0001386278false00013862782025-02-272025-02-270001386278dei:FormerAddressMember2025-02-272025-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 27, 2025

Green Dot Corporation

(Exact Name of the Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation) | | | | | | | | |

| 001-34819 | | 95-4766827 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1675 N. Freedom Blvd (200 West) Building 1 | | | | | | |

| Provo, | Utah | 84604 | | | | (626) | 765-2000 | |

| (Address of Principal Executive Offices) | | (Registrant's Telephone Number, Including Area Code) |

| | | | | | | | |

| 114 W 7th Street, Suite 240 |

| Austin, | Texas | 78701 |

(Former Name or Former Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class: | Trading Symbol(s): | Name of each exchange on which registered: |

| Class A Common Stock, $0.001 par value | GDOT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 27, 2025, Green Dot Corporation issued a press release announcing its financial results for the quarter ended December 31, 2024 and certain other financial information. A copy of the press release is furnished as Exhibit 99.01 to this Current Report and is incorporated herein by reference.

The information furnished in this Current Report, including the exhibit hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description of Exhibits |

| | |

| 99.01 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| GREEN DOT CORPORATION | |

| | | |

| By: | | /s/ Jess Unruh | |

| | Jess Unruh | |

| | Chief Financial Officer | |

Date: February 27, 2025

Green Dot Reports Fourth Quarter 2024 Results

–Company Posts Active Account Growth, Expands Embedded Finance Business with New Fintech, Retail & Other BaaS Partnerships

–2025 Guidance Expects Embedded Finance Including BaaS and Money Movement to Drive 2025 Growth

Provo, UT - February 27, 2025 - Green Dot Corporation (NYSE: GDOT), a leading digital bank and fintech that delivers seamless banking and payment tools for consumers and businesses, today reported financial results for the quarter ended December 31, 2024.

“It was a solid year and fourth quarter for Green Dot as we accelerated revenue and earnings growth and saw our first positive quarter of account growth in several years,” said George Gresham, Chief Executive Officer of Green Dot. "We balanced the impact of ongoing headwinds with operational improvements and growth in our B2B and embedded finance businesses, aided by new partner wins including Varo, Clip Money, DolFintech and others -- reflecting the increasing demand and growth opportunity in embedded finance and Green Dot’s unique value proposition. This reinforces our investments in Arc, our embedded finance brand and platform, and further bolsters my confidence in our growth strategy and path forward.”

Consolidated Results Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Year Ended December 31, | | |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| (In thousands, except per share data and percentages) | | |

GAAP financial results | | | | | | | | | | | |

| Total operating revenues | $ | 455,024 | | | $ | 366,043 | | | 24% | | $ | 1,723,876 | | | $ | 1,501,328 | | | 15% |

| Net income (loss) | $ | 5,103 | | | $ | (23,603) | | | (122)% | | $ | (26,702) | | | $ | 6,722 | | | (497)% |

| Diluted earnings (loss) per common share | $ | 0.09 | | | $ | (0.45) | | | (120)% | | $ | (0.50) | | | $ | 0.13 | | | (485)% |

| | | | | | | | | | | |

Non-GAAP financial results1 | | | | | | | | | | | |

Non-GAAP total operating revenues1 | $ | 451,717 | | | $ | 361,717 | | | 25% | | $ | 1,707,715 | | | $ | 1,483,795 | | | 15% |

Adjusted EBITDA1 | $ | 43,841 | | | $ | 25,727 | | | 70% | | $ | 165,386 | | | $ | 170,874 | | | (3)% |

| Adjusted EBITDA/Non-GAAP total operating revenues (adjusted EBITDA margin) | 9.7 | % | | 7.1 | % | | 2.6% | | 9.7 | % | | 11.5 | % | | (1.8)% |

Non-GAAP net income1 | $ | 22,191 | | | $ | 7,325 | | | 203% | | $ | 74,005 | | | $ | 85,214 | | | (13)% |

Non-GAAP diluted earnings per share1 | $ | 0.40 | | | $ | 0.14 | | | 186% | | $ | 1.37 | | | $ | 1.62 | | | (15)% |

Unencumbered cash at the holding company was approximately $86 million as of December 31, 2024.

| | | | | |

| 1 | Reconciliations of total operating revenues to non-GAAP total operating revenues, net income to adjusted EBITDA, net income to non-GAAP net income, and diluted earnings per share to non-GAAP diluted earnings per share, respectively, are provided in the tables immediately following the unaudited consolidated financial statements. Additional information about the Company's non-GAAP financial measures can be found under the caption “About Non-GAAP Financial Measures” below. |

Key Metrics

The following table shows Green Dot's quarterly key business metrics for each of the last eight calendar quarters on a consolidated basis and by each of its reportable segments. Please refer to Green Dot’s latest Annual Report on Form 10-K for a description of the key business metrics, as well as additional information regarding how Green Dot organizes its business by segment.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | 2023 |

| Q4 | Q3 | Q2 | Q1 | | Q4 | Q3 | Q2 | Q1 |

| (In millions) |

| Consolidated * | | | | | | | | | |

| Gross dollar volume | $ | 35,282 | | $ | 33,473 | | $ | 32,130 | | $ | 30,755 | | | $ | 26,355 | | $ | 24,836 | | $ | 24,724 | | $ | 23,289 | |

| Number of active accounts | 3.67 | | 3.46 | | 3.41 | | 3.51 | | | 3.57 | | 3.67 | | 3.71 | | 3.84 | |

| Purchase volume | $ | 5,152 | | $ | 4,887 | | $ | 5,012 | | $ | 5,274 | | | $ | 5,273 | | $ | 5,362 | | $ | 5,734 | | $ | 6,145 | |

| Consumer Services | | | | | | | | | |

| Gross dollar volume | $ | 4,060 | | $ | 3,983 | | $ | 4,014 | | $ | 4,500 | | | $ | 4,290 | | $ | 4,619 | | $ | 5,122 | | $ | 5,677 | |

