UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________

FORM 11-K

_______________________________

x ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number: 1-38962

_______________________________

Full title of the plan and the address of the plan, if different from that of the issuer named below:

FISERV 401(k) SAVINGS PLAN

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Fiserv, Inc.

600 N. Vel R. Phillips Avenue

Milwaukee, Wisconsin 53203

REQUIRED INFORMATION

The Fiserv 401(k) Savings Plan (the “Plan”) is subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). Therefore, in lieu of the requirements of Items 1-3 of Form 11-K, the financial statements of the Plan as of December 31, 2023 and 2022 and for the fiscal year ended December 31, 2023 and supplemental schedule of the Plan as of December 31, 2023, which have been prepared in accordance with the financial reporting requirements of ERISA, are attached hereto as Appendix 1 and incorporated herein by this reference.

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description |

| |

| 23.1 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the agent for the Plan has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | Fiserv 401(k) Savings Plan |

| | | | | |

| | | | | |

| Date: | June 20, 2024 | | By: | | /s/ Robert W. Hau |

| | | | | Robert W. Hau |

| | | | | On behalf of the Plan |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Date: | June 20, 2024 | | By: | | /s/ Kenneth F. Best |

| | | | | Kenneth F. Best |

| | | | | On behalf of the Plan |

| | | | | |

Appendix 1

FISERV 401(k) SAVINGS PLAN

Financial Statements as of December 31, 2023 and 2022 and for the Year Ended December 31, 2023,

Supplemental Schedule as of December 31, 2023, and

Report of Independent Registered Public Accounting Firm

FISERV 401(k) SAVINGS PLAN

| | | | | | | | | | |

| TABLE OF CONTENTS | | |

| | | | |

| | Page | | |

| | | | |

| | | |

| | | | |

FINANCIAL STATEMENTS: | | | |

| | | | |

| Statements of Net Assets Available for Benefits as of December 31, 2023 and 2022 | | | |

| | | |

| Statement of Changes in Net Assets Available for Benefits for the Year Ended December 31, 2023 | | | |

| | | |

| Notes to Financial Statements as of December 31, 2023 and 2022 and for the Year Ended December 31, 2023 | | | |

| | | | |

| SUPPLEMENTAL SCHEDULE FURNISHED PURSUANT TO DEPARTMENT OF LABOR’S RULES AND REGULATIONS | | | |

| | | | |

| | | |

| | | | |

| Form 5500, Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2023 | | | |

| | | | |

| NOTE: | All other schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable. | | | |

| | | |

| | | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Participants and Plan Administrator of Fiserv 401(k) Savings Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Fiserv 401(k) Savings Plan (the “Plan”) as of December 31, 2023 and 2022, the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the year ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplemental Schedule

The supplemental schedule of assets (held at end of year) as of December 31, 2023, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in compliance with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, such schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ DELOITTE & TOUCHE LLP

Milwaukee, Wisconsin

June 20, 2024

We have served as the auditor of the Plan since 2021.

FISERV 401(k) SAVINGS PLAN

| | | | | | | | | | | |

| STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS | | | |

| (In thousands) | | | |

| | | |

| December 31, |

| 2023 | | 2022 |

| ASSETS: | | | |

| Investments: | | | |

| Investments at fair value | $ | 4,506,250 | | | $ | 4,003,126 | |

| Investments at contract value | 275,950 | | | 314,296 | |

| Total investments | 4,782,200 | | | 4,317,422 | |

| Receivables: | | | |

| Notes receivable from participants | 48,625 | | | 48,310 | |

| Employer contributions, net of forfeitures | 2,095 | | | 2,971 | |

| Total receivables | 50,720 | | | 51,281 | |

| Total assets | 4,832,920 | | | 4,368,703 | |

| | | |

| LIABILITIES: | | | |

| Accrued administrative expenses | 484 | | | 432 | |

| | | |

NET ASSETS AVAILABLE FOR BENEFITS | $ | 4,832,436 | | | $ | 4,368,271 | |

See accompanying notes to financial statements.

FISERV 401(k) SAVINGS PLAN

| | | | | | | |

| STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS |

| (In thousands) | | | |

| | | |

| Year Ended December 31, 2023 | | |

| ADDITIONS: | | | |

| CONTRIBUTIONS: | | | |

| Participant contributions | $ | 216,689 | | | |

| Employer contributions, net of forfeitures | 68,763 | | | |

| Rollover contributions | 22,368 | | | |

| Total contributions | 307,820 | | | |

INVESTMENT AND OTHER INCOME: | | | |

| Net appreciation in fair value of investments | 711,388 | | | |

| Dividends and interest | 12,596 | | | |

| Interest on notes receivable from participants | 3,220 | | | |

| Other income | 1,122 | | | |

| Total investment and other income | 728,326 | | | |

| Total additions | 1,036,146 | | | |

| DEDUCTIONS: | | | |

| Benefits paid to participants | 570,301 | | | |

| | | |

| Administrative expenses | 1,680 | | | |

| Total deductions | 571,981 | | | |

| INCREASE IN NET ASSETS | 464,165 | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| NET ASSETS AVAILABLE FOR BENEFITS: | | | |

| Beginning of year | 4,368,271 | | | |

| End of year | $ | 4,832,436 | | | |

See accompanying notes to financial statements.

FISERV 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023 AND 2022 AND FOR THE YEAR ENDED DECEMBER 31, 2023

1. PLAN DESCRIPTION

The following description of the amended and restated Fiserv 401(k) Savings Plan (the “Plan”) is provided for informational purposes only. Participants should refer to the Plan document for a complete description of the Plan’s provisions.

