false000150707900015070792025-01-242025-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2025

Floor & Decor Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38070 | 27-3730271 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | |

| 2500 Windy Ridge Parkway SE | 30339 |

| Atlanta, | Georgia |

| (Address of principal executive offices) | (Zip Code) |

(404) 471-1634

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, $0.001 par value per share | FND | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously announced, on September 3, 2024, Trevor S. Lang, President of Floor & Decor Holdings, Inc. (the “Company”), informed the Company that he intended to retire from the Company, with the effective date of that retirement to be determined. On January 24, 2025, Mr. Lang informed the Company that his retirement date will be March 1, 2025. Mr. Lang will not receive any severance or other compensation in connection with his retirement, and any equity awards that are not vested as of his retirement date will be forfeited.

On January 24, 2025, the Board of Directors of the Company (the “Board”) approved the appointment of Bradley S. Paulsen as President of the Company, effective April 28, 2025. Mr. Paulsen, age 49, has served as CEO, North America for Rentokil Initial plc since December 2023, where he was responsible for all operations for the North American region and was a member of the executive leadership team. Prior to Rentokil, Mr. Paulsen served as chief executive officer of Rexel USA, a leading distributor of electrical parts, services and solutions, from April 2021 to December 2023. From 2015 to 2021, he served in a number of leadership roles at HD Supply, one of the United States’ largest MRO (maintenance, repair, and operating products) distributors, including most recently as Chief Operating Officer, responsible for overseeing the sales, supply chain and customer care teams. He also spent nine years with The Home Depot in leadership and merchandising roles. Mr. Paulsen holds a Bachelor of Science in Economics from the United States Military Academy at West Point, and a Master of Business Administration from Vanderbilt University.

On January 27, 2025, the Company, Floor and Decor Outlets of America, Inc., and Mr. Paulsen entered into an employment agreement, effective April 28, 2025 (the “Employment Agreement”). The Employment Agreement has an initial term of four years, renewing annually thereafter unless either party provides at least 60-days’ notice of non-renewal. Pursuant to the terms of the Employment Agreement, Mr. Paulsen will receive an initial base salary of $800,000, and his annual cash incentive target under the Company’s annual performance bonus program will be 100% of base salary. For the fiscal year ended December 25, 2025 (“Fiscal 2025”), the amount of his annual cash incentive will be prorated for the number of days in the fiscal year that he is employed by the Company, and any payout will be subject to the Company’s performance against the performance metrics set by the Compensation Committee of the Board for the Fiscal 2025 annual performance bonus program. Mr. Paulsen will also receive a cash sign-on bonus of $1.6 million, as a partial make-whole payment for foregone and/or repaid bonus and equity compensation from his prior employer. If his employment is terminated for “cause” (as defined below) before the second anniversary of his employment effective date, the sign-on bonus is subject to repayment in full. The sign-on bonus is also subject to repayment in full if Mr. Paulsen voluntarily resigns without “good reason” (as defined below) before the first anniversary of his employment effective date and is subject to pro rata repayment based on the number of days served if he resigns without good reason between the first and second anniversaries of his employment effective date. Mr. Paulsen will also receive a long-term equity compensation award in the amount of $3.7 million, to be granted on May 5, 2025, the first quarterly equity grant date following the effective date of his employment. Fifty percent of the award will be in the form of time-based restricted stock units that will vest in three equal annual installments on the first three anniversaries of the grant date, and 50% will be in the form of performance share units that will vest in accordance with the terms of the performance share units awards to be granted for Fiscal 2025 to Company’s other executive officers.

The Employment Agreement provides that if Mr. Paulsen is terminated by the Company without cause or due to Company non-renewal of the Employment Agreement, or if he resigns for good reason, he will receive severance in the form of (i) 18-months salary continuation, (ii) any unpaid annual cash incentive bonus from the prior completed fiscal year, and (iii) the annual cash incentive bonus for the current fiscal year, based on the Company’s performance against the performance metrics set by the Compensation Committee, pro-rated based on the date of termination and payable at the same time that it is paid to other executives. “Cause” is generally defined as: (i) his (x) commission of, or being indicted for a felony, or (y) commission of a misdemeanor where imprisonment may be imposed (other than a traffic-related offense); (ii) any act of material misconduct or gross negligence in the performance of his duties or any act of moral turpitude; (iii) any act of theft, fraud or material dishonesty; (iv) willful failure to perform any reasonable duties assigned by the Chief Executive Officer, or refusal to follow the directives of the Company that is not cured within 30 days; (v) any material breach of an agreement with the Company that is not cured within ten days; or (vi) unlawful appropriation of a material corporate opportunity. “Good reason” is generally defined any of the following occurring without his consent: (i) a material diminution of his authority, duties or responsibilities; (ii) a material diminution of his base salary; (iii) a relocation of his office to a location that is more than 50 miles from the Atlanta, Georgia metropolitan area; or (iv) any material breach of the Employment Agreement by the Company, in each case that is not cured within 60 days. The Employment Agreement also contains certain non-compete and non-solicitation restrictions applicable to Mr. Paulsen while employed and for two years after termination of employment. In addition, Mr. Paulsen is subject to confidentiality and non-disparagement restrictions.

