Endeavour Silver Corp. ("Endeavour" or the "Company")

(NYSE: EXK; TSX: EDR) is pleased to announce that it has

entered into an agreement with a syndicate of underwriters (the

“Underwriters”) led by BMO Capital Markets, pursuant to which the

Underwriters have agreed to buy on a bought-deal basis 15,825,000

common shares of the Company (the “Common Shares”), at a price of

US$4.60 per Common Share for aggregate gross proceeds of

approximately US$73 million (the “Offering”). The Company has

granted the Underwriters an option, exercisable in whole or in part

for a period of 30 days following the closing of the Offering, to

purchase up to an additional 10% of the Common Shares offered under

the Offering to cover over-allotments, if any.

The principal objectives for use of the net

proceeds of the Offering are for general working capital and the

advancement of the Pitarrilla Project.

The Offering is expected to close on or about

November 27, 2024 and is subject to Endeavour receiving all

necessary regulatory approvals and the approval of the Toronto

Stock Exchange and the New York Stock Exchange.

The Common Shares will be offered in all

provinces of Canada (except Quebec) pursuant to a short form base

shelf prospectus (the “Base Shelf Prospectus”) as accompanied by a

prospectus supplement (the “Prospectus Supplement”) and will be

offered in the United States pursuant to a prospectus supplement to

a base shelf prospectus forming part of the Company’s registration

statement on Form F-10 (together with any amendments thereto, the

“Registration Statement”) registering the Common Shares under the

United States Securities Act of 1933, as amended, pursuant to the

Multi-Jurisdictional Disclosure System adopted by the United States

and Canada. The final prospectus supplement will be filed with the

securities commissions and other similar regulatory authorities in

each of the provinces of Canada, except Quebec, and the United

States, within two business days. The Common Shares may also be

offered on a private placement basis in certain jurisdictions

outside of Canada and the United States pursuant to applicable

prospectus exemptions. However, there will not be any sale of

Common Shares in any province, state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the applicable securities laws of such

province, state or jurisdiction.

A final base shelf prospectus containing

important information relating to the securities described in this

document has been filed with the securities regulatory authorities

in all provinces of Canada (except Quebec). Copies of the final

base shelf prospectus and any applicable shelf prospectus

supplement may be obtained from BMO Capital Markets for which

contact details are provided below. This document does not provide

full disclosure of all material facts relating to the Common

Shares. Investors should read the final base shelf prospectus, the

accompanying prospectus supplement and any amendments thereto for

disclosure of those facts, especially risk factors relating to the

Common Shares, before making an investment decision. Investing in

the Common Shares involves risk. See “Risk Factors” in the final

base shelf prospectus and in the prospectus supplement. Endeavour

has filed the Registration Statement with the U.S. Securities and

Exchange Commission (“SEC”) for the Offering to which this

communication relates. Before you invest, you should read the

prospectus supplement relating to the Offering, the Registration

Statement and other documents Endeavour has filed with the SEC for

more complete information about Endeavour and the Offering.

Copies of the applicable offering documents,

when available, can be obtained free of charge under the Company’s

profile on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

Access to the Prospectus Supplement, the Base

Shelf Prospectus and any amendments thereto are provided in Canada

in accordance with securities legislation relating to the

procedures for providing access to a shelf prospectus supplement, a

base shelf prospectus and any amendment to such documents. The Base

Shelf Prospectus is, and the Prospectus Supplement will be (within

two business days from the date hereof), accessible through SEDAR+.

An electronic or paper copy of these documents, when available, may

be obtained, without charge, in Canada from BMO Nesbitt Burns Inc.

by mail at Brampton Distribution Centre c/o The Data Group of

Companies, 9195 Torbram Road, Brampton, ON, L6S 6H2, by telephone

at 905-791-3151 Ext 4312, or by email at

torbramwarehouse@datagroup.ca and in the United States from BMO

Capital Markets Corp., Attn: Equity Syndicate Department, 151 W

42nd Street, 32nd Floor, New York, NY 10036, or by email at

bmoprospectus@bmo.com by providing BMO Nesbitt Burns Inc. or BMO

Capital Markets Corp. with an email address or mailing address, as

applicable. No securities regulatory authority has either approved

or disapproved of the contents of this news release.

About Endeavour Silver

Corp.Endeavour is a mid-tier precious metals company

committed to sustainable and responsible mining practices. With

operations in Mexico and the development of the new cornerstone

mine in Jalisco State, the Company aims to contribute positively to

the mining industry and the communities in which it operates. In

addition, Endeavour has a portfolio of exploration projects in

Mexico, Chile, and the United States, which has helped it achieve

its goal of becoming a premier senior silver producer.

Contact Information Allison Pettit, Director of

Investor RelationsTel: (604) 640 4804Email:

apettit@edrsilver.com

Cautionary Note Regarding

Forward-Looking Statements

This news release contains "forward-looking

statements" within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and "forward-looking

information" within applicable Canadian securities legislation.

Such forward-looking statements and information herein include but

are not limited to statements regarding the anticipated Offering,

including the securities and their terms, the Underwriters, the

timing of the Offering, the filing of the prospectus supplement,

the jurisdictions in which the securities will be offered, the

intended use of proceeds and the closing of the Offering, including

the satisfaction and timing of the receipt of all required

regulatory approvals, including the approval of the TSX and NYSE,

and other conditions to closing the Offering.

Forward-looking statements or information

involve known and unknown risks, uncertainties, and other factors

that may cause actual events to be materially different from those

expressed or implied by such statements. Such factors include but

are not limited to the timing of, and ability to obtain, regulatory

approvals; changes in production and costs guidance; the ongoing

effects of inflation and supply chain issues on mine economics;

national and local governments’ legislation, taxation, controls,

regulations and political or economic developments in Canada,

Chile, the USA and Mexico; financial risks due to precious metals

prices; operating or technical difficulties in mineral exploration,

development and mining activities; risks and hazards of mineral

exploration, development and mining; the speculative nature of

mineral exploration and development; risks in obtaining necessary

licenses and permits; continued compliance with the project loan

debt facility; fluctuations in the prices of silver and gold;

fluctuations in the currency markets (particularly the Mexican

peso, Chilean peso, Canadian dollar and US dollar); and challenges

to the Company's title to properties; as well as those factors

described in the section "risk factors" contained in the Company's

most recent form 40F/Annual Information Form filed with the SEC and

Canadian securities regulatory authorities.

Forward-looking statements are based on

assumptions management believes to be reasonable, including but not

limited to the continued operation of the Company's mining

operations, no material adverse change in the market price of

commodities, mining operations will operate and the mining products

will be completed under management's expectations and achieve their

stated production outcomes, and such other assumptions and factors

as set out herein. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements or

information, other factors may cause results to be materially

different from those anticipated, described, estimated, assessed,

or intended. These forward-looking statements represent the

Company’s views as of the date of this release. There can be no

assurance that any forward-looking statements or information will

be accurate, as actual results and future events could differ

materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance

on forward-looking statements or information. The Company does not

intend to and does not assume any obligation to update

forward-looking statements or information other than as required by

applicable law.

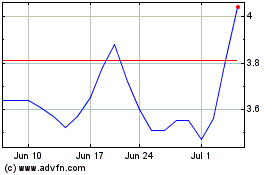

Endeavour Silver (NYSE:EXK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Endeavour Silver (NYSE:EXK)

Historical Stock Chart

From Dec 2023 to Dec 2024