General —The Plan was established effective July 1, 1990 as a defined contribution plan, is maintained by Fiserv, Inc. (the “Company”) in order to aid eligible employees to accumulate savings for their retirement, and is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended. Employees who (i) are not subject to a collective bargaining agreement; (ii) receive compensation payable in U.S. dollars; (iii) are not leased employees, independent contractors or interns; (iv) are not residents of Puerto Rico; and (v) are classified as a full-time or part-time employee on the U.S. payroll and personnel records with participating employers are eligible to participate in the Plan.

Administration — The Plan is administered by Fiserv Solutions, LLC (the “Plan Sponsor”), a wholly-owned subsidiary of Fiserv, Inc. Merrill Lynch, a Bank of America company (“Merrill”), is the third-party recordkeeper of the Plan, and administrator of the self-directed brokerage accounts within, the Plan. Bank of America, N.A. (the “Trustee”) acts as the custodian and trustee of the Plan.

Contributions — Participants under the Plan may elect to make salary reduction contributions, subject to federal tax limitations, of not less than 1% or greater than 75% of their eligible compensation. New participants are automatically enrolled in the Plan at a 5% pre-tax savings rate which is automatically increased 1% annually, up to a maximum of 15% of compensation, unless the participant elects a different percentage. Participants may also roll over distributions from other qualified plans into the Plan, including personal individual retirement accounts. Participants who have attained age 50 before the close of the Plan year are eligible to make an additional tax-deferred payroll catch-up contribution. All of the above participant contributions and elections are subject to regulatory and Plan limitations.

Eligible participants under the Plan receive an employer matching contribution equal to 100% of the first 1% and 50% of the next 4% of a participant's contributions, for a maximum possible matching contribution of 3% of the participant's eligible compensation. However, to the extent permitted by ERISA and the Internal Revenue Code (“IRC”), the Company may elect to decrease or eliminate the Company's matching contribution. Employees in a position of senior vice president or higher are not eligible to receive employer matching contributions. Based upon the level of employer matching contributions, the Plan is not considered to be a safe harbor plan. The Company remits participant and employer matching contributions to the Trustee in the period in which payroll deductions are made.

The Company may make a special contribution to participants who are eligible employees on the last day of the Plan year or are eligible employees during the Plan year who terminated employment due to death, disability, or retirement (defined as attaining age 65). Any special contributions are allocated based upon the ratio of a participant's compensation to the compensation of all eligible participants and may be made in the form of the Fiserv Stock Fund, cash, or any combination thereof. The Company did not make a special contribution for the 2023 Plan year.

All contributions are invested as directed by Plan participants. Participants may irrevocably designate all or any part of their elective deferrals to the Plan as Roth 401(k) deferrals, provided the eligibility requirements have been met. The Roth 401(k) deferrals are contributed to the Plan on an after-tax basis and are included in the computation of the participant’s personal income. Because the amounts are contributed on an after-tax basis, the deferrals and, in most cases, earnings on the deferrals, are not subject to federal income taxes when distributed to participants as long as

the distributions are considered to be qualified. The combined total of pre-tax deferrals and Roth 401(k) deferrals may not exceed the maximum dollar limitation allowable under law.

Participant Accounts — Individual accounts are maintained for each Plan participant. Each participant’s account reflects participant contributions, employer contributions, transfers into and out of the Plan, benefits paid to participants, forfeitures and allocations of investment income, and losses and administrative expenses. Allocations to each participant's account are based on the proportion that the balance of each participant's account bears to the total balance of all participants in each investment fund. The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested account.

Vesting — Plan participants are entitled to the vested balance in their respective accounts as of their respective termination date, 65th birthday, death or permanent disability. Participant, rollover and special contributions vest immediately. Employer contributions vest 100% after two years of employment with the Company. In the event of a corporate divestiture, death, disability or retirement at or after age 65, all amounts allocated to a participant’s account under the Plan are 100% vested.

Forfeitures — The Plan provides for restoration of forfeited funds upon re-employment of former participants in specified circumstances. Forfeited non-vested accounts are used to reduce future employer matching contributions and pay administrative expenses of the Plan. Unallocated forfeitures totaled $2,522 thousand and $1,589 thousand at December 31, 2023 and 2022, respectively. During 2023, employer contributions were reduced by $1,589 thousand from forfeited non-vested accounts. The $2,095 thousand employer contribution receivable at December 31, 2023 represents an employer match contribution made in March 2024 for the 2023 plan year, reduced by the unallocated forfeiture balance of $2,522 thousand. The $2,971 thousand employer contribution receivable at December 31, 2022 represents an employer match contribution made in March 2023 for the 2022 plan year, reduced by the unallocated forfeiture balance of $1,589 thousand.

Investment Options — Participants direct the investment of their account balance into the investment options of the Plan in 1% increments. The Plan offers investments in registered investment companies, collective investment trusts, the Fiserv Stock Fund, and a separately managed stable value fund. The collective investment trusts held by the Plan are primarily comprised of target funds which invest in mutual funds using an asset allocation strategy designed for investors planning to retire or leave the workplace in or within a few years of the target year and index funds designed to track the performance of certain benchmark indices. The Fiserv Stock Fund is limited, in general, to no more than 25% of the participant's account balance. The stable value fund primarily holds synthetic guaranteed investment contracts (“SGICs”) comprised of underlying investments in common collective trusts and fixed income securities plus fully-benefit responsive wrapper contracts.

Participants may also direct the investment of their account balance into a Self-Directed Brokerage Account (“SDBA”), which allows participants to buy and sell almost any registered investment company or other public security available. If a participant does not affirmatively elect an investment allocation, the participant's account balance will be invested in the applicable target retirement trust based on the participant's projected retirement age of 65. The investment options in the Plan are reviewed and modified as deemed appropriate by the Fiserv Investment Committee. While direct exchanges from the stable value fund into a competing fund are prohibited, participants may otherwise redeem their investments held by the Plan without restriction. A participant may change their investment elections daily.

