false

0001592000

0001592000

2024-01-16

2024-01-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

January 16, 2024

ENLINK

MIDSTREAM, LLC

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36336 |

|

46-4108528 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer Identification No.) |

1722

ROUTH STREET, SUITE

1300

DALLAS,

Texas |

|

75201 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (214) 953-9500

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECURITIES REGISTERED PURSUANT TO SECTION 12(b)

OF THE SECURITIES EXCHANGE ACT OF 1934:

| Title of Each Class |

|

Symbol |

|

Name of Exchange on which Registered |

Common

Units Representing Limited Liability Company Interests |

|

ENLC |

|

The

New York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

| Item 1.01. | Entry into a Material Definitive Agreement. |

On January 16, 2024, EnLink Midstream, LLC

(the “Company”) and each of GIP III Stetson I, L.P. and GIP III Stetson II, L.P. (together “GIP Entities”), the

holders of approximately 46.2%, in the aggregate, of the outstanding common units of the Company (the “Common Units”) and,

in the case of GIP III Stetson I, L.P., the owner of all of the equity interests in EnLink Midstream Manager, LLC, the managing member

of the Company (the “Manager”), entered into a Unit Repurchase Agreement (the “Repurchase Agreement”) pursuant

to which the Company agreed to repurchase, on a quarterly basis, a number of Common Units held by the GIP Entities (the “GIP Units”)

based upon the number of Common Units repurchased from public unitholders by the Company during the applicable quarter, beginning with

the quarter ending March 31, 2024, as described below. The Repurchase Agreement is substantially similar to the repurchase agreement

entered into by the Company and the GIP Entities on December 20, 2022, which provided for proportional repurchases by the Company

of GIP Units during 2023, and which agreement terminated as of December 31, 2023 in accordance with its terms.

Under the Repurchase Agreement, following each

fiscal quarter beginning with the quarter ending March 31, 2024, the Company will repurchase from the GIP Entities a number of GIP

Units equal to (i) the aggregate number of Common Units repurchased by the Company in the open market during such quarter, multiplied

by (ii) a percentage such that the GIP Entities’ then-existing economic ownership percentage of outstanding Common Units is

maintained after the open market repurchases are taken into account. The initial percentage will be adjusted each quarter, as necessary,

so that the GIP Entities’ economic ownership interest will remain the same after giving effect to the open market repurchases. The

per unit price the Company will pay for the GIP Units will be the average per unit price paid by the Company for the Common Units repurchased

from public unitholders during the applicable quarter.

The repurchase of GIP Units by the Company will

occur one business day before the Company’s reporting of earnings for such quarter. The Company will disclose in its periodic reports

filed with the Commission the number of GIP Units purchased by the Company with respect to each quarter.

The Repurchase Agreement will renew for successive

one-year terms (each, a “Renewal Year”) on January 1 of each Renewal Year, with the first Renewal Year beginning on January 1,

2025, unless either the Company or the GIP Entities elects to terminate the Repurchase Agreement prior to the start of any Renewal Year,

during a two-week period in December preceding the applicable Renewal Year. The Repurchase Agreement may also be terminated at any

time by either the Company or the GIP Entities upon 10 days’ written notice to the other party or upon the mutual agreement of the

parties thereto. The terms of the Repurchase Agreement were unanimously approved by the Manager’s Board of Directors (the “Board”)

and, based upon the related party nature of the Repurchase Agreement with the GIP Entities, the Conflicts Committee of the Board.

The foregoing description of the Repurchase Agreement

does not purport to be complete and is qualified in its entirety by reference to the full text of the Repurchase Agreement, a copy of

which is filed as Exhibit 10.1 to this report and is incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

|

| (d) |

Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ENLINK MIDSTREAM, LLC |

| |

|

| |

By: |

EnLink Midstream Manager, LLC,

its Managing Member |

| |

|

| Date: January 16, 2024 |

By: |

/s/ Benjamin D. Lamb |

| |

|

Benjamin D. Lamb |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 10.1

Execution Version

UNIT

REPURCHASE AGREEMENT

This UNIT REPURCHASE AGREEMENT

(this “Agreement”), dated as of January 16, 2024 (the “Effective Date”), is entered

into by and between EnLink Midstream, LLC, a Delaware limited liability company (the “Company”), on the one

hand, and GIP III Stetson I, L.P., a Delaware limited partnership (“GIP Stetson

I”) and GIP III Stetson II, L.P., a Delaware limited partnership (“GIP

Stetson II” and, together with GIP Stetson I, the “GIP Parties”),

on the other hand. The Company and each of the GIP Parties are sometimes individually referred to herein as a “Party”

and collectively as the “Parties.” Capitalized terms used but not defined herein shall have the meanings

assigned to such terms in Article I of this Agreement.

RECITALS

WHEREAS,

GIP Stetson I and GIP Stetson II are the record and beneficial owners of 101,295,177 and

107,470,034 common units representing limited liability company interests in the Company, respectively (the “GIP Units”);

WHEREAS,

the Board of Directors of EnLink Midstream Manager, LLC, a Delaware limited liability company and the sole managing member of the Company,

may authorize a common unit repurchase program from time to time for the repurchase of the outstanding common units representing limited

liability company interests in the Company (the “Common Units”), with such repurchases to be made from time

to time in open market or private transactions in accordance with applicable securities laws and depending on market conditions;

WHEREAS,

the Parties desire to establish a repurchase arrangement pursuant to which the Company will purchase from each of GIP Stetson I and GIP

Stetson II a number of GIP Units representing a fixed percentage of the Common Units bought through the common unit repurchase program,

on the terms and subject to the conditions of this Agreement;

WHEREAS,

in connection with the repurchase by the Company of GIP Units from time to time, each of the GIP Parties will enter into an Assignment

Agreement with the Company in the form attached as Exhibit A hereto (each, an “Assignment”), which

Assignment shall provide for the assignment of the applicable GIP Units from such GIP Parties to the Company; and

WHEREAS,

the Conflicts Committee has reviewed and approved this Agreement, the other Transaction Documents and the transactions contemplated hereby

and thereby, with such approval constituting Special Approval (as defined in the Company Agreement).

