false 0001708035 0001708035 2023-11-28 2023-11-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 28, 2023

Ecovyst Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-38221

|

|

|

| Delaware |

|

81-3406833 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 300 Lindenwood Drive Malvern, Pennsylvania |

|

19355 |

| (Address of principal executive offices) |

|

(Zip Code) |

(484) 617-1200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading symbol |

|

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

ECVT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

On November 28, 2023, Ecovyst Inc. will host an Investor Day. A copy of the presentation to be displayed during the Investor Day is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K (including the exhibits attached hereto) shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K (including the exhibits attached hereto) shall not be deemed incorporated by reference into any filing or other document under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing or document.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: November 28, 2023 |

|

Ecovyst Inc. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Joseph S. Koscinski |

|

|

|

|

Name: |

|

Joseph S. Koscinski |

|

|

|

|

Title: |

|

Vice President, Chief Administrative Officer, General Counsel and Secretary |

EXHIBIT 99.1 November 28, 2023

Legal Discussion Continuing Operations Financial results are presented

on a continuing operations basis, which excludes the Performance Materials business and Performance Chemicals business unless otherwise indicated. Forward-Looking Statements Some of the information contained in this presentation, the conference call

during which this presentation is reviewed and any discussions that follow constitutes “forward-looking statements.” Forward-looking statements can be identified by words such as “anticipates,” “intends,”

“plans,” “seeks,” “believes,” “estimates,” “expects,” “projects” and similar references to future periods. Forward-looking statements are based on our current expectations and

assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict.

Examples of forward looking statements include, but are not limited to, our future results of operations, financial condition, liquidity, prospects, growth, goals, strategies, capital allocation programs (including our share repurchase program),

product and service offerings, and expected end use demand trends and 2023-2028 financial goals. Our actual results may differ materially from those contemplated by the forward-looking statements. We caution you, therefore, against relying on any of

these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements

include, but are not limited to, regional, national or global political, economic, business, competitive, market and regulatory conditions, including tariffs and trade disputes, currency exchange rates, effects of inflation, and other factors,

including those described in the sections titled “Risk Factors” and “Management’s Discussion & Analysis of Financial Condition and Results of Operations” in our filings with the SEC, which are available on the

SEC’s website at www.sec.gov. Any forward-looking statement made by us in this presentation, the conference call during which this presentation is reviewed and any discussions that follow speaks only as of the date on which it is made. Factors

or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to update any forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by applicable law. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, including adjusted EBITDA, Organic Adjusted EBITDA margin, adjusted free cash

flow, net debt leverage ratio, return on average net tangible assets, and cash conversion, which are provided to assist in an understanding of our business and its performance. These non-GAAP financial measures should be considered only as

supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Non-GAAP financial measures should be read only in conjunction with consolidated financials prepared in accordance with GAAP. Reconciliations of non-GAAP

measures to the relevant GAAP measures are provided in the appendix of this presentation. In reliance upon the unreasonable efforts exemption provided under Item 10(e)(1)(i)(B) of Regulation S-K, the Company is not able to provide a reconciliation

of the Company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain

non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow,

due to the uncertainty and variability of the nature and amount of these future charges and costs. Because this information is uncertain, the Company is unable to address the probable significance of the unavailable information, which could be

material to future results. 2

Agenda 9:00am–9:05am Gene Shiels, Director of Investor Relations

Introduction and FLS 9:05am – 9:25am Kurt Bitting, Chief Executive Officer Strategy Update Colleen Donofrio, VP, Environment 9:25am – 9:35am Sustainability Framework & Sustainability 9:35am – 10:00am George L. Vann, President,

Ecoservices Ecoservices Overview 10:00am – 10:10am Break Advanced Materials & Paul Whittleston, President, 10:10am – 10:35am Advanced Materials & Catalysts Catalysts Overview Financial Overview and 10:35am – 10:50am Mike

Feehan, Chief Financial Officer Long-Term Targets 10:50am – 11:30am All Speakers Q&A 3

Kurt Bitting, CEO More than 25 years of experience Originally joined the

company in 2006, serving in Ecoservices, at the time a division of Rhodia, as Sulfur Products Manager, Business Director and Vice President Played a key role in Ecoservices’ divestiture from Solvay and eventual merger with PQ Corp Appointed

President, Ecoservices in 2019 Promoted to Chief Executive Officer in April 2022 4

Strategy Update Kurt Bitting Chief Executive Officer 5

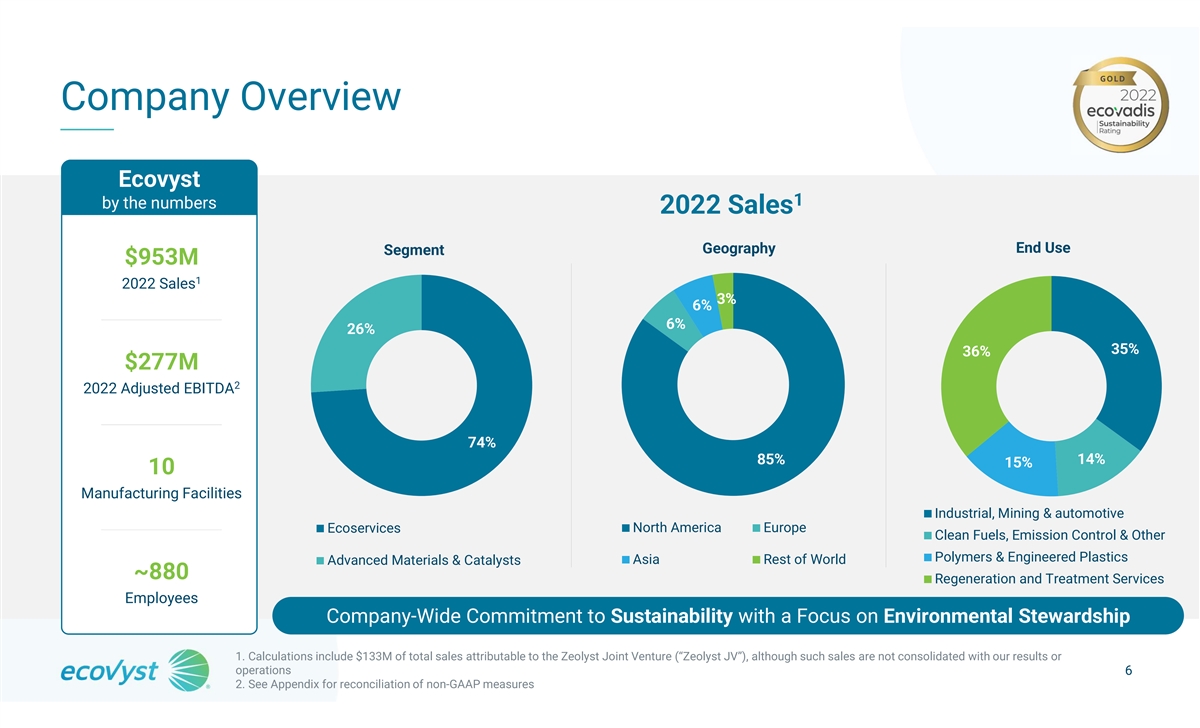

Company Overview E Ec co ov vy ys st t 1 b by y t th he e n nu um mb be

er rs s 2022 Sales Geography End Use Segment $953M 1 2022 Sales 3% 6% 6% 26% 35% 36% $277M 2 2022 Adjusted EBITDA 74% 14% 85% 15% 10 Manufacturing Facilities Industrial, Mining & automotive Ecoservices North America Europe Clean Fuels, Emission

Control & Other Polymers & Engineered Plastics Asia Rest of World Advanced Materials & Catalysts ~880 Regeneration and Treatment Services Employees Company-Wide Commitment to Sustainability with a Focus on Environmental Stewardship 1.

Calculations include $133M of total sales attributable to the Zeolyst Joint Venture (“Zeolyst JV”), although such sales are not consolidated with our results or operations 6 2. See Appendix for reconciliation of non-GAAP

measures

2018-2022 Historical Financial Performance 1 Sales 6% 9% CAGR 2 Adjusted

EBITDA CAGR Chart Title Adjusted 2 EBITDA $953 6% CAGR ~30% $743 2 Adjusted EBITDA Margins $703 $684 $625 ~70% 2,3 Cash Conversion $277 $240 $228 $218 $193 ~24 Million Shares Repurchased 2018 2019 2020 2021 2022 since April 2022 Sales ($M) Adj.

EBITDA ($M) 1. Includes 50% share of sales from Zeolyst Joint Venture 2. See Appendix for reconciliation of non-GAAP measures 7 3. Cash conversion % = (Adjusted EBITDA – CapEx) / (Adjusted EBITDA)

Advanced Materials & Catalysts Formerly Catalyst Technologies Silica

Catalysts for HDPE Global Leadership Hydrocracking Catalysts Renewable Fuels Materials Key Supplier of Essential Products And Services Ecoservices Regeneration for North American Refining, Supplying Leading Refineries #1 Supplier Largest Producer in

North of Merchant Sulfuric Acid America Regen and Virgin Acid Leader in Catalyst Activation Technologies 8

Core material science expertise highly aligned with decarbonization

technologies Established solutions in sustainable segments with large growth potential Competitive Advantages Drive Longstanding, sticky relationships with high barriers to entry Value Proposition Favorable industry structures that protect margins

and balance sheet Unrivaled supply infrastructure and manufacturing networks 9

Decades of History, Adapting to Solve the Problems of the Future New

Management Team Catalyst Chem32 Pioneered Regeneration Products Focused on Executing Process Launched IPO Acquisition Growth Strategy 2023 & 2021 1880s – 1890s 1950s–1980s 1988 2020-2021 Beyond 1943 1980 2017 2021 2022 Strengthen

Core First Sulfuric Acid Plant Build out of Zeolyst Joint Divestiture of Potters Transition to Business and Invest in and Beginning of Oldest Ecoservices Plant Venture Formed and PQ Businesses Ecovyst Emerging Technologies Customer Relationship

Network 10

Strategy for Creating Shareholder Value Strengthen Leading Positions in

Core Segments Regeneration Hydrocracking • Maximize production capabilities and reliability via digitization, Treatment Services AI, and efficiency gains Emissions Controls • Deliver strong margins and cash generation through commercial

excellence Capture Share in Industrial Segments Polyethylene Virgin Acid • Growth through capacity expansion and debottlenecking Custom & Chemical Catalysts • Leverage technology and service advantages to capture share Accelerate

Growth in Emerging Sustainable and Low Carbon Segments Renewable Fuels Functional Silica/Enzymes • Drive innovation through material science expertise Advanced Plastics Recycling • Commercialize new products through deep customer

relationships Activation and Services Carbon Capture • Expand capacity and technology via organic and inorganic investments Sustain an industry-leading safe and responsible workplace 11

Enabling Customers to Solve Complex, Everyday Challenges I N D U S T R

I A L G R O W T H C O R E G R O W T H E M E R G I N G G R O W T H Virgin Acid Zeolites Advanced Silicas Advanced Silicas Plastics Circularity CO Capture Immobilized Enzymes Piping, Building Materials, 2 Apparel, Automotive Virgin Acid Mining

(copper) Advanced Silicas Films, Packaging, HDPE Zeolites Renewable Diesel, SAF Waste Treatment Chem32 Catalyst Activation for Conventional and Renewable Fuels Zeolites Zeolites Renewable Diesel Hydrocracking, Emission Control EV Charging Station EV

Chem32 Catalyst Activation Virgin Sulfuric Acid Acid Regeneration Alkylate Production Lead Acid Batteries, Ethanol Production, 12 Mining (copper, borates, lithium)