Notes Receivable from Participants — Participants under the Plan may request loans, subject to consideration for adequate collateral, in a minimum amount of $1 thousand and up to a maximum amount of the lesser of the following: (i) $50 thousand (reduced by the excess, if any, of the participant’s highest outstanding loan balance during the previous twelve months over the outstanding loan balance on the date of the loan); or (ii) 50% of the current market value of the participant’s vested and non-forfeitable account balances. The rate of interest charged on participant loans (3.25% to 11.00% at December 31, 2023) is based on the prime rate published in the Wall Street Journal on the first business day of the calendar quarter during which the loan is processed, plus 2%, unless otherwise determined by the Plan Sponsor, and is fixed at the borrowing date for the term of the loan. Generally, loans require repayment within five years; however, primary residence loan maturities can be up to 15 years, subject to certain requirements. Loans with maturities exceeding these limits may be transferred into the Plan and continue

to be repaid according to their original terms when plans sponsored by entities acquired by the Company are merged into the Plan. A maximum of two loans per participant, one residential and one otherwise, are allowed to be outstanding at a time.

Payment of Benefits — Upon termination of employment for any reason, including death or disability, a participant may elect to receive a distribution of the vested portion of his or her account in a lump sum or as a direct rollover. If no such election is made within 90 days and the participant’s vested interest in the Plan is more than $1 thousand but not more than $5 thousand, it will automatically be rolled over to a new individual retirement account designated by the Plan Sponsor. If the vested interest is $1 thousand or less, a lump sum cash distribution will be made. If a participant’s vested interest exceeds $5 thousand, the vested portion of his or her account will remain in the Plan until the participant or the participant’s representative elects to receive a distribution. Upon termination of employment, a participant may request that amounts invested in the Fiserv Stock Fund be distributed entirely in cash or stock as part of a lump sum distribution.

An in-service withdrawal of all or a portion of a participant’s account may be made under certain conditions, including election by the participant after attaining age 59½. Upon experiencing severe financial hardship, a participant may request a hardship withdrawal if certain criteria are met. Hardship withdrawals are made in cash. The Plan contains special rules prescribed by the IRC regarding the commencement of distributions to participants who attain age 72, or 73 for participants who attain the age of 72 on or after January 1, 2023.

Administrative Expenses — Expenses of administering the Plan are shared between the Plan and Plan participants. Recordkeeping fees are paid through Plan participant accounts, whereas investment advisory and other fees are paid by the Plan. The Plan may also use forfeited non-vested accounts to pay such administrative expenses. Certain investment management fees are included as a reduction of investment income and are recorded within net appreciation in fair value of investments in the statement of changes in net assets available for benefits. Administrative expenses totaled $1,680 thousand during the year ended December 31, 2023.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting — The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

Use of Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ materially from those estimates and are subject to change in the near term.

Investment Valuation — The Plan’s investments are stated at fair value (see Note 3), except for fully benefit-responsive investment contracts which are reported at contract value (see Note 4). Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Income Recognition — Purchases and sales of investments are recorded on a trade-date basis. Interest income is accrued when earned. Dividend income is recorded on the ex-dividend date. Capital gains and losses are recorded within net appreciation in fair value of investments in the statement of changes in net assets available for benefits. Net appreciation in fair value of investments includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Notes Receivable from Participants — Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2023 or 2022. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded.

Payment of Benefits — Benefit payments to participants are recorded upon distribution. At December 31, 2023 and 2022, approved and unpaid benefit payments were $3,767 thousand and $2,376 thousand, respectively.

Risks and Uncertainties — The Plan invests in various investments. Investments, in general, are exposed to various risks, such as interest rate risk, credit risk and overall market volatility. Global macroeconomic conditions, including international conflicts, could also impact the value of investment securities. Due to the level of risk associated with investments, it is reasonably possible that changes in the values of investments will occur in the near term and that such changes could materially affect the amounts reported in the financial statements.

Subsequent Events — Subsequent events have been evaluated through the issuance date of this report.

3. FAIR VALUE MEASUREMENTS

Fair value represents the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities, the Plan uses the hierarchy prescribed in Accounting Standards Codification (“ASC”) 820, Fair Value Measurements, and considers the principal or most advantageous market and the market-based risk measurements or assumptions that market participants would use in pricing the asset or liability. The three levels in the hierarchy are as follows:

•Level 1 - Quoted prices (unadjusted) for identical assets or liabilities in active markets that are accessible as of the measurement date.

•Level 2 - Inputs other than quoted prices within Level 1 that are observable either directly or indirectly, including but not limited to quoted prices in markets that are not active, quoted prices in active markets for similar assets or liabilities and observable inputs other than quoted prices such as interest rates or yield curves.

•Level 3 - Unobservable inputs reflecting the Plan’s own judgments about the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk.

The Plan maximizes the use of relevant observable inputs and minimizes the use of unobservable inputs. Financial instruments carried and measured at fair value on a recurring basis are classified as follows according to the fair value hierarchy described above:

| | | | | | | | | | | | | | | | | |

| (In thousands) | Level 1 | | Level 2 | | Total |

| December 31, 2023 | | | | | |

| Money market fund | $ | 3,857 | | | $ | — | | | $ | 3,857 | |

| Fiserv Stock Fund: | | | | | |

| Fiserv, Inc. common stock | 131,398 | | | — | | | 131,398 | |

| Money market | 60 | | | — | | | 60 | |

| Self-directed brokerage accounts | 166,816 | | | 19,723 | | | 186,539 | |

| Registered investment companies | 87,836 | | | — | | | 87,836 | |

| Total investments in fair value hierarchy table | $ | 389,967 | | | $ | 19,723 | | | $ | 409,690 | |

