0000012659false00000126592025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 4, 2025

H&R BLOCK, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | |

| Missouri | 1-06089 | 44-0607856 |

| (State or other jurisdiction of | (Commission File Number) | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

One H&R Block Way, Kansas City, MO 64105

(Address of Principal Executive Offices) (Zip Code)

(816) 854-3000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, without par value | HRB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 4, 2025, H&R Block, Inc. (the "Company") issued a press release regarding the Company’s results of operations for the fiscal quarter ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit Number Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | H&R BLOCK, INC. |

| | | |

| Date: | February 4, 2025 | By: | /s/ Katharine M. Haynes |

| | | Katharine M. Haynes |

| | | Vice President and Corporate Secretary |

Exhibit 99.1

News Release

For Immediate Release: February 4, 2025

H&R Block Reports Fiscal 2025 Second Quarter Results

— Repurchased $190 Million of Shares—

— Reaffirms Full Year Outlook —

KANSAS CITY, Mo. - H&R Block, Inc. (NYSE: HRB) (the "Company") today released financial results1 for its fiscal 2025 second quarter ended December 31, 2024.

"I am pleased with our performance in the first half of the year," said Jeff Jones, president and chief executive officer. "We are reaffirming our fiscal 2025 outlook, and are well prepared to deliver this tax season and in the second half of the fiscal year."

Fiscal 2025 Second Quarter Results and Key Financial Metrics

"We are on track for the year and we are well positioned to deliver strong results," said Tiffany Mason, chief financial officer. "During the second quarter, we repurchased 3.2 million shares for $190 million, reflecting our confidence in the long-term value of our stock and our commitment to delivering shareholder returns."

For the second quarter, the Company delivered total revenue of $179.1 million, which was flat to the prior year. Increases in revenue from Wave and international tax preparation were offset by lower interest and fee income on Emerald Advance® due to a decrease in loan originations.

Total operating expenses of $472.4 million increased by $25.8 million as expected, primarily due to higher tax professional and corporate wages, increased healthcare costs, an increase in occupancy costs and the timing of marketing expenses versus the prior year.

Pretax loss increased by $29.4 million to $312.3 million.

Loss per share from continuing operations2 increased to $(1.79) from $(1.33) and adjusted loss per share from continuing operations2 increased to $(1.73) from $(1.27), due to a higher net loss and fewer shares outstanding as a result of share repurchases, which are accretive to earnings per share on a full-year basis.

Capital Allocation

The Company reported the following related to its capital structure:

•Repurchased and retired 3.2 million shares at an aggregate price of $190.5 million, or $58.65 per share in the second quarter.

•The Company has approximately $1.1 billion remaining on its $1.5 billion share repurchase program.

Since 2016, the Company has returned more than $4.4 billion to shareholders in the form of dividends and share repurchases, buying back over 43% of its shares outstanding3.

1All amounts in this release are unaudited. Unless otherwise noted, all comparisons refer to the current period compared to the corresponding prior year period.

2All per share amounts are based on fully diluted shares at the end of the corresponding period. The Company reports non-GAAP financial measures of performance, including adjusted earnings per share (EPS), earnings before interest, tax, depreciation, and amortization (EBITDA) from continuing operations, free cash flow, and free cash flow yield, which it considers to be useful metrics for management and investors to evaluate and compare the ongoing operating performance of the Company. See "About Non-GAAP Financial Information" below for more information regarding financial measures not prepared in accordance with generally accepted accounting principles (GAAP).

3Shares outstanding calculated as of April 30, 2016.

Fiscal Year 2025 Outlook Reaffirmed

The Company continues to expect:

•Revenue to be in the range of $3.69 to $3.75 billion.

•EBITDA4 to be in the range of $975 million to $1.02 billion.

•Effective tax rate to be approximately 13%, resulting in a one-time benefit to EPS of approximately 50 cents.

•Adjusted Diluted Earnings Per Share4 to be in the range of $5.15 to $5.35.

Conference Call

The Company will host a conference call for analysts and investors to discuss second quarter 2025 results at 4:30 p.m. ET on Tuesday, February 4, 2025. To join live, participants must register at https://register.vevent.com/register/BI06a7e8ddc07544a6853995c1fe75ea2c. Once registered, the participant will receive a dial-in number and unique PIN to access the call. Please join approximately 5 minutes prior to the scheduled start time.