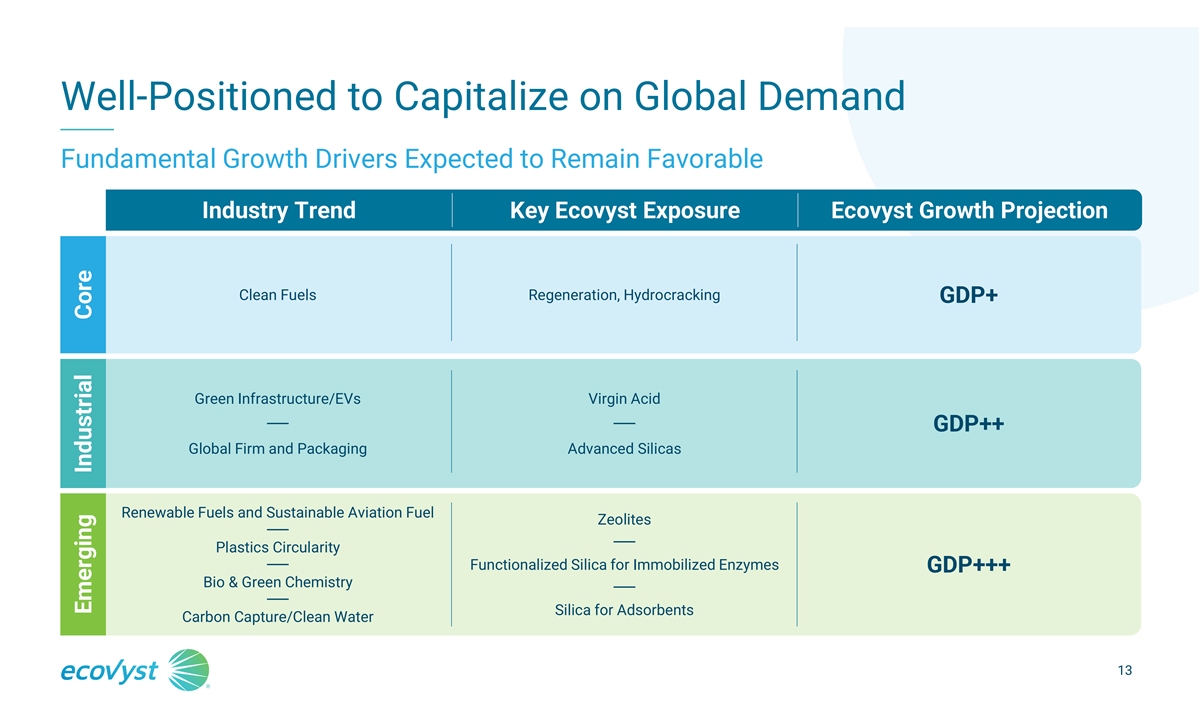

Well-Positioned to Capitalize on Global Demand Fundamental Growth

Drivers Expected to Remain Favorable Industry Trend Key Ecovyst Exposure Ecovyst Growth Projection Clean Fuels Regeneration, Hydrocracking GDP+ Green Infrastructure/EVs Virgin Acid GDP++ Global Firm and Packaging Advanced Silicas Renewable Fuels and

Sustainable Aviation Fuel Zeolites Plastics Circularity Functionalized Silica for Immobilized Enzymes GDP+++ Bio & Green Chemistry Silica for Adsorbents Carbon Capture/Clean Water 13 Emerging Industrial Core

Balanced Growth from Emerging and Leadership Segments 45% Emerging +

Industrial 38% Emerging + Industrial Each Growth Tier Delivers ~1/3 of Sales Growth Attractive Organic Growth, Best-in-Class Compounding Shareholder Returns Margins, Strong Cash Generation 14

Ecoservices $603 Million $206 Million September 2023 TTM September 2023

1 Segment Adjusted TTM Sales 1 EBITDA Regeneration Services Catalyst Activation Virgin Sulfuric Acid Treatment Services Regeneration services for Oleum Hazardous and non- refinery alkylation Hydro-processing hazardous waste High strength for mining

minerals and metals production Renewable fuel production Electrolyte grades (for water treatment, semiconductors, and lead acid batteries) 1. See Appendix for Reconciliation of non-GAAP measures 15 Applications

Ecoservices Growth Drivers Expected Growth Driven by a Changing and

Charging World Rates 2022-2028 1 Gasoline Exports : Favorable alkylate demand +800 KBPD for high-octane fuels Regeneration +1300 KBPD by 2040 Services 1 Refinery Utilization : High industry utilization 92% Electrification and growing 2 Copper

Production : Virgin Favorable needs for industrial +3% Sulfuric Acid applications (mining, nylon) Industry Structure Growing demand for ex-situ 3 Catalyst Activation : activation in both traditional +17% Activation and renewable fuels $19B: North

Treatment Debottlenecking providing for American Chemical further growth opportunities Services 4 Expansions by 2025 1. 2023 EIA Annual Energy Outlook. KBPD = thousands of barrels per day. 2. Bloomberg, Refined Copper Demand from traditional versus

energy transition sectors 16 3. Management Estimate 4. American Chemistry Council - Chemistry Outlook June 2023

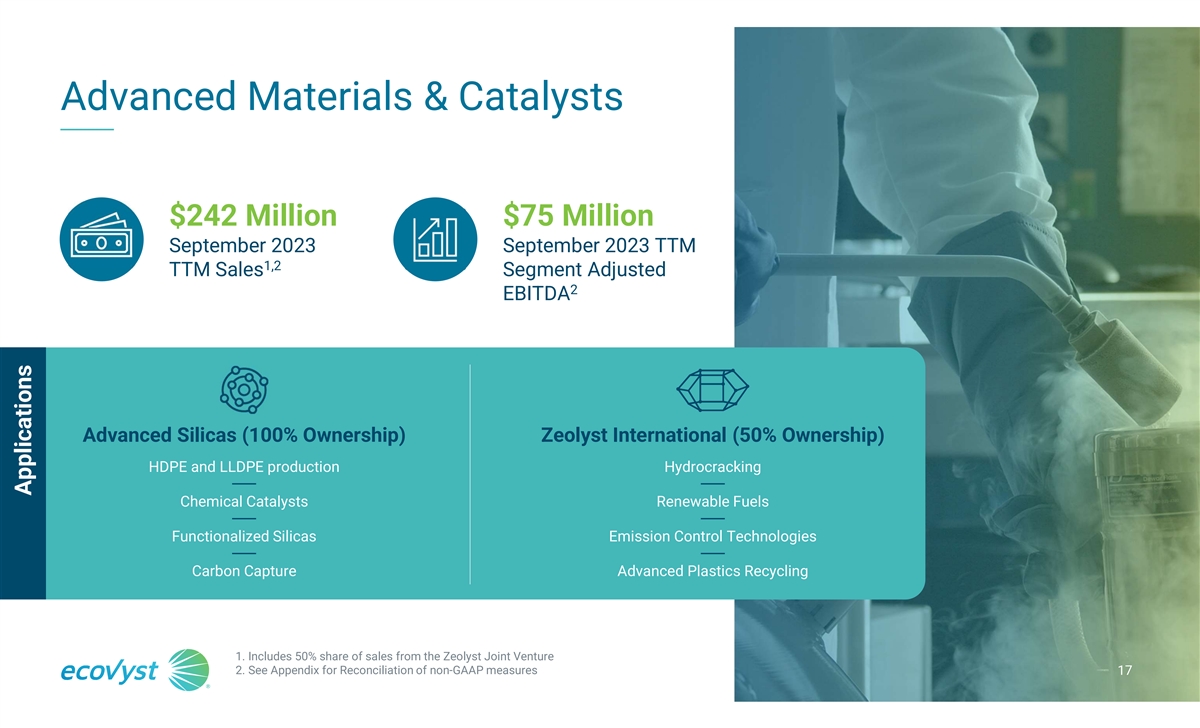

Advanced Materials & Catalysts $242 Million $75 Million September

2023 September 2023 TTM 1,2 TTM Sales Segment Adjusted 2 EBITDA Advanced Silicas (100% Ownership) Zeolyst International (50% Ownership) HDPE and LLDPE production Hydrocracking Chemical Catalysts Renewable Fuels Functionalized Silicas Emission

Control Technologies Carbon Capture Advanced Plastics Recycling 1. Includes 50% share of sales from the Zeolyst Joint Venture 2. See Appendix for Reconciliation of non-GAAP measures 17 Applications

Advanced Materials and Catalysts Growth Drivers Global Sustainability

Initiatives Boosting Growth Expected CAGR 2022-2028 Polyethylene Strengthening and Light Weighting of Materials 1 Polyethylene +3% A Ad dv va an nc ce ed d Bio-Catalysts and Green Chemistry S Si il li ic ca as s 2 CO Capture 2 Carbon Capture +25%

Renewable Diesel and 3 SAF Production Decarbonization of Heavy Duty and Air Transport +27% Z Ze eo ol ly ys st t I In nt te er rn na at ti io on na al l 4 Plastics Circularity Advanced Plastics Recycling +25% 1. Chemical Market Analysis by OPS April

23 2. Bloomberg NEF, Global Carbon Capture to Rise Six Fold 18 3. Bloomberg Renewable Fuels Announced Capacity Database Oct 23 4. Bloomberg NEF and Management Estimates

Vision for Long-Term Sustainable Growth Sustainability- Share Gain

Capital-Efficient Opportunistic Driven Innovation Opportunities Expansion Inorganic Growth Materials science Asymmetric win rate Capacity expansions Adjacent and sensible expertise enables with leading and debottlenecking bolt-on opportunities

sustainable solutions producers Leverage development Deliver attractive Technology-enabled Increase scale and and rapid margins via value- reliability and technical capabilities commercialization based pricing efficiency gains capabilities

19

Flat operational hierarchy with strong focus on developing lasting

customer relationships Culture of Purpose is Empowered employees are driven to Driving Success execute with speed and efficiency High number of customer touchpoints leading to meaningful partnerships and innovative solutions 20

Committed to Implementing the Ecovyst Strategy and Creating Value for

Shareholders Kurt Bitting Mike Feehan George L. Vann Paul Whittleston Chief Executive Officer Chief Financial Officer President, Ecoservices President, Advanced 25 Years of Experience Materials & Catalysts 25 Years of Experience 30+ Years of

Experience 30 Years of Experience ALSO IN ATTENDANCE: Board Chair Kevin Fogarty Board Members David Bradley Sean Dineen Colleen Donofrio Joseph S. Koscinski Vice President, Strategy Vice President, Environment Chief Administrative Officer, Vice Anna

Catalano and Business Development & Sustainability President, Secretary & General Counsel 25+ Years of Experience 35+ Years of Experience 25+ Years of Experience 21

Products and technology already capitalizing on global sustainability

trends Industry leadership positions provide durable competitive advantages Attractive Investment Attractive and stable margins Case Driven by Profitable Growth Strong free cash flow generation Ability to reinvest earnings into business, funding

strong organic growth opportunities Balanced capital allocation strategy 22

Sustainability Colleen Grace Donofrio VP, Environment &

Sustainability 23

Focusing on Sustainability Internally & Externally Through our

Operations and Products Spent Sulfuric Acid Regeneration R&D Investment in Sustainability 2015: 60% 2022: 83% • Recycles 1.5M tons of spent acid each year • Provides steam to reduce carbon footprint Advanced Silicas & Supports

– Alpha™ • Processes for heat, steam, and electricity • Adsorb contaminants in produced water from oil and generation could power ~11,000 homes per year gas production • Carbon capture Treatment Services (TS) •

Immobilize enzymes for bio-catalysis • Accepts customers high heat value waste • Capture and recover metals from waste streams Virgin Acid Production Zeolites – Opal™ • Supports electrification end uses • Decrease

energy intensity of plastics recycling • Support sustainable aviation fuel (SAF) production Catalyst Activation • Supports renewable diesel production • Foster NOx emissions abatement for diesel vehicles Inorganic Solutions

24

Inaugural Ecovyst Environmental Initiative Award for the Most Impactful

Climate Change Reduction Project 2021-2022 Baton Rouge furnace optimization project: Addition of temperature and oxygen controls to reduce natural gas consumption I In nt te er rn na all S Su us st ta aiin na ab biilliit ty y Automation driven

optimizations in natural gas usage t th hr ro ou ug gh h O Op pe er ra at tiio on ns s exceeded our target by over 20% in the first year 2 20 02 21 1- -2 20 02 22 2 F Fu ur rn na ac ce e O Op pt tiim miiz za at tiio on n P Pr ro ojje ec ct t

Deployed at another Baton Rouge furnace and the Dominguez furnace Plans for the remaining Ecoservices acid plants by 2028 25

External Sustainability though Products: R&D Collaborations &

Innovative Products Drive Sustainability Demand Stemming from Waste Oil & Fats Customers and the Environment Bio-Oils • Decarbonization requires transitioning to cleaner fuels Hydro-deoxygenation Zeolites Meet the Demand Hydrocracking

• Improve fuel properties to meet regulatorily-set fuel specifications Dewaxing • Contribute to meeting US challenges and Dewaxing proposed EU mandates Sustainable Fuels Our Zeolites and Catalysts for SAF and Renewable Diesel for

Aviation & Heavy production are used at over 15 customer locations with more than 30 additional customer projects in the pipeline Trucking 26