| Investments measured at net asset value: | | | | | |

| Collective investment trusts | | | | | 4,096,560 | |

| Total investments at fair value | | | | | $ | 4,506,250 | |

| | | | | | | | | | | | | | | | | |

| (In thousands) | Level 1 | | Level 2 | | Total |

| December 31, 2022 | | | | | |

| Money market fund | $ | 2,413 | | | $ | — | | | $ | 2,413 | |

| Fiserv Stock Fund: | | | | | |

| Fiserv, Inc. common stock | 113,729 | | | — | | | 113,729 | |

| Money market | 564 | | | — | | | 564 | |

| Self-directed brokerage accounts | 126,670 | | | 17,592 | | | 144,262 | |

| Registered investment companies | 94,219 | | | — | | | 94,219 | |

| Total investments in fair value hierarchy table | $ | 337,595 | | | $ | 17,592 | | | $ | 355,187 | |

| Investments measured at net asset value: | | | | | |

| Collective investment trusts | | | | | 3,647,939 | |

| Total investments at fair value | | | | | $ | 4,003,126 | |

The Plan’s investments in collective investment trusts are measured using the net asset value (“NAV”) per share (or its equivalent) practical expedient in accordance with ASC 820, and therefore such investments have not been classified in the fair value hierarchy above. The fair value amounts presented in the table are intended to permit reconciliation of the fair value hierarchy to the amounts presented within the statements of net assets available for benefits. The following table provides summarized information related to investments measured at fair value based on NAV per share at December 31:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value | | | | | | |

| (In thousands) | | 2023 | | 2022 | | Unfunded Commitments | | Redemption Frequency | | Redemption Notice Period |

| Collective investment trusts | | $ | 4,096,560 | | | $ | 3,647,939 | | | $ | — | | | Daily | | Same Day |

For the year ended December 31, 2023, there were no significant transfers between Levels 1 and 2 and no transfers in or out of Level 3. The Plan's investments were segregated into the following major categories and levels for determining their fair value at December 31, 2023 and 2022:

Money Market Fund – The money market fund consists of the BlackRock Liquidity Fund. The fund intends to maintain a net asset value of approximately $1 per share. The fund has been valued using Level 1 inputs as these are quoted prices in active markets.

Fiserv Stock Fund – The Fiserv Stock Fund consists of Fiserv, Inc. common stock, which is valued at the quoted market price from an active market, and cash equivalents which provide liquidity for trading. These investments have been valued using Level 1 inputs as these are quoted prices in active markets.

Self-Directed Brokerage Accounts – Plan participants can invest in almost any publicly traded securities, registered investment companies and certain other securities through a self-directed brokerage account. The underlying investments are valued as follows:

•Registered investment companies: The fair value is based on the reported NAV on December 31. Consistent with the registered investment companies discussed below, these investments have been valued using Level 1 inputs as these are quoted prices in active markets.

•Publicly traded equities and exchange traded funds (includes common stock and preferred stock): Values for shares of publicly traded equities and exchange traded funds are the per share prices listed by the exchange. These investments have been valued using Level 1 inputs as these are quoted prices in active markets.

•Fixed income securities (includes certificates of deposit, government obligations and corporate bonds): The fair value of the fixed income securities are obtained with the assistance of a third-party pricing vendor. The third-party pricing vendor utilizes evaluated pricing models that vary by asset class and incorporate available market data. Because many fixed income securities do not trade on a daily basis, the evaluated pricing applications apply available information through processes such as benchmark curves, benchmarking of like securities, sector groupings and matrix pricing. The pricing models vary by asset class but all rely on observable standard market inputs such as benchmark yields, reported trades, broker/dealer quotes, issuer spreads, two-sided markets, benchmark securities, bids, offers and reference data including market research publications. These securities have been valued using Level 2 inputs.

Registered Investment Companies – The Plan is invested in shares of several registered investment companies that are registered with the Securities and Exchange Commission. Prices of these funds are based on the NAV calculated by the funds and are publicly reported on national exchanges. Although the prices are listed on national exchanges, exiting the investment is generally only accomplished through redemption with the fund itself. Thus, redemption with the fund is the principal market in which the Plan could exit the investments. The funds redeem shares at the NAV with few restrictions and redemption with the funds is an active market. These investments are classified as Level 1 in the fair value hierarchy.

Collective Investment Trusts – Target retirement trusts and certain index funds managed by Vanguard Fiduciary Trust Company are organized as collective investment trusts (“CITs”). Each target retirement trust invests in investments using an asset allocation strategy designed for investors planning to retire and leave the workforce within a few years of the target year. The BlackRock Government Short-Term Investment Fund, which is a component of the Stable Value Fund as further described below within Note 4, is organized as a CIT. The fund's strategy is to generate income while preserving principal and to maintain a net asset value of approximately $1 per unit. Prices of these pooled groups of assets are valued at the NAV (as a practical expedient) which is based on the fair value of the underlying investments held by each CIT less its liabilities. This practical expedient is not used when it is determined to be probable that the CIT will sell the investment for an amount different than the reported net asset value. Participant transactions (purchases and sales) may occur daily. Were the Plan to initiate a full redemption of the CITs, the investment advisor reserves the right to temporarily delay withdrawal from the trusts in order to confirm that securities liquidations will be carried out in an orderly business manner.

The preceding methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

4. FULLY BENEFIT-RESPONSIVE INVESTMENT CONTRACTS

The Plan holds a portfolio of investments (the “Stable Value Fund”) that is comprised of a short term investment fund and a portfolio of synthetic guaranteed investment contracts. The portfolio of synthetic guaranteed investment contracts meets the fully benefit-responsive investment contract criteria and, therefore, is reported at contract value in the statements of net assets available for benefits. Contract value is the relevant measurement because it is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. The Plan invests in these investment contracts through the separately managed account strategy.

