UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-33153

ENDEAVOUR SILVER CORP.

(Translation of registrant's name into English)

#1130-609 Granville Street

Vancouver, British Columbia, Canada V7Y 1G5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Endeavour Silver Corp. |

| |

(Registrant) |

| |

|

|

| Date: September 26, 2024 |

By: |

/s/ Daniel Dickson |

| |

|

Daniel Dickson |

| |

Title: |

CEO |

FIRST AMENDING AGREEMENT

THIS AGREEMENT made as of the 28th day of March, 2024.

BETWEEN:

ING CAPITAL LLC

(in its capacity as administrative agent of the Lenders, the "Administrative Agent")

and

ING BANK N.V., DUBLIN BRANCH and SOCIÉTÉ GÉNÉRALE

(collectively, the "Lenders")

and

TERRONERA PRECIOUS METALS, S.A. DE C.V.

(the "Borrower")

WHEREAS the Lenders have established certain credit facilities in favour of the Borrower pursuant to a credit agreement dated October 6, 2023 entered into between, inter alia, the Borrower, the Lenders and the Administrative Agent (the "Credit Agreement");

AND WHEREAS the parties hereto wish to amend certain provisions of the Credit Agreement;

NOW THEREFORE in consideration of the mutual covenants and agreements contained in this agreement and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the Borrower, the Lenders and the Administrative Agent, the Borrower, the Lenders and the Administrative Agent covenant and agree as follows:

ARTICLE 1

DEFINED TERMS

1.1 Capitalized Terms

All capitalized terms which are used herein without being specifically defined herein shall have the meaning ascribed thereto in the Credit Agreement as amended hereby.

ARTICLE 2

AMENDMENTS

2.1 General Rule

Subject to the terms and conditions herein contained, the Credit Agreement is hereby amended to the extent necessary to give effect to the provisions of this agreement and to incorporate the provisions of this agreement into the Credit Agreement.

2.2 Amendments

(a) Section 1.1 of the Credit Agreement is hereby amended as follows:

(i) the following new definitions of "Excess Equity Amount", "Top-Up Equity Amounts", "Tranche One Top-Up Equity Amount" and "Tranche Two Top-Up Equity Amount" are hereby added in alphabetical order:

""Excess Equity Amount" means such amount spent by the Borrower on Project Costs (excluding any Project Cost Overruns) in excess of the Initial Required Equity Amount prior to the execution of the Initial Mandatory Gold Hedge/Mandatory CapEx FX Hedge (which, as of March 27, 2024 was REDACTED [amount redacted])."

"Top-Up Equity Amounts" has the meaning given to it in Section 10.3(ee).

"Tranche One Top-Up Equity Amount" has the meaning given to it in Section 10.3(ee).

"Tranche Two Top-Up Equity Amount" has the meaning given to it in Section 10.3(ee)."

(ii) the definition of "Initial Required Equity Amount" is hereby deleted in its entirety and replaced with the following:

"Initial Required Equity Amount" means the aggregate of (i) REDACTED [amount redacted] provided that such amount shall include amounts spent on Capital Expenditures prior to the execution of the Initial Mandatory Gold Hedge/Mandatory CapEx FX Hedge (which, as of June 30, 2023 was REDACTED [amount redacted]), and (ii) the Top-Up Equity Amounts, if and to the extent required under Section 10.3(ee).

(iii) the definition of "Project Cost Overrun Funding" is hereby deleted in its entirety and replaced with the following:

""Project Cost Overrun Funding" means

(a) prior to the execution of the Initial Mandatory Gold Hedge/Mandatory CapEx FX Hedge, cash collateral held by the Borrower or letter of credit issued by a Canadian financial institution, with a credit rating by a Rating Agency of A- or equivalent acceptable to the Administrative Agent, such letter of credit to be in form and substance satisfactory to the Administrative Agent, in each case, in an amount not less than $24,000,000 less any Excess Equity Amount and any Project Cost Overruns funded by the Project Cost Overrun Funding, provided that the Project Cost Overrun Funding shall not be negative;

(b) prior to the initial drawdown under Tranche One of the Credit Facility, cash collateral held by the Borrower or letter of credit issued by a Canadian financial institution, with a credit rating by a Rating Agency of A- or equivalent acceptable to the Administrative Agent, such letter of credit to be in form and substance satisfactory to the Administrative Agent, in each case, in an amount not less than $24,000,000 less any Excess Equity Amount and any Project Cost Overruns funded by the Project Cost Overrun Funding, provided that the Project Cost Overrun Funding shall not be negative;

(c) immediately following the initial drawdown under Tranche One of the Credit Facility, cash collateral held by the Borrower or letter of credit issued by a Canadian financial institution, with a credit rating by a Rating Agency of A- or equivalent acceptable to the Administrative Agent, such letter of credit to be in form and substance satisfactory to the Administrative Agent, in each case, in an amount not less than $24,000,000; and

(d) prior to the initial drawdown under Tranche Two of the Credit Facility, (i) cash collateral held by the Borrower or letter of credit issued by a Canadian financial institution, with a credit rating by a Rating Agency of A- or equivalent acceptable to the Administrative Agent, such letter of credit to be in form and substance satisfactory to the Administrative Agent, in each case, in an amount not less than $27,900,000, and (ii) cash collateral in an amount not less than $20,000,000 held by the Sponsor,

in each case, to be used solely to pay (A) Project Costs designated as Project Cost Overruns, and (B) prior to the availability of the Credit Facility only, Project Costs constituting Excess Equity Amounts. For certainty, following the initial drawdown of Tranche One the Project Cost Overrun Funding shall not be used to fund Project Costs constituting Excess Equity Amounts."

