Goldman Sachs BDC, Inc. (“GSBD”, the “Company”, “we”, “us”, or

“our”) (NYSE: GSBD) today reported financial results for the third

quarter ended September 30, 2023 and filed its Form 10-Q with the

U.S. Securities and Exchange Commission.

QUARTERLY HIGHLIGHTS

- Net investment income per share for the quarter ended September

30, 2023 was $0.67. Excluding purchase discount amortization per

share of $0.03 from the Merger (as defined below), adjusted net

investment income per share was $0.64, equating to an annualized

net investment income yield on book value of 17.5%.1 Earnings per

share for the quarter ended September 30, 2023 was $0.47.

- Net asset value ("NAV") per share for the quarter ended

September 30, 2023 increased 0.14% to $14.61 from $14.59 as of June

30, 2023.

- As of September 30, 2023, the Company’s total investments at

fair value and commitments were $3,803.2 million, comprised of

investments in 137 portfolio companies across 38 industries. The

investment portfolio was comprised of 97.5% senior secured debt,

including 94.9% in first lien investments.2

- During the quarter, the Company made new investment commitments

of $168.2 million, funded new investment commitments of $120.7

million, and had fundings of previously unfunded commitments of

$26.4 million. Sales and repayments activity totaled $257.4

million, resulting in a net funded portfolio change of $(110.3)

million.

- During the quarter, two new portfolio companies were placed on

non-accrual status and one portfolio company was removed from

non-accrual. As of September 30, 2023, investments on non-accrual

status amounted to 2.3% and 4.2% of the total investment portfolio

at fair value and amortized cost, respectively. Subsequent to

quarter-end, we placed one additional portfolio company on

non-accrual status. The addition of this portfolio company to

non-accrual status does not constitute a meaningful change to the

non-accrual percentages presented.

- The Company’s ending net debt to equity ratio was 1.13x as of

September 30, 2023 and 1.20x as of June 30, 2023.

- As of September 30, 2023, 45.6% of the Company’s approximately

$1,884.5 million of total principal amount of debt outstanding was

in unsecured debt and 54.4% in secured debt.

- The Company’s Board of Directors declared a regular fourth

quarter dividend of $0.45 per share payable to shareholders of

record as of December 29, 2023.3

SELECTED FINANCIAL HIGHLIGHTS

(in $ millions, except per share data)

As of September 30, 2023

As of June 30, 2023

Investment portfolio, at fair value2

$

3,438.7

$

3,550.0

Total debt outstanding4

$

1,884.5

$

1,962.1

Net assets

$

1,600.6

$

1,596.9

Net asset value per share

$

14.61

$

14.59

Ending net debt to equity

1.13x

1.20x

(in $ millions, except per share data)

Three Months Ended September 30,

2023

Three Months Ended June 30,

2023

Total investment income

$

120.1

$

112.1

Net investment income after taxes

$

72.9

$

64.5

Less: Purchase discount amortization

3.2

1.4

Adjusted net investment income after

taxes1

$

69.7

$

63.1

Net realized and unrealized gains

(losses)

$

(21.3

)

$

1.4

Add: Realized/Unrealized depreciation from

the purchase discount

3.2

1.4

Adjusted net realized and unrealized gains

(losses)1

$

(18.1

)

$

2.8

Net investment income per share (basic and

diluted)

$

0.67

$

0.59

Less: Purchase discount amortization per

share

0.03

0.01

Adjusted net investment income per

share1

$

0.64

$

0.58

Weighted average shares outstanding

109.5

109.5

Regular distribution per share

$

0.45

$

0.45

Total investment income for the three months ended September 30,

2023 and June 30, 2023 was $120.1 million and $112.1 million,

respectively. The increase in investment income was primarily

driven by an increase in repayments and related accretion of

discounted positions.

Net expenses before taxes for the three months ended September

30, 2023 and June 30, 2023 were $45.6 million and $46.7 million,

respectively. Net expenses decreased by $1.1 million primarily as a

result of a decrease in incentive fee.