| Number of active accounts | 1.88 | | 1.78 | | 1.76 | | 1.93 | | | 2.05 | | 2.16 | | 2.35 | | 2.41 | |

| Direct deposit active accounts | 0.43 | | 0.44 | | 0.45 | | 0.46 | | | 0.49 | | 0.52 | | 0.59 | | 0.60 | |

| Purchase volume | $ | 3,082 | | $ | 2,904 | | $ | 3,036 | | $ | 3,339 | | | $ | 3,312 | | $ | 3,553 | | $ | 3,984 | | $ | 4,344 | |

| B2B Services | | | | | | | | | |

| Gross dollar volume | $ | 31,222 | | $ | 29,490 | | $ | 28,116 | | $ | 26,255 | | | $ | 22,065 | | $ | 20,217 | | $ | 19,602 | | $ | 17,612 | |

| Number of active accounts | 1.79 | | 1.68 | | 1.65 | | 1.58 | | | 1.52 | | 1.51 | | 1.36 | | 1.43 | |

| Purchase volume | $ | 2,070 | | $ | 1,983 | | $ | 1,976 | | $ | 1,935 | | | $ | 1,961 | | $ | 1,809 | | $ | 1,750 | | $ | 1,801 | |

| Money Movement | | | | | | | | | |

| Number of cash transfers | 8.14 | | 8.22 | | 8.15 | | 7.77 | | | 8.19 | | 8.31 | | 8.66 | | 8.70 | |

| Number of tax refunds processed | 0.15 | | 0.19 | | 4.20 | | 9.28 | | | 0.16 | | 0.20 | | 3.87 | | 9.91 | |

* Represents the sum of Green Dot's Consumer Services and B2B (as defined herein) Services segments.

“We delivered fourth quarter results in line with our expectations and observed another quarter of revenue and earnings growth, while achieving an increase in active accounts for the first time in over three years,” said Jess Unruh, Chief Financial Officer of Green Dot. “Though our 2025 guidance indicates a decline in adjusted EBITDA, this is primarily due to continued headwinds in our Consumer Services segment. Nevertheless, I remain optimistic about the potential for continued growth in our B2B and Money Movement segments, which are integral to our embedded finance strategy.”

2025 Financial Guidance

Green Dot has provided its financial outlook for 2025. Green Dot’s outlook is based on a number of assumptions that management believes are reasonable at the time of this earnings release. In particular, its outlook reflects several considerations, including but not limited to the current macro-economic environment, the effect of inflation and interest rates, negative trends within certain channels of its business, investment in strategic initiatives and compliance programs, and cost reduction initiatives. Information regarding potential risks that could cause the actual results to differ from these forward-looking statements is set forth below and in Green Dot's filings with the Securities and Exchange Commission.

Total Non-GAAP Operating Revenues2

•Green Dot expects its full year non-GAAP total operating revenues2 to be between $1.85 billion and $1.90 billion, or up approximately 10% year over year at the mid-point.

Adjusted EBITDA2

•Green Dot expects its full year adjusted EBITDA2 to be between $145 million and $155 million, or down approximately 9% year over year at the mid-point.

Non-GAAP EPS2

•Green Dot expects its full year non-GAAP EPS2 to be between $1.05 and $1.20, or down 18% year over year at the mid-point.

The components of Green Dot's non-GAAP EPS2 guidance range are as follows:

| | | | | | | | | | | |

| Range |

| Low | | High |

| (In millions, except per share data) |

| Adjusted EBITDA | $ | 145.0 | | | $ | 155.0 | |

| Depreciation and amortization* | (62.0) | | | (62.0) | |

| | | |

| Net interest expense | (7.9) | | | (7.9) | |

| Non-GAAP pre-tax income | $ | 75.1 | | | $ | 85.1 | |

| Tax impact** | (16.1) | | | (18.3) | |

| Non-GAAP net income | $ | 59.0 | | | $ | 66.8 | |

| Diluted weighted-average shares issued and outstanding | 55.9 | | | 55.9 | |

| Non-GAAP earnings per share | $ | 1.05 | | | $ | 1.20 | |

| | | | | |

| * | Excludes the impact of amortization of acquired intangible assets |

| |

| ** | Assumes a non-GAAP effective tax rate of approximately 22% for full year. |

| | | | | |

| 2 | For additional information, see reconciliations of forward-looking guidance for these non-GAAP financial measures to their respective, most directly comparable projected GAAP financial measures provided in the tables immediately following the reconciliation of Net Income to Adjusted EBITDA. |

Conference Call

Green Dot's management will host a conference call to discuss fourth quarter 2024 financial results today at 5:00 p.m. ET. The conference call can be accessed live from Green Dot's investor relations website at http://ir.greendot.com/. Green Dot uses this website as a tool to disclose important information about the company to investors and comply with its disclosure obligations under Regulation Fair Disclosure. A replay of the webcast will be available at the same website following the call. The replay will be available until Thursday, March 6, 2025.

Forward-Looking Statements

This earnings release contains forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, among other things, statements in the quotes of Green Dot's executive officers and under the heading "2025 Financial Guidance," and other future events that involve risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements contained in this earnings release, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from those projected include, among other things, impacts from and changes in general economic conditions on Green Dot’s business, results of operations and financial condition, shifts in consumer behavior towards electronic payments, the timing and impact of revenue growth activities, Green Dot's dependence on revenues derived from Walmart or other large partners, the timing and impact of non-renewals or terminations of agreements with other large partners, impact of competition, Green Dot's reliance on retail distributors for the promotion of its products and services, demand for Green Dot's new and existing products and services, continued and improving returns from Green Dot's investments in strategic initiatives, Green Dot's ability to operate in a highly regulated environment, including with respect to any restrictions imposed on its business, changes to governmental policies or rulemaking or enforcement priorities affecting financial institutions or to existing laws or regulations affecting Green Dot's operating methods or economics, Green Dot's reliance on third-party vendors, changes in credit card association or other network rules or standards, changes in card association and debit network fees or products or interchange rates, instances of fraud developments in the financial services industry that impact debit card usage generally, business interruption or systems failure, economic, political and other conditions may adversely affect trends in consumer spending and Green Dot's involvement in litigation or investigations. These and other risks are discussed in greater detail in Green Dot's Securities and Exchange Commission filings, including its most recent annual report on Form 10-K and quarterly report on Form 10-Q available on Green Dot's investor relations website at ir.greendot.com and on the SEC website at www.sec.gov. All information provided in this release and in the attachments is as of February 27, 2025, and Green Dot assumes no obligation to update this information as a result of future events or developments, except as required by law.