(b) Section 10.3(b) is hereby deleted in its entirety and replaced with the following:

"(b) Use of Proceeds. The Borrower shall apply all of the proceeds of the Credit Facility to (i) finance Project Costs in accordance with the Development Plan, and (ii) if and to the extent required, the Borrower shall apply proceeds of the initial drawdown of Tranche One to top-up the Project Cost Overrun Funding, provided that, for certainty, the Borrower shall not be permitted to apply the proceeds of the Credit Facility to top-up the Project Cost Overrun Funding for amounts used to fund Project Cost Overruns. Neither the Sponsor nor its Subsidiaries nor their respective directors, officers, employees or agents, in each case, acting in their official capacity, shall, directly or indirectly, use the proceeds of the Credit Facility, or lend, contribute or otherwise make available such proceeds to any Person, (w) for the purpose of funding, financing or facilitating any activities, business or transaction of or with any Restricted Person or any Restricted Territory, (x) for the purpose of furthering an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any Person in violation of any AML Laws or Anti-Corruption Laws, (y) for any payments to any governmental official or employee, political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in violation of Anti-Corruption Laws or (z) in any other manner, in each case as will result in a violation or breach of any Sanctions by, or could result in the imposition of Sanctions against, any Person (including any Person participating in the transactions contemplated hereby, whether as underwriter, advisor, investor, lender, hedge provider, facility or security agent or otherwise)."

(c) The table set forth in Section 8.1 of the Credit Agreement is hereby deleted in its entirety and replaced with the following:

|

Date of Repayment

|

Amount of Scheduled Repayment

|

|

|

|

|

December 31, 2025

|

$1,000,000.00

|

|

|

|

|

March 31, 2026

|

$4,500,000.00

|

|

June 30, 2026

|

$4,500,000.00

|

|

September 30, 2026

|

$6,000,000.00

|

|

December 31, 2026

|

$6,500,000.00

|

|

|

|

|

March 31, 2027

|

$4,000,000.00

|

|

June 30, 2027

|

$4,000,000.00

|

|

September 30, 2027

|

$2,500,000.00

|

|

December 31, 2027

|

$4,500,000.00

|

|

|

|

|

March 31, 2028

|

$4,500,000.00

|

|

June 30, 2028

|

$4,000,000.00

|

|

September 30, 2028

|

$2,000,000.00

|

|

December 31, 2028

|

$3,000,000.00

|

|

|

|

|

March 31, 2029

|

$7,000,000.00

|

|

June 30, 2029

|

$6,500,000.00

|

|

September 30, 2029

|

$6,500,000.00

|

|

December 31, 2029

|

$8,000,000.00

|

|

|

|

|

March 31, 2030

|

$8,000,000.00

|

|

June 30, 2030

|

$5,000,000.00

|

|

September 30, 2030

|

$4,000,000.00

|

|

December 31, 2030

|

$4,000,000.00

|

|

|

|

|

March 31, 2031

|

$5,000,000.00

|

|

June 30, 2031

|

$5,000,000.00

|

|

September 30, 2031

|

$5,000,000.00

|

|

|

|

|

Maturity Date (December 31, 2031)

|

$5,000,000.00

|

|

|

|

|

Total

|

$120,000,000

|

(d) Section 10.3(dd)(v)(A) is hereby amended by deleting the reference to "180 days" and replacing it with "360 days".

(e) Section 10.3(ee) is hereby deleted in its entirety and replaced with the following:

"(ee) Project Cost Overrun Funding. The Project Cost Overrun Funding shall remain available to fund Project Cost Overruns, in the amounts set out in the definition of "Project Cost Overrun Funding", and the initial funding of the Debt Service Reserve Account in accordance with Section 10.3(m) and shall be in full force and effect. In the event that a Project Cost Overrun occurs and is funded by the Project Cost Overrun Funding (i) prior to the initial drawdown under Tranche One, then the Borrower shall be required to top-up the Project Cost Overrun Funding in an amount equal to the aggregate of all such Project Cost Overruns funded by the Project Cost Overrun Funding with the proceeds of additional Equity issued by the Borrower to the Parent or, with the prior written consent of the Lenders, another Sponsor Group Member (the "Tranche One Top-Up Equity Amount"), and (ii) prior to the initial drawdown under Tranche Two, then the Borrower shall be required to top-up the Project Cost Overrun Funding in an amount equal to the aggregate of all such Project Cost Overruns funded by the Project Cost Overrun Funding with the proceeds of additional Equity issued by the Borrower to the Parent or, with the prior written consent of the Lenders, another Sponsor Group Member (the "Tranche Two Top-Up Equity Amount" and together with the Tranche One Top-Up Equity Amount, the "Top-Up Equity Amounts")."