Award-Winning Sustainability Program *Insert Gold 2022 EcoVadis Logo*

2022 EcoVadis 2022 American Chemistry Council 2022-2023 Transportation Product Gold Sustainability Rating Certificates of Excellence Stewardship & Safe Handling & Achievement Daily commitment to safety beyond our facility borders & a

testament Achievements in environmental, Recognition of safety, culture, and to Ecovyst’s safety culture labor & human rights, ethics and results sustainable procurement BNSF Product Stewardship Canadian National Safe Handling Excellence 7

U.S. Sites 2022 Gold Rating Union Pacific Pinnacle Safety Award Top 3% in our peer group Achievement 2 U.S. Sites 9,222 Incident-free Shipments in 2022 >99.9% Our Sustainable Program Aligns With Recognized Standards Sustainability Accounting

Global Reporting Initiative UN Sustainable Development Standards Board (SASB) (GRI) Standards Goals (SDGs) 27

Innovating for a Sustainable Future 2025 2030 Achieve ~10% reduction

Implement a network-wide in natural gas usage or obtain FUEL USAGE Reduction of natural gas optimization plan equivalent offsets ~66,000 mt CO 2 Emissions Achieve 75-80% of Equivalent of Achieve of electricity 65-70% electricity usage from ~16,000

Cars usage from on-site generation and/or POWER USAGE on-site generation and/or renewable energy by EOY renewable energy Achieve Perfect HEALTH, SAFETY Achieve Perfect Days within Days within each business each business segment of ≥ 92% &

ENVIRONMENT segment of ≥ 95% Standardize tracking of all community COMMUNITY Target 1,800 hours engagement activities & permit all employees of volunteer time per year ENGAGEMENT to take up to 8 hrs/yr paid volunteer leave 28

Sustainability Goals

Ecoservices Overview George L. Vann, Jr President, Ecoservices

29

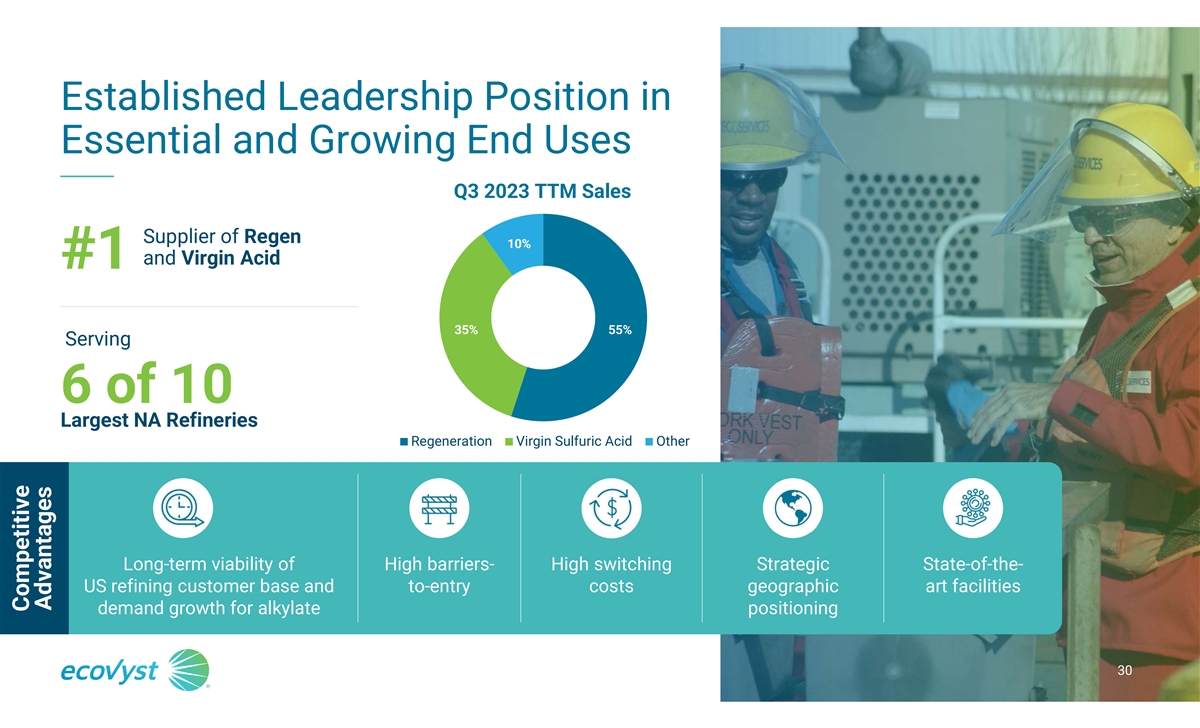

Established Leadership Position in Essential and Growing End Uses Q3

2023 TTM Sales Supplier of Regen 10% and Virgin Acid #1 35% 55% Serving 6 of 10 Largest NA Refineries Regeneration Virgin Sulfuric Acid Other Long-term viability of High barriers- High switching Strategic State-of-the- US refining customer base and

to-entry costs geographic art facilities demand growth for alkylate positioning 30 Competitive Advantages

INDUSTRIAL EMERGING Diverse, Industry-Leading Business Units 01 02

VIRGIN SULFURIC ACID REGENERATION SERVICES & SULFUR PRODUCTS • Regeneration services for Refinery • North American leading producer Alkylation Units (virgin acid) • Chemical spent regeneration • Oleum • Industry

leader • Electrolyte grades • 35% expansion of Gulf Coast • Dilute Acid capacity since 2016 • Sulfur Co-Products TREATMENT SERVICES CATALYST ACTIVATION • Converts waste into energy • Leading Ex-Situ Catalyst

• Hazardous/Non-Hazardous Activation provider • Primarily Gulf Coast • Hydro-processing/Renewable fuels • Additional services include air stabilization and cracked feed tolerance 04 03 31 CORE CORE

Network Agility Provides Competitive Advantage Service provider model

designed to drive higher margins BARGE RAIL PIPELINE TRUCK 26% 24% 30% 20% UNRIVALED SUPPLY INFRASTRUCTURE Hammond, IN Martinez, CA Managing end to end supply chain & customer inventories Production redundancy in key refining Dominguez, CA

locations enables the highest degree of reliability >65% Of alky capacity located in West Coast and Gulf FAVORABLE CUSTOMER Coast regions Baytown, TX POSITIONS Plant Sites Long-term contracts with cost pass-through Baton Rouge, LA Houston, TX Key

Customer Chem32 Typically, majority share of supply for customers Orange, TX Locations Take-or-pay and capacity reservation fees 32

Operational Excellence and Enhanced Reliability Expected to increase

Operational Efficiency >10% by 2028 Automation of Sites to Strategic Initiatives Improve Operating Efficiency Expected capacity increase >70kt by 2028, for Organic Growth with improved on-stream time Expansion of Catalyst Activation Production

Capability Expected to double catalyst activation capacity by 2027 33

Tightening Regulations Driving Global Alkylate Demand 1 Spread Between

Retail Premium and Regular Gasoline Regular Premium 12-13% alkylate 40-45% alkylate Gasoline content p/g gasoline Gasoline content p/g gasoline $0.60 $0.40 10.5% $0.20 3 7.5% CAGR $- 2010-2020 Increase in smaller engines (4- Expanding and

strengthening US Exports of cylinder/turbo charged) which supply chain operations to Finished Motor require premium gasoline maintain logistics advantage Gasoline 1 Premium Gasoline % of Total Gasoline Pool 15.0% Alkylate is the most desirable

blending component because it increases 10.0% octane while keeping other clean fuel parameters in specification 5.0% FCC/Coker Butane/ Naphtha Alkylate Reformate Ethanol 0.0% Naphtha Butene Isomerate 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

2020 2021 Olefins - - 2 Alkylate Economics (cts/gal) Aromatics 600 RON/MON 400 200 Octane - - - - 0 Sulfur - - Vapor Pressure Iso Butane Price Butane Price Alkylate Price Gross Margin on Alkylate 1. EIA 2. Bloomberg 34 3. LMC

Regeneration Services Mirrors Industrial Gas Business Model Strategic

Sulfuric Acid How We Win Growth Drivers Initiatives Impact A catalyst used in the Reliability improves on-stream Pricing increases Operational production of Alkylate, a high-value, time delivering Excellence and gasoline-blending component >10%

volume increase Enhanced Reliability Opportunities for spot Automation business based on Expansion of logistics component component component constrained assets at capability enable capture of other suppliers customer’s additional volume

Growth Through 4.4M Major Refinery Customer Barrels of sulfuric acid we regenerate annually Ecoservices Capital plan to upgrade major Additional volume based equipment, increasing on customers’ expansions Price & operational efficiency

Customer Expansions 35

Sulfuric Acid Product Electrolyte High Strength Oleum Industries Nylon

Industrial Mining Intermediates End Use Virgin Sulfuric Acid Serves Growing, Diverse Industries • Pet Chem and Chemical • Electrification • Vehicle lightweighting • Lead Acid Batteries • Construction / Infrastructure

• Construction • Water Treatment • Personal Devices • Coatings and Packaging • Semiconductors Ecoservices Advantages High purity acid is used for Lead High strength acid is used Largest producer of Oleum, Acid

Batteries, water treatment, in mining applications for copper a super saturated sulfuric and other growing industrial leaching and borate production acid primarily used for segments including pet chem (electric vehicles, tech devices, Nylon

production and semiconductors and construction) 36

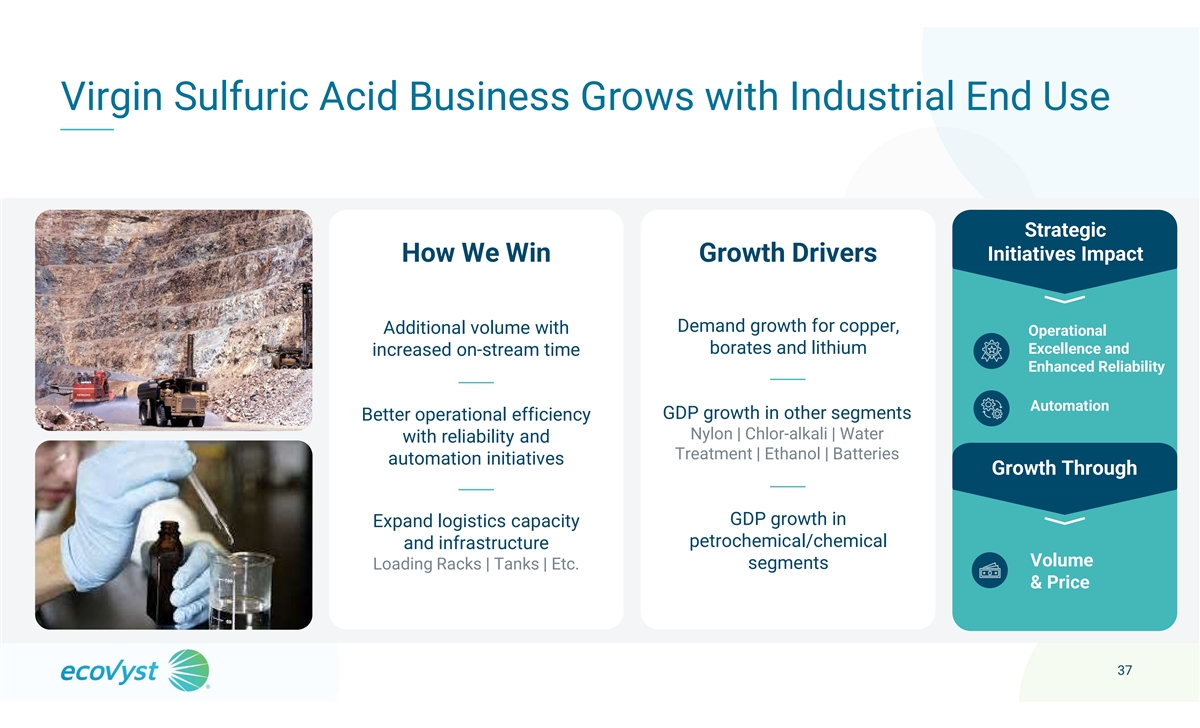

Virgin Sulfuric Acid Business Grows with Industrial End Use Strategic

Initiatives Impact How We Win Growth Drivers Demand growth for copper, Additional volume with Operational borates and lithium Excellence and increased on-stream time Enhanced Reliability Automation GDP growth in other segments Better operational

efficiency Nylon | Chlor-alkali | Water with reliability and Treatment | Ethanol | Batteries automation initiatives Growth Through GDP growth in Expand logistics capacity petrochemical/chemical and infrastructure Volume segments Loading Racks |

