Simbe Raises $50 Million in Series C Funding Led by Growth Equity at Goldman Sachs Alternatives

October 24 2024 - 6:00AM

Simbe, a leading provider of Store Intelligence™ solutions,

today announced the closing of a $50 million Series C equity

financing round led by Growth Equity at Goldman Sachs Alternatives

(“Goldman Sachs”), with participation from Eclipse and Valo

Ventures and other existing investors. Since raising its Series B

in July 2023, Simbe has achieved significant momentum and

milestones such as introducing multiple capabilities and securing

numerous new and expanded partnerships across various retail

sectors. The new capital, which brings the total amount raised by

Simbe to over $100 million, will be used to meet surging demand for

retail technology across retail verticals, expand into new product

areas, and continue scaling its best-in-class solutions to

retailers and brands around the world.

Since introducing the world’s first advanced autonomous

item-scanning robot, Tally, Simbe has refined, expanded, and scaled

its platform to power automated shelf intelligence for the largest

number of retail banners in the world. Through industry-leading

computer vision, AI, and robotics, retailers and their vendors gain

unprecedented visibility into store and shelf conditions –

ultimately driving data-driven decisions across all channels,

stronger business performance, and enhanced store team and shopper

experiences.

This year, the company announced new and expanded partnerships

with major retailers and their banners, including SpartanNash

(Family Fare, Martin’s Super Markets, D&W Fresh Market, VG's

Grocery), Wakefern Food Corp. (ShopRite), Northeast Grocery (Market

32, Price Chopper Supermarkets, Tops Friendly Markets), Albertsons

Companies (Market Street, United Supermarkets, Albertsons Market),

and CarrefourSA, while continuing to strengthen existing

partnerships with BJ's Wholesale Club, Schnuck Markets, Inc., and

multiple Fortune 500 retailers yet to be formally announced. Today,

Simbe powers automated shelf intelligence for leading retailers

across three continents and is the only retail technology vendor

delivering proven value at scale with multiple chain-wide

deployments and long-standing customer successes.

"Retail is a cornerstone of modern society, yet physical stores

remain burdened by what we call the last great data desert –

knowing precisely what's happening on store shelves. In partnership

with top global retailers, Simbe is building the essential system

of record to power retail's operating layer,” said Brad Bogolea,

Simbe’s Co-Founder and Chief Executive Officer. “Goldman Sachs is

renowned for supporting and scaling enterprise technology and

automation companies, and this new capital underscores our vision

to transform retail with true in-store visibility. Simbe’s

technology will power every store, improving the experience for

every retailer, brand, employee and shopper.”

In 2024, Simbe introduced numerous products and capabilities,

including:

- Simbe Brand Insights, which extends the

enormous value of near real-time, shelf-level data to retailers’

vendors, brands, and manufacturers for the first time,

strengthening partnerships, performance, and the retail experience

for all;

- Simbe Virtual Tour, which allows retailers to

view their stores from anywhere in the world at a depth and

frequency that’s never been possible before;

- Simbe Mobile, which streamlines work for store

teams by providing a prioritized list of pricing and restocking

tasks in near real-time, right at their fingertips;

- Simbe Wholesale Club Solution, the industry’s

first and only shelf-intelligence platform designed specifically

for wholesale club environments.

“Retail automation is a rapidly growing sector, and Simbe is

well-positioned to capitalize on the enormous market opportunity

due to its strong track record with top global retailers,

underscoring its proven impact at scale and strong capabilities,”

said Ben Fife, Investor, Growth Equity at Goldman Sachs

Alternatives. “We proactively led Simbe’s $50 million round because

we recognize their distinct ability to steer retail transformation

and meet surging demand for AI and robotics. It’s only a matter of

time until we see technology like Simbe’s in every retail

store.”

Proceeds will be used to accelerate global deployments, broaden

retail offerings, and pursue strategic growth opportunities. Simbe

will also expand its team, which grew by 100% in the past year with

the addition of top talent at the leadership level and beyond, to

further propel the future of retail and the next phase of company

growth.

For more information about Simbe and its leading retail

automation solutions, visit www.simberobotics.com.

About SimbeSimbe’s market-leading Store

Intelligence™ platform increases retailer performance with

unprecedented visibility and near real-time insights. Cutting-edge

AI and robotics power business-critical intelligence that

streamlines inventory management and store operations, while

elevating store teams and shoppers’ experiences.

Simbe’s comprehensive platform includes the world’s first

autonomous, item-scanning robot, Tally, which identifies exact

product location, stock level, and pricing & promotion

information with market-leading computer vision. Simbe works with

top worldwide brands in the US, Europe and Asia. For more

information, visit www.simberobotics.com.

About Growth Equity at Goldman Sachs

AlternativesGoldman Sachs (NYSE: GS) is one of the leading

investors in alternatives globally, with over $500 billion in

assets and more than 30 years of experience. The business invests

in the full spectrum of alternatives including private equity,

growth equity, private credit, real estate, infrastructure, hedge

funds and sustainability. Clients access these solutions through

direct strategies, customized partnerships, and open-architecture

programs. The business is driven by a focus on partnership and

shared success with its clients, seeking to deliver long-term

investment performance drawing on its global network and deep

expertise across industries and markets. The alternative

investments platform is part of Goldman Sachs Asset Management,

which delivers investment and advisory services across public and

private markets for the world’s leading institutions, financial

advisors and individuals. Goldman Sachs has over $3.1 trillion in

assets under supervision globally as of September 30, 2024. Since

2003, Growth Equity at Goldman Sachs Alternatives has invested over

$13 billion in companies led by visionary founders and CEOs. The

team focuses on investments in growth stage and technology-driven

companies spanning multiple industries, including enterprise

technology, financial technology, consumer and healthcare.

ContactCaitlin AllenSVP of

Marketpress@simberobotics.com

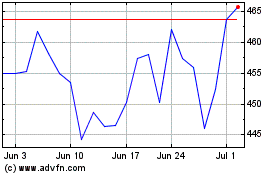

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Dec 2024 to Jan 2025

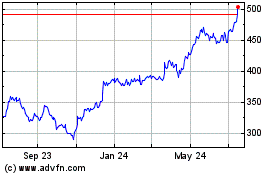

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Jan 2024 to Jan 2025