About Non-GAAP Financial Measures

To supplement Green Dot's consolidated financial statements presented in accordance with accounting principles generally accepted in the United States of America (GAAP), Green Dot uses measures of operating results that are adjusted for, among other things, non-operating net interest income and expense; other non-interest investment income earned by its bank; income tax benefit and expense; depreciation and amortization, including amortization of acquired intangibles; certain legal settlement gains and charges; stock-based compensation and related employer payroll taxes; changes in the fair value of contingent consideration; transaction costs from acquisitions; amortization attributable to deferred financing costs, impairment charges; extraordinary severance expenses; earnings or losses from equity method investments; changes in the fair value of loans held for sale; commissions and

certain processing-related costs associated with Banking as a Service ("BaaS") products and services where Green Dot does not control customer acquisition; realized gains on investment securities; other charges and income not reflective of ongoing operating results; and income tax effects. This earnings release includes non-GAAP total operating revenues, adjusted EBITDA, non-GAAP net income, and non-GAAP diluted earnings per share. These non-GAAP financial measures are not calculated or presented in accordance with, and are not alternatives or substitutes for, financial measures prepared in accordance with GAAP, and should be read only in conjunction with Green Dot's financial measures prepared in accordance with GAAP. Green Dot's non-GAAP financial measures may be different from similarly-titled non-GAAP financial measures used by other companies. Green Dot believes that the presentation of non-GAAP financial measures provides useful information to management and investors regarding underlying trends in its consolidated financial condition and results of operations. Green Dot's management regularly uses these supplemental non-GAAP financial measures internally to understand, manage and evaluate Green Dot's business and make operating decisions. For additional information regarding Green Dot's use of non-GAAP financial measures and the items excluded by Green Dot from one or more of its historic and projected non-GAAP financial measures, investors are encouraged to review the reconciliations of Green Dot's historic and projected non-GAAP financial measures to the comparable GAAP financial measures, which are attached to this earnings release, and which can be found by clicking on “Financial Information” in the Investor Relations section of Green Dot's website at http://ir.greendot.com/.

About Green Dot

Green Dot Corporation (NYSE: GDOT) is a financial technology platform and registered bank holding company that builds banking and payment solutions to create value, retain and reward customers, and accelerate growth for businesses of all sizes. For more than two decades, Green Dot has delivered financial tools and services that address the most pressing financial needs of consumers and businesses, and that transform the way people and businesses manage and move money

Green Dot delivers a broad spectrum of financial products to consumers and businesses through its portfolio of brands, including: GO2bank, a leading digital and mobile bank account offering simple, secure and useful banking for Americans living paycheck to paycheck; the Green Dot Network (“GDN”) of more than 90,000 retail distribution and cash access locations nationwide; Arc by Green Dot, the single-source embedded finance platform combining all of Green Dot’s secure banking and money processing capabilities to power businesses at all stages of growth; rapid! wage and disbursements solutions, providing pay card and earned wage access services to more than 6,000 businesses and their employees; and Santa Barbara TPG (“SBTPG”), the company’s tax division, which processes more than 14 million tax refunds annually.

Founded in 1999, Green Dot has managed more than 80 million accounts to date both directly and through its partners. Green Dot Bank is a subsidiary of Green Dot Corporation and member of the FDIC. For more information about Green Dot’s products and services, please visit www.greendot.com.

Contacts

Investor Relations: IR@greendot.com

Media Relations: PR@greendotcorp.com

GREEN DOT CORPORATION

CONSOLIDATED BALANCE SHEETS | | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| (unaudited) | | |

| Assets | (In thousands, except par value) |

| Current assets: | | | |

| Unrestricted cash and cash equivalents | $ | 1,592,391 | | | $ | 682,263 | |

| Restricted cash | 44 | | | 4,239 | |

| Investment securities available-for-sale, at fair value | 24,152 | | | 33,859 | |

| Settlement assets | 616,172 | | | 737,989 | |

| Accounts receivable, net | 132,007 | | | 110,141 | |

| Prepaid expenses and other assets | 63,424 | | | 69,419 | |

| | | |

| Total current assets | 2,428,190 | | | 1,637,910 | |

| Investment securities available-for-sale, at fair value | 2,008,650 | | | 2,203,142 | |

Loans to bank customers, net of allowance for credit losses of $17,542 and $11,383 as of December 31, 2024 and December 31, 2023, respectively | 31,961 | | | 30,534 | |

| Prepaid expenses and other assets | 242,707 | | | 221,656 | |

| Property, equipment, and internal-use software, net | 188,363 | | | 179,376 | |

| Operating lease right-of-use assets | 10,823 | | | 5,342 | |

| Deferred expenses | 1,242 | | | 1,546 | |

| Net deferred tax assets | 124,405 | | | 117,139 | |

| Goodwill and intangible assets | 397,941 | | | 420,477 | |

| Total assets | $ | 5,434,282 | | | $ | 4,817,122 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 103,765 | | | $ | 119,870 | |