The call, along with a presentation for viewing, will also be webcast in a listen-only format for the media and general public. The webcast can be accessed directly at https://edge.media-server.com/mmc/p/qdeqpgfd and will be available for replay 2 hours after the call is concluded and continuing for 90 days.

About H&R Block

H&R Block, Inc. (NYSE: HRB) provides help and inspires confidence in its clients and communities everywhere through global tax preparation services, financial products, and small-business solutions. The company blends digital innovation with human expertise and care as it helps people get the best outcome at tax time, and be better with money using its mobile banking app, Spruce. Through Block Advisors and Wave, the company helps small-business owners thrive with year-round bookkeeping, payroll, advisory, and payment processing solutions. For more information, visit H&R Block News.

About Non-GAAP Financial Information

This press release and the accompanying tables include non-GAAP financial information. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with generally accepted accounting principles, please see the section of the accompanying tables titled "Non-GAAP Financial Information."

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words such as "expects," "anticipates," "intends," "plans," "believes," "commits," "seeks," "estimates," "projects," "forecasts," "targets," "would," "will," "should," "goal," "could" or "may" or other similar expressions. Forward-looking statements provide management's current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. They may include estimates of revenues, client trajectory, income, effective tax rate, earnings per share, cost savings, capital expenditures, dividends, share repurchases, liquidity, capital structure, market share, industry volumes or other financial items, descriptions of management’s plans or objectives for future operations, products or services, or descriptions of

4Adjusted Diluted EPS and EBITDA from continuing operations are non-GAAP financial measures. Future period non-GAAP outlook includes adjustments for items not indicative of our core operations, which may include, without limitation, items described in the below section titled “Non-GAAP Financial Information” and in the accompanying tables. Such adjustments may be affected by changes in ongoing assumptions and judgments, as well as nonrecurring, unusual, or unanticipated charges, expenses or gains, or other items that may not directly correlate to the underlying performance of our business operations. The exact amounts of these adjustments are not currently determinable but may be significant. It is therefore not practicable to provide the comparable GAAP measures or reconcile this non-GAAP outlook to the most comparable GAAP measures.

assumptions underlying any of the above. They may also include the expected impact of external events beyond the Company’s control, such as outbreaks of infectious disease, severe weather events, natural or manmade disasters, or changes in the regulatory environment in which we operate. All forward-looking statements speak only as of the date they are made and reflect the Company's good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data or methods, future events or other changes, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to a variety of economic, competitive and regulatory factors, many of which are beyond the Company's control, that are described in our Annual Report on Form 10-K for the most recently completed fiscal year in the section entitled "Risk Factors" and additional factors we may describe from time to time in other filings with the Securities and Exchange Commission. You may get such filings for free at our website at https://investors.hrblock.com. In addition, factors that may cause the Company’s actual estimated effective tax rate to differ from estimates include the Company’s actual results from operations compared to current estimates, future discrete items, changes in interpretations and assumptions the Company has made, future actions of the Company, or increases in applicable tax rates in jurisdictions where the Company operates. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

| | | | | | | | |

| For Further Information |

| | |

| Investor Relations: | | Colby Brown, (816) 854-4559, colby.brown@hrblock.com |

| | Jordyn Eskijian, (816) 854-5674, jordyn.eskijian@hrblock.com |

| Media Relations: | | Teri Daley, (816) 854-3787, teri.daley@hrblock.com |

| | Media Desk, mediadesk@hrblock.com |

TABLES FOLLOW

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| FINANCIAL RESULTS | | (unaudited, in 000s - except per share amounts) |

| | Three months ended December 31, | | Six months ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| REVENUES: | | | | | | | | |

| U.S. tax preparation and related services: | | | | | | | | |

| Assisted tax preparation | | $ | 48,380 | | | $ | 48,342 | | | $ | 91,343 | | | $ | 87,605 | |

| Royalties | | 3,499 | | | 5,454 | | | 9,351 | | | 11,155 | |

| DIY tax preparation | | 13,744 | | | 13,111 | | | 16,980 | | | 16,959 | |

| Refund Transfers | | 637 | | | 813 | | | 1,497 | | | 1,955 | |

| Peace of Mind® Extended Service Plan | | 16,145 | | | 17,440 | | | 39,242 | | | 42,287 | |

| Tax Identity Shield® | | 4,013 | | | 4,694 | | | 7,922 | | | 9,274 | |

| Other | | 11,824 | | | 9,592 | | | 25,633 | | | 20,572 | |

| Total U.S. tax preparation and related services | | 98,242 | | | 99,446 | | | 191,968 | | | 189,807 | |

