By Amrith Ramkumar

Oil prices are staging a furious comeback from last month's

collapse, lifted by record supply cuts and a pickup in global fuel

demand that many investors hope heralds a swift economic

recovery.

With prices still below levels at which most producers can make

money, companies from Exxon Mobil Corp. to EOG Resources Inc. are

curtailing output and shutting off productive wells. Those supply

cuts come with rising factory activity in China boosting fuel

consumption while economic growth in what is the world's largest

consumer of raw materials returns to normal. Demand for gasoline is

also on the mend there and in parts of the U.S. and Europe, with

drivers returning to roads.

As more lockdown measures imposed to halt the spread of the

coronavirus pandemic are eased around the world, some investors

predict a long-term increase in oil prices. The turnaround is a

boon to the beaten-down energy industry and underscores investors'

hopes for a global economic recovery. Oil tends to rally when more

people are traveling, factories are operating and ships laden with

goods are moving around the world, trends that also often boost

stock prices.

The S&P 500 rose Monday to a two-month high, led by a 7.6%

rebound in energy stocks, which mirrored gains in crude prices.

"As we see transportation demand recover and the globe

reopening, that will help the oil price gradually grind higher,"

said Rob Thummel, a senior portfolio manager who manages energy

assets at the investment firm Tortoise. "We've still got a long way

to go."

The most heavily traded U.S. crude-oil futures contracts have

risen to $31.65 a barrel after hitting a low of $11.57 last month.

Prices started the year above $60. Brent crude futures, the global

gauge of oil prices, have rebounded to $34.81.

Oil's gains on Monday came as investors made wagers on brighter

days ahead for the world economy. Those hopes pushed up other

commodities sensitive to growth, such as copper and aluminum, and

buoyed Treasury yields. Yields rise when bond prices fall and tend

to climb when investors are anticipating a pickup in growth and

inflation.

Underpinning those bets is an uptick in movement by consumers

around the world. U.S. motor gasoline supplied by energy companies,

a proxy for demand from drivers, rose nearly 40% in the three-week

period ended May 8, according to government data. Demand for

distillate fuel including diesel -- commonly used by trucks, trains

and boats -- is also climbing, though jet-fuel consumption remains

weak.

Real-time gasoline demand indicators such as daily requests for

driving directions on Apple Inc.'s Maps app also show a recent

surge.

President Trump touted the energy rally with a tweet on Monday,

saying "OIL (ENERGY) IS BACK!!!!" He recently called for higher

prices to support the energy industry, and the U.S. was

instrumental in the completion of a globally coordinated supply cut

last month.

Hedge funds and other speculative investors are positioning for

a long-term rebound. They recently pushed net bets on higher U.S.

crude prices to their highest level since September 2018, Commodity

Futures Trading Commission data show.

Reinforcing that optimism is a drop in key stockpile hubs around

the world. Inventories of crude oil in China have started to

decline, and U.S. stockpiles fell during the week ended May 8 for

the first time since January. They also dropped at a key hub in

Cushing, Okla., fueling bets that the worst of the industry's

storage crisis has passed. For much of April, traders were

struggling to find available storage, and ships carrying oil were

floating at sea with nowhere to go.

Those trends are starting to reverse. While U.S. stockpiles are

still near a record hit in March 2017, traders say tumbling supply

will likely prevent them from reaching their maximum capacity

moving forward. The number of rigs drilling for oil and gas in the

U.S. is at a record low in data going back to 1991 and less than

half of what it was at the start of the year, data from Baker

Hughes show.

"We believe the historic and prolific oil production growth by

U.S. shale may have been forever altered," EOG Chief Executive

William Thomas said on the company's earnings call earlier this

month. EOG has closed wells and cut spending in response to what

Mr. Thomas called "an unprecedented downturn."

Saudi Arabia, the world's largest crude exporter, recently said

it would cut supply to the lowest level since 2002 next month. The

output cut goes beyond record-setting global supply reductions that

were part of the deal producers reached last month. That agreement

ended a production dispute between the kingdom and Russia that

raised output even as demand crashed earlier in the year.

While oil's decline forced large suppliers to compromise,

investors said rising prices might push producers to start boosting

output. Analysts are looking ahead to a meeting of the Organization

of the Petroleum Exporting Countries and allies scheduled for next

month for signs the group will extend recent supply cuts.

For now, suppliers remain focused on supporting the market,

particularly given the fragile outlook for fuel demand.

"It's still a complete crisis," said Regina Mayor, who leads

KPMG LLP's energy practice. "We can't get overly excited about

$30."

Oil's bounceback is also a reflection of shifts in the market's

structure after April's chaos. One price for U.S. crude oil fell

below zero a barrel for the first time ever on April 20, with

investors desperate to avoid being stuck with actual oil.

The turmoil drove changes to products including the U.S. Oil

Fund, the largest exchange-traded fund tied to crude. The fund and

others like it now hold futures for oil to be delivered several

months from now rather than near-dated futures that can go haywire

around expiration. Front-month U.S. crude futures for June delivery

are set to expire without major issues on Tuesday.

Traders said that the shift has instilled more confidence in the

crude market, reinforcing the nascent optimism about the recovery

in demand.

"We are in a 'buy the dip' oil market" as investors use any

price drops as buying opportunities, said Gary Ross, chief

executive of Black Gold Investors LLC and founder of consulting

firm PIRA Energy Group.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

May 19, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

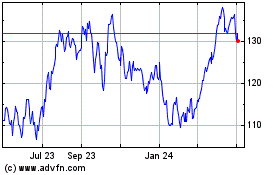

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Oct 2024 to Nov 2024

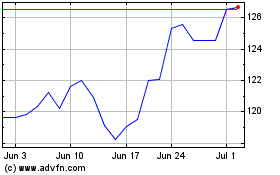

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Nov 2023 to Nov 2024