There are no arrangements or understandings between Mr. Paulsen and any other person pursuant to which he was appointed to the position of President of the Company. There is no family relationship between Mr. Paulsen and any director, executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company. The Company has not entered into any transactions with Mr. Paulsen that would require disclosure under Item 404(a) of Regulation S-K.

A copy of the press release announcing Mr. Paulsen’s appointment is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | |

| Exhibit Number | Description |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| FLOOR & DECOR HOLDINGS, INC. |

| | | |

| | | |

| | | |

| Date: January 28, 2025 | | By: | /s/ David V. Christopherson |

| | Name: | David V. Christopherson |

| | Title: | Executive Vice President, Chief Administrative Officer and Chief Legal Officer |

Floor & Decor Appoints Bradley Paulsen as President

ATLANTA--(BUSINESS WIRE)--January 28, 2025--Floor & Decor Holdings, Inc. (the “Company”) (NYSE: FND), a leading specialty retailer of hard surface flooring, announced today the appointment of Bradley Paulsen as President, effective April 28, 2025, reporting to Tom Taylor, Chief Executive Officer of the Company. Mr. Paulsen currently serves as CEO, North America for Rentokil Initial plc, a global leader in pest control and hygiene and wellbeing services, and previously held leadership positions at Rexel USA, HD Supply and The Home Depot.

Mr. Taylor commented, “We are thrilled to welcome Brad to the team to help lead the next stage of Floor & Decor’s growth. He is an accomplished leader with significant experience across a mix of retail, commercial and service-based organizations. Brad’s deep understanding of home improvement, merchandising, retail and commercial sales, and supply chain operations will be particularly valuable to our Company. Moreover, his principles of customer service and associate support align perfectly with our core values.”

Mr. Paulsen remarked, “I’m excited about the opportunity to join the leadership team for this exceptional growth company and to support Floor & Decor’s outstanding associates, who give homeowners, professional customers and commercial customers the highest quality, trend-setting hard surface flooring products at everyday low prices.”

About Bradley Paulsen

Bradley Paulsen, age 49, is a seasoned executive with almost two decades of relevant experience. Since December 2023, he has served as CEO, North America for Rentokil Initial plc, where he was responsible for all operations for the North American region and was a member of the executive leadership team. Prior to Rentokil, Mr. Paulsen served as Chief Executive Officer of Rexel USA, a leading distributor of electrical parts, services and solutions. He previously served as Chief Operating Officer of HD Supply, one of the United States' largest MRO (maintenance, repair, and operating products) distributors, overseeing the sales, supply chain and customer care teams, after holding several other senior positions there. He also spent nine years with The Home Depot in leadership and merchandising roles. Mr. Paulsen holds a Bachelor of Science in Economics from the United States Military Academy at West Point, and a Master of Business Administration (MBA) from Vanderbilt University.

About Floor & Decor Holdings, Inc.

Floor & Decor is a multi-channel specialty retailer and commercial flooring distributor operating more than 241 warehouse-format stores and five design studios across 38 states as of September 26, 2024. The Company offers a broad assortment of in-stock hard-surface flooring, including tile, wood, laminate and vinyl, and natural stone along with decorative accessories and wall tile, installation materials, and adjacent categories at everyday low prices. The Company was founded in 2000 and is headquartered in Atlanta, Georgia.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact contained in this release, including statements regarding the Company’s future operating results and financial position, business strategy and plans, and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “seeks,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “budget,” “potential,” or “continue” or the negative of these terms or other similar expressions.

The forward-looking statements contained in this release are based on our current expectations, assumptions, estimates, and projections regarding the Company’s business, the economy, and other future conditions. These statements involve known and unknown risks, uncertainties, and other important factors that may cause the Company’s actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements.