Synthetic Guaranteed Investment Contracts – The Plan's portfolio includes fixed maturity and constant duration SGICs. The Plan owns the assets underlying the investment of the SGIC, and the bank, insurance company or other financial institution issues a contract, referred to as a "wrapper" that maintains the contract value of the underlying investments for the duration of the SGICs. Fixed maturity SGICs consist of an asset or collection of assets and a benefit responsive, book value wrap contract purchased for the portfolio. Constant duration SGICs consist of a portfolio of securities and a benefit responsive, book value wrap contract purchased for the portfolio. The wrapper contract is an agreement for the wrap issuer, such as a bank or insurance company, to make payments to the Plan in certain circumstances. The wrapper contract typically includes certain conditions and limitations on the underlying assets owned by the Plan and provides a guarantee that the crediting rate will not fall below 0%.

The following represents the bifurcation of contract value between investments in the Stable Value Fund at December 31:

| | | | | | | | | | | |

| (In thousands) | 2023 | | 2022 |

| Fixed maturity SGICs | $ | 38,074 | | | $ | 48,189 | |

| Constant duration SGICs | 237,876 | | | 266,107 | |

| Total | $ | 275,950 | | | $ | 314,296 | |

The following events will limit the ability of the fund to transact at contract value: (i) employer communications designed to induce participants to transfer from the fund; (ii) employer-initiated events or events within the control of the Plan or the Plan Sponsor which would have a material and adverse impact on the fund; or (iii) changes of qualification status of the employer or the Plan. Instead, market value will likely be used in determining the payouts to the participants in these circumstances. In general, issuers may terminate the contract and settle at other than contract value if the qualification status of the employer or the Plan changes, breach of material obligations under the contract and misrepresentation by the contract holder, or failure of the underlying portfolio to conform to the pre-established investment guidelines. The Company is not aware of any events which may occur that might limit the ability of the Plan to transact at contract value with the contract issuers and that would also limit the ability of the Plan to transact at contract value with the participants.

5. PARTY-IN-INTEREST AND RELATED-PARTY TRANSACTIONS

The Plan invests in shares or units of certain funds managed by the Trustee and certain Plan investments are in self-directed brokerage accounts managed by Merrill; therefore, these transactions are party-in-interest transactions. Notes receivable from participants are also considered party-in-interest transactions. The Plan held $48,625 thousand and $48,310 thousand in notes receivable from Plan participants at December 31, 2023 and 2022, respectively.

The Plan also offers the Fiserv Stock Fund, which primarily consists of Fiserv, Inc. common stock, as an investment option. Fiserv Solutions, LLC is the sponsoring employer and, therefore, a related party of the Plan. At December 31, 2023, the Plan held 988,924 shares of Fiserv, Inc. common stock, with a cost basis of $105,118 thousand, and at December 31, 2022, the Plan held 1,124,214 shares of Fiserv, Inc. common stock, with a cost basis of $110,657 thousand.

6. RISKS AND UNCERTAINTIES

The Plan holds various investments in registered investment companies, collective investment trusts, a stable value fund, common stock, and other investments through the SDBA. Investments, in general, are exposed to various risks, such as interest rate risk, credit risk and overall market volatility which could materially affect the value of assets held by the Plan. The following table provides details on investments that represent a concentration of 10% or greater of the Plan's net assets at December 31:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| (In thousands) | | Balance | | % of Net Assets | | Balance | | % of Net Assets |

| | | | | | | | |

| Vanguard Target Retirement Trust Select 2030 | | $ | 630,319 | | | 13 | % | | $ | 577,540 | | | 13 | % |

| Vanguard Target Retirement Trust Select 2035 | | 546,959 | | | 11 | % | | 479,771 | | | 11 | % |

| Vanguard Institutional 500 Index Trust | | 782,681 | | | 16 | % | | 663,139 | | | 15 | % |

7. PLAN TERMINATION

The Plan Sponsor has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions set forth in ERISA. In the event that the Plan is terminated, participants would become 100% vested in their accounts, including Company contributions.

8. TAX STATUS

The Internal Revenue Service has determined and informed the Company by a letter dated November 22, 2021 that the amended and restated Plan document and related trust were designed in accordance with the applicable regulations of the IRC. Although the Plan has been amended since receiving this determination letter, the Company and Plan management believe that the Plan is currently designed and operated in compliance with the applicable requirements of the IRC and that the Plan and related trust continue to be tax exempt. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

9. DIFFERENCES BETWEEN FINANCIAL STATEMENTS AND FORM 5500

The following is a reconciliation of net assets available for benefits and changes in net assets available for benefits per the accompanying financial statements to the Form 5500 as of and for the year ended December 31:

| | | | | | | | | | | | | | |

| (In thousands) | | 2023 | | 2022 |

| Net assets available for benefits per the accompanying financial statements | | $ | 4,832,436 | | | $ | 4,368,271 | |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts | | (21,206) | | | (29,064) | |

| Amounts allocated to withdrawing participants | | (3,767) | | | (2,376) | |

| Net assets available for benefits per the Form 5500 | | $ | 4,807,463 | | | $ | 4,336,831 | |

| | | | | | | | |

| (In thousands) | | 2023 |

Increase in net assets available for benefits per the accompanying financial statements | | $ | 464,165 | |

| Changes in adjustment from contract value to fair value for fully benefit-responsive investment contracts | | 7,858 | |

| Changes in amounts allocated to withdrawing participants | | (1,391) | |

Increase in net assets available for benefits per the Form 5500 | | $ | 470,632 | |

Net assets available for benefits in the accompanying financial statements report the SGICs within the Stable Value Fund at contract value; however, such contracts are recorded at fair value within the Plan's Form 5500. Amounts allocated to withdrawing participants are recorded on the Form 5500 for benefit claims that have been processed and approved for payment prior to year-end but not yet distributed.