NOW,

THEREFORE, in consideration of the mutual covenants, representations, warranties and agreements herein contained, the Parties

agree as follows:

Article I

DEFINITIONS

As used in this Agreement:

“Affiliate”

means, with respect to any Person, any other Person that, directly or indirectly, Controls, is Controlled by or is under common Control

with, such specified Person through one or more intermediaries or otherwise; provided, however, that (a) with respect to any

GIP Party, the term “Affiliate” shall not include the Company or any of its subsidiaries, and (b) with respect to the

Company, the term “Affiliate” shall not include either GIP Party or any of its Affiliates (other than the Company and its

subsidiaries).

“Agreement”

has the meaning given to such term in the preamble hereof.

“Aggregate GIP

Ownership Percentage” means the aggregate ownership percentage of the Common Units held by GIP Stetson I and GIP Stetson

II at the close of business on the last business day prior to the start of the applicable Repurchase Quarter and after giving effect to

the GIP Units to be purchased in respect of such prior quarter in accordance with Section 2.1 of this Agreement. For the avoidance

of doubt, the Aggregate GIP Ownership Percentage shall reflect GIP Stetson I’s and GIP Stetson II’s aggregate economic ownership

percentage in the Common Units and shall not take into account the ownership interest represented by any non-economic units, such as the

Class C Common Units.

“Applicable Law”

or “Law” means any applicable statute, law, regulation, ordinance, rule, judgment, rule of law (including

common law), decree, permit, requirement, or other governmental restriction or any similar form of decision of, or any provision or condition

issued under any of the foregoing by, or any determination by any Governmental Authority having or asserting jurisdiction over the matter

or matters in question, whether now or hereafter in effect and in each case as amended (including all of the terms and provisions of the

common law of such Governmental Authority), as interpreted and enforced at the time in question.

“Applicable Distribution

Amount” means, for any Repurchase Quarter, a dollar amount equal to the number of Quarterly Repurchase Units multiplied

by the per unit amount of the Company’s distribution for such Repurchase Quarter.

“Applicable Quarterly

Percentage” means for any Repurchase Quarter, a percentage equal to (i) the applicable Aggregate GIP Ownership Percentage

divided by (ii) 100% minus the applicable Aggregate GIP Ownership Percentage.

“Assignment”

has the meaning given to such term in the recitals hereto.

“Business Day”

means any day except a Saturday, Sunday or other day on which commercial banks in Dallas, Texas are authorized or required by Applicable

Law to be closed.

“Common Units”

has the meaning given to such term in the recitals hereto.

“Company”

has the meaning set forth in the preamble.

“Company Agreement”

means the Second Amended and Restated Operating Agreement of the Company, dated as of January 25, 2019.

“Conflicts Committee”

has the meaning set forth in the Company Agreement.

“Contract”

means any written contract, agreement, indenture, instrument, note, bond, loan, lease, sublease, easement, mortgage, deed of trust, franchise,

license agreement, purchase order, binding bid or offer, binding term sheet or letter of intent or memorandum, commitment, letter of credit

or any other legally binding arrangement, including any amendments or modifications thereof and waivers relating thereto.

“Daily Repurchase

Units” means a number of Common Units equal to (i) the aggregate number of Common Units purchased by the Company in

Open Market Repurchases on a Repurchase Date, multiplied by (ii) the Applicable Quarterly Percentage, rounded to the nearest

whole Common Unit.

“Daily Repurchase

Price” means (i) (A) the aggregate purchase price of the Open Market Units repurchased by the Company on the applicable

Repurchase Date (excluding commissions paid to brokers to execute the open market repurchases) divided by (B) the aggregate

number of Open Market Units repurchased by the Company on the applicable Repurchase Date, multiplied by (ii) the Daily Repurchase

Units.

“Enforceability

Exceptions” has the meaning given to such term in Section 3.2.

“GIP Parties”

has the meaning set forth in the preamble.

“GIP Stetson I”

has the meaning set forth in the preamble.

“GIP Stetson II”

has the meaning set forth in the preamble.

“GIP Units”

has the meaning given to such term in the recitals hereto.

“Governmental

Authority” means any applicable multinational, foreign, federal, state, local or other governmental statutory or administrative

authority, regulatory body or commission or any court, tribunal or judicial or arbitral authority which has any jurisdiction over a matter.

“Lien”

means (a) any lien, hypothecation, pledge, collateral assignment, security interest, charge or encumbrance of any kind, whether such

interest is based on the common law, statute or contract, and whether such obligation or claim is fixed or contingent (including any agreement

to give any of the foregoing) and any option, trust or other preferential arrangement having the practical effect of any of the foregoing,

other than in each case, the restrictions under applicable federal, state and other securities laws, the limited liability company agreement

or limited partnership agreement, as applicable, of either of the GIP Parties, and (b) any purchase option, right of first refusal,

right of first offer, call or similar right of a third party.

“Open Market Repurchase”

means a repurchase by the Company of its Common Units on the open market at prevailing market prices.

“Open Market Units”

means Common Units repurchased by the Company pursuant to an Open Market Repurchase.

“Party”

and “Parties” have the meanings given to such terms in the preamble hereto.

“Person”

means any natural person, corporation, limited partnership, general partnership, limited liability company, joint stock company, joint

venture, association, company, estate, trust, bank trust company, land trust, business trust, or other organization, whether or not a

legal entity, custodian, trustee-executor, administrator, nominee or entity in a representative capacity and any Governmental Authority.

