Guggenheim Investments Announces Appointment of a New Trustee & Election of Chief Executive Officer for Certain Closed-End & ...

May 30 2012 - 5:48PM

Business Wire

The exchange traded funds and certain closed-end funds advised

by Guggenheim Funds Investments Advisors, LLC (together the

“Funds”) today announce the appointment of Mr. Donald C.

Cacciapaglia as a Trustee of each of the Funds. The Funds also

announce the election, by the Funds’ Boards of Trustees, of Mr.

Donald C. Cacciapaglia as the Chief Executive Officer. Mr.

Cacciapaglia succeeds Mr. Kevin M. Robinson as Chief Executive

Officer of the Funds. Mr. Robinson will remain the Chief Legal

Officer of the Funds.

Mr. Donald C.

Cacciapaglia

Mr. Cacciapaglia is Senior Managing Director of Guggenheim

Investments, Guggenheim’s investment management business,

responsible for Board relationships. He joined Guggenheim in

February 2010 as President of the investment management businesses

of Guggenheim Partners and Chief Operating Officer of Guggenheim

Partners Asset Management, LLC. Prior to that he was Chairman and

CEO of Channel Capital Group Inc. and its subsidiary broker-dealer

Channel Capital Group LLC, a Guggenheim affiliated company. From

1996 until 2002 when he joined Channel Capital Group, Mr.

Cacciapaglia held the position of Managing Director and Chief

Operating Officer of the Investment Banking Group at PaineWebber.

Additionally, in 1998, he started PaineWebber’s Private Equity

Group and assumed responsibility for the coverage of Leveraged

Buyout firms and the Investment Bank’s Business Development Group.

Before that, Mr. Cacciapaglia was Chief Operating Officer of the

Short and Intermediate Trading Group at CS First Boston

(1995-1996). From 1977 to 1995, he held numerous positions at

Merrill Lynch & Co., including Chief Operating Officer and

Senior Managing Director of Investment Banking, Senior Managing

Director of Global Fixed Income Research and Analytics and Managing

Director of the Western Institutional Region for sales and trading

in San Francisco. Mr. Cacciapaglia was a Senior Analyst with the

Federal Reserve Bank of New York from 1973 -1977.

In addition to his position with Guggenheim Investments, Don is

President, CEO and Trustee of Rydex Dynamic Funds, Rydex ETF Trust,

Rydex Series Funds and Rydex Variable Trust from 2012 to present.

He is President of SBL Fund, Security Equity Fund, Security Income

Fund, Security Large Cap Value Fund and Security Mid Cap Growth

Fund (the “Security Funds”). He will also become a director of the

Security Funds, effective August 23, 2012.

Mr. Cacciapaglia is also President and CEO of Guggenheim Funds

Distributors, LLC, a FINRA registered broker-dealer, and President

and CEO of Guggenheim Funds Investment Advisors, LLC, an SEC

registered investment adviser.

Mr. Cacciapaglia is also an Independent Board Member and Audit

Committee for Equitrust Life Insurance Company, Guggenheim Life and

Annuity Company, and Paragon Life Insurance Company of Indiana.

Interim Chief Compliance

Officer

The Funds also announce the election, by the Funds’ Boards of

Trustees, of Ms. Ann Edgeworth as Interim Chief Compliance Officer.

Ms. Edgeworth currently serves as a Director with Foreside

Compliance Services, LLC. In addition to her service to the

Guggenheim Funds, Ms. Edgeworth serves as the Chief Compliance

Officer for one other investment company that offers exchange

traded products. Prior to joining Foreside in 2011, Ms. Edgeworth

was a Vice President at State Street from 2007-2011 where she

performed a comparable role in the firm’s Compliance Advisory

Services group. Prior to State Street, Ms. Edgeworth was a Director

at Investors Bank & Trust from 2004-2007.

The Funds for which these changes are applicable include all

exchange traded funds in the Claymore Exchange-Traded Fund Trust

and Claymore Exchange-Traded Fund Trust 2 and the following

closed-end funds advised by Guggenheim Funds Investment Advisors,

LLC:

FMO Fiduciary/Claymore MLP Opportunity Fund GBAB

Guggenheim Build America Bonds Managed Duration Trust GEQ

Guggenheim Equal Weight Enhanced Equity Income Fund GGE Guggenheim

Enhanced Equity Strategy Fund GOF Guggenheim Strategic

Opportunities Fund GPM Guggenheim Enhanced Equity Income Fund

About Guggenheim Investments

Guggenheim Investments represents the investment management

division of Guggenheim Partners, LLC (“Guggenheim”), which consists

of investment managers with approximately $130 billion in combined

total assets*. Collectively, Guggenheim Investments has a long,

distinguished history of serving institutional investors,

ultra-high-net-worth individuals, family offices and financial

intermediaries. Guggenheim Investments offers clients a wide range

of differentiated capabilities built on a proven commitment to

investment excellence. Guggenheim Investments has offices in

Chicago, New York City and Santa Monica, along with a global

network of offices throughout the United States, Europe, and

Asia.

Guggenheim Investments is comprised of several investment

management entities within Guggenheim, which includes Guggenheim

Funds Distributors, Inc. and Guggenheim Funds Investment Advisors,

LLC.

*Asset figure is based upon the best available information as of

March 31, 2012 and consists of assets under management and serviced

assets of the various asset managers comprising Guggenheim

Investments. The total asset figure includes $10.7B of leverage for

assets under management and $0.8B of leverage for serviced assets.

Values from some funds are based upon prior periods.

This information does not represent an offer to sell securities

of the Funds and it is not soliciting an offer to buy securities of

the Funds. There can be no assurance that the Funds will achieve

their investment objectives. The net asset value of the Funds will

fluctuate with the value of the underlying securities. It is

important to note that closed-end funds trade on their market

value, not net asset value, and closed-end funds often trade at a

discount to their net asset value. Past performance is not

indicative of future performance. An investment in closed-end funds

is subject to investment risk, including the possible loss of the

entire amount that you invest. Some general risks and

considerations associated with investing in a closed-end fund

include: Investment and Market Risk; Lower Grade Securities Risk;

Equity Securities Risk; Foreign Securities Risk; Interest Rate

Risk; Illiquidity Risk; Derivative Risk; Management Risk;

Anti-Takeover Provisions; Market Disruption Risk and Leverage Risk.

See www.guggenheimfunds.com/cef for a detailed discussion of

closed-end fund-specific risks.

Investors should consider the investment objectives and

policies, risk considerations, charges and expenses of the Funds

carefully before they invest. To obtain a prospectus, which

contains this and other information, visit guggenheimfunds.com or

contact your sales team at Guggenheim Funds Distributors, LLC 2455

Corporate West Drive, Lisle, IL 60532.

Read a fund’s prospectus and summary prospectus (if

available) carefully before investing. It contains a fund’s

investment objectives, risks, charges, expenses and other

information, which should be considered carefully before investing.

Obtain a Guggenheim Funds prospectus and summary prospectus (if

available) at guggenheimfunds.com or call 800.345.7999.

NOT FDIC-INSURED | NOT BANK-GUARANTEED | MAY LOSE VALUE

Member FINRA/SIPC (5/12)

Guggenheim Taxable Munic... (NYSE:GBAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

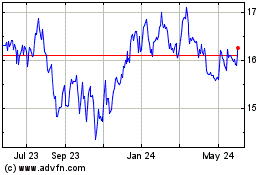

Guggenheim Taxable Munic... (NYSE:GBAB)

Historical Stock Chart

From Jul 2023 to Jul 2024