SUPPLEMENTAL SCHEDULE

| | | | | | | | |

| FISERV 401(k) SAVINGS PLAN |

|

| FORM 5500, SCHEDULE H, PART IV, LINE 4i — |

| SCHEDULE OF ASSETS (HELD AT END OF YEAR) |

| EIN: 39-1833695 Plan: 004 |

| AS OF DECEMBER 31, 2023 |

| (In thousands) |

(b)

Identity of Issue, Borrower, Lessor, or Similar Party | (c)

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par, or Maturity Value | (e)

Current Value |

| Registered Investment Companies: | |

| PIMCO | Total Return Fund | $ | 40,397 | |

| The Vanguard Group | Inflation-Protection Securities Fund | 47,439 | |

| | |

| | |

| | |

| | |

| Total Registered Investment Companies | 87,836 | |

| | |

| Collective Investment Trusts: | |

| Vanguard Fiduciary Trust Company | |

| Vanguard Target Retirement Income Trust Select | 76,054 | |

| Vanguard Target Retirement Trust Select 2020 | 196,348 | |

| Vanguard Target Retirement Trust Select 2025 | 397,484 | |

| Vanguard Target Retirement Trust Select 2030 | 630,319 | |

| Vanguard Target Retirement Trust Select 2035 | 546,959 | |

| Vanguard Target Retirement Trust Select 2040 | 444,703 | |

| Vanguard Target Retirement Trust Select 2045 | 247,465 | |

| Vanguard Target Retirement Trust Select 2050 | 168,788 | |

| Vanguard Target Retirement Trust Select 2055 | 86,290 | |

| Vanguard Target Retirement Trust Select 2060 | 44,478 | |

| Vanguard Target Retirement Trust Select 2065 | 22,915 | |

| Vanguard Target Retirement Trust Select 2070 | 1,707 | |

| Vanguard Institutional 500 Index Trust | 782,681 | |

| Vanguard Institutional Extended Market Index Trust | 155,872 | |

| Vanguard Institutional Total Bond Market Index Trust | 140,459 | |

| Vanguard Institutional Total International Stock Market Index Trust | 148,076 | |

| Total Collective Investment Trusts | 4,090,598 | |

| | |

| Stable Value Fund: | | |

| Standish Mellon | |

| BlackRock Government Short-Term Investment Fund | 5,962 | |

| | |

| | | | | | | | |

| FISERV 401(k) SAVINGS PLAN |

|

| FORM 5500, SCHEDULE H, PART IV, LINE 4i — |

| SCHEDULE OF ASSETS (HELD AT END OF YEAR) |

| EIN: 39-1833695 Plan: 004 |

| AS OF DECEMBER 31, 2023 |

| (In thousands) |

(b)

Identity of Issue, Borrower, Lessor, or Similar Party | (c)

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par, or Maturity Value | (e)

Current Value |

| Constant Duration SGICs: | |

| BlackRock Asset-Back Securities Index Fund | 23,470 | |

| Corporate Bond Funds | |

| BlackRock 1-3 Year Credit Bond Index Fund | 21,422 | |

| BlackRock Intermediate Term Credit Bond Index Fund | 29,232 | |

| | 50,654 | |

| | |

| Government Bond Funds | |

| BlackRock 1-3 Year Government Bond Index Fund | 26,824 | |

| BlackRock Intermediate Government Bond Index Fund | 7,779 | |

| | |

| | 34,603 | |

| Mortgage-backed Securities Funds | |

| BlackRock Commercial Mortgage-Backed Sec. Index Fund | 9,174 | |

| BlackRock Mortgage-backed Sec. Index Fund | 28,858 | |

| | 38,032 | |

| Intermediate Aggregate Fixed Income Funds | |

| Prudential Trust Company Intermediate Aggregate Fixed Income Fund | 45,702 | |

| Western Asset Management Core Bond Collective Fund | 26,046 | |

| | 71,748 | |

| | |

| Total Constant Duration SGICs | 218,507 | |

| | |

| Fixed Maturity SGICs: | |

| Cash | 4,979 | |

| Discover Card Mstr Trust DCENT 2022-A3 A3 3.56% Expected Maturity 7/15/2025 | 820 | |

| * | Bank of America Cr Card BACCT 2021-A1 A1 0.44% Expected Maturity 4/15/2024 | 296 | |

| Capital One Multi Trust COMET 2021-A1 A1 0.55% Expected Maturity 7/15/2024 | 1,169 | |

| AmEx Crdt Acct Mst Trust AMXCA 2021-1 A 0.90% Expected Maturity 11/15/2024 | 603 | |

| FORD AUTO LEASE FORDL 2022-A A3 3.23% Expected Maturity 5/15/2024 | 362 | |

| World Omni Auto Rec WOART 2021-A A3 0.30% Expected Maturity 8/15/2024 | 241 | |

| Hyundai Auto Rec Trust HART 2021-A A3 0.38% Expected Maturity 5/15/2024 | 349 | |

| John Deere Owner Trust JDOT 2021-B A3 0.52% Expected Maturity 3/17/2025 | 934 | |

| John Deere Owner Trust JDOT 2022-A A3 2.32% Expected Maturity 8/15/2025 | 517 | |

| John Deere Owner Trust JDOT 2022-B A3 3.74% Expected Maturity 2/17/2026 | 337 | |

| Public Service NH PSNH 2018-1 A1 3.09% Expected Maturity 2/1/2024 | 14 | |

| AEP Texas Cent Trans Fndg AEPTC 2019-1 A1 2.06% Expected Maturity 2/3/2025 | 149 | |

| | | | | | | | |

| FISERV 401(k) SAVINGS PLAN |

|

| FORM 5500, SCHEDULE H, PART IV, LINE 4i — |

| SCHEDULE OF ASSETS (HELD AT END OF YEAR) |

| EIN: 39-1833695 Plan: 004 |

| AS OF DECEMBER 31, 2023 |

| (In thousands) |

(b)

