false

0001337619

0001337619

2024-09-24

2024-09-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________

FORM 8-K

___________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 24, 2024

___________________

Envestnet, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-34835 |

|

20-1409613 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1000 Chesterbrook Boulevard, Suite 250

Berwyn, Pennsylvania 19312

(Address of principal executive offices, including

zip code)

(312) 827-2800

(Registrant’s telephone number, including area

code)

Not applicable

(Former name or former address, if changed since last

report)

___________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | |

Trading Symbol(s) | |

Name of each exchange on which registered |

| Common Stock, Par Value $0.005 Per Share | |

ENV | |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.07. | Submission of Matters to a Vote of Security Holders. |

On September 24, 2024,

Envestnet, Inc., a Delaware corporation (“Envestnet” or the “Company”), held a special meeting of its stockholders

(the “Special Meeting”) to consider certain proposals related to the Agreement and Plan of Merger, dated as of July

11, 2024 (as it may be amended from time to time, the “Merger Agreement”), by and among BCPE Pequod Buyer, Inc. (“Parent”),

BCPE Pequod Merger Sub, Inc., a direct, wholly owned subsidiary of Parent (“Merger Sub”), and Envestnet, pursuant to which

Merger Sub will merge with and into Envestnet (the “Merger”), with Envestnet surviving the Merger and becoming a wholly owned

subsidiary of Parent. Each proposal voted on at the Special Meeting is described in detail in the Company’s definitive proxy statement

on Schedule 14A (the “Proxy Statement”) filed with the Securities and Exchange Commission (“SEC”) and mailed to

Company stockholders commencing on August 23, 2024.

As of the close of business

on August 20, 2024, the record date for the Special Meeting, there were 55,244,657 shares of common stock of Envestnet, par value $0.005

per share (“Envestnet Common Stock”), outstanding and entitled to be voted at the Special Meeting. A total of 43,118,361

shares of Envestnet Common Stock, representing approximately 78.05% of the outstanding shares of Envestnet Common Stock entitled to vote,

were present virtually or by proxy, constituting a quorum.

The voting results for

the proposals voted on at the Special Meeting are set forth below:

1. The Merger Proposal – To adopt

the Merger Agreement, pursuant to which Merger Sub will merge with and into Envestnet, with Envestnet surviving the Merger and becoming

a wholly owned subsidiary of Parent, and to approve the Merger.

| | | |

| | |

| | |

| |

| | For | | |

| Against | | |

| Abstain | | |

| Broker Non-Votes | |

| | 42,827,672 | | |

| 193,657 | | |

| 97,032 | | |

| - | |

As a result, the Merger Proposal was approved by the requisite vote

of the Company’s stockholders.

2. The Merger-Related Compensation Proposal – To approve,

on a non-binding advisory basis, the compensation that will or may become payable by Envestnet to its named executive officers in connection

with the Merger.

| | | |

| | |

| | |

| |

| | For | | |

| Against | | |

| Abstain | | |

| Broker Non-Votes | |

| | 41,431,052 | | |

| 1,580,029 | | |

| 107,280 | | |

| - | |

As a result, the Merger-Related Compensation Proposal was approved

by the requisite vote of the Company’s stockholders.

3. The Adjournment Proposal – To approve an adjournment

of the Special Meeting, from time to time, if necessary or appropriate, including to solicit additional proxies if there are insufficient

votes at the time of the Special Meeting to approve the Merger Proposal or in the absence of a quorum.

Because there were sufficient votes represented at the time of the

Special Meeting to approve the Merger Proposal, the Adjournment Proposal was moot and was not presented for approval by the Company’s

stockholders at the Special Meeting.

On September 24, 2024, the Company issued a press

release announcing the voting results of the Special Meeting. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated

by reference herein.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

Envestnet,

Inc. |

| |

|

| Date: September 24, 2024 |

By: |

/s/ James L. Fox |

| |

Name:

Title: |

James L. Fox

Interim Chief Executive Officer |

Exhibit 99.1

Envestnet Stockholders Approve Acquisition by Bain

Capital

BERWYN, Pa. – September 24, 2024 –

Envestnet, Inc. (NYSE: ENV) (“Envestnet,” or the “Company”), a leading provider of integrated technology, data

intelligence, and wealth solutions, today announced that, at a special meeting (the “Special Meeting”), the Company’s

stockholders approved the pending acquisition of the Company by affiliates of vehicles managed or advised by Bain Capital (the “Merger”).

Based on a preliminary tally of voting results, approximately

99.33% of the votes represented at the Special Meeting were in favor of the Merger. The final voting results of the Special Meeting will

be filed in a Current Report on Form 8-K with the U.S. Securities and Exchange Commission (“SEC”).

The receipt of stockholder approval satisfies another

closing condition to the Merger, in addition to the expiration of the waiting period under the Hart-Scott Rodino Antitrust Improvements

Act of 1976 on September 3, 2024. The Company expects to complete the Merger in the fourth quarter of 2024, subject to the satisfaction

or waiver of the remaining customary closing conditions.

About Envestnet

Envestnet

is helping to lead the growth of wealth managers and transforming the way financial advice is delivered through its ecosystem of connected

technology, advanced insights, and comprehensive solutions – backed by industry-leading service and support. Serving the wealth

management industry for 25 years with more than $6.2 trillion in platform assets—more than 110,000 advisors, 17 of the 20 largest

U.S. banks, 48 of the 50 largest wealth management and brokerage firms, more than 500 of the largest RIAs—thousands of companies, depend

on Envestnet technology and services to help drive business growth and productivity, and better outcomes for their clients. Data as of

6/30/24.

