Fortis Inc. Announces Pricing of Senior Unsecured Notes

September 05 2024 - 6:03PM

Fortis Inc. (“Fortis” or the “Corporation”) (TSX: FTS) announced

today that it has priced an offering by private placement (the

“Offering”), pursuant to the exemptions from the prospectus

requirements of applicable Canadian securities laws, of $500

million aggregate principal amount of 4.171% senior unsecured notes

due September 9, 2031 (the “Notes”). The Offering is being made on

a best efforts basis through a syndicate of agents co-led by Scotia

Capital Inc., TD Securities Inc. and BMO Nesbitt Burns Inc.

(collectively, the “Joint Bookrunners”) and CIBC World Markets

Inc., RBC Dominion Securities Inc., Desjardins Securities

Inc., National Bank Financial Inc., Merrill Lynch Canada Inc.,

Morgan Stanley Canada Limited, MUFG Securities (Canada),

Ltd. and Wells Fargo Securities Canada, Ltd.

(collectively, the “Co-Managers”, and together with the

Joint Bookrunners, the “Agents”), pursuant to an agency agreement

entered into earlier today by the Corporation and the Agents. The

Offering is expected to close on September 9, 2024.

Interest on the Notes will be payable

semi-annually in arrears on March 9 and September 9 of each year,

commencing on March 9, 2025. The net proceeds of the Offering will

be used to partially repay borrowings under the Corporation’s

non-revolving term credit facility, to repay maturing long-term

notes and for general corporate purposes.

The Notes being offered have not been and will

not be registered under the U.S. Securities Act of 1933,

as amended, and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements. This media release shall not constitute

an offer to sell or an invitation to purchase or subscribe for any

securities in the United States or in any other jurisdiction where

such offer is unlawful.

About FortisFortis is a

well-diversified leader in the North American regulated electric

and gas utility industry with 2023 revenue of $12 billion and total

assets of $69 billion as at June 30, 2024. The Corporation’s 9,600

employees serve utility customers in five Canadian provinces, ten

U.S. states and three Caribbean countries.

Fortis’ shares are listed on the Toronto Stock

Exchange and trade under the symbol FTS.

Additional information can be accessed at www.fortisinc.com,

www.sedarplus.com or www.sec.gov.

Not for distribution to U.S. news wire

services or dissemination in the United States.

Forward-Looking Information

Fortis includes forward-looking information in

this media release within the meaning of applicable Canadian

securities laws and forward-looking statements within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995

(collectively referred to as “forward-looking information”).

Forward-looking information reflects expectations of Fortis

management regarding future growth, results of operations,

performance and business prospects and opportunities. Wherever

possible, words such as anticipates, believes, budgets, could,

estimates, expects, forecasts, intends, may, might, plans,

projects, schedule, should, target, will, would and the negative of

these terms and other similar terminology or expressions have been

used to identify the forward-looking information, which includes,

without limitation: the expected amount of gross proceeds from the

issuance of the Notes assuming all Notes issuable pursuant to the

Offering are sold by the Agents, the Corporation’s expected use of

the net proceeds from the Offering and the expected closing date of

the Offering.

Forward-looking information involves significant

risks, uncertainties and assumptions. Certain material factors or

assumptions have been applied in drawing the conclusions contained

in the forward-looking information. Fortis cautions readers that a

number of factors could cause actual results, performance or

achievements to differ materially from the results discussed or

implied in the forward-looking information. These factors should be

considered carefully and undue reliance should not be placed on the

forward-looking information. For additional information with

respect to certain of these risks or factors, reference should be

made to the continuous disclosure materials filed by the

Corporation from time to time on SEDAR+ and EDGAR. The Corporation

disclaims any intention or obligation to update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise.

A .pdf version of this press release is

available

at: http://ml.globenewswire.com/Resource/Download/3e89d349-991c-492a-be97-db9d98c0ca5e

For more information, please contact

| Investor Enquiries:Ms. Stephanie

AmaimoVice President, Investor RelationsFortis

Inc.248.946.3572investorrelations@fortisinc.com |

Media Enquiries:Ms. Karen

McCarthyVice President, Communications & Government

RelationsFortis Inc.709.737.5323media@fortisinc.com |

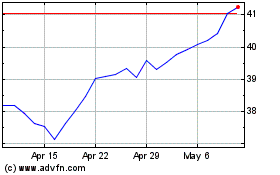

Fortis (NYSE:FTS)

Historical Stock Chart

From Oct 2024 to Nov 2024

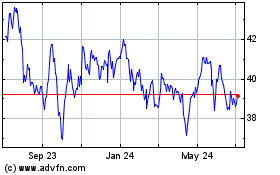

Fortis (NYSE:FTS)

Historical Stock Chart

From Nov 2023 to Nov 2024