Identity of Issue, Borrower, Lessor, or Similar Party | (c)

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par, or Maturity Value | (e)

Current Value |

| Centerpnt Energy Trans Co CNP 2012-1 A3 3.03% Expected Maturity 10/15/2024 | 413 | |

| Fannie Mae FNR 2016-103 KA 3.00% Expected Maturity 1/25/2024 | 109 | |

| Fannie Mae FNR 2015-33 AC 3.00% Expected Maturity 11/25/2024 | 63 | |

| Fannie Mae FNR 2018-58 P 4.00% Expected Maturity 12/28/2026 | 499 | |

| Fannie Mae FNR 2016-95 UG 2.75% Expected Maturity 6/25/2026 | 461 | |

| Fannie Mae FNR 2021-45 EA 2.50% Expected Maturity 10/25/2028 | 829 | |

| Fannie Mae FNR 2021-54 CA 2.50% Expected Maturity 12/26/2029 | 443 | |

| Fannie Mae FNR 2022-13 MA 3.00% Expected Maturity 3/26/2029 | 749 | |

| Fannie Mae FNR 2022-50 A 4.50% Expected Maturity 6/25/2026 | 917 | |

| Freddie Mac FHR 3707 HB 4.00% Expected Maturity 7/15/2025 | 17 | |

| Freddie Mac FHR 4680 LA 3.50% Expected Maturity 12/16/2024 | 47 | |

| Freddie Mac FHR 5020 XA 2.00% Expected Maturity 3/27/2028 | 389 | |

| Freddie Mac FHR 4571 CA 2.50% Expected Maturity 11/17/2025 | 233 | |

| Freddie Mac FHR 4821 NY 4.00% Expected Maturity 7/15/2025 | 173 | |

| Freddie Mac FHR 5081 NH 2.00% Expected Maturity 6/26/2028 | 836 | |

| Freddie Mac FHR 4700 VK 3.50% Expected Maturity 3/15/2024 | 733 | |

| Freddie Mac FHR 5156 HB 1.25% Expected Maturity 2/15/2028 | 503 | |

| Freddie Mac FHR 4060 HC 3.00% Expected Maturity 8/16/2027 | 429 | |

| Ginnie Mae GN 784237 4.50% Expected Maturity 6/17/2024 | 8 | |

| Govt Natl Mortgage Assoc GNR 2012-6 LH 3.50% Expected Maturity 6/16/2025 | 53 | |

| Govt Natl Mortgage Assoc GNR 2014-74 HL 3.00% Expected Maturity 3/16/2026 | 46 | |

| Govt Natl Mortgage Assoc GNR 2020-78 HL 1.00% Expected Maturity 5/16/2028 | 189 | |

| Govt Natl Mortgage Assoc GNR 2021-78 D 2.50% Expected Maturity 1/20/2031 | 857 | |

| Govt Natl Mortgage Assoc GNR 2021-137 KA 2.50% Expected Maturity 1/22/2029 | 482 | |

| Govt Natl Mortgage Assoc GNR 2013-22 AP 2.50% Expected Maturity 8/20/2030 | 900 | |

| Govt Natl Mortgage Assoc GNR 2022-76 AB 4.00% Expected Maturity 5/20/2030 | 973 | |

| Govt Natl Mortgage Assoc GNR 2022-180 DA 5.00% Expected Maturity 3/20/2030 | 558 | |

| BANK BANK 2018-BN14 A2 4.13% Expected Maturity 1/16/2024 | 158 | |

| BENCHMARK mortgage trust BMARK 2019-B10 A2 3.61% Expected Maturity 3/15/2024 | 594 | |

| Citi/Deutsche Comm Mtge CD 2016-CD1 ASB 2.62% Expected Maturity 7/10/2026 | 866 | |

| BMO Mortgage Trust BMO 2022-C3 A2 5.50% Expected Maturity 8/16/2027 | 402 | |

| Deutsche Bank Comm Mtge DBJPM 2017-C6 A4 3.07% Expected Maturity 5/10/2027 | 663 | |

| Barclays Comm Mort Sec BBCMS 2022-C18 A2 5.50% Expected Maturity 11/15/2027 | 651 | |

| US Treasury T 0 1/4 07/31/25 0.25% Expected Maturity 7/31/2025 | 132 | |

| US Treasury T 2 7/8 06/15/25 2.88% Expected Maturity 6/16/2025 | 798 | |

| | | | | | | | |

| FISERV 401(k) SAVINGS PLAN |

|

| FORM 5500, SCHEDULE H, PART IV, LINE 4i — |

| SCHEDULE OF ASSETS (HELD AT END OF YEAR) |

| EIN: 39-1833695 Plan: 004 |

| AS OF DECEMBER 31, 2023 |

| (In thousands) |

(b)

Identity of Issue, Borrower, Lessor, or Similar Party | (c)

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par, or Maturity Value | (e)