Envestnet

refers to the family of operating subsidiaries of the public holding company, Envestnet, Inc. (NYSE: ENV). For a deeper dive into how

Envestnet is shaping the future of financial advice, visit www.envestnet.com. Stay connected with us for the latest updates and insights

on LinkedIn and X (@ENVintel).

About Bain Capital

Bain Capital, LP is one of the world’s leading

private multi-asset alternative investment firms that creates lasting impact for our investors, teams, businesses, and the communities

in which we live. Since our founding in 1984, we’ve applied our insight and experience to organically expand into numerous asset

classes including private equity, credit, public equity, venture capital, real estate, life sciences, insurance, and other strategic areas

of focus. The firm has offices on four continents, more than 1,750 employees and approximately $185 billion in assets under management.

To learn more, visit www.baincapital.com.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains, and the Company’s

other filings and communications may contain, forward-looking statements. All statements other than statements of historical fact are

forward-looking statements. Forward-looking statements give the Company’s current expectations relating to the Company’s financial

condition, results of operations, plans, objectives, future performance and business including, without limitation, statements regarding

the Merger and related transactions, the expected closing of the Merger and the timing thereof, and as to the financing commitments. You

can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements

may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,”

“intend,” “believe,” “may,” “will,” “should,” “can have,” “likely”

and other words and terms of similar meaning. These forward-looking statements are based on management’s beliefs, as well as assumptions

made by, and information currently available to, the Company.

Because such statements are based on expectations

as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected

and are subject to a number of known and unknown risks and uncertainties, including: (i) the risk that the Merger may not be completed

on the anticipated terms in a timely manner or at all, which may adversely affect the Company’s business and the price of the Company’s

common stock; (ii) the failure to satisfy any of the conditions to the consummation of the Merger, including the receipt of certain regulatory

approvals; (iii) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the

merger agreement, including in circumstances requiring the Company to pay a termination fee; (iv) the effect of the announcement or pendency

of the Merger on the Company’s business relationships, operating results and business generally; (v) risks that the Merger disrupts

the Company’s current plans and operations (including the ability of certain customers to terminate or amend contracts upon a change

of control); (vi) the Company’s ability to retain, hire and integrate skilled personnel including the Company’s senior management

team and maintain relationships with key business partners and customers, and others with whom it does business, in light of the Merger;

(vii) risks related to diverting management’s attention from the Company’s ongoing business operations; (viii) unexpected

costs, charges or expenses resulting from the Merger; (ix) the ability to obtain the necessary financing arrangements set forth in the

commitment letters received in connection with the Merger; (x) litigation and potential litigation relating to the Merger that could be

instituted against the parties to the agreement or their respective directors, managers or officers, or the effects of any outcomes related

thereto; (xi) the impact of adverse general and industry-specific economic and market conditions; (xii) certain restrictions during the

pendency of the Merger that may impact the Company’s ability to pursue certain business opportunities or strategic transactions;

(xiii) uncertainty as to timing of completion of the Merger; (xiv) risks that the benefits of the Merger are not realized when and as

expected; (xv) legislative, regulatory and economic developments; (xvi) those risks and uncertainties set forth under the headings “Forward-Looking

Statements” and “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December

31, 2023 filed with the SEC, as such risk factors may be amended, supplemented or superseded from

time to time by other reports filed by the Company with the SEC from time to time, which are available via the SEC’s website at

www.sec.gov; and (xvii) those risks that are described in the Company’s definitive

proxy statement on Schedule 14A (the “Proxy Statement”) filed with the SEC on August 23, 2024 and available from the sources

indicated below.

The Company cautions you that the important factors

referenced above may not contain all the factors that are important to you. These risks, as well

as other risks associated with the Merger, are more fully discussed in the Proxy Statement filed with the SEC on August 23, 2024 in connection

with the Merger. There can be no assurance that the Merger will be completed, or if it is completed, that it will close within

the anticipated time period. These factors should not be construed as exhaustive and should be read in conjunction with the other forward-looking

statements. The forward-looking statements included in this communication are made only as of the date hereof. The Company undertakes

no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise,

except as otherwise required by law. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions

prove to be incorrect, our actual results may vary materially from what we may have expressed or implied by these forward-looking statements.

We caution that you should not place significant weight on any of our forward-looking statements. You should specifically consider the

factors identified in this communication that could cause actual results to differ. Furthermore, new risks and uncertainties arise from

time to time, and it is impossible for us to predict those events or how they may affect the Company.

Investor Relations

investor.relations@envestnet.com

(312) 827-3940

Media Relations

media@envestnet.com

v3.24.3

Cover

|

Sep. 24, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 24, 2024

|

| Entity File Number |

001-34835

|

| Entity Registrant Name |

Envestnet, Inc.

|

| Entity Central Index Key |

0001337619

|

| Entity Tax Identification Number |

20-1409613

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1000 Chesterbrook Boulevard

|

| Entity Address, Address Line Two |

Suite 250

|

| Entity Address, City or Town |

Berwyn

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19312

|

| City Area Code |

(312)

|

| Local Phone Number |

827-2800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.005 Per Share

|

| Trading Symbol |

ENV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

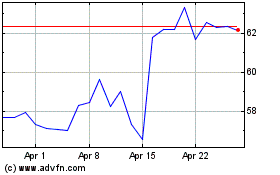

Envestnet (NYSE:ENV)

Historical Stock Chart

From Oct 2024 to Nov 2024

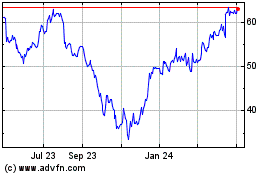

Envestnet (NYSE:ENV)

Historical Stock Chart

From Nov 2023 to Nov 2024