Tanks | Etc. & Price 37

Catalyst Activation Serves Growing Renewable Segment Global Renewable

Fuels International 1 Hydroprocessing Sites Renewable Fuels 140 Benefits Leverage Our Refining Relationships 120 and Sulfur Knowhow 100 80 Sites require new 60 Enables Refineries to Outsource catalysts every Difficult Task of Sulfiding 12-18 40

months Demand Quicker Reactor Startups 20 Drivers Growth in Renewables 0 2018 2022 2026F 2030F Cleaner Fuels - Hydroprocessing 1. Bloomberg 38

Catalyst Activation Expanding in High-Growth Segment Fuels Performance

Strategic Initiatives Impact How We Win Growth Drivers Operational Expansion of reactor capacity Increasing demand for Excellence and to meet customer demand catalysts for renewable fuels Enhanced Reliability Automation Reliability improves

on-stream Continued outsourcing time delivering >10% increased of catalyst activation Expansion volume on existing assets Growth Through Expand customer base to end Gain new business as more users and gain new customers refineries look to

outsource catalyst activation Volume & Price 39

Treatment Services is the Go-To Solution for Chemical Waste Management

Strategic Leader in the treatment of unique chemical waste 1 Demand Drivers Initiatives Impact Consumer spending Capability to dispose of hard-to-handle materials 2 Housing | Construction Benefits component Packaging | Hygiene Operational Repurposes

hazardous waste that otherwise could Preferable to other waste Excellence and 3 go to deep well injection Enhanced Reliability treatment drivers Automation Growth component Opportunities Revenue growth of >50% last several years Growth Through

Only permitted NA producer that processes hazardous wastes, providing for additional opportunities Forecasted growth continues of more than Volume Growing chemical & Price 10% over next five years production in Gulf Coast will increase waste

generated 40

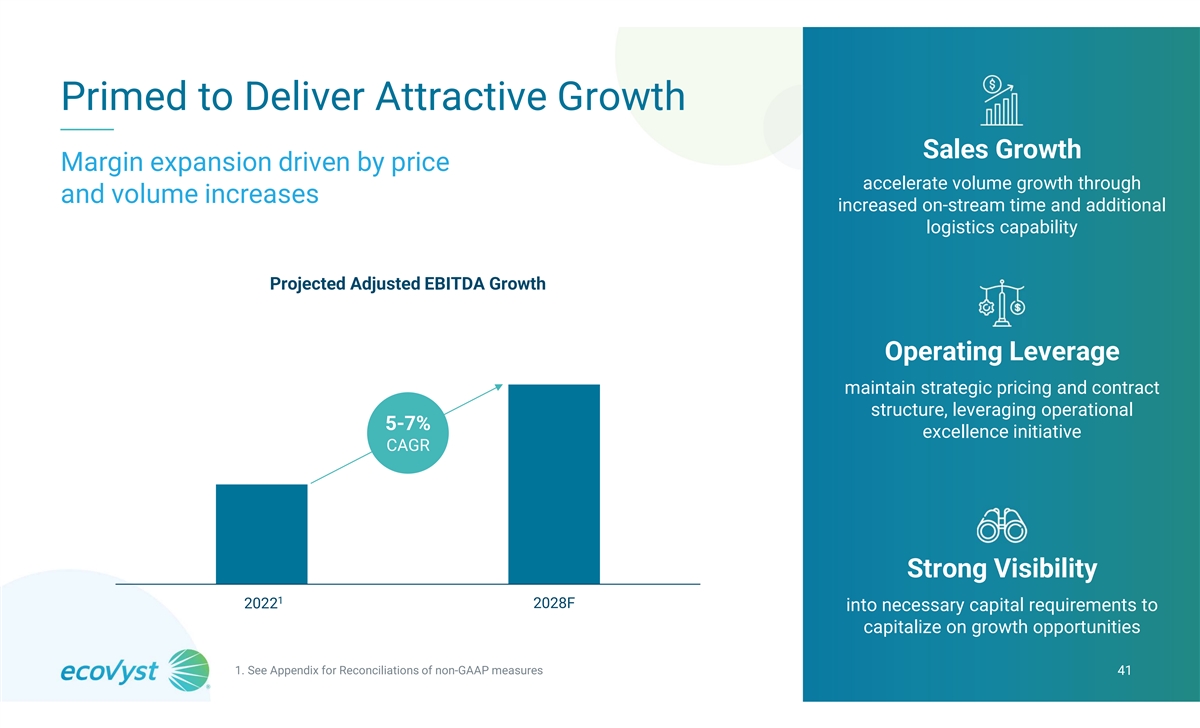

Primed to Deliver Attractive Growth Sales Growth Margin expansion

driven by price accelerate volume growth through and volume increases increased on-stream time and additional logistics capability Projected Adjusted EBITDA Growth Operating Leverage maintain strategic pricing and contract structure, leveraging

operational 5-7% excellence initiative CAGR Strong Visibility 1 2022 2028F 2022 into necessary capital requirements to capitalize on growth opportunities 1. See Appendix for Reconciliations of non-GAAP measures 41

Strong Performance Across Business Segments Continued Growth in Markets

Served Key Takeaways Strategic Initiatives Enable Our Growth Plan 42

43

Advanced Materials & Catalysts Paul Whittleston President, Advanced

Materials & Catalysts 44

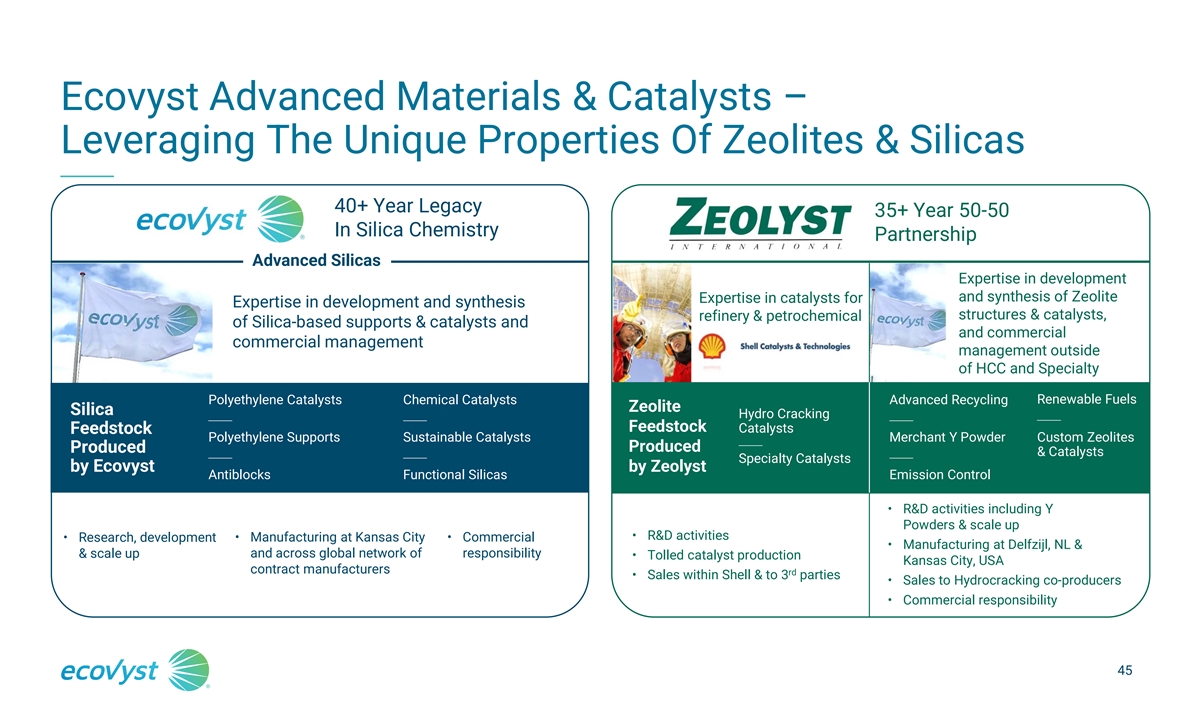

Ecovyst Advanced Materials & Catalysts – Leveraging The

Unique Properties Of Zeolites & Silicas 40+ Year Legacy 35+ Year 50-50 In Silica Chemistry Partnership Advanced Silicas Expertise in development and synthesis of Zeolite Expertise in catalysts for Expertise in development and synthesis

structures & catalysts, refinery & petrochemical of Silica-based supports & catalysts and and commercial commercial management management outside of HCC and Specialty Polyethylene Catalysts Chemical Catalysts Advanced Recycling Renewable

Fuels Zeolite Silica Hydro Cracking Feedstock Catalysts Feedstock Polyethylene Supports Sustainable Catalysts Merchant Y Powder Custom Zeolites Produced Produced & Catalysts Specialty Catalysts by Ecovyst by Zeolyst Antiblocks Functional Silicas

Emission Control • R&D activities including Y Powders & scale up • R&D activities • Manufacturing at Kansas City • Commercial • Research, development • Manufacturing at Delfzijl, NL & & scale

up and across global network of responsibility • Tolled catalyst production Kansas City, USA contract manufacturers rd • Sales within Shell & to 3 parties • Sales to Hydrocracking co-producers • Commercial responsibility

45

Deep Materials Science & Complex Manufacturing Process Know-How

Advanced Silica Zeolyst Simple Materials, High Complexity Processes Porous Materials, High Complexity Processes Heat Aggregate Process Form Mixing Crystallization Process Crystalline Water glass Amorphous Silica Aggregated Formed Silica Gel

Structure Zeolite Silica building block Silica Silica Alumina Formulation Formation Crystals (Sand) Many Different Forms of Silicas From Ecovyst Many Different Types of Zeolites From Ecovyst FAU BEA MOR MFI FER Types ES EP MS Granular

BeadsExtrudates Types Y Powder Beta Mordenite ZSM-5 Ferrierite Shape Pores 46

New Name Reflects Our Competencies, Heritage And Future Our Core

Competencies Our Legacy & Heart Our Competency & Future Deep R&D expertise in Silica 35-year+ partnership for Zeolite- and Zeolite materials based catalysts 40+ years Silica Analytical processing technologies catalysts & additives

for Polyethylene Our Legacy Rapidly develop and & Heart and scale new technologies Flexible manufacturing assets Our core ability to We create value for our customers modify materials using science to through the development and sale create

products with significantly Advanced Materials of catalysts and supports that different functionality & higher & Catalysts enable catalyzed reactions value is differentiating 47

Launching New Product Branding Alongside New Name Business Unit

Advanced Materials & Catalysts Advanced Silicas Zeolyst International® Sub-Business Unit TM TM Alpha Opal Brand TM TM Alpha carries the concept of Opal carries the concepts of specialty leadership and being first products, purity and high

value Polyethylene Catalysts Sustainable Fuels Advanced Recycling Polyethylene Supports Emission Control Application & Anti-blocking Silicas Product Focus Custom Zeolites Chemical / Bio-Catalysts & Supports Hydrocracking & MACH

Functionalized Silicas Oparis™, Zataris™, & ATA 48

Customized Solutions From Lab To Commercial With Speed & Quality

Customer Need Laboratory Scale (Grams) Ecovyst and customer team define Bench scale equipment used to problem & potential solution develop concept and prepare first solutions 1 2 Continuous Innovation Commercialization (Tons) Pilot Plant

(Kilograms) Process Commercialization plants mirror Stage Gate review confirms pilot assets, ensuring consistent business case before rapidly 4 3 quality and rapid scalability introducing pilot scale production Pilot facilities co- Highly

experienced & Global collaboration Depth in Advanced Same team develops, located with R&D qualified team, with 11 PhD, Material Science between R&D scales, and technically team enabling rapid 9 MS & 14 BSc, averaging capabilities

centers supports launch scale up 16 years with Ecovyst 49

Anticipated Launch Advanced Silicas Capabilities 2025 Carbon

Functionalized Silicas for CO 2 Capture capture, storage, and use In-Depth Advanced Materials Capabilities Enable Customers To Develop Solutions Anticipated Launch 2024 for Their Sustainable Future Clean Functionalized Silicas for metal recovery

Water & produced water clean up Anticipated Launch Early 2024 Enzyme Bio-catalysts for food, chemical, Immobilization and biomass-based processes Launched Q2 2023 Renewable Catalysts & Supports for renewable Processes processes e.g.,

Bio-butadiene & SAF EMERGING APPLICATIONS Catalysts & Supports for Polyethylene Polyethylene market INDUSTRIAL APPLICATIONS Chemical Catalysts to produce Methyl Methacrylate & Ethyl Acetate Catalysts 50

Customized Solutions Addressing Polyethylene Market Needs, Targeting

2-3x Market Growth Rate Where We Play Polyethylene (PE) Potential Demand Source: Chemical Market Analytics by OPS April 2023 & Ecovyst Management Estimates 2030F Supports & Antiblocking 1 2 Catalysts 151MT of PE Additives 3 - 4% Films/ Blow

