NOTICE OF 2022 ANNUAL MEETING OF SHAREHOLDERS

To be Held on June 21, 2022

To the Shareholders of Equity Commonwealth:

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Shareholders, and any adjournments or postponements thereof (the “Annual Meeting”), of Equity Commonwealth, a Maryland real estate investment trust (the “Company”), will be held in a virtual-only format on June 21, 2022, at 1:30 p.m., Central Time. You will be able to attend the Annual Meeting, vote your shares electronically and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/EQC2022 and entering your control number included in the notice containing instructions on how to access Annual Meeting materials or your proxy card. The Annual Meeting will be held for the following purposes:

1. to elect the 8 trustees named in our proxy statement to the Board of Trustees (the “Board”);

2. to approve, on a non-binding advisory basis, the compensation of our named executive officers;

3. to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; and

4. to transact such other business as may properly come before the Annual Meeting.

The Board will hold the 2022 Annual Meeting of Shareholders in virtual-only format. Broadridge, a global proxy services firm, will host the virtual-only Annual Meeting. In order to participate in the virtual-only Annual Meeting, vote during the Annual Meeting and submit questions, please log into the meeting platform at: www.virtualshareholdermeeting.com/EQC2022. The virtual-only Annual Meeting will begin promptly at 1:30 p.m. Central Time, on June 21, 2022. Online access will begin at 1:15 p.m. Central Time. We encourage you to access the virtual-only Annual Meeting prior to the start time. Broadridge will have personnel ready to assist you with any technical difficulties you may have accessing the virtual-only Annual Meeting. Shareholders who hold their shares in “street name” through a broker or other financial institution or are registered shareholders may use the 16-digit control number and the instructions previously distributed to them to join the virtual-only Annual Meeting. We know of no other matters to come before the Annual Meeting. Only holders of record of common shares at the close of business on April 14, 2022 are entitled to notice of and to vote at the Annual Meeting or at any adjournments or postponements thereof.

Regardless of the number of shares you hold, as a shareholder your role is very important, and the Board strongly encourages you to exercise your right to vote. Pursuant to the U.S. Securities and Exchange Commission’s “notice and access” rules, our Proxy Statement, proxy card and 2021 Annual Report to Shareholders are available online at www.proxyvote.com.

We encourage you to contact the firm assisting us in the solicitation of proxies, D.F. King & Co., Inc. (“D.F. King”), if you have any questions or need assistance in voting your shares. Banks and brokers may call D.F. King collect at (212) 269-5550. Shareholders may call D.F. King toll-free at (800) 967-4607.

| | | | | |

| By Order of the Board of Trustees, |

| |

| Orrin S. Shifrin |

| April 26, 2022 | Executive Vice President, |

| Chicago, Illinois 60606 | General Counsel and Secretary |

REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE MEETING, YOU ARE URGED TO VOTE AT YOUR EARLIEST CONVENIENCE. IF YOU ATTEND THE MEETING, YOU MAY WITHDRAW YOUR PROXY AND VOTE AT THE ANNUAL MEETING.

TABLE OF CONTENTS

| | | | | |

| PROXY STATEMENT SUMMARY | 1 |

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | 6 |

| PROPOSAL 1: ELECTION OF TRUSTEES | 10 |

| Trustee Nominees | 10 |

| Vote Required and Recommendation | 13 |

| PROPOSAL 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION | 14 |

| Vote Required and Recommendation | 14 |

| PROPOSAL 3: RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 15 |

| Vote Required and Recommendation | 15 |

| Principal Accountant Fees and Services | 15 |

| Pre-Approval Policies and Procedures | 16 |

| AUDIT COMMITTEE REPORT | 17 |

| CORPORATE GOVERNANCE AND BOARD MATTERS | 18 |

| Corporate Governance Profile | 18 |

| Board Leadership Structure | 18 |

| Executive Sessions | 19 |

| Attendance of Trustees at 2021 Board Meetings and Annual Meeting of Shareholders | 19 |

| Committees of the Board | 19 |

| Trustee Nominee Selection Process | 21 |

| Board Oversight of Risk Management | 23 |

| Corporate Governance Guidelines | 23 |

| Code of Business Conduct and Ethics | 24 |

| Sustainability and Social Responsibility | 24 |

| Communications with the Board | 25 |

| Compensation Committee Interlocks and Insider Participation | 25 |

| EXECUTIVE OFFICERS | 26 |

| COMPENSATION DISCUSSION AND ANALYSIS | 27 |

| Compensation Overview | 27 |

| Overview of Company Performance during 2021 | 27 |

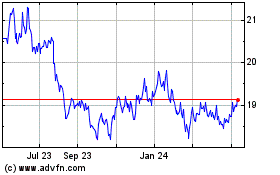

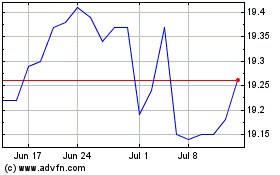

| Performance Over One, Three, and Five Years | 28 |

| Compensation Objectives and Philosophy | 29 |

| Compensation Snapshot | 29 |

| Executive Compensation Program Highlights | 31 |

| Compensation Determination Process | 32 |

| Elements of Compensation | 33 |

| Other Compensation Practices and Policies | 41 |

| 2022 Compensation Actions | 42 |

| COMPENSATION COMMITTEE REPORT | 44 |

| EXECUTIVE COMPENSATION | 45 |

| Summary Compensation Table | 45 |

| Grants of Plan-Based Awards | 46 |

| Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table | 47 |

| Outstanding Equity Awards at 2021 Fiscal Year-End | 48 |

| Option Exercises and Stock Vested | 49 |

| Potential Payments Upon Termination or Change in Control | 49 |

| Pay Ratio Disclosure | 53 |

| |

| |

| | | | | |

| TRUSTEE COMPENSATION | 54 |

| Overview of Trustee Compensation Program | 54 |

| Equity Awards Granted to Independent Trustees | 54 |

| Compensation for the Chairman of the Board | 54 |

| Stock Ownership Guidelines | 55 |

| Trustee Compensation Table for Fiscal Year 2021 | 56 |

| EQUITY COMPENSATION PLAN INFORMATION | 57 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 58 |

| CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | 60 |

| Review and Approval or Ratification of Transactions with Related Persons | 60 |

| Related Person Transactions | 60 |

| Indemnification | 60 |

| MISCELLANEOUS | 62 |

| Other Matters to Come Before the Annual Meeting | 62 |

| Shareholder Proposals and Nominations for the 2023 Annual Meeting of Shareholders | 62 |

| Householding of Annual Meeting Materials | 62 |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON JUNE 21, 2022 | 63 |

EQUITY COMMONWEALTH

Two North Riverside Plaza, Suite 2100

Chicago, IL 60606

PROXY STATEMENT

This Proxy Statement and related proxy materials are being made available to shareholders of Equity Commonwealth (“Equity Commonwealth,” the “Company” or “EQC”) on or about April 26, 2022 in connection with the solicitation by our Board of Trustees (the “Board”) of proxies to be voted at the Company’s 2022 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on June 21, 2022, at 1:30 p.m., Central Time. The Board will hold the Annual Meeting in a virtual-only format in lieu of an in-person meeting.

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. You should read the entire Proxy Statement carefully before voting.