INVESTMENT ACTIVITY2

Summary of Investment Activity for the three months ended

September 30, 2023 was as follows:

New

Investment Commitments

Sales

and Repayments

Investment Type

$

Millions

% of

Total

$

Millions

% of

Total

1st Lien/Senior Secured Debt

$

158.3

94.1

%

$

140.3

54.5

%

1st Lien/Last-Out Unitranche

9.9

5.9

0.1

0.0

2nd Lien/Senior Secured Debt

—

—

110.9

43.1

Unsecured Debt

—

—

—

—

Common Stock

—

—

6.1

2.4

Total

$

168.2

100.0

%

$

257.4

100.0

%

During the three months ended September 30, 2023, new investment

commitments were across eight new portfolio companies and five

existing portfolio companies. Sales and repayments were primarily

driven by the full repayment and exit of investments in seven

portfolio companies.3

PORTFOLIO SUMMARY2

As of September 30, 2023, the Company’s investments consisted of

the following:

Investments at Fair Value

Investment Type

$

Millions

% of

Total

1st Lien/Senior Secured Debt

$

3,141.1

91.3

%

1st Lien/Last-Out Unitranche

123.2

3.6

2nd Lien/Senior Secured Debt

89.0

2.6

Unsecured Debt

9.0

0.3

Preferred Stock

44.8

1.3

Common Stock

31.3

0.9

Warrants

0.3

—

Total

$

3,438.7

100.0

%

The following table presents certain selected information

regarding the Company’s investments:

As of

September 30, 2023

June 30,

2023

Number of portfolio companies

137

135

Percentage of performing debt bearing a

floating rate5

99.9

%

100.0

%

Percentage of performing debt bearing a

fixed rate5

0.1

%

0.0

%

Weighted average yield on debt and income

producing investments, at amortized cost6

12.6

%

12.6

%

Weighted average yield on debt and income

producing investments, at fair value6

13.3

%

13.8

%

Weighted average leverage (net

debt/EBITDA)7

5.9

x

5.9x

Weighted average interest coverage7

1.51

x

1.56x

Median EBITDA7

$

50.2 million

$

51.0 million

As of September 30, 2023, investments on non-accrual status

represented 2.3% and 4.2% of the total investment portfolio at fair

value and amortized cost, respectively. Subsequent to quarter-end,

we placed one additional portfolio company on non-accrual

status.

LIQUIDITY AND CAPITAL RESOURCES

As of September 30, 2023, the Company had $1,884.5 million of

total principal amount of debt outstanding, comprised of $1,024.5

million of outstanding borrowings under its senior secured

revolving credit facility (“Revolving Credit Facility”), $360.0

million of unsecured notes due 2025, and $500.0 million of

unsecured notes due 2026. The combined weighted average interest

rate on debt outstanding was 5.42% for the quarter ended September

30, 2023. As of September 30, 2023, the Company had $670.9 million

of availability under its Revolving Credit Facility and $76.6

million in cash.4,8

The Company’s ending net debt to equity leverage ratio was 1.13x

for the three months ended September 30, 2023, as compared to 1.20x

for the three months ended June 30, 2023. 9

CONFERENCE CALL

The Company will host an earnings conference call on Wednesday,

November 8, 2023 at 9:00 am Eastern Time. All interested parties

are invited to participate in the conference call by dialing (800)

289-0459; international callers should dial +1 (929) 477-0443;

conference ID 427709. All participants are asked to dial in

approximately 10-15 minutes prior to the call, and reference

“Goldman Sachs BDC, Inc.” when prompted. For a slide presentation

that the Company may refer to on the earnings conference call,

please visit the Investor Resources section of the Company’s

website at www.goldmansachsbdc.com. An archived replay will be

available on the Company’s webcast link located on the Investor

Resources section of the Company’s website.

Please direct any questions regarding the conference call to

Goldman Sachs BDC, Inc. Investor Relations, via e-mail, at

gsbdc-investor-relations@gs.com.

ENDNOTES

1)