(f) Section 2(a) of Schedule N is hereby amended by:

(i) deleting the following "over a period of at least five Banking Days,";

(ii) replacing "two (2) years" with "three (3) years"; and

(iii) replacing "March 29, 2024" with "April 2, 2024" to extend the date by which the Borrower is required to execute the initial Mandatory Gold Hedges.

(g) Section 2(b)(i) of Schedule N is hereby amended by replacing "March 29, 2024" with "April 5, 2024" to extend the date by which the Borrower is required to execute the initial Mandatory FX Hedges.

ARTICLE 3

CONDITIONS PRECEDENT TO EFFECTIVENESS OF AGREEMENT

3.1 Conditions Precedent

This agreement shall not become effective unless and until the following conditions precedent are fulfilled:

(a) this agreement shall be executed and delivered by the parties hereto;

(b) no Default which has not otherwise been waived by the Lenders or Majority Lenders, as applicable, shall have occurred and be continuing or would arise upon this agreement becoming effective.

ARTICLE 4

MISCELLANEOUS

4.1 Future References to the Credit Agreement

On and after the date of this agreement, each reference in the Credit Agreement to "this agreement", "hereunder", "hereof", or words of similar meaning referring to the Credit Agreement, and each reference in any related document to the "Credit Agreement", "thereunder", "thereof", or words of similar meaning relating to the Credit Agreement, shall mean and be a reference to the Credit Agreement as amended hereby. The Credit Agreement, as amended hereby, is and shall continue to be in full force and effect and is hereby in all respects ratified and confirmed.

4.2 Governing Law

This agreement shall be governed by and construed in accordance with the laws of the Province of British Columbia and the laws of Canada applicable therein.

4.3 Enurement

This agreement shall enure to the benefit of and shall be binding upon the parties hereto and their respective successors and permitted assigns.

4.4 No Waiver

The execution, delivery and effectiveness of this agreement shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any Finance Document, nor constitute a waiver of any provision of any of the Finance Documents. On and after the effectiveness of this agreement, this agreement shall for all purposes constitute a Credit Document.

4.5 Consent re: Additional Material Project Documents

Pursuant to Section 10.4(e) of the Credit Agreement, the Administrative Agent hereby consents to the Borrower entering into the following Additional Material Project Documents:

(a) REDACTED [material project documents redacted]; and

(b) REDACTED [material project documents redacted].

provided that the foregoing consent is expressly limited to the above-listed Additional Material Project Documents.

4.6 Conflict

If any provision of this agreement is inconsistent or conflicts with any provision of the Credit Agreement, the relevant provision of this agreement shall prevail and be paramount.

4.7 Counterparts

This agreement may be executed in original or pdf file copy or by other electronic means in one or more counterparts, each of which shall be deemed to be an original and all of which taken together shall be deemed to constitute one and the same instrument.

4.8 Representations and Warranties

The Borrower hereby represents and warrants that (a) no Default which has not otherwise been waived by the Lenders or Majority Lenders, as applicable, has occurred and is continuing as of the date hereof or would arise as a result of this agreement becoming effective; and (b) the representations and warranties set forth in Section 9.1 of the Credit Agreement are true and correct in all material respects as if made on the date hereof (except where such representation or warranty is stated to be made as of a particular date).

4.9 Submission to Jurisdiction

Any legal action or proceeding with respect to this Agreement may be brought in the courts of the Province of British Columbia and, by execution and delivery of this Agreement, each of the parties hereby irrevocably accept and submit for themselves and in respect of their property, generally and unconditionally, the jurisdiction of the aforesaid courts. Furthermore, each party hereto hereby waives the right to any other jurisdiction to which it may be entitled by means of its present or future domicile.

[Remainder of page intentionally blank]

IN WITNESS WHEREOF the parties hereto have executed and delivered this agreement on the date first above written.

|

|

TERRONERA PRECIOUS METALS, S.A. DE C.V., as Borrower |

| |

| |

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

Elizabeth Senez

|

|

Title:

|

Treasurer

|

|

|

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

Daniel Dickson

|

|

Title:

|

President

|

[Signature Page – First Amending Agreement]

|

|

ING CAPITAL LLC, as Administrative Agent

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

|

|

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

[Signature Page – First Amending Agreement]

|

|

ING BANK N.V., DUBLIN BRANCH, as Lender

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

|

|

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

[Signature Page – First Amending Agreement]

|

|

SOCIÉTÉ GÉNÉRALE, as Lender

|

| |

|

| |

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

|

|

|

|

By:

|

|

|

Name:

|

|

|

Title:

|

|

[Signature Page – First Amending Agreement]

SECOND AMENDING AGREEMENT

THIS AGREEMENT made as of the 19th day of June, 2024.