Overview

In 2021, we focused our efforts on sourcing and evaluating potential investment opportunities across a range of property types where we could utilize our team’s talents to create long-term value for our shareholders. We worked for much of the year on the acquisition of Monmouth Real Estate Investment Corporation, a publicly-traded industrial REIT (“Monmouth”), entering into a merger agreement to acquire Monmouth on May 4, 2021. Given the competitive environment generally and for industrial real estate specifically, there was significant interest in Monmouth from other potential buyers. After working the better part of the year on the transaction, we stood ready to close on the transaction with 88% of our outstanding common shares voting in favor of the merger. Monmouth, however, failed to obtain the approval of two-thirds of its outstanding common shares needed for the merger. On August 31, 2021, we terminated the merger agreement in accordance with its terms. While we were disappointed with the outcome, we remained disciplined in our approach to pricing and encouraged by the ability and effort of our team throughout the process.

Following the termination of the merger agreement with Monmouth, we have shifted our focus to the evaluation of additional investment opportunities. We are seeking to use the strength and liquidity of our balance sheet for investments in high-quality assets or businesses in a broad range of property types that offer a compelling risk-reward profile in order to create a foundation for long-term growth. We intend to be patient and disciplined in our evaluation of investment opportunities while remaining focused on proactive asset management, leasing and operations at our four remaining properties, some of which we may sell to the extent we determine that is in the best interests of our business objectives. We may also determine to sell, liquidate or otherwise exit our business if we believe doing so will maximize shareholder value.

In 2021, we also repurchased $174.1 million of our common shares, at a weighted average price of $25.85 per share, and we ended the year with $2.8 billion of cash for future investment opportunities. We also made further progress on our sustainability and social responsibility initiatives, significantly improving our score by 25% on the Global Real Estate Sustainability Benchmark (“GRESB”) real estate assessment and implementing a diversity, equity and inclusion initiative, including the signing of the CEO Action for Diversity & Inclusion Pledge, pledging our commitment to: (i) provide a workplace that addresses diversity and inclusion issues, (ii) implement unconscious bias education, (iii) share best practices with other pledge participants, and (iv) create strategic inclusion and diversity initiatives.

Since we took over responsibility for EQC in 2014 with a new Board and internalized management team, we have become a fundamentally different company with a smaller portfolio of higher-quality assets, a strong balance sheet with significant capacity and a track record of consistent execution. Through year-end 2021, we reduced our portfolio to four office properties in three cities, exiting 116 cities, 28 states and Australia:

| | |

|

| * EQC Starting Portfolio includes properties classified as discontinued operations as of March 31, 2014 and excludes two land parcels previously classified as properties. |

Through December 31, 2021, we have also accomplished the following:

•Completed $7.6 billion of dispositions, including the sale of 164 properties totaling 44 million square feet and three land parcels;

•Repaid debt and preferred equity balances of $3.3 billion;

•Paid $1.2 billion, or $9.50 per common share, of distributions to our common shareholders;

•Repurchased $440 million of our common shares at a dividend-adjusted, weighted average price of $21.68 per share; and

•Accumulated a cash balance of $2.8 billion, or over $24.00 per share.

| | |

| Use of Disposition Proceeds |

* includes cash from operations

We have returned $1.6 billion to shareholders through common share distributions and share repurchases, while maintaining a significant cash balance for future opportunities.

2021 Performance Highlights

The Company’s significant accomplishments in 2021 included:

•Sourced and evaluated numerous external growth investment opportunities across a range of property types;

•Managed the potential acquisition of Monmouth with substantially all business, operational, accounting, tax, finance, treasury, engineering, legal, personnel, risk and other matters completed and ready for transition;

•Repurchased $174.1 million, or 6.7 million of our common shares, at a weighted average price of $25.85 per share, reducing our common shares outstanding by over 5.0%;

•Completed approximately 116,000 square feet of leasing in the four properties we held on December 31, 2021, including new leasing of approximately 60,000 square feet and lease renewals covering approximately 56,000 square feet;

•Continued to advance our sustainability and social responsibility initiatives to enhance corporate office and property sustainability as well as social responsibility, including (i) completing EQC’s second annual GRESB real estate assessment with a 25% improvement to our score, and (ii) implementing a diversity, equity & inclusion initiative;

•Continued to adapt business operations in response to the COVID-19 pandemic with an emphasis on tenant and employee safety and productivity while maintaining our focus on rent collections, including:

○ successfully transitioning our employees’ return to the office, and

○ adapting our properties and corporate office to allow for continued occupancy; and

•Fostered an entrepreneurial culture with an emphasis on transparency and open communication, where working passionately and collaboratively is fundamental.

Executive Compensation Highlights

Our executive compensation program is designed to accomplish four key objectives:

1. Reward effective executive officers who create long-term value for the Company’s shareholders;

2. Align the long-term interests of our executive officers with the interests of the Company and the Company’s shareholders;

3. Reward financial and operating performance and leadership excellence; and

4. Retain and motivate executives to remain at the Company for the long-term.

As part of these objectives, our executive compensation program is centered on pay-for-performance principles that are aligned with the interests of our shareholders, including the following key components:

•Pay-for-Performance Alignment – We maintain strong pay-for-performance alignment with 64% of 2021 target compensation for our CEO and 59% for our other named executive officers being at-risk compensation that is contingent upon Company performance (excluding, for 2021, the CFO position due to the transition in that role that occurred in 2021).

•Performance-Based Annual Cash Incentives – For 2021, 67% of our named executive officers’ annual cash bonus targets are based on the achievement of corporate performance goals established at the beginning of the year, with the remaining 33% of annual cash bonus targets being based on individual performance goals. Our cash bonus program may result in significant fluctuations in payouts depending on our financial and operating success each year. In 2021, for our newly appointed chief financial officer, the individual performance achievement determination also took into account his appointment to and performance in that role.

•Focus on Long-Term Performance and Alignment with Our Shareholders – 60% of target compensation for our CEO and an average of 53% for our other named executive officers is paid in long-term equity awards that further enhance our named executive officers’ alignment with shareholders (excluding, for 2021, the CFO position due to the transition in that role that occurred in 2021). 67% of our long-term equity awards consist of performance awards subject to forfeiture based upon a primary metric of three-year relative total shareholder return (“TSR”) with a secondary metric of absolute TSR if the Company’s TSR is negative, reducing any earned performance award by 25%. The remaining 33% of our long-term equity awards are time-based and subject to vesting over a four-year period with half vesting in the fourth year.

•Commitment to Strong Compensation Governance – Our executive compensation program is designed to achieve an appropriate balance between risk and reward by employing both good compensation governance and appropriate risk mitigation features, including:

◦Compensation clawback policy that covers all incentive-based compensation (cash and equity) for all our named executive officers;

◦Equity ownership requirements (including 6x base salary for our CEO), with executives required to hold all equity awards until the guidelines are met;

◦Anti-hedging and anti-pledging policies applicable to all of our named executive officers;

◦Long-term vesting requirements on equity awards;

◦Caps on short-term annual incentive program and long-term incentive compensation payouts;

◦Multiple performance factors that provide for a range of payouts (not all or nothing); and

◦Double-trigger change in control provisions and no excise tax gross-ups.