| Deposits | 4,010,520 | | | 3,293,603 | |

| Obligations to customers | 236,616 | | | 314,278 | |

| Settlement obligations | 48,482 | | | 57,001 | |

| Amounts due to card issuing banks for overdrawn accounts | 84 | | | 225 | |

| Other accrued liabilities | 87,675 | | | 91,239 | |

| Operating lease liabilities | 2,416 | | | 3,369 | |

| Deferred revenue | 6,279 | | | 6,343 | |

| Line of credit | — | | | 61,000 | |

| Income tax payable | 6,648 | | | 6,262 | |

| Total current liabilities | 4,502,485 | | | 3,953,190 | |

| Other accrued liabilities | 1,045 | | | 1,895 | |

| Operating lease liabilities | 8,641 | | | 2,687 | |

| Notes payable | 48,526 | | | — | |

| | | |

| Total liabilities | 4,560,697 | | | 3,957,772 | |

| | | |

| Stockholders’ equity: | | | |

Class A common stock, $0.001 par value; 100,000 shares authorized as of December 31, 2024 and December 31, 2023; 54,227 and 52,816 shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively | 55 | | | 53 | |

| Additional paid-in capital | 408,010 | | | 375,980 | |

| Retained earnings | 743,602 | | | 770,304 | |

| Accumulated other comprehensive loss | (278,082) | | | (286,987) | |

| Total stockholders’ equity | 873,585 | | | 859,350 | |

| Total liabilities and stockholders’ equity | $ | 5,434,282 | | | $ | 4,817,122 | |

GREEN DOT CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands, except per share data) |

| Operating revenues: | | | | | | | |

| Card revenues and other fees | $ | 353,456 | | | $ | 272,185 | | | $ | 1,231,458 | | | $ | 1,007,565 | |

| Cash processing revenues | 33,306 | | | 33,491 | | | 231,753 | | | 225,416 | |

| Interchange revenues | 49,350 | | | 52,053 | | | 198,300 | | | 231,003 | |

| Interest income, net | 18,912 | | | 8,314 | | | 62,365 | | | 37,344 | |

| Total operating revenues | 455,024 | | | 366,043 | | | 1,723,876 | | | 1,501,328 | |

| Operating expenses: | | | | | | | |

| Sales and marketing expenses | 49,262 | | | 50,795 | | | 217,210 | | | 245,325 | |

| Compensation and benefits expenses | 61,077 | | | 45,594 | | | 251,044 | | | 238,528 | |

| Processing expenses | 255,460 | | | 178,673 | | | 887,249 | | | 639,228 | |

| Other general and administrative expenses | 74,848 | | | 117,253 | | | 370,041 | | | 355,577 | |

| Total operating expenses | 440,647 | | | 392,315 | | | 1,725,544 | | | 1,478,658 | |

| Operating income (loss) | 14,377 | | | (26,272) | | | (1,668) | | | 22,670 | |

| Interest expense, net | 1,200 | | | 906 | | | 5,506 | | | 3,027 | |

| Other (expense) income, net | (5,320) | | | 1,040 | | | (15,365) | | | (5,010) | |

| Income (loss) before income taxes | 7,857 | | | (26,138) | | | (22,539) | | | 14,633 | |

| Income tax expense (benefit) | 2,754 | | | (2,535) | | | 4,163 | | | 7,911 | |

| Net income (loss) | $ | 5,103 | | | $ | (23,603) | | | $ | (26,702) | | | $ | 6,722 | |

| | | | | | | |

| Basic earnings (loss) per common share: | $ | 0.09 | | | $ | (0.45) | | | $ | (0.50) | | | $ | 0.13 | |

| Diluted earnings (loss) per common share | $ | 0.09 | | | $ | (0.45) | | | $ | (0.50) | | | $ | 0.13 | |

| Basic weighted-average common shares issued and outstanding: | 53,989 | | | 52,622 | | | 53,527 | | | 52,251 | |

| Diluted weighted-average common shares issued and outstanding: | 55,153 | | | 52,622 | | | 53,527 | | | 52,510 | |

GREEN DOT CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| | (In thousands) |

| Operating activities | | | |

| Net (loss) income | $ | (26,702) | | | $ | 6,722 | |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | |

| Depreciation and amortization of property, equipment and internal-use software | 63,422 | | | 58,714 | |

| Amortization of intangible assets | 21,277 | | | 24,257 | |

| Provision for uncollectible overdrawn accounts from purchase transactions | 19,762 | | | 24,771 | |

| Provision for loan losses | 27,562 | | | 26,311 | |

| Stock-based compensation | 29,928 | | | 33,744 | |

| Losses in equity method investments | 15,751 | | | 9,310 | |

| Amortization of discount on available-for-sale investment securities | (1,986) | | | (2,276) | |

| | | |

| | | |

| Impairment of long-lived assets | 4,944 | | | — | |

| Deferred income tax benefit | (10,356) | | | (11,867) | |

| Other | (40) | | | (4,100) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | (41,628) | | | (60,475) | |

| Prepaid expenses and other assets | 182 | | | 3,354 | |

| Deferred expenses | 304 | | | 13,001 | |

| Accounts payable and other accrued liabilities | (19,469) | | | 690 | |

| Deferred revenue | (917) | | | (19,539) | |

| Income tax receivable/payable | (22) | | | (5,613) | |

| Other, net | (629) | | | 515 | |

| Net cash provided by operating activities | 81,383 | | | 97,519 | |

| | | |

| Investing activities | | | |

| Purchases of available-for-sale investment securities | (11,845) | | | — | |

| Proceeds from maturities of available-for-sale securities | 232,689 | | | 176,665 | |

| Proceeds from sales and calls of available-for-sale securities | 273 | | | 186 | |

| Payments for property, equipment and internal-use software | (74,287) | | | (75,942) | |