Current Value |

| Capital One Multi Trust COMET 2021-A1 A1 0.55% Expected Maturity 7/15/2024 | 672 | |

| Discover Card Mstr Trust DCENT 2021-A1 A1 0.58% Expected Maturity 9/16/2024 | 484 | |

| Hyundai Auto Rec Trust HART 2020-C A3 0.38% Expected Maturity 2/15/2024 | 44 | |

| Hyundai Auto Rec Trust HART 2021-A A3 0.38% Expected Maturity 5/15/2024 | 207 | |

| World Omni Auto Rec WOART 2022-C A3 3.66% Expected Maturity 2/17/2026 | 99 | |

| Nissan Auto Rec OT NAROT 2022-B A3 4.46% Expected Maturity 3/16/2026 | 138 | |

| Case New Holland CNH 2020-A A4 1.51% Expected Maturity 1/15/2025 | 299 | |

| John Deere Owner Trust JDOT 2021-A A3 0.36% Expected Maturity 10/15/2024 | 134 | |

| John Deere Owner Trust JDOT 2022-B A3 3.74% Expected Maturity 2/17/2026 | 177 | |

| Case New Holland CNH 2022-B A3 3.89% Expected Maturity 6/15/2026 | 121 | |

| Public Service NH PSNH 2018-1 A1 3.09% Expected Maturity 2/1/2024 | 23 | |

| Centerpnt Energy Trans Co CNP 2012-1 A3 3.03% Expected Maturity 10/15/2024 | 141 | |

| Fannie Mae FNR 2018-58 P 4.00% Expected Maturity 9/25/2026 | 208 | |

| Fannie Mae FNR 2021-54 CA 2.50% Expected Maturity 6/25/2029 | 280 | |

| Fannie Mae FNR 2016-21 BV 3.00% Expected Maturity 4/25/2025 | 505 | |

| Fannie Mae FNR 2022-54 DA 4.50% Expected Maturity 9/25/2030 | 370 | |

| Fannie Mae FNR 2022-50 A 4.50% Expected Maturity 6/25/2026 | 423 | |

| Freddie Mac FHR 5057 AB 2.50% Expected Maturity 11/25/2026 | 253 | |

| Freddie Mac FHR 4569 A 2.50% Expected Maturity 8/15/2025 | 168 | |

| Freddie Mac FHR 4821 NY 4.00% Expected Maturity 7/15/2025 | 282 | |

| Freddie Mac FHR 5081 NH 2.00% Expected Maturity 4/25/2029 | 294 | |

| Freddie Mac FHR 5254 A 4.50% Expected Maturity 10/25/2030 | 301 | |

| Freddie Mac FHR 5263 EA 4.00% Expected Maturity 5/25/2029 | 424 | |

| Govt Natl Mortgage Assoc GNR 2020-164 KP 1.75% Expected Maturity 7/20/2029 | 249 | |

| Govt Natl Mortgage Assoc GNR 2021-8 TP 2.50% Expected Maturity 5/21/2029 | 232 | |

| Govt Natl Mortgage Assoc GNR 2021-78 D 2.50% Expected Maturity 12/20/2028 | 409 | |

| Govt Natl Mortgage Assoc GNR 2022-100 KA 4.00% Expected Maturity 7/20/2026 | 388 | |

| Govt Natl Mortgage Assoc GNR 2022-180 DA 5.00% Expected Maturity 3/20/2030 | 371 | |

| BENCHMARK mortgage trust BMARK 2021-B26 A2 1.96% Expected Maturity 5/15/2026 | 512 | |

| BMO Mortgage Trust BMO 2022-C3 A2 5.50% Expected Maturity 8/16/2027 | 180 | |

| Citi/Deutsche Comm Mtge CD 2016-CD2 A3 3.25% Expected Maturity 10/13/2026 | 228 | |

| Deutsche Bank Comm Mtge DBJPM 2017-C6 A4 3.07% Expected Maturity 5/10/2027 | 284 | |

| Barclays Comm Mort Sec BBCMS 2022-C18 A2 5.50% Expected Maturity 11/15/2027 | 285 | |

| BANK BANK 2023-BNK45 A2 5.66% Expected Maturity 2/15/2028 | 109 | |

| | |

| | | | | | | | |

| FISERV 401(k) SAVINGS PLAN |

|

| FORM 5500, SCHEDULE H, PART IV, LINE 4i — |

| SCHEDULE OF ASSETS (HELD AT END OF YEAR) |

| EIN: 39-1833695 Plan: 004 |

| AS OF DECEMBER 31, 2023 |

| (In thousands) |

(b)

Identity of Issue, Borrower, Lessor, or Similar Party | (c)

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par, or Maturity Value | (e)

Current Value |

| Total Fixed Maturity SGICs | 36,237 | |

| | |

| Total Stable Value Fund | 260,706 | |

| | |

| BlackRock Liquidity Fund | Money Market | 3,857 | |

| *Fiserv Stock Fund: | | |

*Fiserv, Inc. common stock | Company Stock Fund | 131,398 | |

| The Vanguard Group | Money Market | 60 | |

| *Self-Directed Brokerage Accounts | | 186,539 | |

| *Notes receivable from participants | Interest rates ranging from 3.25% to 11.00%, maturity dates through 2040 | 48,625 | |

| | |

| TOTAL ASSETS (HELD FOR INVESTMENT AT END OF YEAR) | $ | 4,809,619 | |

| | |

| *Represents a party-in-interest | | |

| Cost information is not required for participant-directed investments and therefore is not included. |

EXHIBIT 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement No. 333-235769 of Fiserv, Inc. on Form S-8 of our report dated June 20, 2024, relating to the financial statements and supplemental schedule of the Fiserv 401(k) Savings Plan, appearing in this Annual Report on Form 11-K of the Fiserv 401(k) Savings Plan as of December 31, 2023 and 2022 and for the year ended December 31, 2023.

/s/ DELOITTE & TOUCHE LLP

Milwaukee, Wisconsin

June 20, 2024

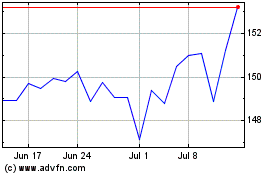

Fiserv (NYSE:FI)

Historical Stock Chart

From Jun 2024 to Jul 2024

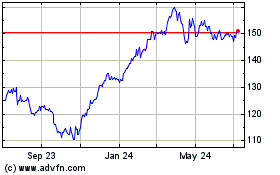

Fiserv (NYSE:FI)

Historical Stock Chart

From Jul 2023 to Jul 2024