Corporate Governance Highlights

We are committed to a corporate governance approach that promotes transparency as well as alignment with and accountability to our shareholders. We consistently look to improve our corporate governance policies and practices, including:

| | | | | |

| ✔ | Majority voting in uncontested trustee elections |

| ✔ | Annual trustee elections, with shareholder approval required to stagger the Board |

| ✔ | Lead independent trustee with robust duties |

| ✔ | Separate chairman and chief executive officer |

| ✔ | 6 of 8 trustees are independent |

| ✔ | Regular executive sessions of independent trustees |

| ✔ | All members of Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are independent |

| ✔ | All members of Audit Committee are financially literate with two of three being audit committee financial experts under SEC rules |

| ✔ | Annual board and committee review and self-evaluations |

| ✔ | Code of Business Conduct and Ethics that covers trustees and employees as well as the Company’s relationships with its vendors |

| ✔ | Meaningful share ownership guidelines for our trustees (4x annual cash retainer), chief executive officer (6x salary) and other named executive officers (3x salary) |

| ✔ | Opted out of Maryland business combination and control share acquisition statutes |

| ✔ | No shareholder rights plan (commonly known as a “poison pill”) |

| ✔ | Active shareholder engagement |

| ✔ | Shareholders have ability to amend the Company’s bylaws by majority vote |

Our Board reviews our corporate governance practices regularly, and we strive to operate the Company on a foundation of strong corporate governance principles. For additional information, see pages 18-25 below regarding our corporate governance policies.

Proposal/Voting Overview

| | | | | | | | |

| Proposal | Board Vote

Recommendation | Page # for

Additional

Information |

| Election of 8 Trustees | FOR each nominee | 10 |

| Advisory vote on executive compensation | FOR | 14 |

| Ratification of the appointment of independent registered public accounting firm | FOR | 15 |

Annual Meeting Information

| | | | | |

| Date & Time: | June 21, 2022, at 1:30 p.m. Central Time |

| Place: | Virtual meeting at www.virtualshareholdermeeting.com/EQC2022 |

| Record Date: | April 14, 2022 |

How to Vote

| | | | | |

| Online: | Vote at www.proxyvote.com using the shareholder identification number provided in the Proxy Notice |

| Telephone: | If you received printed materials, follow the “Vote by Phone” instructions on the proxy card |

| Mail: | If you received printed materials, mark, sign and date the proxy card and return it in the pre-paid envelope |

Trustee Nominees

| | | | | | | | | | | |

| Name | Age as of Annual Meeting | Trustee Since | Independent |

| Sam Zell | 80 | 2014 | |

| Ellen-Blair Chube | 41 | 2020 | X |

| Martin L. Edelman | 81 | 2014 | X |

| David A. Helfand | 57 | 2014 | |

| Peter Linneman | 71 | 2014 | Lead Independent Trustee |

| Mary Jane Robertson | 68 | 2014 | X |

| Gerald A. Spector | 75 | 2014 | X |

| James A. Star | 61 | 2014 | X |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Why am I receiving this Proxy Statement?

This Proxy Statement is furnished by the Board of Equity Commonwealth, a Maryland real estate investment trust, in connection with the Board’s solicitation of proxies for the Annual Meeting, and any adjournments or postponements thereof, to be held in a virtual-only format on June 21, 2022, at 1:30 p.m., Central Time. This Proxy Statement is first being made available to shareholders on or about April 26, 2022. Unless the context requires otherwise, references in this Proxy Statement to “Equity Commonwealth,” “we,” “our,” “us” and the “Company” refer to Equity Commonwealth, together with its consolidated subsidiaries.

Why didn’t I automatically receive a paper copy of the Proxy Statement, proxy card and Annual Report?

Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials via the Internet. Accordingly, rather than paper copies of our proxy materials, we are sending a Notice of Internet Availability of Proxy Materials (the “Proxy Notice”) to our shareholders.

How can I receive electronic access to the proxy materials?

The Proxy Notice includes instructions on how to access our proxy materials over the Internet at www.proxyvote.com and how to request a printed set of the proxy materials by mail or an electronic set of materials by e-mail.

In addition, shareholders may request to receive future proxy materials in printed form by mail or electronically by e-mail on an ongoing basis. Choosing to receive future proxy materials by e-mail will save us the cost of printing and mailing documents to you and will reduce the environmental impact of our annual meetings. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and the proxy voting site. Your election to receive future proxy materials by e-mail will remain in effect until you terminate it.

What am I being asked to vote on?

You are being asked to vote on the following proposals:

● Proposal 1 (Election of Trustees): the election of the 8 trustees named in this Proxy Statement to our Board;

● Proposal 2 (Advisory Vote on Executive Compensation): the approval, on a non-binding advisory basis, of the compensation of our named executive officers; and

● Proposal 3 (Ratification of the Appointment of Ernst & Young LLP): the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

Our Board knows of no other matters to be brought before the Annual Meeting.

What are the Board’s voting recommendations?

The Board recommends that you vote as follows:

● Proposal 1 (Election of Trustees): “FOR” each of the Board’s nominees for election as trustee;

● Proposal 2 (Advisory Vote on Executive Compensation): “FOR” approval, on a non-binding advisory basis, of the compensation of our named executive officers; and

● Proposal 3 (Ratification of the Appointment of Ernst & Young LLP): “FOR” ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

Who is entitled to vote at the Annual Meeting?

The close of business on April 14, 2022 has been fixed as the record date (the “Record Date”) for the Annual Meeting. Only shareholders of record of our common shares of beneficial interest, $0.01 par value per share (“Common Shares”), at the close of business on the Record Date are entitled to notice of, to attend, and to vote at the Annual Meeting. On April 14, 2022, we had 112,670,136 Common Shares outstanding.

What are the voting rights of shareholders?

Each Common Share is entitled to one vote on each matter to be voted on.

How do I vote?

If your shares are registered directly in your name with our transfer agent, Equiniti Trust Company, you are considered the shareholder of record with respect to those shares and the Proxy Notice was sent directly to you by us. In that case, you may instruct the proxy holders named in the proxy card (the “Proxy Agents”) how to vote your Common Shares in one of the following ways:

● Vote online. You can access proxy materials and vote at www.proxyvote.com. To vote online, you must have the shareholder identification number provided in the Proxy Notice.

● Vote by telephone. If you received printed materials, you also have the option to vote by telephone by following the “Vote by Phone” instructions on the proxy card.

● Vote by regular mail. If you received printed materials and would like to vote by mail, please mark, sign and date your proxy card and return it promptly in the postage-paid envelope provided.

Proxies submitted over the Internet, by telephone or by mail must be received by 11:59 p.m., Eastern Time, on June 20, 2022.

If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Proxy Notice was forwarded to you by that organization. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. You should instruct your broker or nominee how to vote your shares by following the voting instructions provided by your broker or nominee.

How are proxy card votes counted?

Proxies submitted properly via one of the methods discussed above will be voted in accordance with the instructions contained therein. If the proxy is submitted but voting instructions are not made, the proxy will be voted “FOR” each of the 8 trustee nominees, “FOR” approval, on a non-binding advisory basis, of the compensation of our named executive officers and “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022, and in such manner as the Proxy Agents, in their discretion, determine upon such other business as may properly come before the Annual Meeting. If the proxy is submitted and voting instructions are made for some, but not all, of the proposals, as to matters in which instructions are given, the proxy will be voted in accordance with those instructions, and for all other proposals, the proxy will be voted as described in the prior sentence.

If your Common Shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, under applicable rules of the New York Stock Exchange (the “NYSE”) (the exchange on which our Common Shares are traded), the brokers will vote your shares according to the specific instructions they receive from you. If brokers that hold Common Shares for a beneficial owner do not receive voting instructions from that owner at least 10 days prior to the Annual Meeting, the broker may vote only on the proposal if it is considered a “routine” matter under the NYSE’s rules. On non-routine matters, nominees do not have discretionary voting power and cannot vote without instructions from the beneficial owners, resulting in a so-called “broker non-vote.” Pursuant to the rules of the NYSE, the election of trustees and the approval of the compensation of our named executive officers are each a “non-routine” matter and brokerage firms may not vote without instructions from their client on these matters, resulting in a broker non-vote. In contrast, ratification of the appointment of an independent registered public accounting firm is considered a “routine” matter under NYSE’s rules, which means that brokers have discretionary voting authority to the extent they have not received voting instructions from their client on the matter.