| Financial services: | | | | | | | | |

Emerald Card® and SpruceSM | | 10,148 | | | 11,700 | | | 18,974 | | | 20,333 | |

| Interest and fee income on Emerald Advance® | | 12,308 | | | 15,235 | | | 12,308 | | | 15,533 | |

| Total financial services | | 22,456 | | | 26,935 | | | 31,282 | | | 35,866 | |

| International | | 31,811 | | | 29,569 | | | 96,666 | | | 90,134 | |

| Wave | | 26,561 | | | 23,133 | | | 52,964 | | | 47,076 | |

| Total revenues | | $ | 179,070 | | | $ | 179,083 | | | $ | 372,880 | | | $ | 362,883 | |

| Compensation and benefits: | | | | | | | | |

| Field wages | | 81,565 | | | 77,795 | | | 149,659 | | | 140,230 | |

| Other wages | | 78,731 | | | 74,671 | | | 156,066 | | | 146,769 | |

| Benefits and other compensation | | 38,402 | | | 36,063 | | | 77,156 | | | 71,311 | |

| | 198,698 | | | 188,529 | | | 382,881 | | | 358,310 | |

| Occupancy | | 104,999 | | | 101,194 | | | 206,317 | | | 200,479 | |

| Marketing and advertising | | 14,863 | | | 11,305 | | | 24,835 | | | 16,786 | |

| Depreciation and amortization | | 29,195 | | | 30,107 | | | 58,026 | | | 60,332 | |

| Bad debt | | 19,416 | | | 21,754 | | | 22,146 | | | 26,552 | |

| Other | | 105,190 | | | 93,626 | | | 200,297 | | | 174,182 | |

| Total operating expenses | | 472,361 | | | 446,515 | | | 894,502 | | | 836,641 | |

| Other income (expense), net | | 2,744 | | | 5,922 | | | 14,661 | | | 15,758 | |

| Interest expense on borrowings | | (21,752) | | | (21,364) | | | (37,599) | | | (37,234) | |

| Pretax loss | | (312,299) | | | (282,874) | | | (544,560) | | | (495,234) | |

| Income tax benefit | | (69,833) | | | (93,758) | | | (130,673) | | | (143,245) | |

| Net loss from continuing operations | | (242,466) | | | (189,116) | | | (413,887) | | | (351,989) | |

| Net loss from discontinued operations | | (954) | | | (639) | | | (2,109) | | | (1,248) | |

| Net loss | | $ | (243,420) | | | $ | (189,755) | | | $ | (415,996) | | | $ | (353,237) | |

| BASIC AND DILUTED LOSS PER SHARE: | | | | | | | | |

| Continuing operations | | $ | (1.79) | | | $ | (1.33) | | | $ | (3.02) | | | $ | (2.44) | |

| Discontinued operations | | (0.01) | | | — | | | (0.01) | | | (0.01) | |

| Consolidated | | $ | (1.80) | | | $ | (1.33) | | | $ | (3.03) | | | $ | (2.45) | |

| WEIGHTED AVERAGE DILUTED SHARES | | 135,563 | | | 142,340 | | | 137,359 | | | 144,307 | |

Adjusted diluted EPS (1) | | $ | (1.73) | | | $ | (1.27) | | | $ | (2.89) | | | $ | (2.31) | |

EBITDA (1) | | $ | (261,352) | | | $ | (231,403) | | | $ | (448,935) | | | $ | (397,668) | |

| | | | | | | | |

| | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEETS | | (unaudited, in 000s - except per share data) |

| As of | | December 31, 2024 | | June 30, 2024 |

| | | | |

| ASSETS | | | | |

| Cash and cash equivalents | | $ | 320,051 | | | $ | 1,053,326 | |

| Cash and cash equivalents - restricted | | 21,473 | | | 21,867 | |

| Receivables, net | | 321,171 | | | 69,075 | |

| | | | |

| Prepaid expenses and other current assets | | 114,658 | | | 95,208 | |

| Total current assets | | 777,353 | | | 1,239,476 | |

| Property and equipment, net | | 143,833 | | | 131,319 | |

| Operating lease right of use assets | | 389,629 | | | 461,986 | |

| Intangible assets, net | | 270,601 | | | 264,102 | |

| Goodwill | | 783,286 | | | 785,226 | |

| Deferred tax assets and income taxes receivable | | 281,694 | | | 271,658 | |

| Other noncurrent assets | | 65,924 | | | 65,043 | |

| Total assets | | $ | 2,712,320 | | | $ | 3,218,810 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| LIABILITIES: | | | | |