CAGR Ethylene Feedstock Ethylene Polyethylene Molding / 2021 Packaging 114MT of PE Pyrolysis 3 Catalysts Positioned to deliver 2 – 3x industry growth Key Drivers How We Win • Partner with key technology licensors & producers •

Increasing global use of Polyethylene • Food storage & preservation needs • Develop new products in partnership with customers • Reliable, quality, and cost-effective supply • Light weighting of materials 51

Advanced Silicas Are Enabling Enzyme Immobilization Technology To

Rapidly Commercialize Where We Play Immobilized Enzymes Potential Source: Grand View Research Enzyme Market Functionalized & Ecovyst Management Estimates 2030F 2 Silicas $1,100M Value 16% CAGR Use Silica Functionalize Immobilize Bio-Catalyst

2021 $300M Value Advanced Enzymes 1 Focus on immobilized Silica for food applications Silicas Key Drivers How We Win • Execute current project pipeline, then broaden • Increasing demand for cost-effective food • Emerging technology

to modify & test enzymes • Rapid R&D & qualification meeting customer needs • Scale commercial & technical expertise • Energy intensity, HSE profile & ease-of-use 52

Advanced Silicas Are Enabling Efficient Capture Of CO Produced From

Power Generation 2 Where We Play Carbon Capture Potential Source: Bloomberg NEF & Ecovyst Functionalized Management Estimates 2030F 1 Silicas 279,000KT of CO2 CO CO CO Downstream 2 2 2 Flue Gas/Air 23% Adsorption Desorption Storage & Use

Processing CAGR 2021 Ecovyst Silica Chemical & 43,000KT of CO2 2 Recovery 3 Bio Catalysts Silica Recovery Focus on CO2 emissions from Power Generation Chemicals Key Drivers How We Win • Execute current project pipeline, then broaden

• Global regulatory and social initiatives to lower CO 2 • High value of CO credits • Identify technology leaders and develop new systems 2 • Scale commercial & technical team • Recovered CO for downstream chemical

production 2 53

Anticipated Launch 2025 Zeolyst International Advanced Sustainable

Zeolites for alcohol to Aviation Fuels jet fuel applications Materials Capabilities Anticipated Launch 2024 In-Depth Advanced Materials Capabilities Advanced Zeolite catalysts for thermal Recycling pyrolysis of plastic waste Enable Customers To

Develop Solutions for Their Sustainable Future Established 2020 & Gen 2 Expected 2025-6 Renewable Zeolites for dewaxing of renewable fuels Diesel EMERGING APPLICATIONS Catalyst & Supports jointly INDUSTRIAL Custom developed for specific

Catalysts APPLICATIONS applications Hydrocracking catalysts for Low Sulfur petroleum-based fuels Fuels CORE APPLICATIONS Emission Zeolites for Emission Control Control 54

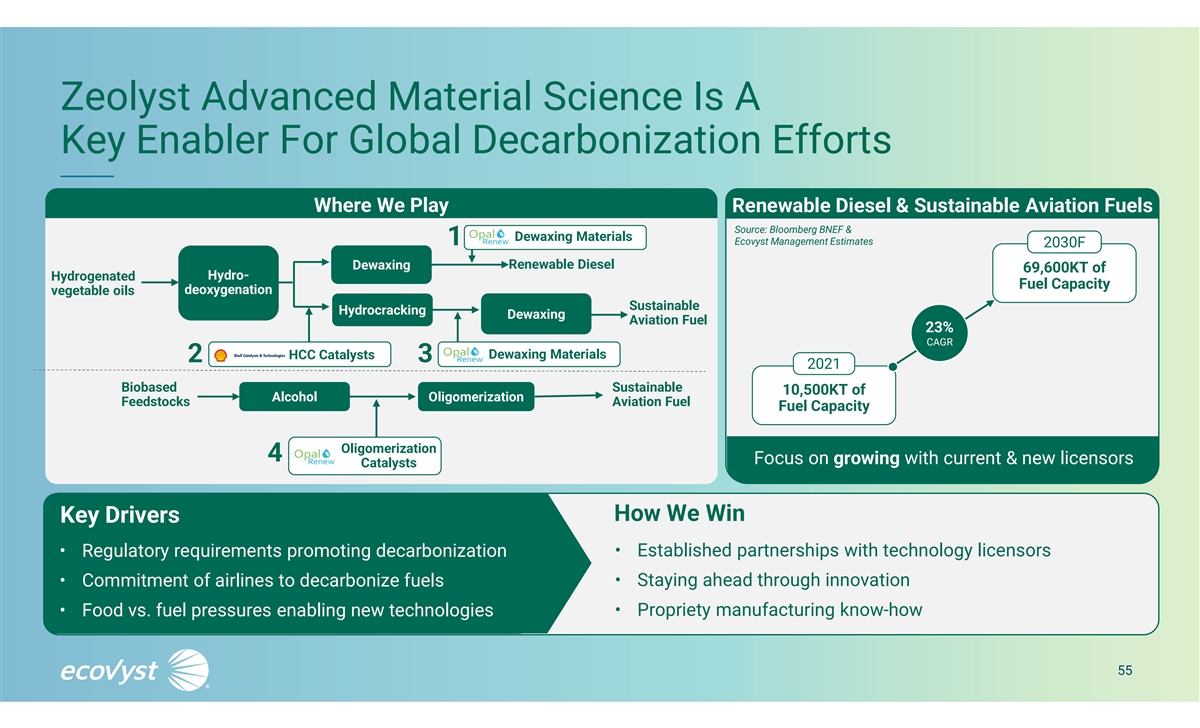

Zeolyst Advanced Material Science Is A Key Enabler For Global

Decarbonization Efforts Where We Play Renewable Diesel & Sustainable Aviation Fuels Source: Bloomberg BNEF & Dewaxing Materials 1 Ecovyst Management Estimates 2030F Renewable Diesel Dewaxing 69,600KT of Hydro- Hydrogenated Fuel Capacity

deoxygenation vegetable oils Sustainable Hydrocracking Dewaxing Aviation Fuel 23% CAGR HCC Catalysts Dewaxing Materials 2 3 2021 Biobased Sustainable 10,500KT of Alcohol Oligomerization Feedstocks Aviation Fuel Fuel Capacity Oligomerization 4 Focus

on growing with current & new licensors Catalysts How We Win Key Drivers • Regulatory requirements promoting decarbonization • Established partnerships with technology licensors • Commitment of airlines to decarbonize fuels

• Staying ahead through innovation • Food vs. fuel pressures enabling new technologies • Propriety manufacturing know-how 55

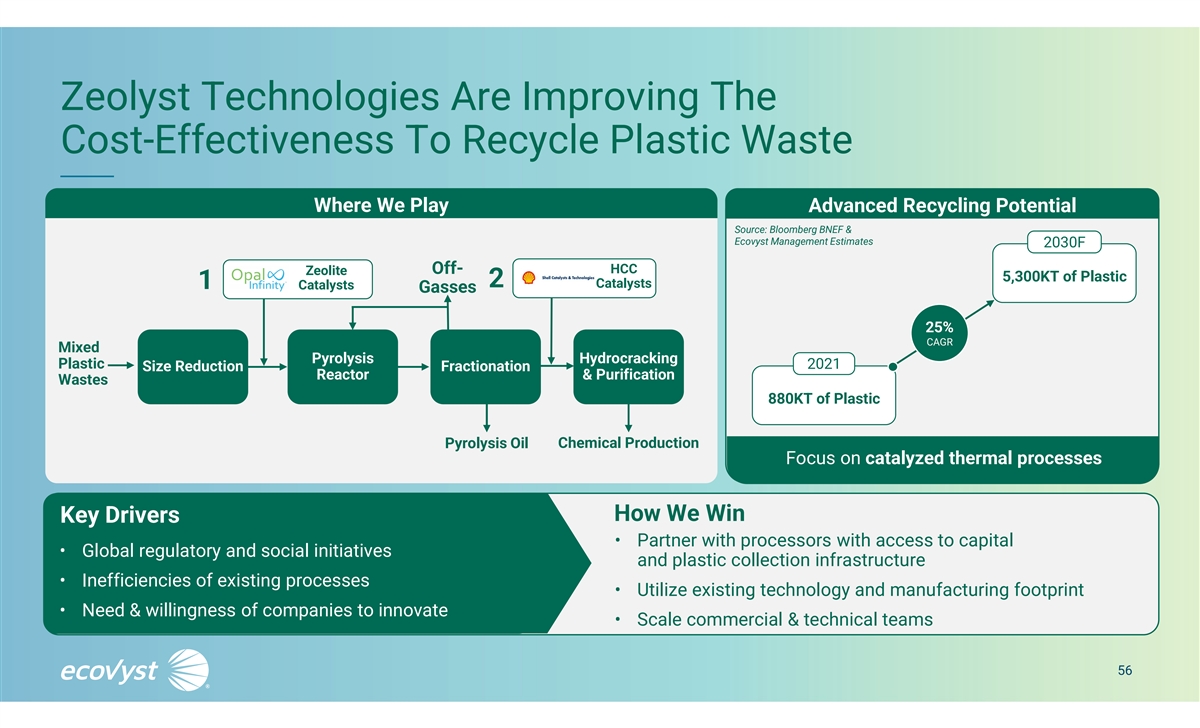

Zeolyst Technologies Are Improving The Cost-Effectiveness To Recycle

Plastic Waste Where We Play Advanced Recycling Potential Source: Bloomberg BNEF & Ecovyst Management Estimates 2030F Off- HCC Zeolite 5,300KT of Plastic 2 Catalysts 1 Catalysts Gasses 25% CAGR Mixed Pyrolysis Hydrocracking Plastic 2021 Size

Reduction Fractionation Reactor & Purification Wastes 880KT of Plastic Pyrolysis Oil Chemical Production Focus on catalyzed thermal processes How We Win Key Drivers • Partner with processors with access to capital • Global regulatory

and social initiatives and plastic collection infrastructure • Inefficiencies of existing processes • Utilize existing technology and manufacturing footprint • Need & willingness of companies to innovate • Scale

commercial & technical teams 56

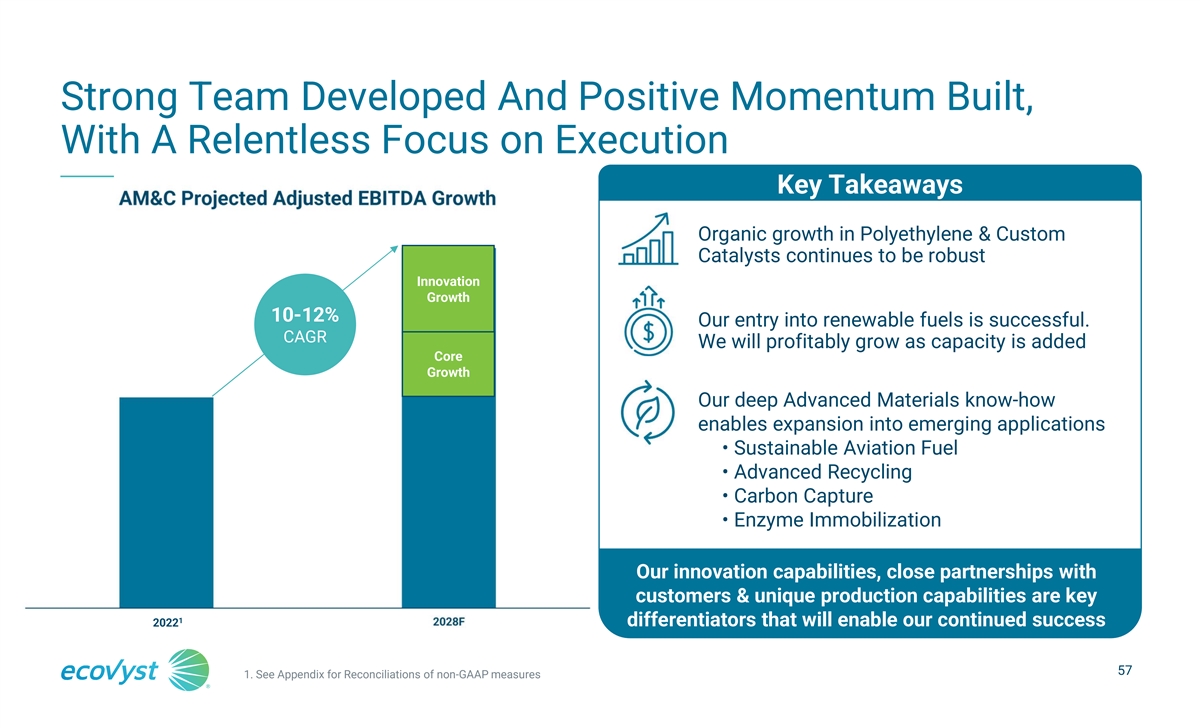

Strong Team Developed And Positive Momentum Built, With A Relentless

Focus on Execution Key Takeaways Organic growth in Polyethylene & Custom Catalysts continues to be robust Innovation 149 Growth 10-12% Our entry into renewable fuels is successful. CAGR We will profitably grow as capacity is added Core Growth