On October 12, 2020, we completed our merger (the “Merger”) with

Goldman Sachs Middle Market Lending Corp. (“MMLC”). The Merger was

accounted for as an asset acquisition in accordance with ASC

805-50, Business Combinations — Related Issues. The consideration

paid to MMLC’s stockholders was less than the aggregate fair values

of the assets acquired and liabilities assumed, which resulted in a

purchase discount (the “purchase discount”). The purchase discount

was allocated to the cost of MMLC investments acquired by us on a

pro-rata basis based on their relative fair values as of the

closing date. Immediately following the Merger with MMLC, we marked

the investments to their respective fair values and, as a result,

the purchase discount allocated to the cost basis of the

investments acquired was immediately recognized as unrealized

appreciation on our Consolidated Statement of Operations. The

purchase discount allocated to the loan investments acquired will

amortize over the life of each respective loan through interest

income, with a corresponding adjustment recorded as unrealized

appreciation on such loan acquired through its ultimate

disposition. The purchase discount allocated to equity investments

acquired will not amortize over the life of such investments

through interest income and, assuming no subsequent change to the

fair value of the equity investments acquired and disposition of

such equity investments at fair value, we will recognize a realized

gain with a corresponding reversal of the unrealized appreciation

on disposition of such equity investments acquired. As a

supplement to our financial results reported in accordance with

generally accepted accounting principles in the United States of

America (“GAAP”), we have provided, as detailed below, certain

non-GAAP financial measures to our operating results that exclude

the aforementioned purchase discount and the ongoing amortization

thereof, as determined in accordance with GAAP. The non-GAAP

financial measures include i) Adjusted net investment income per

share; ii) Adjusted net investment income after taxes; and iii)

Adjusted net realized and unrealized gains (losses). We believe

that the adjustment to exclude the full effect of the purchase

discount is meaningful because it is a measure that we and

investors use to assess our financial condition and results of

operations. Although these non-GAAP financial measures are intended

to enhance investors’ understanding of our business and

performance, these non-GAAP financial measures should not be

considered an alternative to GAAP. The aforementioned non-GAAP

financial measures may not be comparable to similar non-GAAP

financial measures used by other companies.

2)

The discussion of the investment portfolio excludes the investment,

if any, in a money market fund managed by an affiliate of The

Goldman Sachs Group, Inc. As of September 30, 2023, the Company did

not have an investment in the money market fund.

3)

The $0.45 per share dividend is payable on January 26, 2024 to

stockholders of record as of December 29, 2023.

4)

Total debt outstanding excludes netting of debt issuance costs of

$6.3 million and $7.1 million, respectively, as of September 30,

2023 and June 30, 2023.

5)

The fixed versus floating composition has been calculated as a

percentage of performing debt investments measured on a fair value

basis, including income producing preferred stock investments and

excludes investments, if any, placed on non-accrual.

6)

Computed based on the (a) annual actual interest rate or yield

earned plus amortization of fees and discounts on the performing

debt and other income producing investments as of the reporting

date, divided by (b) the total performing debt and other income

producing investments (excluding investments on non-accrual) at

amortized cost or fair value, respectively. This calculation

excludes exit fees that are receivable upon repayment of the

investment. Excludes the purchase discount and amortization related

to the Merger.

7)

For a particular portfolio company, we calculate the level of

contractual indebtedness net of cash (“net debt”) owed by the

portfolio company and compare that amount to measures of cash flow

available to service the net debt. To calculate net debt, we

include debt that is both senior and pari passu to the tranche of

debt owned by us but exclude debt that is legally and contractually

subordinated in ranking to the debt owned by us. We believe this

calculation method assists in describing the risk of our portfolio

investments, as it takes into consideration contractual rights of

repayment of the tranche of debt owned by us relative to other

senior and junior creditors of a portfolio company. We typically

calculate cash flow available for debt service at a portfolio

company by taking net income before net interest expense, income

tax expense, depreciation and amortization (“EBITDA”) for the

trailing twelve month period. Weighted average net debt to EBITDA

is weighted based on the fair value of our debt investments and

excludes investments where net debt to EBITDA may not be the

appropriate measure of credit risk, such as cash collateralized

loans and investments that are underwritten and covenanted based on

recurring revenue. For a particular portfolio company, we

also compare that amount of EBITDA to the portfolio company’s

contractual interest expense (“interest coverage ratio”). We

believe this calculation method assists in describing the risk of

our portfolio investments, as it takes into consideration

contractual interest obligations of the portfolio company. Weighted

average interest coverage is weighted based on the fair value of

our performing debt investments and excludes investments where

interest coverage may not be the appropriate measure of credit

risk, such as cash collateralized loans and investments that are

underwritten and covenanted based on recurring revenue.

Median EBITDA is based on our debt investments and excludes

investments where net debt to EBITDA may not be the appropriate

measure of credit risk, such as cash collateralized loans and

investments that are underwritten and covenanted based on recurring

revenue. Portfolio company statistics are derived from the

financial statements most recently provided to us of each portfolio

company as of the reported end date. Statistics of the portfolio

companies have not been independently verified by us and may

reflect a normalized or adjusted amount. As of September 30, 2023

and June 30, 2023, investments where net debt to EBITDA may not be

the appropriate measure of credit risk represented 43.5% and 42.3%,

respectively, of total debt investments at fair value.

