Businesses Show Growing Optimism Amid Global Challenges

July 09 2024 - 8:45AM

Business Wire

Dun & Bradstreet Q3 2024 Global Business

Optimism Insights report finds improved growth optimism despite

continued geopolitical tensions and supply chain disruptions

Dun & Bradstreet (NYSE:DNB), a leading global provider of

business decisioning data and analytics, today released its Q3 2024

Global Business Optimism Insights report. The latest quarterly

report shows increased optimism across all five indices – business,

supply chain continuity, financial and investment conditions, and

ESG initiatives – for the first time since the launch of the report

in Q3 2023.

Worldwide, businesses have rallied against persistent

geopolitical tensions and supply chain disruptions, with global

business optimism and financial confidence rising by more than 12%.

Additionally, the steps taken by most central banks towards easing

interest rates have bolstered optimism, with global financial

confidence increasing more than 23%. Driven by improved

macroeconomic conditions, businesses are notably optimistic about

sales and new orders, while financial and investment confidence has

surged due to expectations of favorable operating conditions and

reduced borrowing costs.

“The improved optimism among businesses demonstrates resilience

in navigating global disturbances by adapting to the ‘new normal’

and leveraging emerging opportunities,” said Neeraj Sahai,

President of Dun & Bradstreet International. “Surge in

investment confidence among businesses indicates higher capital

requirements and a more buoyant M&A environment for inorganic

growth. As we look with an eye toward the next quarter, it should

be with cautious optimism, as policy uncertainty associated with

upcoming elections globally persists.”

Regionally, business optimism in the U.S. showed a notable

recovery, rising by nearly 17% for Q3. This was reinforced by

service-oriented businesses, particularly within the information

and communications technology (ICT) sector where optimism increased

by 51%. Germany witnessed a nearly 10% increase, supporting the

overall European economic sentiment. The Asia-Pacific region also

saw prominent increases particularly in Indonesia (20%) and Japan

(22%). Conversely, the U.K. saw a nearly 4% decline in business

optimism.

Key findings from the Q3 2024 report’s five indices*:

- The Global Business Optimism Index increased 12.3% on

the back of expected growth in sales, new orders, and favorable

input costs amid easing global inflation. The increase in optimism

is in sync with the latest upward revisions in global GDP forecast

for 2024 by multilateral agencies. Globally, ICT, Wholesale &

retail, and textile are the most optimistic sectors.

- The Global Supply Chain Continuity Index saw a marginal

improvement of 1.2% stemming from businesses adjusting to the new

supply chain environment, which continues to be disturbed by

geopolitical tensions, longer shipping routes and climate-related

disruptions. Large businesses’ optimism deteriorated significantly

reflecting the challenges of an interconnected global supply chain.

However, smaller businesses are more optimistic as they expect to

reduce their supplier concentration risk.

- The Global Business Financial Confidence Index improved

12.3% as businesses are optimistic about their operating conditions

and liquidity risk. Smaller businesses, that may previously have

been relatively constrained in their approach to liquidity risk

management, are now more optimistic about cash flow management

given growing expectations of falling borrowing costs.

- The Global Business Investment Confidence Index

increased 23.3%, signaling a meaningful uptick in optimism for

capital spending, backed by an accommodative global monetary

policy. Globally, small and medium-size businesses were more

confident about the environment for M&A activity than larger

businesses, likely because they see themselves as potentially

attractive acquisition targets, especially promising startups in

digital, fintech, and AI.

- The Global Business ESG Index increased 8.0% as

businesses look to re-engage their sustainability

initiatives. In the survey, more than one in two respondents

indicated increased funding for ESG-related activities.

*Descriptions and information about the indices can be found on

page 23 of the report.

“Improvement across all five indices indicates the optimism for

an accommodative monetary policy regime globally among businesses,”

said Arun Singh, Global Chief Economist, Dun & Bradstreet.

“This optimism is further fueled by improved macroeconomic

conditions as businesses are notably upbeat about sales and new

orders. Further, improvement in supply chain continuity indicates

that businesses are adapting to the ever-evolving global

landscape.”

About the Global Business Optimism Insights Report

The Global Business Optimism Insights report is a synthesis of

data from a comprehensive survey encompassing 32 economies,

covering approximately 10,000 businesses and 17 sectors, alongside

insights from Dun & Bradstreet, leveraging the firm’s

proprietary data and economic expertise. The report is an

amalgamation of five indices which reflect overall business

optimism and expectations about supply chain continuity, financial

and investment conditions and ESG initiatives. An index reading

above 100 indicates an improvement in optimism relative to the base

year (Q3 2023 to Q2 2024), while an index reading below 100

signifies a deterioration in optimism.

View the full report here.

About Dun & Bradstreet

Dun & Bradstreet, a leading global provider of business

decisioning data and analytics, enables companies around the world

to improve their business performance. Dun & Bradstreet’s Data

Cloud fuels solutions and delivers insights that empower customers

to accelerate revenue, lower cost, mitigate risk, and transform

their businesses. Since 1841, companies of every size have relied

on Dun & Bradstreet to help them manage risk and reveal

opportunity. For more information on Dun & Bradstreet, please

visit www.dnb.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240709845245/en/

Media Dawn McAbee 904-648-6328 Mcabeed@dnb.com

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

From Oct 2024 to Nov 2024

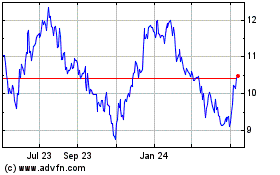

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

From Nov 2023 to Nov 2024