Our deep Advanced Materials know-how enables expansion into emerging applications • Sustainable Aviation Fuel • Advanced Recycling • Carbon Capture • Enzyme Immobilization Our innovation capabilities, close partnerships with

customers & unique production capabilities are key 1 2022 differentiators that will enable our continued success 57 1. See Appendix for Reconciliations of non-GAAP measures

Financial Outlook Mike Feehan Chief Financial Officer 58

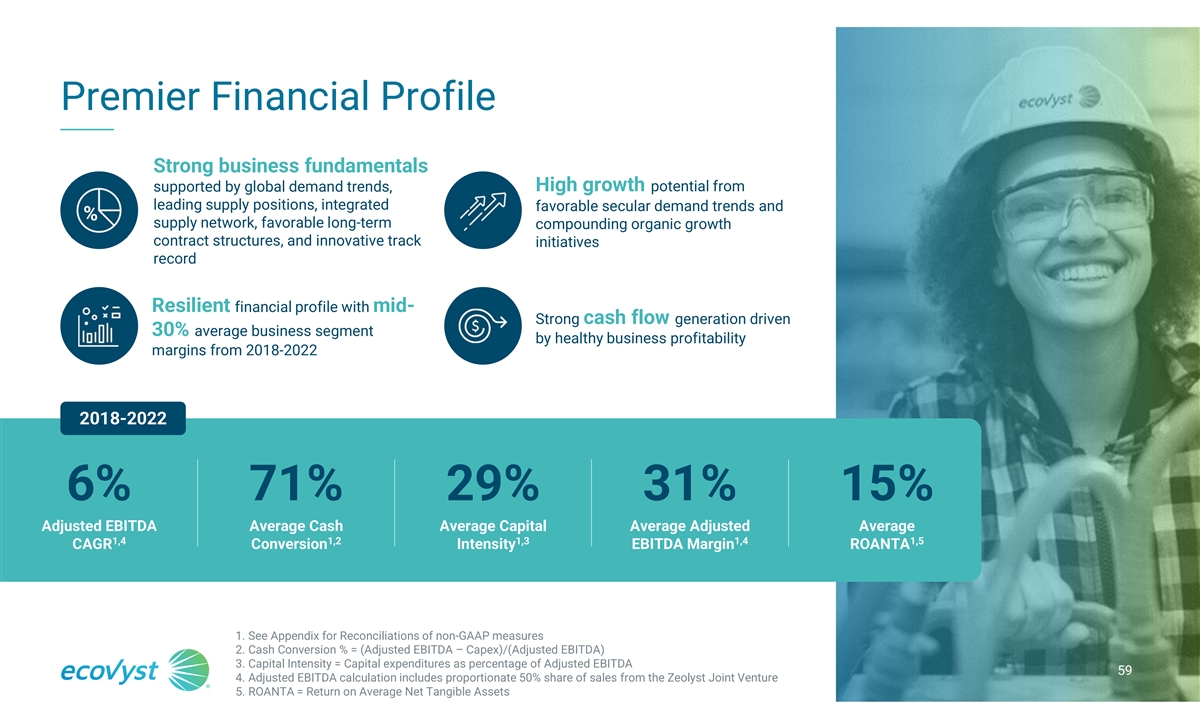

Premier Financial Profile Strong business fundamentals supported by

global demand trends, High growth potential from leading supply positions, integrated favorable secular demand trends and % supply network, favorable long-term compounding organic growth contract structures, and innovative track initiatives record

Resilient financial profile with mid- Strong cash flow generation driven 30% average business segment by healthy business profitability margins from 2018-2022 2018-2022 6% 71% 29% 31% 15% Adjusted EBITDA Average Cash Average Capital Average Adjusted

Average 1,4 1,2 1,3 1,4 1,5 CAGR Conversion Intensity EBITDA Margin ROANTA 1. See Appendix for Reconciliations of non-GAAP measures 2. Cash Conversion % = (Adjusted EBITDA – Capex)/(Adjusted EBITDA) 3. Capital Intensity = Capital expenditures

as percentage of Adjusted EBITDA 59 4. Adjusted EBITDA calculation includes proportionate 50% share of sales from the Zeolyst Joint Venture 5. ROANTA = Return on Average Net Tangible Assets

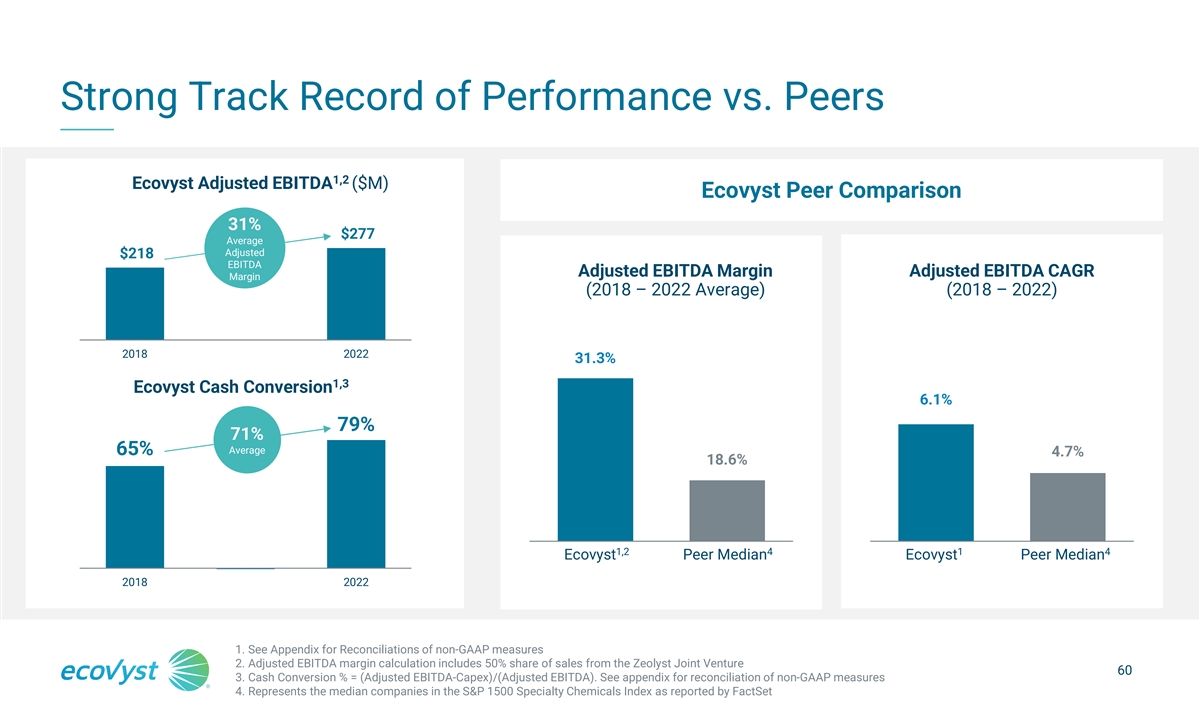

Strong Track Record of Performance vs. Peers 1,2 Ecovyst Adjusted

EBITDA ($M) Ecovyst Peer Comparison 31% $277 Average Adjusted $218 EBITDA Adjusted EBITDA Margin Adjusted EBITDA CAGR Margin (2018 – 2022 Average) (2018 – 2022) 2018 2022 31.3% 1,3 Ecovyst Cash Conversion 6.1% 79% 71% Average 65% 4.7%

18.6% 1,2 4 1 4 Ecovyst Peer Median3 Ecovyst Peer Median3 Ecovyst Peer Median Ecovyst Peer Median 2018 2022 1. See Appendix for Reconciliations of non-GAAP measures 2. Adjusted EBITDA margin calculation includes 50% share of sales from the Zeolyst

Joint Venture 60 3. Cash Conversion % = (Adjusted EBITDA-Capex)/(Adjusted EBITDA). See appendix for reconciliation of non-GAAP measures 4. Represents the median companies in the S&P 1500 Specialty Chemicals Index as reported by

FactSet

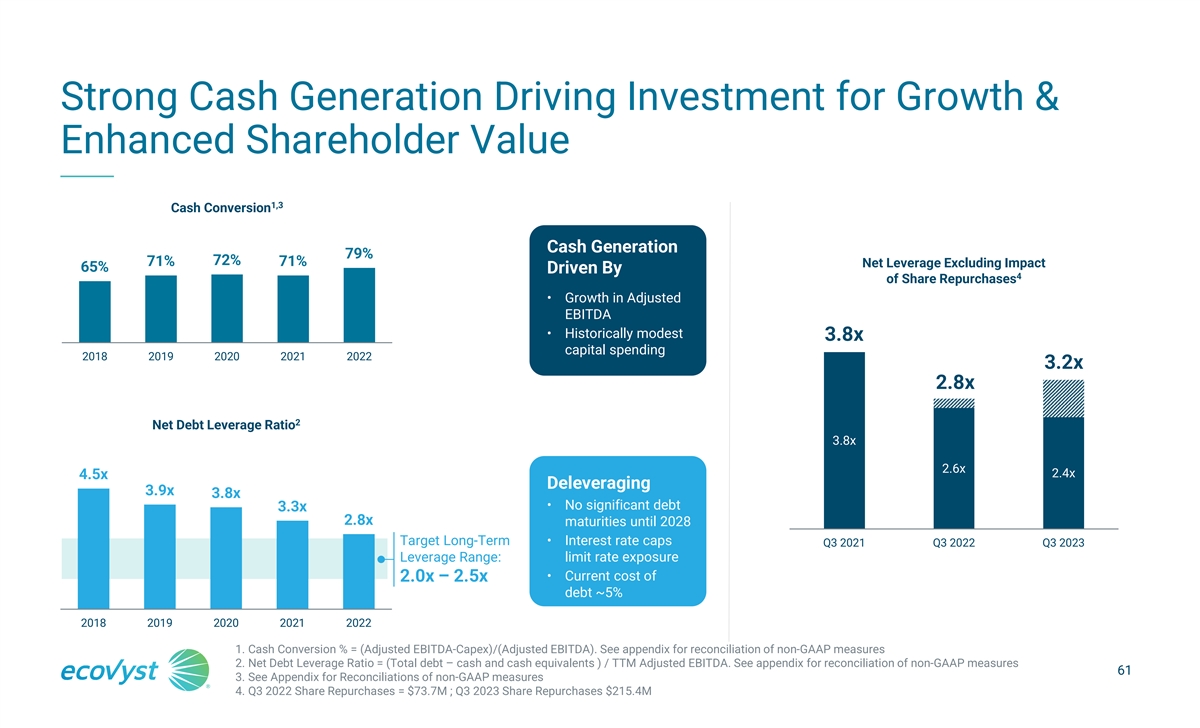

Strong Cash Generation Driving Investment for Growth & Enhanced

Shareholder Value 1,3 Cash Conversion Cash Generation 79% 72% 71% 71% Net Leverage Excluding Impact 65% Driven By 4 of Share Repurchases • Growth in Adjusted EBITDA • Historically modest 3.8x capital spending 2018 2019 2020 2021 2022

3.2x 2.8x 2 Net Debt Leverage Ratio 3.8x 2.6x 2.4x 4.5x Deleveraging 3.9x 3.8x • No significant debt 3.3x 2.8x maturities until 2028 Target Long-Term • Interest rate caps Q3 2021 Q3 2022 Q3 2023 Leverage Range: limit rate exposure

• Current cost of 2.0x – 2.5x debt ~5% 2018 2019 2020 2021 2022 1. Cash Conversion % = (Adjusted EBITDA-Capex)/(Adjusted EBITDA). See appendix for reconciliation of non-GAAP measures 2. Net Debt Leverage Ratio = (Total debt – cash

and cash equivalents ) / TTM Adjusted EBITDA. See appendix for reconciliation of non-GAAP measures 61 3. See Appendix for Reconciliations of non-GAAP measures 4. Q3 2022 Share Repurchases = $73.7M ; Q3 2023 Share Repurchases $215.4M