How many votes are needed for each of the proposals to pass?

The proposals to be voted on at the Annual Meeting have the following voting requirements:

● Proposal 1 (Election of Trustees): You may vote “FOR” all nominees, “WITHHOLD” your vote as to all nominees or vote “FOR” all nominees except those specific nominees from whom you “WITHHOLD” your vote. Pursuant to our Articles of Amendment and Restatement of Declaration of Trust (our “Charter”), in an uncontested election, a majority of votes cast at the Annual Meeting is required to elect each trustee. “Majority of votes cast” means that the number of shares voted “FOR” a trustee’s election exceeds 50% of the total number of votes cast with respect to that trustee’s election, with votes “cast” including all votes “FOR” and “WITHHOLD.” There is no cumulative voting in the election of trustees. For purposes of the election of trustees, abstentions and other shares not voted (whether by broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

● Proposal 2 (Advisory Vote on Executive Compensation): You may vote “FOR,” “AGAINST” or “ABSTAIN” on Proposal 2. The affirmative vote of a majority of votes cast at the Annual Meeting is required to adopt a resolution approving, on a non-binding advisory basis, the compensation of our named executive officers described in this Proxy Statement. For purposes of the vote on Proposal 2, abstentions and other shares not voted (whether by broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the result of the vote, although abstentions and broker non-votes will count toward the presence of a quorum. While the vote on Proposal 2 is advisory in nature and non-binding, the Board will review the voting results and expects to take them into consideration when making future decisions regarding the compensation of our named executive officers.

● Proposal 3 (Ratification of the Appointment of Ernst & Young LLP): You may vote “FOR,” “AGAINST” or “ABSTAIN” on Proposal 3. The affirmative vote of a majority of votes cast at the Annual Meeting is required to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. For purposes of the vote on Proposal 3, abstentions and other shares not voted will not be counted as votes cast and will have no effect on the result of the vote, although abstentions will count toward the presence of a quorum.

What will constitute a quorum at the Annual Meeting?

A quorum of shareholders is required for shareholders to take action at the Annual Meeting, except that the Annual Meeting may be adjourned if less than a quorum is present. The presence, through the virtual meeting platform or by proxy, of holders of Common Shares entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting on any matter will constitute a quorum. Shares that are voted “FOR,” “AGAINST,” “WITHHOLD” or “ABSTAIN” will be treated as being present at the Annual Meeting for purposes of establishing a quorum. Accordingly, if you have returned a valid proxy or attend the Annual Meeting through the virtual meeting platform, your shares will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters. Broker non-votes will also be counted as present for purposes of determining the presence of a quorum.

Who can attend the Annual Meeting?

Only shareholders as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting. Shareholders may be asked to provide proof of stock ownership as of the Record Date. If you are not a shareholder of record but hold shares through a broker or nominee (i.e., in street name), you should provide proof of beneficial ownership on the Record Date, such as your most recent account statement, a copy of the voting instruction card provided by your broker, trustee or nominee or other similar evidence of ownership.

If I plan to attend the Annual Meeting, should I still vote by proxy?

Yes. Voting in advance does not affect your right to attend the virtual-only Annual Meeting. If you send in your proxy card and also attend the Annual Meeting, you do not need to vote again at the Annual Meeting unless you want to change your vote. Ballots will be available at the meeting for shareholders of record. If you are not a shareholder of record but hold shares through a broker or nominee (i.e., in street name), you may vote your shares at the Annual Meeting only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions prior to the meeting as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

Will any other matters be voted on?

The proposals set forth in this Proxy Statement constitute the only business that the Board intends to present at the Annual Meeting. The proxy does, however, confer discretionary authority upon the Proxy Agents or their substitutes to vote on any other business that may properly come before the meeting. If the Annual Meeting is postponed or adjourned, the Proxy Agents can vote your shares on the new meeting date as well, unless you have revoked your proxy.

May I change my vote after I have voted?

You may revoke your proxy at any time prior to its use by (i) delivering a written notice of revocation to our Secretary at Two North Riverside Plaza, Suite 2100, Chicago, Illinois 60606, (ii) filing a duly executed proxy bearing a later date with us, or (iii) attending and voting at the Annual Meeting. If your Common Shares are held by a broker, bank or any other persons holding Common Shares on your behalf, you must contact that institution to revoke a previously authorized proxy.

Who is soliciting the proxies and who pays the costs?

The enclosed proxy for the Annual Meeting is being solicited by the Board. Proxies also may be solicited, without additional compensation, by our trustees and officers by mail, telephone or other electronic means or in person. We are paying the costs of this solicitation, including the preparation, printing, mailing and website hosting of proxy materials. We will request banks, brokers and other custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of our Common Shares and to obtain their voting instructions. We will reimburse those firms for their expenses. In addition, we have retained D.F. King & Co., Inc. (“D.F. King”) to assist in the solicitation of proxies, for which we will pay a fee of $9,000 plus reimbursement of expenses. We have agreed to indemnify D.F. King against certain liabilities arising out of our agreement with D.F. King.

No person is authorized to give any information or to make any representation not contained in this Proxy Statement, and, if given or made, you should not rely on that information or representation as having been authorized by us. The delivery of this Proxy Statement does not imply that the information herein has remained unchanged since the date of this Proxy Statement.

Whom should I call if I have questions or need assistance voting my shares?

Please call the firm assisting us in the solicitation of proxies, D.F. King, if you have any questions or need assistance in voting your shares. Banks and brokers may call D.F. King collect at (212) 269-5550. Shareholders may call D.F. King toll-free at (800) 967-4607.

PROPOSAL 1: ELECTION OF TRUSTEES

The Board has set the number of trustees at 8. The 8 individuals named below, each of whom currently serves on our Board, have been recommended by our Nominating and Corporate Governance Committee and nominated by our Board to serve on the Board until our 2023 Annual Meeting of Shareholders and until their respective successors are elected and qualified. Based on its review of the relationships between the trustee nominees and the Company, the Board has determined that all of our trustees, other than Sam Zell and David Helfand, are independent under applicable SEC and NYSE rules.

The Board has no reason to believe that any of the persons named below as a nominee for our Board will be unable, or will decline, to serve as a member of the Board if elected. If any nominee is unavailable for election or service, the Board may designate a substitute nominee and the persons designated as proxy holders on the proxy card will vote for the substitute nominee recommended by the Board. Under these circumstances, the Board also may, as permitted by our bylaws, decrease the size of the Board.

The Nominating and Corporate Governance Committee has set forth in a written policy minimum qualifications that a trustee candidate must possess. See “Corporate Governance and Board Matters—Trustee Nominee Selection Process.”

Trustee Nominees

The table below sets forth the names and ages of the trustees nominated for election at the Annual Meeting, as well as the positions and offices held.

| | | | | | | | |

| Name | Position With the Company | Age as of

the Annual Meeting |

| Sam Zell | Chairman of the Board | 80 |

| Ellen-Blair Chube | Trustee | 41 |

| Martin L. Edelman | Trustee | 81 |

| David A. Helfand | President, Chief Executive Officer and Trustee | 57 |

| Peter Linneman | Lead Independent Trustee | 71 |

| Mary Jane Robertson | Trustee | 68 |

| Gerald A. Spector | Trustee | 75 |

| James A. Star | Trustee | 61 |

Set forth below is certain biographical information of our trustee nominees.