“Proceeding”

means any action, suit, claim, hearing, proceeding, arbitration, investigation, audit, inquiry, litigation or mediation (whether civil,

criminal, administrative or investigative) commenced, brought, conducted or heard by or before any Governmental Authority, arbitrator

or mediator.

“Quarterly Closing”

has the meaning given to such term in Section 2.1(b).

“Quarterly Closing

Date” has the meaning given to such term in Section 2.1(b).

“Quarterly Earnings

Date” means the publicly announced date of the Company’s earnings release for the applicable Repurchase Quarter.

“Quarterly Repurchase

Price” means an amount equal to the sum of all Daily Repurchase Prices in the applicable Repurchase Quarter less the Applicable

Distribution Amount.

“Quarterly Repurchase

Units” means Common Units equal to the aggregate number of Daily Repurchase Units in the applicable Repurchase Quarter.

“Repurchase Date”

means each Business Day on which the Company repurchases Open Market Units.

“Repurchase Quarter”

means each three (3)-month calendar quarter, beginning with the calendar quarter starting on January 1, 2024.

“Transaction

Documents” means, collectively, this Agreement and the Assignments.

Article II

THE TRANSACTIONS

Section 2.1 Repurchase,

Delivery and Cancellation of the Quarterly Repurchase Units.

(a) At

each Quarterly Closing, the Company agrees to purchase from GIP, and GIP agrees to sell, transfer, assign and deliver to the Company,

free and clear of any Liens (other than as imposed by applicable securities laws or by the Company Agreement), the applicable Quarterly

Repurchase Units in exchange for the Quarterly Repurchase Price, in accordance with the provisions of this Agreement. The Quarterly Repurchase

Units and the Quarterly Repurchase Price shall be allocated between the GIP Parties on a pro rata basis based on their respective

ownership percentages of the Common Units at the close of business on the last business day prior to the start of the applicable Repurchase

Quarter and after giving effect to the GIP Units to be purchased in respect of such prior quarter in accordance with Section 2.1

of this Agreement. Following each repurchase of the Quarterly Repurchase Units hereunder, the Quarterly Repurchase Units shall be cancelled

and shall no longer be deemed to be outstanding.

(b) No

later than fifteen (15) Business Days after the end of each Repurchase Quarter, the Company shall provide to GIP a schedule reflecting

the Applicable Quarterly Percentage for the Repurchase Quarter, the Applicable Distribution Amount, and for each Repurchase Date during

the Repurchase Quarter, the number of Daily Repurchase Units and the Daily Repurchase Price with respect to such Repurchase Date, as well

as the Quarterly Repurchase Units and Quarterly Repurchase Price for such Repurchase Quarter. One (1) Business Day prior to the Quarterly

Earnings Date for such Repurchase Quarter, the Parties shall execute and deliver the items described in Section 2.2 and Section 2.3,

as applicable, and consummate the closing with respect to the Quarterly Repurchase Units for such Repurchase Quarter (each, a “Quarterly

Closing” and the date on which such Quarterly Closing occurs, a “Quarterly Closing Date”).

Section 2.2 GIP

Party Closing Deliverables. At each Quarterly Closing, each of the GIP Parties shall deliver (or cause to be delivered) to the

Company:

(a) a

counterpart to an Assignment, duly executed on behalf of each GIP Party, and such other transfer documents or instruments that may be

reasonably necessary to be delivered by such GIP parties in order to effect a sale, transfer, assignment and delivery of the Quarterly

Repurchase Units to the Company in accordance with Section 2.1(a); and

(b) a

duly completed Internal Revenue Service Form W-9.

Section 2.3 Company

Closing Deliverables. At each Quarterly Closing, the Company shall deliver (or cause to be delivered) to the GIP Parties:

(a) the

Quarterly Repurchase Price payable to each GIP Party in accordance with Section 2.1(a) by wire transfer of immediately

available funds to the account or accounts designated by such GIP Parties in writing and provided to the Company at least two (2) Business

Day prior to the applicable Quarterly Closing Date; and

(b) counterparts

to the Assignments, and such other transfer documents or instruments that may be reasonably necessary to be delivered by the Company in

order to effect the repurchase of the Quarterly Repurchase Units in accordance with Section 2.1(a).

Article III

REPRESENTATIONS AND WARRANTIES OF THE GIP PARTIES

Each of the GIP Parties, severally

and not jointly, and solely with respect to itself, represents and warrants to the Company as of the date hereof and, as of each Quarterly

Closing Date, upon the delivery of an Assignment at each such Quarterly Closing Date, that:

Section 3.1 Organization.

Such GIP Party is a limited partnership duly formed, validly existing and in good standing under the Laws of the State of Delaware.

Section 3.2 Authorization.

Such GIP Party has all requisite limited partnership power and authority to execute, deliver, and perform each Transaction Document to

which it is a party. The execution, delivery, and performance by such GIP Party of the Transaction Documents to which it is a party and

the consummation by such GIP Party of the transactions contemplated hereby and thereby, have been duly authorized by all necessary limited

partnership or limited liability company action, as the case may be. Each Transaction Document executed or to be executed by such GIP

Party has been, or when executed will be, duly executed and delivered by such GIP Party and, assuming the execution and delivery by the

other parties thereto, constitutes, or when executed and delivered by the other parties thereto will constitute, a valid and legally binding

obligation of such GIP Party, enforceable against such GIP Party in accordance with its terms, except to the extent that such enforceability

may be limited by (a) applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, or other similar Applicable

Laws affecting creditors’ rights and remedies generally and (b) equitable principles that may limit the availability of certain

equitable remedies (such as specific performance) in certain instances (the “Enforceability Exceptions”).

