Form 8-K - Current report

September 10 2024 - 4:04PM

Edgar (US Regulatory)

false

0001992243

0001992243

2024-09-04

2024-09-04

0001992243

FREY:CommonStock0.01ParValueMember

2024-09-04

2024-09-04

0001992243

FREY:WarrantsEachWholeWarrantExercisableForOneCommonStockAtExercisePriceFor11.50PerShareMember

2024-09-04

2024-09-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 10, 2024 (September 4, 2024)

FREYR Battery, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

333-274434 |

|

93-3205861 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

6&8 East Court Square, Suite 300,

Newnan, Georgia 30263 |

| (Address of principal executive offices, including zip code) |

Registrant’s telephone number, including

area code: (678) 632-3112

|

Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

|

Title of each

class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

FREY |

|

The New York Stock Exchange |

| Warrants, each whole warrant exercisable for one Common Stock at an exercise price for $11.50 per share |

|

FREY WS |

|

The New York Stock Exchange |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Termination of Employment of Chief Legal Officer

On September 4, 2024,

FREYR Battery, Inc., a Delaware corporation (the “Company”), notified Are L. Brautaset, Chief Legal Officer

(“CLO”), that his employment with the Company will terminate effective September 30, 2024 (the “Termination Date”). The Company is searching for

a replacement CLO to be based in the U.S., consistent with the Company’s strategic plans and as a continuation of the

Company’s recent re-domiciliation into the U.S. Mr. Brautaset will assist the Company with the transition until his

termination.

In connection with Mr. Brautaset's

departure, the Company, FREYR Battery Norway AS (a wholly-owned subsidiary of the Company) and Mr. Brautaset entered into a Separation

and Release Agreement on September 10, 2024 (the “Separation Agreement”), pursuant to which Mr. Brautaset will be entitled

to receive a lump sum cash payment equal to 1.5 times base annual salary, less any applicable withholding taxes, subject to his execution

of a release of claims.

The foregoing description of the Separation Agreement does not purport to be complete and is qualified

in its entirety by reference to the Separation Agreement, which is attached to this Current Report as Exhibit 10.1 and incorporated herein

by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

FREYR Battery, Inc. |

| |

|

|

|

| |

By: |

/s/ Daniel Barcelo |

| |

|

Name: |

Daniel Barcelo |

| |

|

Title: |

Chairman of the Board of Directors |

Dated: September 10, 2024

2

Exhibit 10.1

PRIVILEGED AND CONFIDENTIAL

CHIEF LEGAL OFFICER SEPARATION AND RELEASE

AGREEMENT

(the Separation Agreement)

between

FREYR Battery Norway AS (the “Company”);

FREYR Battery, Inc. (the “Parent

Company”);

and

Are L. Brautaset (the “Employee”)

(jointly referred to as the “Parties”)

WHEREAS the Board of Directors of the Parent Company

(the “Board”) has on June 26, 2024 decided that the Employee shall be terminated.

WHEREAS The Parties agree that the employment of

the Employee contemplated by the employment agreement dated May 5, 2021 (the “Employment Agreement”) shall terminate

on October 31, 2024, (the “Termination Date”).

WHEREAS the Employee will from September 30, 2024

at 4 pm CET (the “Transition Date”) cease serving in the role of Chief Legal Officer and commence serving as a special

advisor to the acting Chief Legal Officer of the Parent Company and will serve in this role until his employment ends on the Termination

Date (the “Transition Period”).]

NOW, THEREFORE, it is agreed as follows:

| 1. | The Employee will leave his role as Chief Legal Officer on the Transition Date. The Companies acknowledges and agrees with such departure. |

| 2. | From the Transition Date the Employee shall be released from the duties and rights to perform the role as Chief Legal Officer pursuant

to the Employment Agreement. During the Transition Period, the Employee agrees to serve as a special advisor to the acting Chief Legal

Officer by providing certain transitional services to secure a smooth transition for the acting Chief Legal Officer in preparing for such

position, as requested by such individual and/or the CEO. |

| 3. | The Employee is eligible to participate in the insurance and pension schemes of the Company until the Termination Date. An offer of

continuation insurance will be issued in accordance with applicable law. |

| 4. | The Company will pay and provide the Employee with his current monthly salary and employee benefits until the Termination Date, less

applicable tax withholding and other authorized deductions. Additionally, the Employee shall receive an amount corresponding to 1.5 times

base annual salary as described under Clause 16.2 of the Employment Agreement, in total NOK 3 617 408,- (Three million six hundred and

seventeen thousand four hundred and eight Norwegian kroner), as severance pay from the Company (the “Severance Pay”). The