BETWEEN:

ING CAPITAL LLC

(in its capacity as administrative agent of the Lenders, the "Administrative Agent")

and

ING BANK N.V., DUBLIN BRANCH and SOCIÉTÉ GÉNÉRALE

(collectively, the "Lenders")

and

TERRONERA PRECIOUS METALS, S.A. DE C.V.

(the "Borrower")

WHEREAS the Lenders have established certain credit facilities in favour of the Borrower pursuant to a credit agreement dated October 6, 2023 entered into between, inter alia, the Borrower, the Lenders and the Administrative Agent (as amended to the date hereof, the "Credit Agreement");

AND WHEREAS the parties hereto wish to amend certain provisions of the Credit Agreement;

NOW THEREFORE in consideration of the mutual covenants and agreements contained in this agreement and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the Borrower, the Lenders and the Administrative Agent, the Borrower, the Lenders and the Administrative Agent covenant and agree as follows:

ARTICLE 1

DEFINED TERMS

1.1 Capitalized Terms

All capitalized terms which are used herein without being specifically defined herein shall have the meaning ascribed thereto in the Credit Agreement as amended hereby.

ARTICLE 2

AMENDMENTS

2.1 General Rule

Subject to the terms and conditions herein contained, the Credit Agreement is hereby amended to the extent necessary to give effect to the provisions of this agreement and to incorporate the provisions of this agreement into the Credit Agreement.

2.2 Amendments

(a) Section 1.1 of the Credit Agreement is hereby amended as follows:

(i) the following new definitions of "Additional Excess Equity Amount", "Change Order", "Permitted Change Order", "Permitted PCOF Usage", "Permitted PCOF Usage Amount", "Temporary PCOF Allowance", "Tranche One PCOF Collateral" and "Tranche Two PCOF Funding Date" are hereby added in alphabetical order:

""Additional Excess Equity Amount" means such amount spent by the Borrower on Project Costs (excluding any Project Cost Overruns) funded by the Sponsor Group in excess of the Initial Required Equity Amount following execution of the Initial Mandatory Gold Hedge/Mandatory CapEx FX Hedge (which, as of the date hereof, is REDACTED [amount redacted]).

"Change Order" means any change order or variation order, amendment, supplement or modification to a Material Project Document.

"Permitted Change Order" means any Change Order designated in writing by the Administrative Agent to the Borrower to be non-material to the development, financing, construction, commissioning, management and operation of the Project as determined by the Administrative Agent using its reasonable discretion and acting in consultation with the Technical Agent, provided that, Change Orders contemplating or relating to any of the following shall be automatically designated as material to the development, financing, construction, commissioning and management and operation of the Project, will not be designated as Permitted Change Orders and will require the prior written consent of the Majority Lenders in accordance with Section 13.4(a):

(a) amendments, supplements or modifications to any provision of a Material Project Document:

(i) relating to the payment of liquidated damages, warranties, liabilities, performance tests, content of performance bonds or guarantees or the payment schedule;

(ii) relating to the timing of posting of performance bonds or guarantees, except an extension of the term or duration of such performance bonds or guarantees not exceeding three months, which is the result of, and corresponds with, a Permitted Change Order that results in a change in the term or duration of the Material Project Document to which such performance bonds or guarantees relates;

(iii) relating to the amount of performance bonds or guarantees required to be posted, other than a change to such amount which is the result of, and corresponds with, a Permitted Change Order that results in a change in Project Costs to be incurred in connection with the Material Project Document to which such performance bonds or guarantees relates;

(iv) that materially amends the technical specifications of the Project;

(v) that could lead to revocation, suspension, cancellation or material adverse modification of any Project Authorization;

(vi) that could have a material impact the ability to achieve Completion by the Project Longstop Date;

(vii) that supersede, conflict with or are inconsistent with the terms of the corresponding Direct Agreement for such Material Project Document, except as it relates to the terms of the applicable Direct Agreement that restrict amendments, supplements or other modifications to Material Project Documents without consent from the Onshore Collateral Agent; or

(viii) that give rise to additional Project Costs in excess of REDACTED [amount redacted];

(b) settle any dispute or claim under a Material Project Document or compromise or settle any liability, in either case that result in payment in excess of REDACTED [amount redacted] becoming due from the Borrower."

"Permitted PCOF Usage" means the use of the Tranche One PCOF Collateral by the Borrower to pay for Project Costs (excluding Project Cost Overruns) prior to the Tranche Two PCOF Funding Date.

"Permitted PCOF Usage Amount" means the amount of the Tranche One PCOF Collateral used by the Borrower as a Permitted PCOF Usage.

"Temporary PCOF Allowance" means the amount of REDACTED [amount redacted].

"Tranche One PCOF Collateral" means the cash collateral held by the Borrower pursuant to paragraph (c) of the definition of "Project Cost Overrun Funding", the initial amount of which is $24,000,000, as may be reduced by Permitted PCOF Usage.

"Tranche Two PCOF Funding Date" means the date that is five (5) Banking Days following the initial drawdown under Tranche Two of the Credit Facility."