Sam Zell has been our trustee and Chairman of the Board since May 2014. Mr. Zell is also the founder and has served as the Chairman of Equity Residential (NYSE: EQR), a multifamily real estate investment trust, and Equity LifeStyle Properties, Inc. (NYSE: ELS), a real estate investment trust focused on manufactured home communities, since 1993. Mr. Zell is also the Chairman of Equity Group Investments (“EGI”), a private entrepreneurial investment firm he founded more than 50 years ago. He is also founder and Chairman of Equity International, a private investment firm focused on real estate-related companies outside the U.S., which introduced the first Brazilian and Mexican real estate companies, respectively, to NYSE. Mr. Zell has also served as Chairman of the Board of Equity Distribution Acquisition Corp. (NYSE: EQD) since 2020. Previously, Mr. Zell served as Chairman of the Board of Covanta Holding Corporation, a world leader in providing sustainable waste and energy solutions, from 2005 to 2021, when it was acquired by EQT Infrastructure. In addition, Mr. Zell founded and served as Chairman of Equity Office Properties Trust (“EOP”), which was sold in February 2007 for $39 billion in the largest private equity transaction at the time. Mr. Zell also previously served as Chairman of Anixter International Inc., a leading global provider of communications, security, and wire and cable products, from 1985 to 2020. Through the Zell Family Foundation, he has led the sponsorship of several leading entrepreneurship programs, including the Zell/Lurie Institute for Entrepreneurial Studies at University of Michigan’s Ross School of Business, the Zell Fellows Program at Northwestern University’s Kellogg School of Management, and the Zell Entrepreneurship Center at the Interdisciplinary Center Herzliya (IDC). The Zell Global Entrepreneur Network (ZGEN) unites the students and alumni of these programs and actively provides them with connections, opportunities, mentorship and support. Mr. Zell also sponsors the Samuel Zell/Robert Lurie Real Estate Center at University of Pennsylvania’s Wharton Real Estate Center. Mr. Zell was recognized in 2017 by Forbes as one of the 100 Greatest Living Business Minds. He holds a J.D. and a B.A. from the University of Michigan.

Our Board determined that Mr. Zell should serve on our Board based on his experience of over 40 years as a chairman, director and executive of various companies, his management of billions of dollars in global investments, his strong track record of stewarding companies towards the maximization of their potential and being recognized as a founder of the modern real estate investment trust (“REIT”) industry and a leading driver for increased transparency and strong corporate governance.

Ellen-Blair Chube became a trustee in September 2020. Ms. Chube has served as a Partner, Managing Director and Client Service Officer for the Investment Bank for William Blair since 2015. Ms. Chube is responsible for high-level engagement with clients, including the development of a global client service platform to obtain insights and feedback from the firm’s clients on their individual and collective interactions. Prior to joining William Blair, Ms. Chube was Vice President and Chief of Staff to the Chairman and CEO at Ariel Investments. In that role, she was responsible for providing strategic and operational support, as well as translating the firm’s short and long-term vision into actionable strategies. Before Ariel, Ms. Chube spent nearly a decade in Washington, DC working on financial services policy in both the House of Representatives and the U.S. Senate. She served as the Staff Director for the Senate Banking Subcommittee on Security, International Trade and Finance, and Senator Evan Bayh's chief adviser on all Banking Committee and economic issues. She was responsible for his legislative priorities (specifically on corporate governance) in the Dodd-Frank financial regulatory reform bill enacted in July 2010. Ms. Chube serves on the board of Oil-Dri Corporation of America (NYSE:ODC), where she serves as Chair of the Nominating Committee and is a member of the Compensation Committee. She is a trustee of the Museum of Contemporary Art in Chicago (Chair, Audit Committee; Finance, Executive Committee) and is on the board of the Chicago Children’s Choir (Chair, Nominating and Governance Committee; Executive Committee). Ms. Chube holds a JD from Georgetown University Law Center and a BA in political science from Northwestern University.

Our Board determined that Ms. Chube should serve on our Board based on her leadership experience in investment management, her extensive knowledge and background in financial regulation and policymaking and her significant experience serving on the boards of public and private companies.

Martin L. Edelman has been our trustee since July 2014. Mr. Edelman has served as Of Counsel in the Real Estate practice of Paul Hastings LLP, an international law firm, since 2000. Mr. Edelman has been a real estate advisor to Grove Investors and is a partner at Fisher Brothers, a real estate partnership. Mr. Edelman is a Director of Blackstone Mortgage Trust, Inc. (NYSE: BXMT), Aldar Properties PJSC (ADX: ALDAR) and GlobalRoundries (NASDAQ: GFS). He served as a Director of Morgans Hotel Group Co. (NASDAQ: MHGC) from 2014 to 2015, as a Director of Avis Budget Group, Inc. (NASDAQ: CAR) from 1997 to 2013, as a Director of Ashford Hospitality Trust, Inc. (NYSE: AHT) from 2003 to 2014 and also served on the Board of Directors of Advanced Micro Devices, Inc. (NYSE: AMD) from 2012 to 2017. He also currently serves on the boards of various nongovernmental organizations. Mr. Edelman has more than 40 years of experience and concentrates his practice on real estate and corporate mergers and acquisitions transactions. The focus of Mr. Edelman’s practice has been large, complex transactions, including cross-border transactions. He has been involved in all stages of legal development of pioneering financial structures, including participating debt instruments, institutional joint ventures in real estate, and joint ventures between U.S. financial sources and European real estate companies. He has also done extensive work in Europe, Canada, Mexico, Japan, the Middle East, and Latin America. Mr. Edelman holds an A.B. from Princeton University and an LL.B. from Columbia Law School.

Our Board determined that Mr. Edelman should serve on our Board based on his experience advising companies in complex real estate and corporate transactions, his extensive legal and financial background with over 40 years of experience in the legal profession and his considerable experience in complex negotiations involving acquisitions, dispositions and financing.

David A. Helfand has been our trustee, President and Chief Executive Officer since May 2014. Mr. Helfand serves as an Advisor to EGI, a private investment firm, where he previously served as Co-President, overseeing EGI’s real estate activities. Prior to EGI, Mr. Helfand was Founder and President of Helix Funds LLC (“Helix Funds”), a private real estate investment management company, where he oversaw the acquisition, management and disposition of more than $2.2 billion of real estate assets. While at Helix Funds, he also served as Chief Executive Officer for American Residential Communities LLC (“ARC”), a Helix Funds portfolio company. Before founding Helix Funds, Mr. Helfand served as Executive Vice President and Chief Investment Officer for EOP, the largest REIT in the U.S. at the time, where he led approximately $12 billion of mergers and acquisitions activity. Prior to working with EOP, Mr. Helfand served as a Managing Director and participated in the formation of Equity International, a private investment firm focused on real estate-related companies outside the U.S. He was also the President and Chief Executive Officer of Equity LifeStyle Properties (NYSE: ELS), an operator of manufactured home communities, and served as Chairman of the board’s audit committee. His earlier career included investment activity in a variety of asset classes, including retail, office, parking and multifamily. Since August 2019, he has served as a Director of Alpine Energy Capital, a private oil and gas company. In February 2021, Mr. Helfand joined the board of Jaws Mustang (NYSE: JWSM), a special purpose acquisition company focused on non-real estate investments in leading companies across a variety of industries with all or a substantial portion of activities in North America and/or Europe. He also serves as a Director of the Ann & Robert H. Lurie Children’s Hospital of Chicago, on the National Association of Real Estate Investment Trusts (Nareit) Advisory Board of Governors, on the Executive Committee of the Samuel Zell and Robert Lurie Real Estate Center at the Wharton School of the University of Pennsylvania, on the Executive Committee of the Kellogg Real Estate Center at Northwestern University, and on the Board of Visitors at the Weinberg College of Arts and Sciences at Northwestern University. Mr. Helfand holds an M.B.A. from the University of Chicago Graduate School of Business and a B.A. from Northwestern University.