| Net changes in loans | (27,857) | | | (28,970) | |

| Investment in TailFin Labs, LLC | (35,000) | | | (35,000) | |

| | | |

| Other investing activities | (2,571) | | | (3,782) | |

| Net cash provided by investing activities | 81,402 | | | 33,157 | |

| | | |

| Financing activities | | | |

| Borrowings on notes payable | 49,501 | | | — | |

| | | |

| Borrowings on revolving line of credit | 238,000 | | | 282,000 | |

| Repayments on revolving line of credit | (299,000) | | | (256,000) | |

| Proceeds from exercise of options and ESPP purchases | 4,996 | | | 5,565 | |

| Taxes paid related to net share settlement of equity awards | (2,892) | | | (3,903) | |

| Net changes in deposits | 717,982 | | | (159,436) | |

| Net changes in settlement assets and obligations to customers | 35,636 | | | (132,245) | |

| | | |

| | | |

| Deferred financing costs | (1,075) | | | — | |

| | | |

| Net cash provided by (used in) financing activities | 743,148 | | | (264,019) | |

| | | |

| Net increase (decrease) in unrestricted cash, cash equivalents and restricted cash | 905,933 | | | (133,343) | |

| Unrestricted cash, cash equivalents and restricted cash, beginning of period | 686,502 | | | 819,845 | |

| Unrestricted cash, cash equivalents and restricted cash, end of period | $ | 1,592,435 | | | $ | 686,502 | |

| | | |

| Cash paid for interest | $ | 12,968 | | | $ | 5,923 | |

| Cash paid for income taxes | $ | 13,590 | | | $ | 24,351 | |

| | | |

| Reconciliation of unrestricted cash, cash equivalents and restricted cash at end of period: | | | |

| Unrestricted cash and cash equivalents | $ | 1,592,391 | | | $ | 682,263 | |

| Restricted cash | 44 | | | 4,239 | |

| Total unrestricted cash, cash equivalents and restricted cash, end of period | $ | 1,592,435 | | | $ | 686,502 | |

GREEN DOT CORPORATION

REPORTABLE SEGMENTS (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Segment Revenue | (In thousands) |

| Consumer Services | $ | 107,184 | | | $ | 111,489 | | | $ | 402,462 | | | $ | 498,617 | |

| B2B Services | 312,146 | | | 221,841 | | | 1,081,804 | | | 772,991 | |

| Money Movement Services | 29,690 | | | 29,370 | | | 217,657 | | | 209,674 | |

| Corporate and Other | 2,697 | | | (983) | | | 5,792 | | | 2,513 | |

| Total segment revenues | 451,717 | | | 361,717 | | | 1,707,715 | | | 1,483,795 | |

| BaaS commissions and processing expenses (8) | 4,425 | | | 5,103 | | | 18,917 | | | 20,449 | |

| Other income (9) | (1,118) | | | (777) | | | (2,756) | | | (2,916) | |

| Total operating revenues | $ | 455,024 | | | $ | 366,043 | | | $ | 1,723,876 | | | $ | 1,501,328 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Segment Profit | (In thousands) |

| Consumer Services | $ | 54,803 | | | $ | 37,740 | | | $ | 161,900 | | | $ | 177,190 | |

| B2B Services | 27,277 | | | 18,495 | | | 92,374 | | | 77,303 | |

| Money Movement Services | 8,727 | | | 9,526 | | | 122,582 | | | 113,176 | |

| Corporate and Other | (46,966) | | | (40,034) | | | (211,470) | | | (196,795) | |

| Total segment profit * | 43,841 | | | 25,727 | | | 165,386 | | | 170,874 | |

| Reconciliation to income (loss) before income taxes | | | | | | | |

| Depreciation and amortization of property, equipment and internal-use software | 15,690 | | | 16,408 | | | 63,422 | | | 58,715 | |

| Stock based compensation and related employer taxes | 5,924 | | | 6,033 | | | 30,353 | | | 34,288 | |

| Amortization of acquired intangible assets | 4,982 | | | 5,664 | | | 21,277 | | | 24,257 | |

| Impairment charges | 1,097 | | | — | | | 9,625 | | | — | |

| Legal settlements and related expenses | 895 | | | 21,650 | | | 33,791 | | | 23,614 | |

| Other expense | 876 | | | 2,244 | | | 8,586 | | | 7,330 | |

| Operating income (loss) | 14,377 | | | (26,272) | | | (1,668) | | | 22,670 | |

| Interest expense, net | 1,200 | | | 906 | | | 5,506 | | | 3,027 | |

| Other (expense) income, net | (5,320) | | | 1,040 | | | (15,365) | | | (5,010) | |

| Income (loss) before income taxes | $ | 7,857 | | | $ | (26,138) | | | $ | (22,539) | | | $ | 14,633 | |

* Total segment profit is also referred to herein as adjusted EBITDA in its non-GAAP measures. Additional information about the Company's non-GAAP financial measures can be found under the caption “About Non-GAAP Financial Measures."

Green Dot's segment reporting is based on how its Chief Operating Decision Maker (“CODM”) manages its businesses, including resource allocation and performance assessment. Its CODM (who is the Chief Executive Officer) organizes and manages the businesses primarily on the basis of the channels in which its product and services are offered and uses net revenue and segment profit to assess profitability. Segment profit reflects each segment's net revenue less direct costs, such as sales and marketing expenses, processing expenses, transaction losses and fraud management, and customer support and related expenses. Green Dot’s operations are aggregated amongst three reportable segments: 1) Consumer Services, 2) Business to Business ("B2B") Services and 3) Money Movement Services.

The Corporate and Other segment primarily consists of net interest income, certain other investment income earned by Green Dot's bank, interest profit sharing arrangements with certain BaaS partners (a reduction of revenue), eliminations of inter-segment revenues and expenses, and unallocated corporate expenses, which include Green Dot's fixed expenses, such as salaries, wages and related benefits for its employees and certain third-party contractors, professional services fees, software licenses, telephone and communication costs, rent, utilities, and insurance that are not considered when Green Dot's CODM evaluates segment performance. Non-cash expenses such as stock-based compensation, depreciation and amortization of long-lived assets, impairment charges and other non-recurring expenses that are not considered by Green Dot's CODM when it is evaluating overall consolidated financial results are excluded from its unallocated corporate expenses.