(ii) The definition of "Material Project Documents" shall be deleted and replaced with the following:

""Material Project Documents" shall mean collectively, the agreements listed in Schedule K hereto and, after the execution and delivery of this Agreement, each Additional Material Project Document, any Change Order (whether a Permitted Change Order or a Change Order that has otherwise been consented to by the Majority Lenders in writing in accordance with Section 13.4(a)) and any replacement Material Project Document resulting from the Borrower exercising its Replacement Rights."

(iii) the definition of "Project Cost Overrun Funding" is hereby deleted in its entirety and replaced with the following:

""Project Cost Overrun Funding" means

(a) prior to the execution of the Initial Mandatory Gold Hedge/Mandatory CapEx FX Hedge, cash collateral held by the Borrower or letter of credit issued by a Canadian financial institution, with a credit rating by a Rating Agency of A- or equivalent acceptable to the Administrative Agent, such letter of credit to be in form and substance satisfactory to the Administrative Agent, in each case, in an amount not less than $24,000,000 less any Excess Equity Amount and any Project Cost Overruns funded by the Project Cost Overrun Funding, provided that the Project Cost Overrun Funding shall not be negative;

(b) prior to the initial drawdown under Tranche One of the Credit Facility, cash collateral held by the Borrower or letter of credit issued by a Canadian financial institution, with a credit rating by a Rating Agency of A- or equivalent acceptable to the Administrative Agent, such letter of credit to be in form and substance satisfactory to the Administrative Agent, in each case, in an amount not less than $24,000,000 less any Excess Equity Amount and any Project Cost Overruns funded by the Project Cost Overrun Funding, provided that the Project Cost Overrun Funding shall not be negative;

(c) immediately following the initial drawdown under Tranche One of the Credit Facility, cash collateral held by the Borrower or letter of credit issued by a Canadian financial institution, with a credit rating by a Rating Agency of A- or equivalent acceptable to the Administrative Agent, such letter of credit to be in form and substance satisfactory to the Administrative Agent, in each case, in an amount not less than $24,000,000;

(d) prior to the initial drawdown under Tranche Two of the Credit Facility, (i) cash collateral held by the Borrower or letter(s) of credit issued by a Canadian financial institution, with a credit rating by a Rating Agency of A- or equivalent acceptable to the Administrative Agent, such letter(s) of credit to be in form and substance satisfactory to the Administrative Agent, in each case, in an aggregate amount not less than $27,900,000, less the Additional Excess Equity Amount, the Temporary PCOF Allowance and the Permitted PCOF Usage Amount, provided that the Project Cost Overrun Funding under this sub-paragraph (i) shall not be negative, and (ii) cash collateral in an amount not less than $20,000,000 held by the Sponsor; and

(e) by the Tranche Two PCOF Funding Date, (i) cash collateral held by the Borrower or letter(s) of credit issued by a Canadian financial institution, with a credit rating by a Rating Agency of A- or equivalent acceptable to the Administrative Agent, such letter(s) of credit to be in form and substance satisfactory to the Administrative Agent, in each case, in an aggregate amount not less than $27,900,000, and (ii) cash collateral in an amount not less than $20,000,000 held by the Sponsor,

in each case, to be used solely to pay (A) Project Costs designated as Project Cost Overruns, (B) prior to the availability of the Credit Facility only, Project Costs constituting Excess Equity Amounts, and (C) prior to the Tranche Two PCOF Funding Date, Project Costs (excluding Project Cost Overruns) pursuant to Permitted PCOF Usage. For certainty, following the initial drawdown of Tranche One the Project Cost Overrun Funding shall not be used to fund Project Costs constituting Excess Equity Amounts."

(b) Section 10.3(b) is hereby deleted in its entirety and replaced with the following:

"(b) Use of Proceeds. The Borrower shall apply all of the proceeds of the Credit Facility to (i) finance Project Costs in accordance with the Development Plan, and (ii) if and to the extent required, the Borrower shall apply proceeds of the initial drawdown of Tranche One or Tranche Two to top-up the Project Cost Overrun Funding, provided that, for certainty, the Borrower shall not be permitted to apply the proceeds of the Credit Facility to top-up the Project Cost Overrun Funding for amounts used to fund Project Cost Overruns. Neither the Sponsor nor its Subsidiaries nor their respective directors, officers, employees or agents, in each case, acting in their official capacity, shall, directly or indirectly, use the proceeds of the Credit Facility, or lend, contribute or otherwise make available such proceeds to any Person, (w) for the purpose of funding, financing or facilitating any activities, business or transaction of or with any Restricted Person or any Restricted Territory, (x) for the purpose of furthering an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any Person in violation of any AML Laws or Anti-Corruption Laws, (y) for any payments to any governmental official or employee, political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in violation of Anti-Corruption Laws or (z) in any other manner, in each case as will result in a violation or breach of any Sanctions by, or could result in the imposition of Sanctions against, any Person (including any Person participating in the transactions contemplated hereby, whether as underwriter, advisor, investor, lender, hedge provider, facility or security agent or otherwise)."