Section 3.3 No

Conflicts or Violations. The execution, delivery, and performance of each of the Transaction Documents to which such GIP Party

is a party, and the consummation of the transactions contemplated hereby and thereby, do not: (a) violate or conflict with any provision

of the organizational documents of such GIP Party; (b) violate any Law applicable to such GIP Party; (c) violate, result in

a breach of, constitute (with due notice or lapse of time or both) a default or cause any obligation, penalty or premium to arise or accrue

under any Contract to which such GIP Party is a party; or (d) result in the creation or imposition of any Lien upon any of the properties

or assets of such GIP Party, except, in the case of clauses (b) through (d), as would not, individually or in the aggregate, reasonably

be expected to materially impede the ability of such GIP Party to consummate any of the transactions contemplated by this Agreement.

Section 3.4 Consents

and Approvals. Except (a) as would not, individually or in the aggregate, reasonably be expected to materially impede the

ability of such GIP Party to consummate any of the transactions contemplated hereby, or (b) for any filings required for compliance

with any applicable requirements of the federal securities Laws, any applicable state or other local securities Laws and any applicable

requirements of a national securities exchange, neither the execution and delivery by such GIP Party of any of the Transaction Documents

to which such GIP Party is a party, nor the performance by such GIP Party of its respective obligations thereunder, requires the consent,

approval, waiver or authorization of, or declaration, filing, registration or qualification with any Governmental Authority by such GIP

Party.

Section 3.5 Ownership

of Common Units. As of the date hereof, GIP Stetson I and GIP Stetson II are the record

and beneficial owners of 101,295,177 and 107,470,034 Common Units, respectively, and prior to giving effect to the sale and transfer

of the Quarterly Repurchase Units on each Quarterly Closing Date, each of GIP Stetson I and GIP Stetson II shall be, the record and beneficial

owner of all the Quarterly Repurchase Units to be delivered to the Company, with each GIP Party having the full power to sell and transfer

to the Company all such Quarterly Repurchase Units. On each Quarterly Closing Date, such GIP Parties shall deliver the applicable Quarterly

Repurchase Units to the Company, free and clear of all Liens (other than as imposed by applicable securities laws or by the Company Agreement).

None of the Quarterly Repurchase Units is subject to any voting trust or other contract, agreement, arrangement, commitment or understanding,

written or oral, restricting or otherwise relating to the voting or disposition of the Quarterly Repurchase Units, other than this Agreement

and the organizational documents or other voting arrangements among the GIP Parties. No proxies or powers of attorney have been granted

with respect to the Quarterly Repurchase Units to be delivered by such GIP Parties to the Company. Except as contemplated by this Agreement,

there are no outstanding warrants, options, agreements, convertible or exchangeable securities or other commitments pursuant to which

such GIP Party is or may become obligated to transfer any of the Quarterly Repurchase Units, except as (a) would not reasonably be

expected to impair the ability of such GIP Party to deliver the applicable Quarterly Repurchase Units to the Company as contemplated by

this Agreement and (b) would not apply to the Quarterly Repurchase Units following the delivery of the Quarterly Repurchase Units

to the Company pursuant to this Agreement.

Section 3.6 Litigation.

There is no Proceeding pending or, to the knowledge of such GIP Party, threatened against such GIP Party, or against any officer, manager

or director of such GIP Party, in each case related to the Quarterly Repurchase Units to be delivered by such GIP Party to the Company

or the transactions contemplated hereby. Such GIP Party is not a party or subject to any order, writ, injunction, judgment or decree of

any court or Governmental Authority relating to the Quarterly Repurchase Units to be delivered by such GIP Party to the Company or the

transactions contemplated by this Agreement.

Section 3.7 Brokers

and Finders. No investment banker, broker, finder, financial advisor or other intermediary is entitled to any broker’s,

finder’s, financial advisor’s or other similar based fee or commission in connection with the transactions contemplated hereby

as a result of being engaged by such GIP Party or any of its Affiliates.

Section 3.8 Acknowledgments.

Such GIP Party acknowledges (for itself and on behalf of its Affiliates and representatives) that it has not relied on any advice or recommendation

by the Company or its managers, directors, officers, agents or Affiliates with respect to its decision to enter into this Agreement and

to consummate the transactions contemplated hereby. Such GIP Party (i) is a sophisticated seller with respect to the GIP Units and

has sufficient knowledge, including but not limited to knowledge of the Company, and expertise, including with respect to investments

in and dispositions of securities issued by the Company and comparable entities, to evaluate the business and financial condition of the

Company and its subsidiaries and the merits and risks of the sale of the GIP Units, (ii) has had sufficient opportunity and time

to investigate and review the business, management and financial affairs of the Company, and it has conducted, to its satisfaction, its

own independent investigation, before its decision to enter into this Agreement, and further has had the opportunity to consult with all

advisers it deems appropriate or necessary to consult with in connection with this Agreement and any action arising hereunder, including

investment, legal, tax and accounting advisers and (iii) acknowledges and understands that the Company may, as of the Effective Date

or as of any Quarterly Closing Date, possess or have access to material nonpublic information regarding the Company and the Common Units

not known to GIP that may affect the value of the GIP Units and that the Company is or may be unable to disclose such information. Such

GIP Party acknowledges that, in connection with its entry into this Agreement and consummation of the transactions contemplated hereby,

it has not relied on any express or implied representations or warranties of any nature, oral or written, made by or on behalf of the

Company or any of its managers, directors, officers, Affiliates or representatives, except for the representations or warranties of the

Company set forth in Article IV.

Article IV

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

The Company represents and

warrants to each of the GIP Parties, as of the date hereof and, as of each Quarterly Closing Date, upon the delivery of a counterpart

signature to the Assignment at each such Quarterly Closing Date, that:

Section 4.1 Organization.

The Company is a limited liability company, duly formed, validly existing and in good standing under the Laws of the State of Delaware.

Section 4.2 Authorization.