Severance Pay shall be paid to the Employee as a lump sum payment, less withholding taxes, paid on the first ordinary payroll after the

Termination Date. No holiday allowance or pension contribution shall be calculated on the Severance Pay. |

PRIVILEGED AND CONFIDENTIAL

| 5. | The Employee shall receive accrued, but previously unpaid, holiday allowance until the end of the Transition Period. The holiday allowance

shall be paid on the first ordinary payroll after the Termination Date. Any accrued holiday shall be considered taken out by the Employee

prior to the expiry of the Transition Period and the Employee is not entitled to any additional compensation in this regard. |

| 6. | Each Party shall be responsible for taxes, duties etc. for which such Party is liable to pay as a result of this Separation Agreement.

Tax deductions are made pursuant to ordinary rules, and the amount will be reported to the tax authorities in accordance with applicable

law. |

| 7. | All options granted to the Employee not already vested shall in accordance with Clause 16.2 vest on the Termination Date. All the

Employee’s options shall be exercisable for three (3) months from Termination Date (but in no event longer than the expiration of

the term of such options). If Employee does not exercise his vested options within such three months period, the options will automatically

terminate and are forfeited without payment of any consideration. The Employee shall not receive (or be entitled to receive) any additional

equity incentive awards from the Transition Date onwards. The Employee shall not be entitled to payment of any cash bonus under the Parent

Company’s short-term incentive plan for 2024. |

| 8. | The Employee shall be relieved from his non-compete obligations pursuant to the Employment Agreement Clause 13.1 and will accordingly

not receive any payment in accordance with Clause 13.7 of the Employment Agreement. |

| 9. | Any provision of the Employment Agreement that pursuant to its terms survives termination of the Employment Agreement and regulates

rights and obligations of the Parties following the termination of the Employment Agreement, shall continue to apply after the Termination

Date in accordance with its terms, including Confidentiality (Clause 12), Non-Solicitation (Clause 13 - except for the Non-Competition

provision in 13.1) and Intellectual Property (Clause 15). |

| 10. | Any indemnification from liability arising from the role as Chief Legal Officer of the Parent Company and any other positions with

the Parent Company or any of its subsidiaries (including all officerships, directorships and committee memberships thereof) shall not

be affected by the Employee leaving his positions as Chief Legal Officer or the terms of this Separation Agreement and shall continue

in accordance with its terms. |

PRIVILEGED AND CONFIDENTIAL

| 11. | If not effectuated earlier, effective as of the Termination Date, the Employee is deemed to have automatically resigned from all directorships

of the Company and any Group Company. If required or requested by the Parent Company or any Group Company, the Employee shall promptly

take any action to formalize such resignation. |

| 12. | The Employee, on behalf of himself, the Employee’s spouse, heirs, administrators, representatives, executors, successors, assigns,

and all other persons claiming through the Employee (collectively, the “Employee Releasers”), does hereby voluntarily, knowingly,

and willingly release, waive, and forever discharge the Company, the Parent Company, the group companies together with each of their respective

affiliates, together with each of their current, former or future directors, officers, partners, agents, members, employees, trustees,

stockholders, investors, joint ventures, representatives, and attorneys, and each of their respective subsidiaries, affiliates, estates,

predecessors, successors and assigns, both individually and in their official capacities (each, individually, a “Company Releasee”

and collectively, the “Company Releasees”) from, and does fully waive any obligations of any of the Company Releasees to Employee

Releasers for, any and all rights, actions, charges, causes of action, demands, damages, claims for relief, complaints, remuneration,

sums of money, suits, debts, covenants, contracts, agreements, promises, obligations, demands, accounts, expenses (including attorneys’

fees and costs) or liabilities of any kind whatsoever, whether known or unknown, contingent or absolute (collectively, “Claims”),

which the Employee or any other Employee Releaser ever had, now has, or may hereafter claim to have by reason of any matter, cause, or

thing whatsoever: (i) arising from the beginning of time up to the date the Employee executes this Agreement, including, but not limited

to, (A) any such Claims relating in any way to the Employee’s employment with the Company, the Parent Company or any other Company

Releasee, including, but not limited to, the Employee’s relationship as a special advisor to the acting Chief Legal Officer, and