(c) Section 10.1(b) is hereby amended by adding the following as the new (xx):

(xx) any proposed Change Orders.

(d) Section 10.3(ee) is hereby deleted in its entirety and replaced with the following:

"(ee) Project Cost Overrun Funding. The Project Cost Overrun Funding shall be in full force and effect, in the amounts set out in the definition of "Project Cost Overrun Funding" and remain available to fund: (i) Project Cost Overruns; (ii) the initial funding of the Debt Service Reserve Account in accordance with Section 10.3(m); (iii) the initial funding of the Operating Reserve Account in accordance with Section 10.3(n); and (iv) prior to the Tranche Two PCOF Funding Date, Permitted PCOF Usage. In the event that a Project Cost Overrun occurs and is funded by the Project Cost Overrun Funding (i) prior to the initial drawdown under Tranche One, then the Borrower shall be required to top-up the Project Cost Overrun Funding in an amount equal to the aggregate of all such Project Cost Overruns funded by the Project Cost Overrun Funding with the proceeds of additional Equity issued by the Borrower to the Parent or, with the prior written consent of the Lenders, another Sponsor Group Member (the "Tranche One Top-Up Equity Amount"), and (ii) prior to the Tranche Two PCOF Funding Date, then the Borrower shall be required to top-up the Project Cost Overrun Funding in an amount equal to the aggregate of all such Project Cost Overruns funded by the Project Cost Overrun Funding with the proceeds of additional Equity issued by the Borrower to the Parent or, with the prior written consent of the Lenders, another Sponsor Group Member (the "Tranche Two Top-Up Equity Amount" and together with the Tranche One Top-Up Equity Amount, the "Top-Up Equity Amounts") "

(e) Section 10.4(e) is hereby deleted in its entirety and replaced with the following:

"(e) Amendments / Compliance with Constating Documents, Development Plan, Material Project Documents and Project Authorizations. The Borrower shall not, and shall not suffer or permit any other Obligor to, amend its Constating Documents in a manner that would be prejudicial to the interests of the Administrative Agent or any of the Finance Parties under the Finance Documents or which could reasonably be expected to have a Material Adverse Effect. The Borrower shall not make any amendments to, waive compliance, consent or agree to any assignment, transfer or similar dealing with any party or otherwise deviate materially from the terms of the Development Plan, Material Project Documents or Project Authorizations without the prior written consent of the Lenders in consultation with the Independent Technical Consultant and the Independent Environmental and Social Consultant, provided that, notwithstanding the foregoing, the Borrower shall be permitted to enter into Permitted Change Orders without the prior written consent of the Lenders. The Borrower shall not, and shall not suffer or permit any other Obligor to, enter into any new Material Project Document without the prior written consent of the Administrative Agent."

(f) Schedule J of the Credit Agreement is hereby amended by deleting the second bullet in its entirety and replacing it with the following:

- REDACTED [commercially sensitive information redacted].

(g) Schedule K is hereby deleted in its entirety and replaced with the updated Schedule K attached hereto as Exhibit A.

ARTICLE 3

CONDITIONS PRECEDENT TO EFFECTIVENESS OF AGREEMENT

3.1 Conditions Precedent

This agreement shall not become effective unless and until the following conditions precedent are fulfilled:

(a) this agreement shall be executed and delivered by the parties hereto;

(b) no Default which has not otherwise been waived by the Lenders or Majority Lenders, as applicable, shall have occurred and be continuing or would arise upon this agreement becoming effective.

ARTICLE 4

MISCELLANEOUS

4.1 Future References to the Credit Agreement

On and after the date of this agreement, each reference in the Credit Agreement to "this agreement", "hereunder", "hereof", or words of similar meaning referring to the Credit Agreement, and each reference in any related document to the "Credit Agreement", "thereunder", "thereof", or words of similar meaning relating to the Credit Agreement, shall mean and be a reference to the Credit Agreement as amended hereby. The Credit Agreement, as amended hereby, is and shall continue to be in full force and effect and is hereby in all respects ratified and confirmed.

4.2 Governing Law

This agreement shall be governed by and construed in accordance with the laws of the Province of British Columbia and the laws of Canada applicable therein.

4.3 Enurement

This agreement shall enure to the benefit of and shall be binding upon the parties hereto and their respective successors and permitted assigns.

4.4 No Waiver

The execution, delivery and effectiveness of this agreement shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any Finance Document, nor constitute a waiver of any provision of any of the Finance Documents. On and after the effectiveness of this agreement, this agreement shall for all purposes constitute a Credit Document.

4.5 Conflict

If any provision of this agreement is inconsistent or conflicts with any provision of the Credit Agreement, the relevant provision of this agreement shall prevail and be paramount.

4.6 Counterparts

This agreement may be executed in original or pdf file copy or by other electronic means in one or more counterparts, each of which shall be deemed to be an original and all of which taken together shall be deemed to constitute one and the same instrument.