GREEN DOT CORPORATION

Reconciliation of Total Operating Revenues to Non-GAAP Total Operating Revenues (1)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands) |

| Total operating revenues | $ | 455,024 | | | $ | 366,043 | | | $ | 1,723,876 | | | $ | 1,501,328 | |

| BaaS commissions and processing expenses (8) | (4,425) | | | (5,103) | | | (18,917) | | | (20,449) | |

| Other income (9) | 1,118 | | | 777 | | | 2,756 | | | 2,916 | |

| Non-GAAP total operating revenues | $ | 451,717 | | | $ | 361,717 | | | $ | 1,707,715 | | | $ | 1,483,795 | |

Reconciliation of Net (Loss) Income to Non-GAAP Net Income (1)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands, except per share data) |

| Net income (loss) | $ | 5,103 | | | $ | (23,603) | | | $ | (26,702) | | | $ | 6,722 | |

| Stock-based compensation and related employer payroll taxes (3) | 5,924 | | | 6,033 | | | 30,353 | | | 34,288 | |

| Amortization of acquired intangible assets (4) | 4,982 | | | 5,664 | | | 21,277 | | | 24,257 | |

| | | | | | | |

| Transaction and related acquisition costs (4) | — | | | — | | | — | | | (3) | |

| Amortization of deferred financing costs (5) | 117 | | | 36 | | | 243 | | | 144 | |

| Impairment charges (5) | 3,597 | | | — | | | 12,125 | | | — | |

| Legal settlements and related expenses (5) | 895 | | | 21,650 | | | 33,791 | | | 23,614 | |

| Losses in equity method investments (5) | 3,820 | | | 24 | | | 15,751 | | | 9,310 | |

| Change in fair value of loans held for sale (5) | (2) | | | (264) | | | (246) | | | (1,365) | |

| | | | | | | |

| Extraordinary severance expenses (6) | — | | | 1,326 | | | 6,072 | | | 4,741 | |

| Other income, net (5) | (122) | | | 118 | | | (126) | | | (343) | |

| Income tax effect (7) | (2,123) | | | (3,659) | | | (18,533) | | | (16,151) | |

| Non-GAAP net income | $ | 22,191 | | | $ | 7,325 | | | $ | 74,005 | | | $ | 85,214 | |

| Diluted earnings (loss) per common share | | | | | | | |

| GAAP | $ | 0.09 | | | $ | (0.45) | | | $ | (0.50) | | | $ | 0.13 | |

| Non-GAAP | $ | 0.40 | | | $ | 0.14 | | | $ | 1.37 | | | $ | 1.62 | |

| | | | | | | |

| Diluted weighted-average common shares issued and outstanding | | | | | | | |

| GAAP | 55,153 | | | 52,622 | | | 53,527 | | | 52,510 | |

| Non-GAAP | 55,153 | | | 52,852 | | | 54,207 | | | 52,510 | |

Reconciliation of GAAP to Non-GAAP Diluted Weighted-Average

Shares Issued and Outstanding

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In thousands) |

| Diluted weighted-average shares issued and outstanding | 55,153 | | | 52,622 | | | 53,527 | | | 52,510 | |

| Anti-dilutive shares due to GAAP net loss | — | | | 230 | | | 680 | | | — | |

| Non-GAAP diluted weighted-average shares issued and outstanding | 55,153 | | | 52,852 | | | 54,207 | | | 52,510 | |

GREEN DOT CORPORATION

Supplemental Detail on Diluted Weighted-Average Common Shares Issued and Outstanding

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands) |

| Class A common stock outstanding as of December 31: | 54,227 | | | 52,816 | | | 54,227 | | | 52,816 | |

| Weighting adjustment | (238) | | | (194) | | | (700) | | | (565) | |

| Dilutive potential shares: | | | | | | | |

| | | | | | | |

| Service based restricted stock units | 1,128 | | | 165 | | | 666 | | | 138 | |

| Performance-based restricted stock units | 18 | | | 24 | | | 5 | | | 52 | |

| Employee stock purchase plan | 18 | | | 41 | | | 9 | | | 69 | |

| Diluted weighted-average shares issued and outstanding | 55,153 | | | 52,852 | | | 54,207 | | | 52,510 | |

Reconciliation of Net Income (Loss) to Adjusted EBITDA (1)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands) |

| Net income (loss) | $ | 5,103 | | | $ | (23,603) | | | $ | (26,702) | | | $ | 6,722 | |

| Interest expense, net (2) | 1,200 | | | 906 | | | 5,506 | | | 3,027 | |

| Income tax expense | 2,754 | | | (2,535) | | | 4,163 | | | 7,911 | |

| Depreciation and amortization of property, equipment and internal-use software (2) | 15,690 | | | 16,408 | | | 63,422 | | | 58,715 | |

| Stock-based compensation and related employer payroll taxes (2)(3) | 5,924 | | | 6,033 | | | 30,353 | | | 34,288 | |

| Amortization of acquired intangible assets (2)(4) | 4,982 | | | 5,664 | | | 21,277 | | | 24,257 | |

| | | | | | | |

| Transaction and related acquisition costs (2)(4) | — | | | — | | | — | | | (3) | |

| Impairment charges (2)(5) | 3,597 | | | — | | | 12,125 | | | — | |

| Legal settlements and related expenses (2)(5) | 895 | | | 21,650 | | | 33,791 | | | 23,614 | |

| Losses in equity method investments (2)(5) | 3,820 | | | 24 | | | 15,751 | | | 9,310 | |

| Change in fair value of loans held for sale (2)(5) | (2) | | | (264) | | | (246) | | | (1,365) | |

| | | | | | | |

| Extraordinary severance expenses (2)(6) | — | | | 1,326 | | | 6,072 | | | 4,741 | |

| Other income, net (2)(5) | (122) | | | 118 | | | (126) | | | (343) | |

| Adjusted EBITDA | $ | 43,841 | | | $ | 25,727 | | | $ | 165,386 | | | $ | 170,874 | |

| | | | | | | |

| Non-GAAP total operating revenues | $ | 451,717 | | | $ | 361,717 | | | $ | 1,707,715 | | | $ | 1,483,795 | |

| Adjusted EBITDA/Non-GAAP total operating revenues (adjusted EBITDA margin) | 9.7 | % | | 7.1 | % | | 9.7 | % | | 11.5 | % |