Our Board determined that Mr. Helfand should serve on our Board based on his over 25 years of extensive experience managing real estate investments and his executive leadership of domestic and international real estate-related companies in the residential and commercial space.

Dr. Peter Linneman has been our trustee since May 2014. Dr. Linneman has been the Founding Principal of Linneman Associates, a real estate advisory firm, since 1979. Dr. Linneman has served as the Chief Executive Officer of American Land Funds and KL Realty Fund, private real estate acquisition firms, since 2010. Dr. Linneman previously served as Senior Managing Director of Equity International, a private investment firm focused on real estate-related companies outside the U.S., from 1998 to 1999, and Vice Chairman of Amerimar Realty, a private real estate investment company, from 1996 to 1997. Dr. Linneman has served on over 20 public and private company boards, including having served as Chairman of the Board of Rockefeller Center Properties, Inc., a real estate investment trust, where he led the successful restructuring and sale of Rockefeller Center in the mid-1990s, and having served on the Board of Directors of Atrium European Real Estate, a public European real estate company. Dr. Linneman currently serves on the Board of Directors of Regency Centers Corporation (NASDAQ: REG), AG Mortgage Investment Trust, Inc. (NYSE: MITT) and Paramount Group Inc. (NYSE: PGRE), each of which is a public real estate investment trust. He has experience as a financial consultant and has served on numerous audit committees. He is the author of the Linneman Letter, Real Estate Finance and Investments: Risks and Opportunities and over 100 scholarly publications. Dr. Linneman is also the Emeritus Albert Sussman Professor of Real Estate, Finance and Public Policy at the Wharton School of the University of Pennsylvania, where he was a professor of Real Estate, Finance and Public Policy from 1979 to 2011 and was the founding co-editor of The Wharton Real Estate Review. He also served as the Director of Wharton’s Samuel Zell and Robert Lurie Real Estate Center for 13 years. Dr. Linneman holds both Master’s and Doctoral degrees in economics from the University of Chicago and a B.A. from Ashland University.

Our Board determined that Dr. Linneman should serve on our Board based on his active involvement in real estate investment, strategy and operation for nearly 40 years and his extensive experience serving on the boards of public companies.

Mary Jane Robertson has been our trustee since July 2014. Ms. Robertson was the Executive Vice President, Chief Financial Officer and Treasurer of Crum & Forster Holdings Corp. (“C&F”), an insurance holding company and a wholly-owned subsidiary of Fairfax Financial Holdings Limited (TSX: FFH), from 1999 to 2014. C&F was an SEC reporting company from 2004 to 2010. Prior to joining C&F, from 1998 to 1999, Ms. Robertson was Managing Principal, Chief Financial Officer and Treasurer of Global Markets Access Ltd. (Bermuda), a company that was formed to act as a financial guaranty reinsurer. Ms. Robertson also served as Senior Vice President and Chief Financial Officer of Capsure Holdings Corp. (“Capsure”), a former NYSE-traded insurance holding company, from 1993 to 1997 and was Executive Vice President and Chief Financial Officer of United Capitol Insurance Company, a specialty excess and surplus lines insurer in Atlanta acquired by Capsure in 2010, from its founding in 1986 to 1993. She is a Certified Public Accountant with 10 years of public accounting experience at Coopers & Lybrand. From 2009 to 2014, Ms. Robertson served as a Director of C&F and, from 1999 to 2014, she served as a Director of substantially all of C&F’s direct and indirect wholly owned subsidiaries. Ms. Robertson previously served on the Board of Directors of Russell Corporation, a former NYSE-listed public company, from July 2000 to August 2006 and was Chair of its audit committee from 2002 to 2006. Ms. Robertson holds a Bachelor of Commerce from the University of Toronto. She is currently engaged in charitable activities and serves on not-for-profit boards.

Our Board determined that Ms. Robertson should serve on our Board based on her 30 years of experience as Chief Financial Officer of public and private companies and her accounting background.

Gerald A. Spector has been our trustee since July 2014. From June 1993 through June 2019, Mr. Spector served on the Board of Trustees of Equity Residential, a real estate investment and management company focusing on apartment communities, including as the Vice Chairman from 2007 through June 2019 and as a member of the audit committee. Mr. Spector was the Chief Operating Officer of the Tribune Company from December 2009 through December 2010, and served as its Chief Administrative Officer from December 2007 through December 2009, following the Tribune’s 2008 Chapter 11 bankruptcy. Mr. Spector was Executive Vice President of Equity Residential from March 1993 and was Chief Operating Officer of Equity Residential from February 1995 until his retirement in December 2007. He began his real estate career in the early 1970s and has extensive prior public and private board experience as well. Mr. Spector holds a B.S.B.A. from Roosevelt University. Mr. Spector is a Certified Public Accountant.

Our Board determined that Mr. Spector should serve on our Board based on his extensive management and financial experience acquired through more than 45 years of managing and operating real estate companies through various business cycles, his experience in driving operational excellence and development of strategic changes in portfolio focus and his demonstrated leadership skills at the corporate board and executive levels.

James A. Star has been our trustee since July 2014. Mr. Star is Executive Chairman (previously having served, since 2003, as President and Chief Executive Officer) of Longview Asset Management (“Longview”), a multi-strategy investment firm which assesses, implements and oversees a wide variety of publicly traded and private equity investments across multiple industries and countries, for which he had been a portfolio manager since 1998. He has also served since 1994 as a Vice President of Henry Crown and Company, a private family investment firm affiliated with Longview. Mr. Star began his investment career in 1991 as a securities analyst after practicing corporate and securities law as a member of the Illinois bar. Mr. Star has been a member of the investment committees for the retirement plans of Henry Crown and Company since 1995, Great Dane Limited Partnership since 1997 and, since 2014, Gillig LLC, Provisur Technologies, Inc. and Trail King Industries, Inc. He has also served as a manager of Longview Trust Company since 2006. Since May 2019, Mr. Star has served on the Board of Directors of Chewy, Inc. (NYSE: CHWY), a leading online retailer of pet food and products. Mr. Star also served on the Board of Directors of the parent company of PetSmart, a leading retailer of pet supplies and services, from 2014 to 2019. Mr. Star also previously served on the Boards of Directors of Allison Transmission Holdings, Inc. (NYSE: ALSN) from May 2016 to May 2018, and Teaching Strategies, a software company focused on the education market, from 2014 until its sale in 2021. He is a non-executive chairman of Atreides Management, a technology-focused investment firm, a director of a private company focused on ESG-rated securities, and serves on advisory boards related to Paragon Biosciences (a drug discovery company), Valor Equity Partners (a growth capital firm) and Kabouter Management (an international equities manager). Mr. Star received a B.A. from Harvard University and holds a J.D. from Yale Law School and a Masters of Management from Kellogg Graduate School of Management at Northwestern University.

Our Board determined that Mr. Star should serve on our Board based on his significant investment management experience and his experience serving on boards of trustees.

Vote Required and Recommendation

Trustees are elected by a majority of votes cast in an uncontested election (meaning an election in which the number of nominees for election equals or is less than the number of trustees to be elected). The current election is uncontested and therefore, a majority of votes cast for each trustee nominee is required to elect a trustee nominee. For purposes of this proposal, “a majority of votes cast” means that the number of shares voted “FOR” a trustee’s election exceeds 50% of the total number of votes cast with respect to that trustee’s election, and votes “cast” means votes “FOR” and “WITHHOLD.” There is no cumulative voting in the election of trustees. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT

SHAREHOLDERS VOTE “FOR” ELECTION OF EACH OF THE NOMINEES SET FORTH ABOVE.