4.7 Representations and Warranties

The Borrower hereby represents and warrants that (a) no Default which has not otherwise been waived by the Lenders or Majority Lenders, as applicable, has occurred and is continuing as of the date hereof or would arise as a result of this agreement becoming effective; and (b) the representations and warranties set forth in Section 9.1 of the Credit Agreement are true and correct in all material respects as if made on the date hereof (except where such representation or warranty is stated to be made as of a particular date and, with respect to Material Project Documents numbered 6, 7, 9, and 10 in Schedule K, except as such Material Project Documents have expired in accordance with their terms).

4.8 Submission to Jurisdiction

Any legal action or proceeding with respect to this Agreement may be brought in the courts of the Province of British Columbia and, by execution and delivery of this Agreement, each of the parties hereby irrevocably accept and submit for themselves and in respect of their property, generally and unconditionally, the jurisdiction of the aforesaid courts. Furthermore, each party hereto hereby waives the right to any other jurisdiction to which it may be entitled by means of its present or future domicile.

[Remainder of page intentionally blank]

IN WITNESS WHEREOF the parties hereto have executed and delivered this agreement on the date first above written.

|

|

TERRONERA PRECIOUS METALS, S.A. DE C.V., as Borrower

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

Daniel Dickson

|

|

Title:

|

President

|

|

|

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

Elizabeth Senez

|

|

Title:

|

Treasurer

|

[Signature Page – Second Amending Agreement]

|

|

ING CAPITAL LLC, as Administrative Agent

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

|

|

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

[Signature Page – Second Amending Agreement]

|

|

ING BANK N.V., DUBLIN BRANCH, as Lender

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

|

|

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

[Signature Page – Second Amending Agreement]

|

|

SOCIÉTÉ GÉNÉRALE, as Lender

|

| |

| |

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

|

|

|

|

By:

|

|

|

Name:

|

|

|

Title:

|

|

[Signature Page – Second Amending Agreement]

EXHIBIT A

SCHEDULE K

MATERIAL PROJECT DOCUMENTS

REDACTED [material project documents redacted]

THIRD AMENDING AGREEMENT

THIS AGREEMENT made as of the 18th day of July, 2024.

BETWEEN:

ING CAPITAL LLC

(in its capacity as administrative agent of the Lenders, the "Administrative Agent")

and

ING BANK N.V., DUBLIN BRANCH and SOCIÉTÉ GÉNÉRALE

(collectively, the "Lenders")

and

TERRONERA PRECIOUS METALS, S.A. DE C.V.

(the "Borrower")

WHEREAS the Lenders have established certain credit facilities in favour of the Borrower pursuant to a credit agreement dated October 6, 2023 entered into between, inter alia, the Borrower, the Lenders and the Administrative Agent (as amended to the date hereof, the "Credit Agreement");

AND WHEREAS the parties hereto wish to further amend certain provisions of the Credit Agreement;

NOW THEREFORE in consideration of the mutual covenants and agreements contained in this agreement and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the Borrower, the Lenders and the Administrative Agent, the Borrower, the Lenders and the Administrative Agent covenant and agree as follows:

ARTICLE 1

DEFINED TERMS

1.1 Capitalized Terms

All capitalized terms which are used herein without being specifically defined herein shall have the meaning ascribed thereto in the Credit Agreement as amended hereby.

ARTICLE 2

AMENDMENTS

2.1 General Rule

Subject to the terms and conditions herein contained, the Credit Agreement is hereby amended to the extent necessary to give effect to the provisions of this agreement and to incorporate the provisions of this agreement into the Credit Agreement.

2.2 Amendments

(a) The definition of "Tranche Two PCOF Funding Date" in Section 1.1 of the Credit Agreement is hereby deleted and replaced with the following:

""Tranche Two PCOF Funding Date" means the date that is five (5) Banking Days following the date of the drawdown under Tranche Two of the Credit Facility which results, together with all other drawdowns under Tranche Two of the Credit Facility, in the aggregate amount advanced under Tranche Two of the Credit Facility exceeding $25,000,000."

(b) Section 10.3(b) of the Credit Agreement is hereby deleted in its entirety and replaced with the following:

"(b) Use of Proceeds. The Borrower shall apply all of the proceeds of the Credit Facility to (i) finance Project Costs in accordance with the Development Plan, and (ii) if and to the extent required, the Borrower shall apply proceeds of the initial drawdown of Tranche One, or the drawdown under Tranche Two which results, together with all other drawdowns under Tranche Two, in the aggregate amount advanced under Tranche Two exceeding $25,000,000, to top-up the Project Cost Overrun Funding by no later than the Tranche Two PCOF Funding Date, provided that, for certainty, the Borrower shall not be permitted to apply the proceeds of the Credit Facility to top-up the Project Cost Overrun Funding for amounts used to fund Project Cost Overruns. Neither the Sponsor nor its Subsidiaries nor their respective directors, officers, employees or agents, in each case, acting in their official capacity, shall, directly or indirectly, use the proceeds of the Credit Facility, or lend, contribute or otherwise make available such proceeds to any Person, (w) for the purpose of funding, financing or facilitating any activities, business or transaction of or with any Restricted Person or any Restricted Territory, (x) for the purpose of furthering an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any Person in violation of any AML Laws or Anti-Corruption Laws, (y) for any payments to any governmental official or employee, political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in violation of Anti-Corruption Laws or (z) in any other manner, in each case as will result in a violation or breach of any Sanctions by, or could result in the imposition of Sanctions against, any Person (including any Person participating in the transactions contemplated hereby, whether as underwriter, advisor, investor, lender, hedge provider, facility or security agent or otherwise)."

