Energy Transfer Submits HSR Act Filing In Connection With WTG Acquisition

June 17 2024 - 4:15PM

Business Wire

Provides Update on BANGL Pipeline Interest

Energy Transfer LP (NYSE: ET) announced that it recently

submitted its premerger notification filing under the

Hart-Scott-Rodino Antitrust Improvements Act of 1976 (the “HSR

Act”) in connection with its previously announced acquisition of

WTG Midstream Holdings LLC (WTG).

In addition, Energy Transfer announced that the 20% interest in

the BANGL pipeline, which was subject to a right of first offer,

will not be included in the transaction. As a result, the purchase

price for WTG has been revised to approximately $3.075 billion.

Energy Transfer continues to expect accretion of $0.04 per common

unit in 2025, increasing to $0.07 per common unit in 2027.

Energy Transfer continues to expect the transaction to close in

the third quarter of 2024, subject to receiving HSR Act clearance

and customary closing conditions.

WTG owns and operates the largest private Permian Basin gas

gathering and processing business with assets located in the core

of the Midland Basin. The addition of WTG assets is expected to

provide Energy Transfer with increased access to growing supplies

of natural gas and NGL volumes enhancing the partnership’s Permian

operations and downstream businesses.

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the

largest and most diversified portfolios of energy assets in the

United States, with more than 125,000 miles of pipeline and

associated energy infrastructure. Energy Transfer’s strategic

network spans 44 states with assets in all of the major U.S.

production basins. Energy Transfer is a publicly traded limited

partnership with core operations that include complementary natural

gas midstream, intrastate and interstate transportation and storage

assets; crude oil, natural gas liquids (“NGL”) and refined product

transportation and terminalling assets; and NGL fractionation.

Energy Transfer also owns Lake Charles LNG Company, as well as the

general partner interests, the incentive distribution rights and

approximately 21% of the outstanding common units of Sunoco LP

(NYSE: SUN), and the general partner interests and approximately

39% of the outstanding common units of USA Compression Partners, LP

(NYSE: USAC). For more information, visit the Energy Transfer LP

website at www.energytransfer.com.

Forward Looking Statements

This news release may include certain statements concerning

expectations for the future that are forward-looking statements as

defined by federal law. Such forward-looking statements are subject

to a variety of known and unknown risks, uncertainties, and other

factors that are difficult to predict and many of which are beyond

management’s control. An extensive list of factors that can affect

future results are discussed in the Partnership’s Annual Report on

Form 10-K and other documents filed from time to time with the

Securities and Exchange Commission. The Partnership undertakes no

obligation to update or revise any forward-looking statement to

reflect new information or events.

The information contained in this press release is available on

our website at energytransfer.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240617994908/en/

Energy Transfer Investor Relations: Bill Baerg Brent

Ratliff Lyndsay Hannah (214) 981-0795 Media Relations: Vicki

Granado (214) 840-5820

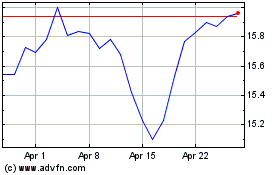

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Nov 2024 to Dec 2024

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Dec 2023 to Dec 2024