Dun & Bradstreet Global Business Optimism Insights Report Shows Quarterly Increase

October 10 2024 - 4:20PM

Business Wire

Improving market dynamics have provided relief,

indicating confidence in both domestic and global economic

conditions

Dun & Bradstreet (NYSE:DNB), a leading global provider of

business decisioning data and analytics, today released its Q4 2024

Global Business Optimism Insights report. The report, fielded in Q3

2024, found a 7% increase in business optimism

quarter-over-quarter, driven by gradual easing of inflation rates

and favorable borrowing conditions.

Nearly four in five businesses are expressing increased optimism

in domestic and export orders, capital expenditures and financial

risk due to a combination of easing financial pressures, shifts in

monetary policies, robust regulatory frameworks and higher

participation in sustainability initiatives.

U.S. businesses recorded a nearly 9% rise in optimism, aided by

falling inflation and expectations of further rate cuts. Similarly,

business optimism in the U.K. and Spain showed notable recoveries

as their respective central banks initiated monetary easing, rising

by 13% and 9%, respectively. Emerging economies, such as Argentina

and India, saw jumps in optimism levels due to declining inflation

and increased domestic demand respectively.

“While overall global business optimism has increased and

inflation has abated, it’s important to recognize that geopolitics

contribute to economic uncertainty,” said Neeraj Sahai, President

of Dun & Bradstreet International. “Industry-specific

regulatory risks and more stringent data requirements have emerged

as the top concerns among a third of respondents. To mitigate these

risks, businesses are considering diversifying their supply chains

and markets to manage regulatory risk.”

Key findings from the Q4 report’s five indices

include:

- The Global Business Optimism Index increased by 7.3%

over Q3 2024. This is a significant increase with 75% of

businesses, especially smaller businesses, expressing confidence in

sales and domestic and export orders ahead of the holiday season.

The real estate (12.5%) and utilities (10.4%) sectors saw the

highest jumps in optimism levels.

- The Global Supply Chain Continuity Index improved 6.8%,

stemming from businesses reducing burdens on their supply chains by

adopting nearshoring, using alternative and less-congestive routes,

and relying on domestic supplies. One in four businesses in the

U.S., as well as Switzerland and Spain, are considering

diversifying supply chains and markets as their preferred strategy

to manage their regulatory risk.

- The Global Business Financial Confidence Index increased

6.3% due to expectations of improved financial conditions and

reduced borrowing costs as many economies have started to cut

interest rates. Confidence in the U.S. and South Korea notably

improved by 5.2% and 11.2%, respectively, on indications of their

central banks pivoting towards looser monetary policies.

- The Global Business Investment Confidence Index improved

3.6%, showcasing optimism in capital spending centered around signs

of global monetary policies becoming more accommodative, along with

improvement in macroeconomic activities.

- The Global Business ESG Index increased by 6.1%,

stemming from businesses’ efforts to meet regulatory requirements,

stricter disclosure mandates and heightened investor awareness.

Globally, stricter environmental regulations, such as the European

Union’s Carbon Border Adjustment Mechanism and the German Supply

Chain Due Diligence Act, are among top concerns for 29% of

businesses, resulting in almost one in four conducting risk

assessments or implementing regulatory compliance strategies.

Descriptions and information about the indices can be found on

page 24 of the report.

"Businesses are increasingly confident as borrowing costs

decline, boosting optimism for higher sales, stronger exports, and

reduced financial risks," said Arun Singh, Global Chief Economist

at Dun & Bradstreet. "This confidence is driving capital

investments, with easing supply chain pressures supporting growth

in the year's final quarter."

About the Global Business Optimism Insights Report

The Global Business Optimism Insights report is a synthesis of

data from a comprehensive survey encompassing 32 economies,

covering approximately 10,000 businesses and 17 sectors, alongside

insights from Dun & Bradstreet, leveraging the firm’s

proprietary data and economic expertise. The report is an

amalgamation of five indices which reflect overall business

optimism and expectations about supply chain continuity, financial

and investment conditions and ESG initiatives. An index reading

above 100 indicates an improvement in optimism relative to the base

year (Q3 2023 to Q2 2024), while an index reading below 100

signifies a deterioration in optimism.

View the full report here.

About Dun & Bradstreet

Dun & Bradstreet, a leading global provider of business

decisioning data and analytics, enables companies around the world

to improve their business performance. Dun & Bradstreet’s Data

Cloud fuels solutions and delivers insights that empower customers

to accelerate revenue, lower cost, mitigate risk, and transform

their businesses. Since 1841, companies of every size have relied

on Dun & Bradstreet to help them manage risk and reveal

opportunity. For more information on Dun & Bradstreet, please

visit www.dnb.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241010658906/en/

Media Contact: Ginny Walthour 904-528-1506 walthourg@dnb.com

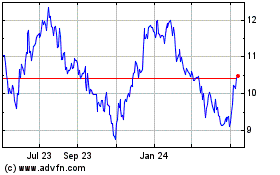

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

From Mar 2024 to Mar 2025