6-8% 75% Organic Adjusted Average Cash Conversion EBITDA Growth 2028

Financial Goals 2.0x-2.5x >20% % Net Debt Leverage Ratio ROANTA Average 62

Capital Allocation Priorities Capital Allocation Strategy Focused on

Maximizing Shareholder Value Cash Flow from Operations Projected Free Cash Flow / Leverage Maintenance Capex $200 $150 2.0x – 2.5x $100 Expansion Growth Capex $50 Operational Improvement $- 2023F 2024F 2025F 2026F 2027F 2028F FCF Net Leverage

Leverage Reduction Allows for Flexible Capital Adjusted EBITDA Growth Target Net Leverage of Allocation Strategy to and Cash Conversion to 2.0x-2.5x Early in Include Bolt-On Acquisitions Bolt-on Acquisitions drive Free Cash Flow Projection Period

and Share Repurchases Generation Share Repurchases 63

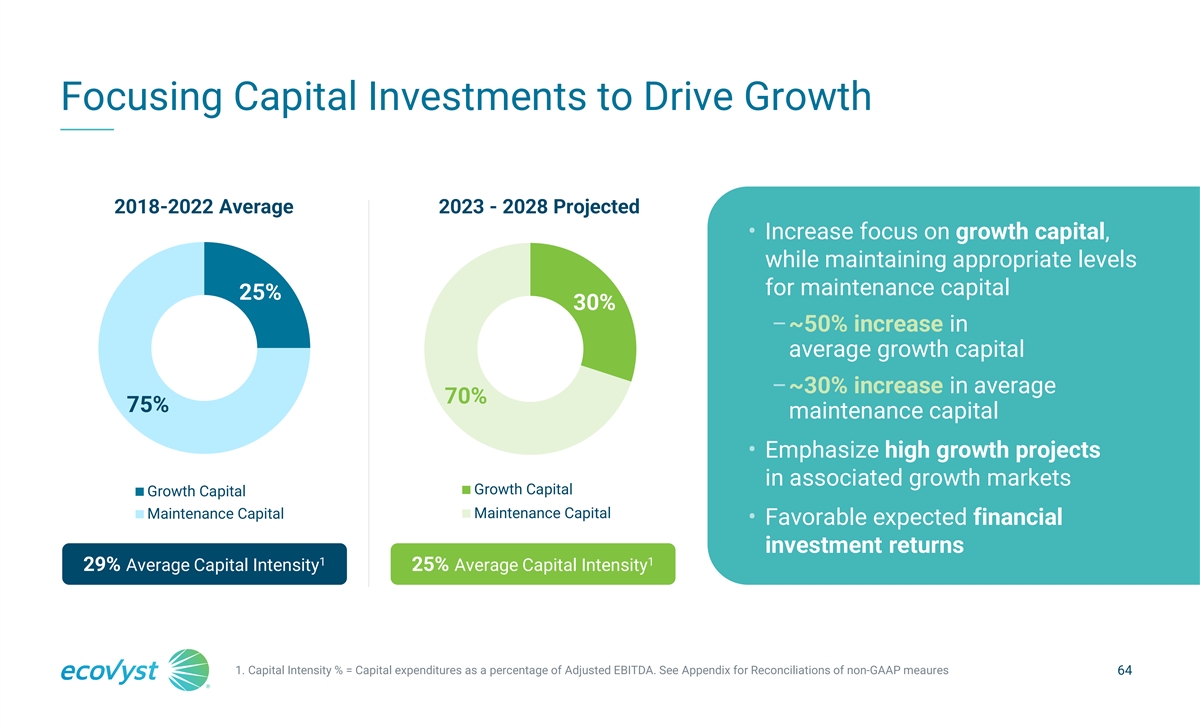

Focusing Capital Investments to Drive Growth 2018-2022 Average 2023 -

2028 Projected • Increase focus on growth capital, while maintaining appropriate levels for maintenance capital 25% 30% –~50% increase in average growth capital –~30% increase in average 70% 75% maintenance capital •

Emphasize high growth projects in associated growth markets Growth Capital Growth Capital Maintenance Capital Maintenance Capital • Favorable expected financial investment returns 1 1 29% Average Capital Intensity 25% Average Capital Intensity

1. Capital Intensity % = Capital expenditures as a percentage of Adjusted EBITDA. See Appendix for Reconciliations of non-GAAP meaures 64

Key Initiatives to Drive Organic Growth Preferred technology and

increasing sustainable product offerings projected to drive growth through 2028 Advanced Materials & Catalysts Grow at above market rates in polyethylene through know-how and customer partnerships Expansion of catalyst activation for

hydroprocessing and renewable fuel production Continue growth of product offerings in renewable fuels driven by global decarbonization Debottlenecking virgin sulfuric acid production to Expand commercial technology of advanced meet demand in mining

and industrials recycling for plastic pyrolysis Drive chemical catalyst growth in sustainable processes for new novel catalysts, such as enzyme development Favorable pricing benefit from inflation through long-term contract structure Advance

functionalized silicas to capture demand from electrification and carbon capture 65

Opportunistic Exposure to Return on emerging trends and investment >

cost Bolt-on M&A Strategy areas of growth in of capital sustainable markets Advanced Materials & Catalysts New catalyst technology platforms for Adjacent or Sustainable growth building on or adjacent to Zeolite and Silica complementary and

margin profile capabilities technologies or services New services associated with efficient catalyst lifecycle Ecoservices Differentiated Synergy Expansion of virgin acid capabilities intellectual property opportunities and application Geographic

reach know-how/expertise Expansion into adjacent services and technologies Financially Cultural fit/High 66 accretive customer intimacy Strategic Criteria Financial Criteria

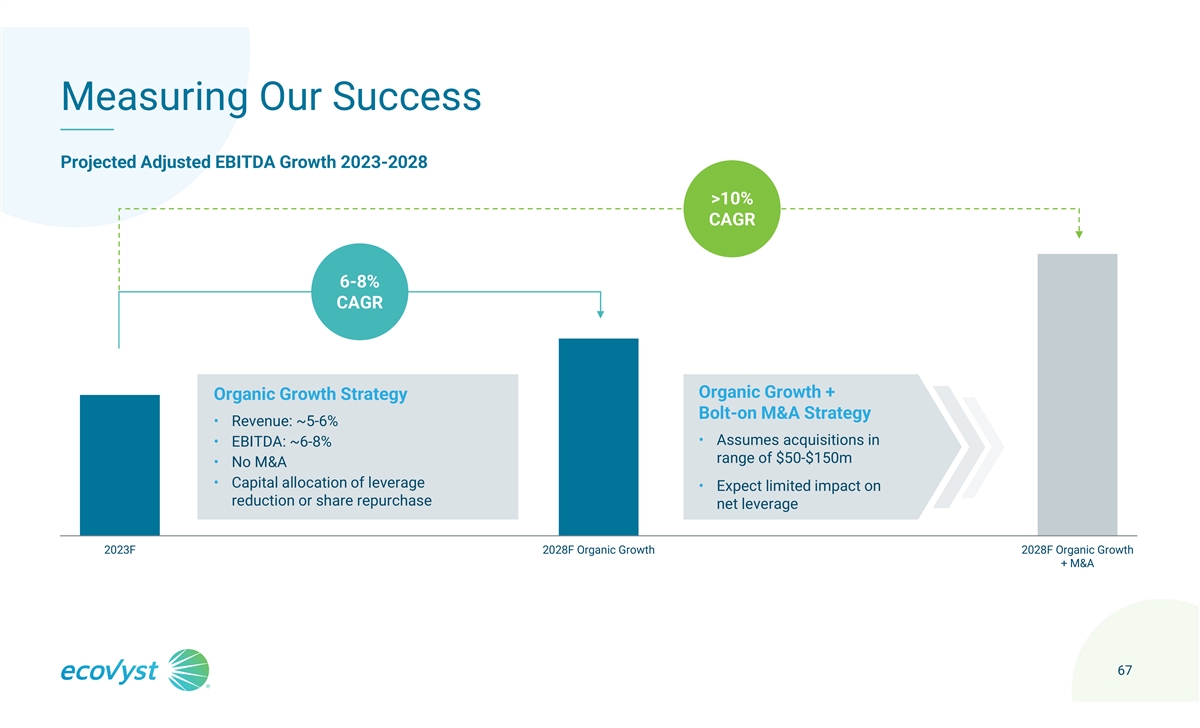

Measuring Our Success Projected Adjusted EBITDA Growth 2023-2028

>10% CAGR 6-8% CAGR Organic Growth + Organic Growth Strategy Bolt-on M&A Strategy • Revenue: ~5-6% • Assumes acquisitions in • EBITDA: ~6-8% range of $50-$150m • No M&A • Capital allocation of leverage

• Expect limited impact on reduction or share repurchase net leverage 2023F 2028F Organic Growth 2028F Organic Growth + M&A 67

Creating Lasting Shareholder Value S St tr ro on ng g C Ca as sh h D Du

ur ra ab bl le e B Br ro oa ad d- -B Ba as se ed d F Fa av vo or ra ab bl le e G Ge en ne er ra at ti io on n B Bu us siin ne es ss s G Gr ro ow wt th h A Ac cr ro os ss s I In nd du us st tr ry y T Tr re en nd ds s F Fu un nd diin ng g a a M Mo od

de ell w wiit th h A Al ll l S Se eg gm me en nt ts s,, D Dr riiv viin ng g D De em ma an nd d B Ba alla an nc ce ed d D Di if ff fe er re en nt ti ia at te ed d B Bu uiilld diin ng g a a M Mo or re e f fo or r P Pr ro od du uc ct ts s a an nd d C

Ca ap piit ta all C Co om mp pe et ti it ti iv ve e E Ev vo ollv ve ed d S Se er rv viic ce es s A Allllo oc ca at tiio on n A Ad dv va an nt ta ag ge es s B Bu us siin ne es ss s M Miix x S St tr ra at te eg gy y 68

69

Annual Segment Sales, Adjusted EBITDA and Margins TTM Year Ended

December 31, September 30, ($ in millions, except %) 2023 2022 2021 2020 2019 2018 Sales: Ecoservices 603.3 702.5 500.5 401.9 447.1 455.6 Advanced Silica 97.8 117.7 110.7 94.0 85.7 72.1 Total sales 701.1 820.2 611.2 495.9 532.8 527.7 Zeolyst Joint

Venture sales 143.7 132.6 131.3 128.6 170.3 156.7 1 Adjusted EBITDA : Ecoservices 206.0 227.8 177.7 157.2 175.6 176.5 Advanced Materials & Catalysts 75.1 78.0 88.0 74.5 107.8 81.1 Unallocated corporate expenses (21.8) (29.0) (38.1) (39.1) (43.3)

(39.4) Total Adjusted EBITDA 259.3 276.8 227.6 192.6 240.1 218.2 1 Adjusted EBITDA Margin : Ecoservices 34.1% 32.4% 35.5% 39.1% 39.3% 38.7% 3 Advanced Materials & Catalysts 31.1% 31.2% 36.4% 33.5% 42.1% 35.4% 1,2 30.7% 29.0% 30.7% 30.8% 34.1%

31.9% Total Adjusted EBITDA Margin 1. See Appendix for Reconciliations of non-GAAP measures 2. Totals include corporate costs 3. Adjusted EBITDA includes proportionate 50% share of sales from the Zeolyst Joint Venture * Rounding discrepancies may

arise when rounding results from dollars (in thousands) to dollars (in millions) 71

Reconciliation of Net Income to Adjusted EBITDA TTM Year Ended

September 30, September 30, September 30, December December December December December ($ in millions, except %) 2023 2022 2021 31, 2022 31, 2021 31, 2020 31, 2019 31, 2018 Reconciliation of net income to Adjusted EBITDA Net income 62.7 56.2 40.0

69.8 1.8 54.3 31.1 5.3 Provision (benefit) for income taxes 20.5 29.0 (42.0) 24.9 12.1 (52.1) 12.3 8.0 Interest expense, net 41.2 35.7 37.7 37.2 37.0 50.4 66.9 72.3 Depreciation and amortization 82.9 78.4 80.5 79.2 79.7 76.9 74.8 72.2 EBITDA 207.3

199.3 116.2 211.1 130.6 129.5 185.1 157.8 (a) Joint venture depreciation, amortization and interest 14.1 16.2 15.0 16.0 15.6 14.7 14.7 12.6 (b) Amortization of investment in affiliate step-up 6.4 6.4 6.5 6.4 6.5 6.6 7.5 6.6 Debt extinguishment costs