ARTICLE 3

CONDITIONS PRECEDENT TO EFFECTIVENESS OF AGREEMENT

3.1 Conditions Precedent

This agreement shall not become effective unless and until the following conditions precedent are fulfilled:

(a) this agreement shall be executed and delivered by the parties hereto;

(b) no Default which has not otherwise been waived by the Lenders or Majority Lenders, as applicable, shall have occurred and be continuing or would arise upon this agreement becoming effective.

ARTICLE 4

MISCELLANEOUS

4.1 Future References to the Credit Agreement

On and after the date of this agreement, each reference in the Credit Agreement to "this agreement", "hereunder", "hereof", or words of similar meaning referring to the Credit Agreement, and each reference in any related document to the "Credit Agreement", "thereunder", "thereof", or words of similar meaning relating to the Credit Agreement, shall mean and be a reference to the Credit Agreement as amended hereby. The Credit Agreement, as amended hereby, is and shall continue to be in full force and effect and is hereby in all respects ratified and confirmed.

4.2 Governing Law

This agreement shall be governed by and construed in accordance with the laws of the Province of British Columbia and the laws of Canada applicable therein.

4.3 Enurement

This agreement shall enure to the benefit of and shall be binding upon the parties hereto and their respective successors and permitted assigns.

4.4 No Waiver

The execution, delivery and effectiveness of this agreement shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any Finance Document, nor constitute a waiver of any provision of any of the Finance Documents. On and after the effectiveness of this agreement, this agreement shall for all purposes constitute a Credit Document.

4.5 Conflict

If any provision of this agreement is inconsistent or conflicts with any provision of the Credit Agreement, the relevant provision of this agreement shall prevail and be paramount.

4.6 Counterparts

This agreement may be executed in original or pdf file copy or by other electronic means in one or more counterparts, each of which shall be deemed to be an original and all of which taken together shall be deemed to constitute one and the same instrument.

4.7 Representations and Warranties

The Borrower hereby represents and warrants that (a) no Default which has not otherwise been waived by the Lenders or Majority Lenders, as applicable, has occurred and is continuing as of the date hereof or would arise as a result of this agreement becoming effective; and (b) the representations and warranties set forth in Section 9.1 of the Credit Agreement are true and correct in all material respects as if made on the date hereof, except: (i) to the extent that such representations and warranties refer specifically to an earlier date, in which case such representations and warranties shall have been true and correct as of such earlier date; (ii) with respect to Material Project Documents numbered 6 and 9 in Schedule K of the Credit Agreement, as such Material Project Documents have expired in accordance with their terms; (iii) the last sentence of Section 9.1(s) of the Credit Agreement as it relates to that certain REDACTED [commercially sensitive information redacted].

4.8 Submission to Jurisdiction

Any legal action or proceeding with respect to this Agreement may be brought in the courts of the Province of British Columbia and, by execution and delivery of this Agreement, each of the parties hereby irrevocably accept and submit for themselves and in respect of their property, generally and unconditionally, the jurisdiction of the aforesaid courts. Furthermore, each party hereto hereby waives the right to any other jurisdiction to which it may be entitled by means of its present or future domicile.

[Remainder of page intentionally blank]

IN WITNESS WHEREOF the parties hereto have executed and delivered this agreement on the date first above written.

|

|

TERRONERA PRECIOUS METALS, S.A. DE C.V., as Borrower

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

Elizabeth Senez

|

|

Title:

|

Treasurer

|

|

|

|

|

By:

|

|

|

Name:

|

|

|

Title:

|

|

[Signature Page – Third Amending Agreement]

|

|

ING CAPITAL LLC, as Administrative Agent

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

|

|

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

[Signature Page – Third Amending Agreement]

|

|

ING BANK N.V., DUBLIN BRANCH, as Lender

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

|

|

|

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

[Signature Page – Third Amending Agreement]

|

|

SOCIÉTÉ GÉNÉRALE, as Lender

|

| |

| |

|

By:

|

REDACTED [signature redacted]

|

|

Name:

|

REDACTED [name redacted]

|

|

Title:

|

REDACTED [title redacted]

|

|

|

|

|

By:

|

|

|

Name:

|

|

|

Title:

|

|

[Signature Page – Third Amending Agreement]

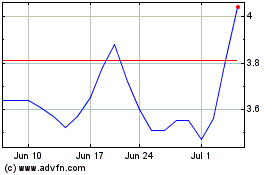

Endeavour Silver (NYSE:EXK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Endeavour Silver (NYSE:EXK)

Historical Stock Chart

From Dec 2023 to Dec 2024