| Accounts payable and accrued expenses | | $ | 136,893 | | | $ | 155,830 | |

| Accrued salaries, wages and payroll taxes | | 64,993 | | | 105,548 | |

| Accrued income taxes and reserves for uncertain tax positions | | 149,255 | | | 318,830 | |

| Current portion of long-term debt | | 349,611 | | | — | |

| Operating lease liabilities | | 170,726 | | | 206,070 | |

| Deferred revenue and other current liabilities | | 187,885 | | | 191,050 | |

| Total current liabilities | | 1,059,363 | | | 977,328 | |

| Long-term debt and line of credit borrowings | | 1,932,545 | | | 1,491,095 | |

| Deferred tax liabilities and reserves for uncertain tax positions | | 292,643 | | | 291,063 | |

| Operating lease liabilities | | 228,041 | | | 265,373 | |

| Deferred revenue and other noncurrent liabilities | | 72,188 | | | 103,357 | |

| Total liabilities | | 3,584,780 | | | 3,128,216 | |

| COMMITMENTS AND CONTINGENCIES | | | | |

| STOCKHOLDERS’ EQUITY: | | | | |

| Common stock, no par, stated value $.01 per share | | 1,644 | | | 1,709 | |

| Additional paid-in capital | | 752,093 | | | 762,583 | |

| Accumulated other comprehensive loss | | (71,762) | | | (48,845) | |

| Retained earnings (deficit) | | (908,785) | | | 12,654 | |

| Less treasury shares, at cost | | (645,650) | | | (637,507) | |

| Total stockholders' equity (deficiency) | | (872,460) | | | 90,594 | |

| Total liabilities and stockholders' equity | | $ | 2,712,320 | | | $ | 3,218,810 | |

| | | | |

| | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | | (unaudited, in 000s) |

| Six months ended December 31, | | 2024 | | 2023 |

| | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| Net loss | | $ | (415,996) | | | $ | (353,237) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Depreciation and amortization | | 58,026 | | | 60,331 | |

| Provision for credit losses | | 20,727 | | | 21,536 | |

| Deferred taxes | | (1,531) | | | (35,525) | |

| Stock-based compensation | | 17,945 | | | 17,525 | |

| Changes in assets and liabilities, net of acquisitions: | | | | |

| Receivables | | (262,348) | | | (348,833) | |

| Prepaid expenses, other current and noncurrent assets | | 2,588 | | | (7,395) | |

| Accounts payable, accrued expenses, salaries, wages and payroll taxes | | (76,806) | | | (58,543) | |

| Deferred revenue, other current and noncurrent liabilities | | (45,170) | | | (58,520) | |

| Income tax receivables, accrued income taxes and income tax reserves | | (192,340) | | | (180,706) | |

| Other, net | | (733) | | | 1,201 | |

| Net cash used in operating activities | | (895,638) | | | (942,166) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

| | | | |

| | | | |

| | | | |

| Capital expenditures | | (49,115) | | | (32,708) | |

| Payments made for business acquisitions, net of cash acquired | | (28,017) | | | (27,158) | |

| | | | |

| | | | |

| | | | |

| Franchise loans funded | | (17,442) | | | (15,491) | |

| Payments from franchisees | | 971 | | | 2,747 | |

| | | | |

| Other, net | | 6,110 | | | 1,565 | |

| Net cash used in investing activities | | (87,493) | | | (71,045) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Repayments of line of credit borrowings | | (100,000) | | | (25,000) | |

| Proceeds from line of credit borrowings | | 890,000 | | | 825,000 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Dividends paid | | (96,960) | | | (89,854) | |

| Repurchase of common stock, including shares surrendered | | (436,233) | | | (378,709) | |

| | | | |

| Other, net | | 1,791 | | | 4,011 | |

| Net cash provided by financing activities | | 258,598 | | | 335,448 | |

| Effects of exchange rate changes on cash | | (9,136) | | | 671 | |

| Net decrease in cash and cash equivalents, including restricted balances | | (733,669) | | | (677,092) | |