— — 35.4 — 26.9 25.0 3.4 7.8 (c) Net loss on asset disposals 5.7 2.4 8.1 3.6 5.7 4.7 4.6 10.4 (d) Foreign currency exchange (gain) loss (1.1) 2.0 0.1 1.4 4.7 (5.3) 1.2 13.9 (e) LIFO expense (benefit) 2.3 0.1 (2.5) (0.2) (1.9) (5.3)

6.5 0.8 (f) Transaction and other related costs 2.9 7.3 1.3 7.0 2.0 1.1 0.2 0.5 Equity-based compensation 15.8 26.4 26.7 20.6 31.8 17.2 13.3 16.9 Restructuring, integration and business optimization 6.0 8.6 3.1 11.6 3.0 2.0 2.6 6.8 (g) expenses (h)

Gain on contract termination — — — — — — — (20.6) (i) Other (0.1) 2.0 0.4 (0.7) 2.7 2.4 1.0 4.7 1 Adjusted EBITDA 259.3 270.7 210.3 276.8 227.6 192.6 240.1 218.2 1. For additional information with respect to

each adjustment, see appendix Descriptions for reconciliations of Non-GAAP financial measures * Rounding discrepancies may arise when rounding results from dollars (in thousands) to dollars (in millions) 72

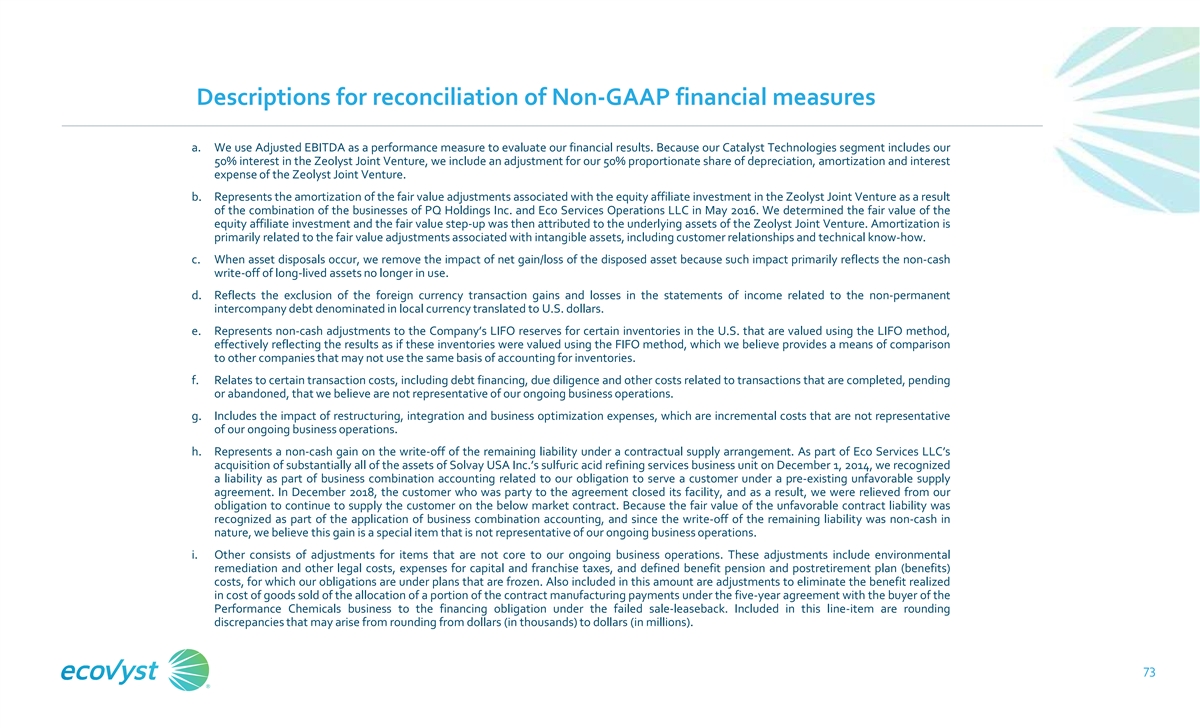

Descriptions for reconciliation of Non-GAAP financial measures a. We

use Adjusted EBITDA as a performance measure to evaluate our financial results. Because our Catalyst Technologies segment includes our 50% interest in the Zeolyst Joint Venture, we include an adjustment for our 50% proportionate share of

depreciation, amortization and interest expense of the Zeolyst Joint Venture. b. Represents the amortization of the fair value adjustments associated with the equity affiliate investment in the Zeolyst Joint Venture as a result of the combination of

the businesses of PQ Holdings Inc. and Eco Services Operations LLC in May 2016. We determined the fair value of the equity affiliate investment and the fair value step-up was then attributed to the underlying assets of the Zeolyst Joint Venture.

Amortization is primarily related to the fair value adjustments associated with intangible assets, including customer relationships and technical know-how. c. When asset disposals occur, we remove the impact of net gain/loss of the disposed asset

because such impact primarily reflects the non-cash write-off of long-lived assets no longer in use. d. Reflects the exclusion of the foreign currency transaction gains and losses in the statements of income related to the non-permanent intercompany

debt denominated in local currency translated to U.S. dollars. e. Represents non-cash adjustments to the Company’s LIFO reserves for certain inventories in the U.S. that are valued using the LIFO method, effectively reflecting the results as

if these inventories were valued using the FIFO method, which we believe provides a means of comparison to other companies that may not use the same basis of accounting for inventories. f. Relates to certain transaction costs, including debt

financing, due diligence and other costs related to transactions that are completed, pending or abandoned, that we believe are not representative of our ongoing business operations. g. Includes the impact of restructuring, integration and business

optimization expenses, which are incremental costs that are not representative of our ongoing business operations. h. Represents a non-cash gain on the write-off of the remaining liability under a contractual supply arrangement. As part of Eco

Services LLC’s acquisition of substantially all of the assets of Solvay USA Inc.’s sulfuric acid refining services business unit on December 1, 2014, we recognized a liability as part of business combination accounting related to our

obligation to serve a customer under a pre-existing unfavorable supply agreement. In December 2018, the customer who was party to the agreement closed its facility, and as a result, we were relieved from our obligation to continue to supply the

customer on the below market contract. Because the fair value of the unfavorable contract liability was recognized as part of the application of business combination accounting, and since the write-off of the remaining liability was non-cash in

nature, we believe this gain is a special item that is not representative of our ongoing business operations. i. Other consists of adjustments for items that are not core to our ongoing business operations. These adjustments include environmental

remediation and other legal costs, expenses for capital and franchise taxes, and defined benefit pension and postretirement plan (benefits) costs, for which our obligations are under plans that are frozen. Also included in this amount are

adjustments to eliminate the benefit realized in cost of goods sold of the allocation of a portion of the contract manufacturing payments under the five-year agreement with the buyer of the Performance Chemicals business to the financing obligation

under the failed sale-leaseback. Included in this line-item are rounding discrepancies that may arise from rounding from dollars (in thousands) to dollars (in millions). 73

Cash Conversion & Net Debt Leverage Ratio Cash Conversion Year

Ended December 31, ($ in millions, except %) 2022 2021 2020 2019 2018 Adjusted EBITDA 276.8 227.6 192.6 240.1 218.2 1 Less: Capex 59.5 66.4 54.5 70.3 77.0 Cash Conversion 217.5 161.2 138.1 169.9 141.3 2 Cash Conversion % 79% 71% 72% 71% 65% 3

Capital Intensity % 21.5% 29.2% 28.3% 29.3% 35.3% Net Debt Leverage Ratio Year Ended December 31, TTM ($ in millions, except %) 2022 2021 2020 2019 2018 Q3 2023 Q3 2022 Q3 2021 4 Total debt 886.4 895.5 1,426.4 1,932.1 2,148.4 879.8 888.8 897.7 4

Less: Cash and cash equivalents 110.9 140.9 137.2 73.9 59.8 38.3 121.4 104.8 Net debt 775.5 754.6 1,289.2 1,858.2 2,088.6 841.5 767.4 792.9 Adjusted EBITDA - Continuing Operations 276.8 227.6 192.6 240.1 218.2 259.3 270.7 210.3 Adjusted EBITDA -

Discontinued Operations — — 142.4 231.0 243.4 — — — Net Debt Leverage Ratio 2.8x 3.3x 3.8x 3.9x 4.5x 3.2x 2.8x 3.8x 1. Capex for cash conversion includes 50% of spend for the Zeolyst Joint Venture 2. Cash Conversion % =

(Adjusted EBITDA-Capex)/(Adjusted EBITDA) 3. Capital Intensity % = (Capex/Adjusted EBITDA) 4. 2018-2020 Net Debt and Cash & Cash Equivalents includes discontinued 74 operations

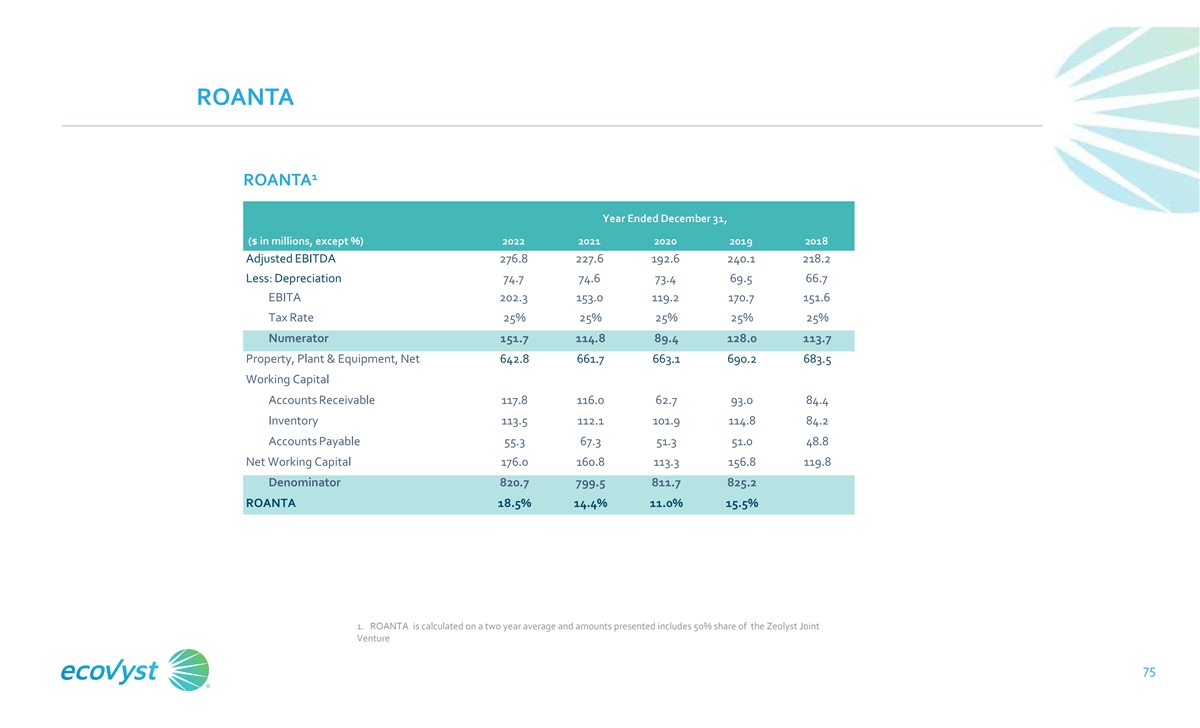

ROANTA 1 ROANTA Year Ended December 31, ($ in millions, except %) 2022

2021 2020 2019 2018 Adjusted EBITDA 276.8 227.6 192.6 240.1 218.2 Less: Depreciation 74.7 74.6 73.4 69.5 66.7 EBITA 202.3 153.0 119.2 170.7 151.6 Tax Rate 25% 25% 25% 25% 25% Numerator 151.7 114.8 89.4 128.0 113.7 Property, Plant & Equipment,

Net 642.8 661.7 663.1 690.2 683.5 Working Capital Accounts Receivable 117.8 116.0 62.7 93.0 84.4 Inventory 113.5 112.1 101.9 114.8 84.2 Accounts Payable 55.3 67.3 51.3 51.0 48.8 Net Working Capital 176.0 160.8 113.3 156.8 119.8 Denominator 820.7

799.5 811.7 825.2 ROANTA 18.5% 14.4% 11.0% 15.5% 1. ROANTA is calculated on a two year average and amounts presented includes 50% share of the Zeolyst Joint Venture 75

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Ecovyst (NYSE:ECVT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ecovyst (NYSE:ECVT)

Historical Stock Chart

From Jan 2024 to Jan 2025