(B) any such Claims arising under any Norwegian or US federal, local, or state statute or regulation, or any other foreign law (statutory,

regulatory, or otherwise) that may be legally waived or released; (ii) arising out of or relating to the termination of the Employee’s

employment with the Company, the Parent Company or any other Company Releasee, including, but not limited to, the Employee’s relationship

as a special advisor to the acting Chief Legal Officer; or (iii) arising under or relating to any policy, agreement, understanding, or

promise, written or oral, formal or informal, between the Company, the Parent Company or any other Company Releasee and the Employee (including,

without limitation, the Employment Agreement). |

| 13. | Notwithstanding anything herein to the contrary, Employee Releasers do not release, and this release and waiver does not apply to

and shall not be construed to apply to: (A) any Claims the Employee may have that cannot be waived under applicable law; (B) rights under

this Separation Agreement; (C) any rights the Employee may have to vested benefits under qualified retirement and welfare programs; (D)

any rights the Employee has or may have as a shareholder with respect to any shares of the Parent Company owned outright by the Employee;

and (E) any claims or rights relating to indemnification of the Employee by the Company and Parent Company or to benefits under any directors

or officers insurance policy maintained by the Company and/or Parent Company. |

PRIVILEGED AND CONFIDENTIAL

| 14. | The Company, the Parent Company, and the Group Companies, each on their own behalf and together on behalf of each of their respective

affiliates and together with each of their current, former or future directors, officers, partners, agents, members, employees, trustees,

stockholders, investors, joint ventures, representatives, and attorneys, and each of their respective subsidiaries, affiliates, estates,

predecessors, successors and assigns, both individually and in their official capacities (each, individually, a “Company Releaser”

and collectively, the “Company Releasers”), hereby releases and discharges the Employee and the Employee’s spouse, heirs,

administrators, representatives, executors, successors, assigns, and all other persons claiming through the Employee (the “Employee

Releasees”) from any and all Claims that any of the Company Releasers now has or ever had relating to or arising from any matter

whatsoever, including but not limited to the Employee’s employment by and termination of employment with the Company, the Parent

Company or any Group Company. Notwithstanding anything herein to the contrary, Company Releasers do not release, and this release and

waiver does not apply to and shall not be construed to apply to potential Claims, if any, that are based on fraud or misappropriation

by the Employee, which the Company Releasers were not aware of or should not have been aware of at the date of this Separation Agreement. |

| 15. | The Employee agrees that neither this Separation Agreement, nor the furnishing of the consideration for this general release of claims,

shall be deemed or construed at any time to be an admission by the Company, any other Company Releasee or the Employee of any improper

or unlawful conduct. The Employee further acknowledges and agrees that the Company and the other Company Releasees have fully satisfied

any and all obligations owed to the Employee arising out of or relating to the Employee’s employment with the Company or any other

Company Releasees, and no further sums, payments, or benefits are owed to the Employee by the Company or any of the other Company Releasees

arising out of or relating to the Employee’s employment with the Company or any of the other Company Releasees, except as expressly

provided in this Separation Agreement. |

| 16. | The Company Releasers hereby acknowledges and confirms that as of the date of this Separation Agreement, the Company Releasers are

not aware of any circumstances implying or that might suggest that the Employee has acted inappropriately in the performance of his duties.

Specifically, the Company Releasers confirms they have no reason to believe the Employee has withheld relevant information from the board

of directors or has otherwise engaged in any mismanagement of the Company. The Company Releasers further acknowledges that throughout

the term of employment, the Employee has fulfilled his role in accordance with all applicable laws, regulations, and internal policies

and has duly executed his obligations and responsibilities as the Chief Legal Officer of the Parent Company and any other positions that

the Employee holds or have held with the Parent Company or any of its subsidiaries (including all officerships, directorships and committee

memberships thereof). In the event it comes to the Company Releasers’ attention, subsequent to the execution of this Separation

Agreement, that the Chief Legal Officer’s conduct met the standards expected of an executive in its position and that no evidence

supporting a contrary belief exists, the Company Releasers shall take all necessary steps to correct any previous implications or indications

otherwise made by Company Releasers, including the issuance of a public retraction or correction. |

PRIVILEGED AND CONFIDENTIAL

| 17. | The Company Releasers represents and warrants that the confirmation of conduct as stated in this Separation Agreement is true and

accurate and acknowledges that the Employee has relied upon this representation and warranty in executing this Separation Agreement. |

| 18. | This Separation Agreement implies a full and final settlement between the Parties in connection with the employment relationship,

as well as any other positions that the Employee holds or have held with the Parent Company or any of its subsidiaries (including all

officerships, directorships and committee memberships thereof) and the termination thereof. Through this Separation Agreement, the Parties

waive the right to bring any further claims against each other, except for the terms of this Separation Agreement. |

| 19. | The Employee confirms that, except for the terms of this Separation Agreement, he has no claims or any other rights whatsoever against

the Parent Company or its affiliates and subsidiaries, and the Parent Company confirms that, except for the terms of this Separation Agreement,

it and its affiliates and subsidiaries have no claims or any other rights whatsoever against the Employee. Each Party hereby irrevocably

and unconditionally waives, releases and dismisses any such claims and rights with respect to the Parent Company, its affiliates and subsidiaries.

