Energy Transfer LP Announces Cash Distribution on Series I Preferred Units

April 19 2024 - 8:30AM

Business Wire

Series E Preferred Units to be Redeemed as

Previously Announced

Energy Transfer LP (“ET”) today announced the quarterly

cash distribution of $0.2111 per Series I Preferred Unit (NYSE:

ETprI).

The cash distribution for the Series I unitholders will be paid

on May 15, 2024 to Series I unitholders of record as of the close

of business on May 1, 2024.

In addition, on March 20, 2024, Energy Transfer LP (NYSE: ET)

issued a notice to redeem all of its outstanding Series E

Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred

Units (the “Units”) on May 15, 2024 at a redemption price per Unit

of $25.00. Holders of Units as of May 1, 2024, the record date for

quarterly distributions on the Units, will separately receive

accrued distributions to, but excluding, May 15, 2024, in an amount

of $0.4750 per Unit.

Energy Transfer LP (NYSE: ET) owns and operates one of

the largest and most diversified portfolios of energy assets in the

United States, with more than 125,000 miles of pipeline and

associated energy infrastructure. Energy Transfer’s strategic

network spans 44 states with assets in all of the major U.S.

production basins. Energy Transfer is a publicly traded limited

partnership with core operations that include complementary natural

gas midstream, intrastate and interstate transportation and storage

assets; crude oil, natural gas liquids (“NGL”) and refined product

transportation and terminalling assets; and NGL fractionation.

Energy Transfer also owns Lake Charles LNG Company, as well as the

general partner interests, the incentive distribution rights and

approximately 34% of the outstanding common units of Sunoco LP

(NYSE: SUN), and the general partner interests and approximately

45% of the outstanding common units of USA Compression Partners, LP

(NYSE: USAC). For more information, visit the Energy Transfer LP

website at www.energytransfer.com.

Forward Looking Statements

This news release may include certain statements concerning

expectations for the future that are forward-looking statements as

defined by federal law. Such forward-looking statements are subject

to a variety of known and unknown risks, uncertainties, and other

factors that are difficult to predict and many of which are beyond

management’s control. An extensive list of factors that can affect

future results, including future distribution levels and leverage

ratio, are discussed in the Partnership’s Annual Report on Form

10-K and other documents filed from time to time with the

Securities and Exchange Commission. The Partnership undertakes no

obligation to update or revise any forward-looking statement to

reflect new information or events.

Qualified Notice

This release serves as qualified notice to nominees as provided

for under Treasury Regulation Section 1.1446-4(b)(4) and (d).

Please note that one hundred percent (100%) of Energy Transfer LP’s

distributions to foreign investors are attributable to income that

is effectively connected with a United States trade or business.

Accordingly, all of Energy Transfer LP’s distributions to foreign

investors are subject to federal tax withholding at the highest

applicable effective tax rate. Nominees, and not Energy Transfer

LP, are treated as withholding agents responsible for withholding

distributions received by them on behalf of foreign investors. For

purposes of Treasury Regulation section 1.1446(f)-4(c)(2)(iii),

brokers and nominees should treat one hundred percent (100%) of the

distributions as being in excess of cumulative net income for

purposes of determining the amount to withhold.

The information contained in this press release is available on

our website at www.energytransfer.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240418805385/en/

Investor Relations: Bill Baerg Brent Ratliff Lyndsay Hannah

214-981-0795

Media Relations: Vicki Granado 214-840-5820

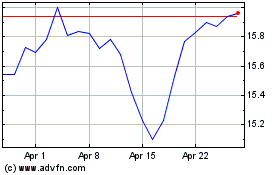

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Nov 2024 to Dec 2024

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Dec 2023 to Dec 2024