PROPOSAL 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), we are presenting this proposal, commonly known as a “say-on-pay” proposal, to provide shareholders the opportunity to vote to approve, on a non-binding advisory basis, the compensation of our named executive officers as described in this Proxy Statement.

We believe our executive compensation policies and procedures are centered on pay-for-performance principles and are closely aligned with the long-term interests of our shareholders. As described under the heading “Compensation Discussion and Analysis,” our executive compensation program is designed to attract and retain effective executives, to reward them for superior performance and to ensure that compensation provided to them remains competitive. We seek to align the interests of our executives and shareholders by tying compensation to the achievement of key operating objectives that we believe enhance shareholder value over the long term and by encouraging executive share ownership so that a portion of each executive’s compensation is tied directly to shareholder value.

For these reasons, we are recommending that our shareholders vote “FOR” the following resolution:

“RESOLVED, that the shareholders hereby approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers for 2021, as disclosed in the “Compensation Discussion and Analysis,” the compensation tables and the related narrative executive compensation disclosure contained in the Proxy Statement.”

While the vote on this resolution is advisory in nature and therefore will not bind us to take any particular action, our Board intends to carefully consider the shareholder vote resulting from the proposal in making future decisions regarding the compensation of our named executive officers.

Vote Required and Recommendation

The affirmative vote of a majority of the votes cast at the Annual Meeting with respect to the matter is required to endorse (on a non-binding advisory basis) the compensation of the Company’s named executive officers. For purposes of the vote on this proposal, abstentions and other shares not voted (whether by broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the result of the vote.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR”

APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

PROPOSAL 3: RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board is directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm selected to audit our consolidated financial statements. The Audit Committee has selected and appointed Ernst & Young LLP as our independent registered public accounting firm to audit our consolidated financial statements for the year ending December 31, 2022. Ernst & Young LLP has been engaged as the Company’s independent registered public accounting firm since 1986.

In order to ensure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of our independent registered public accounting firm. In selecting Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022, the Audit Committee carefully considered Ernst & Young LLP’s qualifications, including the firm’s performance as independent registered public accountants for the Company in prior years and its reputation for integrity and competence in the fields of accounting and auditing. Further, the Audit Committee and its Chair were directly involved in the selection of Ernst & Young LLP’s lead engagement partner. The members of the Audit Committee and the Board believe that the continued retention of Ernst & Young LLP to serve as our independent registered public accounting firm is in the best interests of the Company and its shareholders.

Although shareholder approval is not required, we desire to obtain from our shareholders an indication of their approval of the Audit Committee’s selection of Ernst & Young LLP as our independent registered public accounting firm for 2022. Even if the appointment of Ernst & Young LLP as our independent registered public accounting firm is ratified, the Audit Committee may, in its discretion, change that appointment at any time during the year should it determine such a change would be in our and our shareholders’ best interests. If our shareholders do not ratify this appointment, the Audit Committee may consider the appointment of another independent registered public accounting firm, but will not be required to appoint a different firm.

A representative of Ernst & Young LLP will not be making a statement at the Annual Meeting but will be present and available to respond to appropriate questions.

Vote Required and Recommendation

The affirmative vote of a majority of votes cast at the Annual Meeting is required to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. Therefore, for purposes of this proposal, abstentions and other shares not voted will not be counted as votes cast and will have no effect on the result of the vote, although abstentions will count toward the presence of a quorum.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022.

Principal Accountant Fees and Services

Ernst & Young LLP acted as our independent registered public accounting firm for 2021 and 2020. The fees and expenses for services provided by Ernst & Young LLP to us for the last two fiscal years are listed in the table below:

| | | | | | | | | | | |

| 2021 | | 2020 |

| Audit fees | $814,926 | | $684,600 |

| Audit related fees | $152,000 | | $ 0 |

| Tax fees | $ 0 | | $ 0 |

Subtotal* | $966,926 | | $684,600 |

| All other fees** | $ 2,000 | | $ 1,505 |

| Total fees | $968,926 | | $686,105 |

* Of the 2021 “Audit” and “Audit related fees” outlined above, $327,000 is related to the work performed in connection with the potential acquisition of Monmouth, which was subsequently reimbursed by Monmouth after the merger agreement terminated.

** “All other fees” related to subscription fees incurred for Ernst & Young LLP’s online accounting and reporting research tool.

Pre-Approval Policies and Procedures

The Audit Committee has established policies and procedures to review and approve the engagement of the Company’s independent auditor to provide any audit or non-audit services to the Company, either pursuant to the Audit Committee’s Policy Regarding Pre-Approval of Audit and Non-Audit Services (the “Pre-Approval Policy”) or through a separate pre-approval by the Audit Committee, which policies and procedures are intended to control the services provided by our independent registered public accounting firm and to monitor their continuing independence.

Under these policies and procedures, no services may be undertaken by the independent registered public accounting firm unless the engagement is specifically approved by the Audit Committee or the services are included within a category that has been pre-approved in the Pre-Approval Policy. The maximum charge for services is established by the Pre-Approval Policy or by the Audit Committee when the specific engagement or the category of services is approved.

All services for which we engaged our independent registered public accounting firm in 2021 and 2020 were approved by the Audit Committee. The total fees for audit and non-audit services provided by Ernst & Young LLP in 2021 and 2020 are set forth above. The Audit Committee approved the engagement of Ernst & Young LLP to provide the non-audit services because it determined that Ernst & Young LLP providing these services would not compromise its independence and that its familiarity with our record keeping and accounting systems would permit it to provide these services with equal or higher quality, more quickly and at a lower cost than we could obtain these services from other providers.

AUDIT COMMITTEE REPORT

The Audit Committee is currently composed of Ms. Robertson, Ms. Chube and Mr. Linneman. The members of the Audit Committee are appointed by and serve at the discretion of the Board. All members of the Audit Committee are independent under applicable NYSE and SEC rules.

One of the principal purposes of the Audit Committee is to assist the Board in the oversight of the integrity of the Company’s financial statements. The Company’s management team has the primary responsibility for the financial statements and the reporting process, including the Company’s accounting policies, internal audit function, system of internal controls and disclosure controls and procedures. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in our Annual Report on Form 10-K for the year ended December 31, 2021 with our management.

The Audit Committee also is responsible for assisting the Board in the oversight of the qualification, independence and performance of the Company’s independent auditors. The Company’s independent auditor is currently Ernst & Young LLP. The Audit Committee reviewed the audited financial statements for the year ended December 31, 2021 with the independent auditors, which are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards and those matters required to be discussed by applicable standards of the Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard 1301, Communications with Audit Committees, and SEC rules and regulations, including Rule 2-07, Communication with Audit Committees, of Regulation S-X.

The independent auditors have provided to the Audit Committee the written disclosures regarding the independent auditor’s independence required by PCAOB Ethics and Independence Rule 3526, Communication with Audit Committees Concerning Independence, and the Audit Committee has discussed with the independent auditors their independence.