GREEN DOT CORPORATION

Reconciliation of Forward Looking Guidance for Non-GAAP Financial Measures to

Projected GAAP Total Operating Revenues (1)

(Unaudited) | | | | | | | | | | | | | | | | | |

| | | | | FY 2025 |

| | | | | Range |

| | | | | | | Low | | High |

| | | | | | | (In millions) |

| Total operating revenues | | | | | | | $ | 1,860 | | | $ | 1,910 | |

| Adjustments (8)(9) | | | | | | | (10) | | | (10) | |

| Non-GAAP total operating revenues | | | | | | | $ | 1,850 | | | $ | 1,900 | |

Reconciliation of Forward Looking Guidance for Non-GAAP Financial Measures to

Projected GAAP Net Income and Loss (1)

(Unaudited) | | | | | | | | | | | | | | | |

| | | FY 2025 |

| | | Range |

| | | | | Low | | High |

| | | | | (In millions) |

| Net income (loss) | | | | | $ | (7.5) | | | $ | 0.1 | |

| Adjustments (10) | | | | | 152.5 | | | 154.9 | |

| Adjusted EBITDA | | | | | $ | 145.0 | | | $ | 155.0 | |

| | | | | | | |

| Non-GAAP total operating revenues | | | | | $ | 1,900 | | | $ | 1,850 | |

| Adjusted EBITDA/Non-GAAP total operating revenues (adjusted EBITDA margin) | | | | | 7.6 | % | | 8.4 | % |

Reconciliation of Forward Looking Guidance for Non-GAAP Financial Measures to

Projected GAAP Net Income and Loss(1)

(Unaudited)

| | | | | | | | | | | | | |

| | | FY 2025 |

| | | Range |

| | | Low | | High |

| | | (In millions, except per share data) |

| Net income (loss) | | | $ | (7.5) | | | $ | 0.1 | |

| Adjustments (10) | | | 66.5 | | | 66.7 | |

| Non-GAAP net income | | | $ | 59.0 | | | $ | 66.8 | |

| Diluted earnings (loss) per share | | | | | |

| GAAP | | | $ | (0.13) | | | $ | — | |

| Non-GAAP | | | $ | 1.05 | | | $ | 1.20 | |

| | | | | |

| Diluted weighted-average shares issued and outstanding | | | | | |

| GAAP | | | 55.9 | | | 55.9 | |

| | | | | |

| | | | | |

(1)To supplement Green Dot’s consolidated financial statements presented in accordance with GAAP, Green Dot uses measures of operating results that are adjusted to exclude various, primarily non-cash, expenses and charges. These financial measures are not calculated or presented in accordance with GAAP and should not be considered as alternatives to or substitutes for operating revenues, operating income, net income or any other measure of financial performance calculated and presented in accordance with GAAP. These financial measures may not be comparable to similarly-titled measures of other organizations because other organizations may not calculate their measures in the same manner as Green Dot does. These financial measures are adjusted to eliminate the impact of items that Green Dot does not consider indicative of its core operating performance. You are encouraged to evaluate these adjustments and the reasons Green Dot considers them appropriate.

Green Dot believes that the non-GAAP financial measures it presents are useful to investors in evaluating Green Dot’s operating performance for the following reasons:

•adjusted EBITDA is widely used by investors to measure a company’s operating performance without regard to items, such as non-operating net interest income and expense, income tax benefit and expense, depreciation and amortization, stock-based compensation and related employer payroll taxes, changes in the fair value of contingent consideration, transaction costs, impairment charges, extraordinary severance expenses, certain legal settlement and related expenses, earnings or losses from equity method investments, changes in the fair value of loans held for sale, and other charges and income that can vary substantially from company to company depending upon their respective financing structures and accounting policies, the book values of their assets, their capital structures and the methods by which their assets were acquired;

•securities analysts use adjusted EBITDA as a supplemental measure to evaluate the overall operating performance of companies; and

•Green Dot records stock-based compensation from period to period, and recorded stock-based compensation expenses and related employer payroll taxes, net of forfeitures, of approximately $5.9 million and $6.0 million for the three months ended December 31, 2024 and 2023, respectively. By comparing Green Dot’s adjusted EBITDA, non-GAAP net income and non-GAAP diluted earnings per share in different historical periods, investors can evaluate Green Dot’s operating results without the additional variations caused by stock-based compensation expense and related employer payroll taxes, which may not be comparable from period to period due to changes in the fair market value of Green Dot’s Class A common stock (which is influenced by external factors like the volatility of the public markets and the financial performance of Green Dot’s peers) and is not a key measure of Green Dot’s operations.

Green Dot’s management uses the non-GAAP financial measures:

▪as measures of operating performance, because they exclude the impact of items not directly resulting from Green Dot’s core operations;

▪for planning purposes, including the preparation of Green Dot’s annual operating budget;

▪to allocate resources to enhance the financial performance of Green Dot’s business;

▪to evaluate the effectiveness of Green Dot’s business strategies;

▪to establish metrics for variable compensation; and

▪in communications with Green Dot’s board of directors concerning Green Dot’s financial performance.