Consequently, the agreement implies that the Employee cannot invoke the employment protection right under the Norwegian Working Environment

Act or any other applicable law against the Parent Company or its affiliates and subsidiaries. |

| 20. | The Employee shall continue to be covered by the Parent Company’s D&O insurance policy and other insurance policies in accordance

with their terms with respect to former directors and officers of the Parent Company. To the extent permitted by applicable law, the Parent

Company shall also indemnify and hold the Employee harmless from and against any claims from its subsidiaries and affiliates, and from

third party claims relating to his position as Chief Legal Officer or any other positions with the Parent Company or any of its subsidiaries

(including all officerships, directorships and committee memberships thereof), and shall offer all required assistance and access to information

in connection with any potential claims. |

| 21. | Subject to applicable law and regulations, including the Parent Company’s disclosure obligations as a company listed on the

New York Stock Exchange, this Separation Agreement is confidential. Subject to the Parent Company’s disclosure obligations, the

Parties shall in good faith agree any required public communication concerning the departure of the Employee and this Separation Agreement. |

PRIVILEGED AND CONFIDENTIAL

| 22. | Each of the Parties shall refrain from malicious disparage or otherwise making harmful or unfavorable public statements that will

damage the reputation of the other Party. The Company, the Parent Company, and the Group Companies shall not, and shall instruct their

respective senior executive officers and directors not to, engage in any conduct or make any statement disparaging in any way the Employee’s

business or reputation, or any goods or services offered by the Employee. Furthermore, the Company, the Parent Company and the Group Companies

shall not, and shall instruct such individuals not to, engage in any other conduct or make any other statement that could reasonably be

expected to impair the Employee’s goodwill or reputation. |

| 23. | This Separation Agreement has been duly approved by the Companies. |

| 24. | This Separation Agreement shall be governed by and construed in accordance with Norwegian law and the Parties give exclusive jurisdiction

to the Norwegian Courts. |

This Separation Agreement has been prepared and signed

in two original copies, one copy having been delivered to and to be retained by each of the Parties.

| |

|

September 10, 2024 |

| |

|

|

| For the Company |

|

The Employee |

| |

|

|

| /s/ Tom Einar Jensen |

|

/s/ Are Brautaset |

| Tom Einar Jensen |

|

Are Brautaset |

For the Parent Company

| /s/ Tom Einar Jensen |

|

| Tom Einar Jensen |

|

6

v3.24.2.u1

Cover

|

Sep. 04, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 04, 2024

|

| Entity File Number |

333-274434

|

| Entity Registrant Name |

FREYR Battery, Inc.

|

| Entity Central Index Key |

0001992243

|

| Entity Tax Identification Number |

93-3205861

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

6&8 East Court Square, Suite 300

|

| Entity Address, City or Town |

Newnan

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30263

|

| City Area Code |

678

|

| Local Phone Number |

632-3112

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.01 par value |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

FREY

|

| Security Exchange Name |

NYSE

|

| Warrants, each whole warrant exercisable for one Common Stock at an exercise price for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one Common Stock at an exercise price for $11.50 per share

|

| Trading Symbol |

FREY WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FREY_CommonStock0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FREY_WarrantsEachWholeWarrantExercisableForOneCommonStockAtExercisePriceFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

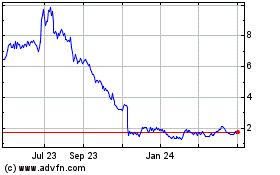

FREYR Battery (NYSE:FREY)

Historical Stock Chart

From Nov 2024 to Dec 2024

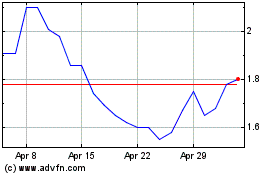

FREYR Battery (NYSE:FREY)

Historical Stock Chart

From Dec 2023 to Dec 2024