The Company has all requisite limited liability company power and authority to execute, deliver, and perform each Transaction Document

to which it is a party. The execution, delivery, and performance by the Company of the Transaction Documents to which it is a party and

the consummation by the Company of the transactions contemplated hereby and thereby, have been duly authorized by all necessary limited

liability company action on the part of the Company. Each Transaction Document executed or to be executed by the Company has been, or

when executed will be, duly executed and delivered by the Company and, assuming the execution and delivery by the other parties thereto,

constitutes, or when executed and delivered by the other parties thereto will constitute, a valid and legally binding obligation of the

Company, enforceable against the Company in accordance with its terms, except to the extent that such enforceability may be limited by

the Enforceability Exceptions.

Section 4.3 No

Conflicts or Violations. The execution, delivery, and performance of each of the Transaction Documents to which the Company is

a party, and the consummation of the transactions contemplated hereby and thereby, do not: (a) violate or conflict with any provision

of the organizational documents of the Company; (b) violate any Law applicable to the Company; (c) violate, result in a breach

of, constitute (with due notice or lapse of time or both) a default or cause any obligation, penalty or premium to arise or accrue under

any Contract to which the Company is a party; or (d) result in the creation or imposition of any Lien upon any of the properties

or assets of the Company, except, in the case of clauses (b) through (d), as would not, individually or in the aggregate, reasonably

be expected to materially impede the ability of the Company to consummate any of the transactions contemplated by this Agreement.

Section 4.4 Consents

and Approvals. Except (a) as would not, individually or in the aggregate, reasonably be expected to materially impede the

ability of the Company to consummate any of the transactions contemplated hereby, or (b) for any filings required for compliance

with any applicable requirements of the federal securities Laws, any applicable state or other local securities Laws and any applicable

requirements of a national securities exchange, neither the execution and delivery by the Company of any of the Transaction Documents

to which the Company is a party, nor the performance by the Company of its respective obligations thereunder, requires the consent, approval,

waiver, or authorization of, or declaration, filing, registration, or qualification with any Governmental Authority by the Company.

Section 4.5 Litigation.

There is no Proceeding pending or, to the knowledge of the Company, threatened against the Company, or against any officer, manager or

director of the Company, in each case related to the Quarterly Repurchase Units to be delivered by the GIP Parties to the Company or the

transactions contemplated hereby. The Company is not a party or subject to any order, writ, injunction, judgment or decree of any court

or Governmental Authority relating to the Quarterly Repurchase Units to be delivered by the GIP Parties to the Company or the transactions

contemplated by this Agreement.

Section 4.6 Brokers

and Finders. No investment banker, broker, finder, financial advisor or other intermediary is entitled to any broker’s,

finder’s, financial advisor’s or other similar based fee or commission in connection with the transactions contemplated hereby

as a result of being engaged by the Company or any of its Affiliates.

Section 4.7 Acknowledgments.

The Company acknowledges that it has not relied on any advice or recommendation by the GIP Parties or their respective partners, directors,

officers, agents or affiliates with respect to the Company’s decision to enter into this Agreement and to consummate the transactions

contemplated hereby. The Company has had the opportunity to consult with all advisors it deems appropriate or necessary to consult with

in connection with this agreement and any action arising hereunder. The Company acknowledges that, in connection with its entry into this

Agreement and consummation of the transactions contemplated hereby, it has not relied on any express or implied representations or warranties

of any nature, oral, or written, made by or on behalf of any GIP Party or any of their respective Affiliates or representatives, except

for the representations or warranties of the GIP Parties set forth in Article III.

Article V

COVENANTS

Section 5.1 Further

Assurances. On and after the Effective Date, the Parties shall use their respective commercially reasonable efforts to take or

cause to be taken all appropriate actions and do, or cause to be done, all things reasonably necessary or appropriate to make effective

the transactions contemplated hereby, including the execution of any assignment or similar documents or instruments of transfer of any

kind at each Quarterly Closing Date, the obtaining of consents that may be reasonably necessary or appropriate to carry out any of the

provisions hereof and the taking of all such other actions as such Party may reasonably request to be taken by the other Party from time

to time, consistent with the terms of this Agreement, in order to effectuate the provisions and purposes of this Agreement and the transactions

contemplated hereby.

Section 5.2 Quarterly

Distributions. Each GIP Party shall be entitled to receive, and the Company shall pay to each GIP Party, any cash distribution

payable under the Company Agreement with respect to the Quarterly Repurchase Units transferred by such GIP Party on the applicable Quarterly

Closing Date and as and when paid to the holders of the Common Units pursuant to the Company Agreement, so long as such GIP Party is the

record and beneficial owner of such Quarterly Repurchase Units as of the Record Date (as defined in the Company Agreement) for such cash

distribution.

Article VI

TERMINATION

Section 6.1 Termination

Notice. Subject to the proviso in Section 6.2, below, the initial terms of this Agreement shall extend until December 31,

2024 and, thereafter, shall automatically renew for successive one-year terms (each a “Renewal Year”), beginning

on January 1 of each Renewal Year, unless either Party elects to terminate this Agreement prior to the start of any Renewal Year,

by providing the other Party with written notice of such termination during the period between December 5 and December 20 preceding

the applicable Renewal Year. Any such termination shall be effective as of the close of business on December 31 of the initial term

or the then current Renewal Year, as applicable. In addition, this Agreement may be earlier terminated and the transactions contemplated

hereby may be abandoned at any time by:

| (i) | the mutual written agreement of the Parties, effective as of the date designated as the termination date

in such written agreement, or |

(ii) either

the Company or the GIP Parties upon the delivery of a written notice (the “Termination Notice”) of such termination

to the other party or their representative, which notice shall set forth an effective date for such termination; provided, however,

that, in the case of this clause (ii), the effective date of such termination shall be no earlier than 10 days from the date of delivery

of the Termination Notice.

