EOG Expects Tough 1Q As Lower Oil Prices Bite

April 06 2020 - 9:27AM

Dow Jones News

By Micah Maidenberg

EOG Resources Inc. said Monday it expects the difficult economic

environment for energy producers, including lower commodity prices,

to be reflected in its first quarter results.

The company said it remains flexible in developing and executing

on its capital plan by continuing to reduce its capital and

operating expenses in light of the current economic

environment.

Like other companies focused on U.S. shale production regions,

EOG has faced significant pressure amid weaker oil prices due to

the coronavirus pandemic and a battle for market share in the

global oil market between Russia and Saudi Arabia.

On April 1, EOG used cash on hand to repay a bond that matured

on that date, the company said. EOG has also recently entered into

derivative contracts to help it manage risks related to oil prices,

according to a filing.

The company said it has $2.9 billion in cash and cash

equivalents and another $2 billion availability under a credit

line.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 06, 2020 09:12 ET (13:12 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

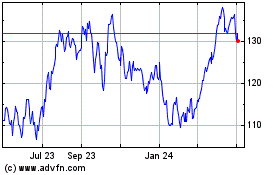

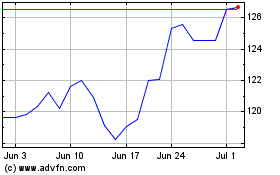

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Dec 2024 to Jan 2025

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Jan 2024 to Jan 2025