

Current Report

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 4, 2021

HECLA MINING COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware

|

1-8491

|

77-0664171

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

of incorporation)

|

|

|

6500 North Mineral Drive, Suite 200

Coeur d'Alene, Idaho 83815-9408

(Address of principal executive offices) (Zip Code)

(208) 769-4100

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.25 per share

|

HL

|

New York Stock Exchange

|

|

Series B Cumulative Convertible Preferred Stock, par value $0.25 per share

|

HL-PB

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This Form 8-K/A is being filed as an amendment to the Current Report on Form 8-K filed by Hecla Mining Company with the U.S. Securities and Exchange Commission on November 4, 2021. The purpose of this Amendment is to re-furnish the News Release dated November 4, 2021, attached as Exhibit 99.1 (“News Release”) in order to correct the following:

|

|

(i)

|

to include the Nevada Operations Cash costs per gold ounce and AISC per gold ounce in the table on page 4;

|

|

|

(ii)

|

to change the decrease in Greens Creek Mine AISC per ounce to $0.64 per ounce on page 5;

|

|

|

(iii)

|

to change the quarter to the third quarter when describing Lucky Friday cost of sales on page 6;

|

|

|

(iv)

|

to change the dividend payable date of the Series B Cumulative Convertible Preferred Stock to on or about January 3, 2022 on page 7;

|

|

|

(v)

|

to change the amount stated as the silver-linked component of the common stock dividend on page 7 of the News Release from “0.75 cent per share” to “0.25 cent per share”;

|

|

|

(vi)

|

to include a line item for cash flow activity, namely ’Other non-cash items, net’ in the operating section and ’Proceeds from exchange of investments’ in investing activities sections of the condensed consolidated cash flow statement on page 12;

|

|

|

(vii)

|

to change the amount of a non-cash flow element, namely ‘Deferred income taxes’ in the operating activities section of the condensed consolidated cash flow statement on page 12;

|

|

|

(viii)

|

to correct underground and surface production data for Casa Berardi in the table on page 14;

|

|

|

(ix)

|

in the reconciliations of Cost of Sales and Other Direct Production Costs and Amortization (GAAP) to Cash Cost, Before By-product Credits and Cash Cost, Before By-product Credits and All-In Sustaining Cost, After By-products Credits (non-GAAP):

|

|

|

(a)

|

To correct ‘AISC, Before By-product Credits, per Ounce’ and ‘AISC, After By-product Credits, per Ounce’ for the Nevada Operations on page 17;

|

|

|

(b)

|

To correct ‘Cash Cost, Before By-product Credits, per Ounce’ and ‘Cash Cost, After By-product Credits, per Ounce’ for San Sebastian on page 19;

|

|

|

(c)

|

To include a line item ‘Exclusion of Nevada cash costs’ on pages 20 and 26 for the Nevada Operations;

|

|

|

(d)

|

To correct the ‘Total Gold’ column on pages 21 and 27 for the Exclusion of the Nevada cash costs;

|

|

|

(e)

|

To correct the ‘Total’ column on pages 21 and 27 for the Exclusion of the Nevada cash costs;

|

|

|

(f)

|

To correct the ‘Total Silver’ ‘Cost of sales and other direct production costs and depreciation, depletion and amortization amounts’ which impact ‘Cash Cost, Before By-product Credits, AISC, Before By-product Credits, Cash Cost, After By-product Credits and AISC, After By-product Credits’ on page 25 and 27;

|

|

|

(g)

|

To correct the following items in the ‘Casa Berardi’ column on page 31:

|

|

|

●

|

‘Cash Cost, Before By-product Credits’

|

|

|

●

|

‘AISC, Before By-product Credits’

|

|

|

●

|

‘Cash Cost, After By-product Credits’

|

|

|

●

|

‘AISC, After By-product Credits’

|

|

|

●

|

‘AISC, After By-product Credits, per Ounce’

|

|

|

(h)

|

To correct the following line items in the ‘Total Gold’ column on page 31:

|

|

|

●

|

‘Change in product inventory’

|

|

|

●

|

‘Reclamation and other costs’

|

|

|

●

|

‘Cash Cost, Before By-product Credits’

|

|

|

●

|

‘Reclamation and other costs’

|

|

|

●

|

‘AISC, Before By-product Credits’

|

|

|

●

|

‘By-Products Credits: Silver’

|

|

|

●

|

‘Total By-product Credits’

|

|

|

●

|

‘Cash Cost, After By-product Credits’

|

|

|

●

|

‘AISC, After By-product Credits’

|

|

|

(i)

|

To correct the ‘Total Silver’ line item ‘AISC, After By-product Credits, per Ounce’ on page 30; and

|

|

|

(j)

|

To correct the ‘Total Gold’ line item ‘Cash Cost, After By-product Credits, per Ounce’ and the ‘Total Silver’ line item ‘AISC, After By-product Credits, per Ounce’ on page 32 of the News Release.

|

Except for the foregoing, this Form 8-K/A does not amend, modify, or update the disclosures contained in the original Form 8-K.

Item 2.02 Results of Operations and Financial Condition.

On November 4, 2021, Hecla Mining Company (the “Company”) issued a news release announcing the Company’s third quarter 2021 financial results. The news release is attached hereto as Exhibit 99.1 to this Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any of the Company’s filings or other documents filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events

On November 4, 2021, the Company announced it would pay a dividend on its shares of common stock in the amount of 0.625 cent, to shareholders of record as of November 19, 2021, payable on or about December 3, 2021. In addition to the common stock dividend, the Company also announced it declared a dividend of 87.5 cents on its Series B Cumulative Convertible Preferred Stock to shareholders of record as of December 15, 2021, payable on or about

January 3, 2022.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101).

|

|

|

|

|

|

|

|

* Furnished herewith

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HECLA MINING COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David C. Sienko

|

|

|

|

|

David C. Sienko

|

|

|

|

|

Vice President and General Counsel

|

|

Dated: November 5, 2021

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Jun 2024 to Jul 2024

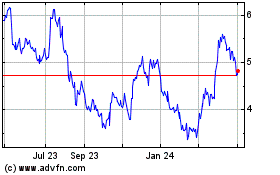

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Jul 2023 to Jul 2024