Although the Company believes that the expectations reflected in the forward-looking statements in this release are reasonable, the Company cannot guarantee future events, results, performance or achievements. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements, including, without limitation, (1) an overall decline in the health of the economy, the hard surface flooring industry, consumer confidence and discretionary spending, and the housing market, including as a result of persistently high or rising inflation or interest rates, (2) our failure to successfully manage the challenges that our planned new store growth poses or the impact of unexpected difficulties or higher costs during our expansion, (3) our inability to enter into leases for additional stores on acceptable terms, renew or replace our current store leases, or make payments under our leases, (4) our failure to maintain and enhance our brand image and awareness, (5) our failure to

successfully anticipate and manage trends, consumer preferences, and demand, (6) our inability to successfully manage increased competition, (7) geopolitical risks, U.S. policies related to global trade and tariffs, and any antidumping and countervailing duties, any of which could impact our ability to import from foreign suppliers or raise our costs, (8) our inability to manage our inventory, including the impact of inventory obsolescence, shrink, and damage, (9) any disruption in our distribution capabilities, supply chain, and our related planning and control processes, including carrier capacity constraints, port congestion, strike, or shut down, and other supply chain costs or product shortages, (10) any increases in wholesale prices of products, materials, and transportation costs beyond our control, including increases in costs due to inflation, (11) the resignation, incapacitation, or death of any key personnel, including our executive officers, (12) our inability to attract, hire, train, and retain highly qualified managers and staff, (13) the impact of any labor activities, (14) our dependence on foreign imports for the products we sell, including risks associated with obtaining products from abroad, (15) any failure by any of our suppliers to supply us with quality products on attractive terms and prices or to adhere to the quality standards that we set for our products, (16) our inability to locate sufficient suitable natural products, (17) the effects of weather conditions, natural disasters, or other unexpected events, including public health crises, that may disrupt our operations, (18) restrictions imposed by our indebtedness on our current and future operations, including risks related to our variable rate debt, (19) any allegations, investigations, lawsuits, or violations of laws and regulations applicable to us, our products, or our suppliers, (20) our inability to adequately protect the privacy and security of information related to our customers, us, our associates, our suppliers, and other third parties, (21) any material disruption in our information systems, including our website, (22) our ability to manage our comparable store sales, (23) our inability to maintain sufficient levels of cash flow or liquidity to fund our expanding business and service our existing indebtedness, (24) new or changing laws or regulations, including tax laws and trade policies and regulations, (25) any failure to protect our intellectual property rights or disputes regarding our intellectual property or the intellectual property of third parties, (26) the impact of any future strategic transactions, and (27) our ability to manage risks related to corporate social responsibility. Additional information concerning these and other factors are described in “Forward-Looking Statements,” Item 1, “Business,” Item 1A, “Risk Factors,” and Item 1C, “Cybersecurity” of Part I and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 9A, “Controls and Procedures” of Part II of the Company’s Annual Report on Form 10-K for the fiscal year ended December 28, 2023, filed with the Securities and Exchange Commission (the “SEC”) on February 22, 2024 (the “Annual Report”) and elsewhere in the Annual Report, and those described in Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 26, 2024 (the “10-Q”) and elsewhere in the 10-Q, and those described in the Company’s other filings with the SEC.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The forward-looking statements contained in this release speak only as of the date hereof. New risks and uncertainties arise over time, and it is not possible for the Company to predict those events or how they may affect the Company. If a change to the events and circumstances reflected in the Company’s forward-looking statements occurs, the Company’s business, financial condition, and operating results may vary materially from those expressed in the Company’s forward-looking statements. Except as required by applicable law, the Company does not plan to publicly update or revise any forward-looking statements contained, whether as a result of any new information, future events, or otherwise.

Investor Contacts:

Wayne Hood

Senior Vice President of Investor Relations

678-505-4415

wayne.hood@flooranddecor.com

or

Matt McConnell

Senior Manager of Investor Relations

770-257-1374

matthew.mcconnell@flooranddecor.com

v3.24.4

Cover Page

|

Jan. 24, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 24, 2025

|

| Entity Registrant Name |

Floor & Decor Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38070

|

| Entity Tax Identification Number |

27-3730271

|

| Entity Address, Address Line One |

2500 Windy Ridge Parkway SE

|

| Entity Address, City or Town |

Atlanta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30339

|

| City Area Code |

404

|

| Local Phone Number |

471-1634

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.001 par value per share

|

| Trading Symbol |

FND

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001507079

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

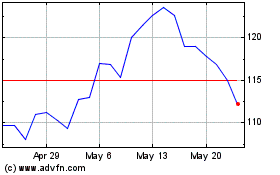

Floor and Decor (NYSE:FND)

Historical Stock Chart

From Jan 2025 to Feb 2025

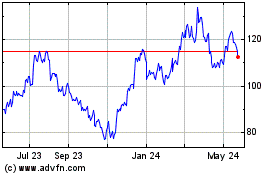

Floor and Decor (NYSE:FND)

Historical Stock Chart

From Feb 2024 to Feb 2025