8)

The Company’s revolving credit facility has debt outstanding

denominated in currencies other than U.S. Dollars (“USD”). These

balances have been converted to USD using applicable foreign

currency exchange rates as of September 30, 2023. As a result, the

revolving credit facility’s outstanding borrowings and the

available debt amounts may not sum to the total debt commitment

amount.

9)

The ending net debt to equity leverage ratio is calculated by using

the total borrowings net of cash and cash equivalents divided by

equity as of September 30, 2023 and excludes unfunded commitments.

Goldman Sachs BDC, Inc. Consolidated Statements of

Assets and Liabilities (in thousands, except share and per

share amounts)

September 30, 2023

(Unaudited)

December 31, 2022

Assets

Investments, at fair value

Non-controlled/non-affiliated investments

(cost of $3,525,145 and $3,598,963)

$

3,397,985

$

3,465,225

Non-controlled affiliated investments

(cost of $71,344 and $69,712)

40,711

40,991

Controlled affiliated investments (cost of

$22,366 and $22,366)

—

—

Total investments, at fair value (cost of

$3,618,855 and $3,691,041)

$

3,438,696

$

3,506,216

Cash

76,602

39,602

Interest and dividends receivable

30,827

31,779

Deferred financing costs

10,576

12,772

Other assets

1,573

942

Total assets

$

3,558,274

$

3,591,311

Liabilities

Debt (net of debt issuance costs of $6,278

and $8,741)

$

1,878,203

$

2,012,660

Interest and other debt expenses

payable

6,006

13,309

Management fees payable

8,870

9,063

Incentive fees payable

6,237

—

Distribution payable

49,304

46,283

Unrealized depreciation on foreign

currency forward contracts

381

484

Directors’ fees payable

205

—

Accrued expenses and other liabilities

8,491

7,118

Total liabilities

$

1,957,697

$

2,088,917

Commitments and contingencies (Note

8)

Net assets

Preferred stock, par value $0.001 per

share (1,000,000 shares authorized, no shares issued and

outstanding)

$

—

$

—

Common stock, par value $0.001 per share

(200,000,000 shares authorized, 109,563,525 and 102,850,589 shares

issued and outstanding as of September 30, 2023 and December 31,

2022, respectively)

110

103

Paid-in capital in excess of par

1,810,588

1,709,914

Distributable earnings (loss)

(208,700

)

(206,202

)

Allocated income tax expense

(1,421

)

(1,421

)

Total net assets

$

1,600,577

$

1,502,394

Total liabilities and net

assets

$

3,558,274

$

3,591,311

Net asset value per share

$

14.61

$

14.61

Goldman Sachs BDC, Inc. Consolidated Statements of

Operations (in thousands, except share and per share

amounts) (Unaudited)

For the Three Months

Ended

For the Nine Months

Ended

September 30, 2023

September 30, 2022

September 30, 2023

September 30, 2022

Investment income:

From non-controlled/non-affiliated

investments:

Interest income

$

109,117

$

88,326

$

309,199

$

231,605

Payment-in-kind income

9,221

5,154

25,673

14,266

Other income

809

1,384

2,355

3,550

From non-controlled affiliated

investments:

Dividend income

256

133

501

258

Interest income

590

120

1,629

469

Payment-in-kind income

53

101

153

553

Other income

10

—

33

—

From controlled affiliated

investments:

Payment-in-kind income

—

—

—

259

Interest income

—

—

—

16

Total investment income

$

120,056

$

95,218

$

339,543

$

250,976

Expenses:

Interest and other debt expenses

$

28,174

$

21,979

$

83,213

$

53,823

Incentive fees

6,237

—

36,376

12,023

Management fees

8,870

9,157

26,761

26,933

Professional fees

982

814

2,748

2,559

Directors’ fees

204

209

619

616

Other general and administrative

expenses

1,137

1,041

3,220

3,301

Total expenses

$

45,604

$

33,200

$

152,937

$

99,255

Fee waivers

$

—

$

—

$

(1,986

)

$

(11,724

)