Green Dot understands that, although adjusted EBITDA and other non-GAAP financial measures are frequently used by investors and securities analysts in their evaluations of companies, these measures have limitations as an analytical tool, and you should not consider them in isolation or as substitutes for an analysis of Green Dot’s results of operations as reported under GAAP. Some of these limitations are:

▪that these measures do not reflect Green Dot’s capital expenditures or future requirements for capital expenditures or other contractual commitments;

▪that these measures do not reflect changes in, or cash requirements for, Green Dot’s working capital needs;

▪that these measures do not reflect non-operating interest expense or interest income;

▪that these measures do not reflect cash requirements for income taxes;

▪that, although depreciation and amortization are non-cash charges, the assets being depreciated or amortized will often have to be replaced in the future, and these measures do not reflect any cash requirements for these replacements; and

▪that other companies in Green Dot’s industry may calculate these measures differently than Green Dot does, limiting their usefulness as comparative measures.

(2)Green Dot does not include any income tax impact of the associated non-GAAP adjustment to adjusted EBITDA, as the case may be, because each of these adjustments to the non-GAAP financial measure is provided before income tax expense.

(3)This expense consists primarily of expenses for restricted stock units (including performance-based restricted stock units) and related employer payroll taxes. Stock-based compensation expense is not comparable from period to period due to changes in the fair market value of Green Dot’s Class A common stock (which is influenced by external factors like the volatility of public markets and the financial performance of Green Dot’s peers) and is not a key measure of Green Dot’s operations. Green Dot excludes stock-based compensation expense from its non-GAAP financial measures primarily because it consists of non-cash expenses that Green Dot does not believe are reflective of ongoing operating results. Green Dot also believes that it is not useful to investors to understand the impact of stock-based compensation to its results of operations. Further, the related employer payroll taxes are dependent upon volatility in Green Dot's stock price, as well as the timing and size of option exercises and vesting of restricted stock units, over which Green Dot has limited to no control. This expense is included as a component of compensation and benefits expenses on Green Dot's consolidated statements of operations.

(4)Green Dot excludes certain income and expenses that are the result of acquisitions. These acquisition-related adjustments include items such as transaction costs, the amortization of acquired intangible assets, changes in the fair value of contingent consideration, settlements of contingencies established at time of acquisition and other acquisition related charges, such as integration charges and professional and legal fees, which result in Green Dot recording expenses or fair value adjustments in its GAAP financial statements. Green Dot analyzes the performance of its operations without regard to these adjustments. In determining whether any acquisition-related adjustment is appropriate, Green Dot takes into consideration, among other things, how such adjustments would or would not aid in the understanding of the performance of its operations. These items are included as a component of other general and administrative expenses on Green Dot's consolidated statements of operations, as applicable for the periods presented.

(5)Green Dot excludes certain income and expenses that are not reflective of ongoing operating results. It is difficult to estimate the amount or timing of these items in advance. Although these events are reflected in Green Dot's GAAP financial statements, Green Dot excludes them in its non-GAAP financial measures because Green Dot believes these items may limit the comparability of ongoing operations with prior and future periods. These adjustments include items such as amortization attributable to deferred financing costs, impairment charges related to long-lived assets, earnings or losses from equity method investments, legal settlements and related expenses, changes in the fair value of loans held for sale, realized gains on investment securities and other income and expenses, as applicable for the periods presented. In determining whether any such adjustment is appropriate, Green Dot takes into consideration, among other things, how such adjustments would or would not aid in the understanding of the performance of its operations. Each of these adjustments, except for amortization of deferred financing costs, earnings and losses from equity method investments, fair value changes on loans held for sale, and realized gains on investment securities, which are all included below operating income, are included within other general and administrative expenses on Green Dot's consolidated statements of operations.

(6)During the year ended December 31, 2024, Green Dot recorded $6.1 million related to extraordinary severance expenses, which were paid out in connection with reductions in force and other extraordinary involuntary terminations of employment. Although severance expenses may arise throughout the fiscal year, Green Dot believes the nature of these extraordinary costs are not indicative of its core operating performance. This expense is included as a component of compensation and benefits expenses on Green Dot's consolidated statements of operations.

(7)Represents the tax effect for the related non-GAAP measure adjustments using Green Dot's year to date non-GAAP effective tax rate. It also excludes both the impact of excess tax benefits related to stock-based compensation and the IRC §162(m) limitation that applies to performance-based restricted stock units expense as of December 31, 2024.

(8)Represents commissions and certain processing-related costs associated with BaaS products and services where Green Dot does not control customer acquisition. This adjustment is netted against Green Dot's B2B Services revenues when evaluating segment performance.

(9)Represents other non-interest investment income earned by Green Dot Bank. This amount is included along with operating interest income in Green Dot's Corporate and Other segment since the yield earned on these investments are generated on a recurring basis and earned similarly to its investment securities available for sale.

(10)These amounts represent estimated adjustments for items such as income taxes, depreciation and amortization, employee stock-based compensation and related employer taxes, amortization attributable to deferred financing costs, earnings and losses from equity method investments, and other income and expenses. Employee stock-based compensation expense includes assumptions about the future fair value of the Company’s Class A common stock (which is influenced by external factors like the volatility of public markets and the financial performance of the Company’s peers).

v3.25.0.1

COVER PAGE

|

Feb. 27, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2025

|

| Entity Registrant Name |

Green Dot Corp

|

| Entity Central Index Key |

0001386278

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34819

|

| Entity Tax Identification Number |

95-4766827

|

| Entity Address, Address Line One |

1675 N. Freedom Blvd (200 West) Building 1

|

| Entity Address, City or Town |

Provo,

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84604

|

| City Area Code |

(626)

|

| Local Phone Number |

765-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.001 par value

|

| Trading Symbol |

GDOT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Former Address |

|

| Document Information [Line Items] |

|

| Entity Address, Address Line One |

114 W 7th Street, Suite 240

|

| Entity Address, City or Town |

Austin,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78701

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

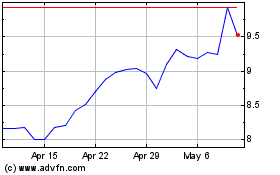

Green Dot (NYSE:GDOT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Green Dot (NYSE:GDOT)

Historical Stock Chart

From Mar 2024 to Mar 2025