Advisory Board Co. to Be Split and Sold for $2.58 Billion, Including Debt -- Update

August 29 2017 - 9:37AM

Dow Jones News

By Anna Wilde Mathews and Laura Cooper

The Advisory Board Co. will be split up and sold in a deal worth

around $2.21 billion, with its health-care business going to

UnitedHealth Group Inc. and its education unit to private-equity

firm Vista Partners LLC.

The consulting and software company had announced in February

that its board was exploring strategic alternatives, including a

possible sale. That move came after activist hedge fund Elliott

Management Corp. said it and related entities had bought about 8.3%

of the company's shares, saying at the time that they were

undervalued and it wanted to engage in a dialogue with the

company's board.

The companies said that the total value of the deal was around

$2.58 billion, a figure that includes the assumption of debt.

Advisory Board shareholders will get approximately $54.29 in cash

per share, which includes a fixed payment of $52.65 per share in

addition to the estimated after-tax value of the Advisory Board's

stake in Evolent Health Inc.

Vista will pay about $1.55 billion for EAB, the education unit,

which focuses largely on colleges and universities. After that deal

closes, UnitedHealth will complete its acquisition of the Advisory

Board's health operation, which goes by the name of the parent

company, paying $1.3 billion including the assumption of debt.

The Advisory Board, which is a well-known name in the hospital

industry, had around $803 million in revenue last year. For the

second quarter of 2017, it reported net income of $14.7 million, or

36 cents per share, compared with $7.5 million, or 18 cents a

share, a year earlier. Shares closed at $49.85 on Monday.

The Advisory Board becomes the latest high-profile takeover for

UnitedHealth's Optum health-services arm. Optum has grown rapidly

over the years with an aggressive spate of acquisitions, bolting

together everything from a burgeoning network of doctor practices

to a major pharmacy-benefit manager to a large outpatient surgery

company.

Eric Murphy, the chief executive of OptumInsight, the unit that

will absorb Advisory Board, said there are "terrific synergies"

between the two companies, with the acquisition bringing research

and other capabilities that Optum doesn't currently have.

UnitedHealth said Robert Musslewhite, who is the chief executive

of the Advisory Board parent company, will continue to lead its

consulting work within Optum.

The acquisition may raise questions among some Advisory Board

clients, who entrust their data to the firm and may rely on its

work in their pricing negotiations with big insurers like

UnitedHealthcare, the insurance unit of UnitedHealth.

Michael J. Dowling, chief executive of Northwell Health, a huge

New York hospital system that is an Advisory Board client, said

before the deal was announced that he would want to understand the

details. "It would all depend as to what the nature of the

relationship would be," he said. "You'd want to be able to be

sure....that the data is protected and doesn't bleed into other

entities." Northwell already has a good relationship with Optum,

which he expects to continue, he said.

Optum itself is already a major adviser to hospitals, as well as

insurers that compete directly with UnitedHealthcare. UnitedHealth

has always said that Optum clients' information is walled off

completely from the company's corporate sibling, and Optum has long

been able to win business despite the relationship. Mr. Musslewhite

said it expected questions from some clients about the

UnitedHealthcare relationship, but "we'll be able to answer that

question easily." He said Optum has "been able to demonstrate a lot

of proof of the fact that they guard that very seriously."

UnitedHealth said it expects to close the acquisition in late

2017 or early next year.

Vista Equity Partners invests in a software, data and

technology-focused companies -- including a major education-related

firm, PowerSchool, which provides software for the K-12 market. The

investment firm recently closed its largest buyout fund, collecting

over $11 billion in capital -- making it one of the largest

technology-focused vehicles ever. Across its differentiated funds,

the firm has raised over $30 billion to pursue deals.

With a large war chest, Vista has been active on the acquisition

trail. After several deals to take companies private last year, the

firm agreed to take-private Canadian financial technology company

D+H Corp. for 2.7 billion Canadian dollars in March to merge with

its portfolio company Misys Group Ltd. It also recently agreed to

sell the communities and sports divisions of its portfolio company

Active Network Inc. to Global Payments Inc. in a cash-and-stock

deal valued at roughly $1.2 billion.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Laura

Cooper at laura.cooper@wsj.com

(END) Dow Jones Newswires

August 29, 2017 09:22 ET (13:22 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

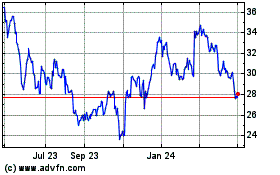

Evolent Health (NYSE:EVH)

Historical Stock Chart

From Oct 2024 to Nov 2024

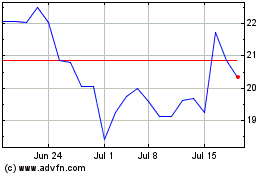

Evolent Health (NYSE:EVH)

Historical Stock Chart

From Nov 2023 to Nov 2024