Net expenses

$

45,604

$

33,200

$

150,951

$

87,531

Net investment income before

taxes

$

74,452

$

62,018

$

188,592

$

163,445

Income tax expense, including excise

tax

$

1,503

$

829

$

3,155

$

2,494

Net investment income after

taxes

$

72,949

$

61,189

$

185,437

$

160,951

Net realized and unrealized gains

(losses) on investment transactions:

Net realized gain (loss) from:

Non-controlled/non-affiliated

investments

$

(5,180

)

$

—

$

(44,394

)

$

(5,054

)

Controlled affiliated investments

—

—

—

(2,035

)

Foreign currency forward contracts

—

90

—

171

Foreign currency and other

transactions

(10

)

(1,565

)

185

(2,413

)

Net change in unrealized appreciation

(depreciation) from:

Non-controlled/non-affiliated

investments

(17,813

)

(50,069

)

6,578

(89,028

)

Non-controlled affiliated investments

(2,089

)

(3,529

)

(1,912

)

(1,585

)

Controlled affiliated investments

—

(18,685

)

—

(19,746

)

Foreign currency forward contracts

232

(35

)

103

11

Foreign currency translations and other

transactions

3,568

4,974

(57

)

10,051

Net realized and unrealized gains

(losses)

$

(21,292

)

$

(68,819

)

$

(39,497

)

$

(109,628

)

(Provision) benefit for taxes on

unrealized appreciation/depreciation on investments

$

(62

)

$

130

$

(618

)

$

12

Net increase (decrease) in net assets

from operations

$

51,595

$

(7,500

)

$

145,322

$

51,335

Weighted average shares outstanding

109,535,156

102,367,005

107,881,454

102,069,593

Basic and diluted net investment income

per share

$

0.67

$

0.60

$

1.72

$

1.58

Basic and diluted earnings (loss) per

share

$

0.47

$

(0.07

)

$

1.35

$

0.50

ABOUT GOLDMAN SACHS BDC, INC.

Goldman Sachs BDC, Inc. is a specialty finance company that has

elected to be regulated as a business development company under the

Investment Company Act of 1940. GSBD was formed by The Goldman

Sachs Group, Inc. (“Goldman Sachs”) to invest primarily in

middle-market companies in the United States, and is externally

managed by Goldman Sachs Asset Management, L.P., an SEC-registered

investment adviser and a wholly-owned subsidiary of Goldman Sachs.

GSBD seeks to generate current income and, to a lesser extent,

capital appreciation primarily through direct originations of

secured debt, including first lien, first lien/last-out unitranche

and second lien debt, and unsecured debt, including mezzanine debt,

as well as through select equity investments. For more information,

visit www.goldmansachsbdc.com. Information on the website is not

incorporated by reference into this press release and is provided

merely for convenience.

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements that

involve substantial risks and uncertainties. You can identify these

statements by the use of forward-looking terminology such as “may,”

“will,” “should,” “expect,” “anticipate,” “project,” “target,”

“estimate,” “intend,” “continue,” or “believe” or the negatives

thereof or other variations thereon or comparable terminology. You

should read statements that contain these words carefully because

they discuss our plans, strategies, prospects and expectations

concerning our business, operating results, financial condition and

other similar matters. These statements represent the Company’s

belief regarding future events that, by their nature, are uncertain

and outside of the Company’s control. Any forward-looking statement

made by us in this press release speaks only as of the date on

which we make it. Factors or events that could cause our actual

results to differ, possibly materially from our expectations,

include, but are not limited to, the risks, uncertainties and other

factors we identify in the sections entitled “Risk Factors” and

“Cautionary Statement Regarding Forward-Looking Statements” in

filings we make with the Securities and Exchange Commission, and it

is not possible for us to predict or identify all of them. We

undertake no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107584988/en/

Goldman Sachs BDC, Inc. Investor Contact: Austin Neri,

212-902-1000 Media Contact: Avery Reed, 212-902-5400

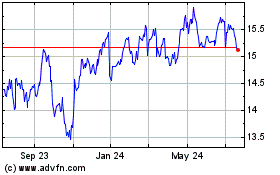

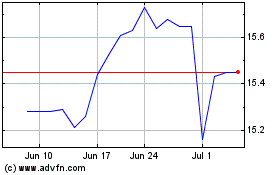

Goldman Sachs BDC (NYSE:GSBD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Goldman Sachs BDC (NYSE:GSBD)

Historical Stock Chart

From Jan 2024 to Jan 2025