Section 6.2 Effect

of Termination. On the effective date of the termination pursuant to Section 6.1 (the “Termination Date”),

this Agreement shall terminate, and there shall be no further liability or obligation hereunder or thereunder on the part of any Party

hereto; provided, however, that (i) the Parties shall effect a “Quarterly Closing” of Quarterly Repurchase

Units with respect to any Repurchase Dates effected during the Repurchase Quarter in which the Termination Date occurs, by applying the

provisions of Section 2.1(b) as if the Termination Date were the end of the applicable Repurchase Quarter (mutatis

mutandis), and (ii) nothing contained in this Agreement (including this sentence) will relieve any party from liability for any

breach of any of its representations, warranties, covenants or agreements set forth in this Agreement.

Article VII

SURVIVAL

Section 7.1 All

representations and warranties of the Parties contained in this Agreement shall terminate as of each Quarterly Closing Date in respect

of the Quarterly Repurchase Units delivered by the GIP Parties to the Company as of such Quarterly Closing Date.

Section 7.2 All

covenants and agreements of the Parties contemplated to be performed prior to each Quarterly Closing Date shall terminate as of such Quarterly

Closing Date in respect of the Quarterly Repurchase Units delivered by the GIP Parties to the Company as of such Quarterly Closing Date.

Section 7.3 All

covenants and agreements of the Parties contemplated to be performed following each Quarterly Closing Date shall survive such Quarterly

Closing Date until performed in accordance with their respective terms.

Section 7.4 Regardless

of any purported general termination of this Agreement, the provisions of Sections 6.2 and Article 8 shall remain operative

and in full force and effect as between the Company and each GIP Party, unless the Company and each GIP Party execute a writing that expressly

terminates such rights and obligations as between the Company and each GIP Party.

Article VIII

MISCELLANEOUS

Section 8.1 Headings;

References; Interpretation. All Article and Section headings in this Agreement are for convenience only and shall not

be deemed to control or affect the meaning or construction of any of the provisions hereof. The words “hereof,” “herein”

and “hereunder” and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole, and not

to any particular provision of this Agreement. All references herein to Articles and Sections shall, unless the context requires a different

construction, be deemed to be references to the Articles and Sections of this Agreement. All personal pronouns used in this Agreement,

whether used in the masculine, feminine or neuter gender, shall include all other genders, and the singular shall include the plural and

vice versa. The use herein of the word “including” following any general statement, term or matter shall not be construed

to limit such statement, term or matter to the specific items or matters set forth immediately following such word or to similar items

or matters, whether or not non-limiting language (such as “without limitation,” “but not limited to” or other

words of similar import) is used with reference thereto, but rather shall be deemed to refer to all other items or matters that could

reasonably fall within the broadest possible scope of such general statement, term or matter.

Section 8.2 No

Third-Party Rights. The provisions of this Agreement are intended to bind the Parties as to each other and are not intended to,

and do not, create rights in any other Person or confer upon any other Person any benefits, rights or remedies, and no Person is or is

intended to be a third-party beneficiary of any of the provisions of this Agreement. Without limiting the generality of the foregoing,

the Parties agree that their respective representations, warranties and covenants set forth in this Agreement are the product of negotiations

among the Parties and are for the sole benefit of the Parties, in accordance with and subject to the terms of this Agreement, and no other

Person has the right to rely upon the representations and warranties, or the right to enforce any covenants, set forth herein. Any inaccuracies

in such representations and warranties are subject to waiver by the Parties in accordance with Section 8.6 without notice

or liability to any other Person. In some instances, the representations and warranties in this Agreement may represent an allocation

among the Parties of risks associated with particular matters regardless of the knowledge of any of the Parties. Consequently, Persons

other than the Parties may not rely upon the representations and warranties in this Agreement as characterizations of actual facts or

circumstances as of the date of this Agreement or as of any other date.

Section 8.3 Successors

and Assigns. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective successors and

assigns. No Party may assign, in whole or in part, either this Agreement or any of its rights, interests or obligations hereunder without

the prior written approval of the other Parties.

Section 8.4 Notices.

All notices and demands provided for hereunder shall be in writing and shall be given by registered or certified mail, return receipt

requested, electronic mail, air courier guaranteeing overnight delivery or personal delivery to the following addresses:

If to the Company:

EnLink Midstream, LLC

1722 Routh Street

Suite 1300

Dallas, TX, 75201

Attention: General Counsel

Email: legal@enlink.com

If to the GIP Parties:

GIP III Stetson I, L.P.

GIP III Stetson II, L.P.

c/o Global Infrastructure Management, LLC

1345 Avenue of the Americas

New York, New York 10105

Attention: Julie Ashworth

Email: GIPLegal@global-infra.com

Section 8.5 Severability.

Whenever possible, each provision of this Agreement shall be interpreted in such manner as to be valid and effective under Applicable

Law, but if any provision of this Agreement or the application of any such provision to any Person or circumstance shall be held invalid,

illegal or unenforceable in any respect by a court of competent jurisdiction, such invalidity, illegality or unenforceability shall not

affect any other provision hereof, and the Parties shall negotiate in good faith with a view to substitute for such provision a suitable

and equitable solution in order to carry out, so far as may be valid and enforceable, the intent and purpose of such invalid, illegal

or unenforceable provision.

Section 8.6 Amendment

or Modification; Waiver. This Agreement may be amended, supplemented or modified from time to time only by the written agreement

of all the Parties. Each such instrument shall be reduced to writing and shall be designated on its face as an amendment to this Agreement.

Any extension or waiver of the obligations herein of any Party shall be valid only if set forth in an instrument in writing referring

to this section and executed by the Party to be bound thereby. Any waiver of any term or condition shall not be construed as a waiver

of any subsequent breach or a subsequent waiver of the same term or condition, or a waiver of any other term or condition, of this Agreement.