| Cash, cash equivalents and restricted cash, beginning of period | | 1,075,193 | | | 1,015,316 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 341,524 | | | $ | 338,224 | |

| SUPPLEMENTARY CASH FLOW DATA: | | | | |

| Income taxes paid, net (includes payments for purchased investment tax credits) | | $ | 62,290 | | | $ | 72,160 | |

| Interest paid on borrowings | | 33,412 | | | 35,496 | |

| Accrued additions to property and equipment | | 3,798 | | | 4,036 | |

| New operating right of use assets and related lease liabilities | | 47,135 | | | 70,532 | |

| Accrued dividends payable to common shareholders | | 50,176 | | | 45,273 | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in 000s) |

| | Three months ended December 31, | | Six months ended December 31, |

| NON-GAAP FINANCIAL MEASURE - EBITDA | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Net loss - as reported | | $ | (243,420) | | | $ | (189,755) | | | $ | (415,996) | | | $ | (353,237) | |

| Discontinued operations, net | | 954 | | | 639 | | | 2,109 | | | 1,248 | |

| Net loss from continuing operations - as reported | | (242,466) | | | (189,116) | | | (413,887) | | | (351,989) | |

| Add back: | | | | | | | | |

| Income tax benefit | | (69,833) | | | (93,758) | | | (130,673) | | | (143,245) | |

| Interest expense | | 21,752 | | | 21,364 | | | 37,599 | | | 37,234 | |

| Depreciation and amortization | | 29,195 | | | 30,107 | | | 58,026 | | | 60,332 | |

| | (18,886) | | | (42,287) | | | (35,048) | | | (45,679) | |

| EBITDA from continuing operations | | $ | (261,352) | | | $ | (231,403) | | | $ | (448,935) | | | $ | (397,668) | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in 000s, except per share amounts) |

| | Three months ended December 31, | | Six months ended December 31, |

| NON-GAAP FINANCIAL MEASURE - ADJUSTED EPS | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Net loss from continuing operations - as reported | | $ | (242,466) | | | $ | (189,116) | | | $ | (413,887) | | | $ | (351,989) | |

| Adjustments: | | | | | | | | |

| Amortization of intangibles related to acquisitions (pretax) | | 10,910 | | | 12,269 | | | 22,038 | | | 24,824 | |

Tax effect of adjustments (1) | | (2,539) | | | (3,087) | | | (5,184) | | | (6,022) | |

| Adjusted net loss from continuing operations | | $ | (234,095) | | | $ | (179,934) | | | $ | (397,033) | | | $ | (333,187) | |

| Diluted loss per share from continuing operations - as reported | | $ | (1.79) | | | $ | (1.33) | | | $ | (3.02) | | | $ | (2.44) | |

| Adjustments, net of tax | | 0.06 | | | 0.06 | | | 0.13 | | | 0.13 | |

| Adjusted diluted loss per share from continuing operations | | $ | (1.73) | | | $ | (1.27) | | | $ | (2.89) | | | $ | (2.31) | |

| | | | | | | | |

(1)Tax effect of adjustments is the difference between the tax provision calculated on a GAAP basis and on an adjusted non-GAAP basis.

Non-GAAP Financial Information

Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. Because these measures are not measures of financial performance under GAAP and are susceptible to varying calculations, they may not be comparable to similarly titled measures for other companies.

We consider our non-GAAP financial measures to be performance measures and a useful metric for management and investors to evaluate and compare the ongoing operating performance of our business. We make adjustments for certain non-GAAP financial measures related to amortization of intangibles from acquisitions and goodwill impairments. We may consider whether other significant items that arise in the future should be excluded from our non-GAAP financial measures.

We measure the performance of our business using a variety of metrics, including earnings before interest, taxes, depreciation and amortization (EBITDA) from continuing operations, adjusted EBITDA from continuing operations, adjusted diluted earnings per share from continuing operations, free cash flow, and free cash flow yield. We also use EBITDA from continuing operations and pretax income from continuing operations, each subject to permitted adjustments, as performance metrics in incentive compensation calculations for our employees.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

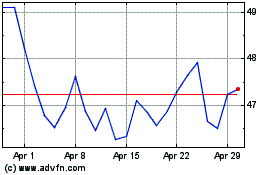

H and R Block (NYSE:HRB)

Historical Stock Chart

From Jan 2025 to Feb 2025

H and R Block (NYSE:HRB)

Historical Stock Chart

From Feb 2024 to Feb 2025