In reliance on the review and discussions referred to above, the Audit Committee recommended to the Board the inclusion of the Company’s audited consolidated financial statements in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021, for filing with the SEC.

| | | | | |

| | Respectfully submitted, |

| | |

| | THE AUDIT COMMITTEE |

| | |

| | Mary Jane Robertson, Chair |

| | Ellen-Blair Chube |

| | Peter Linneman |

CORPORATE GOVERNANCE AND BOARD MATTERS

Corporate Governance Profile

Our corporate governance is structured in a manner that the Board believes closely aligns our interests with those of our shareholders. Some notable features of our corporate governance structure include the following:

● our Charter requires that in uncontested trustee elections, each trustee must be elected by at least a majority of votes cast in his or her election;

● our Board is not staggered, with each of our trustees subject to re-election annually, and the Board cannot elect to stagger the Board without shareholder approval;

● we have a lead independent trustee with robust duties;

● we have separate chairman and chief executive officer positions;

● 6 of the 8 persons who serve on our Board, or 75% of our trustees, have been determined by the Board to be independent for purposes of the NYSE’s corporate governance listing standards and Rule 10A-3 under the Exchange Act;

● our independent trustees hold regular executive sessions;

● all members of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are independent under applicable NYSE and SEC rules;

● all members of our Audit Committee are financially literate and two of three qualify as audit committee financial experts under SEC rules;

● we review the performance of our Board and committees annually and our Board conducts annual self-evaluations;

● our trustees and employees are bound by our Code of Business Conduct and Ethics, which also applies to our relationships with our vendors;

● we have meaningful share ownership guidelines for our trustees (4x annual cash retainer), chief executive officer (6x salary) and other named executive officers (3x salary);

● we have opted out of the Maryland business combination and control share acquisition statutes;

● we do not have a shareholder rights plan (commonly known as a “poison pill”);

● our trustees and executive officers are bound by our anti-hedging and anti-pledging policies;

● incentive compensation granted to all of our named executive officers is subject to a compensation clawback policy;

● we actively engage with our shareholders throughout the year;

● our shareholders have the ability to amend the Company’s bylaws by majority vote; and

● our Board and committees actively oversee and manage the Company’s risk.

Our Charter and bylaws provide that the number of trustees constituting the Board may be increased or decreased by a majority vote of the entire Board, provided the number of trustees may not be greater than 13 and may not be decreased to fewer than three.

There are no family relationships among our executive officers and trustees. The Board has affirmatively determined that all of our trustee nominees except Mr. Zell, the Chairman of the Board, and Mr. Helfand, our President and Chief Executive Officer, are independent under applicable NYSE and SEC rules.

Board Leadership Structure

Sam Zell has served as Chairman of the Board and David Helfand has served as our President and Chief Executive Officer since May 2014. The Board does not have a policy requiring the separation of the roles of Chief Executive Officer and Chairman of the Board. However, it evaluated the combined role of Chairman and Chief Executive Officer, and the Board has determined that, based on Messrs. Zell and Helfand’s combined experience, it is in the best interests of our shareholders at this time to separate the roles.

To strengthen the role of our independent trustees and encourage independent Board leadership, the Board has established the position of lead independent trustee. Currently, Mr. Linneman serves as our lead independent trustee. In accordance with our Corporate Governance Guidelines, the responsibilities of the lead independent trustee include, among others:

● serving as liaison among (i) management, including the Chief Executive Officer, (ii) our other independent trustees, (iii) employees reporting misconduct that by its nature cannot be brought to management, and (iv) interested third parties and the Board;

● presiding at executive sessions of the independent trustees;

● serving as the focal point of communication to the Board regarding management plans and initiatives;

● ensuring that the division of roles between Board oversight and management operations is respected;

● providing the medium for informal dialogue with and among independent trustees, allowing for free and open communication within that group; and

● serving as the communication conduit for third parties who wish to communicate with the Board.

Our lead independent trustee will be selected on an annual basis by a majority of the independent trustees then serving on the Board.

Executive Sessions

Pursuant to our Corporate Governance Guidelines and the NYSE listing standards, our Board devotes a portion of each regularly scheduled board meeting to executive sessions without management participation to promote open discussion among non-management trustees. In addition, our Corporate Governance Guidelines provide that if the group of non-management trustees includes trustees who are not independent, as defined in the NYSE’s listing standards, at least one such executive session convened per year shall include only independent trustees, at which the lead independent trustee presides.

Attendance of Trustees at 2021 Board Meetings and Annual Meeting of Shareholders

During the year ended December 31, 2021, our Board held nine meetings and took six actions by unanimous written consent. In 2021, each trustee attended 75% or more of the aggregate of all meetings of the Board and the committees on which he or she served. All 8 of our trustees attended our 2021 annual meeting of shareholders. In accordance with our Corporate Governance Guidelines, the Company’s policy is for trustees to attend board meetings, meetings of committees on which they serve and the annual meeting of shareholders.

Committees of the Board

Our Board has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Each of these committees must be comprised entirely of independent trustees, as that term is defined in the NYSE listing standards, and have at least three members. Our Board may from time to time establish other committees to facilitate the management of our Company.

The table below provides membership information for each of the Board committees as of the date of this Proxy Statement:

| | | | | | | | | | | | | | |

| Trustee | Independent | Audit

Committee | Compensation

Committee | Nominating and Corporate

Governance Committee |

| Ellen-Blair Chube | X | X | | X |

| Martin L. Edelman | X | | | X |

| Peter Linneman | Lead Independent Trustee | X* | X | |

| Mary Jane Robertson | X | Chair* | | |

| Gerald A. Spector | X | | Chair | |

| James A. Star | X | | X | Chair |

* Audit committee financial expert

The Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee each operate under written charters adopted by the Board. These charters are available on our website at www.eqcre.com.

Audit Committee

The Audit Committee consists of Ms. Robertson, Ms. Chube and Mr. Linneman, with Ms. Robertson serving as its Chair. The Audit Committee Charter requires that all members of the committee meet the independence, experience and financial literacy and expertise requirements of the NYSE, the Sarbanes-Oxley Act of 2002, the Exchange Act and applicable rules and regulations of the SEC. Our Board has determined that all of the members of the Audit Committee meet the foregoing requirements. The Board also has determined that Ms. Robertson and Mr. Linneman each qualifies as an audit committee financial expert, as defined by the applicable SEC regulations and NYSE corporate governance listing standards.

The Audit Committee Charter sets forth the principal functions of the Audit Committee, which include overseeing:

● our accounting and financial reporting processes;

● the integrity and audits of our consolidated financial statements and financial reporting process;

● our systems of disclosure controls and procedures and internal control over financial reporting;

● our compliance with financial, legal and regulatory requirements;

● the evaluation of the qualifications, independence and performance of our independent registered public accounting firm;

● the performance of our internal audit function;

● the review of all related party transactions in accordance with our related party transactions policy; and

● our overall risk profile.

The Audit Committee also is responsible for engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm, including all audit and non-audit services, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. The Audit Committee also approves the audit committee report required by SEC regulations to be included in our annual proxy statement.

During the year ended December 31, 2021, our Audit Committee held seven meetings.

Compensation Committee

The Compensation Committee consists of Messrs. Spector, Linneman and Star, with Mr. Spector serving as its Chair. The Compensation Committee Charter requires that all members of the committee meet the independence requirements of the NYSE, applicable rules and regulations of the SEC and any other applicable rules relating to independence, qualify as a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act and qualify as an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended. Our Board has determined that all of the current members of the Compensation Committee meet the foregoing requirements.

The Compensation Committee Charter sets forth the principal functions of the Compensation Committee, which include:

● reviewing and approving on an annual basis the corporate goals and objectives relevant to our Chief Executive Officer’s compensation, evaluating our Chief Executive Officer’s performance in light of such goals and objectives and determining and approving the remuneration of our Chief Executive Officer based on such evaluation;

● reviewing and approving the compensation of our other executive officers;

● reviewing our executive compensation policies and plans;