The failure of any Party to assert any of its rights hereunder shall not constitute a waiver of any of such rights.

Section 8.7 Integration.

This Agreement, each of the other Transaction Documents and each of the other instruments referenced herein and therein and in the exhibits

attached hereto supersede all previous understandings or agreements among the Parties, whether oral or written, with respect to the subject

matter of this Agreement, each of the other Transaction Documents and such other instruments. This Agreement, each of the other Transaction

Documents and each of the other instruments referenced herein or therein contain the entire understanding of the Parties with respect

to the subject matter hereof and thereof. There are no unwritten oral agreements between the parties. No understanding, representation,

promise or agreement, whether oral or written, is intended to be or shall be included in or form part of this Agreement unless it is contained

in a written amendment hereto executed by the Parties after the date of this Agreement.

Section 8.8 Expenses.

Except as otherwise provided in this Agreement, each of the Parties will bear and pay all other costs and expenses incurred by it or on

its behalf in connection with the transactions contemplated pursuant to this Agreement.

Section 8.9 Applicable

Law. This Agreement shall be construed in accordance with and governed by the Laws of the State of Delaware, without regard to

the principles of conflicts of law. EACH OF THE PARTIES AGREES THAT THIS AGREEMENT INVOLVES AT LEAST U.S. $100,000.00 AND THAT THIS AGREEMENT

HAS BEEN ENTERED INTO IN EXPRESS RELIANCE UPON 6 Del. C. § 2708. EACH OF THE PARTIES IRREVOCABLY AND UNCONDITIONALLY AGREES (a) TO

BE SUBJECT TO THE JURISDICTION OF THE COURTS OF THE STATE OF DELAWARE AND OF THE FEDERAL COURTS SITTING IN THE STATE OF DELAWARE, AND

(b) TO THE EXTENT SUCH PARTY IS NOT OTHERWISE SUBJECT TO SERVICE OF PROCESS IN THE STATE OF DELAWARE, TO APPOINT AND MAINTAIN AN

AGENT IN THE STATE OF DELAWARE AS SUCH PARTY’S AGENT FOR ACCEPTANCE OF LEGAL PROCESS AND TO NOTIFY THE OTHER PARTIES OF THE NAME

AND ADDRESS OF SUCH AGENT.

Section 8.10 Specific

Performance. The Parties agree that irreparable damage would occur and that there would be no adequate remedy at Law in the event

that any of the provisions of this Agreement were not performed prior to termination of this Agreement in accordance with their specific

terms or were otherwise breached. It is accordingly agreed that the Parties shall be entitled to an injunction or injunctions to prevent

breaches of this Agreement and to enforce specifically the terms and provisions of this Agreement in the Court of Chancery of the State

of Delaware without bond or other security being required, this being in addition to any other remedy to which they are entitled at law

or in equity.

Section 8.11 Withholding.

All payments and distributions under this Agreement shall be subject to withholding and backup withholding of tax to the extent required

by Applicable Law, and amounts withheld, if any, shall be treated as received by the GIP Parties. The Company shall notify each GIP Party

if it intends to withhold, pursuant to this Section 8.11, any amounts payable to such GIP Party.

Section 8.12 No

Presumption Against Drafting Party. Each of the Parties acknowledge that it has been represented by counsel in connection with

this Agreement and the transactions contemplated by this Agreement. Accordingly, any rule of law or any legal decision that would

require interpretation of any claimed ambiguities in this Agreement against the drafting party has no application and is expressly waived.

Section 8.13 Counterparts.

This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, and all of which, when taken together,

shall be deemed one agreement. The exchange of copies of this Agreement and of signature pages by facsimile or electronically including

by PDF transmission shall constitute effective execution and delivery of this Agreement for all purposes. Signatures of the Parties hereto

transmitted by facsimile or electronically including by PDF transmission shall be deemed to be their original signatures for all purposes.

The words “execution,” “signed,” “signature” and words of like import in this Agreement or in any

other certificate, agreement or document related to this Agreement shall include images of manually executed signatures transmitted by

facsimile or other electronic format (including “pdf,” “tif” or “jpg”) and other electronic signatures

(including DocuSign and AdobeSign). The use of electronic signatures and electronic records (including any contract or other record created,

generated, sent, communicated, received or stored by electronic means) shall be of the same legal effect, validity and enforceability

as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including

the Federal Electronic Signatures in Global and National Commerce Act, the Delaware Uniform Electronic Transactions Act, the New York

State Electronic Signatures and Records Act, and any other applicable law.

[Signature

page follows]

IN WITNESS WHEREOF, each of

the Parties has duly executed this Agreement as of the date first written above.

| |

ENLINK MIDSTREAM, LLC |

| |

|

| |

By: |

EnLink Midstream Manager, LLC, |

| |

|

its Managing Member |

| |

|

| |

By: |

/s/ Benjamin D. Lamb |

| |

Name: |

Benjamin D. Lamb |

| |

Title: |

Executive Vice President and Chief Financial Officer |

[Signature Page to Unit Repurchase Agreement]

| |

GIP III STETSON I, L.P. |

| |

By: |

GIP III Stetson GP, LLC, its general partner |

| |

|

| |

By: |

/s/ Gregg Myers |

| |

Name: |

Gregg Myers |

| |

Title: |

Chief Financial Officer |

| |

|

| |

GIP III STETSON II, L.P. |

| |

By: GIP III Stetson GP, LLC, its general partner |

| |

|

| |

By: |

/s/ Gregg Myers |

| |

Name: |

Gregg Myers |

| |

Title: |

Chief Financial Officer |

[Signature Page to Unit Repurchase Agreement]

Exhibit A

Assignment of Common Units

[See attached]

ASSIGNMENT OF COMMON UNITS

THIS ASSIGNMENT OF COMMON

UNITS (this “Agreement”) is made effective as of [●] (the “Effective Date”),

by and between EnLink Midstream, LLC, a Delaware limited liability company (the “Company”), on the one hand,

and [GIP III Stetson I, L.P., a Delaware limited partnership][GIP

III Stetson II, L.P., a Delaware limited partnership] (the “Assignor”), on the other hand. Capitalized

terms used but not defined herein shall have the meanings assigned to such terms in the Purchase Agreement (as defined below).

RECITALS

WHEREAS, Assignor is

the record and beneficial owner of [●] Common Units of the Company;

WHEREAS, the Company and Assignor

have entered into that certain Unit Repurchase Agreement (the “Purchase Agreement”), dated as of January 16,

2024, pursuant to which, among other things, (a) the Company agreed to purchase from Assignor a number of Common Units as determined

in accordance with Section 2.1(a) thereof, which as of the date hereof is [●] Units (the “Subject Units”)

and (b) Assignor agreed to sell, transfer, assign and deliver all of its right, title and interest in and to the Subject Units to

the Company;

WHEREAS, Assignor desires

to assign all of its right, title and interest in and to the Subject Units to the Company, and the Company desires to accept Assignor’s

assignment of the Subject Units (the “Assignment”);

WHEREAS, immediately following

the Assignment, the Company shall cancel the Subject Units, and the Subject Units shall cease to be outstanding; and

WHEREAS, in order to effectuate

the Assignment, the Company and Assignor are executing and delivering this Agreement.

NOW, THEREFORE, in consideration

of the mutual agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby

acknowledged, and intending to be legally bound hereby, the parties hereto agree as follows:

1. Assignment.

Effective as of the Effective Date, Assignor hereby irrevocably assigns, transfers and delivers to the Company all of Assignor’s

right, title and interest in and to the Subject Units, together with all rights and obligations existing or arising with respect to the

Subject Units, whether arising or attributable to periods prior to or after the Effective Date.

2. Acceptance,

Assumption and Acknowledgment. Effective as of the Effective Date, the Company hereby accepts Assignor’s assignment of the Subject

Units pursuant to Section 1.

3. Effect

of Assignment. Effective as of the Effective Date, (a) Assignor shall cease to have any right, title or interest in or to the

Subject Units and shall have no further rights or obligations with respect to the Subject Units under the Company Agreement or otherwise

and (b) each of the Subject Units shall cease to be outstanding.

4. Choice

of Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware, without giving effect

to the principles of conflict of laws of that state.

5. Further

Assurances. Each of Assignor and the Company agrees to take such further action as may be necessary or appropriate to effect the purposes

of this Agreement.

6. General.

This Agreement is binding on and shall inure to the benefit of the signatories hereto and their respective successors and assigns. This

Agreement is expressly subject to the terms, provisions and limitations of the Purchase Agreement and, in the event of any conflict between

the terms of this Agreement and the terms of the Purchase Agreement, the terms of the Purchase Agreement shall control. This Agreement

may be executed in one or more counterparts, each of which shall be deemed an original, and all of which, when taken together, shall be

deemed one agreement. The exchange of copies of this Agreement and of signature pages by facsimile or electronically including by

PDF transmission shall constitute effective execution and delivery of this Agreement for all purposes. Signatures of the Parties hereto

transmitted by facsimile or electronically including by PDF transmission shall be deemed to be their original signatures for all purposes.

The words “execution,” “signed,” “signature” and words of like import in this Agreement or in any

other certificate, agreement or document related to this Agreement shall include images of manually executed signatures transmitted by

facsimile or other electronic format (including “pdf,” “tif” or “jpg”) and other electronic signatures

(including DocuSign and AdobeSign). The use of electronic signatures and electronic records (including any contract or other record created,

generated, sent, communicated, received or stored by electronic means) shall be of the same legal effect, validity and enforceability

as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including

the Federal Electronic Signatures in Global and National Commerce Act, the Delaware Uniform Electronic Transactions Act, the New York

State Electronic Signatures and Records Act, and any other applicable law. Each provision of this Agreement shall be considered severable

and if for any reason any provision or provisions herein are determined to be invalid, unenforceable or illegal under any existing or

future law, such invalidity, unenforceability or illegality shall not impair the operation of or affect those portions of this Agreement

which are valid, enforceable and legal.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, each of

the Parties has duly executed this Agreement as of the date first written above.

| |

ENLINK MIDSTREAM, LLC |

| |

|

| |

By: |

EnLink Midstream Manager, LLC, |

| |

|

its Managing Member |

| |

|

| |

By: |

|

| |

|

Benjamin D. Lamb |

| |

|

Executive Vice President and Chief Financial Officer |

[Signature Page to Assignment]

| |

[GIP III STETSON I, L.P. |

| |

By: GIP III Stetson GP, LLC, its general partner] |

| |

|

| |

By: |

|

| |

Name: |

| |

Title: |

| |

|

| |

[GIP III STETSON II, L.P. |

| |

By: GIP III Stetson GP, LLC, its general partner] |

| |

|

| |

By: |

|

| |

Name: |

| |

Title: |

[Signature Page to Assignment]

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

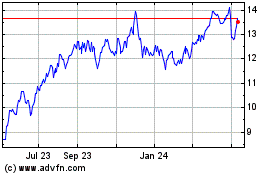

EnLink Midstream (NYSE:ENLC)

Historical Stock Chart

From Oct 2024 to Nov 2024

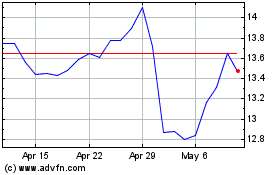

EnLink Midstream (NYSE:ENLC)

Historical Stock Chart

From Nov 2023 to Nov 2024